Armstrong World (AWI)

We see solid potential in Armstrong World. Its blend of high growth and robust profitability makes for an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why We Like Armstrong World

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE:AWI) provides ceiling and wall products to commercial and residential spaces.

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 18.7% outpaced its revenue gains

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its rise over the last five years was fueled by some leverage on its fixed costs

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are climbing as it finds even more attractive growth opportunities

We have an affinity for Armstrong World. The valuation seems reasonable in light of its quality, so this might be a prudent time to invest in some shares.

Why Is Now The Time To Buy Armstrong World?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Armstrong World?

Armstrong World is trading at $189.00 per share, or 23.2x forward P/E. Most industrials companies are more expensive, so we think Armstrong World is a good deal when considering its quality characteristics.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. Armstrong World (AWI) Research Report: Q3 CY2025 Update

Ceiling and wall solutions company Armstrong World Industries (NYSE:AWI) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10% year on year to $425.2 million. The company expects the full year’s revenue to be around $1.63 billion, close to analysts’ estimates. Its non-GAAP profit of $2.05 per share was 1.3% above analysts’ consensus estimates.

Armstrong World (AWI) Q3 CY2025 Highlights:

- Revenue: $425.2 million vs analyst estimates of $421.7 million (10% year-on-year growth, 0.8% beat)

- Adjusted EPS: $2.05 vs analyst estimates of $2.02 (1.3% beat)

- Adjusted EBITDA: $148 million vs analyst estimates of $152.1 million (34.8% margin, 2.7% miss)

- The company slightly lifted its revenue guidance for the full year to $1.63 billion at the midpoint from $1.62 billion

- Management raised its full-year Adjusted EPS guidance to $7.50 at the midpoint, a 3.8% increase

- EBITDA guidance for the full year is $558 million at the midpoint, in line with analyst expectations

- Operating Margin: 27.6%, down from 28.8% in the same quarter last year

- Free Cash Flow Margin: 28.9%, up from 19.9% in the same quarter last year

- Market Capitalization: $8.77 billion

Company Overview

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE:AWI) provides ceiling and wall products to commercial and residential spaces.

The company makes ceilings and walls that improve the aesthetic and acoustic environment of interiors for businesses and homeowners. Its products help its customers build spaces that are visually appealing and functionally superior, promoting comfort and productivity.

The company offers a diverse range of ceiling and wall solutions, including mineral fiber, fiberglass, and metal ceiling tiles, along with suspension systems and walls. These products cater to various settings, from commercial buildings to residential homes, providing options for sound absorption, durability, and design flexibility.

It earns revenue primarily through the sale of its ceiling and wall products to contractors, builders, and architects for both new construction and renovation projects. The large majority of its net sales are to distributors, with large home centers like the Home Depot coming in second. Sales directly to customers and retailers make up the remaining small portion of its revenue.

4. Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Competitors offering wall and ceiling solutions include Saint-Goabin (EPA:SGO.PA) and private companies Hunter Douglas and USG Corporation.

5. Revenue Growth

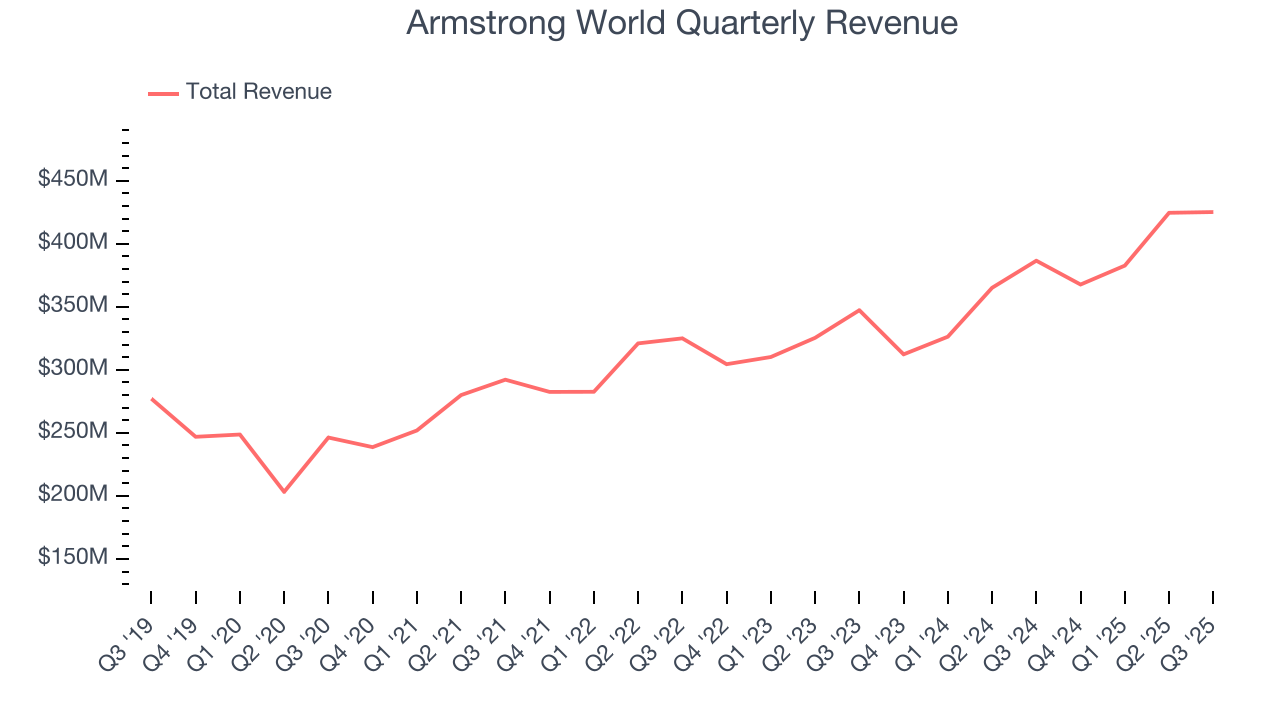

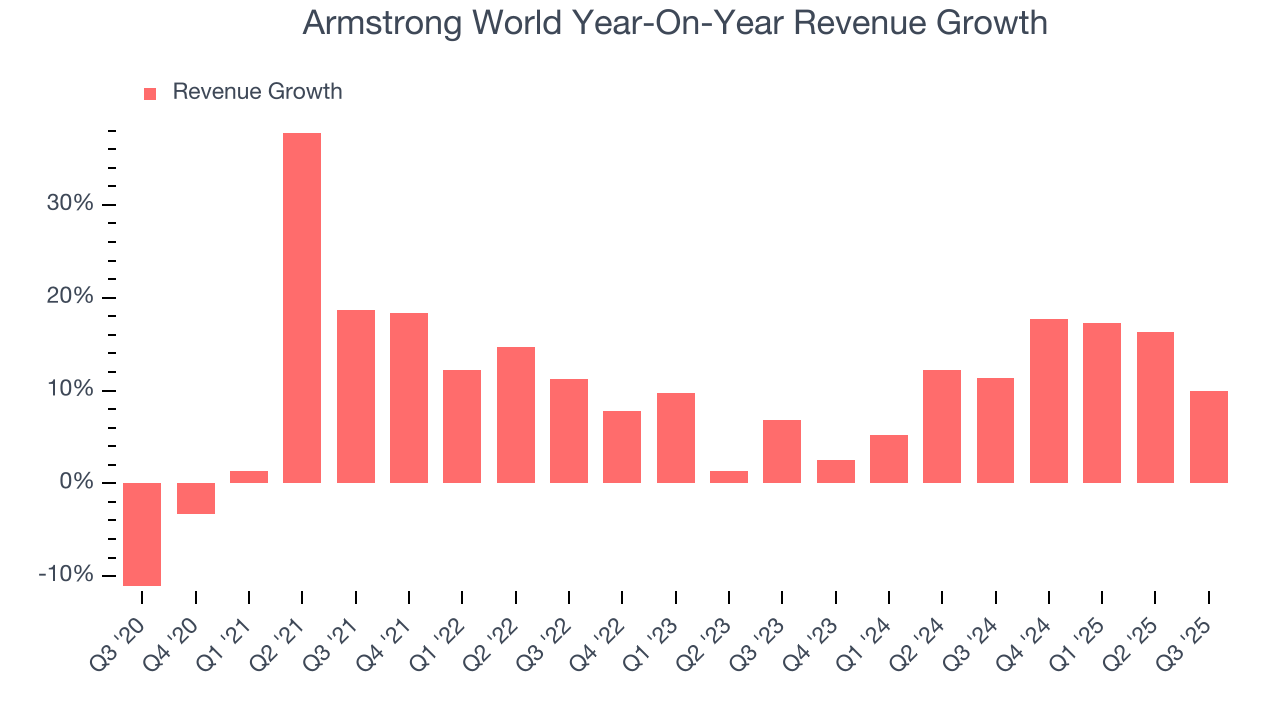

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Armstrong World’s sales grew at an impressive 11.1% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Armstrong World’s annualized revenue growth of 11.5% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Armstrong World reported year-on-year revenue growth of 10%, and its $425.2 million of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

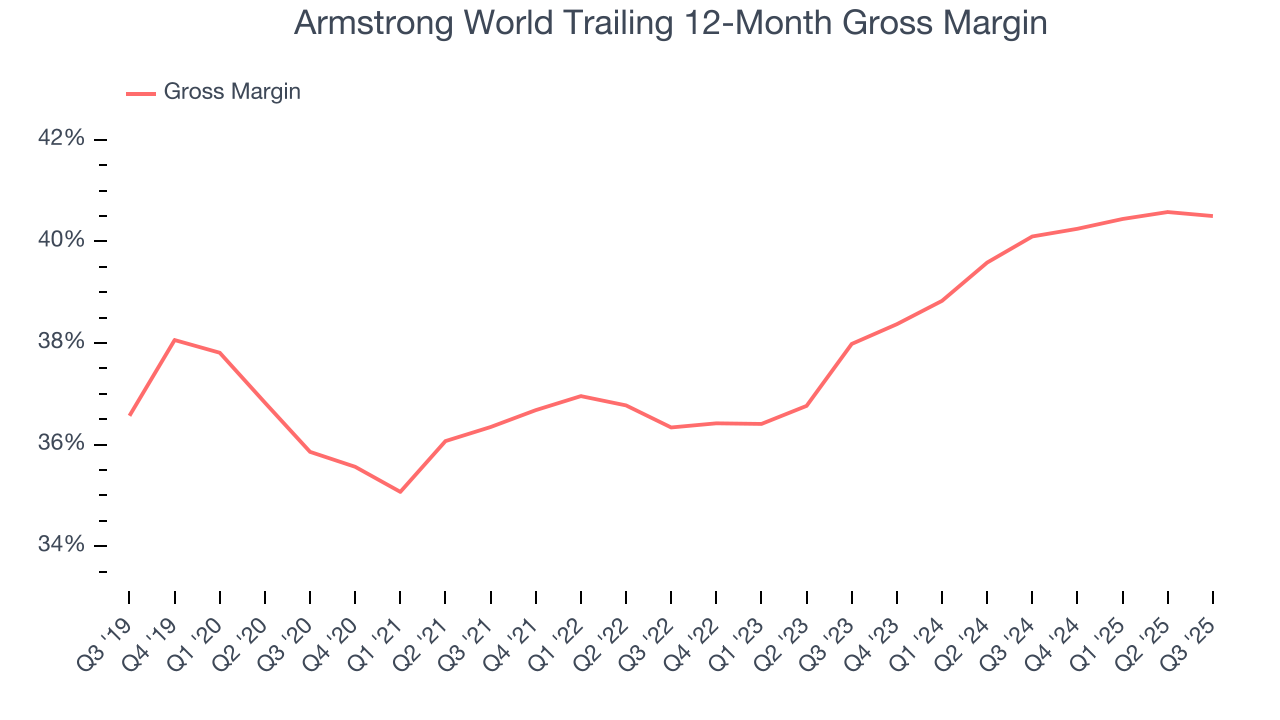

Armstrong World’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 38.5% gross margin over the last five years. That means Armstrong World only paid its suppliers $61.52 for every $100 in revenue.

Armstrong World produced a 42% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

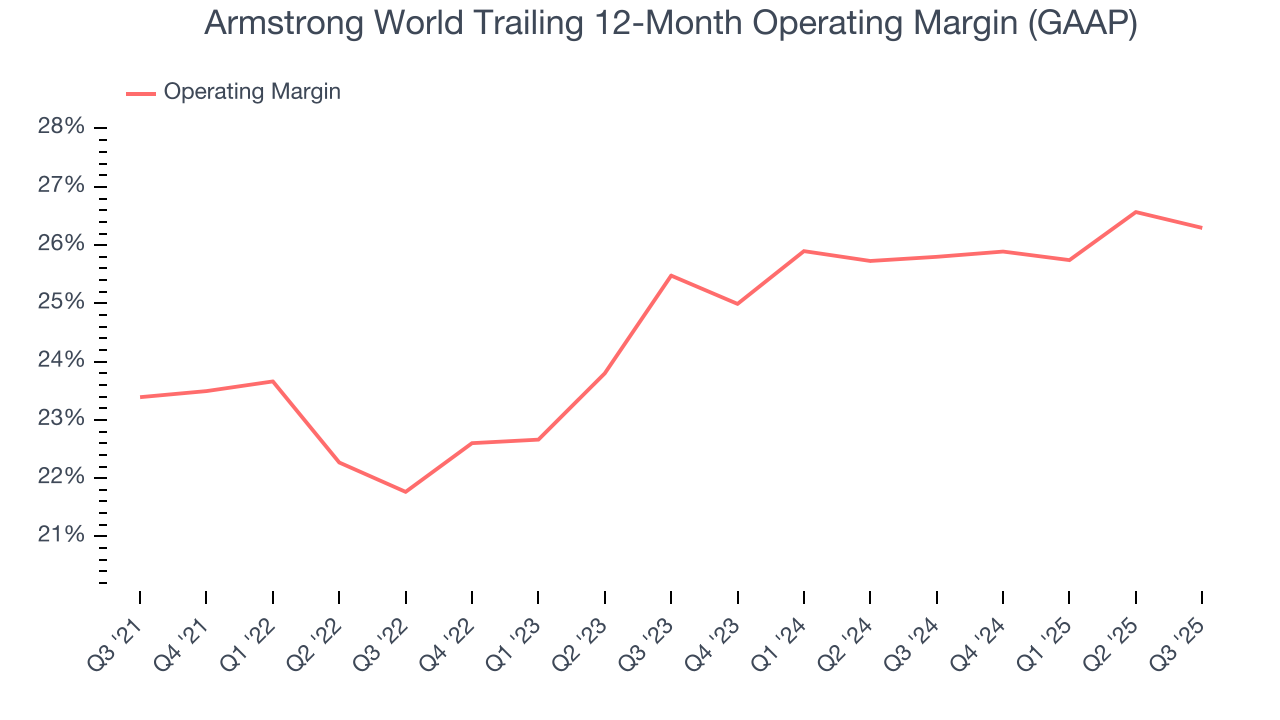

Armstrong World has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Armstrong World’s operating margin rose by 2.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Armstrong World generated an operating margin profit margin of 27.6%, down 1.2 percentage points year on year. Since Armstrong World’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

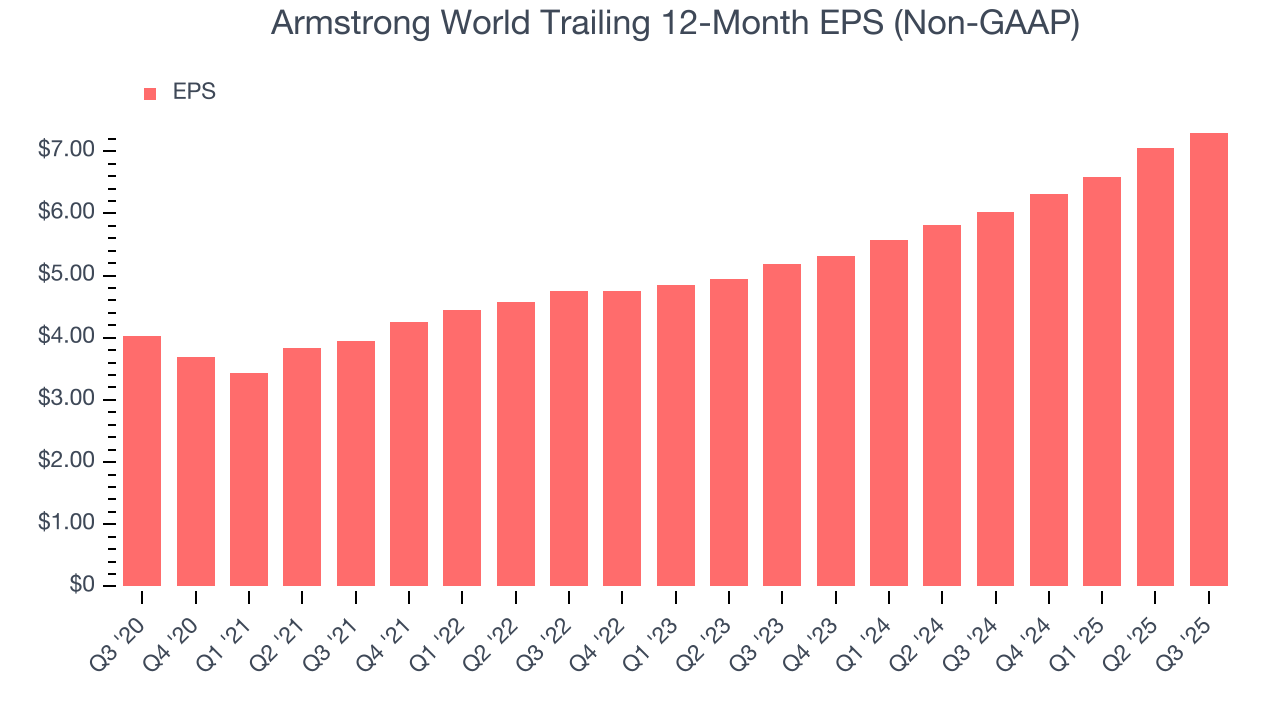

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Armstrong World’s remarkable 12.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Armstrong World’s two-year annual EPS growth of 18.7% was fantastic and topped its 11.5% two-year revenue growth.

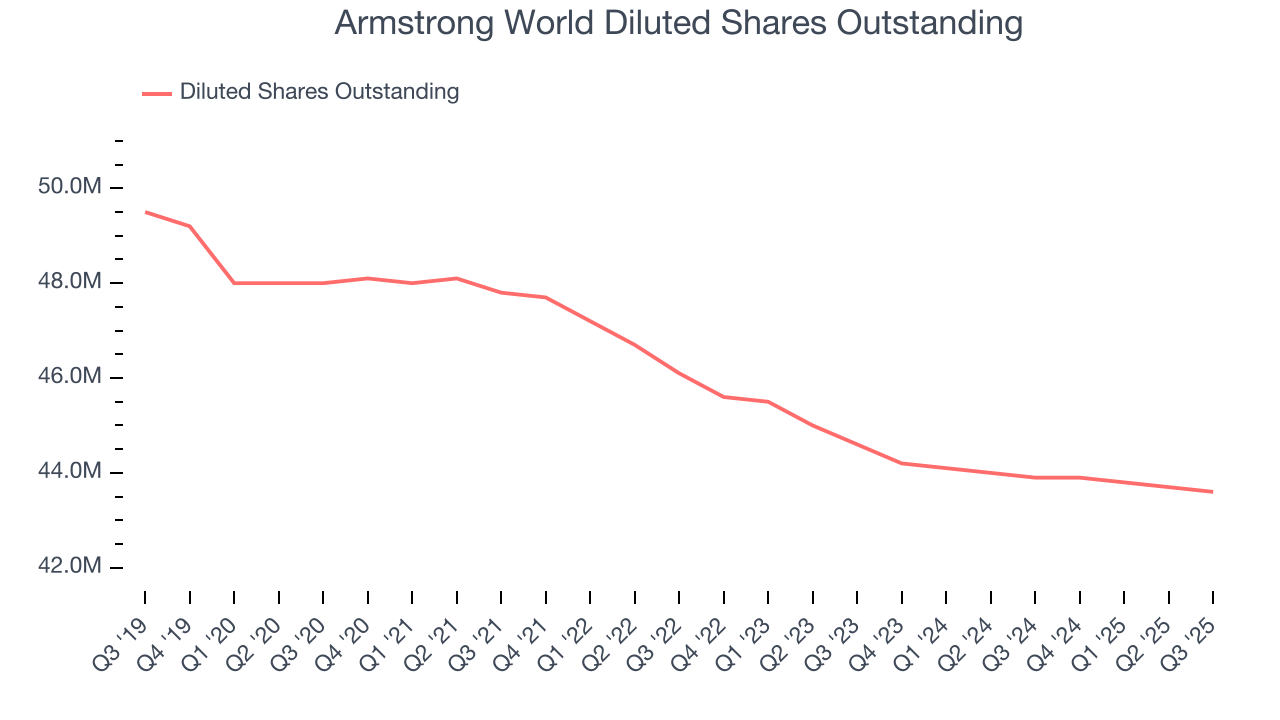

Diving into Armstrong World’s quality of earnings can give us a better understanding of its performance. A two-year view shows that Armstrong World has repurchased its stock, shrinking its share count by 2.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Armstrong World reported adjusted EPS of $2.05, up from $1.81 in the same quarter last year. This print beat analysts’ estimates by 1.3%. Over the next 12 months, Wall Street expects Armstrong World’s full-year EPS of $7.30 to grow 10.3%.

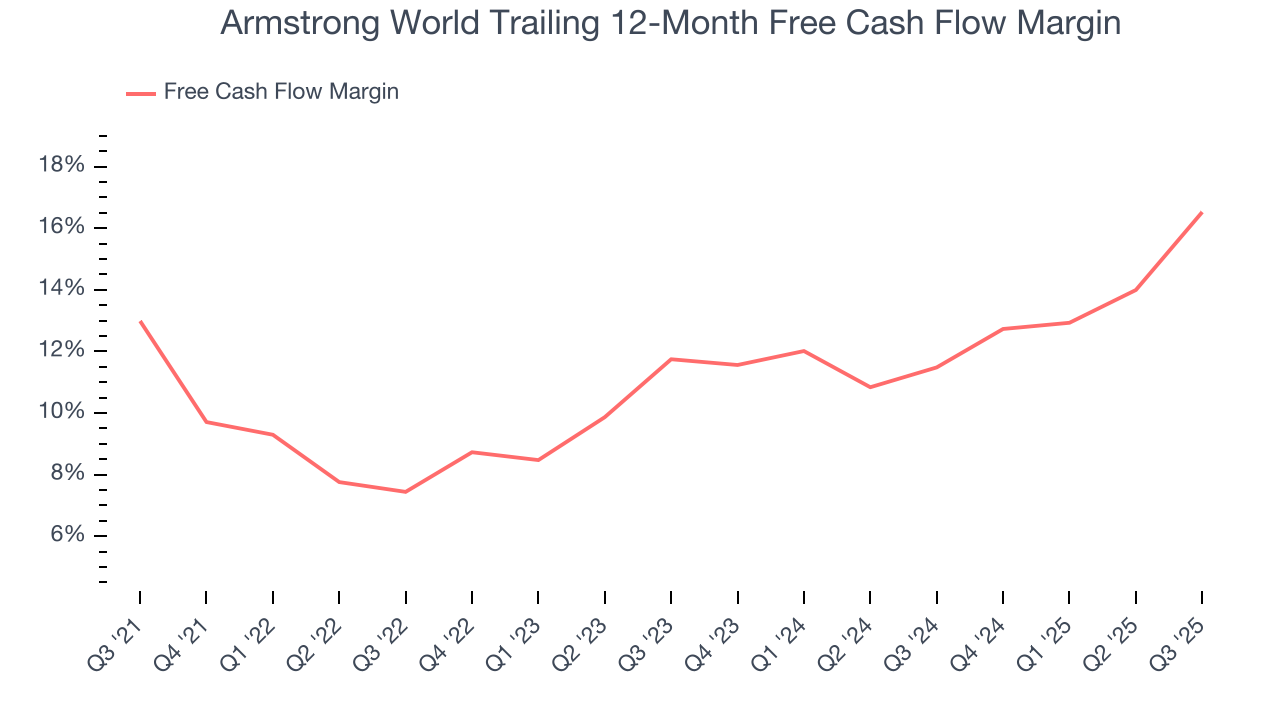

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Armstrong World has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.3% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Armstrong World’s margin expanded by 3.5 percentage points during that time. This is encouraging because it gives the company more optionality.

Armstrong World’s free cash flow clocked in at $123 million in Q3, equivalent to a 28.9% margin. This result was good as its margin was 9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Armstrong World’s five-year average ROIC was 22.4%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Armstrong World’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

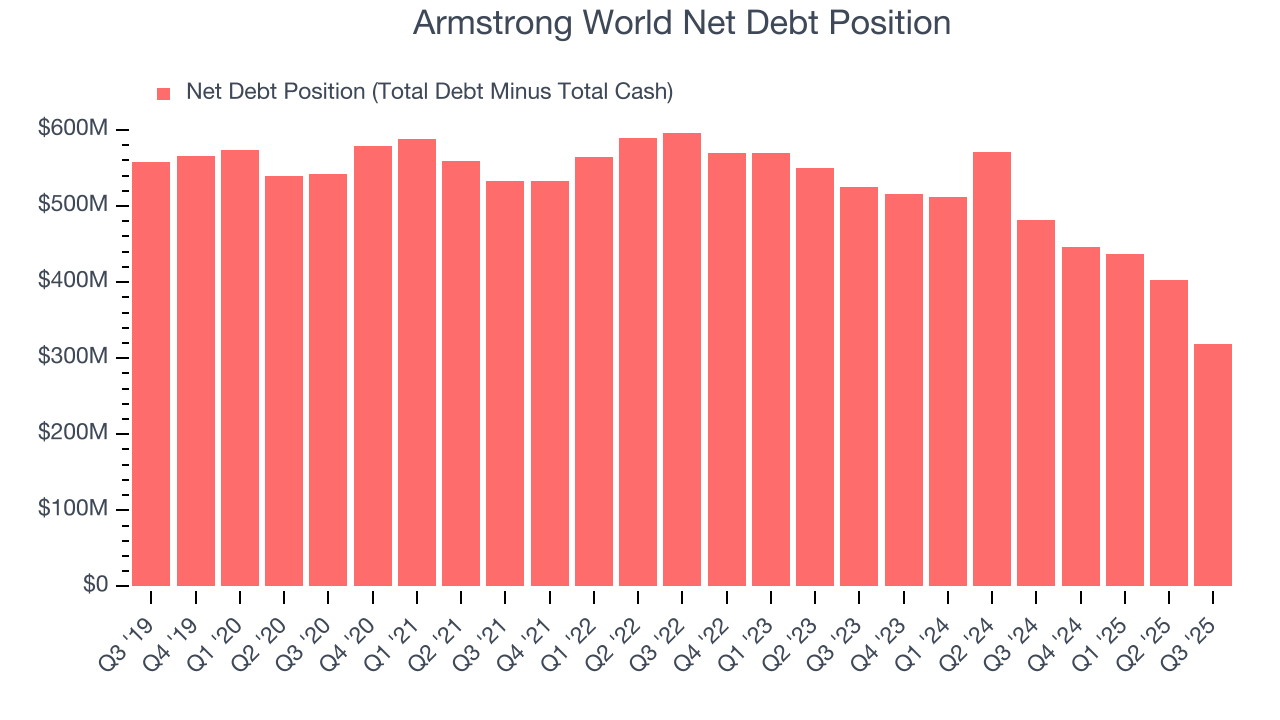

11. Balance Sheet Assessment

Armstrong World reported $90.1 million of cash and $408.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $543 million of EBITDA over the last 12 months, we view Armstrong World’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $14.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Armstrong World’s Q3 Results

It was good to see Armstrong World narrowly top analysts’ revenue and EPS expectations this quarter. Full-year guidance was also raised. Overall, this was a solid quarter. The stock remained flat at $202.57 immediately following the results.

13. Is Now The Time To Buy Armstrong World?

Updated: January 23, 2026 at 10:00 PM EST

Before deciding whether to buy Armstrong World or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Armstrong World is a high-quality business worth owning. For starters, its revenue growth was impressive over the last five years. On top of that, its impressive operating margins show it has a highly efficient business model, and its stellar ROIC suggests it has been a well-run company historically.

Armstrong World’s P/E ratio based on the next 12 months is 23.1x. Looking at the industrials landscape today, Armstrong World’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $211.10 on the company (compared to the current share price of $187.29), implying they see 12.7% upside in buying Armstrong World in the short term.