Vertex Pharmaceuticals (VRTX)

Vertex Pharmaceuticals doesn’t impress us. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Vertex Pharmaceuticals Is Not Exciting

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ:VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

- One positive is that its disciplined cost controls and effective management have materialized in a strong adjusted operating margin

Vertex Pharmaceuticals lacks the business quality we seek. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Vertex Pharmaceuticals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Vertex Pharmaceuticals

At $443.95 per share, Vertex Pharmaceuticals trades at 22.1x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Vertex Pharmaceuticals (VRTX) Research Report: Q3 CY2025 Update

Biotech company Vertex Pharmaceuticals (NASDAQ:VRTX) met Wall Streets revenue expectations in Q3 CY2025, with sales up 11% year on year to $3.08 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $11.95 billion at the midpoint. Its non-GAAP profit of $4.80 per share was 4.9% above analysts’ consensus estimates.

Vertex Pharmaceuticals (VRTX) Q3 CY2025 Highlights:

- Revenue: $3.08 billion vs analyst estimates of $3.06 billion (11% year-on-year growth, in line)

- Adjusted EPS: $4.80 vs analyst estimates of $4.58 (4.9% beat)

- Adjusted Operating Income: $1.38 billion vs analyst estimates of $1.38 billion (45% margin, in line)

- The company slightly lifted its revenue guidance for the full year to $11.95 billion at the midpoint from $11.93 billion

- Operating Margin: 38.6%, down from 40.3% in the same quarter last year

- Market Capitalization: $109.1 billion

Company Overview

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ:VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex has built its reputation on developing precision medicines that address the root causes of diseases rather than just managing symptoms. The company's most established franchise is in cystic fibrosis (CF), where it has five approved medicines that treat the underlying genetic defect in approximately three-quarters of the 94,000 CF patients in the U.S., Europe, Australia, and Canada.

The company's CF treatments work by modulating the defective CFTR protein that causes the disease. Its flagship product, TRIKAFTA/KAFTRIO, has transformed CF care by dramatically improving lung function and quality of life for patients. In late 2024, Vertex expanded its CF portfolio with ALYFTREK, its newest triple combination therapy.

Beyond CF, Vertex has successfully diversified into other serious genetic diseases. In 2023, the company received approval for CASGEVY, a groundbreaking CRISPR/Cas9 gene-editing therapy developed with CRISPR Therapeutics for sickle cell disease and transfusion-dependent beta thalassemia. This therapy represents the first approved CRISPR-based treatment and works by editing a patient's own stem cells to produce functional hemoglobin.

In early 2025, Vertex entered the pain management market with JOURNAVX, a non-opioid treatment for moderate-to-severe acute pain that works by inhibiting specific pain signals. The company is also advancing this compound for chronic neuropathic pain conditions.

Vertex's pipeline includes promising candidates for several other serious diseases. The company is developing treatments for APOL1-mediated kidney disease, IgA nephropathy, type 1 diabetes, myotonic dystrophy type 1, and autosomal dominant polycystic kidney disease. Its type 1 diabetes program, which uses stem cell-derived insulin-producing islet cells, aims to potentially cure the disease rather than just manage it.

The company employs a "serial innovation" strategy, advancing multiple compounds for each disease area and using various therapeutic modalities including small molecules, cell therapies, and genetic approaches. This approach has allowed Vertex to build a diverse pipeline while maintaining focus on diseases with clear biological targets and significant unmet needs.

Vertex generates revenue primarily through sales of its medicines to specialty pharmacies and distributors. The company invests heavily in research and development, typically reinvesting a substantial portion of its revenue into discovering and developing new treatments.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Vertex's competitors vary by therapeutic area. In cystic fibrosis, it faces limited competition due to its dominant position, though companies like AbbVie (NYSE:ABBV) and Pfizer (NYSE:PFE) have programs in development. For gene therapies like CASGEVY, competitors include bluebird bio (NASDAQ:BLUE) and CRISPR Therapeutics (NASDAQ:CRSP). In pain management, Vertex competes with traditional pharmaceutical companies like Pfizer, Eli Lilly (NYSE:LLY), and various makers of opioid and non-opioid pain medications.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $11.72 billion in revenue over the past 12 months, Vertex Pharmaceuticals has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

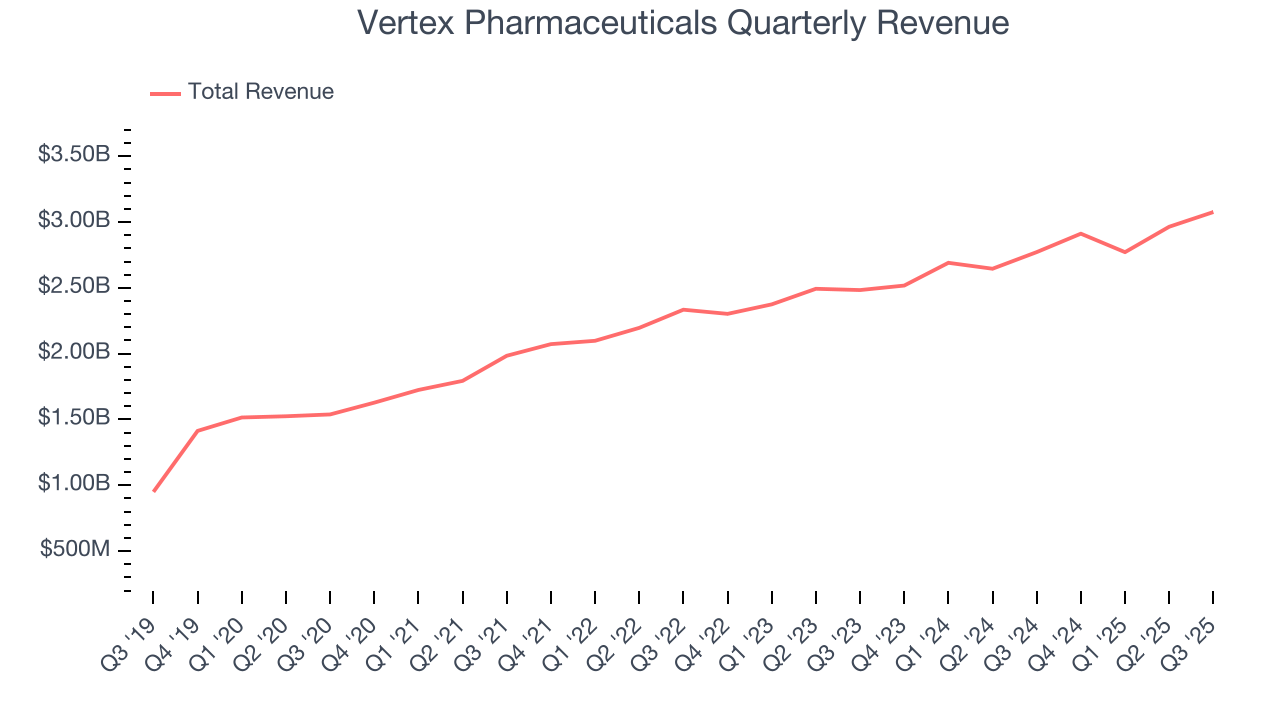

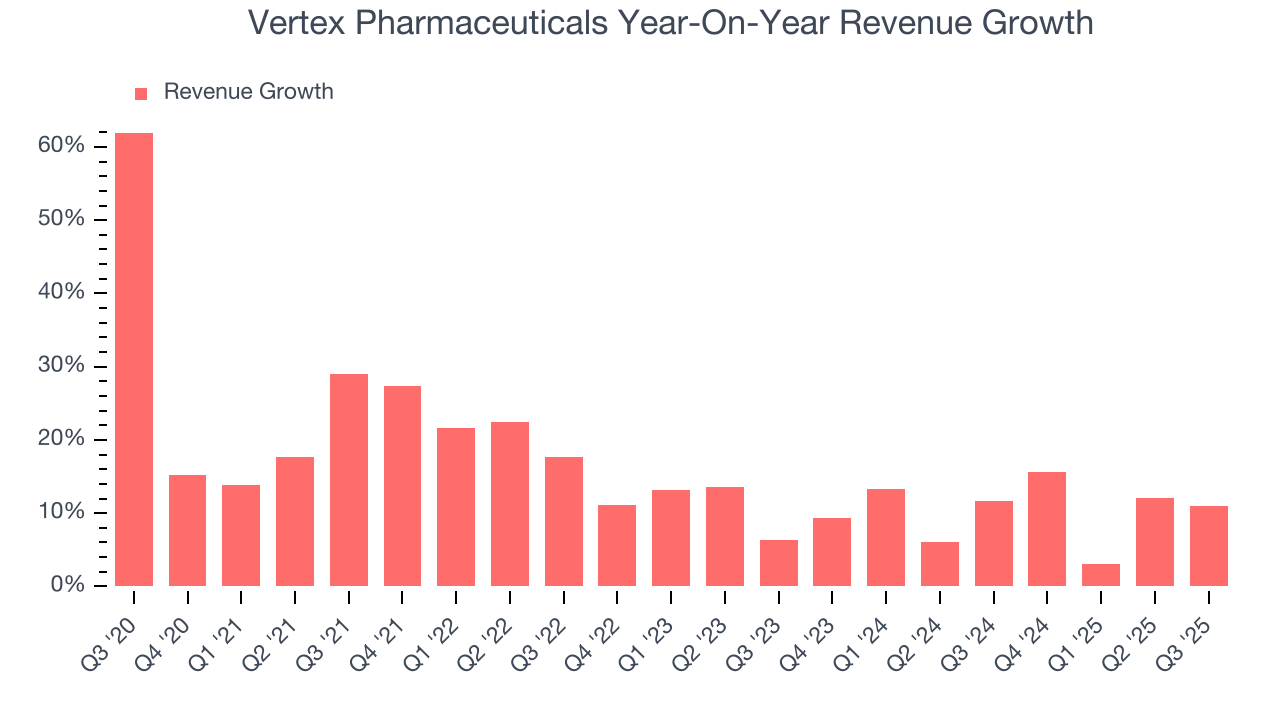

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Vertex Pharmaceuticals’s 14.4% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Vertex Pharmaceuticals’s annualized revenue growth of 10.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Vertex Pharmaceuticals’s year-on-year revenue growth was 11%, and its $3.08 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, similar to its two-year rate. This projection is particularly noteworthy for a company of its scale and indicates the market is baking in success for its products and services.

7. Adjusted Operating Margin

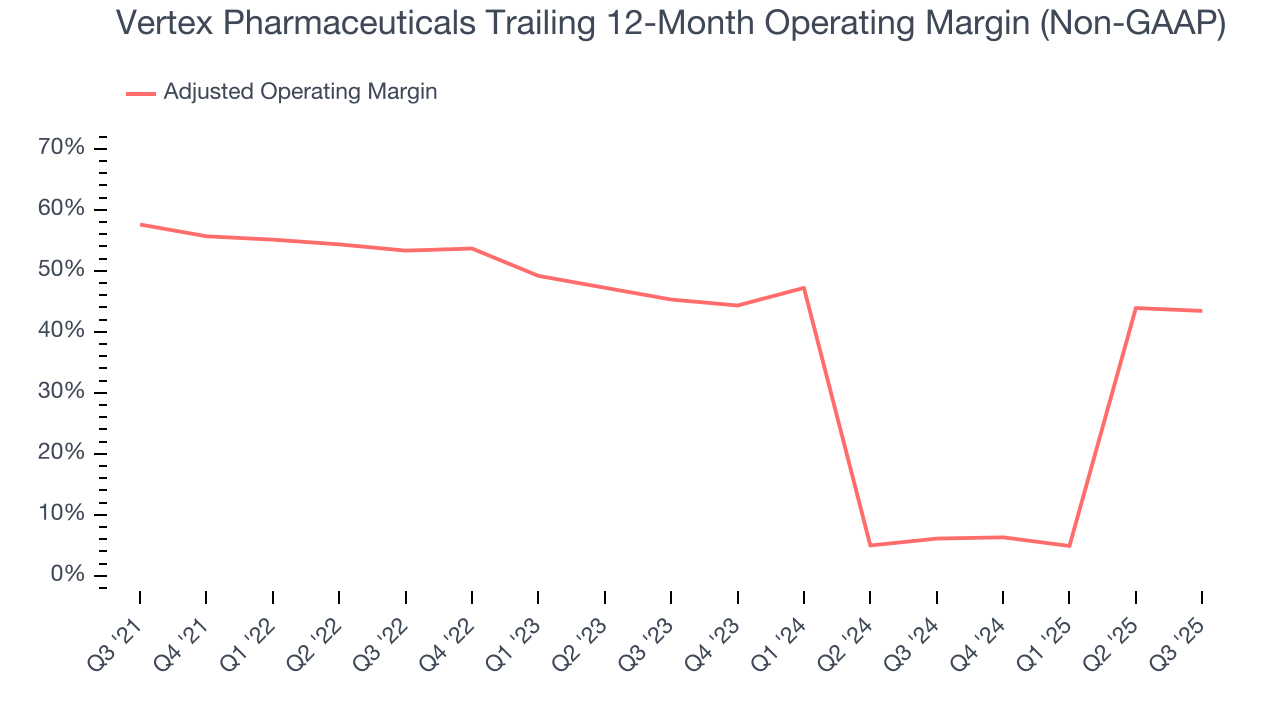

Vertex Pharmaceuticals has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 39.4%.

Looking at the trend in its profitability, Vertex Pharmaceuticals’s adjusted operating margin decreased by 14.2 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 1.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Vertex Pharmaceuticals generated an adjusted operating margin profit margin of 45%, down 2.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

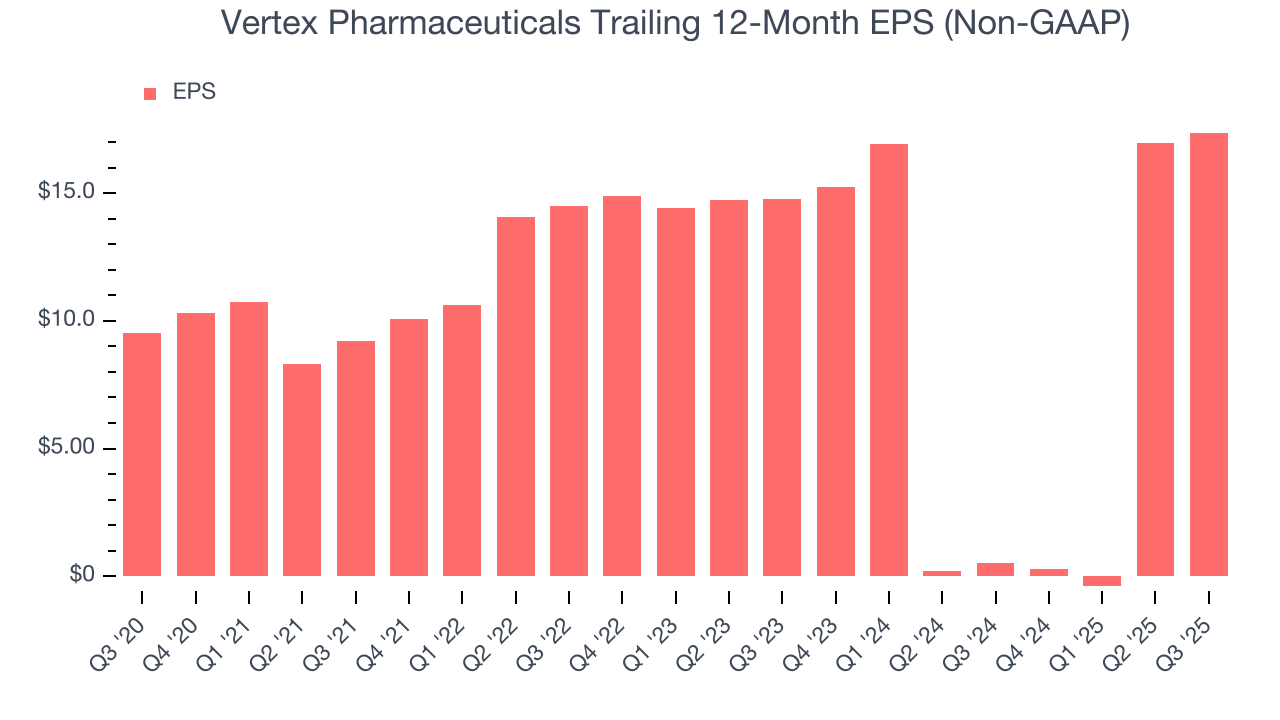

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Vertex Pharmaceuticals’s spectacular 12.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, Vertex Pharmaceuticals reported adjusted EPS of $4.80, up from $4.38 in the same quarter last year. This print beat analysts’ estimates by 4.9%. Over the next 12 months, Wall Street expects Vertex Pharmaceuticals’s full-year EPS of $17.37 to grow 15.8%.

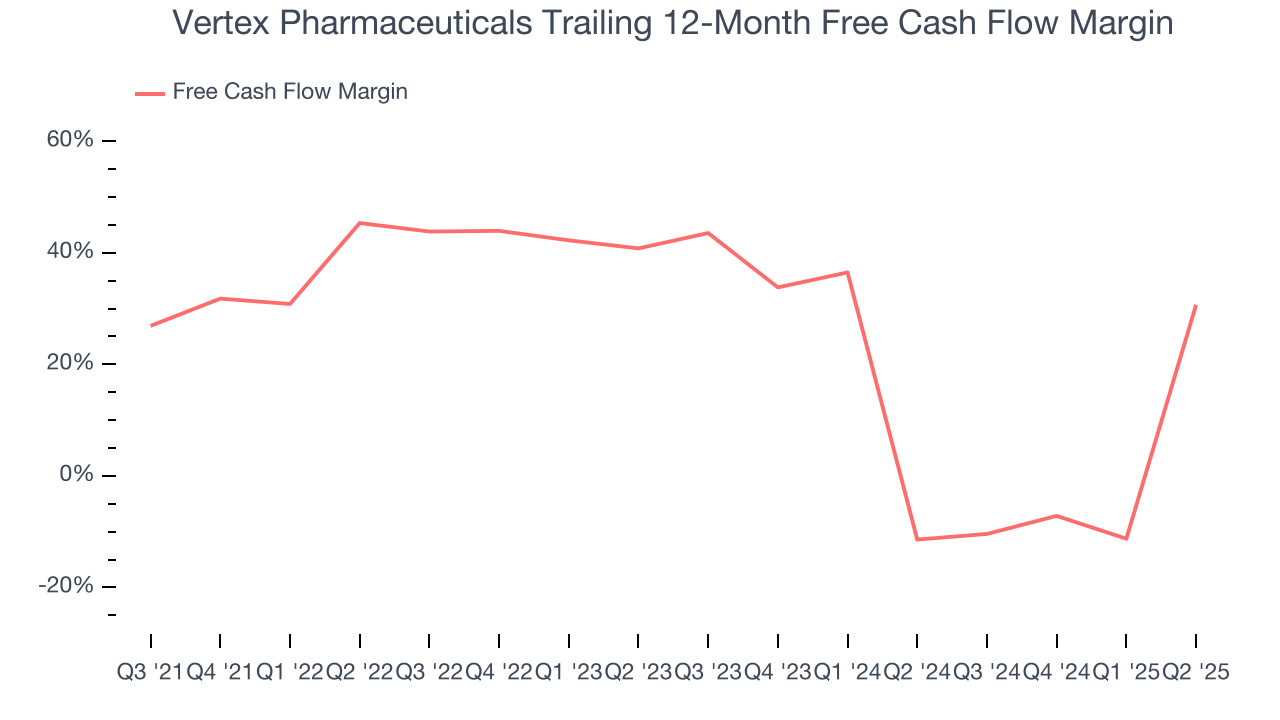

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Vertex Pharmaceuticals has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 24.6% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Vertex Pharmaceuticals’s margin expanded by 5.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Vertex Pharmaceuticals’s five-year average ROIC was 43.1%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Vertex Pharmaceuticals’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

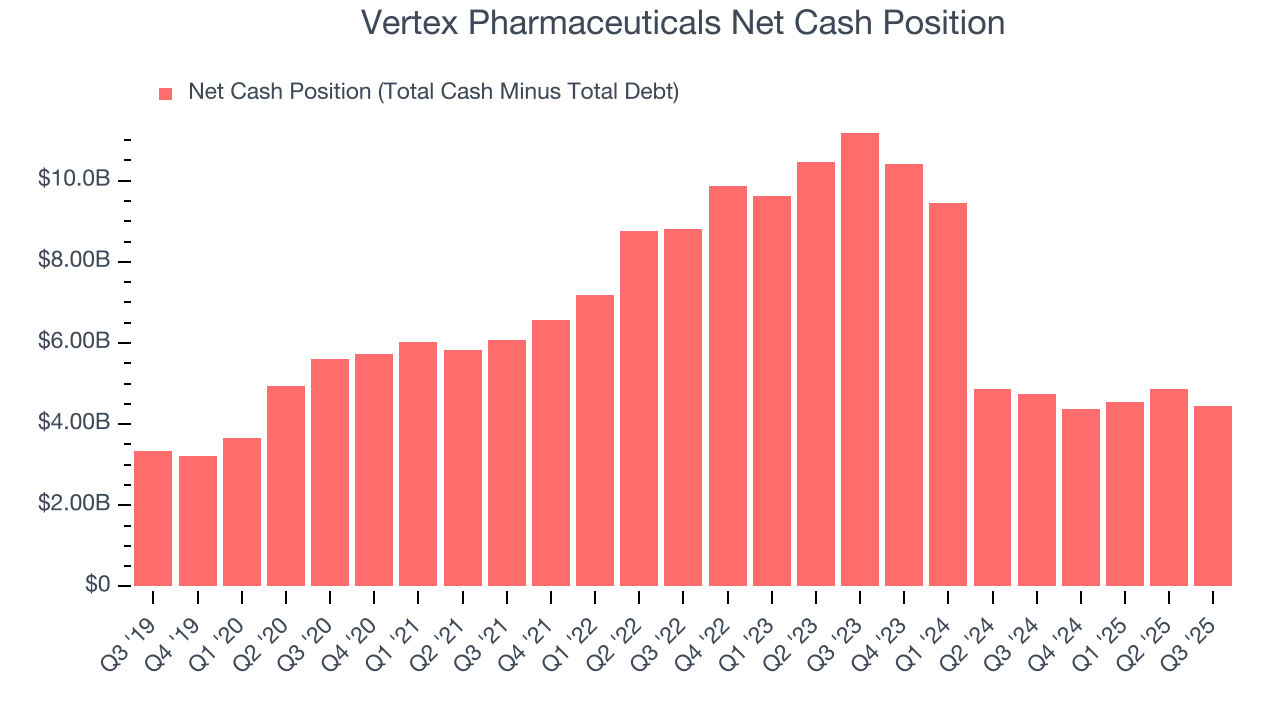

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Vertex Pharmaceuticals is a profitable, well-capitalized company with $6.29 billion of cash and $1.83 billion of debt on its balance sheet. This $4.45 billion net cash position is 4.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Vertex Pharmaceuticals’s Q3 Results

It was good to see Vertex Pharmaceuticals beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance was in line. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 3.8% to $410 immediately following the results.

13. Is Now The Time To Buy Vertex Pharmaceuticals?

Updated: January 20, 2026 at 11:04 PM EST

Before making an investment decision, investors should account for Vertex Pharmaceuticals’s business fundamentals and valuation in addition to what happened in the latest quarter.

Vertex Pharmaceuticals doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was solid over the last five years. And while Vertex Pharmaceuticals’s diminishing returns show management's prior bets haven't worked out, its impressive operating margins show it has a highly efficient business model.

Vertex Pharmaceuticals’s P/E ratio based on the next 12 months is 22.1x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $500.40 on the company (compared to the current share price of $443.95).