Wintrust Financial (WTFC)

Wintrust Financial piques our interest, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Wintrust Financial Is Not Exciting

Founded in 1991 as a community-focused alternative to big banks in the Chicago area, Wintrust Financial (NASDAQGS:WTFC) operates community banks in the Chicago area and provides specialty finance services including insurance premium financing and wealth management.

- Net interest income is projected to tank by 6.7% over the next 12 months as demand evaporates

- 9.4% annual revenue growth over the last two years was slower than its banking peers

- High interest payments compared to its earnings raise concerns about its ability to service its debt consistently

Wintrust Financial has some noteworthy aspects, but we wouldn’t buy the stock until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Wintrust Financial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wintrust Financial

At $142.00 per share, Wintrust Financial trades at 1.3x forward P/B. While valuation is appropriate for the quality you get, we’re still not buyers.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Wintrust Financial (WTFC) Research Report: Q4 CY2025 Update

Regional banking company Wintrust Financial (NASDAQ:WTFC) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 10.8% year on year to $714.3 million. Its non-GAAP profit of $3.15 per share was 7.5% above analysts’ consensus estimates.

Wintrust Financial (WTFC) Q4 CY2025 Highlights:

- Net Interest Income: $583.9 million vs analyst estimates of $577.1 million (11.2% year-on-year growth, 1.2% beat)

- Net Interest Margin: 3.5% vs analyst estimates of 3.5% (2.3 basis point beat)

- Revenue: $714.3 million vs analyst estimates of $702.7 million (10.8% year-on-year growth, 1.6% beat)

- Efficiency Ratio: 53.9% vs analyst estimates of 54.5% (54.2 basis point beat)

- Adjusted EPS: $3.15 vs analyst estimates of $2.93 (7.5% beat)

- Tangible Book Value per Share: $88.66 vs analyst estimates of $87.93 (17.6% year-on-year growth, 0.8% beat)

- Market Capitalization: $9.77 billion

Company Overview

Founded in 1991 as a community-focused alternative to big banks in the Chicago area, Wintrust Financial (NASDAQGS:WTFC) operates community banks in the Chicago area and provides specialty finance services including insurance premium financing and wealth management.

Wintrust operates through fifteen nationally chartered banks, giving it a unique multi-bank structure that allows customers to benefit from expanded FDIC insurance coverage through its MaxSafe deposit accounts. This structure differentiates Wintrust from competitors who have consolidated their bank charters into branch networks.

The company's business is organized into three main segments. The Community Banking segment offers personal and commercial banking services, including deposit products, loans, and treasury management services. Wintrust has developed specialized lending niches such as condominium association services, mortgage warehouse lending, insurance agency financing, and franchise lending.

In its Specialty Finance segment, Wintrust has built a significant presence in insurance premium financing through FIRST Insurance Funding and Wintrust Life Finance. These divisions provide loans to businesses and individuals to finance their insurance policy premiums, with operations extending throughout the United States and Canada. This segment also includes Wintrust Asset Finance, which provides equipment financing, and Tricom, which offers accounts receivable financing and administrative services to the temporary staffing industry.

The Wealth Management segment delivers investment advisory, trust services, securities brokerage, and retirement planning through subsidiaries including The Chicago Trust Company, Wintrust Investments, Great Lakes Advisors, and Chicago Deferred Exchange Company. The latter provides tax-deferred like-kind exchange services under IRC Section 1031, which can generate customer deposits for Wintrust's banks.

A typical Wintrust customer might be a mid-sized business in the Chicago area that uses the bank for commercial loans and cash management services, while also utilizing its wealth management services for the business owner's personal investments and estate planning.

4. Regional Banks

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

Wintrust Financial competes with larger regional banks like Fifth Third Bancorp (NASDAQ:FITB) and U.S. Bancorp (NYSE:USB), as well as local Chicago-area financial institutions such as First Midwest Bancorp (now part of Old National Bancorp, NASDAQ:ONB) and MB Financial (acquired by Fifth Third). In its specialty finance segments, particularly premium finance, it competes with IPFS Corporation and Afco Credit Corporation.

5. Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Luckily, Wintrust Financial’s revenue grew at a decent 10.6% compounded annual growth rate over the last five years. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Wintrust Financial’s recent performance shows its demand has slowed as its annualized revenue growth of 9.4% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Wintrust Financial reported year-on-year revenue growth of 10.8%, and its $714.3 million of revenue exceeded Wall Street’s estimates by 1.6%.

Net interest income made up 76.5% of the company’s total revenue during the last five years, meaning lending operations are Wintrust Financial’s largest source of revenue.

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

6. Efficiency Ratio

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

Over the last five years, Wintrust Financial’s efficiency ratio has swelled by 6 percentage points, going from 66.2% to 55.5%. Said differently, the company’s expenses have grown at a slower rate than revenue, which typically signals prudent management.

In Q4, Wintrust Financial’s efficiency ratio was 53.9%, beating analysts’ expectations by 54.2 basis points (100 basis points = 1 percentage point).

For the next 12 months, Wall Street expects Wintrust Financial to maintain its trailing one-year ratio with a projection of 54.8%.

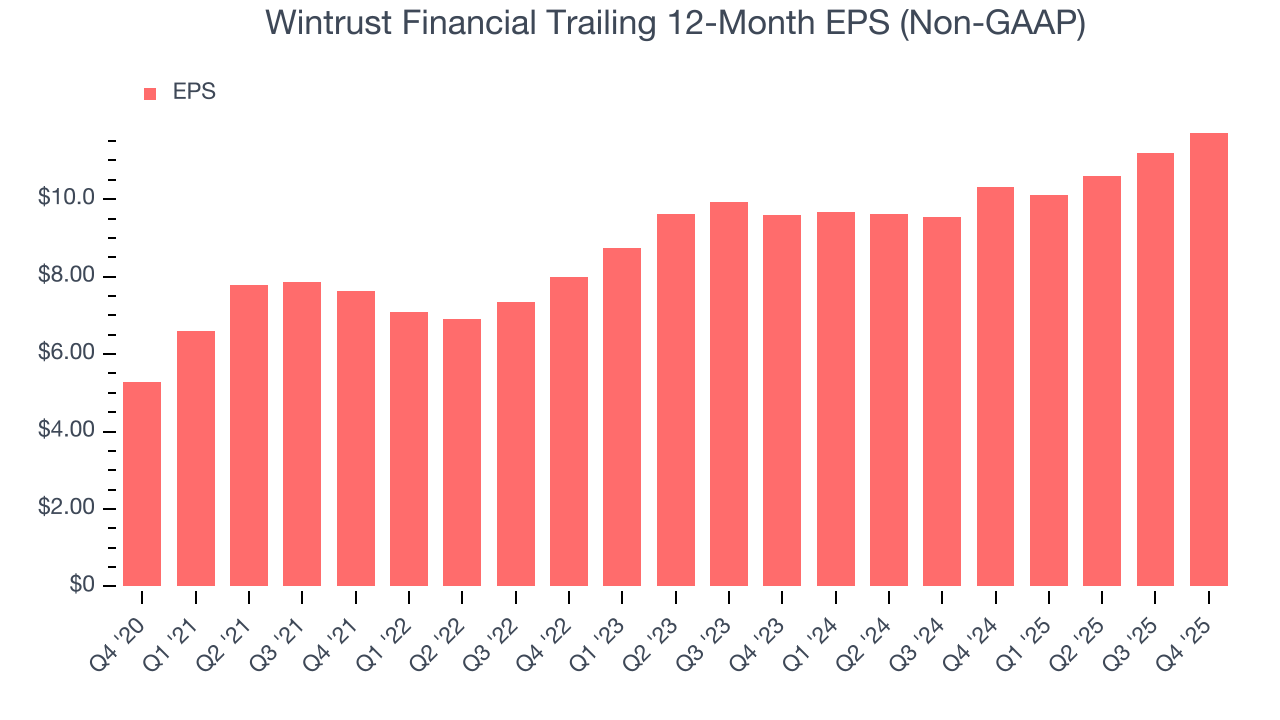

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Wintrust Financial’s EPS grew at a spectacular 17.3% compounded annual growth rate over the last five years, higher than its 10.6% annualized revenue growth. However, we take this with a grain of salt because its efficiency ratio didn’t improve and it didn’t repurchase its shares, meaning the delta came from factors we consider non-core or less sustainable over the long term.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Wintrust Financial, its two-year annual EPS growth of 10.6% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Wintrust Financial reported adjusted EPS of $3.15, up from $2.63 in the same quarter last year. This print beat analysts’ estimates by 7.5%. Over the next 12 months, Wall Street expects Wintrust Financial’s full-year EPS of $11.72 to grow 1.9%.

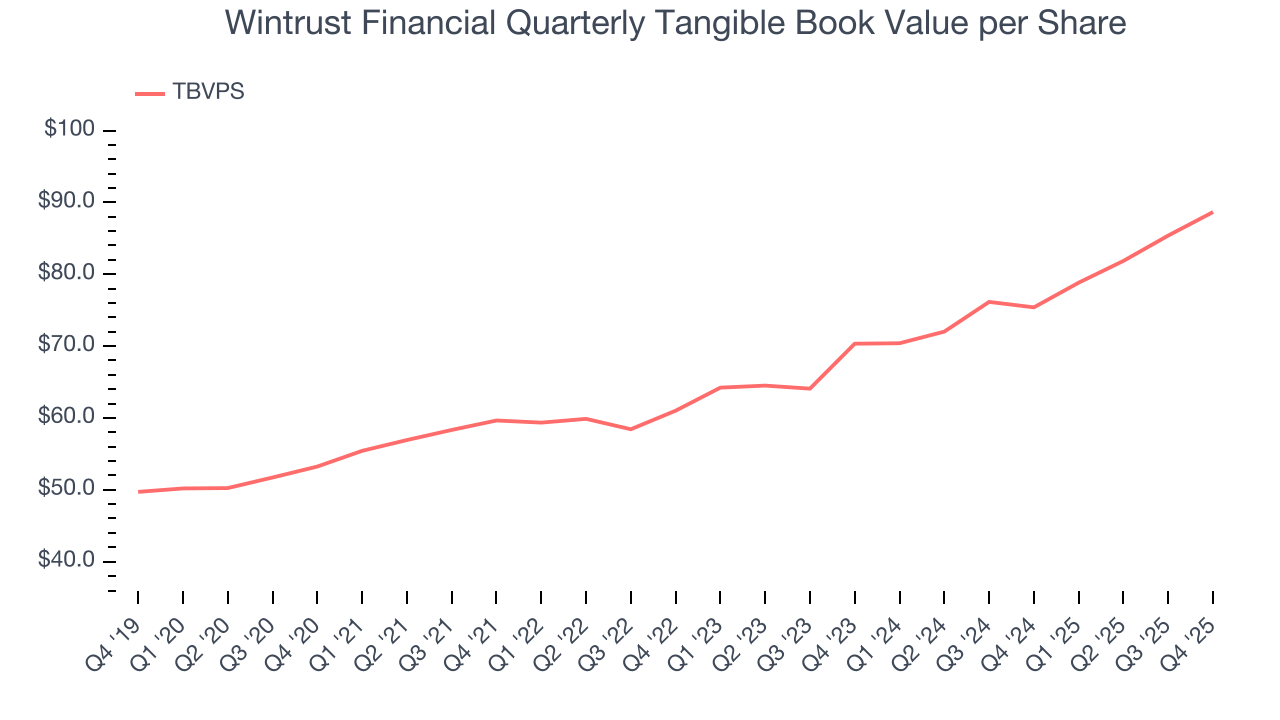

8. Tangible Book Value Per Share (TBVPS)

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to M&A or accounting rules allowing for loan losses to be spread out.

Wintrust Financial’s TBVPS grew at an incredible 10.7% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 12.3% annually over the last two years from $70.33 to $88.66 per share.

Over the next 12 months, Consensus estimates call for Wintrust Financial’s TBVPS to grow by 11.4% to $98.78, mediocre growth rate.

9. Balance Sheet Risk

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Wintrust Financial has averaged a Tier 1 capital ratio of 9.9%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

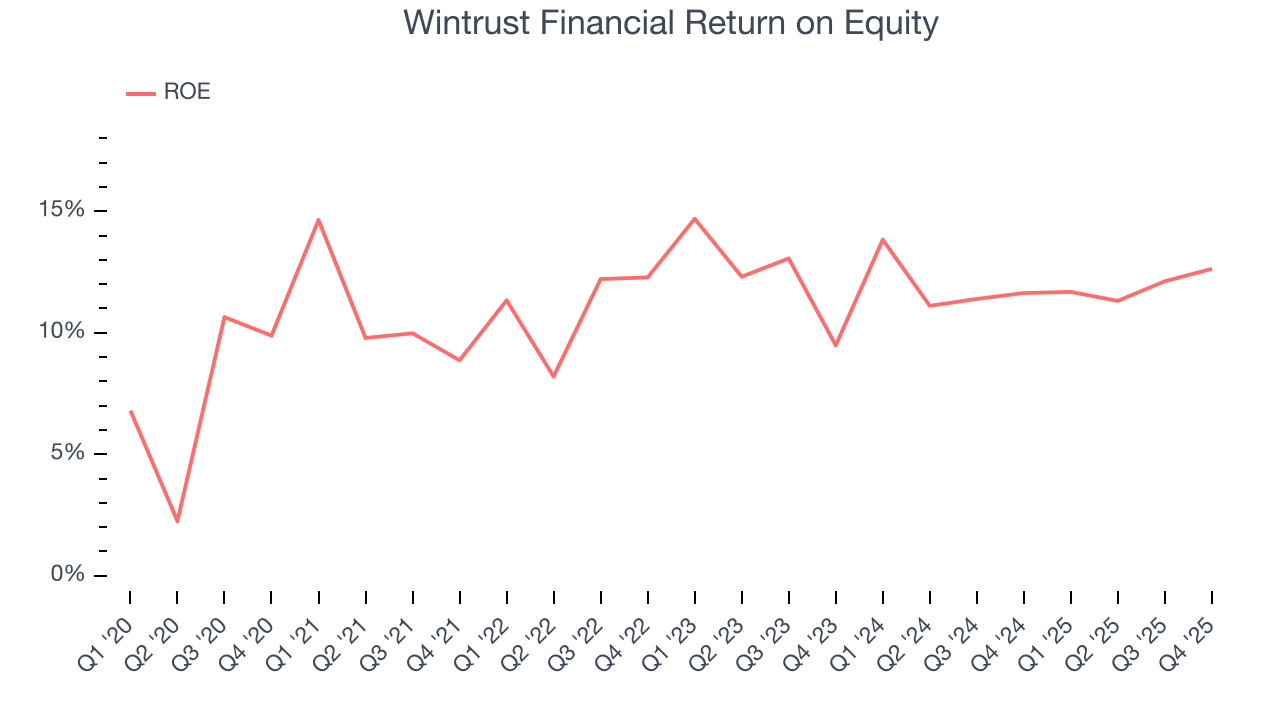

10. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Wintrust Financial has averaged an ROE of 11.6%, respectable for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired.

11. Key Takeaways from Wintrust Financial’s Q4 Results

It was encouraging to see Wintrust Financial beat analysts’ revenue expectations this quarter. We were also happy its net interest income narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $146.00 immediately after reporting.

12. Is Now The Time To Buy Wintrust Financial?

Updated: February 28, 2026 at 12:26 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Wintrust Financial is a pretty decent company if you ignore its balance sheet. First off, its revenue growth was decent over the last five years. And while its estimated net interest income for the next 12 months are weak, its TBVPS growth was exceptional over the last five years. On top of that, its net interest income growth was exceptional over the last five years.

Wintrust Financial’s P/B ratio based on the next 12 months is 1.3x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company’s debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $172.43 on the company (compared to the current share price of $142.00).