AutoNation (AN)

We wouldn’t recommend AutoNation. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think AutoNation Will Underperform

With a vast network of over 300 locations strategically concentrated in America's Sunbelt region, AutoNation (NYSE:AN) operates one of America's largest networks of automotive dealerships, selling new and used vehicles, parts, and services across multiple brands.

- Poor same-store sales performance over the past two years indicates it’s having trouble bringing new shoppers into its brick-and-mortar locations

- Gross margin of 17.9% is below its competitors, leaving less money for marketing and promotions

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

AutoNation doesn’t measure up to our expectations. You should search for better opportunities.

Why There Are Better Opportunities Than AutoNation

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AutoNation

At $204.14 per share, AutoNation trades at 10.5x forward P/E. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. AutoNation (AN) Research Report: Q4 CY2025 Update

Automotive retail giant AutoNation (NYSE:AN) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 3.9% year on year to $6.93 billion. Its non-GAAP profit of $5.08 per share was 4.2% above analysts’ consensus estimates.

AutoNation (AN) Q4 CY2025 Highlights:

- Revenue: $6.93 billion vs analyst estimates of $7.19 billion (3.9% year-on-year decline, 3.6% miss)

- Adjusted EPS: $5.08 vs analyst estimates of $4.88 (4.2% beat)

- Adjusted EBITDA: $375.4 million vs analyst estimates of $400.3 million (5.4% margin, 6.2% miss)

- Operating Margin: 4.5%, in line with the same quarter last year

- Free Cash Flow was -$86.3 million, down from $83.5 million in the same quarter last year

- Same-Store Sales fell 5% year on year (0.2% in the same quarter last year)

- Market Capitalization: $7.44 billion

Company Overview

With a vast network of over 300 locations strategically concentrated in America's Sunbelt region, AutoNation (NYSE:AN) operates one of America's largest networks of automotive dealerships, selling new and used vehicles, parts, and services across multiple brands.

The company's business spans four key segments: Domestic (brands like Ford and Chevrolet), Import (Toyota, Honda), Premium Luxury (BMW, Mercedes-Benz), and AutoNation Finance, which provides indirect financing options for vehicle purchases. Beyond traditional dealership operations, AutoNation has diversified into additional automotive services, including collision repair centers, parts distribution facilities, and used vehicle stores branded as AutoNation USA.

AutoNation generates revenue through several channels: new vehicle sales, used vehicle reconditioning and sales, automotive maintenance and repair services, wholesale parts operations, and financial products. When a customer purchases a vehicle, AutoNation can enhance profitability by arranging financing through third-party lenders or its own captive finance company, as well as by offering extended warranties, maintenance plans, and insurance products.

For example, a customer might visit an AutoNation Mercedes-Benz dealership to purchase a new SUV, then opt for an AutoNation-branded extended warranty and have routine maintenance performed at the dealership's service center over the following years. The business model allows AutoNation to maintain customer relationships throughout the vehicle ownership lifecycle, from initial purchase through maintenance, repairs, financing, and eventually replacement.

4. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

AutoNation competes with other major automotive retailers including Lithia Motors (NYSE:LAD), Group 1 Automotive (NYSE:GPI), Sonic Automotive (NYSE:SAH), and Penske Automotive Group (NYSE:PAG), as well as thousands of independent dealerships across the country.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $27.63 billion in revenue over the past 12 months, AutoNation is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To expand meaningfully, AutoNation likely needs to tweak its prices or enter new markets.

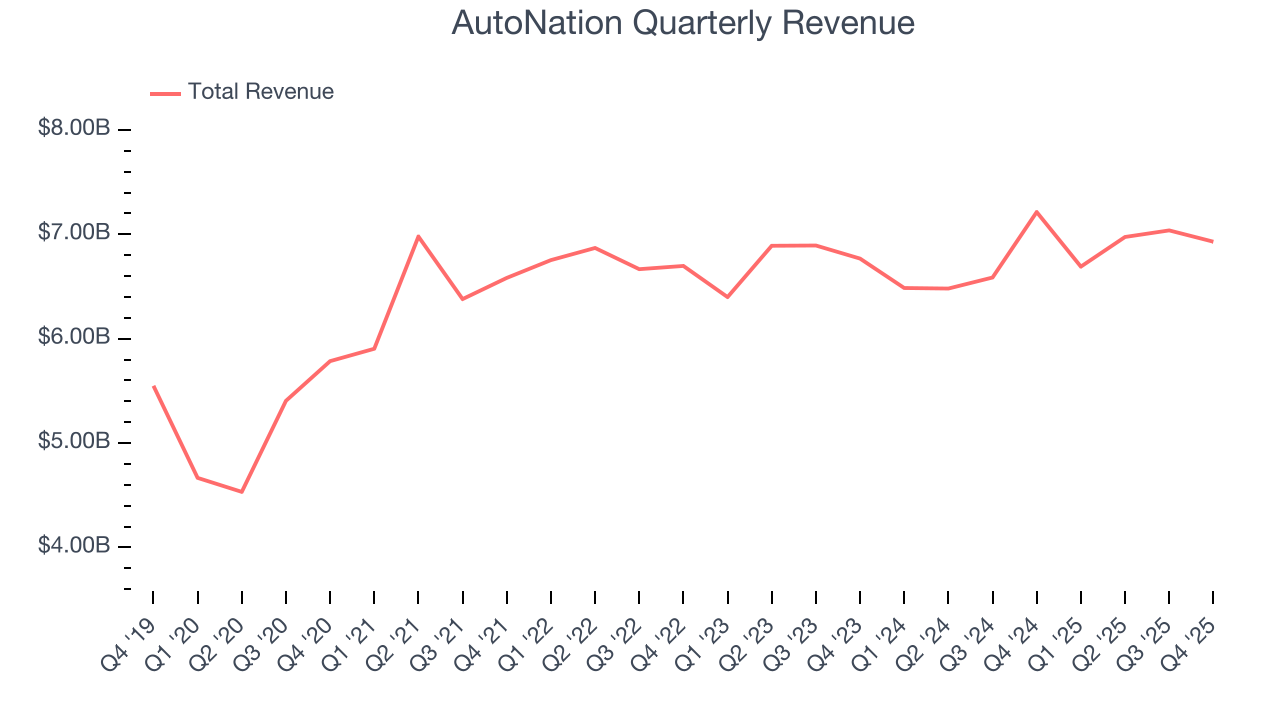

As you can see below, AutoNation struggled to increase demand as its $27.63 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, AutoNation missed Wall Street’s estimates and reported a rather uninspiring 3.9% year-on-year revenue decline, generating $6.93 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months. Although this projection indicates its newer products will spur better top-line performance, it is still below the sector average.

6. Same-Store Sales

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

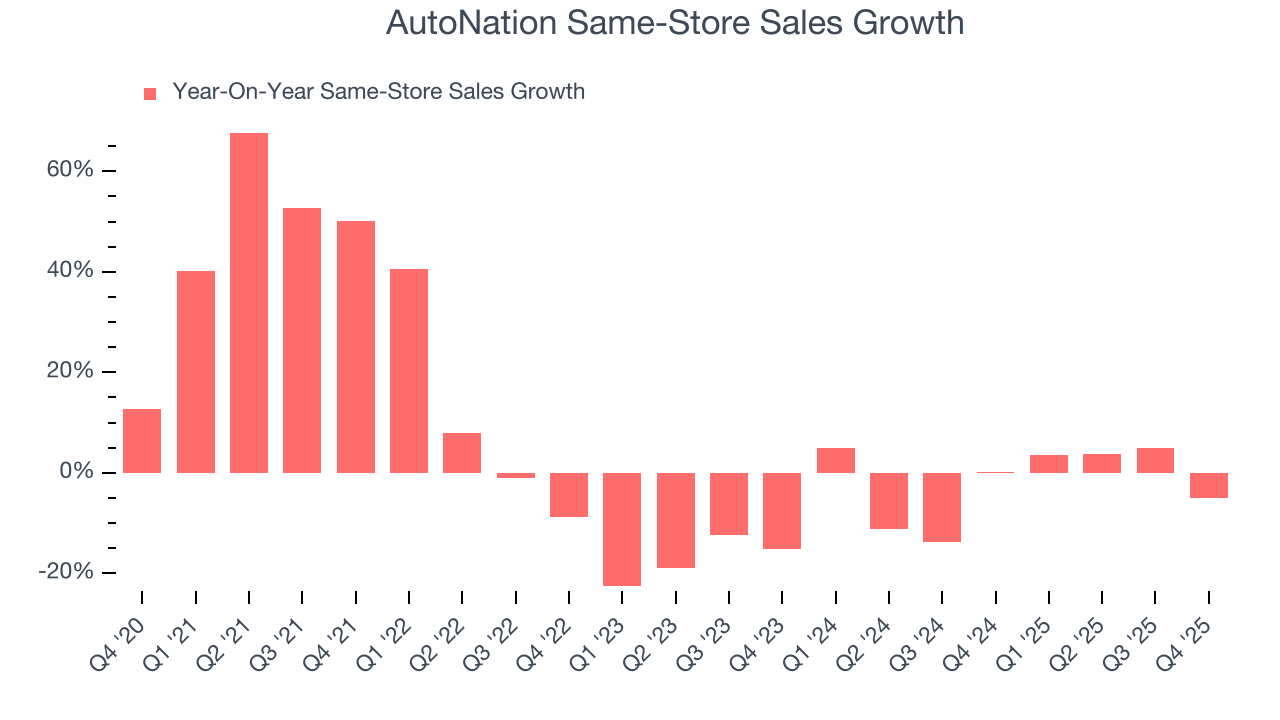

AutoNation’s demand has been shrinking over the last two years as its same-store sales have averaged 1.6% annual declines.

In the latest quarter, AutoNation’s same-store sales fell by 5% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

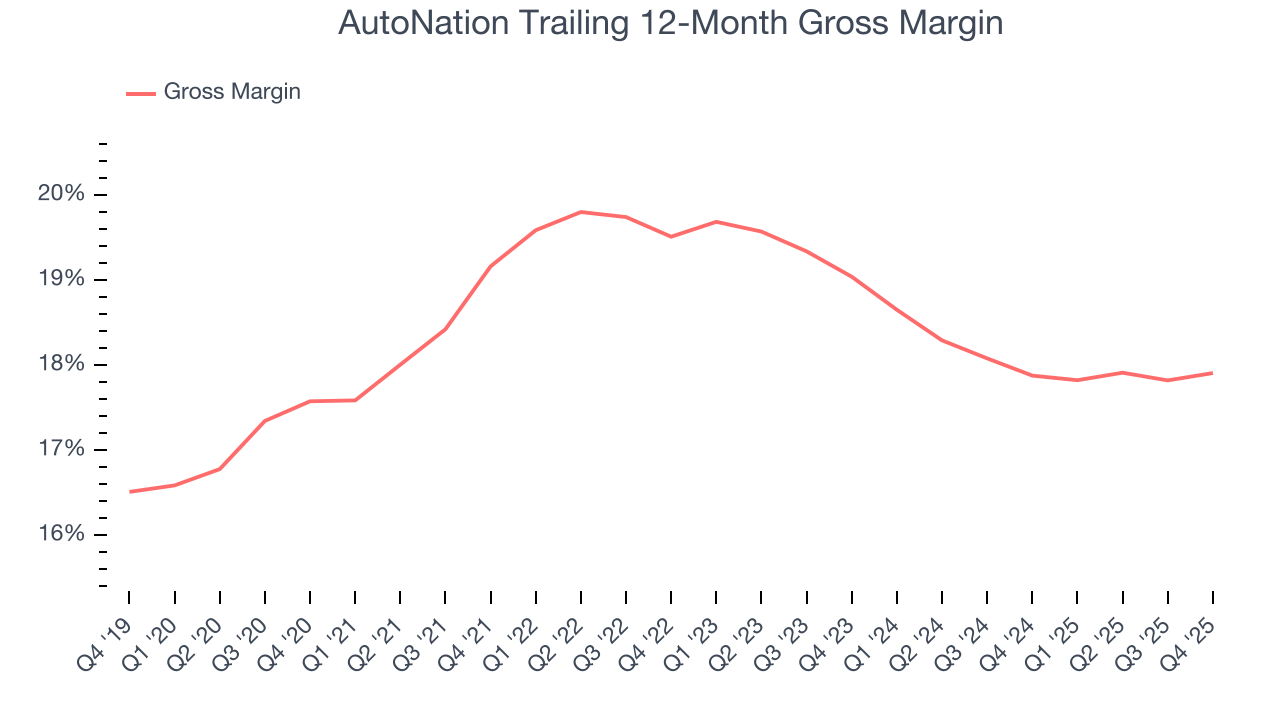

AutoNation has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 17.9% gross margin over the last two years. Said differently, AutoNation had to pay a chunky $82.11 to its suppliers for every $100 in revenue.

AutoNation’s gross profit margin came in at 17.5% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

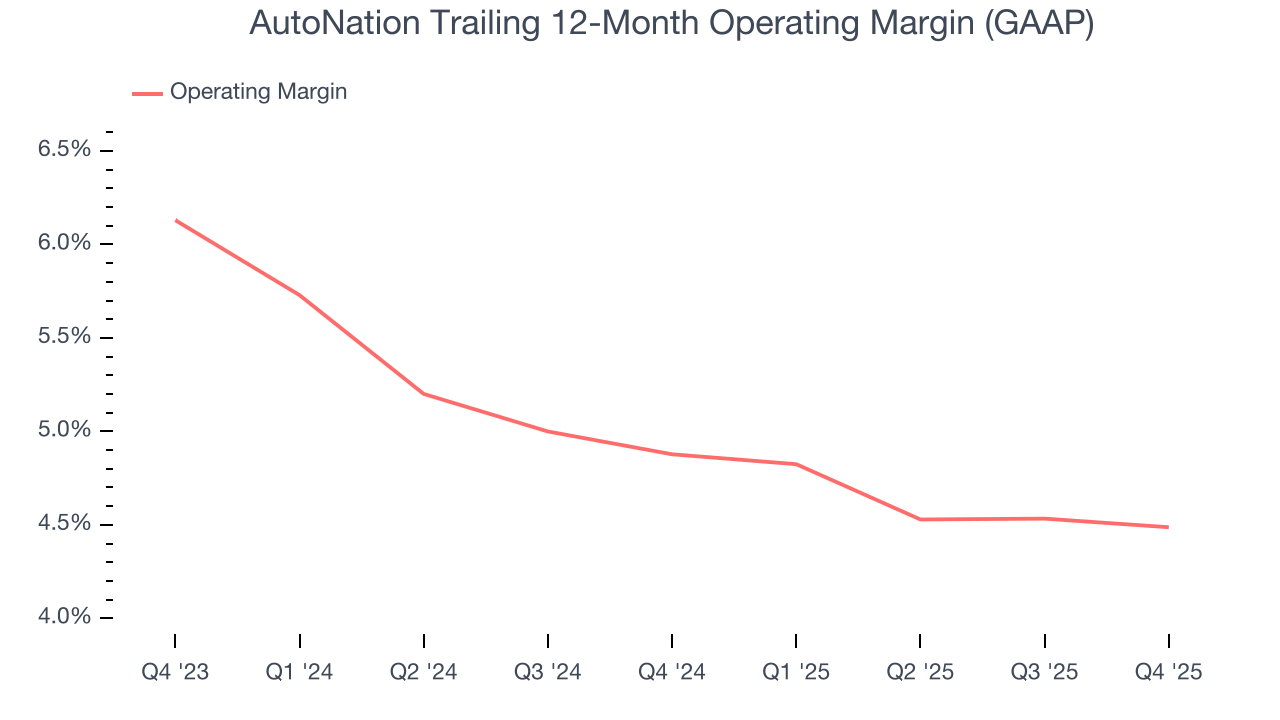

AutoNation’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.7% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, AutoNation’s operating margin might fluctuated slightly but has generally stayed the same over the last year, meaning it will take a fundamental shift in the business model to change.

This quarter, AutoNation generated an operating margin profit margin of 4.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

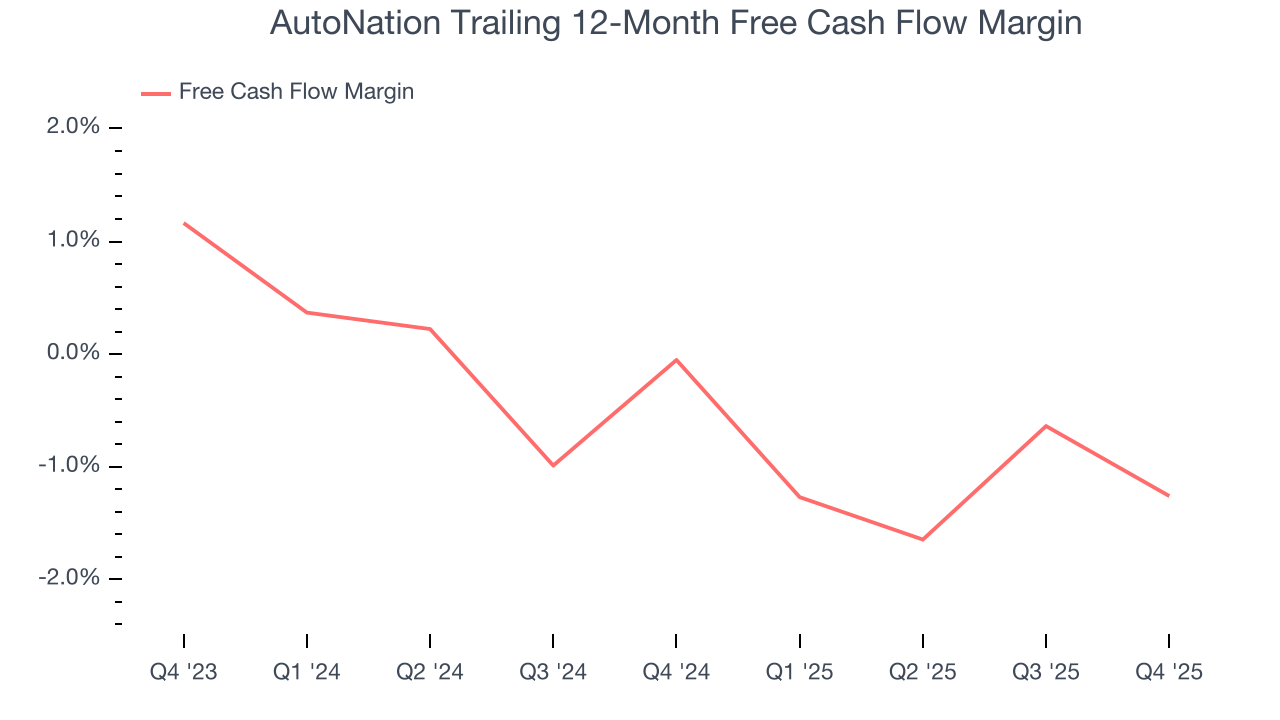

AutoNation broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that AutoNation’s margin dropped by 1.2 percentage points over the last year. This decrease warrants extra caution because AutoNation failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

AutoNation burned through $86.3 million of cash in Q4, equivalent to a negative 1.2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AutoNation’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.4%, slightly better than typical consumer retail business.

11. Balance Sheet Assessment

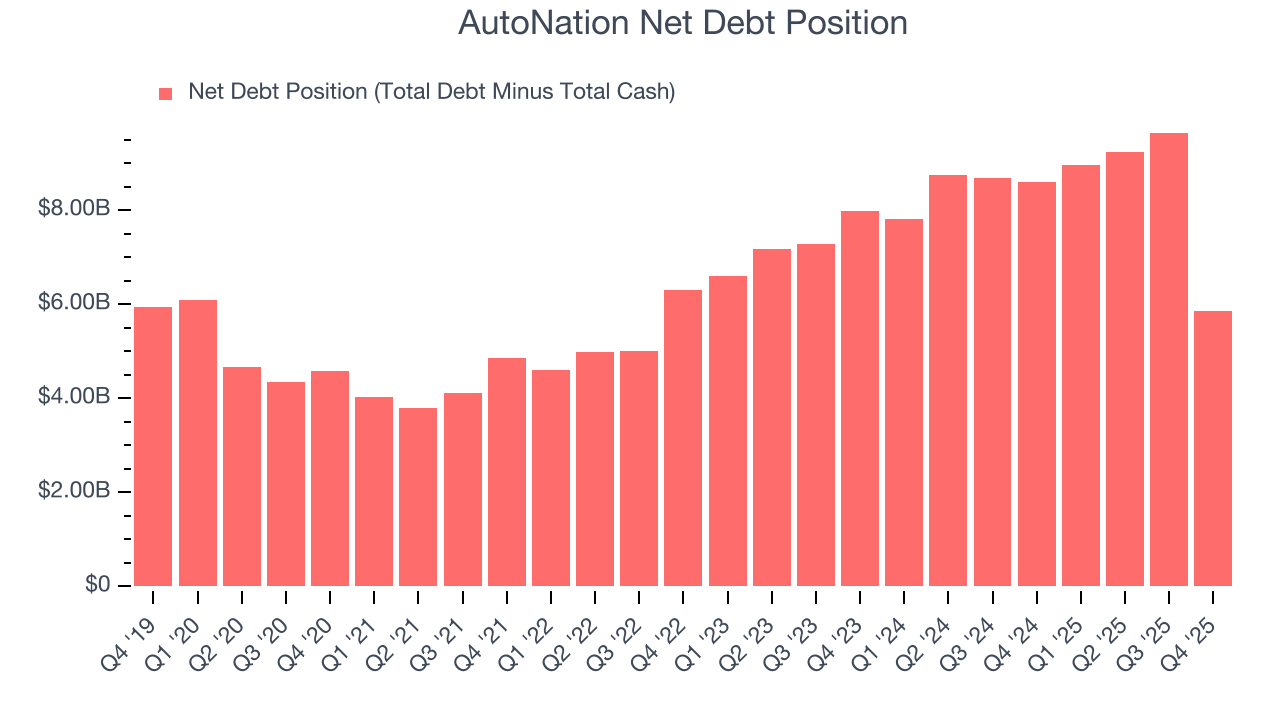

AutoNation reported $58.6 million of cash and $5.92 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.61 billion of EBITDA over the last 12 months, we view AutoNation’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $223 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AutoNation’s Q4 Results

We enjoyed seeing AutoNation beat analysts’ gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1.1% to $206.18 immediately following the results.

13. Is Now The Time To Buy AutoNation?

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own AutoNation, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies serving everyday consumers, but in the case of AutoNation, we’ll be cheering from the sidelines. To kick things off, its revenue growth was uninspiring over the last three years. And while its popular brand gives it meaningful influence over consumers’ purchasing decisions, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its shrinking same-store sales tell us it will need to change its strategy to succeed.

AutoNation’s P/E ratio based on the next 12 months is 9.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $239.30 on the company (compared to the current share price of $206.18).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.