Avantor (AVTR)

Avantor is up against the odds. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Avantor Will Underperform

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE:AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 3% annually over the last two years

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Earnings per share were flat over the last five years and fell short of the peer group average

Avantor doesn’t fulfill our quality requirements. There are more appealing investments to be made.

Why There Are Better Opportunities Than Avantor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Avantor

Avantor’s stock price of $8.68 implies a valuation ratio of 11.1x forward P/E. Avantor’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Avantor (AVTR) Research Report: Q4 CY2025 Update

Life sciences company Avantor (NYSE:AVTR) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 1.4% year on year to $1.66 billion. Its non-GAAP profit of $0.22 per share was in line with analysts’ consensus estimates.

Avantor (AVTR) Q4 CY2025 Highlights:

- Revenue: $1.66 billion vs analyst estimates of $1.64 billion (1.4% year-on-year decline, 1.5% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.22 (in line)

- Adjusted EBITDA: $252.2 million vs analyst estimates of $260.5 million (15.2% margin, 3.2% miss)

- Operating Margin: 7.6%, down from 37.8% in the same quarter last year

- Free Cash Flow Margin: 7%, down from 8.6% in the same quarter last year

- Organic Revenue fell 4% year on year (beat)

- Market Capitalization: $7.61 billion

Company Overview

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE:AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

Avantor operates as a comprehensive supplier for scientific endeavors, offering everything from ultra-high purity chemicals and lab consumables to specialized equipment and on-site services. The company's portfolio includes millions of products across three main categories: materials and consumables (like chemicals, reagents, and lab supplies), equipment and instrumentation (such as filtration systems and analytical instruments), and services (including lab management and biopharmaceutical scale-up support).

Scientists and researchers rely on Avantor's products for precision and consistency in their work. For example, a pharmaceutical researcher developing a new cancer treatment might use Avantor's ultra-pure J.T.Baker chemicals during initial testing, their specialized filtration systems during production scale-up, and their logistics services to manage inventory throughout the process.

The company generates revenue through direct sales of products and services to a diverse customer base spanning approximately 180 countries. Its business model is designed to support customers throughout their entire workflow – from initial discovery research through full-scale production. This integrated approach allows Avantor to become deeply embedded in customers' operations, with approximately 40% of sales coming from relationships lasting 15 years or more.

Avantor maintains a significant digital presence, with about 76% of transactions flowing through its e-commerce platforms. These digital tools help streamline procurement for customers while providing Avantor with valuable data on customer needs and trends. The company also employs approximately 3,500 sales professionals, including over 200 specialists with deep technical knowledge who can advise customers on complex applications.

Manufacturing capabilities are a key strength, particularly for high-purity materials. The company produces proprietary products under brands like J.T.Baker chemicals and NuSil silicones, which can achieve purity levels as stringent as one part-per-trillion – critical for applications in life sciences and electronics.

4. Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Avantor competes with other life sciences suppliers including Thermo Fisher Scientific (NYSE:TMO), Danaher Corporation (NYSE:DHR), MilliporeSigma (a division of Merck KGaA), and Bio-Rad Laboratories (NYSE:BIO), as well as more specialized suppliers in specific product categories.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $6.55 billion in revenue over the past 12 months, Avantor has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Avantor struggled to consistently increase demand as its $6.55 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Avantor’s recent performance shows its demand remained suppressed as its revenue has declined by 3% annually over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Avantor’s organic revenue averaged 2.3% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Avantor’s revenue fell by 1.4% year on year to $1.66 billion but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

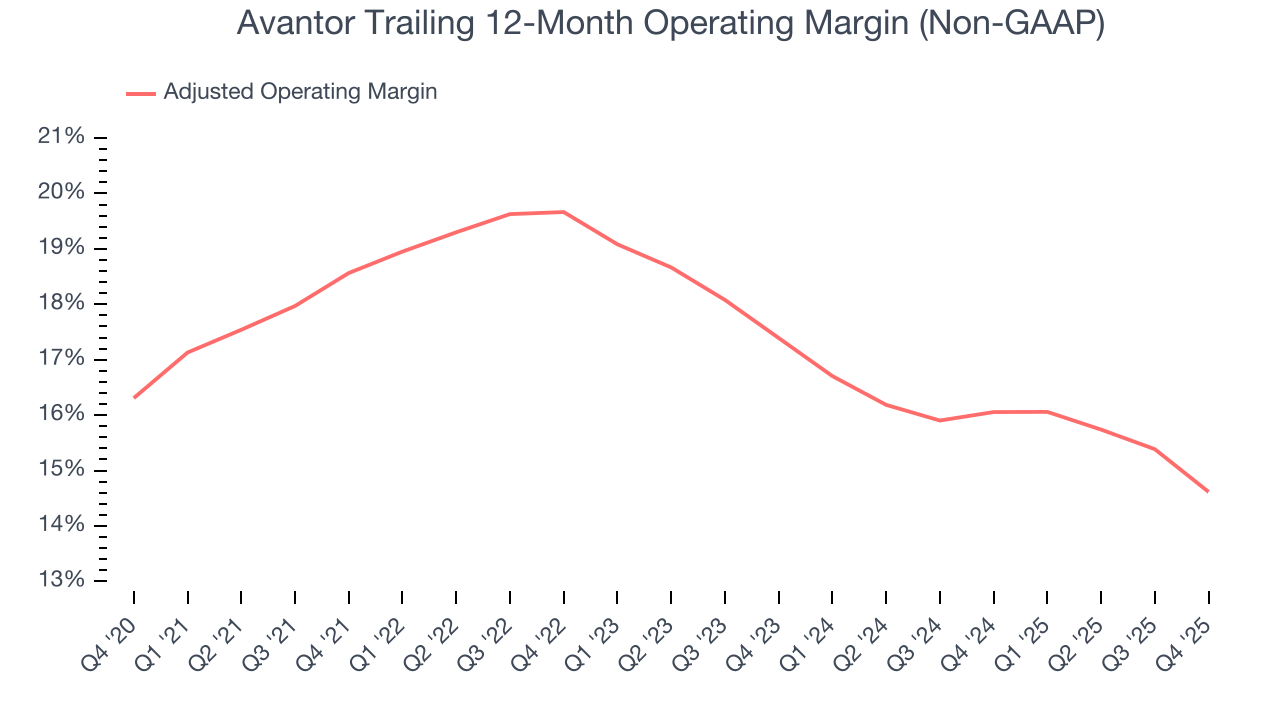

7. Adjusted Operating Margin

Avantor has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 17.3%.

Looking at the trend in its profitability, Avantor’s adjusted operating margin decreased by 3.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Avantor generated an adjusted operating margin profit margin of 13.5%, down 3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

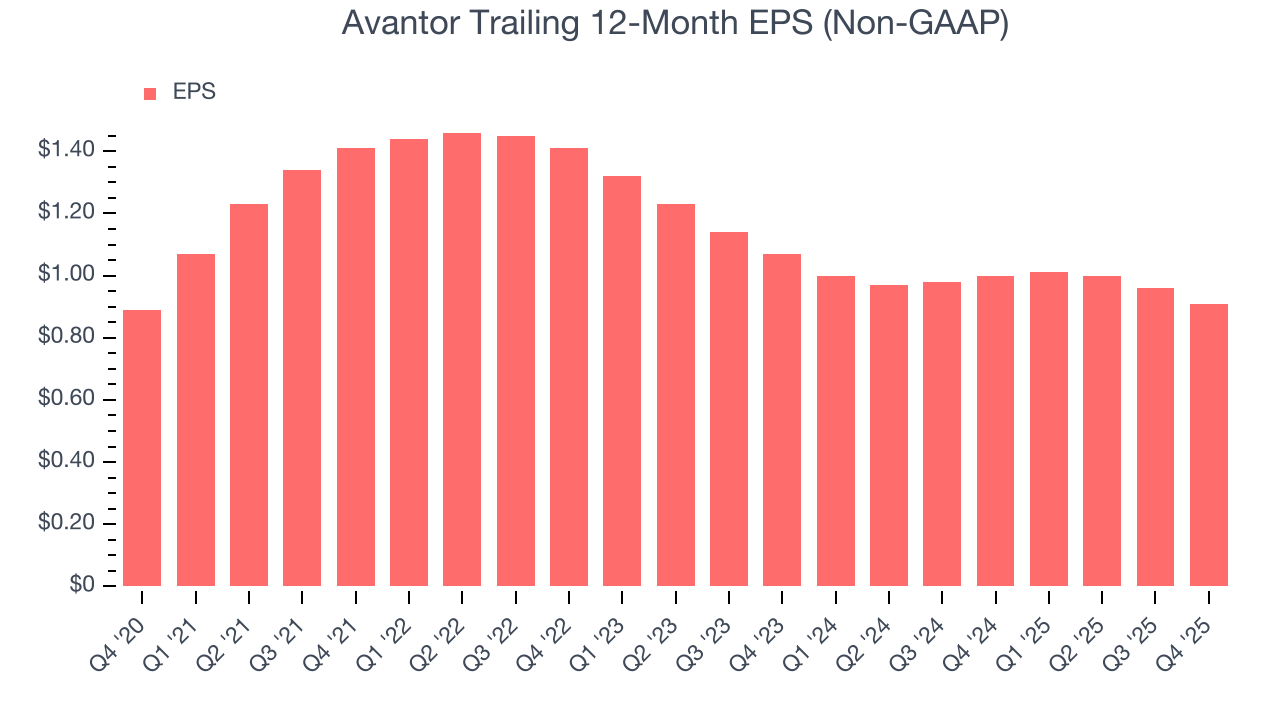

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Avantor’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

In Q4, Avantor reported adjusted EPS of $0.22, down from $0.27 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Avantor’s full-year EPS of $0.91 to stay about the same.

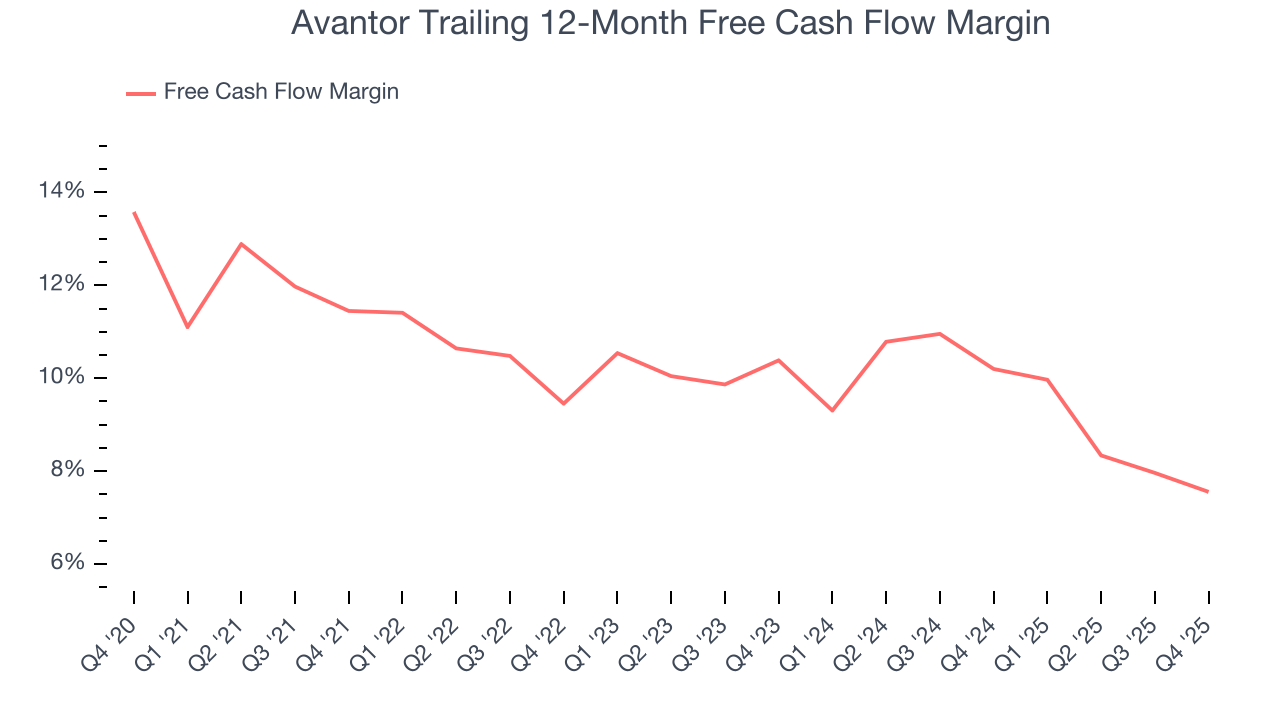

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Avantor has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.8% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Avantor’s margin dropped by 3.9 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Avantor’s free cash flow clocked in at $117.2 million in Q4, equivalent to a 7% margin. The company’s cash profitability regressed as it was 1.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Avantor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.3%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Avantor’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

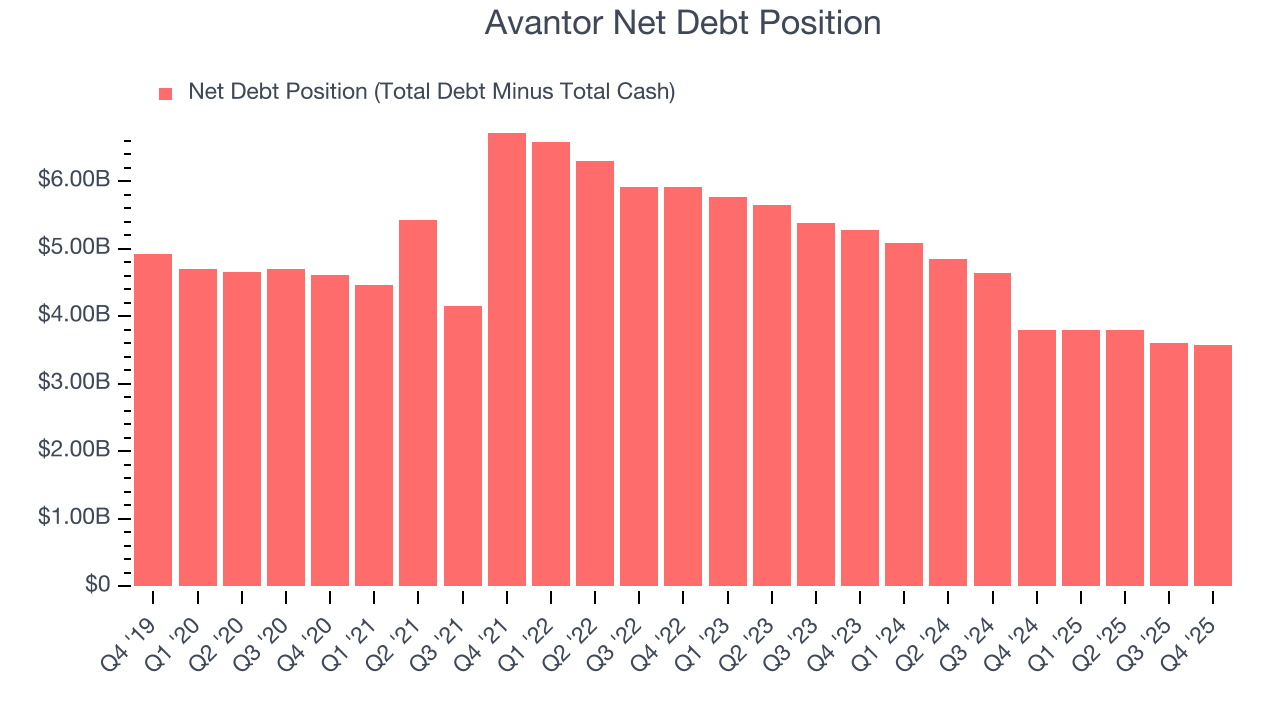

Avantor reported $365.4 million of cash and $3.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.07 billion of EBITDA over the last 12 months, we view Avantor’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $171.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Avantor’s Q4 Results

It was good to see Avantor narrowly top analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 7.6% to $10.32 immediately after reporting.

13. Is Now The Time To Buy Avantor?

Updated: March 1, 2026 at 11:43 PM EST

Before deciding whether to buy Avantor or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies helping people live better, but in the case of Avantor, we’ll be cheering from the sidelines. To begin with, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its sturdy operating margins show it has disciplined cost controls, the downside is its organic revenue declined. On top of that, its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Avantor’s P/E ratio based on the next 12 months is 11.4x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $10.89 on the company (compared to the current share price of $8.95).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.