Amphenol (APH)

Amphenol sets the gold standard. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Amphenol

With over 90 years of connecting the world's technologies, Amphenol (NYSE:APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

- Annual revenue growth of 20.3% over the past five years was outstanding, reflecting market share gains this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 26.6% over the last five years outstripped its revenue performance

- Enormous revenue base of $20.97 billion provides significant distribution advantages

Amphenol is a market leader. The valuation seems fair based on its quality, and we believe now is a favorable time to invest in the stock.

Why Is Now The Time To Buy Amphenol?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Amphenol?

At $167.88 per share, Amphenol trades at 38.4x forward P/E. Most companies in the business services sector may feature a cheaper multiple, but we think Amphenol is priced fairly given its fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. Amphenol (APH) Research Report: Q4 CY2025 Update

Electrical connector manufacturer Amphenol (NYSE:APH) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 49.1% year on year to $6.44 billion. On top of that, next quarter’s revenue guidance ($6.95 billion at the midpoint) was surprisingly good and 3.5% above what analysts were expecting. Its non-GAAP profit of $0.97 per share was 3.1% above analysts’ consensus estimates.

Amphenol (APH) Q4 CY2025 Highlights:

- Revenue: $6.44 billion vs analyst estimates of $6.23 billion (49.1% year-on-year growth, 3.3% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.94 (3.1% beat)

- Adjusted EBITDA: $2.01 billion vs analyst estimates of $1.94 billion (31.3% margin, 4% beat)

- Revenue Guidance for Q1 CY2026 is $6.95 billion at the midpoint, above analyst estimates of $6.72 billion

- Adjusted EPS guidance for Q1 CY2026 is $0.92 at the midpoint, above analyst estimates of $0.90

- Operating Margin: 26.8%, up from 22.1% in the same quarter last year

- Free Cash Flow Margin: 22.8%, up from 15% in the same quarter last year

- Market Capitalization: $203.5 billion

Company Overview

With over 90 years of connecting the world's technologies, Amphenol (NYSE:APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

Amphenol's products serve as the critical infrastructure that powers modern electronics, from the tiniest medical devices to massive data centers. The company produces a vast array of specialized components including ruggedized connectors that withstand extreme conditions, high-speed data transmission cables, power distribution systems, antennas, and sophisticated sensors that measure everything from temperature to pressure.

These components are essential in countless applications. In automotive manufacturing, Amphenol's connectors and sensors enable everything from advanced driver assistance systems to electric vehicle charging. In aerospace, its high-reliability interconnects withstand extreme vibration and temperature fluctuations while transmitting critical flight data. For industrial equipment, the company's robust connectors ensure uninterrupted power and data flow in harsh factory environments.

Consider a modern electric vehicle: Amphenol's connectors might link the battery management system to power controllers, its sensors could monitor battery temperature, and its high-voltage interconnects might safely transfer power from charging stations to the vehicle's battery pack.

The company operates through three main segments: Harsh Environment Solutions for rugged applications like defense and industrial equipment; Communications Solutions for broadband and data center infrastructure; and Interconnect and Sensor Systems for specialized sensing applications and value-added interconnect systems.

Amphenol maintains manufacturing facilities in approximately 40 countries, allowing it to serve global customers while meeting local requirements. This worldwide presence also provides manufacturing flexibility and reduces supply chain risks. The company employs advanced manufacturing processes including precision molding, computer-controlled machining, and automated assembly to produce billions of components annually.

Through both organic development and strategic acquisitions, Amphenol has continuously expanded its technological capabilities and market reach, evolving from its connector roots to become a comprehensive provider of interconnection solutions across the electronics landscape.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Amphenol competes with several major interconnect and sensor manufacturers including TE Connectivity (NYSE:TEL), Molex (owned by Koch Industries), Aptiv (NYSE:APTV), Sensata Technologies (NYSE:ST), and Foxconn (TPE:2317), along with specialized players like Glenair, HARTING, and Hirose Electric.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $23.09 billion in revenue over the past 12 months, Amphenol is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

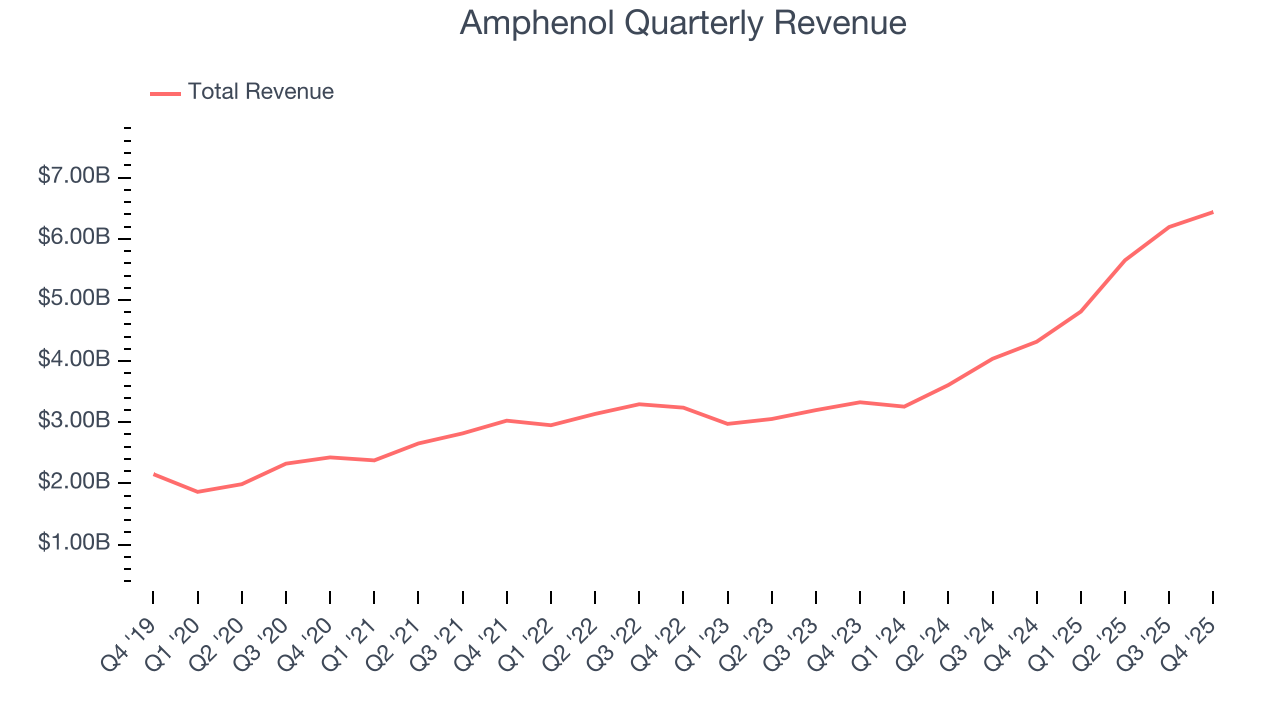

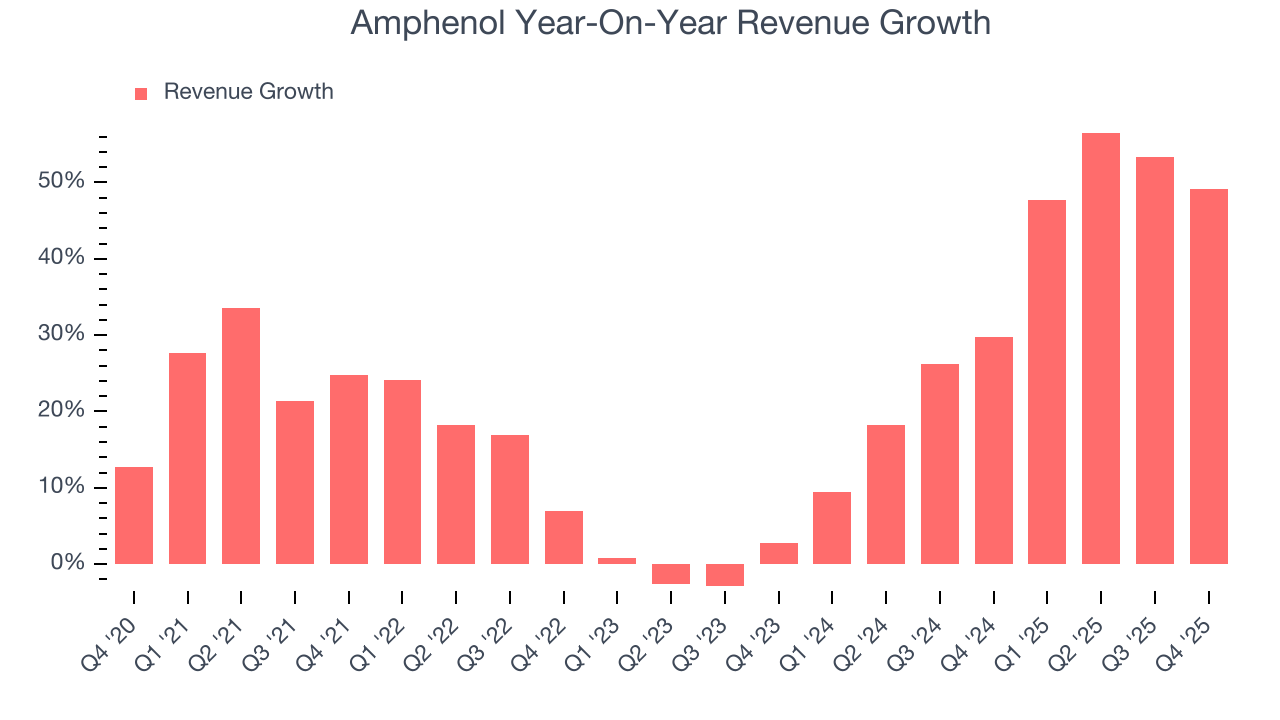

As you can see below, Amphenol’s sales grew at an incredible 21.8% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Amphenol’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Amphenol’s annualized revenue growth of 35.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Amphenol reported magnificent year-on-year revenue growth of 49.1%, and its $6.44 billion of revenue beat Wall Street’s estimates by 3.3%. Company management is currently guiding for a 44.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 30.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and implies the market sees success for its products and services.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

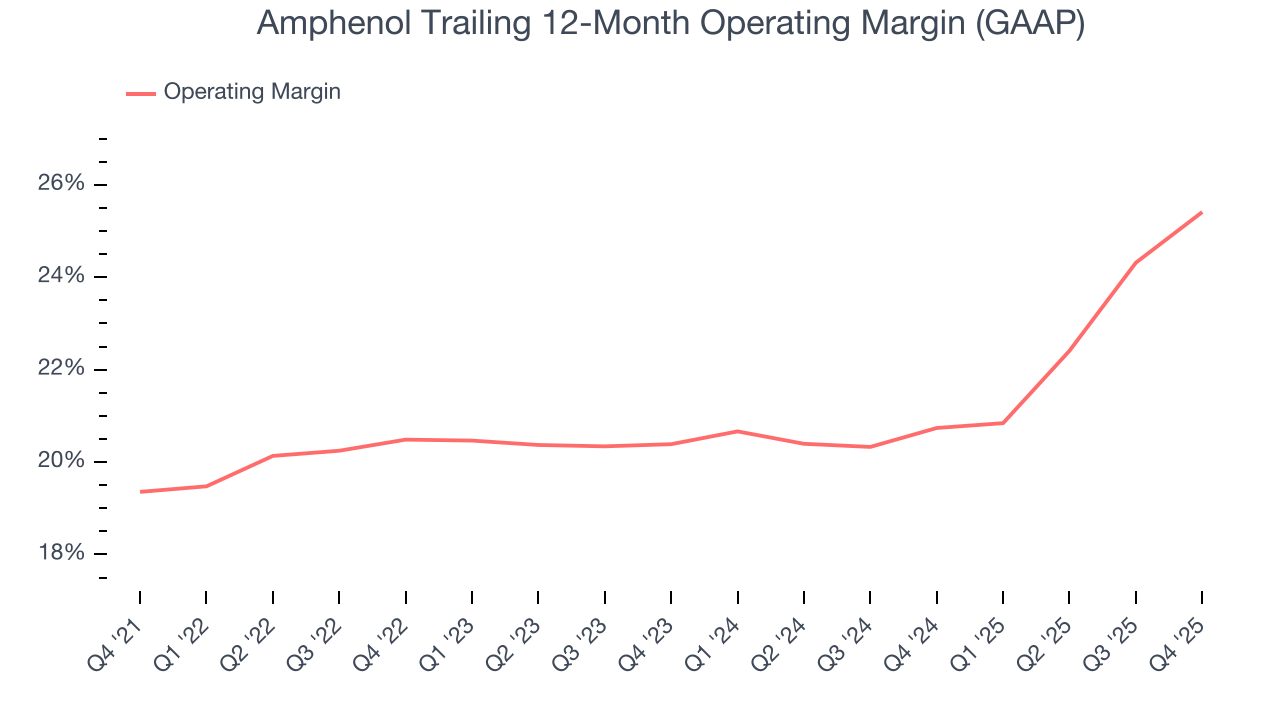

Amphenol has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 21.9%.

Analyzing the trend in its profitability, Amphenol’s operating margin rose by 6.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Amphenol generated an operating margin profit margin of 26.8%, up 4.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

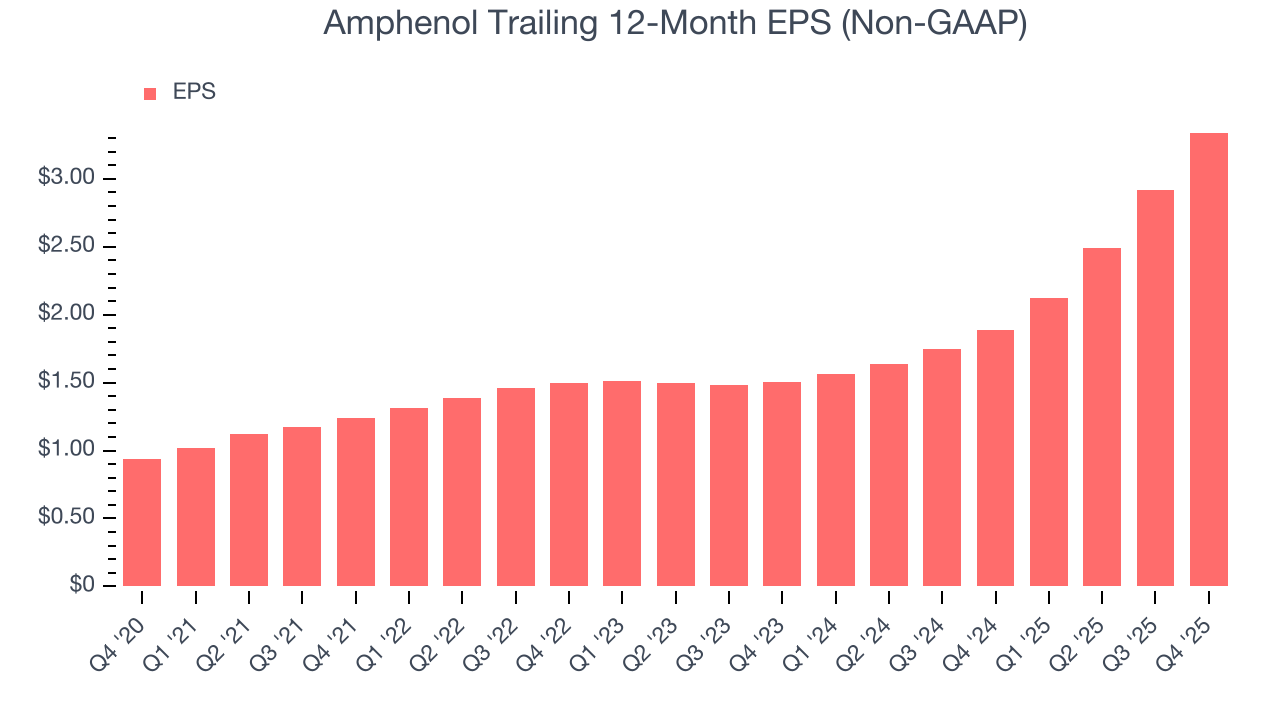

Amphenol’s EPS grew at an astounding 29% compounded annual growth rate over the last five years, higher than its 21.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Amphenol’s earnings can give us a better understanding of its performance. As we mentioned earlier, Amphenol’s operating margin expanded by 6.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Amphenol, its two-year annual EPS growth of 49% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Amphenol reported adjusted EPS of $0.97, up from $0.55 in the same quarter last year. This print beat analysts’ estimates by 3.1%. Over the next 12 months, Wall Street expects Amphenol’s full-year EPS of $3.34 to grow 28.2%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

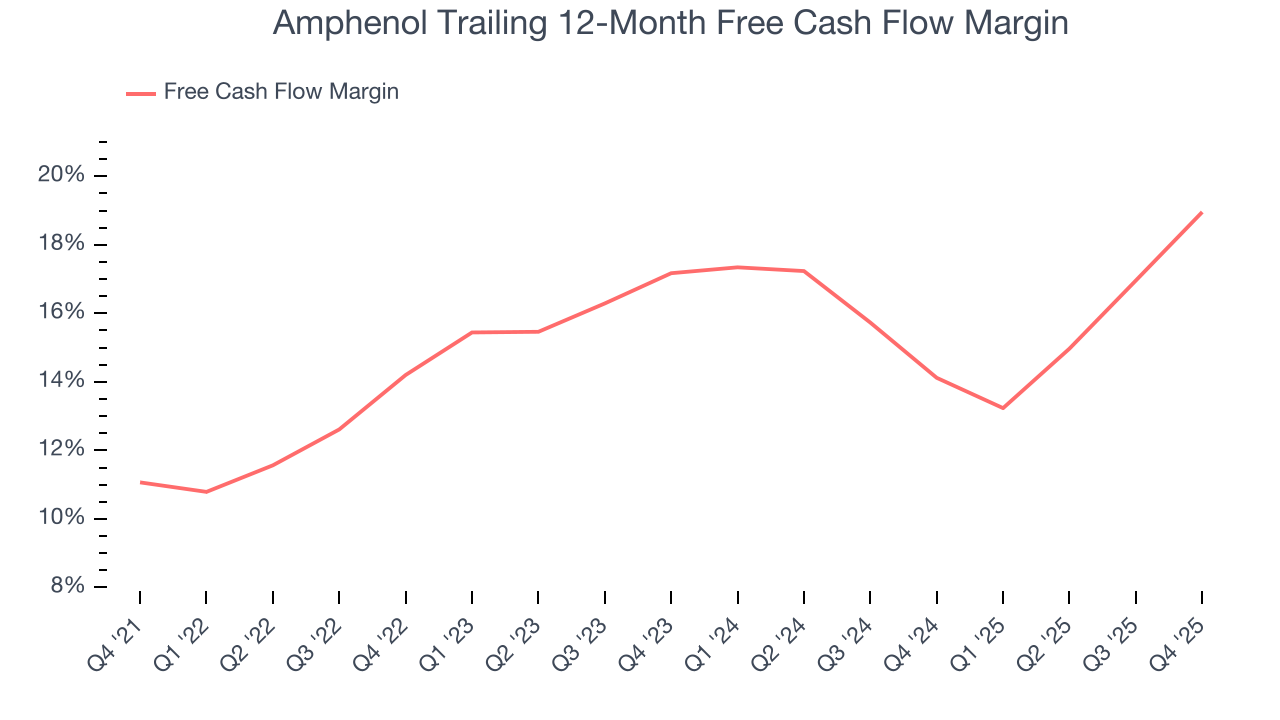

Amphenol has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 15.7% over the last five years.

Taking a step back, we can see that Amphenol’s margin expanded by 7.9 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Amphenol’s free cash flow clocked in at $1.47 billion in Q4, equivalent to a 22.8% margin. This result was good as its margin was 7.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

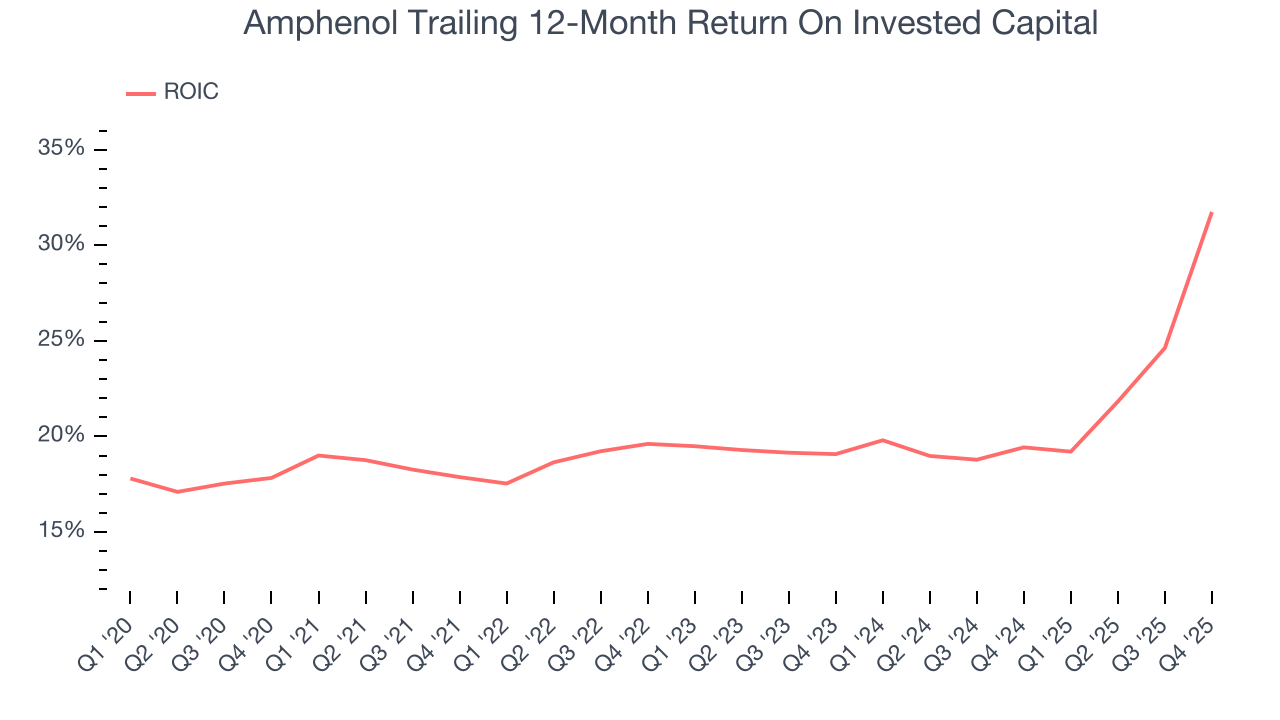

Amphenol’s five-year average ROIC was 21.5%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Amphenol’s ROIC has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

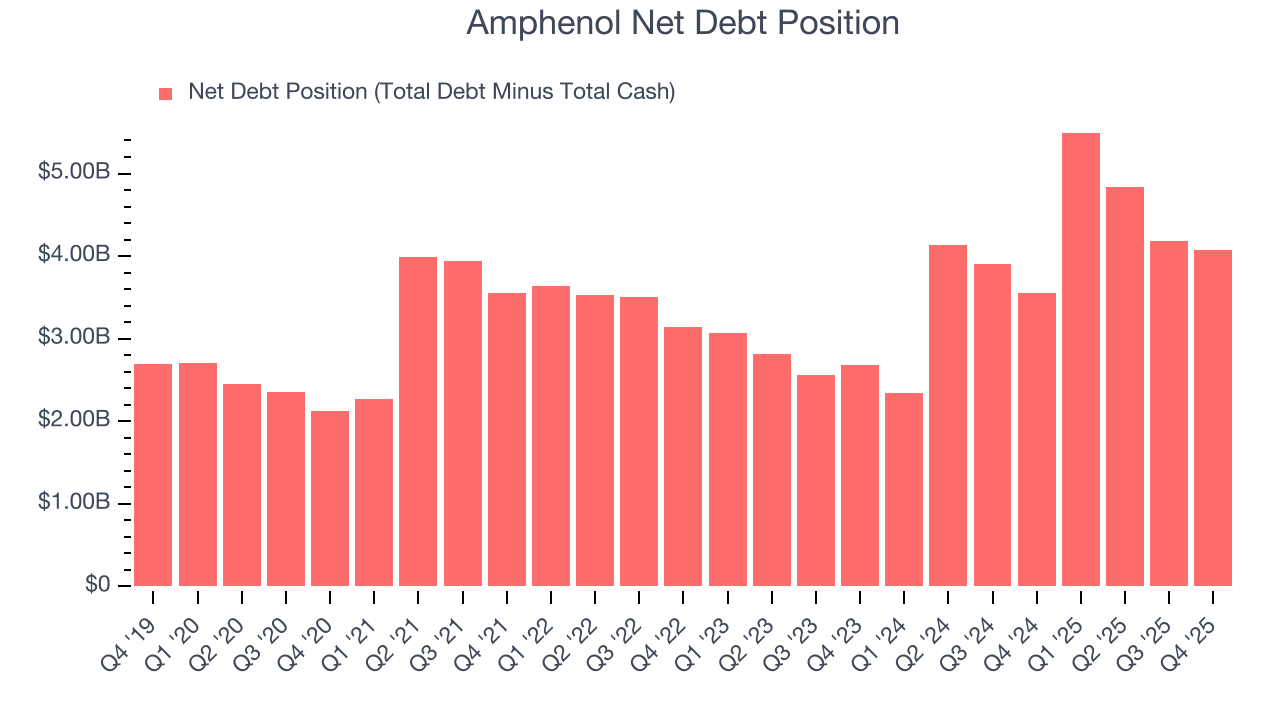

Amphenol reported $11.43 billion of cash and $15.5 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $6.97 billion of EBITDA over the last 12 months, we view Amphenol’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $108.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Amphenol’s Q4 Results

We were impressed by Amphenol’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. EPS guidance also impressed. Additionally, we were glad its revenue outperformed Wall Street’s estimates, leading to an EPS beat in the quarter. Zooming out, we think this quarter featured many important positives. Still, shares traded down 13.3% to $144.85 immediately following the results.

12. Is Now The Time To Buy Amphenol?

Updated: January 28, 2026 at 8:17 AM EST

Before deciding whether to buy Amphenol or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Amphenol is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. On top of that, its scale makes it a trusted partner with negotiating leverage, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Amphenol’s P/E ratio based on the next 12 months is 38.8x. Looking across the spectrum of business services businesses, Amphenol’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $160.49 on the company (compared to the current share price of $144.85), implying they see 10.8% upside in buying Amphenol in the short term.