American Express (AXP)

We’re bullish on American Express. Its impressive sales growth and high returns on capital tee it up for fast and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why We Like American Express

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE:AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 32.6% over the last five years outstripped its revenue performance

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

- Annual revenue growth of 16.4% over the past five years was outstanding, reflecting market share gains this cycle

American Express is at the top of our list. The price looks reasonable based on its quality, and we think now is an opportune time to invest in the stock.

Why Is Now The Time To Buy American Express?

Why Is Now The Time To Buy American Express?

American Express is trading at $307.50 per share, or 17.7x forward P/E. While this multiple is higher than most financials companies, we think the valuation is fair given its quality characteristics.

By definition, where you buy a stock impacts returns. But according to our work on the topic, business quality is a much bigger determinant of market outperformance over the long term compared to entry price.

3. American Express (AXP) Research Report: Q4 CY2025 Update

Global payments company American Express (NYSE:AXP) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 10.6% year on year to $17.57 billion. Its GAAP profit of $3.53 per share was in line with analysts’ consensus estimates.

American Express (AXP) Q4 CY2025 Highlights:

- Revenue: $17.57 billion vs analyst estimates of $18.93 billion (10.6% year-on-year growth, 7.2% miss)

- Pre-tax Profit: $3.09 billion (17.6% margin)

- EPS (GAAP): $3.53 vs analyst estimates of $3.53 (in line)

- Market Capitalization: $247 billion

Company Overview

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE:AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

American Express operates through an integrated payments platform that connects cardholders with merchants worldwide. The company's business model is "spend-centric," focusing primarily on generating revenue from transaction fees when customers use their cards and secondarily from annual card fees, interest charges, and other services. This approach allows American Express to offer premium rewards and benefits that attract high-spending customers, creating a virtuous cycle that benefits both cardholders and merchants.

The company's operations are organized into four main segments: U.S. Consumer Services, Commercial Services, International Card Services, and Global Merchant and Network Services. Through these divisions, American Express serves a diverse customer base ranging from individual consumers to large corporations across approximately 110 countries and territories.

What distinguishes American Express from many competitors is its closed-loop network, where it typically serves as both the card issuer and merchant acquirer. This gives the company direct relationships with both cardholders and merchants, providing valuable data that helps American Express offer targeted services and better manage risk. For example, a restaurant owner might use an American Express business card to purchase supplies, while also accepting American Express cards from customers dining at their establishment.

Beyond card services, American Express offers business checking accounts, B2B payment solutions, cash flow management tools, and travel-related services. The company also maintains strategic partnerships, most notably with Delta Air Lines, along with hotel chains like Marriott and Hilton, to offer co-branded cards that provide specialized benefits to cardholders.

4. Credit Card

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

American Express competes with global payment networks like Visa (NYSE:V), Mastercard (NYSE:MA), and Discover (NYSE:DFS), as well as with major card-issuing banks such as JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), and Bank of America (NYSE:BAC). In certain markets, it also faces competition from regional players like China UnionPay and JCB.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, American Express grew its revenue at an impressive 16.4% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. American Express’s annualized revenue growth of 9.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, American Express’s revenue grew by 10.6% year on year to $17.57 billion but fell short of Wall Street’s estimates.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Credit Card companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, American Express’s pre-tax profit margin has fallen by 6.9 percentage points, going from 24.4% to 20.6%. It has also expanded by 1.7 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, American Express’s pre-tax profit margin was 17.6%. This result was in line with the same quarter last year.

7. Earnings Per Share

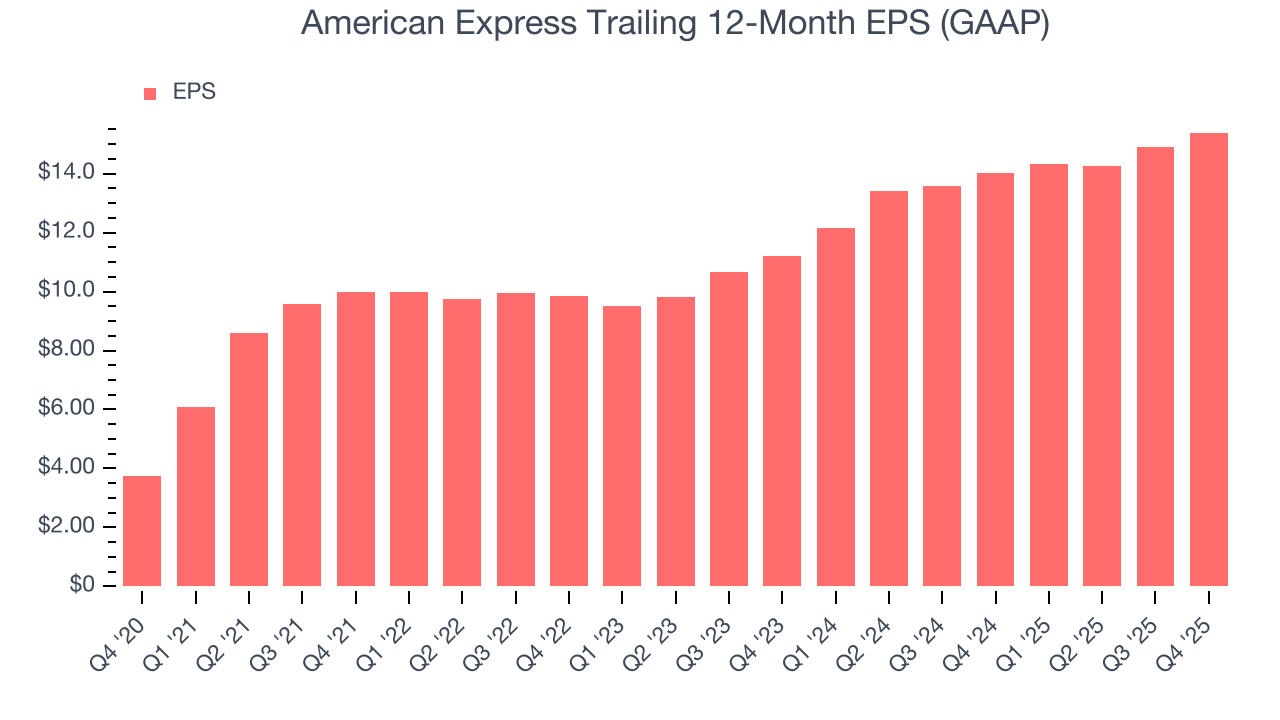

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

American Express’s EPS grew at an astounding 32.6% compounded annual growth rate over the last five years, higher than its 16.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For American Express, its two-year annual EPS growth of 17.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, American Express reported EPS of $3.53, up from $3.04 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects American Express’s full-year EPS of $15.39 to grow 13.1%.

8. Tangible Book Value Per Share (TBVPS)

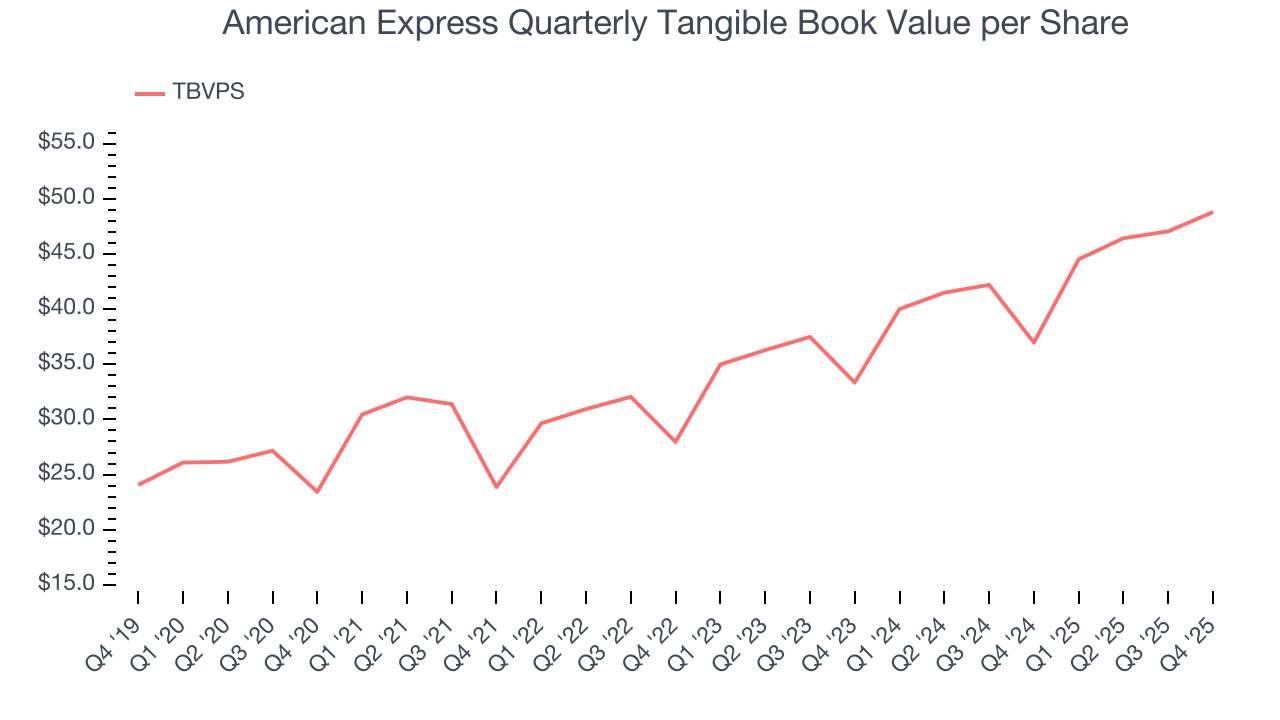

Financial firms generate earnings through diverse intermediation activities, making them fundamentally balance sheet-driven enterprises. Investors focus on balance sheet quality and consistent book value compounding when evaluating these multifaceted financial institutions.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

American Express’s TBVPS grew at an excellent 15.8% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 21% annually over the last two years from $33.34 to $48.80 per share.

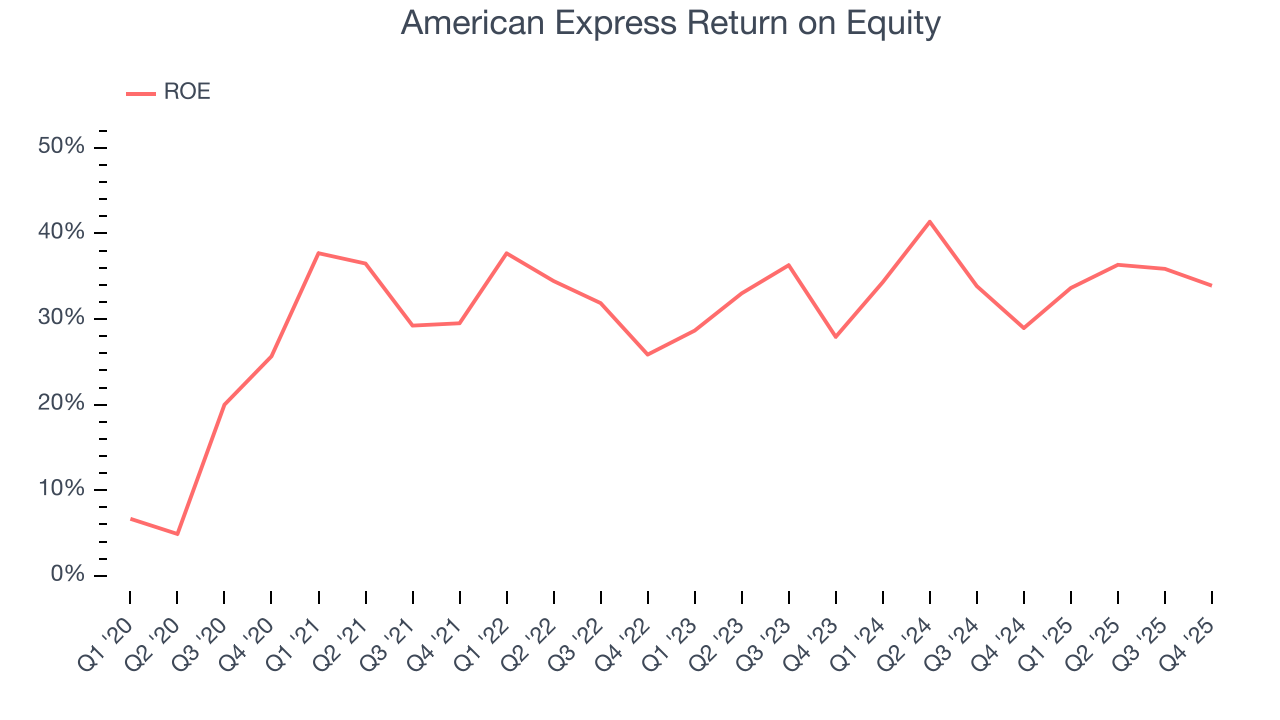

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, American Express has averaged an ROE of 33.3%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows American Express has a strong competitive moat.

10. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, American Express has averaged a Tier 1 capital ratio of 10.6%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

11. Key Takeaways from American Express’s Q4 Results

We struggled to find many positives in these results. Revenue missed, and EPS was just in line. Overall, this was a weaker quarter. The stock traded down 2.6% to $349.20 immediately following the results.

12. Is Now The Time To Buy American Express?

Updated: March 5, 2026 at 11:49 PM EST

Before deciding whether to buy American Express or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

American Express is an amazing business ranking highly on our list. For starters, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. On top of that, its stellar ROE suggests it has been a well-run company historically, and its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

American Express’s P/E ratio based on the next 12 months is 17.7x. Looking at the financials space today, American Express’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $378.94 on the company (compared to the current share price of $307.50), implying they see 23.2% upside in buying American Express in the short term.