Zions Bancorporation (ZION)

We’re cautious of Zions Bancorporation. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why Zions Bancorporation Is Not Exciting

Founded in 1873 during Utah's pioneer era and named after Mount Zion in the Bible, Zions Bancorporation (NASDAQ:ZION) operates seven regional banks across the Western United States, providing commercial, retail, and wealth management services to over a million customers.

- Net interest income is projected to tank by 37.2% over the next 12 months as demand evaporates

- Flat tangible book value per share over the last five years suggest it must find different ways to enhance shareholder value during this cycle

- A positive is that its performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 15.1% outpaced its revenue gains

Zions Bancorporation doesn’t measure up to our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Zions Bancorporation

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zions Bancorporation

Zions Bancorporation’s stock price of $59.05 implies a valuation ratio of 1.3x forward P/B. Zions Bancorporation’s multiple may seem like a great deal among banking peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Zions Bancorporation (ZION) Research Report: Q4 CY2025 Update

Regional banking company Zions Bancorporation (NASDAQ:ZION) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.5% year on year to $891 million. Its GAAP profit of $1.76 per share was 12.4% above analysts’ consensus estimates.

Zions Bancorporation (ZION) Q4 CY2025 Highlights:

- Net Interest Income: $683 million vs analyst estimates of $684.6 million (71.9% year-on-year decline, in line)

- Net Interest Margin: 3.3% vs analyst estimates of 3.3% (in line)

- Revenue: $891 million vs analyst estimates of $870.1 million (8.5% year-on-year growth, 2.4% beat)

- Efficiency Ratio: 62.3% vs analyst estimates of 61.4% (90.9 basis point miss)

- EPS (GAAP): $1.76 vs analyst estimates of $1.57 (12.4% beat)

- Tangible Book Value per Share: $40.79 vs analyst estimates of $40.25 (20.5% year-on-year growth, 1.4% beat)

- Market Capitalization: $8.80 billion

Company Overview

Founded in 1873 during Utah's pioneer era and named after Mount Zion in the Bible, Zions Bancorporation (NASDAQ:ZION) operates seven regional banks across the Western United States, providing commercial, retail, and wealth management services to over a million customers.

Zions' business model centers on its seven separately managed affiliate banks: Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington. Each affiliate maintains its own local branding, management team, and community focus while being supported by centralized technology and back-office functions from the parent company.

The bank primarily serves small and medium-sized businesses with commercial lending, treasury management, and capital markets services. For example, a growing manufacturing company in Utah might use Zions Bank for a term loan to expand facilities, cash management services to optimize working capital, and interest rate derivatives to hedge against rate fluctuations.

Commercial real estate lending forms another significant portion of Zions' business, financing multi-family housing developments, office buildings, and industrial properties. The bank also provides retail banking services including residential mortgages, home equity lines, and personal banking accounts.

Zions generates revenue primarily through net interest income—the difference between interest earned on loans and investments and interest paid on deposits—as well as through fees from services like wealth management, merchant processing, and treasury management. The bank operates throughout eleven Western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming, giving it a substantial regional footprint while avoiding the regulatory complexity of being designated a global systemically important bank.

4. Regional Banks

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

Zions Bancorporation competes with other regional banks operating in the Western United States, including U.S. Bancorp (NYSE:USB), PNC Financial Services (NYSE:PNC), Regions Financial (NYSE:RF), and Western Alliance Bancorporation (NYSE:WAL), as well as national banks like JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC).

5. Sales Growth

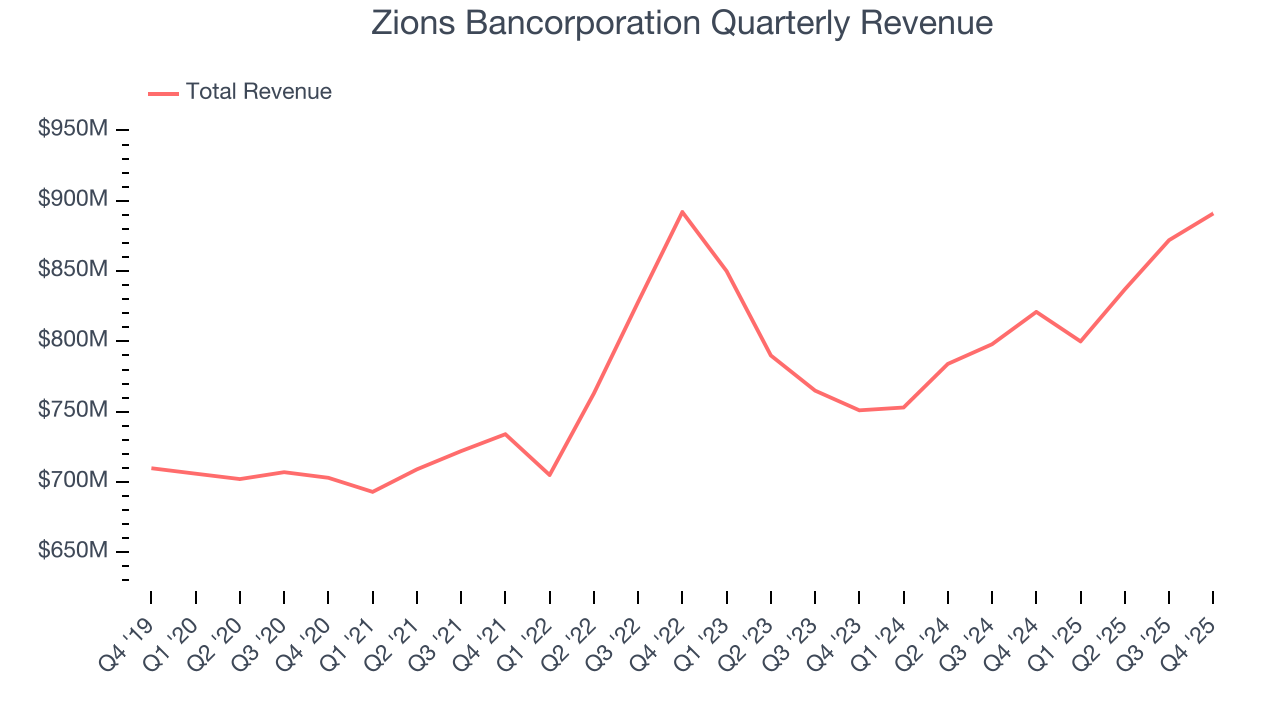

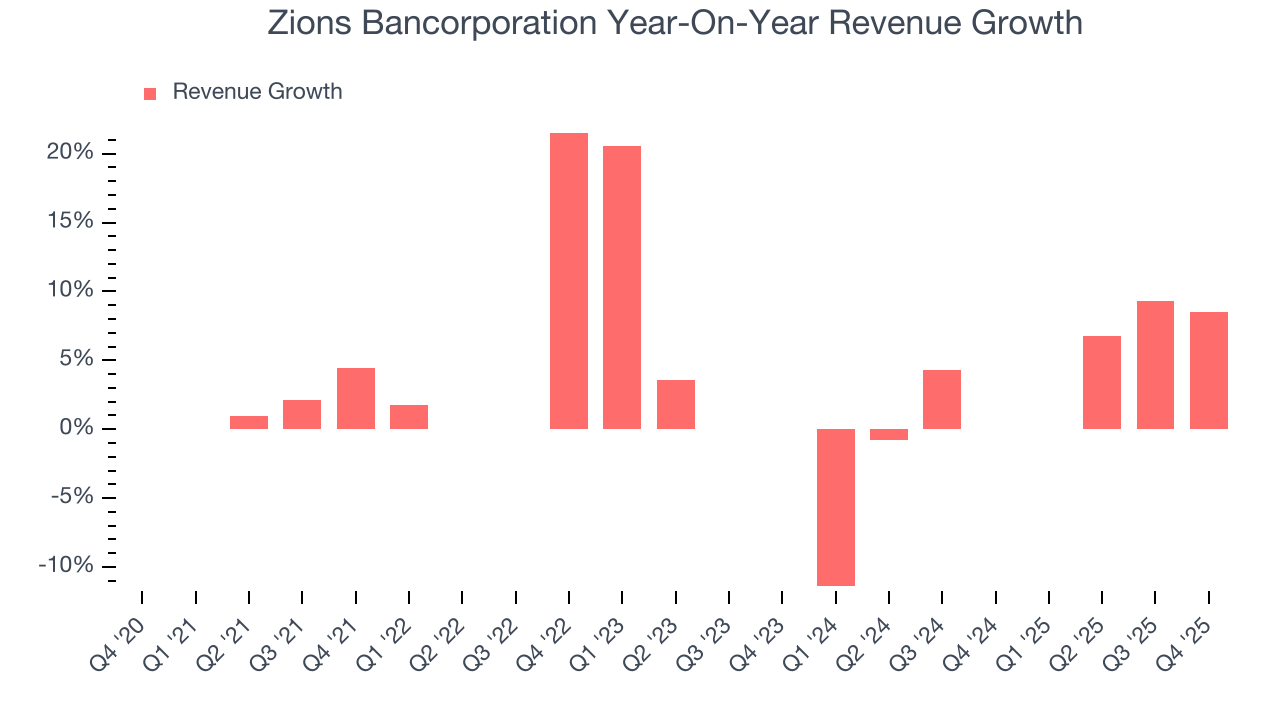

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Over the last five years, Zions Bancorporation grew its revenue at a sluggish 3.8% compounded annual growth rate. This fell short of our benchmark for the banking sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Zions Bancorporation’s annualized revenue growth of 3.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Zions Bancorporation reported year-on-year revenue growth of 8.5%, and its $891 million of revenue exceeded Wall Street’s estimates by 2.4%.

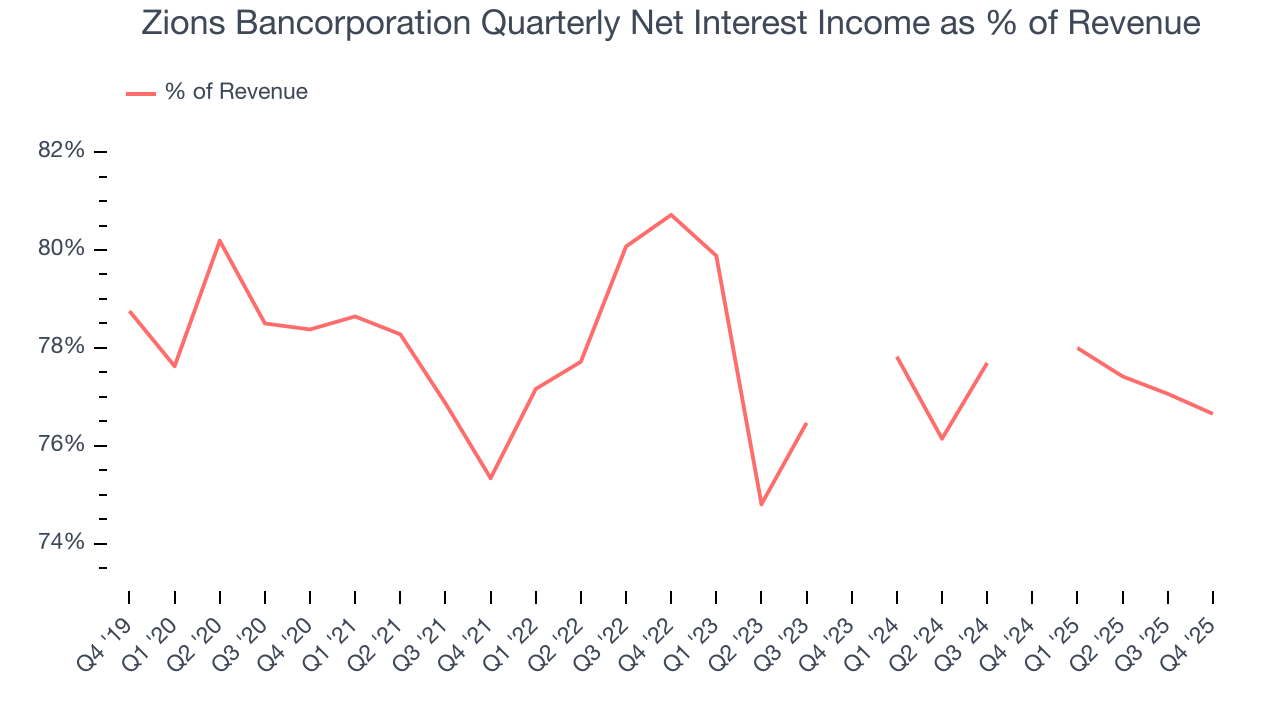

Since the company recorded losses on certain securities, it generated more net interest income than revenue during the last five years, meaning Zions Bancorporation lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

6. Efficiency Ratio

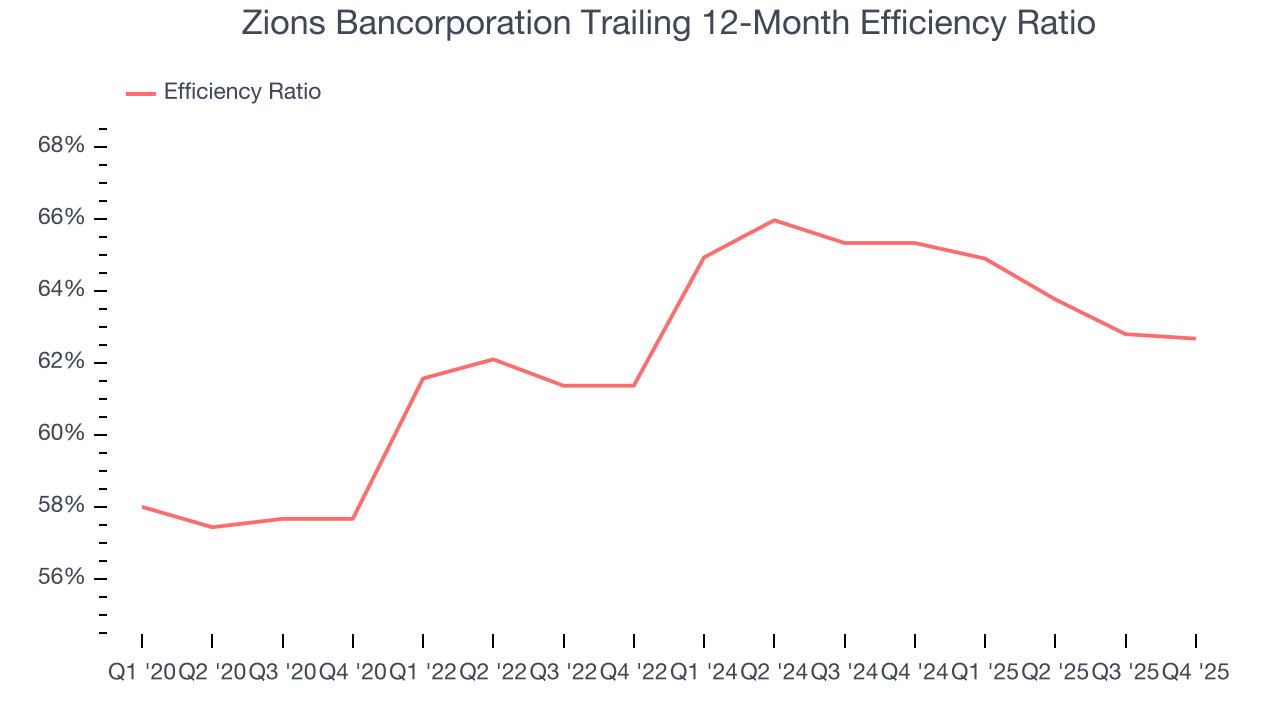

Topline growth is certainly important, but the overall profitability of this growth matters for the bottom line. For banks, we look at efficiency ratio, which is non-interest expense (salaries, rent, IT, marketing, excluding interest paid out to depositors) as a percentage of total revenue.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

Over the last five years, Zions Bancorporation’s efficiency ratio has increased by 5 percentage points, hitting 62.7% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

Zions Bancorporation’s efficiency ratio came in at 62.3% this quarter, falling short of analysts’ expectations by 90.9 basis points (100 basis points = 1 percentage point).

For the next 12 months, Wall Street expects Zions Bancorporation to maintain its trailing one-year ratio with a projection of 62.5%.

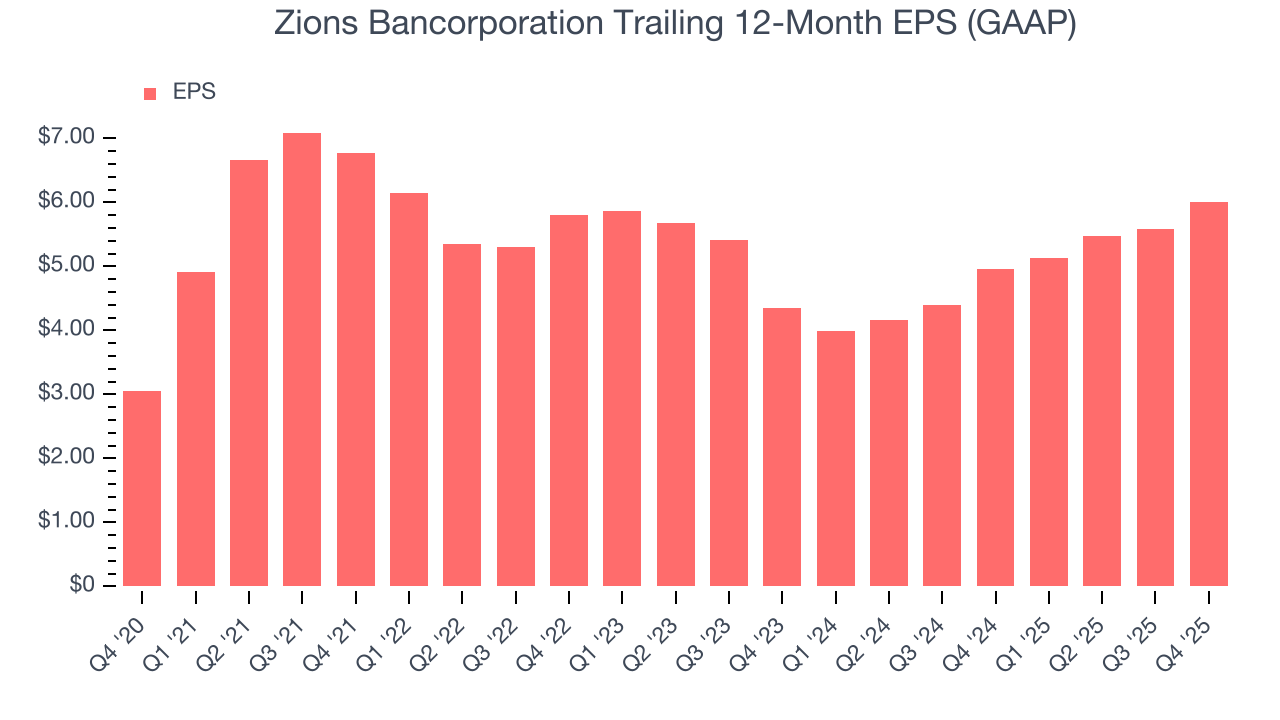

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Zions Bancorporation’s EPS grew at a remarkable 14.5% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Zions Bancorporation, its two-year annual EPS growth of 17.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Zions Bancorporation reported EPS of $1.76, up from $1.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Zions Bancorporation’s full-year EPS of $6 to grow 1.4%.

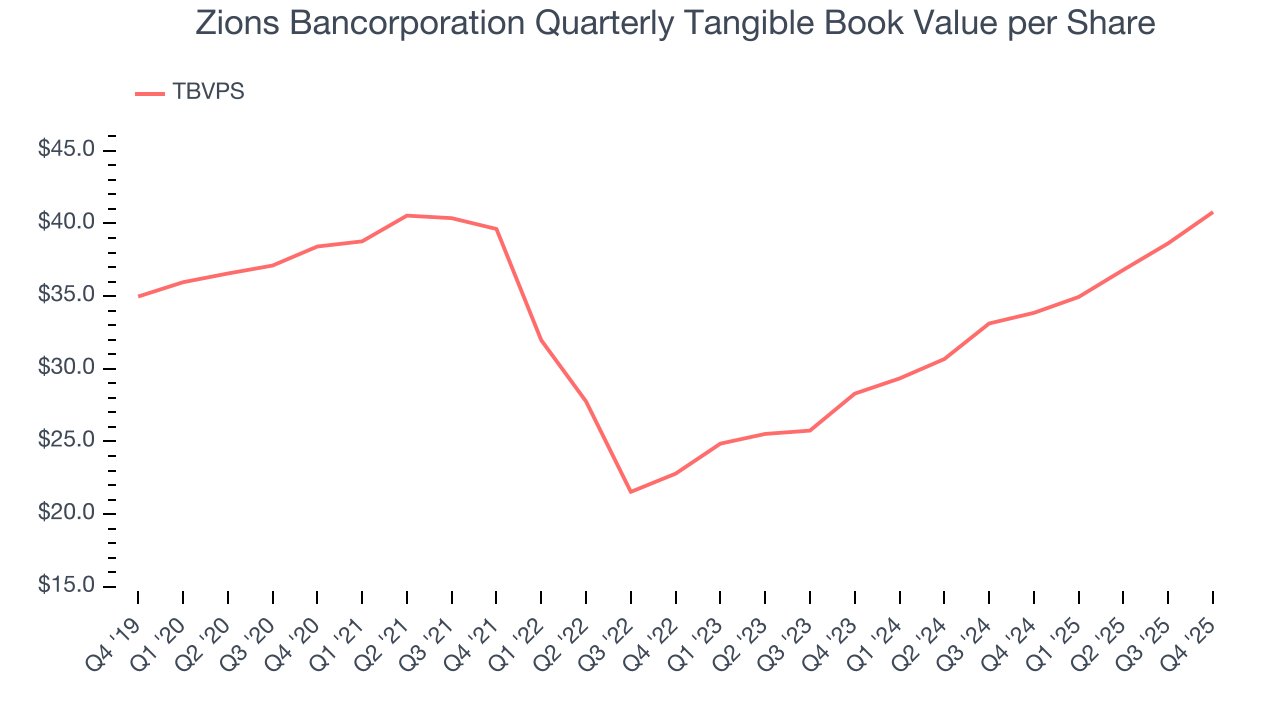

8. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This is why we consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Zions Bancorporation’s TBVPS grew at a sluggish 1.2% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 20.1% annually over the last two years from $28.30 to $40.79 per share.

Over the next 12 months, Consensus estimates call for Zions Bancorporation’s TBVPS to grow by 11.2% to $45.37, mediocre growth rate.

9. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Zions Bancorporation has averaged a Tier 1 capital ratio of 10.9%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

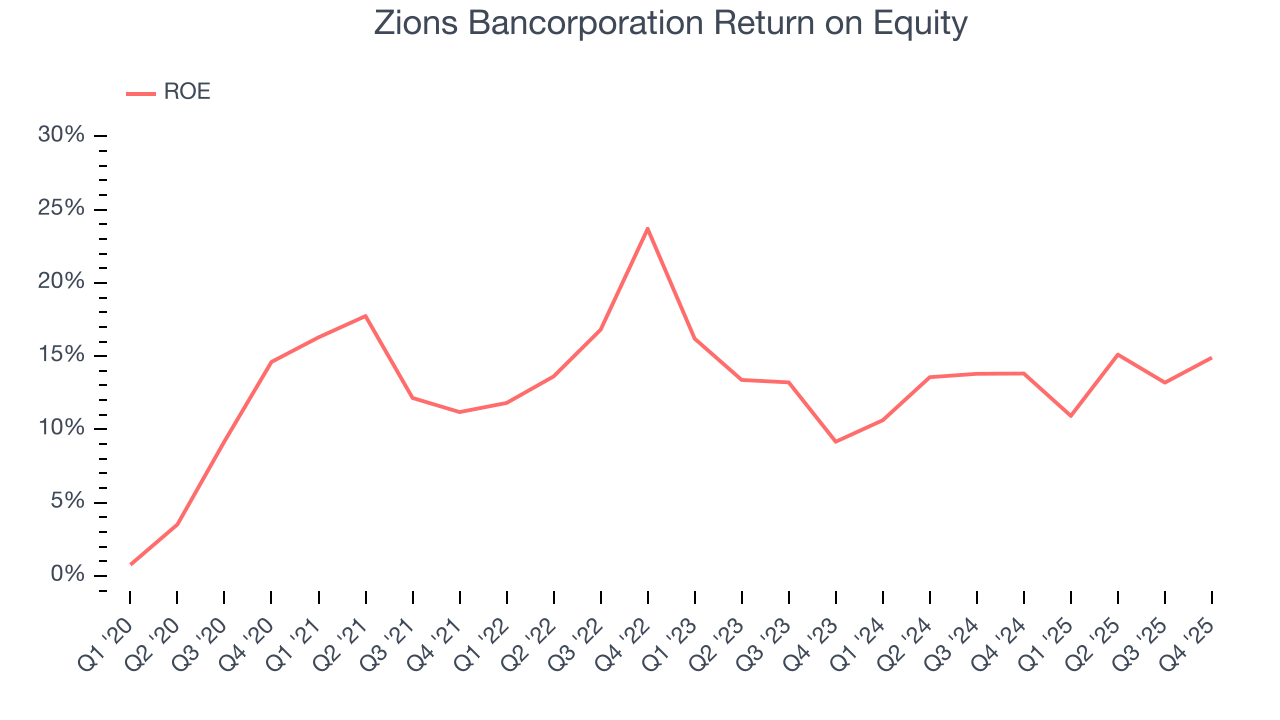

10. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Zions Bancorporation has averaged an ROE of 14.1%, impressive for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This is a bright spot for Zions Bancorporation.

11. Key Takeaways from Zions Bancorporation’s Q4 Results

It was good to see Zions Bancorporation beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.2% to $59.83 immediately after reporting.

12. Is Now The Time To Buy Zions Bancorporation?

Updated: January 20, 2026 at 4:38 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Zions Bancorporation isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its net interest income growth was weak over the last five years. On top of that, its TBVPS growth was weak over the last five years.

Zions Bancorporation’s P/B ratio based on the next 12 months is 1.1x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $65 on the company (compared to the current share price of $59.83).