Adtalem (ATGE)

Adtalem is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Adtalem Will Underperform

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

- Muted 13.9% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Low returns on capital reflect management’s struggle to allocate funds effectively

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Adtalem’s quality isn’t great. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Adtalem

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Adtalem

At $98.54 per share, Adtalem trades at 11.9x forward P/E. Adtalem’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Adtalem (ATGE) Research Report: Q4 CY2025 Update

Vocational education company Adtalem Global Education (NYSE:ATGE) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 12.4% year on year to $503.4 million. The company expects the full year’s revenue to be around $1.92 billion, close to analysts’ estimates. Its non-GAAP profit of $2.43 per share was 11.1% above analysts’ consensus estimates.

Adtalem (ATGE) Q4 CY2025 Highlights:

- Revenue: $503.4 million vs analyst estimates of $490.6 million (12.4% year-on-year growth, 2.6% beat)

- Adjusted EPS: $2.43 vs analyst estimates of $2.19 (11.1% beat)

- Adjusted EBITDA: $87.91 million vs analyst estimates of $138.3 million (17.5% margin, 36.5% miss)

- The company reconfirmed its revenue guidance for the full year of $1.92 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $7.90 at the midpoint, a 1.9% increase

- Operating Margin: 22.1%, in line with the same quarter last year

- Free Cash Flow was $15.12 million, up from -$29.7 million in the same quarter last year

- Market Capitalization: $4.02 billion

Company Overview

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

Adtalem’s portfolio encompasses several educational institutions and companies, each specializing in different fields. These include Chamberlain University, which focuses on nursing and healthcare education, Ross University School of Medicine and Ross University School of Veterinary Medicine, providing medical and veterinary education, and Walden University, known for its online learning programs in various disciplines. This diverse array of institutions reflects Adtalem’s commitment to addressing workforce needs in sectors like healthcare, veterinary science, and business.

Adtalem focuses on providing practical, real-world education that aligns with industry needs. The company collaborates with employers and professional organizations to design curricula and programs that prepare students for the demands of the job market. This focus ensures that graduates are not only well-educated but also job-ready, equipped with the skills and knowledge needed in their respective fields.

The company also has comprehensive support services, including career advising, job placement assistance, and alumni networks. Adtalem’s focus on student outcomes has helped build its reputation as a provider of quality education and professional training.

4. Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Adtalem's primary competitors include Laureate Education (NASDAQ:LAUR), Grand Canyon Education (NASDAQ:LOPE), Strayer Education (NASDAQ:STRA), and Kaplan (owned by Graham Holdings Company NYSE:GHC), and private company Apollo Education Group.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Adtalem grew its sales at a 13.9% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Adtalem’s recent performance shows its demand has slowed as its annualized revenue growth of 12.4% over the last two years was below its five-year trend.

This quarter, Adtalem reported year-on-year revenue growth of 12.4%, and its $503.4 million of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Operating Margin

Adtalem’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 19.5% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Adtalem generated an operating margin profit margin of 22.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

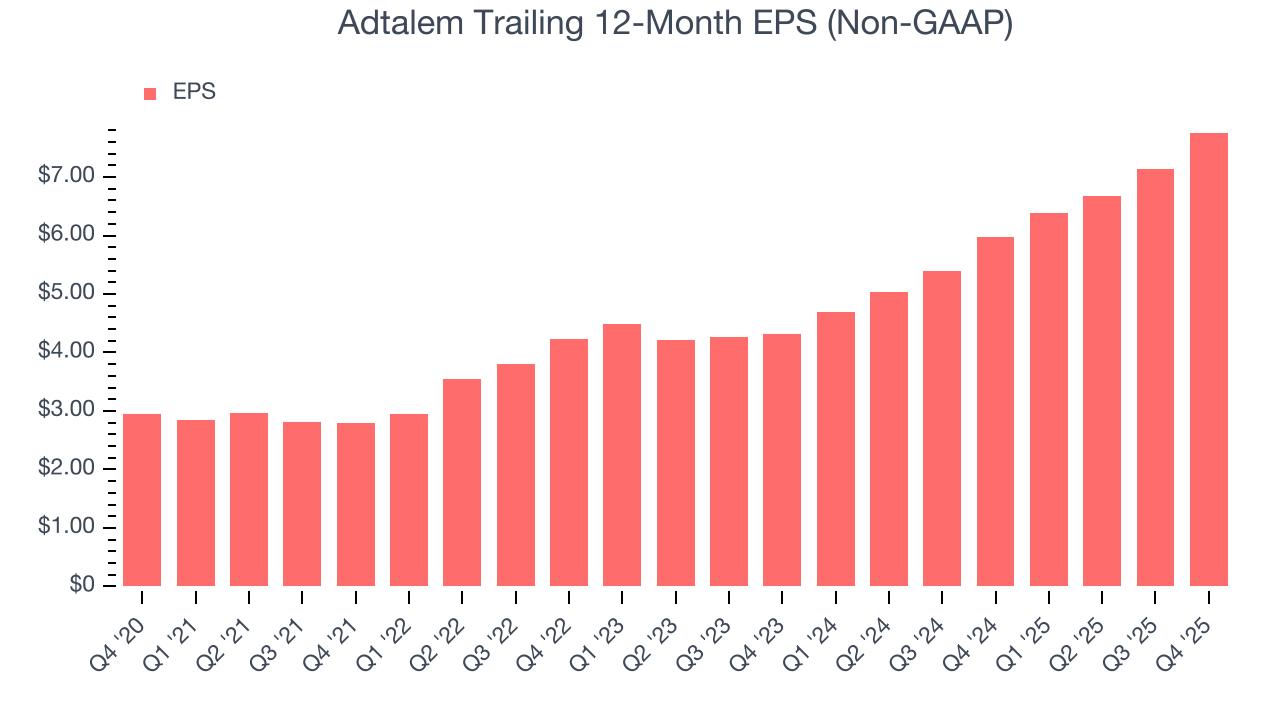

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Adtalem’s EPS grew at a weak 21.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 13.9% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Adtalem reported adjusted EPS of $2.43, up from $1.81 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Adtalem has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 16.8%, lousy for a consumer discretionary business.

Adtalem’s free cash flow clocked in at $15.12 million in Q4, equivalent to a 3% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Adtalem’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 19.5% for the last 12 months will decrease to 17.3%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Adtalem historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.1%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Adtalem’s ROIC has increased. This is a good sign, and we hope the company can continue improving.

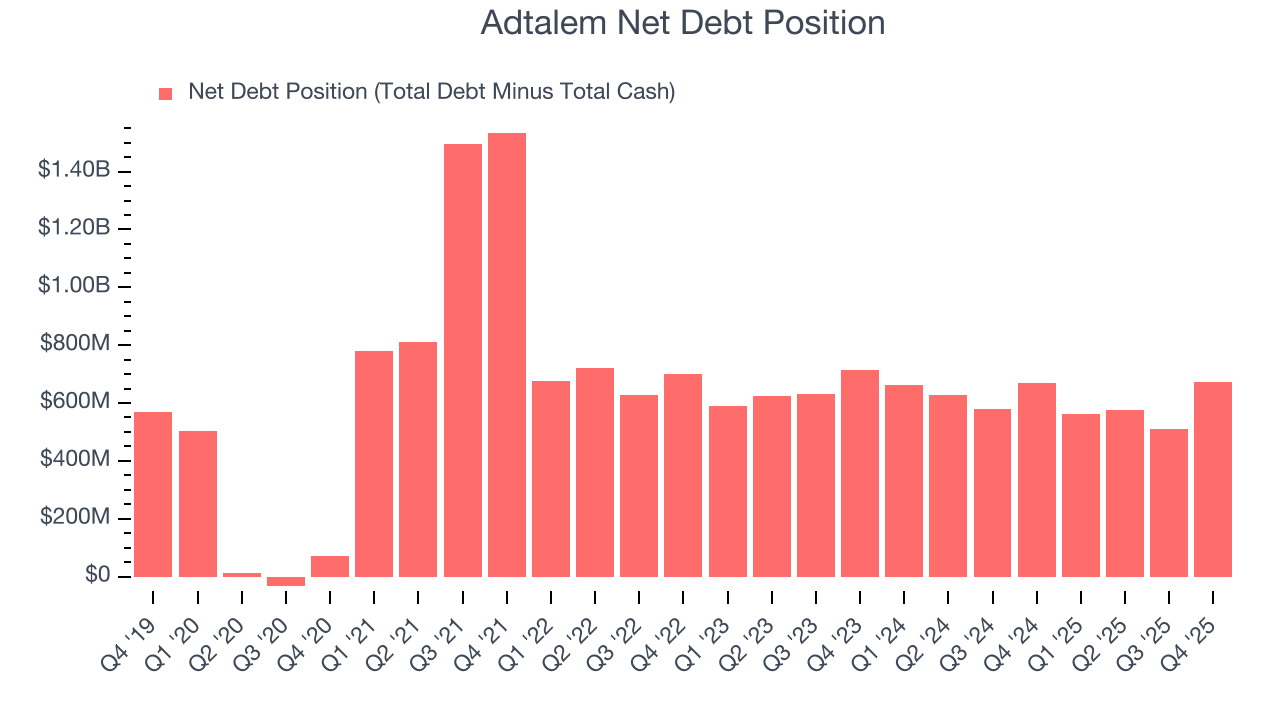

10. Balance Sheet Assessment

Adtalem reported $58.64 million of cash and $729.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $437.9 million of EBITDA over the last 12 months, we view Adtalem’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $18.52 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Adtalem’s Q4 Results

It was good to see Adtalem beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this was a weaker quarter. The stock traded up 3.1% to $119.54 immediately following the results.

12. Is Now The Time To Buy Adtalem?

Updated: March 1, 2026 at 9:10 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Adtalem falls short of our quality standards. On top of that, Adtalem’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its projected EPS for the next year is lacking.

Adtalem’s P/E ratio based on the next 12 months is 11.9x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $161 on the company (compared to the current share price of $98.54).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.