Upstart (UPST)

Upstart piques our interest. Its fast growth, robust unit economics, and strong outlook give it an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why Upstart Is Interesting

Using over 2,500 data variables and trained on nearly 82 million repayment events, Upstart (NASDAQ:UPST) is an AI-powered lending platform that uses machine learning to help banks and credit unions more accurately assess borrower risk for personal loans, auto loans, and home equity lines of credit.

- Expected revenue growth of 35.7% for the next year suggests its market share will rise

- Operating profits and efficiency rose over the last year as it benefited from some fixed cost leverage

- On the other hand, its negative free cash flow raises questions about the return timeline for its investments

Upstart has some respectable qualities. If you’re a believer, the price seems reasonable.

Why Is Now The Time To Buy Upstart?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Upstart?

Upstart’s stock price of $30.66 implies a valuation ratio of 2.5x forward price-to-sales. Upstart’s valuation seems like a good deal for the revenue momentum you get.

It could be a good time to invest if you see something the market doesn’t.

3. Upstart (UPST) Research Report: Q4 CY2025 Update

AI lending platform Upstart (NASDAQ:UPST) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 35.2% year on year to $296.1 million. The company’s full-year revenue guidance of $1.4 billion at the midpoint came in 10.1% above analysts’ estimates. Its GAAP profit of $0.17 per share was 12.7% above analysts’ consensus estimates.

Upstart (UPST) Q4 CY2025 Highlights:

- Revenue: $296.1 million vs analyst estimates of $289 million (35.2% year-on-year growth, 2.5% beat)

- EPS (GAAP): $0.17 vs analyst estimates of $0.15 (12.7% beat)

- Adjusted EBITDA: $63.69 million vs analyst estimates of $63 million (21.5% margin, 1.1% beat)

- Operating Margin: 6.4%, up from -2.2% in the same quarter last year

- Free Cash Flow was $104.6 million, up from -$135.3 million in the previous quarter

- Market Capitalization: $3.78 billion

Company Overview

Using over 2,500 data variables and trained on nearly 82 million repayment events, Upstart (NASDAQ:UPST) is an AI-powered lending platform that uses machine learning to help banks and credit unions more accurately assess borrower risk for personal loans, auto loans, and home equity lines of credit.

Upstart serves as a digital intermediary that connects borrowers with lenders through its marketplace. The company's competitive advantage lies in its sophisticated artificial intelligence models that analyze traditional credit factors alongside non-traditional variables like education, employment history, and bank account transactions to determine creditworthiness. These models aim to identify qualified borrowers who might be overlooked by conventional credit scoring methods.

When consumers visit Upstart.com or a partner-branded site, they can quickly check loan rates without affecting their credit score. Behind the scenes, Upstart's AI evaluates the application against its models for default risk, fraud detection, and income verification. For example, a recent college graduate with limited credit history but strong employment prospects might receive loan approval through Upstart when traditional methods would decline them.

The company generates revenue primarily through fees paid by lending partners when loans are originated. Upstart's business model includes three main channels: direct lending through Upstart.com, white-labeled solutions for bank partners, and Upstart Auto Retail software for dealerships. The company also services most loans originated through its platform, managing communications with borrowers and collections when necessary.

Beyond personal loans, which range from $200 to $50,000, Upstart has expanded into secured auto loans ($3,000 to $60,000) and home equity lines of credit ($26,000 to $250,000), creating additional growth avenues while applying its AI expertise to larger lending markets.

4. Lending Software

Businesses have come to use data driven insights to stratify their customers into more granular buckets that enable more personalized (and profitable) offerings. Lending software is a prime example of fintech democratizing access to loans in a still-profitable manner for financial institutions.

Upstart competes with traditional credit scoring companies like FICO (NYSE:FICO) and Experian (OTCMKTS:EXPGY), fintech lenders such as LendingClub (NYSE:LC) and SoFi (NASDAQ:SOFI), and AI lending platforms including Pagaya Technologies (NASDAQ:PGY).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Upstart grew its sales at an excellent 34.9% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Upstart’s annualized revenue growth of 42.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Upstart reported wonderful year-on-year revenue growth of 35.2%, and its $296.1 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 22.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and suggests the market is baking in success for its products and services.

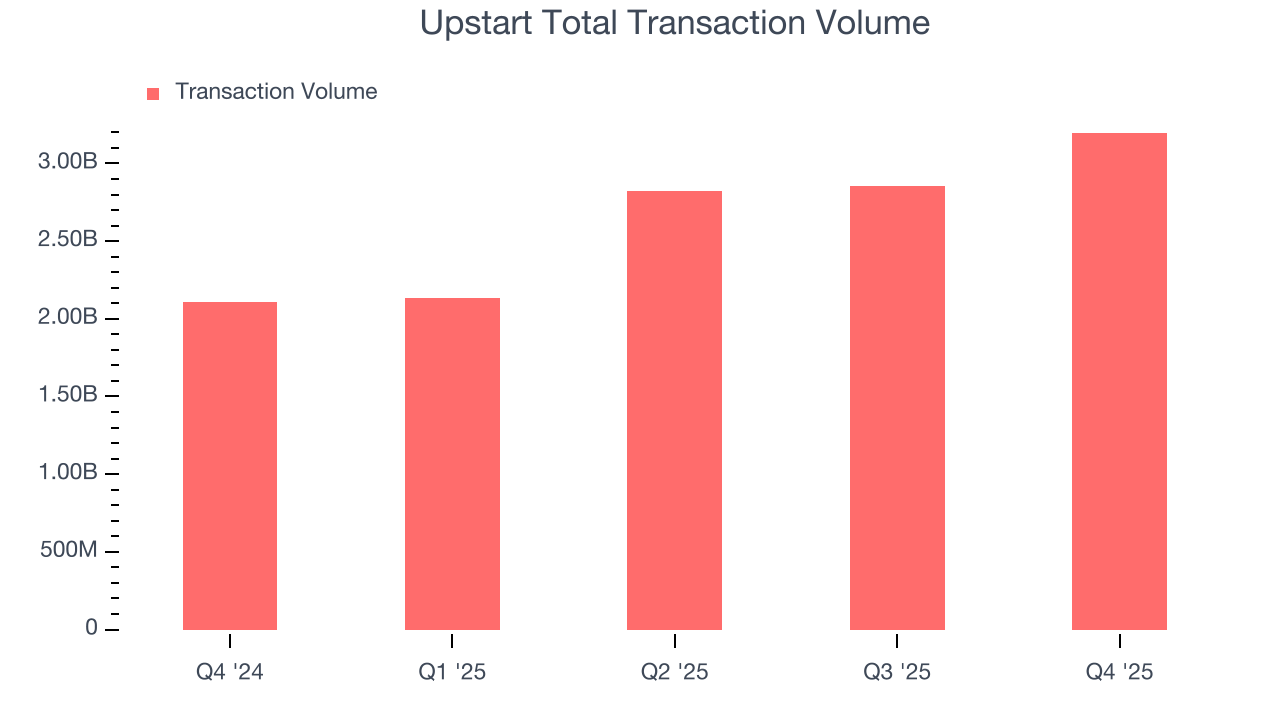

6. Total Transaction Volume

Total transaction volumes show the aggregate dollar value of loans processed on Upstart’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more accurate its software becomes at assessing credit risk.

Upstart’s transaction volume punched in at $3.20 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 51.6% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the interest income from loans retained on its balance sheet outpaced its loan processing fees. This is a double-edged sword - if the trend continues, it would expand Upstart’s revenue opportunities but also expose it to more delinquencies and defaults, increasing its risk profile.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Upstart’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

8. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Upstart’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 81.7% gross margin over the last year. Said differently, roughly $81.74 was left to spend on selling, marketing, and R&D for every $100 in revenue.

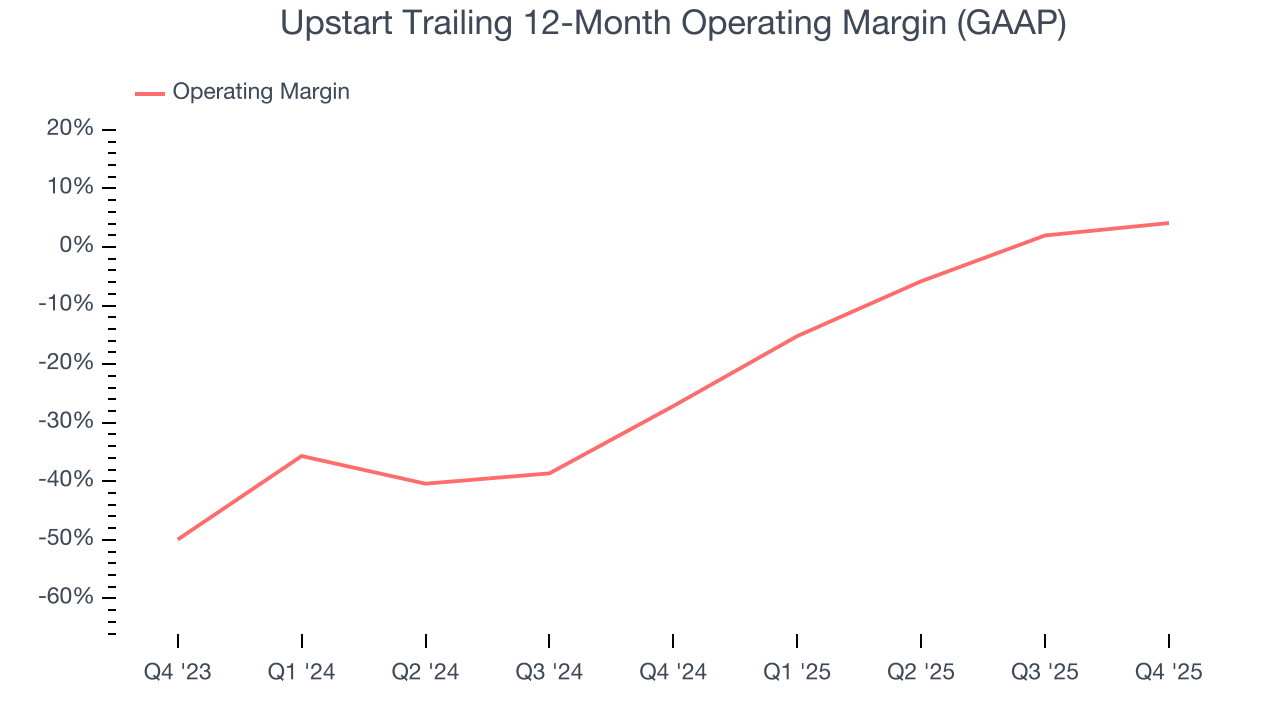

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Upstart has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 4.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Upstart’s operating margin rose by 31.2 percentage points over the last two years, as its sales growth gave it immense operating leverage.

This quarter, Upstart generated an operating margin profit margin of 6.4%, up 8.6 percentage points year on year. The increase was solid and shows its expenses recently grew slower than its revenue, leading to higher efficiency.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Upstart posted positive free cash flow this quarter, the broader story hasn’t been so clean. Upstart’s demanding reinvestments have drained its resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 18.2%, meaning it lit $18.16 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Upstart’s free cash flow clocked in at $104.6 million in Q4, equivalent to a 35.3% margin. Its cash flow turned positive after being negative in the same quarter last year

Looking forward, analysts predict Upstart will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 18.2% for the last 12 months will increase to positive 17%, giving it more optionality.

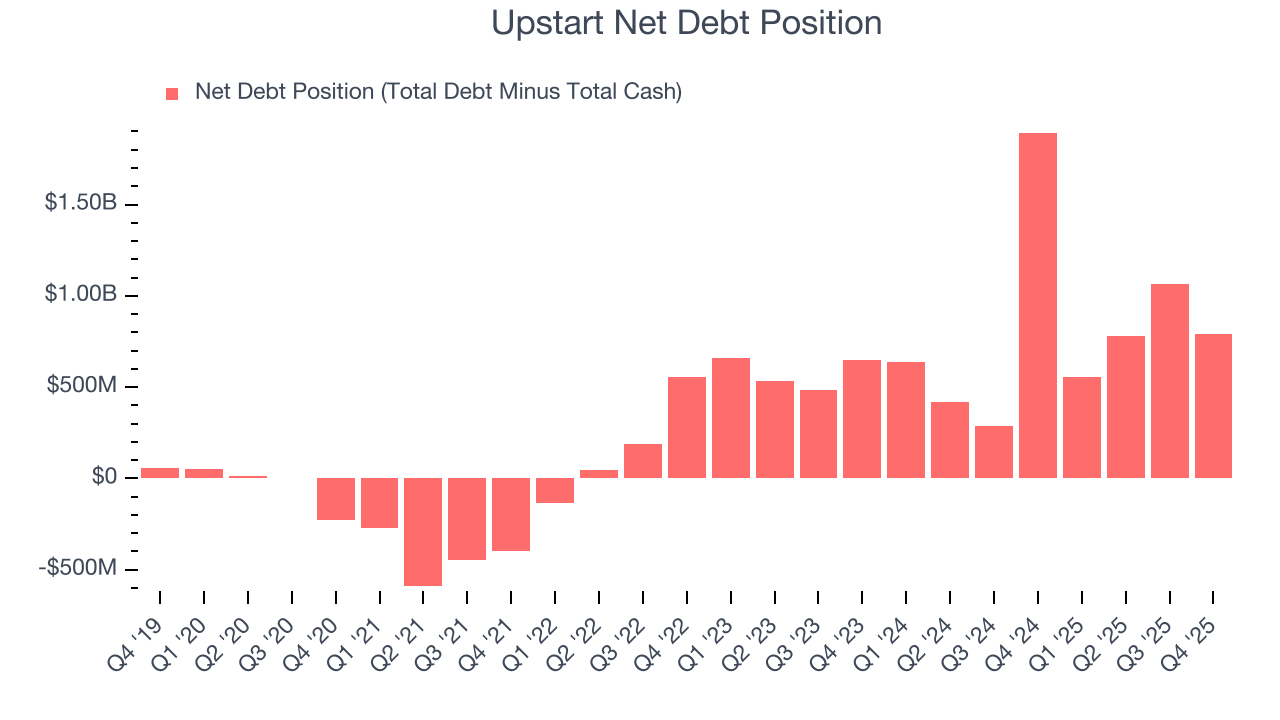

11. Balance Sheet Assessment

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Upstart burned through $189.6 million of cash over the last year. Although the company has $1.85 billion of debt on its balance sheet, we think its $1.06 billion of cash gives it enough runway (we typically look for at least two years) to prioritize growth over profitability.

12. Key Takeaways from Upstart’s Q4 Results

We were impressed by Upstart’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.9% to $41.20 immediately after reporting.

13. Is Now The Time To Buy Upstart?

Updated: February 19, 2026 at 9:16 PM EST

Before investing in or passing on Upstart, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There’s plenty to admire about Upstart. First off, its revenue growth was exceptional over the last five years, and analysts believe it can continue growing at these levels. And while its customer acquisition is less efficient than many comparable companies, its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its transaction volumes have soared, showcasing high user engagement and robust platform activity.

Upstart’s price-to-sales ratio based on the next 12 months is 2.5x. Looking at the software space right now, Upstart trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $52.33 on the company (compared to the current share price of $30.66), implying they see 70.7% upside in buying Upstart in the short term.