ATI (ATI)

ATI is a sound business. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why ATI Is Interesting

With its materials flying in nearly every commercial and military aircraft in service today, ATI (NYSE:ATI) produces highly specialized materials and components for aerospace, defense, medical, and energy applications using advanced metallurgy and manufacturing processes.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 80.9% outpaced its revenue gains

- A downside is its push for growth has led to negative returns on capital, signaling value destruction

ATI is close to becoming a high-quality business. If you believe in the company, the valuation looks fair.

Why Is Now The Time To Buy ATI?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ATI?

ATI is trading at $117 per share, or 32.1x forward P/E. While this multiple is higher than most industrials companies, we think the valuation is fair for the quality you get.

It could be a good time to invest if you see something the market doesn’t.

3. ATI (ATI) Research Report: Q3 CY2025 Update

Specialty materials manufacturer ATI (NYSE:ATI) met Wall Streets revenue expectations in Q3 CY2025, with sales up 7.1% year on year to $1.13 billion. Its non-GAAP profit of $0.85 per share was 15.2% above analysts’ consensus estimates.

ATI (ATI) Q3 CY2025 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.13 billion (7.1% year-on-year growth, in line)

- Adjusted EPS: $0.85 vs analyst estimates of $0.74 (15.2% beat)

- Adjusted EBITDA: $225.1 million vs analyst estimates of $206 million (20% margin, 9.3% beat)

- Operating Margin: 14.4%, in line with the same quarter last year

- Free Cash Flow was $167 million, up from -$41.8 million in the same quarter last year

- Market Capitalization: $15.85 billion

Company Overview

With its materials flying in nearly every commercial and military aircraft in service today, ATI (NYSE:ATI) produces highly specialized materials and components for aerospace, defense, medical, and energy applications using advanced metallurgy and manufacturing processes.

ATI's business is divided into two main segments: High Performance Materials & Components (HPMC) and Advanced Alloys & Solutions (AA&S). The HPMC segment, which generates about 86% of its revenue from aerospace and defense markets, creates sophisticated components for jet engines, airframes, and defense applications from nickel-based superalloys, titanium, and other specialty metals. These components must withstand extreme conditions like the high temperatures inside jet engines.

The AA&S segment produces flat products like plate, sheet, and strip materials used across multiple industries. While aerospace and defense account for approximately 60% of this segment's revenue, it also serves energy, medical, and electronics markets.

ATI's materials science expertise enables it to develop alloys with specific properties crucial for demanding applications. For example, its nickel-based superalloys are used in the hottest sections of jet engines where temperatures exceed 2,000°F, while its titanium components provide strength with lighter weight for aircraft structures. In medical applications, ATI's materials are used in MRI machines, replacement joints, and stents. The company maintains long-term agreements with major aerospace manufacturers, including Boeing, Airbus, GE Aerospace, and Rolls-Royce.

To address the critical titanium supply challenges facing the aerospace industry, ATI has been expanding its titanium melting capacity, with plans to increase it by 80% compared to 2022 levels by late 2025. The company is also investing in additive manufacturing (3D printing) capabilities to produce complex components that can't be made through traditional manufacturing methods.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

ATI's competitors include Berkshire Hathaway-owned Precision Castparts Corporation for specialty alloys and precision forgings, Howmet Aerospace (NYSE:HWM) for titanium alloys, Carpenter Technology Corporation (NYSE:CRS) for specialty alloys, and international competitors like VSMPO-AVISMA for titanium and Aubert & Duval for precision forgings.

5. Revenue Growth

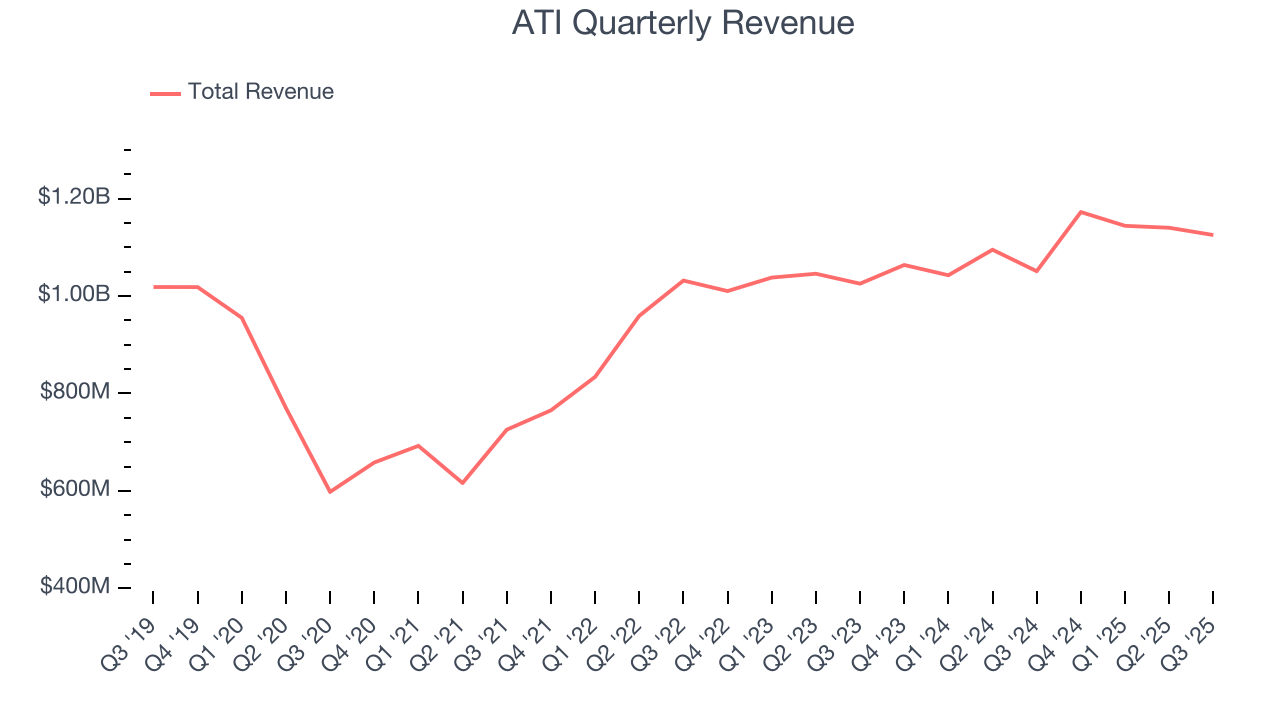

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, ATI’s sales grew at a mediocre 6.5% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about ATI.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ATI’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend.

This quarter, ATI grew its revenue by 7.1% year on year, and its $1.13 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet. At least the company is tracking well in other measures of financial health.

6. Operating Margin

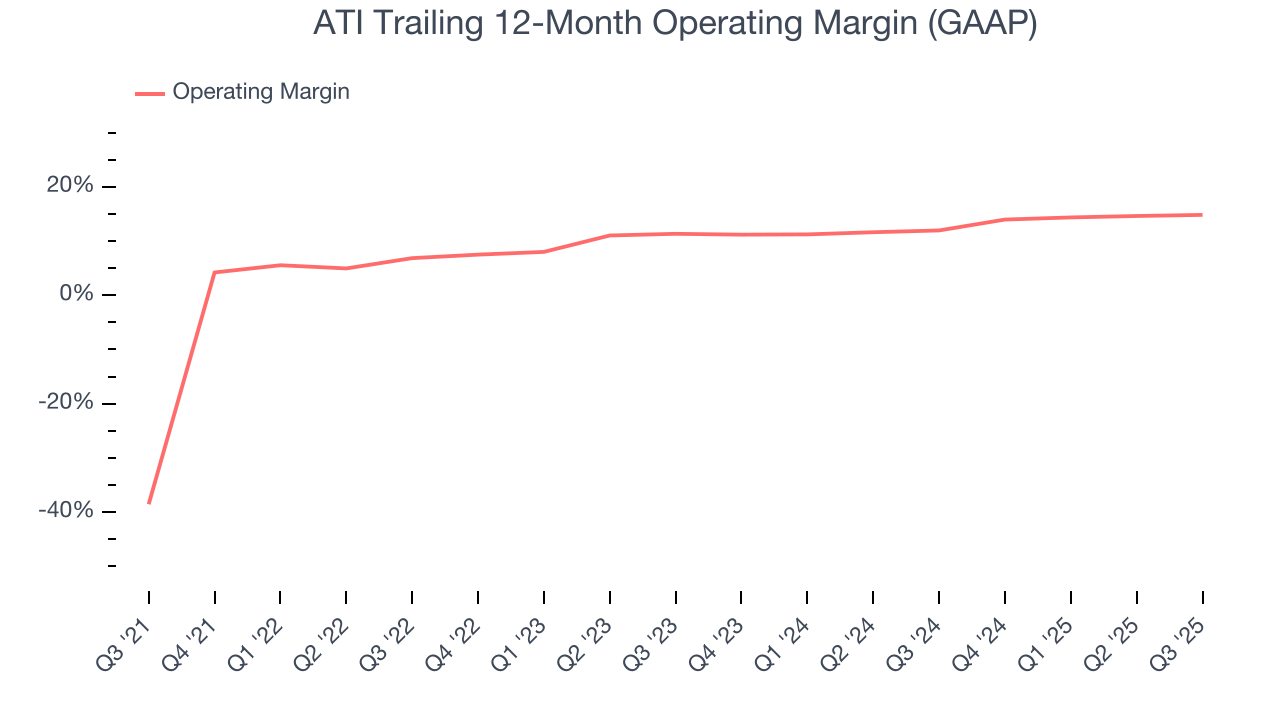

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

ATI was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business.

On the plus side, ATI’s operating margin rose by 53.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, ATI generated an operating margin profit margin of 14.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

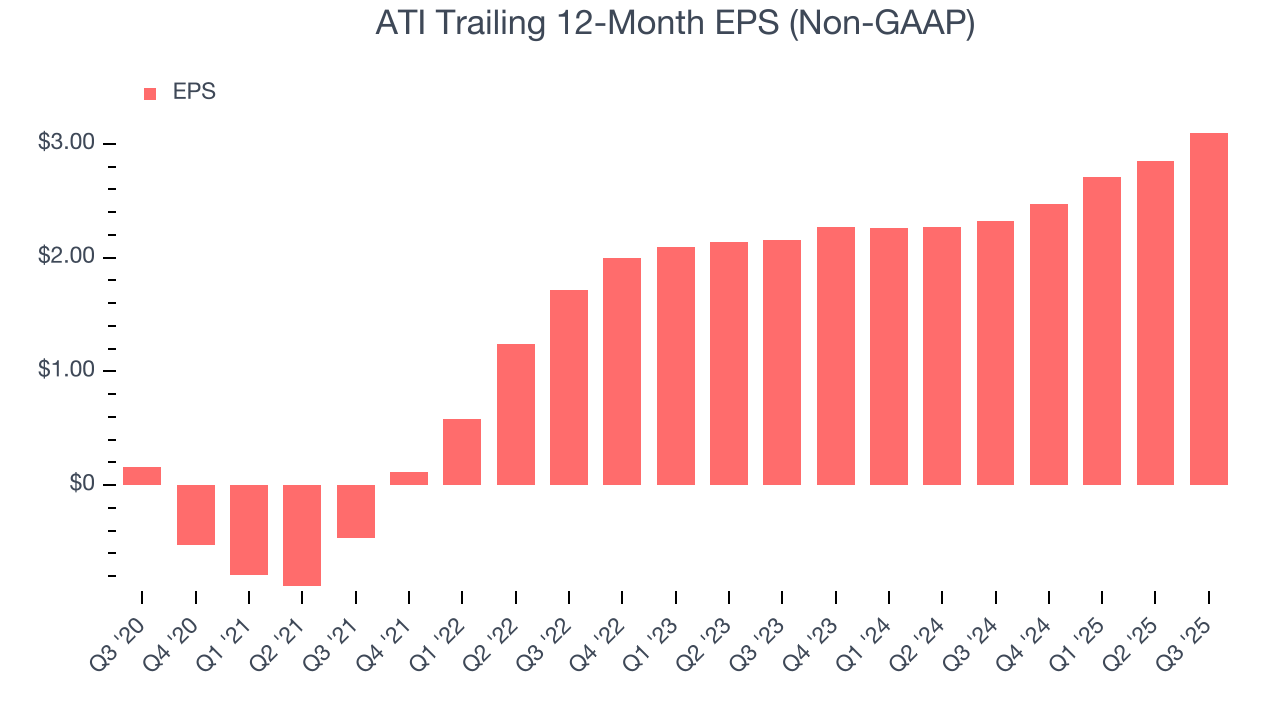

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ATI’s EPS grew at an astounding 80.9% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into ATI’s earnings to better understand the drivers of its performance. As we mentioned earlier, ATI’s operating margin was flat this quarter but expanded by 53.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ATI, its two-year annual EPS growth of 19.8% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, ATI reported adjusted EPS of $0.85, up from $0.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ATI’s full-year EPS of $3.10 to grow 17.5%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

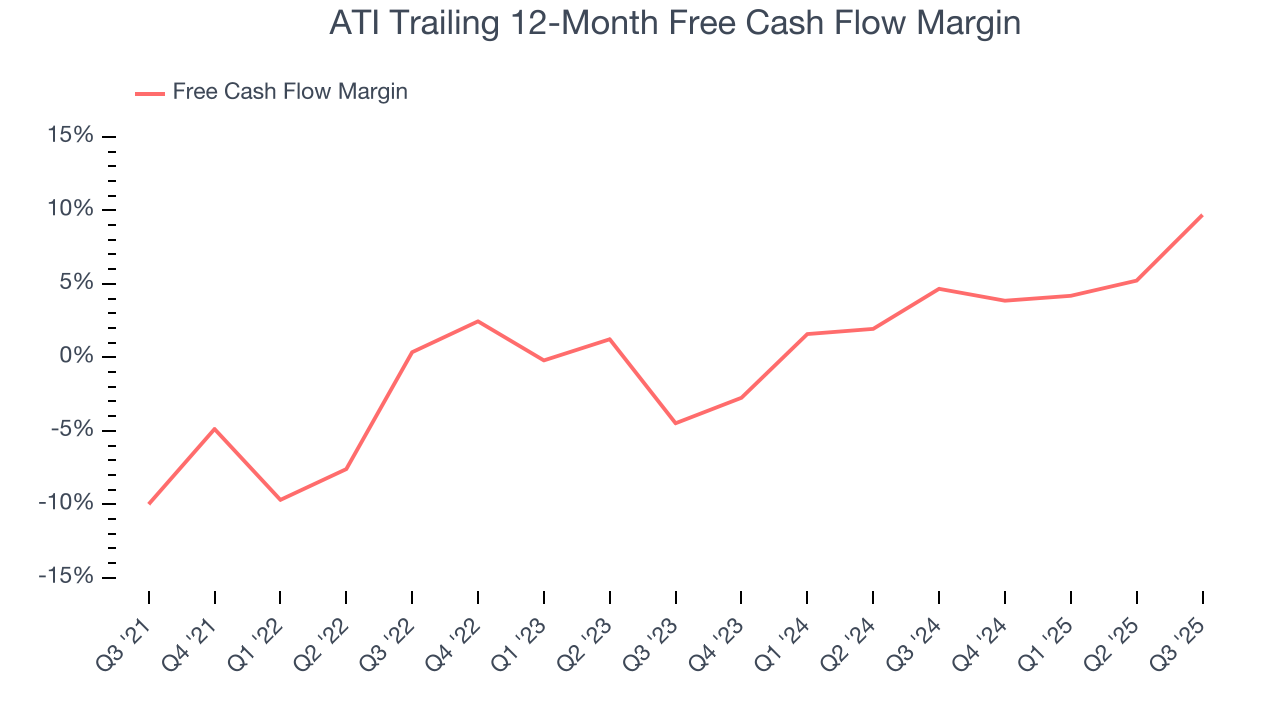

ATI has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1%, lousy for an industrials business.

Taking a step back, an encouraging sign is that ATI’s margin expanded by 19.7 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

ATI’s free cash flow clocked in at $167 million in Q3, equivalent to a 14.8% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

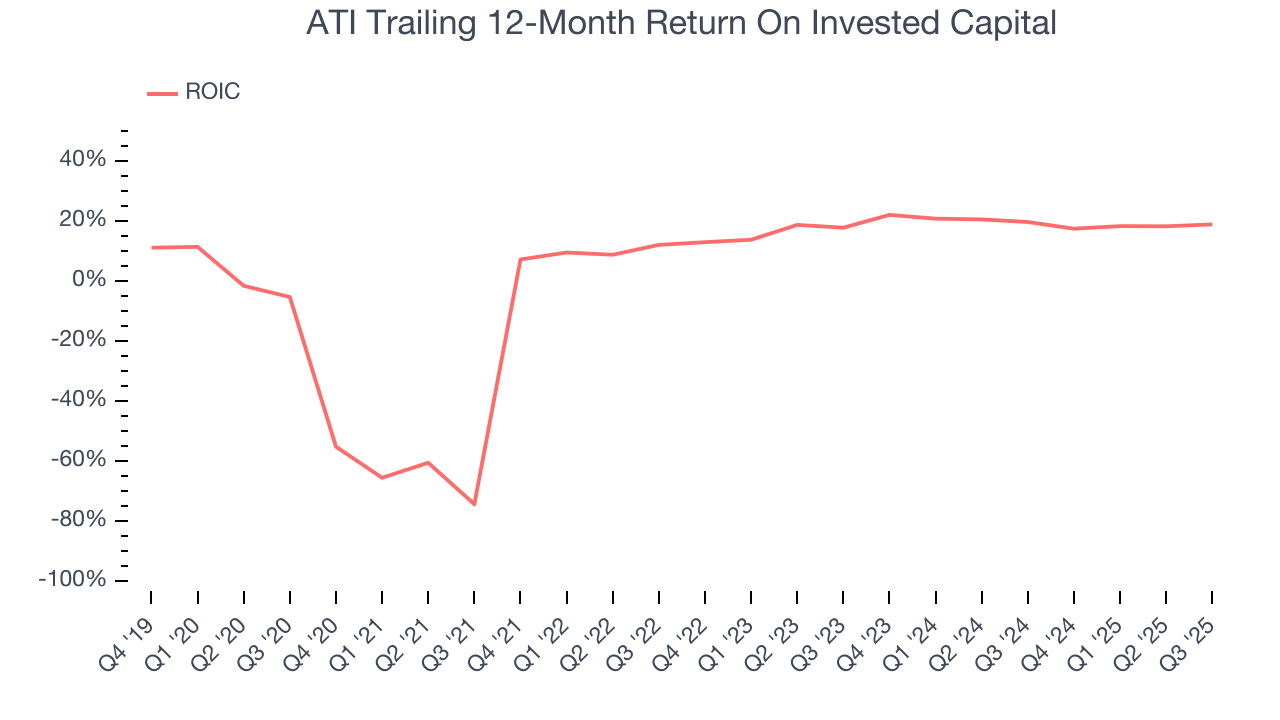

Although ATI has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 1.2%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. ATI’s ROIC has increased significantly over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

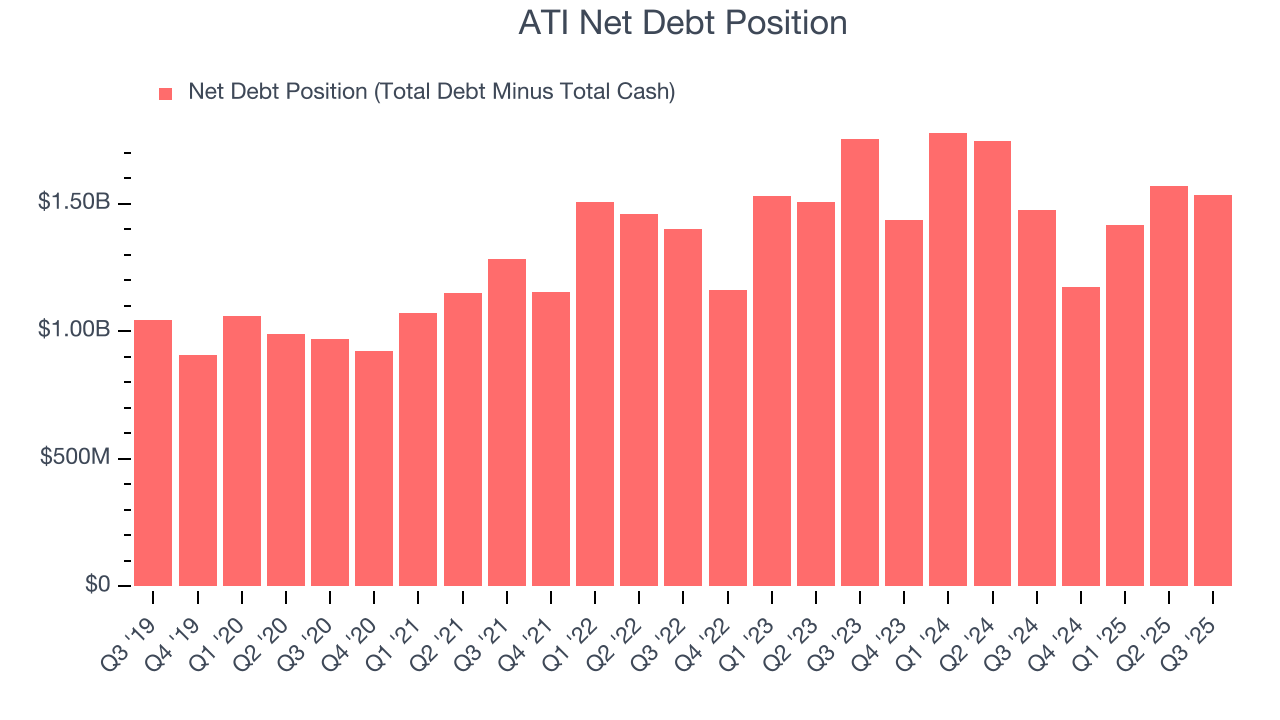

ATI reported $372.2 million of cash and $1.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $837.2 million of EBITDA over the last 12 months, we view ATI’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $99.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ATI’s Q3 Results

We were impressed by how significantly ATI blew past analysts’ EBITDA expectations this quarter. We were also glad its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its revenue missed and its revenue fell short of Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $116.80 immediately following the results.

12. Is Now The Time To Buy ATI?

Before making an investment decision, investors should account for ATI’s business fundamentals and valuation in addition to what happened in the latest quarter.

ATI possesses a number of positive attributes. Although its revenue growth was mediocre over the last five years, its rising cash profitability gives it more optionality. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its expanding operating margin shows the business has become more efficient.

ATI’s P/E ratio based on the next 12 months is 32x. Looking at the industrials space right now, ATI trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $121.25 on the company (compared to the current share price of $116.80), implying they see 3.8% upside in buying ATI in the short term.