Atmus Filtration Technologies (ATMU)

1. News

2. Atmus Filtration Technologies (ATMU) Research Report: Q3 CY2025 Update

Filtration products manufacturer Atmus Filtration Technologies (NYSE:ATMU) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10.9% year on year to $447.7 million. Its non-GAAP profit of $0.69 per share was 15.1% above analysts’ consensus estimates.

Atmus Filtration Technologies (ATMU) Q3 CY2025 Highlights:

- Revenue: $447.7 million vs analyst estimates of $416.4 million (10.9% year-on-year growth, 7.5% beat)

- Adjusted EPS: $0.69 vs analyst estimates of $0.60 (15.1% beat)

- Adjusted EBITDA: $91.5 million vs analyst estimates of $80.69 million (20.4% margin, 13.4% beat)

- Operating Margin: 18.3%, up from 15.7% in the same quarter last year

- Free Cash Flow Margin: 15.4%, up from 13.5% in the same quarter last year

- Market Capitalization: $4.53 billion

Company Overview

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE:ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

Operating primarily under the Fleetguard brand, Atmus produces a comprehensive range of filtration products including fuel filters, lube filters, air filters, crankcase ventilation systems, hydraulic filters, and coolants. These products serve two distinct channels: first-fit, where filters are installed on new vehicles during manufacturing, and aftermarket, where customers purchase replacement filters throughout the vehicle's lifespan. The company's filters work by trapping contaminants before they can damage engines or violate environmental regulations—for instance, a fuel filter on a diesel truck removes impurities from diesel before it enters the engine, while air filters prevent dust and debris from entering the combustion chamber.

Atmus sells to original equipment manufacturers (OEMs) like PACCAR and Traton Group, who install Atmus filters on trucks and heavy equipment during production. The aftermarket channel reaches fleet operators, independent repair shops, and distributors who need replacement filters for maintenance. A trucking company operating a fleet of semi-trucks might purchase Atmus fuel and oil filters every 15,000 to 25,000 miles as part of routine maintenance schedules, with Atmus earning revenue from each filter sold.

The company operates manufacturing facilities and distribution centers across multiple continents, with roughly half of its sales coming from outside the United States and Canada. Cummins remains Atmus's largest customer, accounting for approximately 18% of sales through long-term supply agreements established during the separation, while other major customers include truck manufacturers who rely on Atmus's one-stop-shop approach for various filtration needs across their product lines.

3. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Atmus competes with Donaldson Company (NYSE:DCI) and Parker-Hannifin (NYSE:PH) in filtration products, along with Mann+Hummel and other regional filter manufacturers.

4. Revenue Growth

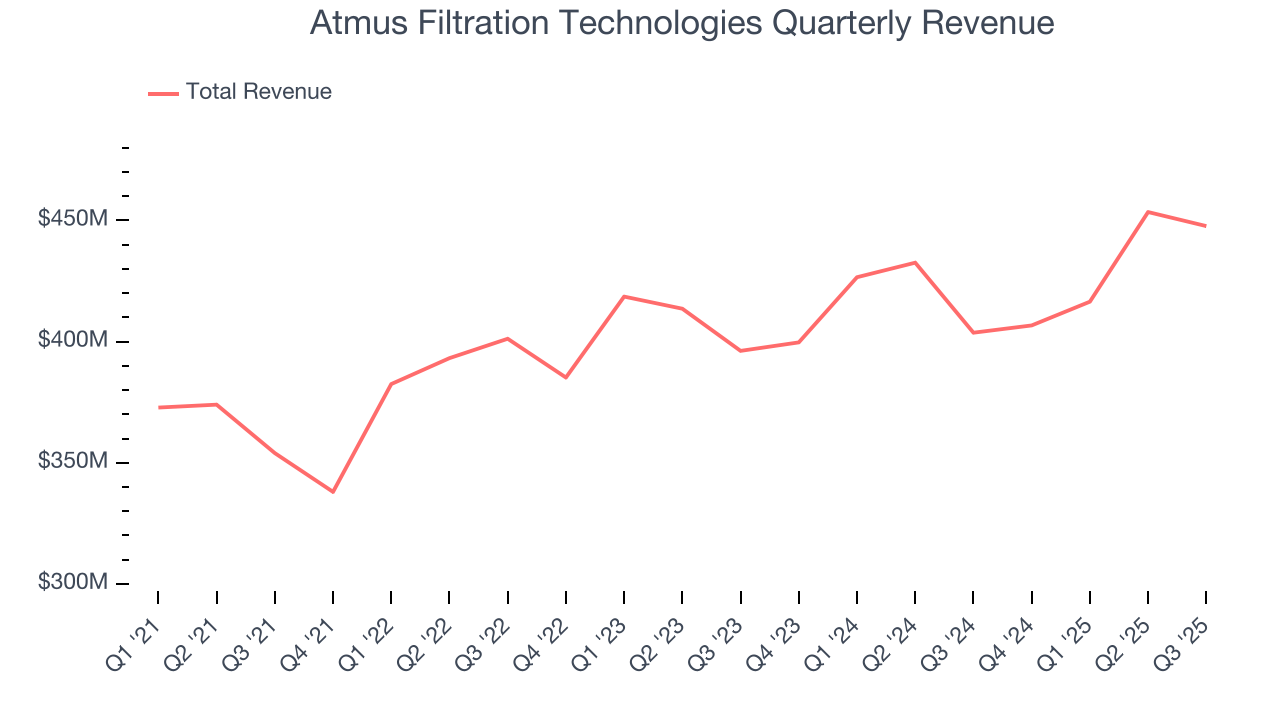

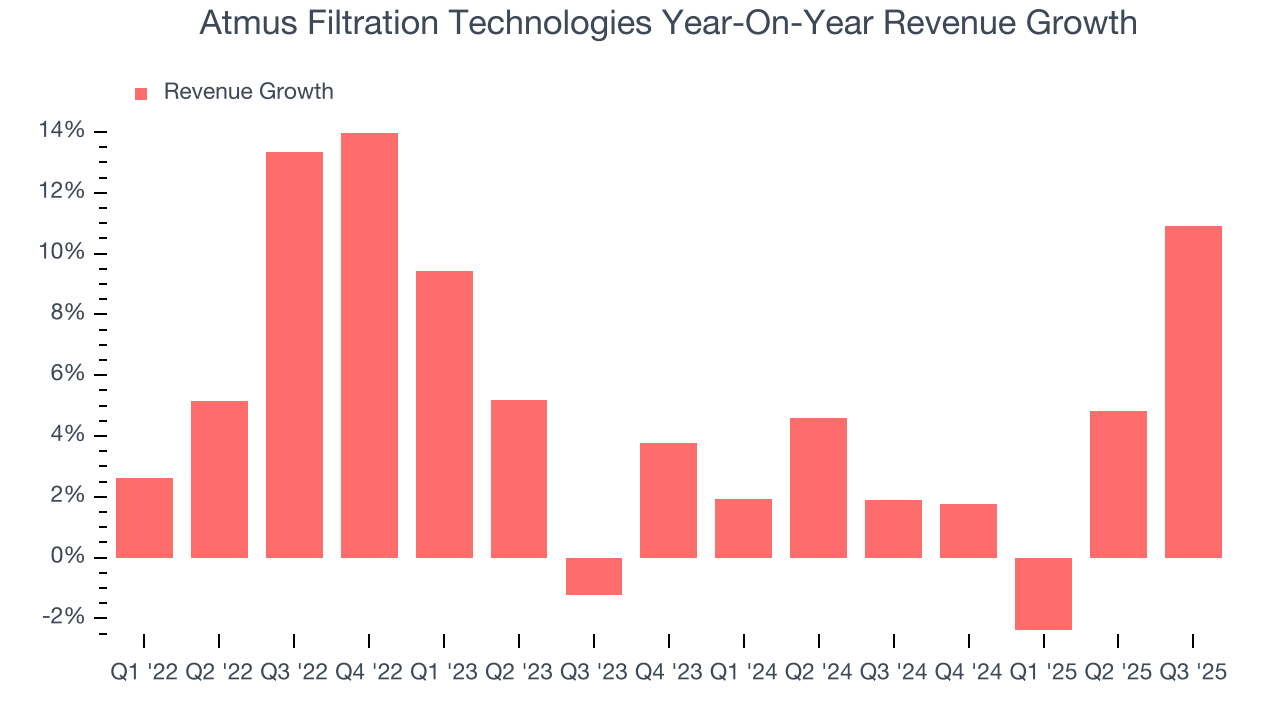

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Atmus Filtration Technologies’s sales grew at a tepid 4.6% compounded annual growth rate over the last four years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Atmus Filtration Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its four-year trend.

This quarter, Atmus Filtration Technologies reported year-on-year revenue growth of 10.9%, and its $447.7 million of revenue exceeded Wall Street’s estimates by 7.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

5. Gross Margin & Pricing Power

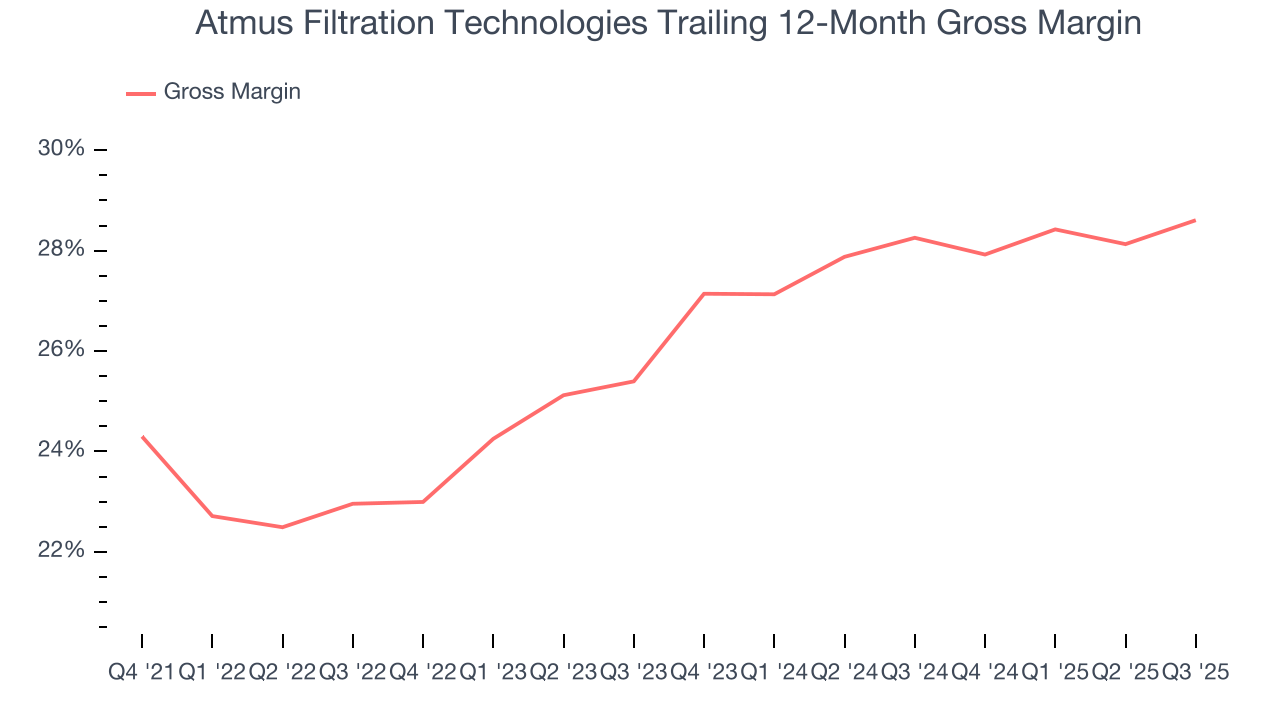

Atmus Filtration Technologies has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.2% gross margin over the last five years. Said differently, Atmus Filtration Technologies had to pay a chunky $73.75 to its suppliers for every $100 in revenue.

In Q3, Atmus Filtration Technologies produced a 29.5% gross profit margin, up 1.9 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

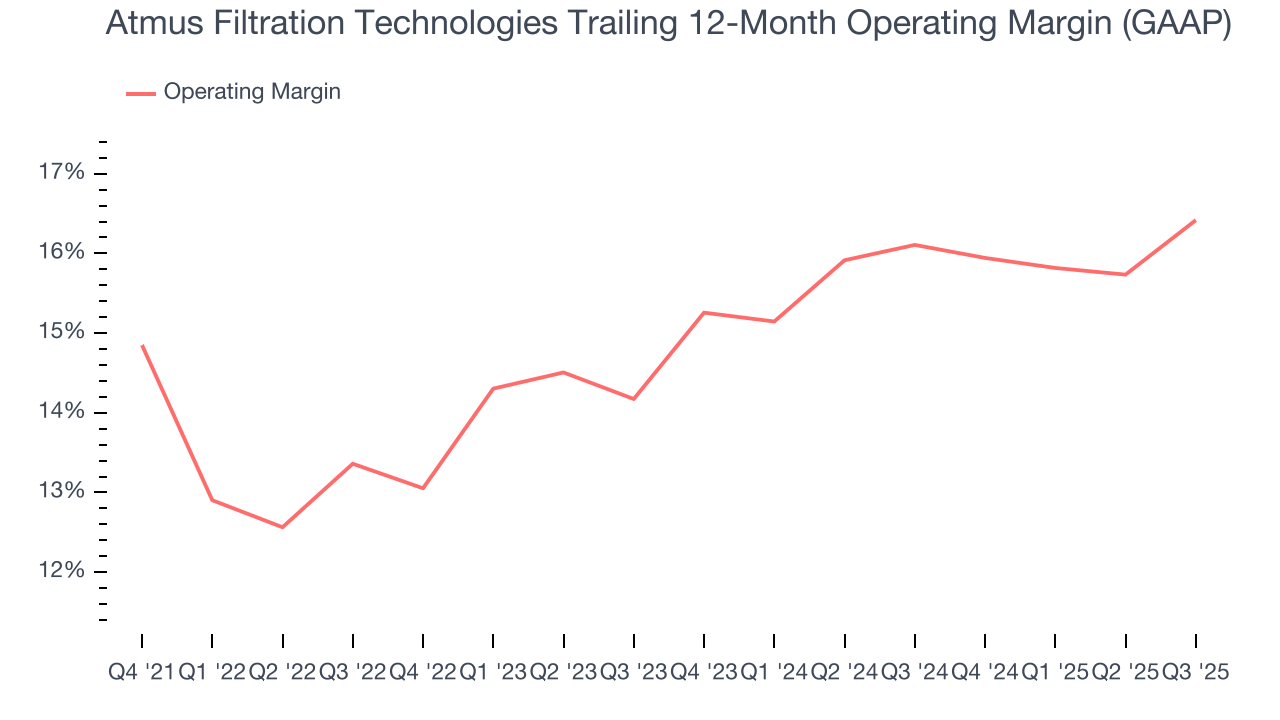

Atmus Filtration Technologies has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Atmus Filtration Technologies’s operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Atmus Filtration Technologies generated an operating margin profit margin of 18.3%, up 2.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

7. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

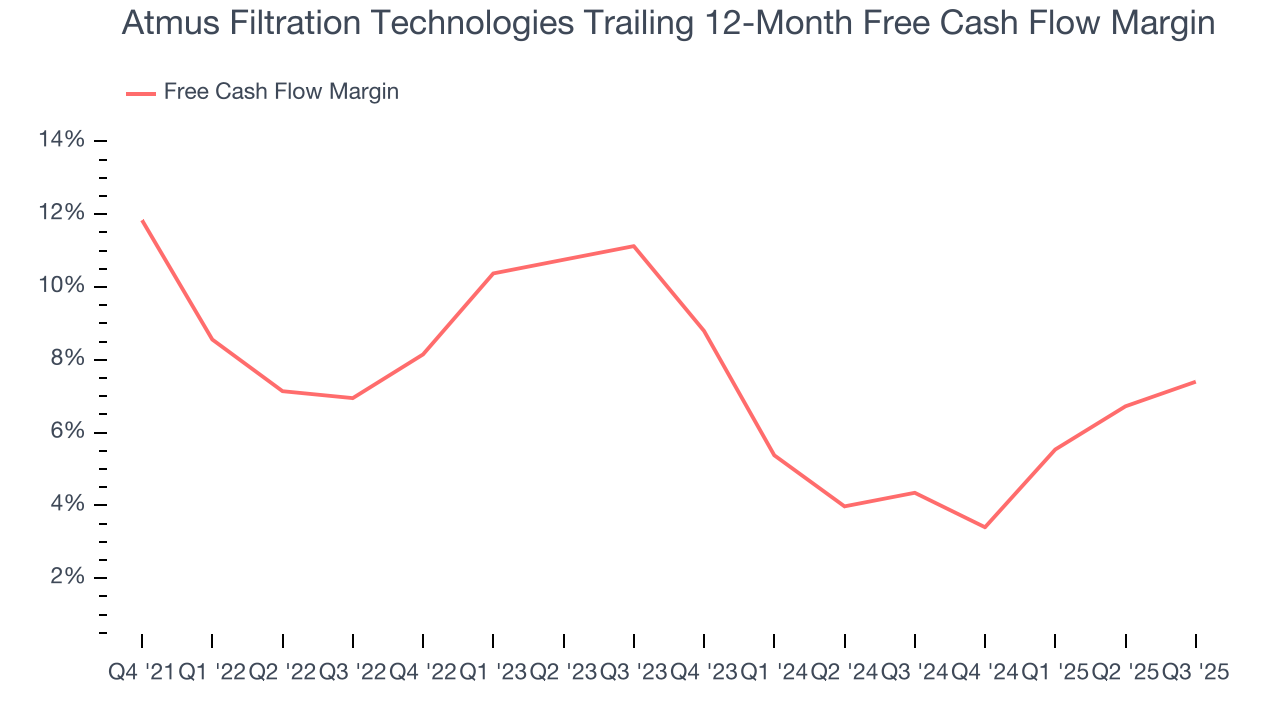

Atmus Filtration Technologies has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.1% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Atmus Filtration Technologies’s margin dropped by 2.9 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Atmus Filtration Technologies’s free cash flow clocked in at $68.9 million in Q3, equivalent to a 15.4% margin. This result was good as its margin was 1.9 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

8. Balance Sheet Assessment

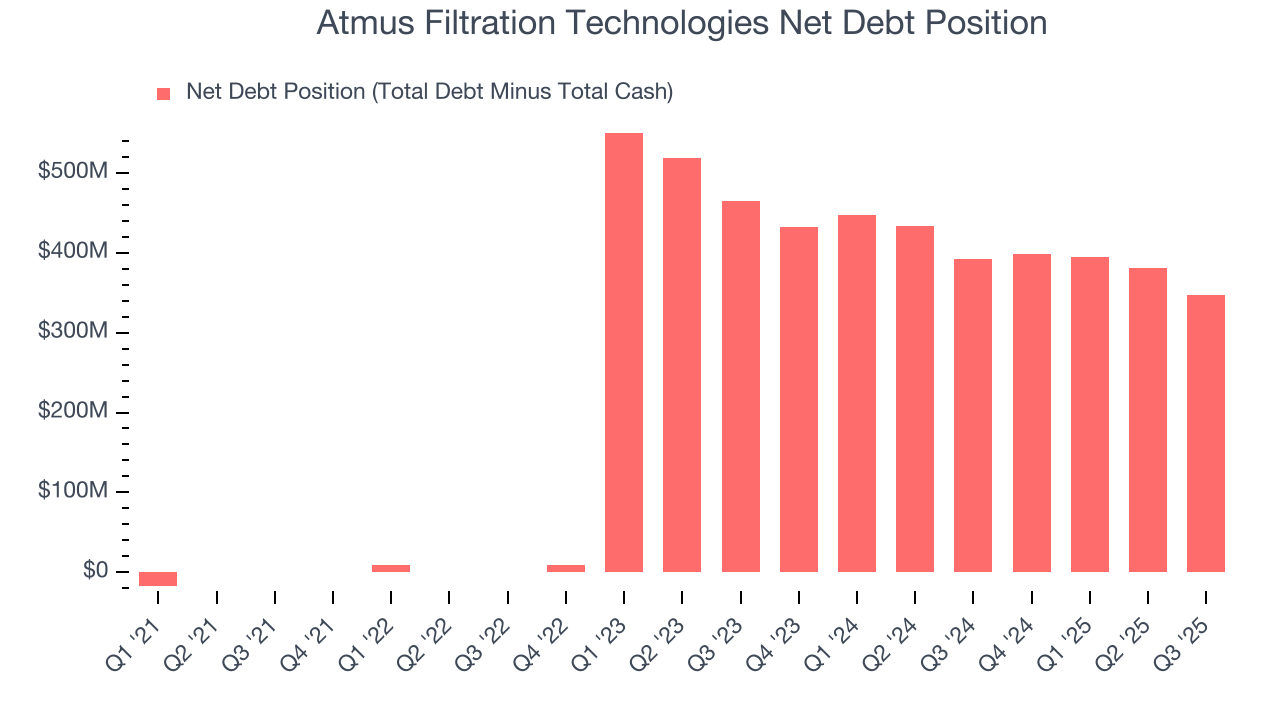

Atmus Filtration Technologies reported $218.3 million of cash and $565.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $346 million of EBITDA over the last 12 months, we view Atmus Filtration Technologies’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $34.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from Atmus Filtration Technologies’s Q3 Results

We were impressed by how significantly Atmus Filtration Technologies blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock remained flat at $57.22 immediately following the results.

10. Is Now The Time To Buy Atmus Filtration Technologies?

Before making an investment decision, investors should account for Atmus Filtration Technologies’s business fundamentals and valuation in addition to what happened in the latest quarter.

Atmus Filtration Technologies isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue growth was uninspiring over the last four years, and analysts expect its demand to deteriorate over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its cash profitability fell over the last five years. On top of that, its gross margins are lower than its industrials peers.

Atmus Filtration Technologies’s forward price-to-sales ratio is 2.7x. The market typically values companies like Atmus Filtration Technologies based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $58.60 on the company (compared to the current share price of $57.22).