Werner (WERN)

We wouldn’t recommend Werner. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Werner Will Underperform

Conducting business in over a 100 countries, Werner (NASDAQ:WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 4.8% annually over the last two years

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 67.1% annually

- Investment activity picked up over the last five years, pressuring its weak free cash flow profitability

Werner is skating on thin ice. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Werner

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Werner

At $37.44 per share, Werner trades at 42.1x forward P/E. This valuation is extremely expensive, especially for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Werner (WERN) Research Report: Q4 CY2025 Update

Freight delivery company Werner (NASDAQ:WERN) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 2.3% year on year to $737.6 million. Its non-GAAP profit of $0.05 per share was 52.3% below analysts’ consensus estimates.

Werner (WERN) Q4 CY2025 Highlights:

- Revenue: $737.6 million vs analyst estimates of $758.6 million (2.3% year-on-year decline, 2.8% miss)

- Adjusted EPS: $0.05 vs analyst expectations of $0.10 (52.3% miss)

- Adjusted EBITDA: $37.52 million vs analyst estimates of $87.74 million (5.1% margin, 57.2% miss)

- Operating Margin: -4.9%, down from 1.8% in the same quarter last year

- Free Cash Flow was -$7.16 million, down from $42.25 million in the same quarter last year

- Market Capitalization: $2.26 billion

Company Overview

Conducting business in over a 100 countries, Werner (NASDAQ:WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

Werner was established in 1956 after the founder sold his family vehicle for a truck and began hauling cargo for other companies. The company expanded by acquiring various truckload carriers to expand its fleet and make deliveries in new regions. It primarily targeted small to medium sized companies such as ECM Transport Group in 2021. Today, the company offers full-truckload, less-than-truckload, and intermodal deliveries.

Its full-truckload deliveries consist of an entire truck dedicated to a single customer's shipment while its less-than-truckload deliveries are made with smaller shipments from multiple customers consolidated into a single truck. Both kinds of deliveries are made through its own fleet of trucks and trailers.

For some of its longer distance deliveries, Werner offers intermodal delivery service which combines the use of trucks and trains to move goods. This starts with Werner’s trucks picking up shipment from the customer’s location and taking them to the nearest rail terminal. The goods are then loaded onto trains, which transport them over long distances. Once the trains reach a terminal near the final destination, Werner's trucks again take over to deliver the goods to the final destination.

The company engages in various long-term agreements with its customers which can even span up to a decade. For example, it provides fleet contracts for its full-truckload deliveries where specific trucks and drivers are assigned exclusively to a single customer. Additionally, Werner provides volume discounts for customers who ship large quantities of goods regularly.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include C.H. Robinson (NASDAQ:CHRW), FedEx (NYSE:FDX), and J.B. Hunt (NASDAQ:JBHT).

5. Revenue Growth

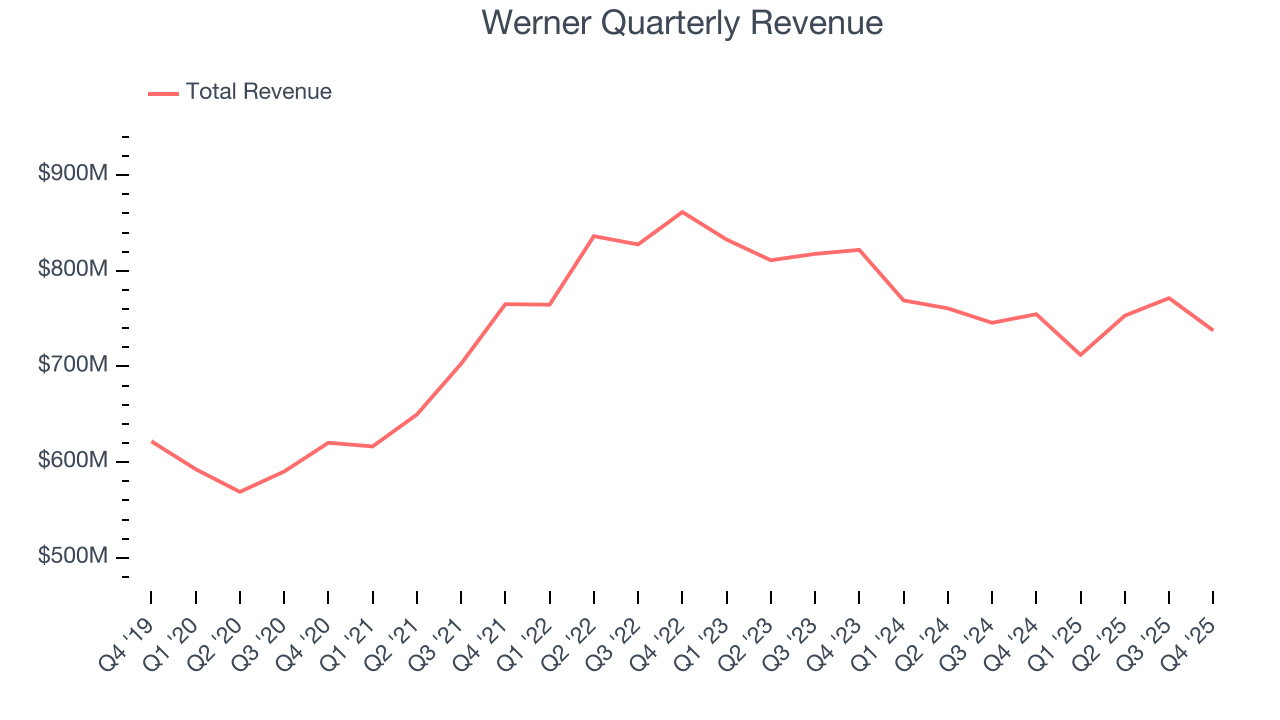

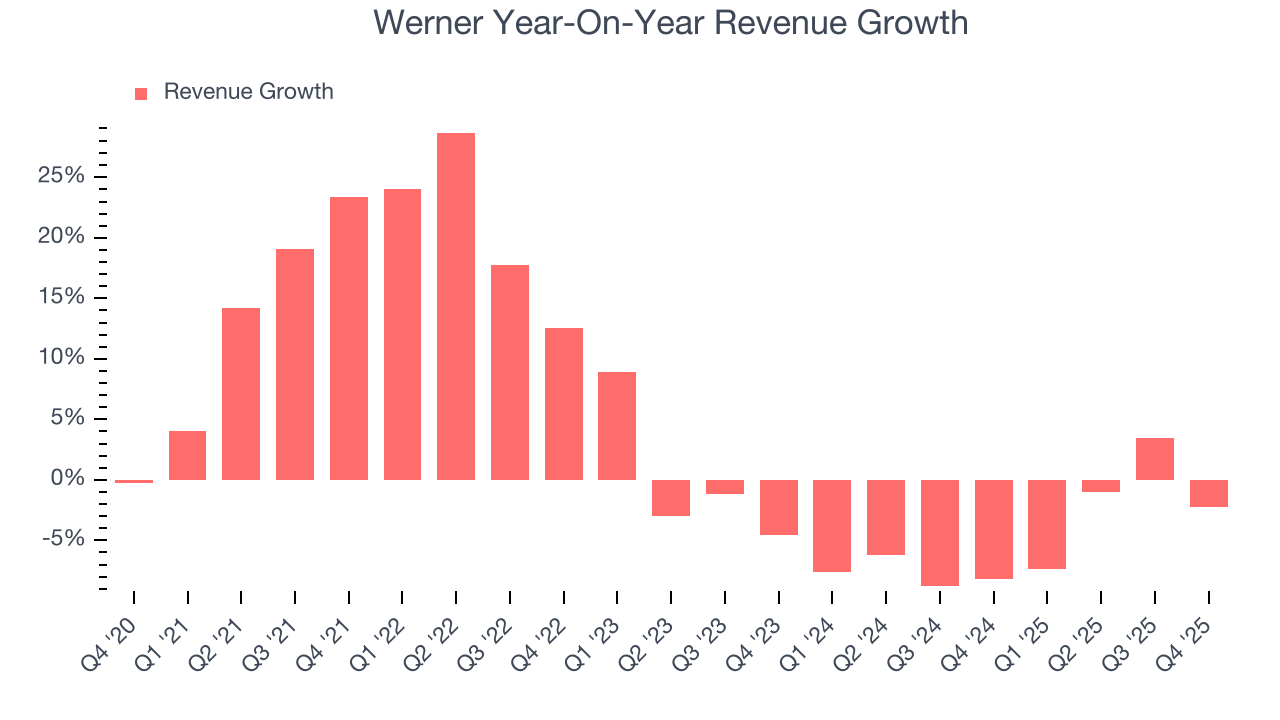

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Werner’s sales grew at a tepid 4.6% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Werner’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.8% annually.

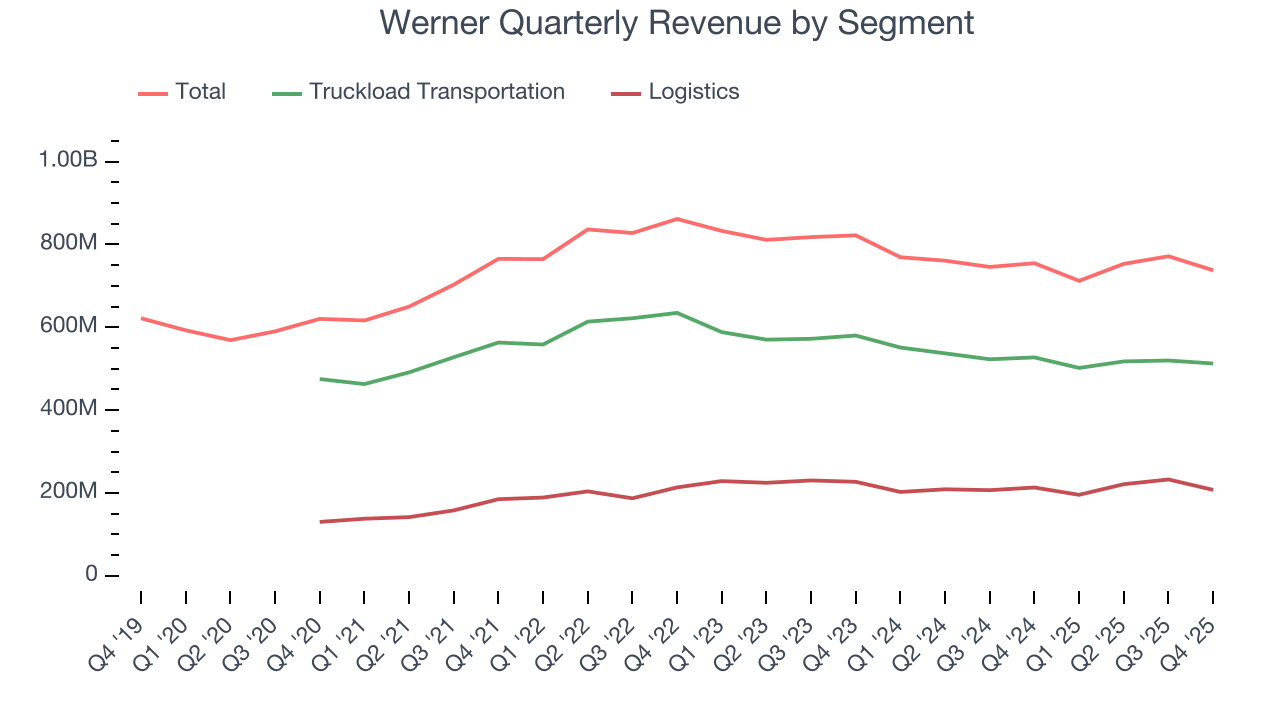

We can better understand the company’s revenue dynamics by analyzing its most important segments, Truckload Transportation and Logistics, which are 69.5% and 28.1% of revenue. Over the last two years, Werner’s Truckload Transportation revenue (deliveries made with Werner's fleet) averaged 5.7% year-on-year declines while its Logistics revenue (brokered deliveries using third-party fleets) averaged 2.8% declines.

This quarter, Werner missed Wall Street’s estimates and reported a rather uninspiring 2.3% year-on-year revenue decline, generating $737.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

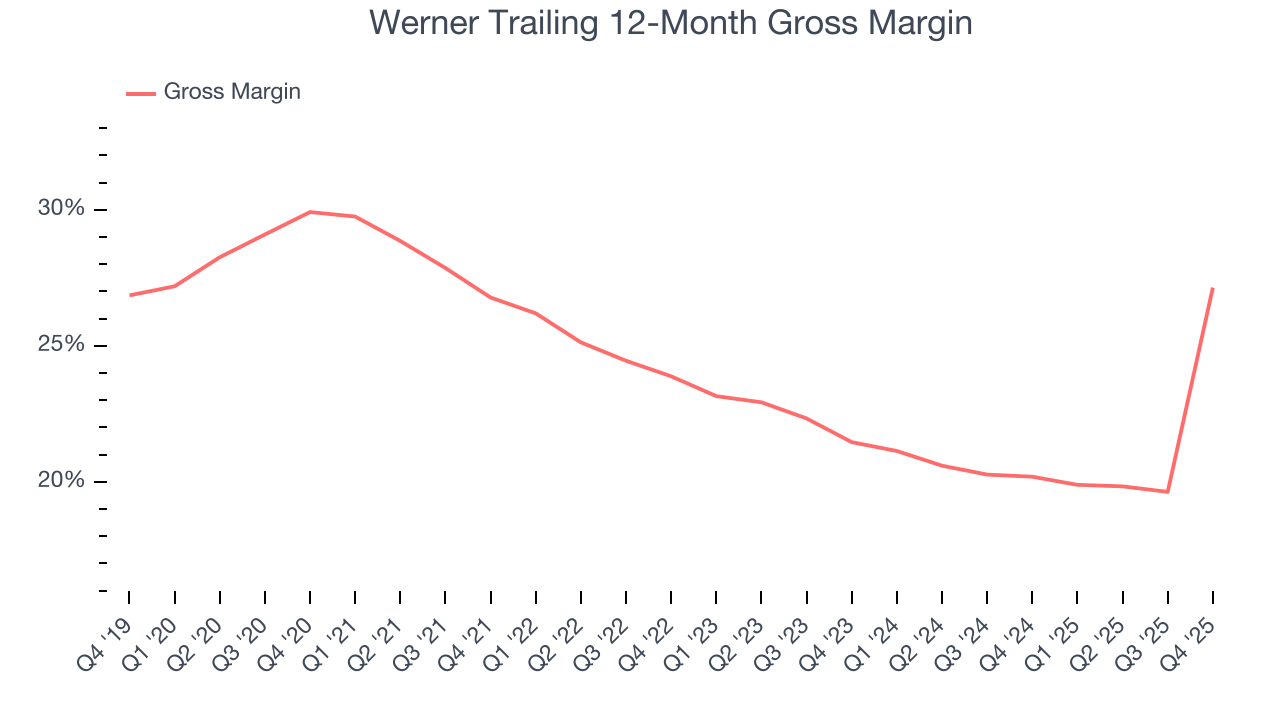

Werner has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 23.8% gross margin over the last five years. Said differently, Werner had to pay a chunky $76.22 to its suppliers for every $100 in revenue.

In Q4, Werner produced a 51.3% gross profit margin, up 30.3 percentage points year on year. Werner’s full-year margin has also been trending up over the past 12 months, increasing by 6.9 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

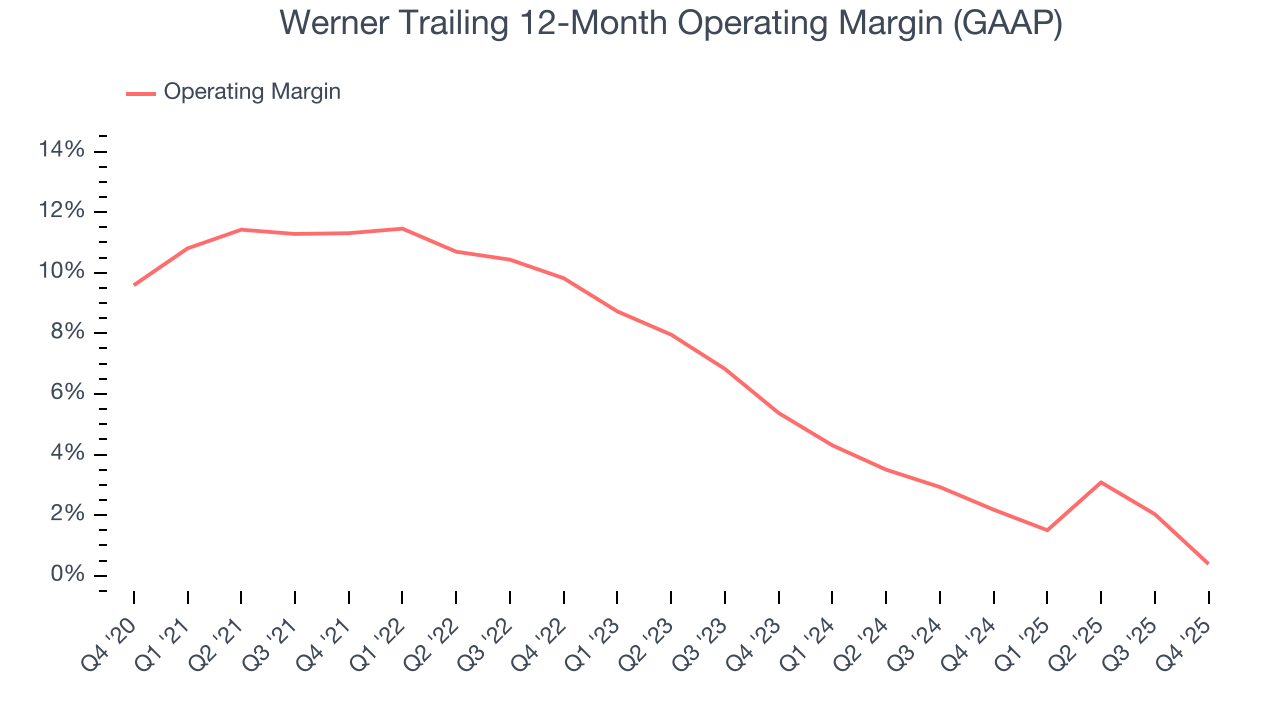

Werner was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Werner’s operating margin decreased by 10.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Werner’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Werner generated an operating margin profit margin of negative 4.9%, down 6.6 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

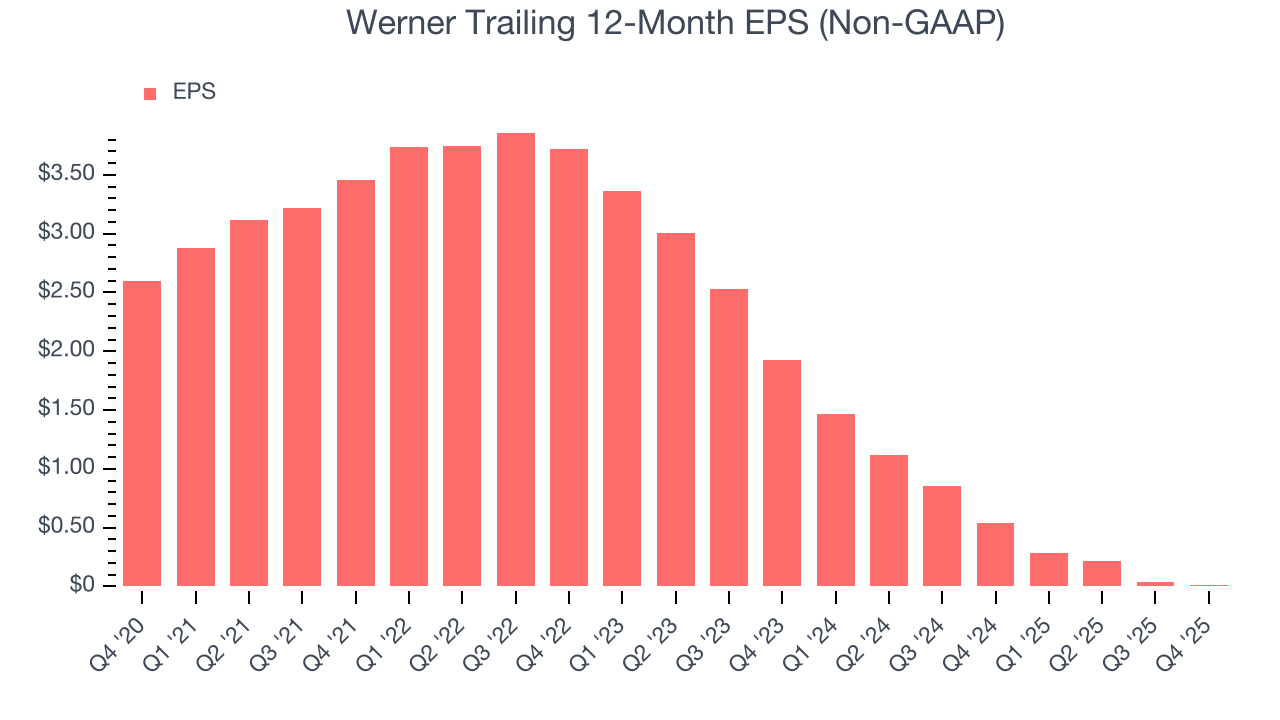

Sadly for Werner, its EPS declined by 67.1% annually over the last five years while its revenue grew by 4.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Werner’s earnings can give us a better understanding of its performance. As we mentioned earlier, Werner’s operating margin declined by 10.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Werner, its two-year annual EPS declines of 92.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Werner reported adjusted EPS of $0.05, down from $0.08 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Werner’s full-year EPS of $0.01 to grow 8,896%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

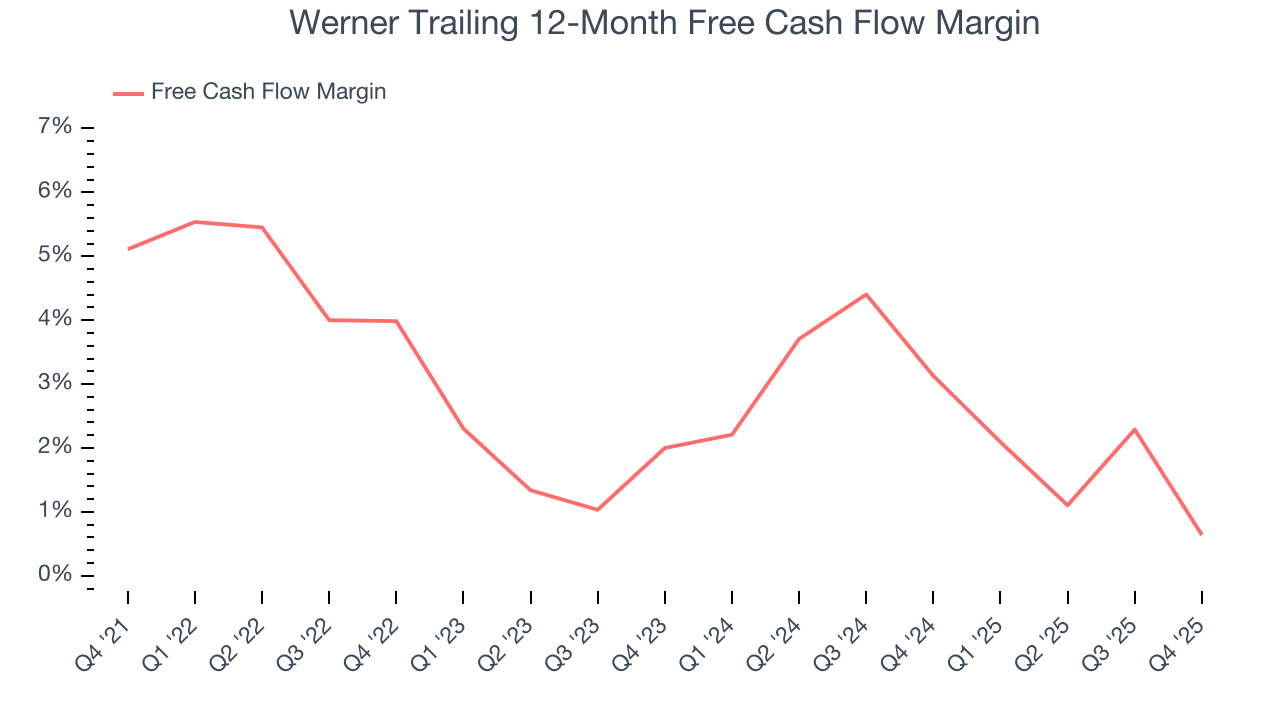

Werner has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.9%, lousy for an industrials business.

Taking a step back, we can see that Werner’s margin dropped by 4.5 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of an investment cycle.

Werner broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 6.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

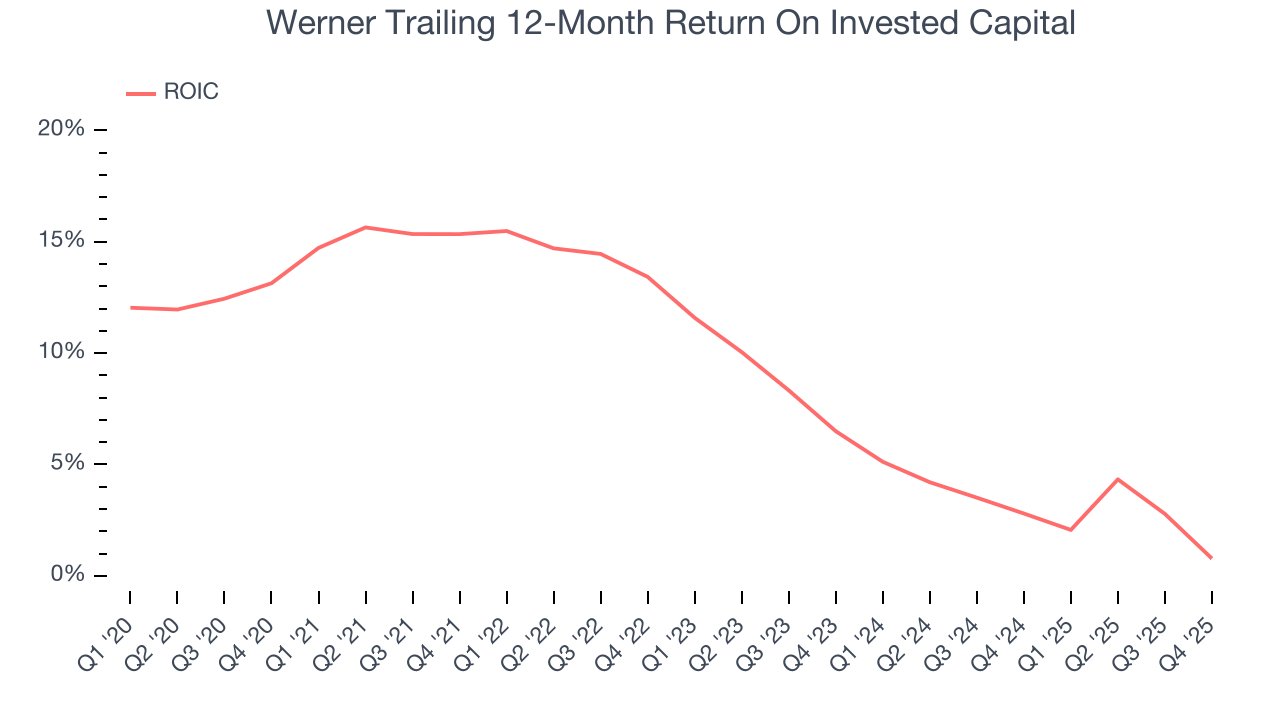

Werner historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Werner’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

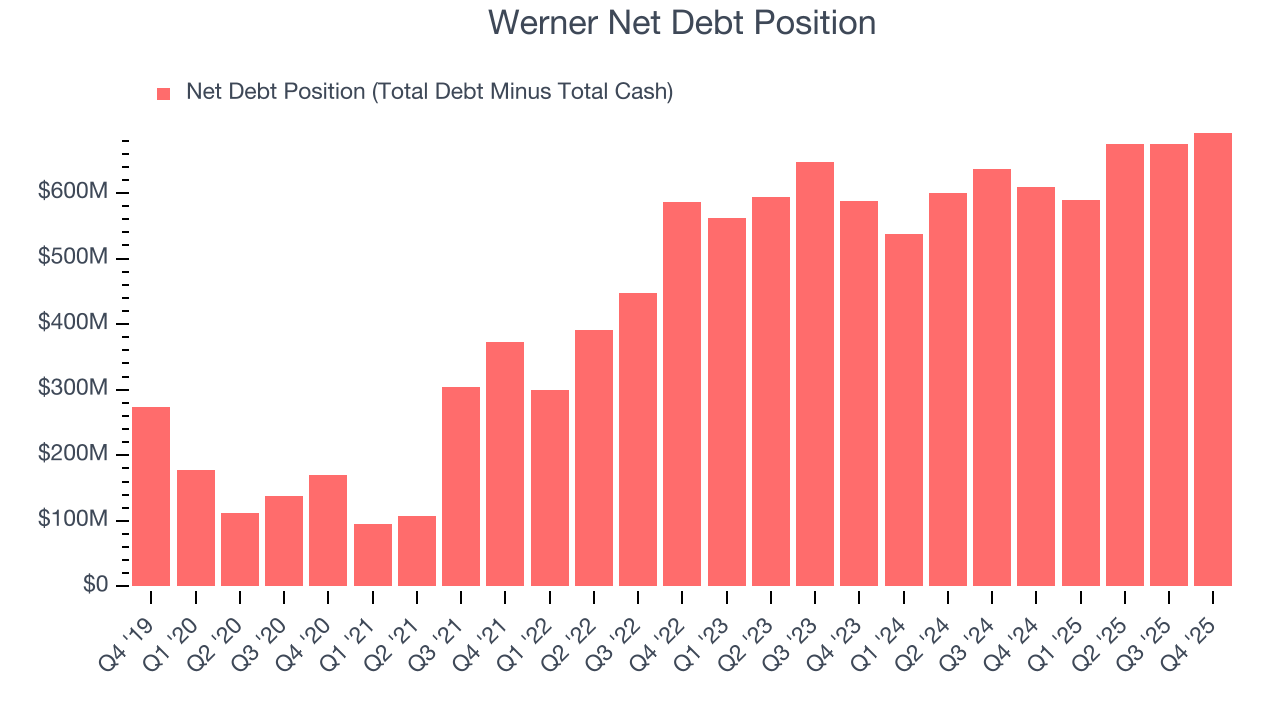

Werner reported $59.92 million of cash and $752 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $268.6 million of EBITDA over the last 12 months, we view Werner’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $15.55 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Werner’s Q4 Results

We struggled to find many positives in these results. Its Logistics revenue missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.2% to $37.44 immediately following the results.

13. Is Now The Time To Buy Werner?

Updated: February 5, 2026 at 10:45 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Werner.

Werner doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Werner’s P/E ratio based on the next 12 months is 42.1x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $32.33 on the company (compared to the current share price of $37.44), implying they don’t see much short-term potential in Werner.