1. News

2. Summary

Why We Like Ares

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE:ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

- Fee-related earnings increased by 33.6% annually over the last five years as it refined its cost structure

- Annual revenue growth of 19.2% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 17.9% annually over the last five years and easily exceeded the peer group average

Ares is a standout company. No coincidence the stock is up 243% over the last five years.

Is Now The Time To Buy Ares?

Is Now The Time To Buy Ares?

At $163.06 per share, Ares trades at 26.8x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Do you like the company and believe the bull case? If so, you can own a smaller position, as our work shows that high-quality companies outperform the market over a multi-year period regardless of entry price.

3. Ares (ARES) Research Report: Q3 CY2025 Update

Alternative asset manager Ares Management (NYSE:ARES) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 97.9% year on year to $1.66 billion. Its GAAP profit of $1.15 per share was 1.2% above analysts’ consensus estimates.

Ares (ARES) Q3 CY2025 Highlights:

- Assets Under Management: $595.7 billion vs analyst estimates of $592.9 billion (28.4% year-on-year growth, in line)

- Management Fees: $971.8 million vs analyst estimates of $939.8 million (28.3% year-on-year growth, 3.4% beat)

- Revenue: $1.66 billion vs analyst estimates of $1.11 billion (97.9% year-on-year growth, 49.5% beat)

- Fee-Related Earnings: $471.2 million vs analyst estimates of $443.3 million (6.3% beat)

- EPS (GAAP): $1.15 vs analyst estimates of $1.14 (1.2% beat)

- Market Capitalization: $32.63 billion

Company Overview

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE:ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

Ares operates through four primary investment strategies: Credit, Private Equity, Real Estate, and Strategic Initiatives. The Credit Group, the largest segment, invests in various debt instruments across the capital structure, from senior secured loans to high-yield bonds and distressed securities. The Private Equity Group focuses on controlling stakes in middle-market companies, particularly in sectors like healthcare, services, and consumer products. The Real Estate Group invests in commercial properties and mortgage debt, while Strategic Initiatives encompasses infrastructure investments and other emerging strategies.

The firm's clients include pension funds, sovereign wealth funds, insurance companies, foundations, endowments, and wealthy individuals seeking investment returns that often exceed those available in public markets. For example, a state pension fund might allocate capital to Ares to manage within a private credit fund that provides direct loans to middle-market companies unable to secure traditional bank financing.

Ares generates revenue primarily through management fees, which are calculated as a percentage of assets under management, and performance-based fees (carried interest), which are earned when investments exceed predetermined return thresholds. The firm also benefits from investment income on its own capital invested alongside clients.

The company has expanded its global footprint through both organic growth and strategic acquisitions, including the purchase of Black Creek Group to enhance its real estate capabilities and SSG Capital to strengthen its position in Asian credit markets. Ares operates offices across North America, Europe, Asia, and Australia, allowing it to source investment opportunities and deploy capital worldwide.

4. Asset Management

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

Ares Management competes with other alternative asset managers including Blackstone (NYSE:BX), KKR (NYSE:KKR), Apollo Global Management (NYSE:APO), The Carlyle Group (NASDAQ:CG), and Brookfield Asset Management (NYSE:BAM).

5. Revenue Growth

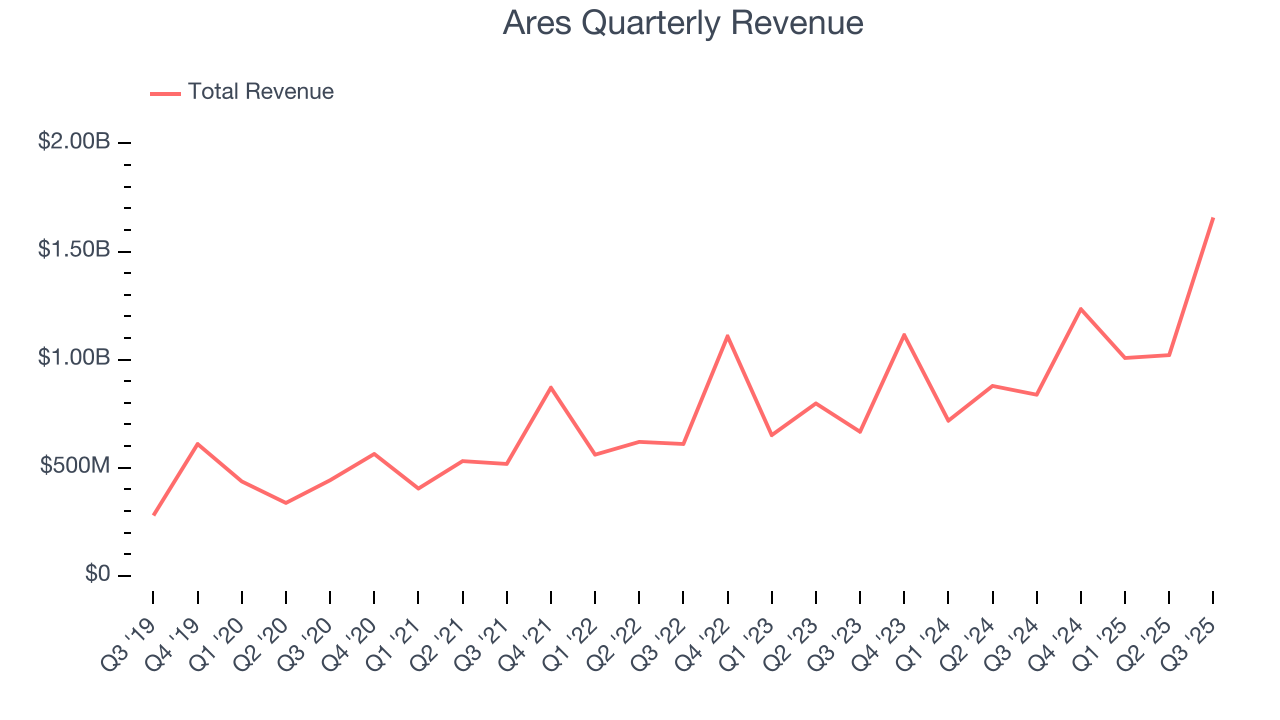

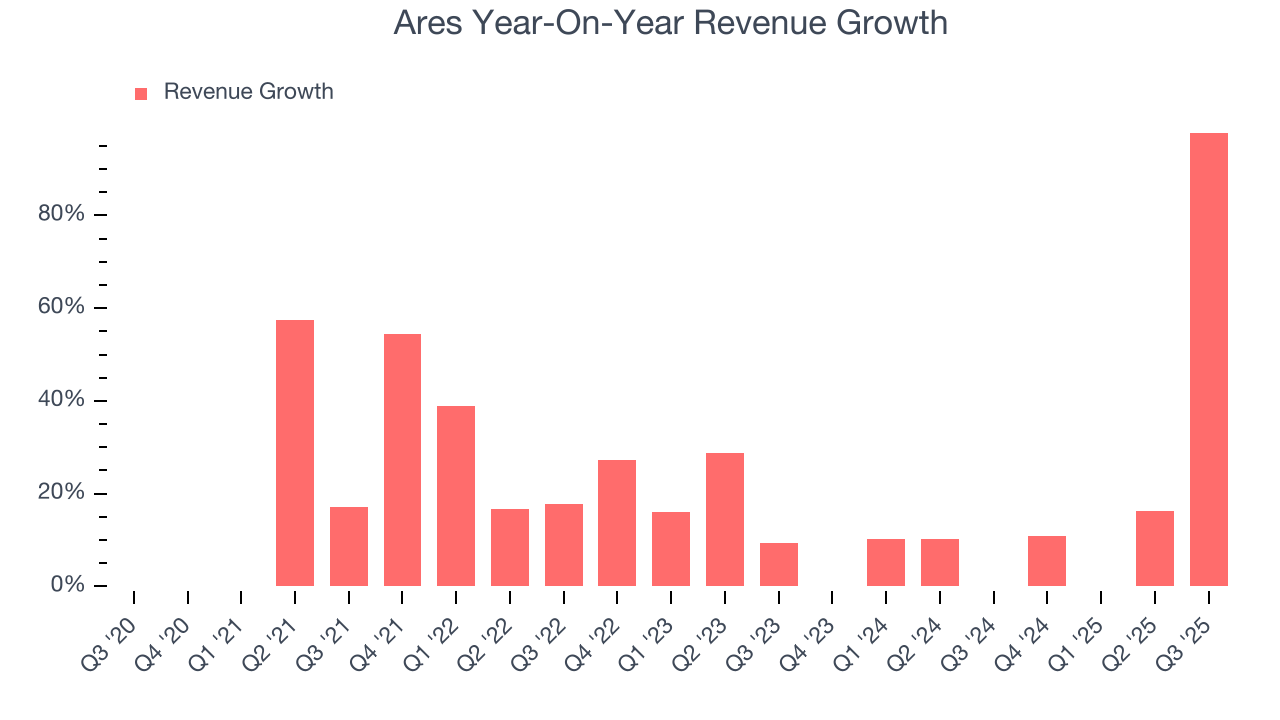

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Ares’s revenue grew at an exceptional 21.9% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Ares’s annualized revenue growth of 23.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ares reported magnificent year-on-year revenue growth of 97.9%, and its $1.66 billion of revenue beat Wall Street’s estimates by 49.5%.

6. Assets Under Management (AUM)

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Ares’s AUM has grown at an annual rate of 23.9% over the last four years, much better than the broader financials industry. When analyzing Ares’s AUM over the last two years, we can see that growth decelerated to 21.7% annually. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

In Q3, Ares’s AUM was $595.7 billion, meeting analysts’ expectations. This print was 28.4% higher than the same quarter last year.

7. Management Fees

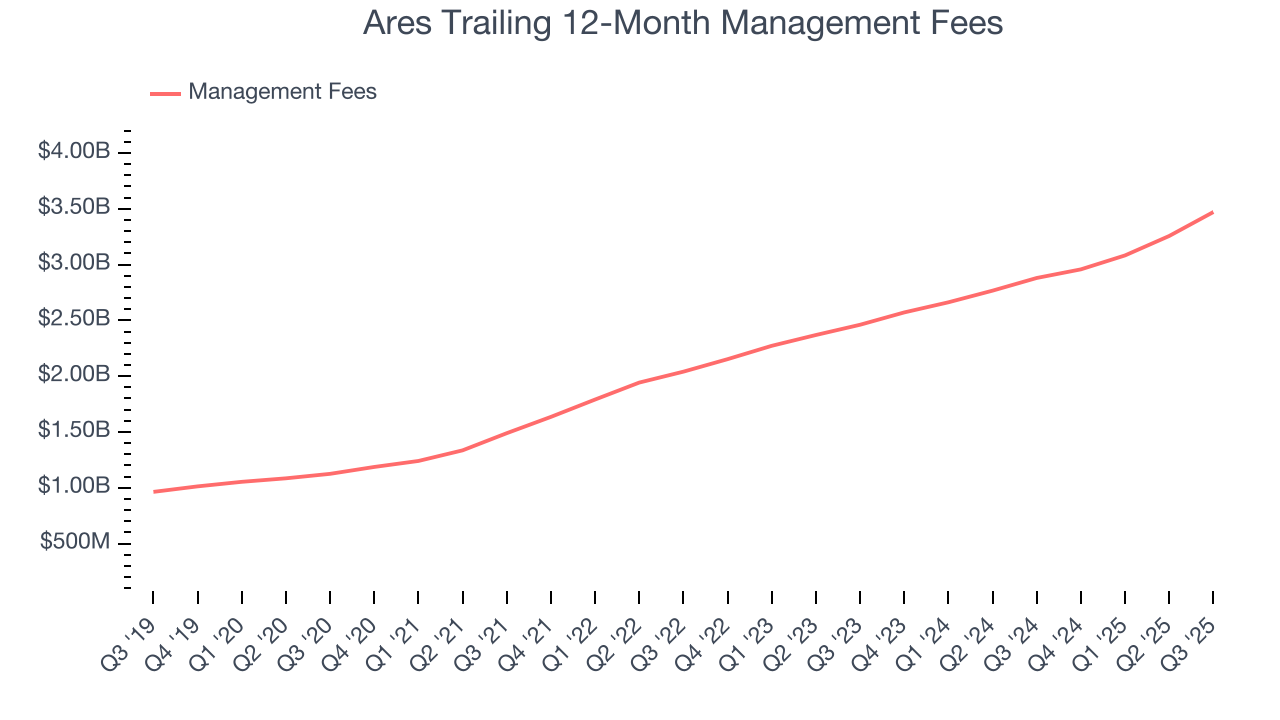

While assets under management are the committed capital by clients - not revenue itself - they directly influence how much firms can earn in the form of management fees, which are charged as a percentage of AUM.

Over the past five years, Ares’s management fees grew by a terrific 25.3% per year and outpaced its total revenue, suggesting its asset management division was a net contributor for the company (ignoring performance fees that typically range from 10-20% of investment gains). A two-year view reveals that growth decelerated to 18.8% annualized, but this was still an acceptable result.

Ares’s management fees punched in at $971.8 million in Q3, topping Consensus estimates by 3.4%. Wall Street opinions aside, management fees grew by 28.3% year on year.

8. Fee-Related Earnings

Revenue trends matter, but the durability of profits is what separates winners from losers. For asset managers, fee-related earnings strip away the noise of performance fees and investment income to reveal the core profitability of their fee-based business model. This represents the steady, predictable earnings that investors can count on.

Ares’s five-year annual fee-related earnings growth of 33.6% was elite and topped its 25.3% five-year management fee growth. Roughly speaking, this means Ares became more efficient in its core operations.

As you’ve seen throughout this report, we supplement with a two-year look because a five-year view may miss recent changes in the business. Over this period, Ares’s fee-related earnings grew by an impressive 20.6% annually, faster than its growth in management fees. This data implies that the change in AUM-related revenue outpaced the operating expenses associated with managing that AUM.

Ares’s fee-related earnings came in at $471.2 million this quarter, beating analysts’ expectations by 6.3%. These results represent 38.9% year-on-year growth.

9. Adjusted Net Earnings per Share (ANI per Share)

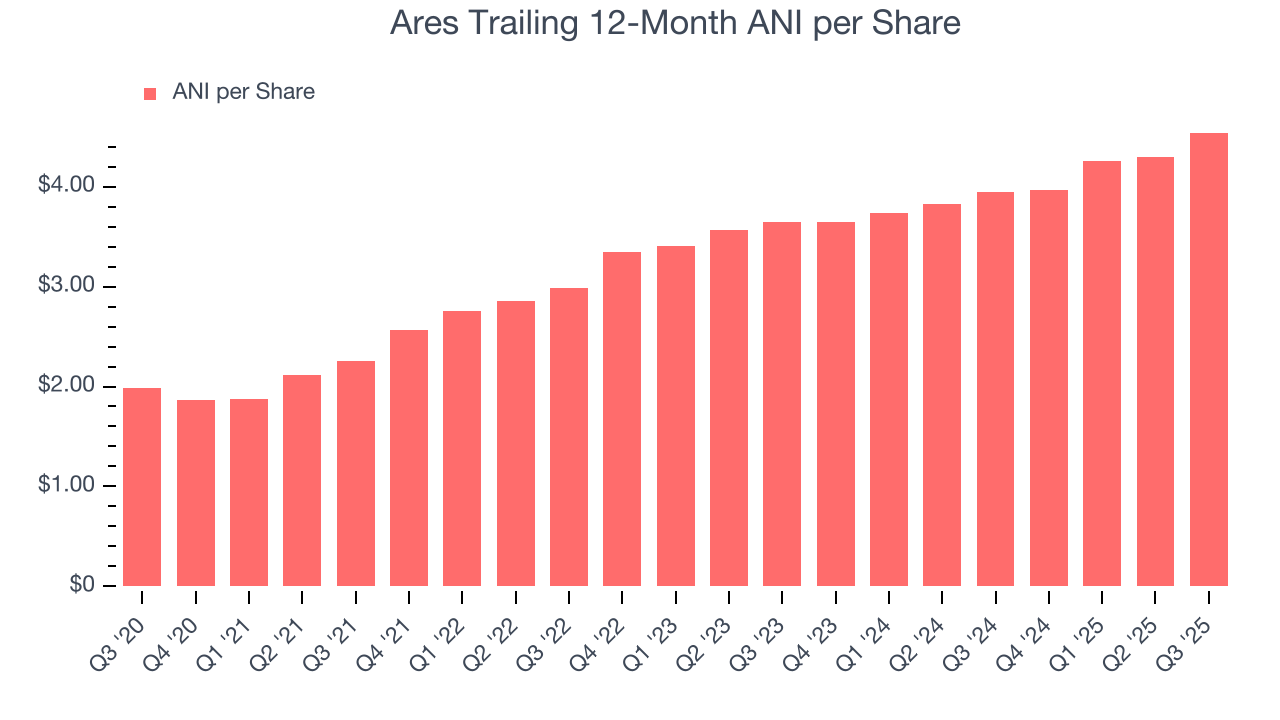

ANI per share serves as the primary earnings metric for asset managers, representing adjusted net income on a per-share basis. It’s essentially the same adjusted EPS calculation used across various sectors.

By excluding unrealized investment movements and non-recurring costs, ANI per share reveals the underlying profitability of the business. The per-share adjustment is crucial because it shows how earnings translate to individual shareholder ownership after accounting for share count changes.

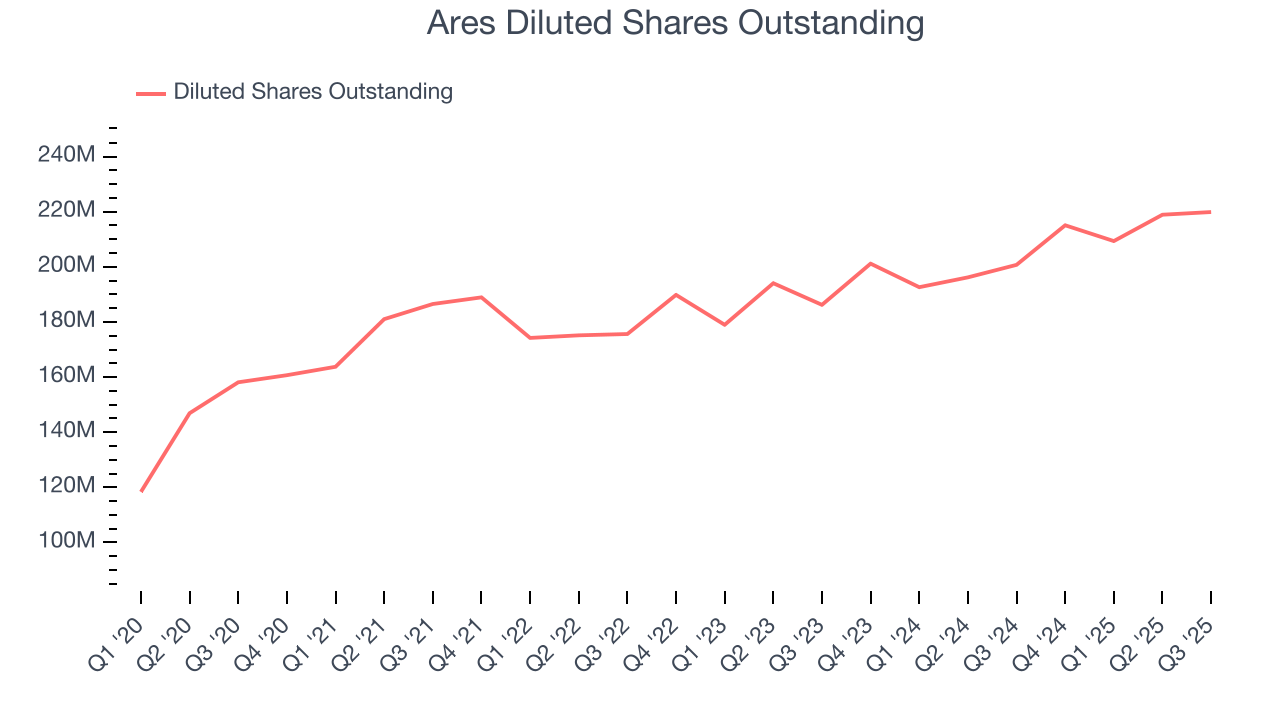

Ares’s 17.9% annualized ANI per share growth over the past five years was remarkable but underperformed its 33.6% fee-related earnings growth. It also diluted shareholders across this stretch, a headwind for its results.

On a two-year basis, Ares’s annualized ANI per share growth decelerated to 11.5%. While this performance was decent on an absolute level, it lagged its fee-related earnings growth over the same period. We note the company continued diluting shareholders during this timeframe, suppressing its ANI per share.

In Q3, Ares reported ANI per share of $1.19, up from $0.95 in the same quarter last year. This print beat analysts’ estimates by 4%.

10. A Word on Book Value and ROE

You may wonder when we will analyze book value and return on equity (ROE) since Ares is a financials company. We pay less attention to these metrics for asset managers because they are not great measures of business quality.

Asset managers are fee-based, capital light firms that manage client capital rather than their own, so they are not balance sheet businesses. Additionally, book value fails to capture the value of brands, investment track records, and other intangibles, thus understating intrinsic value, while ROE can look artificially high due to the relatively smaller bases of equity capital needed to operate the business compared to banks and insurers.

11. Balance Sheet Assessment

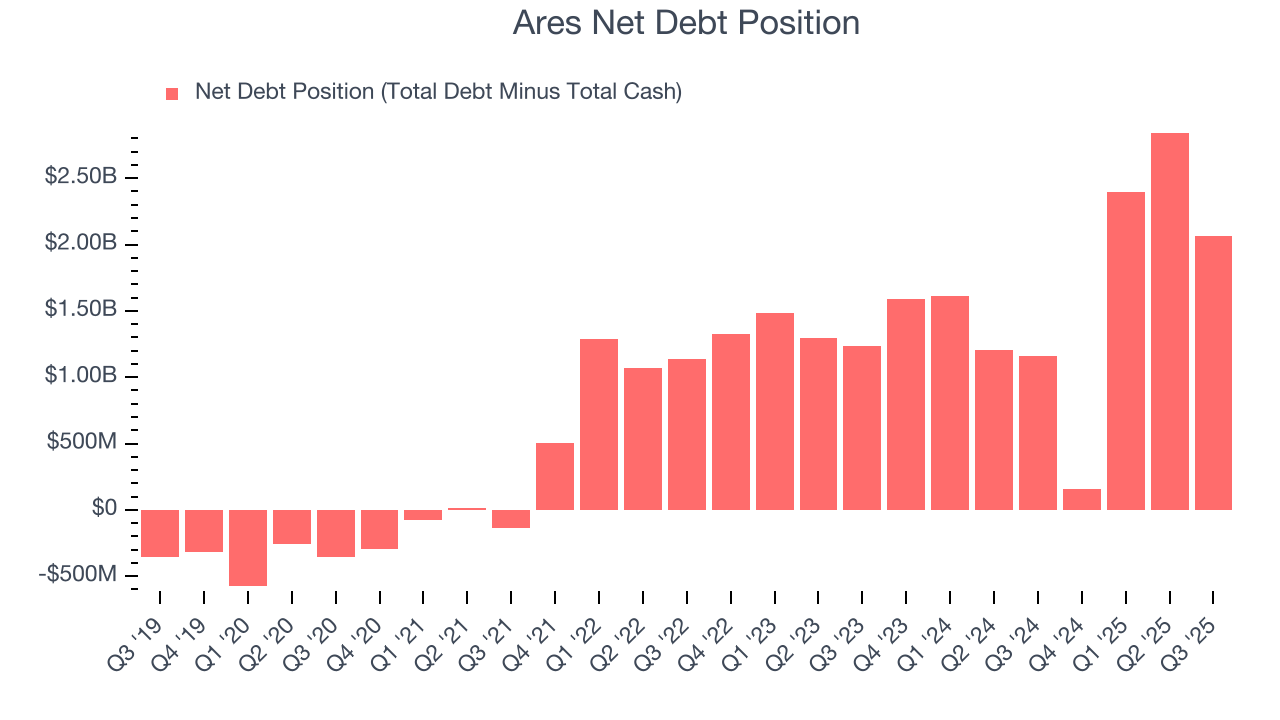

Ares reported $496.7 million of cash and $2.56 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $1.64 billion of fee-related earnings over the last 12 months, we view Ares’s 1.3× net-debt-to-earnings ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Ares’s Q3 Results

We were impressed by how significantly Ares blew past analysts’ revenue expectations this quarter. We were also glad its management fees outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $148.20 immediately after reporting.

13. Is Now The Time To Buy Ares?

Updated: December 4, 2025 at 11:04 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Ares.

Ares is a high-quality business worth owning. For starters, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. On top of that, its expanding fee-related earnings shows the asset management business is generating more profits, and its AUM growth was exceptional over the last five years.

Ares’s P/E ratio based on the next 12 months is 26.8x. Some good news is baked into the stock given its multiple, but we’ll happily own Ares as its fundamentals really stand out. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $183.60 on the company (compared to the current share price of $163.06).