UFP Technologies (UFPT)

UFP Technologies doesn’t impress us. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why UFP Technologies Is Not Exciting

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ:UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

- Subscale operations are evident in its revenue base of $602.8 million, meaning it has fewer distribution channels than its larger rivals

- A bright spot is that its performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 39.9% outpaced its revenue gains

UFP Technologies falls short of our expectations. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than UFP Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than UFP Technologies

UFP Technologies’s stock price of $203.90 implies a valuation ratio of 21.1x forward P/E. While valuation is appropriate for the quality you get, we’re still not buyers.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. UFP Technologies (UFPT) Research Report: Q4 CY2025 Update

Medical products company UFP Technologies (NASDAQ:UFPT) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 3.4% year on year to $148.9 million. Its non-GAAP profit of $2.44 per share was 9.2% above analysts’ consensus estimates.

UFP Technologies (UFPT) Q4 CY2025 Highlights:

- Revenue: $148.9 million vs analyst estimates of $149.1 million (3.4% year-on-year growth, in line)

- Adjusted EPS: $2.44 vs analyst estimates of $2.24 (9.2% beat)

- Adjusted EBITDA: $28.29 million vs analyst estimates of $29.94 million (19% margin, 5.5% miss)

- Operating Margin: 14.4%, down from 16.3% in the same quarter last year

- Market Capitalization: $1.86 billion

Company Overview

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ:UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

UFP Technologies primarily serves the medical technology sector, creating components that are critical to surgical procedures, patient care, and medical device functionality. The company specializes in converting specialty materials into custom-engineered solutions that meet specific performance requirements. For example, a hospital might use UFP's protective drapes during robotic surgery procedures to maintain sterile fields and prevent infections.

The company's medical product portfolio includes disposables for surgical procedures, infection prevention materials, advanced wound care solutions, and packaging for medical devices and orthopedic implants. A surgeon performing minimally invasive procedures might rely on UFP's single-use components designed specifically for their surgical instruments, while a medical device manufacturer might partner with UFP to create specialized packaging that maintains product sterility.

Beyond healthcare, UFP Technologies leverages its materials expertise in automotive, aerospace, defense, and industrial markets. In automotive applications, the company produces components that reduce vehicle weight for better fuel efficiency and improve acoustic insulation. For defense clients, UFP creates protective gear components and custom cases for transporting sensitive equipment.

UFP generates revenue through direct sales of its custom-engineered solutions to original equipment manufacturers and their suppliers. The company maintains FDA-registered facilities with ISO 13485 certification for medical device manufacturing, allowing it to meet the stringent quality requirements of healthcare clients.

The company's engineering teams collaborate with customers from concept through production, using specialized knowledge of materials and manufacturing processes to solve complex design challenges. UFP operates multiple manufacturing locations across the United States, giving it proximity to major customers and the ability to scale production as needed.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

UFP Technologies competes with diversified medical component manufacturers like Integer Holdings (NYSE:ITGR), Nordson Medical (part of Nordson Corporation, NASDAQ:NDSN), and privately-held companies such as Viant Medical and Medbio in the medical device solutions space.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $602.8 million in revenue over the past 12 months, UFP Technologies is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, UFP Technologies’s sales grew at an exceptional 27.4% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. UFP Technologies’s annualized revenue growth of 22.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, UFP Technologies grew its revenue by 3.4% year on year, and its $148.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and implies the market is baking in some success for its newer products and services.

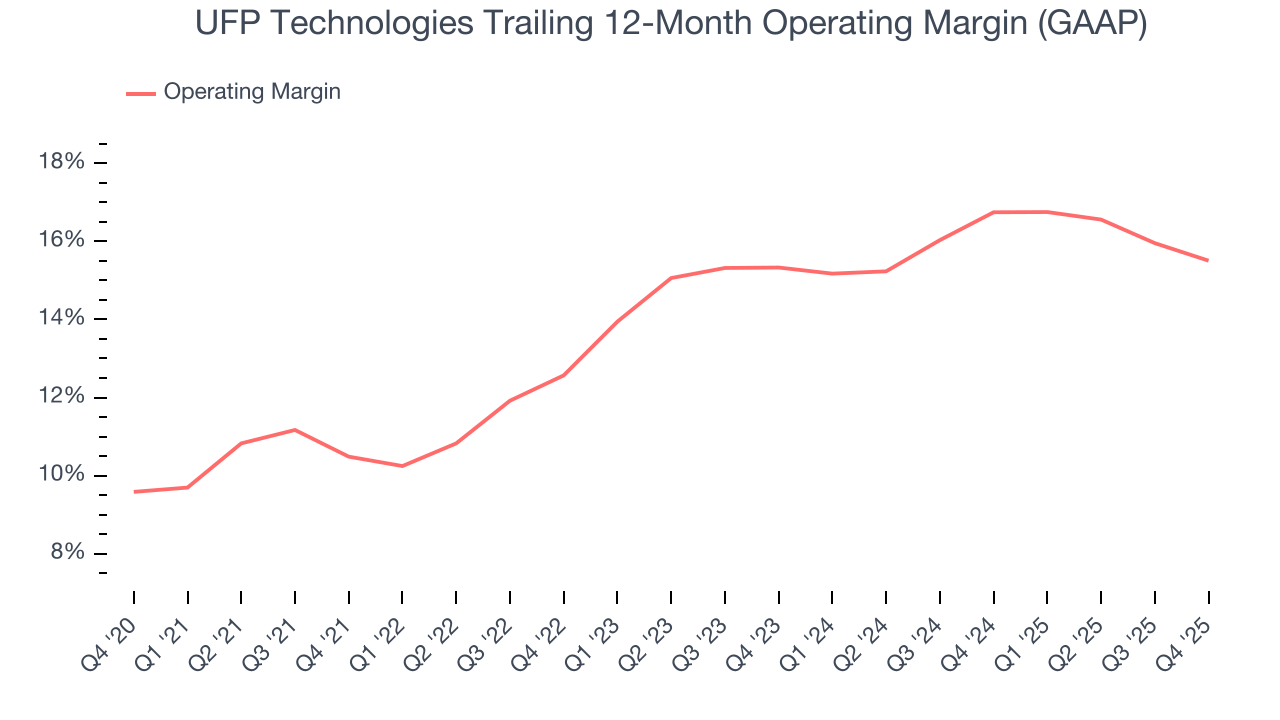

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

UFP Technologies has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 14.8%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, UFP Technologies’s operating margin rose by 5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, UFP Technologies generated an operating margin profit margin of 14.4%, down 1.8 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

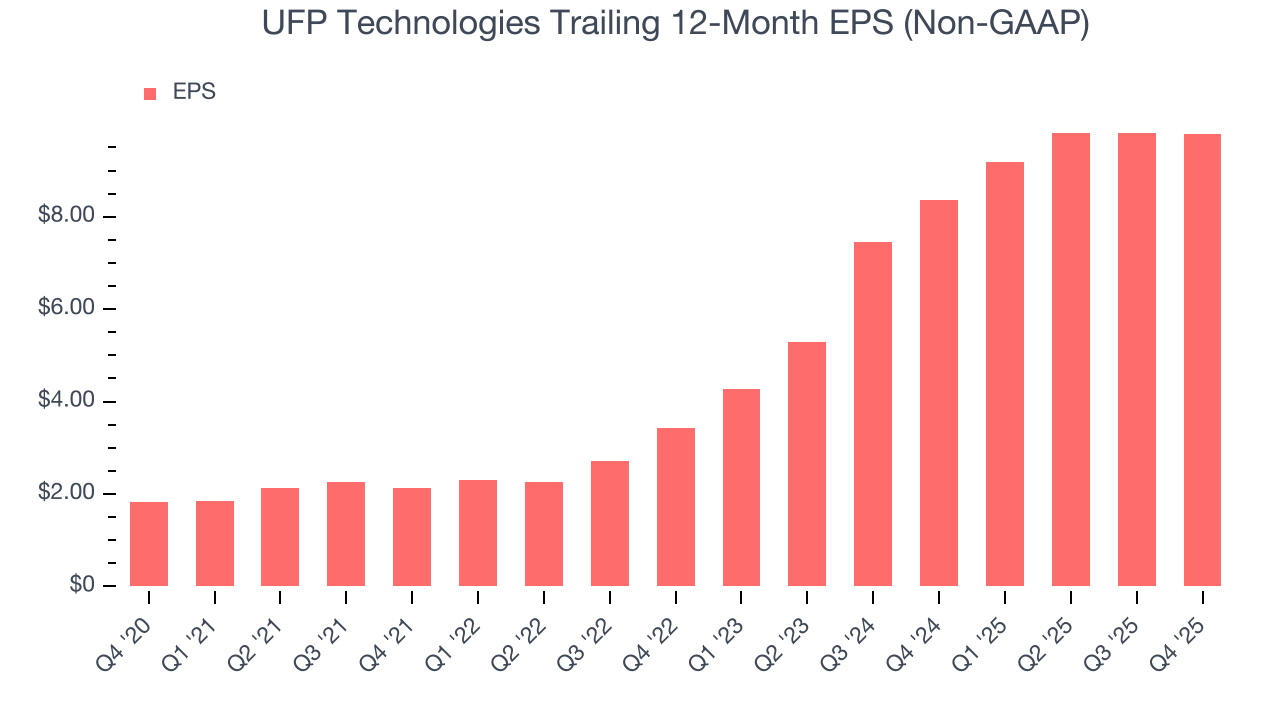

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

UFP Technologies’s EPS grew at an astounding 39.9% compounded annual growth rate over the last five years, higher than its 27.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into UFP Technologies’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, UFP Technologies’s operating margin declined this quarter but expanded by 5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, UFP Technologies reported adjusted EPS of $2.44, down from $2.46 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.2%. Over the next 12 months, Wall Street expects UFP Technologies’s full-year EPS of $9.80 to grow 7.6%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

UFP Technologies has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.7% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that UFP Technologies’s margin expanded by 8.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although UFP Technologies hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.6%, higher than most healthcare businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, UFP Technologies’s ROIC averaged 4.9 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

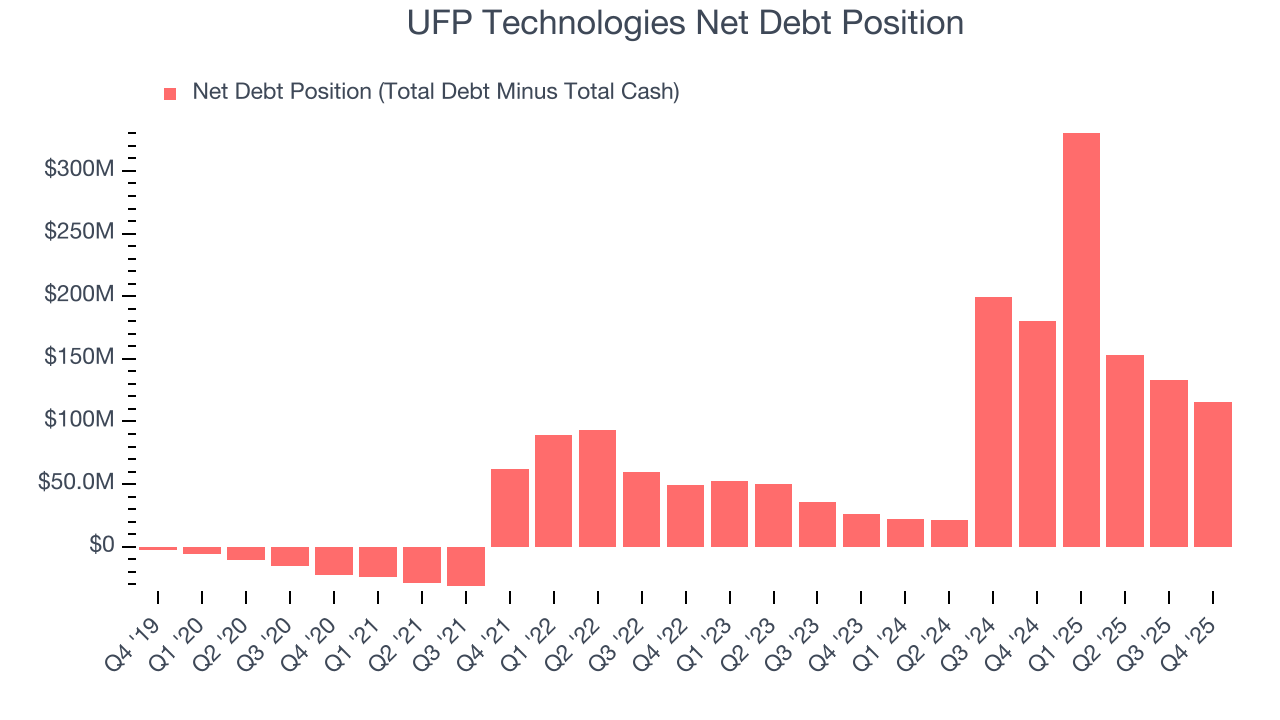

11. Balance Sheet Assessment

UFP Technologies reported $20.3 million of cash and $135.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $121.1 million of EBITDA over the last 12 months, we view UFP Technologies’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $5.94 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from UFP Technologies’s Q4 Results

It was good to see UFP Technologies beat analysts’ EPS expectations this quarter. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 4.5% to $229.03 immediately after reporting.

13. Is Now The Time To Buy UFP Technologies?

Updated: March 2, 2026 at 11:55 PM EST

Before making an investment decision, investors should account for UFP Technologies’s business fundamentals and valuation in addition to what happened in the latest quarter.

UFP Technologies isn’t a bad business, but we’re not clamoring to buy it here and now. To kick things off, its revenue growth was exceptional over the last five years. And while UFP Technologies’s subscale operations give it fewer distribution channels than its larger rivals, its rising cash profitability gives it more optionality.

UFP Technologies’s P/E ratio based on the next 12 months is 21.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $324.50 on the company (compared to the current share price of $203.90).