WillScot Mobile Mini (WSC)

WillScot Mobile Mini keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think WillScot Mobile Mini Will Underperform

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 1.8% annually over the last two years

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Projected sales decline of 4.5% over the next 12 months indicates demand will continue deteriorating

WillScot Mobile Mini is skating on thin ice. There are better opportunities in the market.

Why There Are Better Opportunities Than WillScot Mobile Mini

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WillScot Mobile Mini

WillScot Mobile Mini is trading at $21.61 per share, or 20.8x forward P/E. WillScot Mobile Mini’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. WillScot Mobile Mini (WSC) Research Report: Q4 CY2025 Update

Temporary space provider WillScot (NASDAQ:WSC) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 6.1% year on year to $566 million. On the other hand, the company’s full-year revenue guidance of $2.18 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.29 per share was 11% below analysts’ consensus estimates.

WillScot Mobile Mini (WSC) Q4 CY2025 Highlights:

- Revenue: $566 million vs analyst estimates of $545.2 million (6.1% year-on-year decline, 3.8% beat)

- Adjusted EPS: $0.29 vs analyst expectations of $0.33 (11% miss)

- Adjusted EBITDA: $250 million vs analyst estimates of $249.3 million (44.2% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $900 million at the midpoint, below analyst estimates of $928 million

- Operating Margin: -32.5%, down from 28.9% in the same quarter last year

- Free Cash Flow Margin: 16.2%, down from 22.7% in the same quarter last year

- Market Capitalization: $4.02 billion

Company Overview

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

The company was founded in 1955 when Albert Vaughn “A.V.” Williams patented the technology for building mobile offices. Today, WillScot provides customers with modular office complexes, mobile offices and classrooms, portable restrooms, portable storage containers, fixed-in-place climate control storage units, and large hanger-like metal overhead tent structures. Other specialized solutions consist of blast-resistant modules that protect against petrochemicals and other harmful substances.

WillScot's customers span many industries and end markets such as construction, education, healthcare, and retail organizations. What unites them is the desire to outsource and the need for flexibility. For example, rather than spending time and capex dollars to construct a permanent facility that they may outgrow or soon become obsolete, a customer can outsource its needs to WillScot. This is similar to how enterprises used to erect on-premise, dedicated corporate data centers but are now increasingly outsourcing to companies such as Amazon AWS and Microsoft Azure.

WillScot generates revenue by leasing its modular spaces and portable storage units. Many of these lease agreements are multi-year in nature, which means the company isn't subject to violent swings in demand. It also sells its products on a one-off basis, but the recurring rental income it generates through leasing is its main source of revenue. The company's customers consist of construction, education, healthcare, and retail organizations.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Competitors in the modular space and portable storage industry include Mobile Modular Management (NASDAQ:MGRC), and private companies Modular Space, AKA ModSpace, and Pac-Van.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, WillScot Mobile Mini’s 10.8% annualized revenue growth over the last five years was impressive. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. WillScot Mobile Mini’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.8% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Leasing and Delivery and Installation, which are 77.3% and 16.5% of revenue. Over the last two years, WillScot Mobile Mini’s Leasing revenue (recurring) averaged 4.5% year-on-year declines while its Delivery and Installation revenue (non-recurring) averaged 6.9% declines.

This quarter, WillScot Mobile Mini’s revenue fell by 6.1% year on year to $566 million but beat Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to decline by 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

WillScot Mobile Mini has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 54.3% gross margin over the last five years. Said differently, roughly $54.25 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, WillScot Mobile Mini’s gross profit margin was 50.4% , marking a 5.4 percentage point decrease from 55.8% in the same quarter last year. WillScot Mobile Mini’s full-year margin has also been trending down over the past 12 months, decreasing by 3.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

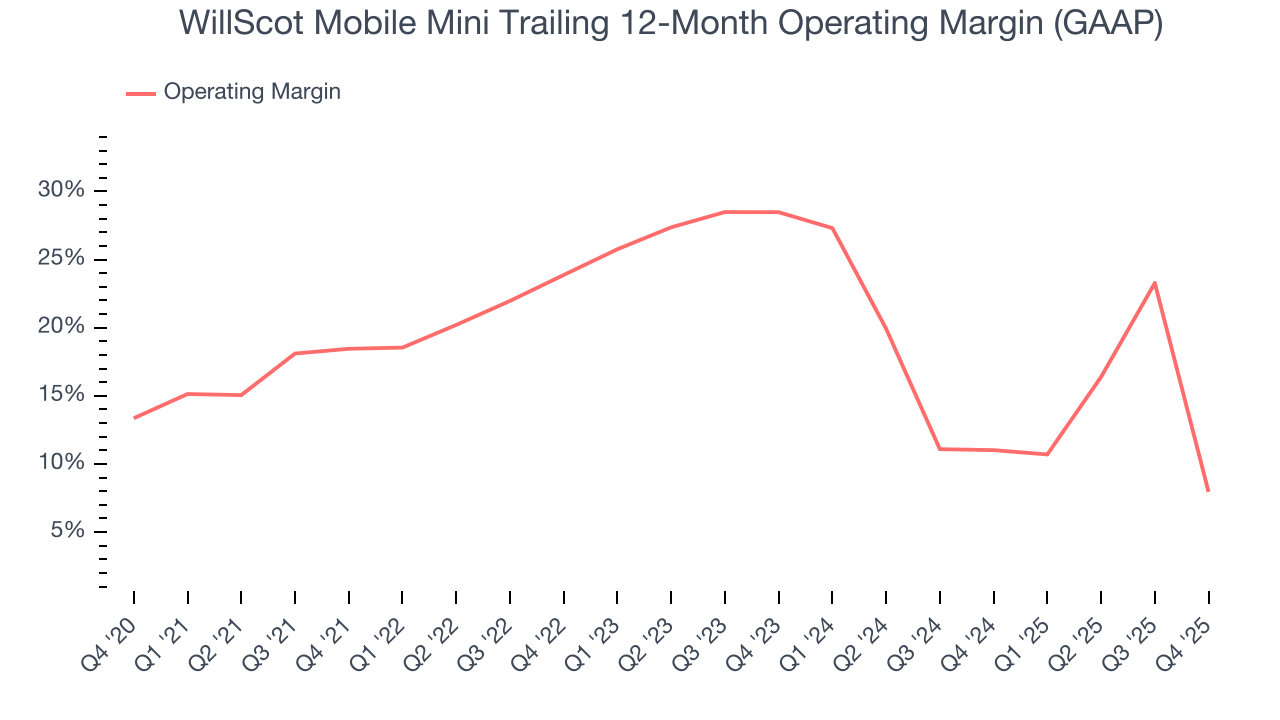

WillScot Mobile Mini has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, WillScot Mobile Mini’s operating margin decreased by 10.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, WillScot Mobile Mini generated an operating margin profit margin of negative 32.5%, down 61.4 percentage points year on year. Since WillScot Mobile Mini’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

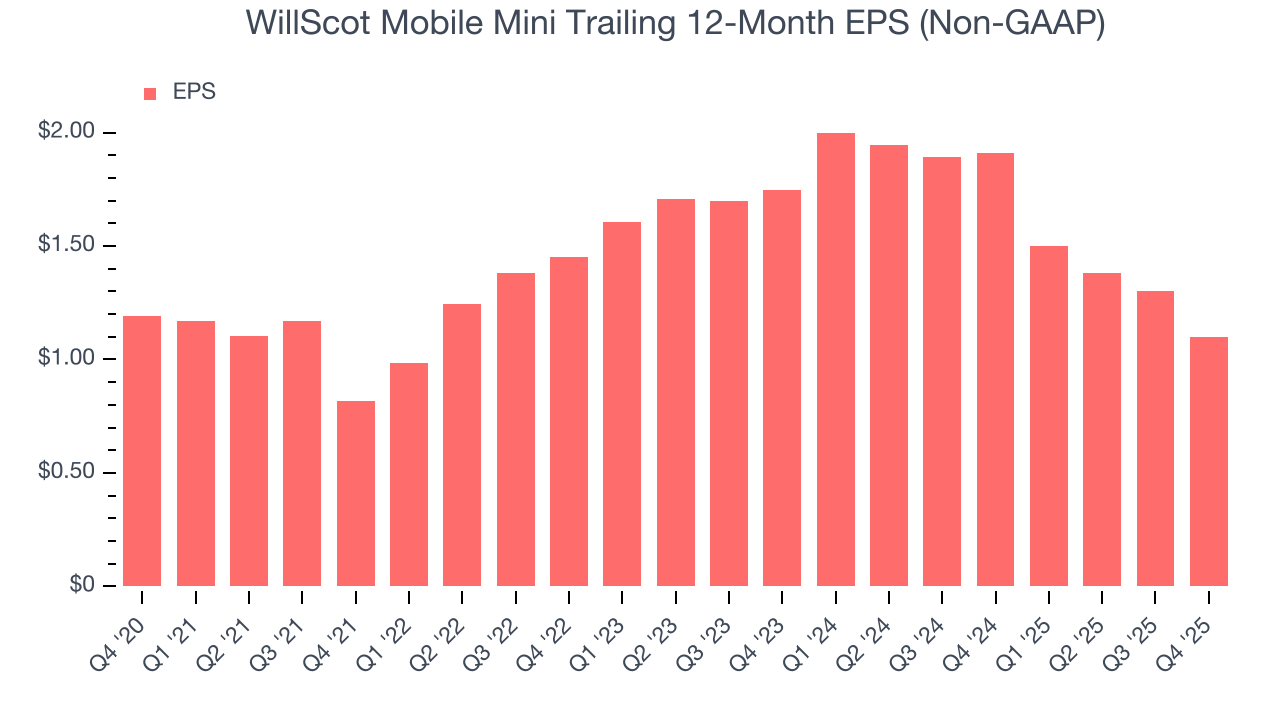

Sadly for WillScot Mobile Mini, its EPS declined by 1.6% annually over the last five years while its revenue grew by 10.8%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into WillScot Mobile Mini’s earnings to better understand the drivers of its performance. As we mentioned earlier, WillScot Mobile Mini’s operating margin declined by 10.5 percentage points over the last five years. Its share count also grew by 4.5%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For WillScot Mobile Mini, its two-year annual EPS declines of 20.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, WillScot Mobile Mini reported adjusted EPS of $0.29, down from $0.49 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects WillScot Mobile Mini’s full-year EPS of $1.10 to shrink by 3.1%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

WillScot Mobile Mini has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.6% over the last five years.

Taking a step back, we can see that WillScot Mobile Mini’s margin expanded by 6.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

WillScot Mobile Mini’s free cash flow clocked in at $91.45 million in Q4, equivalent to a 16.2% margin. The company’s cash profitability regressed as it was 6.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

WillScot Mobile Mini historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, WillScot Mobile Mini’s ROIC decreased by 3.9 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

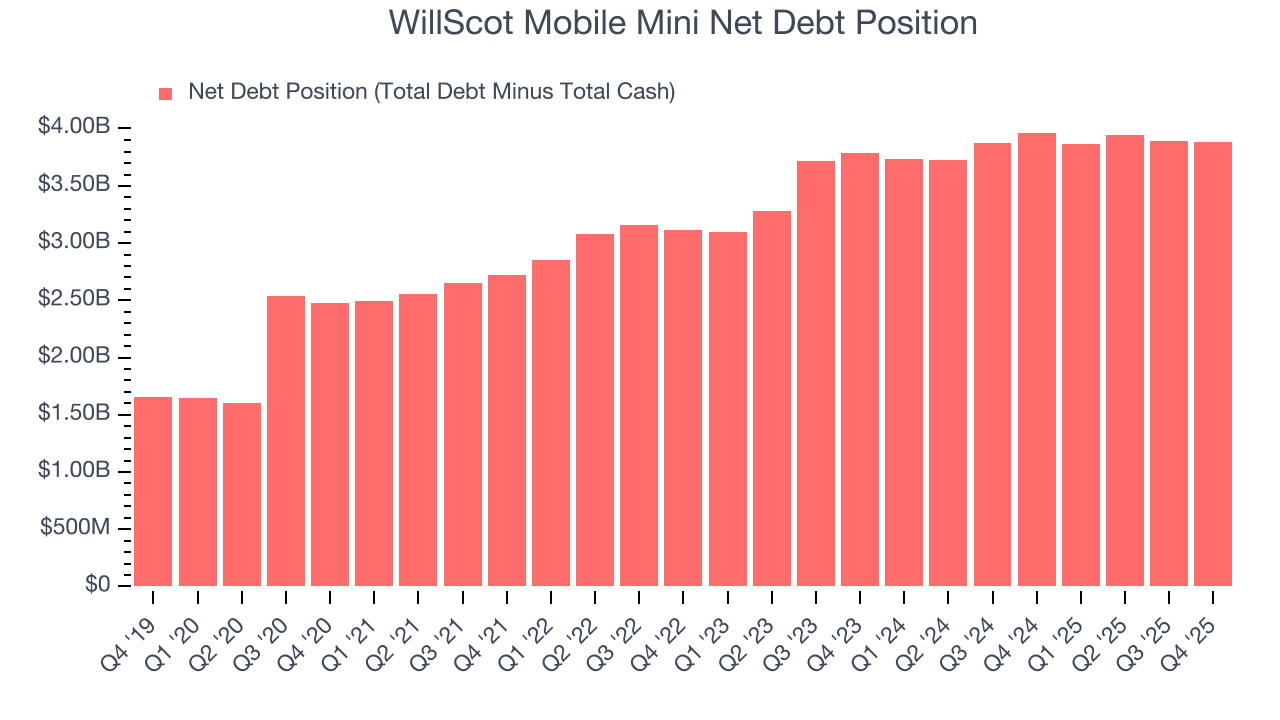

WillScot Mobile Mini reported $14.59 million of cash and $3.90 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $971 million of EBITDA over the last 12 months, we view WillScot Mobile Mini’s 4.0× net-debt-to-EBITDA ratio as safe. We also see its $120.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from WillScot Mobile Mini’s Q4 Results

We were impressed by how significantly WillScot Mobile Mini blew past analysts’ revenue expectations this quarter. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.8% to $21.29 immediately following the results.

13. Is Now The Time To Buy WillScot Mobile Mini?

Updated: February 27, 2026 at 10:37 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own WillScot Mobile Mini, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies making their customers lives easier, but in the case of WillScot Mobile Mini, we’ll be cheering from the sidelines. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s admirable gross margins indicate the mission-critical nature of its offerings, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets.

WillScot Mobile Mini’s P/E ratio based on the next 12 months is 20.8x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $24.85 on the company (compared to the current share price of $21.61).