Advance Auto Parts (AAP)

Advance Auto Parts keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Advance Auto Parts Will Underperform

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

- Store closures and disappointing same-store sales suggest demand is sluggish and it’s rightsizing its operations

- Products aren't resonating with the market as its revenue declined by 8% annually over the last three years

- 7× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Advance Auto Parts doesn’t satisfy our quality benchmarks. You should search for better opportunities.

Why There Are Better Opportunities Than Advance Auto Parts

Why There Are Better Opportunities Than Advance Auto Parts

Advance Auto Parts is trading at $59.35 per share, or 24.1x forward P/E. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Advance Auto Parts (AAP) Research Report: Q4 CY2025 Update

Auto parts and accessories retailer Advance Auto Parts (NYSE:AAP) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 1.2% year on year to $1.97 billion. On the other hand, the company’s full-year revenue guidance of $8.53 billion at the midpoint came in 1.6% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was significantly above analysts’ consensus estimates.

Advance Auto Parts (AAP) Q4 CY2025 Highlights:

- Revenue: $1.97 billion vs analyst estimates of $1.95 billion (1.2% year-on-year decline, 1% beat)

- Adjusted EPS: $0.86 vs analyst estimates of $0.41 (significant beat)

- Adjusted EBITDA: $351.8 million vs analyst estimates of $128.8 million (17.8% margin, significant beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.75 at the midpoint, beating analyst estimates by 4.6%

- Operating Margin: 2.2%, up from -41.1% in the same quarter last year

- Free Cash Flow was -$297.7 million compared to -$124.4 million in the same quarter last year

- Locations: 4,297 at quarter end, down from 4,788 in the same quarter last year

- Same-Store Sales rose 1.1% year on year (-1% in the same quarter last year)

- Market Capitalization: $3.49 billion

Company Overview

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

The company serves both do-it-yourself (DIY) customers as well as professional mechanics and auto repair businesses. The company understands that DIY customers may have varying levels of expertise in auto repair, so stores feature automotive expert sales associates who can help you find which brake pads will fit your 2019 Ford Focus, for example.

For the professional mechanic, Advance Auto Parts has a particularly strong selection of commercial products such as heavy-duty truck parts. The company also offers a commercial program with dedicated account managers, customized billing options, and professional-grade tools for rent. A fleet of commercial delivery vehicles thousands strong make sure professional customers get what they need in a timely manner.

Advance Auto Parts stores are typically located in smaller towns and more rural areas compared to auto parts peers, with a strong footprint in the Eastern US. The typical store is roughly 7,500 square feet, with many featuring areas and help desks specifically for professional customers. In addition to its brick-and-mortar stores, Advance Auto Parts also has an e-commerce presence that allows customers to buy products to be shipped to their homes or to buy and pick up at the nearest store to save time.

4. Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Competitors offering auto parts and accessories include AutoZone (NYSE:AZO), O’Reilly Automotive (NASDAQ:ORLY), Genuine Parts (NYSE:GPC), and private company Pep Boys.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $8.60 billion in revenue over the past 12 months, Advance Auto Parts is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

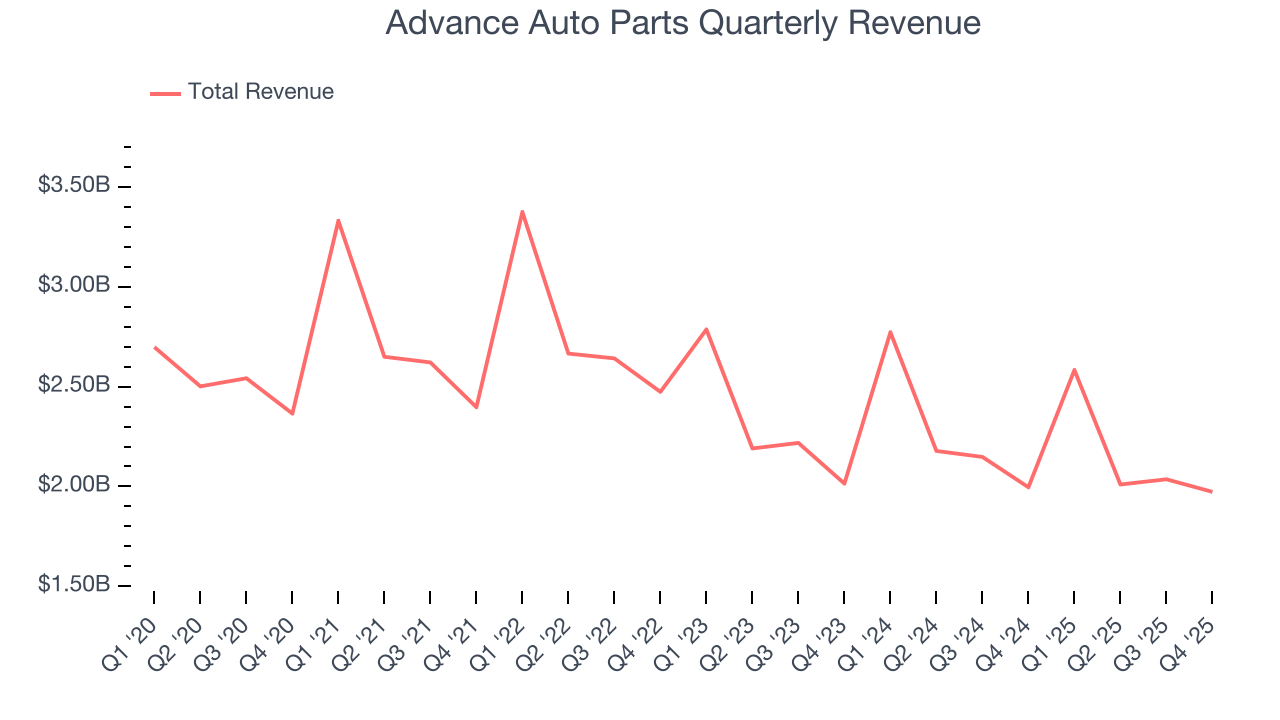

As you can see below, Advance Auto Parts’s revenue declined by 8.3% per year over the last three years as it closed stores.

This quarter, Advance Auto Parts’s revenue fell by 1.2% year on year to $1.97 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products will spur better top-line performance, it is still below average for the sector.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

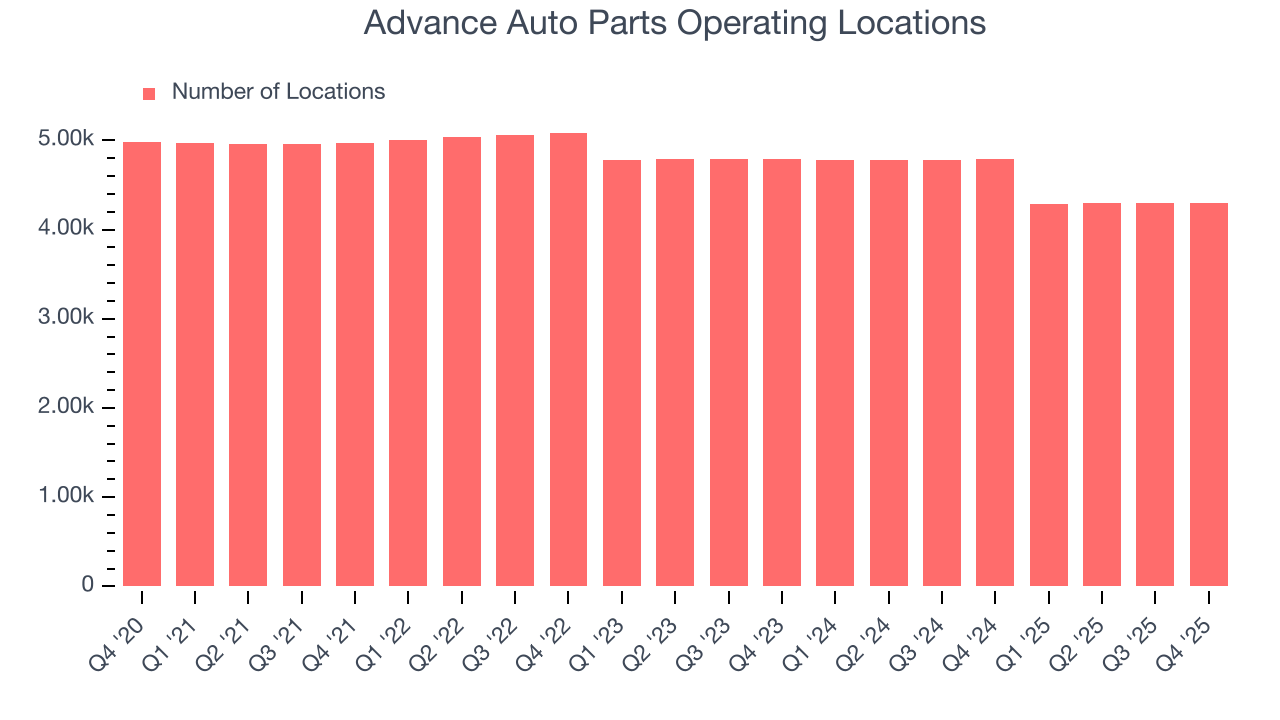

Advance Auto Parts operated 4,297 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 5.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

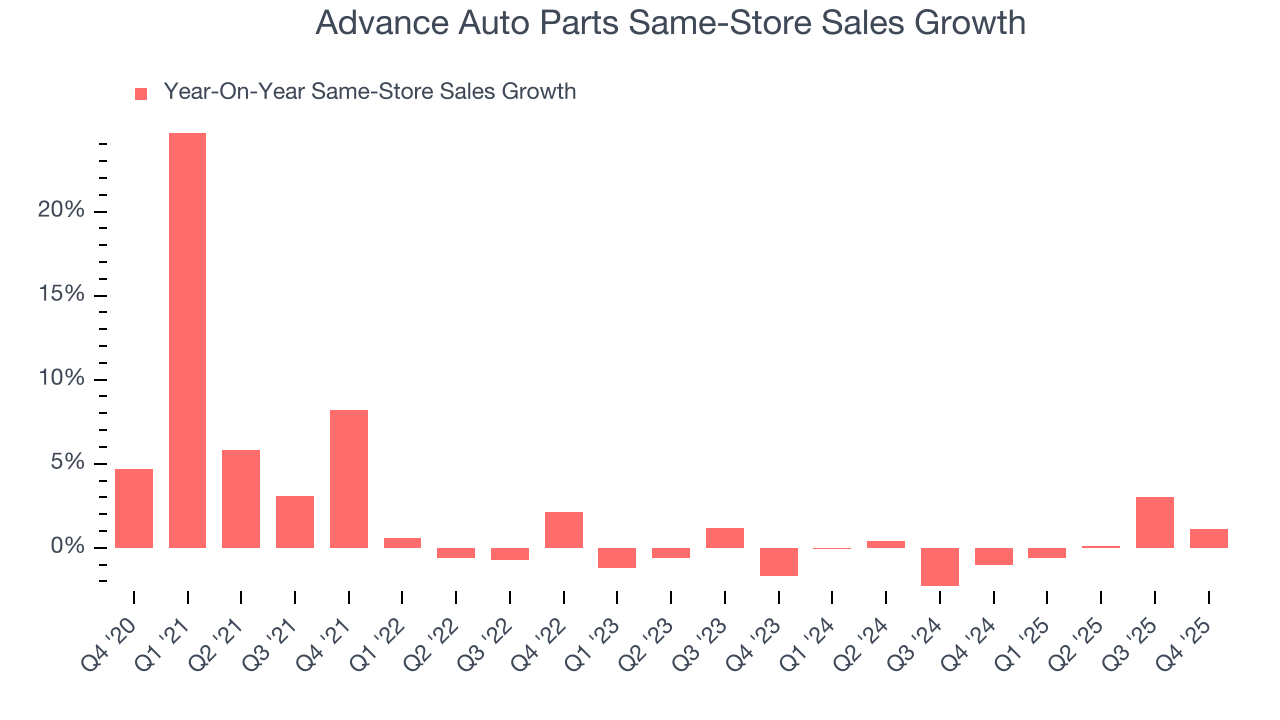

Advance Auto Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Advance Auto Parts is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Advance Auto Parts’s same-store sales rose 1.1% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

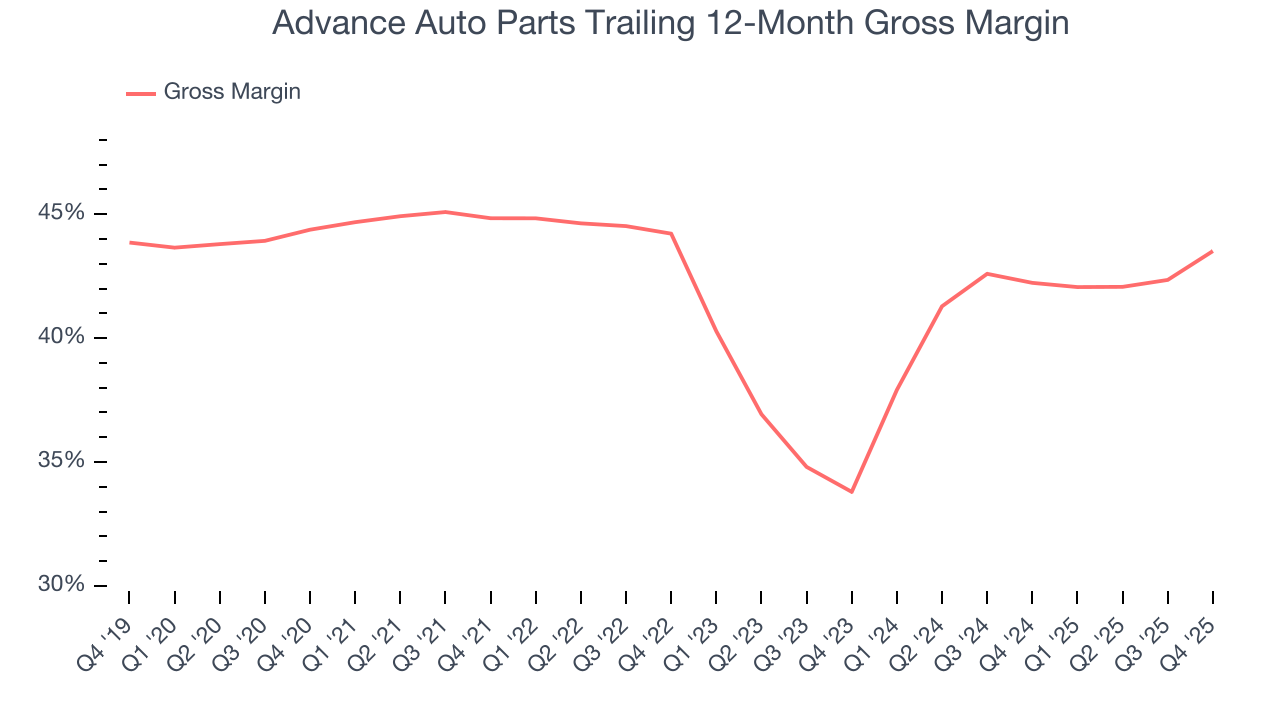

Advance Auto Parts’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 42.9% gross margin over the last two years. Said differently, Advance Auto Parts paid its suppliers $57.15 for every $100 in revenue.

In Q4, Advance Auto Parts produced a 44% gross profit margin, up 5 percentage points year on year. Advance Auto Parts’s full-year margin has also been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest the company has less pressure to discount products and is realizing better unit economics due to stable or shrinking input costs (such as labor and freight expenses to transport goods).

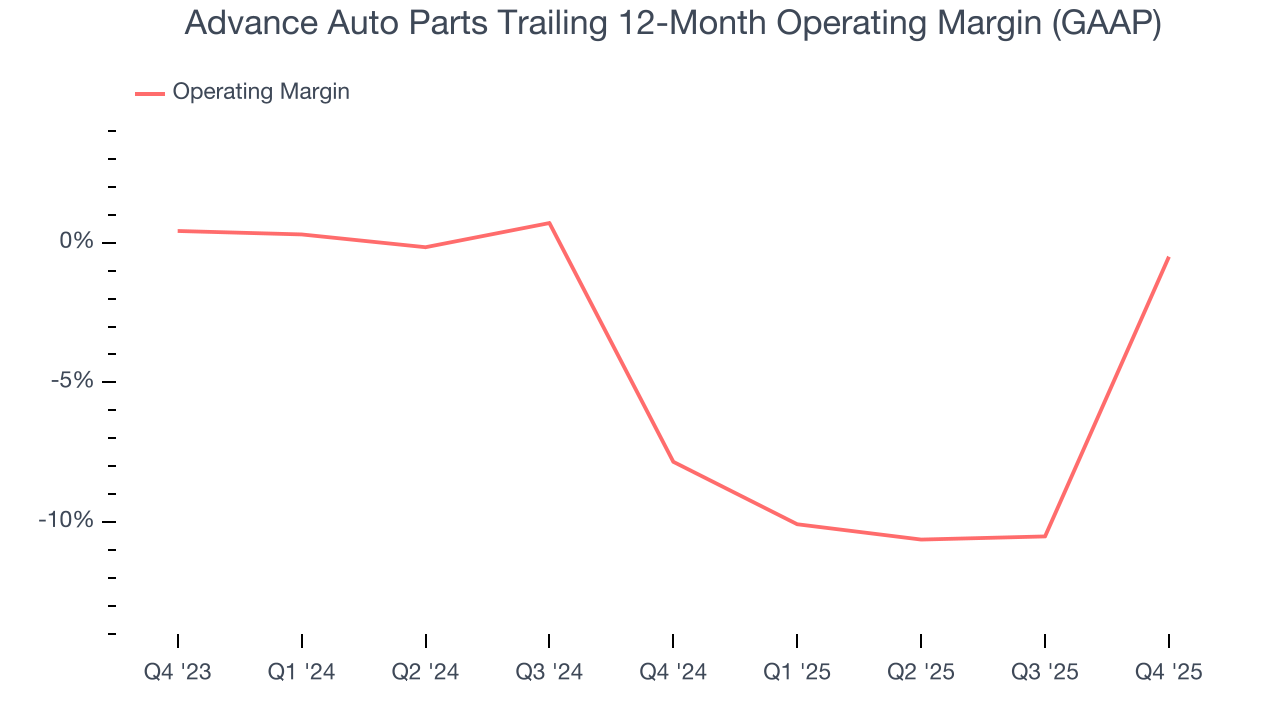

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Although Advance Auto Parts was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 4.3% over the last two years. Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. It’s unfortunate that Advance Auto Parts was one of them.

On the plus side, Advance Auto Parts’s operating margin rose by 7.3 percentage points over the last year. Still, it will take much more for the company to show consistent profitability.

In Q4, Advance Auto Parts generated an operating margin profit margin of 2.2%, up 43.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

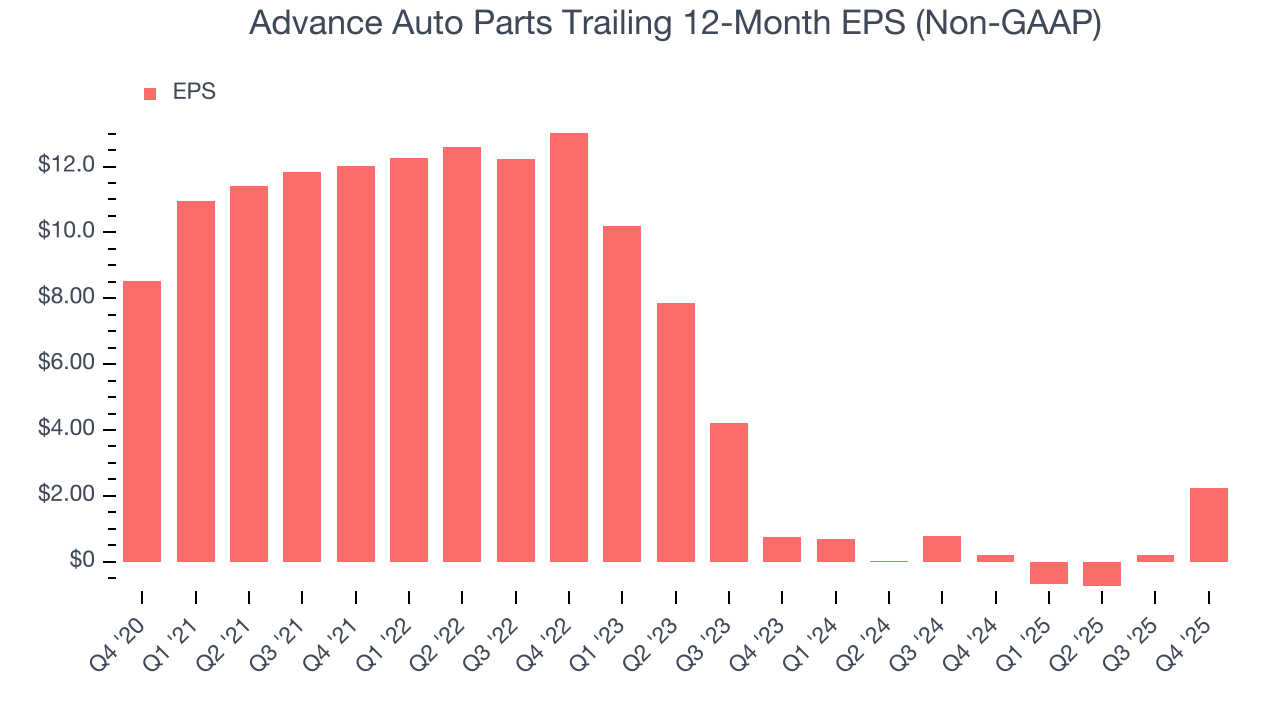

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Advance Auto Parts, its EPS declined by 44.3% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Advance Auto Parts reported adjusted EPS of $0.86, up from negative $1.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Advance Auto Parts’s full-year EPS of $2.25 to grow 18.3%.

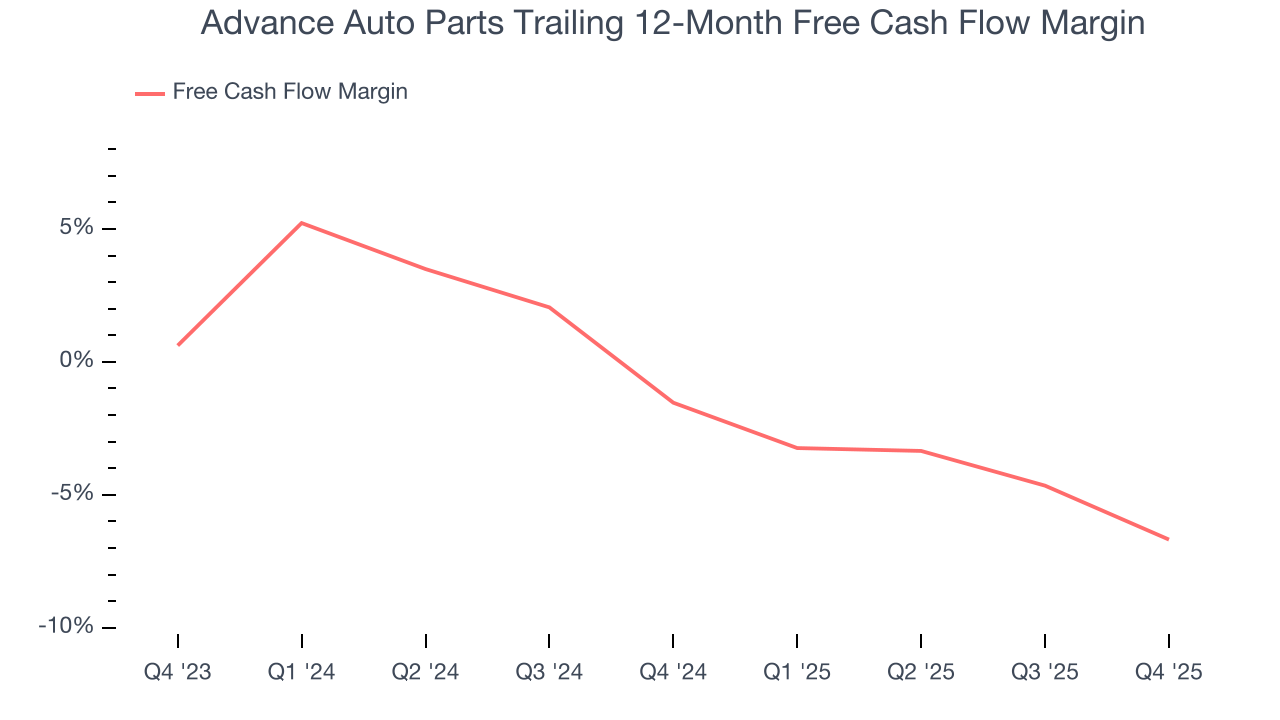

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Advance Auto Parts’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 4%. This means it lit $4.04 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Advance Auto Parts’s margin dropped by 5.1 percentage points over the last year. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Advance Auto Parts burned through $297.7 million of cash in Q4, equivalent to a negative 15.1% margin. The company’s cash burn increased from $124.4 million of lost cash in the same quarter last year.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Advance Auto Parts historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

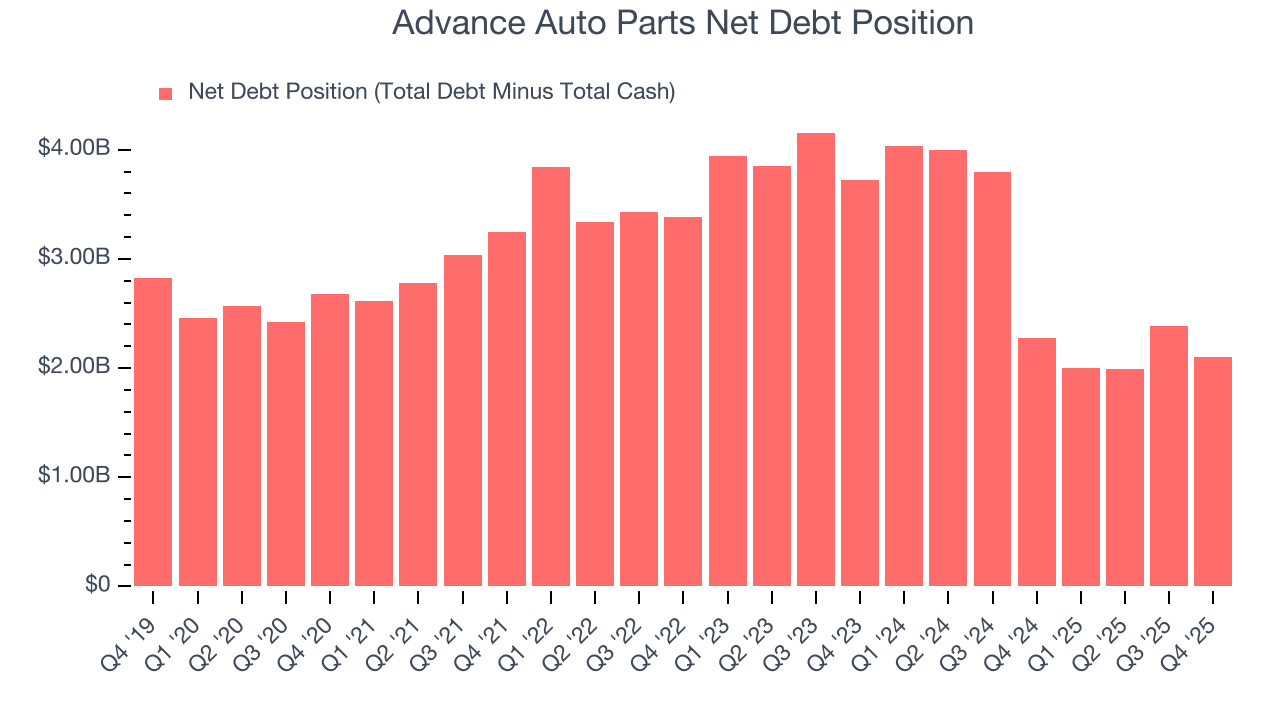

12. Balance Sheet Assessment

Advance Auto Parts reported $3.12 billion of cash and $5.22 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $708.8 million of EBITDA over the last 12 months, we view Advance Auto Parts’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $33 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Advance Auto Parts’s Q4 Results

It was good to see Advance Auto Parts beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance missed. Zooming out, we think this quarter was mixed. The stock remained flat at $58.58 immediately after reporting.

14. Is Now The Time To Buy Advance Auto Parts?

Updated: February 13, 2026 at 6:40 AM EST

Are you wondering whether to buy Advance Auto Parts or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Advance Auto Parts doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Advance Auto Parts’s P/E ratio based on the next 12 months is 21.9x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $51.29 on the company (compared to the current share price of $58.58), implying they don’t see much short-term potential in Advance Auto Parts.