AZZ (AZZ)

AZZ is an exciting business. Its blend of high growth and robust profitability makes for an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why We Like AZZ

Responsible for projects like nuclear facilities, AZZ (NYSE:AZZ) is a provider of metal coating and power infrastructure solutions.

- Additional sales over the last five years increased its profitability as the 24.2% annual growth in its earnings per share outpaced its revenue

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last five years

- Annual revenue growth of 12.7% over the last five years was superb and indicates its market share increased during this cycle

AZZ is a top-tier company. The price seems reasonable in light of its quality, so this might be an opportune time to invest in some shares.

Why Is Now The Time To Buy AZZ?

High Quality

Investable

Underperform

Why Is Now The Time To Buy AZZ?

AZZ is trading at $137.70 per share, or 21.3x forward P/E. This multiple is lower than most industrials companies, and we think the stock is a deal when considering its quality characteristics.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. AZZ (AZZ) Research Report: Q4 CY2025 Update

Metal coating and infrastructure solutions provider AZZ (NYSE:AZZ) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 5.5% year on year to $425.7 million. The company’s full-year revenue guidance of $1.66 billion at the midpoint came in 1.4% above analysts’ estimates. Its non-GAAP profit of $1.52 per share was 2.5% above analysts’ consensus estimates.

AZZ (AZZ) Q4 CY2025 Highlights:

- Revenue: $425.7 million vs analyst estimates of $418.2 million (5.5% year-on-year growth, 1.8% beat)

- Adjusted EPS: $1.52 vs analyst estimates of $1.48 (2.5% beat)

- Adjusted EBITDA: $91.17 million vs analyst estimates of $90.37 million (21.4% margin, 0.9% beat)

- The company dropped its revenue guidance for the full year to $1.66 billion at the midpoint from $1.68 billion, a 0.7% decrease

- Management slightly raised its full-year Adjusted EPS guidance to $6.05 at the midpoint

- EBITDA guidance for the full year is $370 million at the midpoint, above analyst estimates of $365.1 million

- Operating Margin: 16.3%, up from 14.5% in the same quarter last year

- Market Capitalization: $3.32 billion

Company Overview

Responsible for projects like nuclear facilities, AZZ (NYSE:AZZ) is a provider of metal coating and power infrastructure solutions.

Since its founding in 1956, the company has evolved into a leading player in hot-dip galvanizing, coil coating, and related metal finishing services. Today, AZZ operates through three distinct segments: AZZ Metal Coatings, AZZ Precoat Metals, and AZZ Infrastructure Solutions.

The AZZ Metal Coatings segment offers hot-dip galvanizing, spin galvanizing, powder coating, anodizing, and plating services. This business primarily serves the steel fabrication industry and other sectors requiring robust corrosion protection solutions.

Complementing the Metal Coatings segment is AZZ Precoat Metals, which specializes in aesthetic and corrosion-protective coatings for steel and aluminum coils. This division caters to various end markets, including construction, appliance manufacturing, HVAC systems, container production, and transportation. AZZ Precoat Metals operates through multiple plants in the United States and is expanding its capacity with a new facility under construction in Washington, Missouri.

The AZZ Infrastructure Solutions segment represents the company's strategic investment in the power transmission and distribution sector, consisting of AZZ's 40% interest in AIS Investment Holdings, a joint venture formed with Fernweh Group. This partnership focuses on providing specialized products and services for industrial and electrical applications, including custom switchgear, electrical enclosures, and medium to high-voltage bus ducts.

4. Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

AZZ’s top competitors include Valmont Industries (NYSE:VMI) and Haynes International (NYSE:HAYN).

5. Revenue Growth

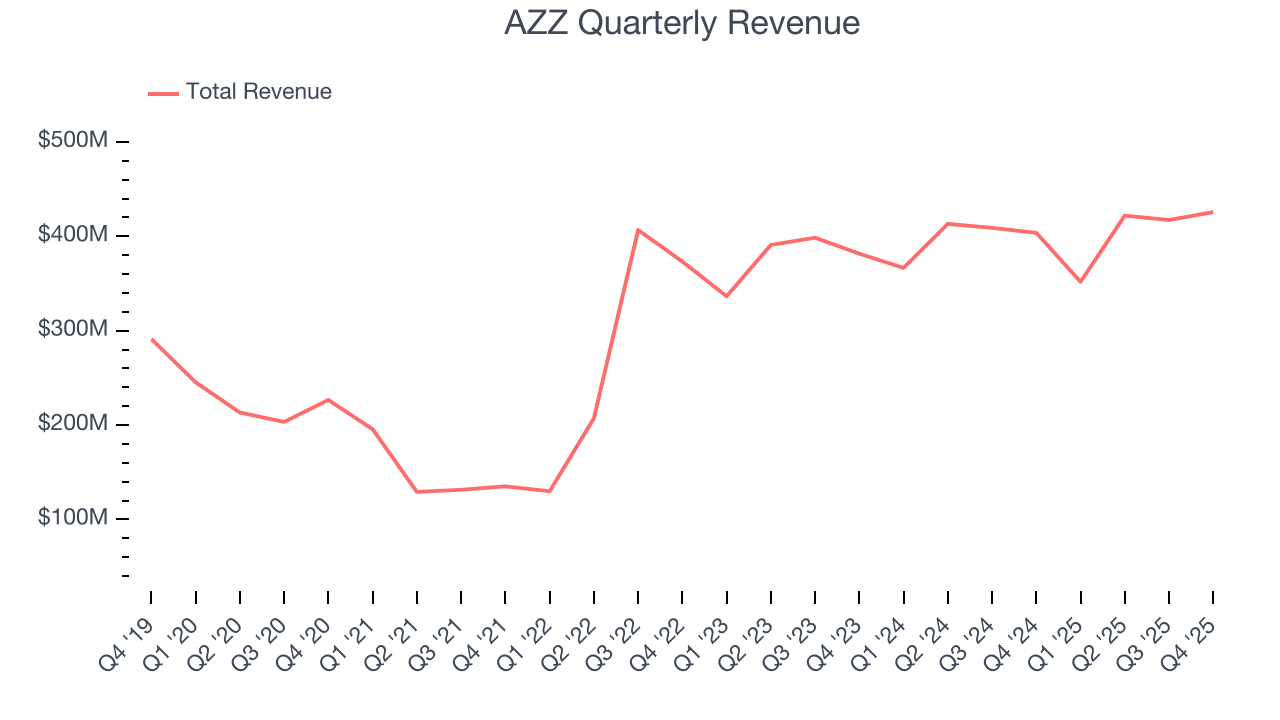

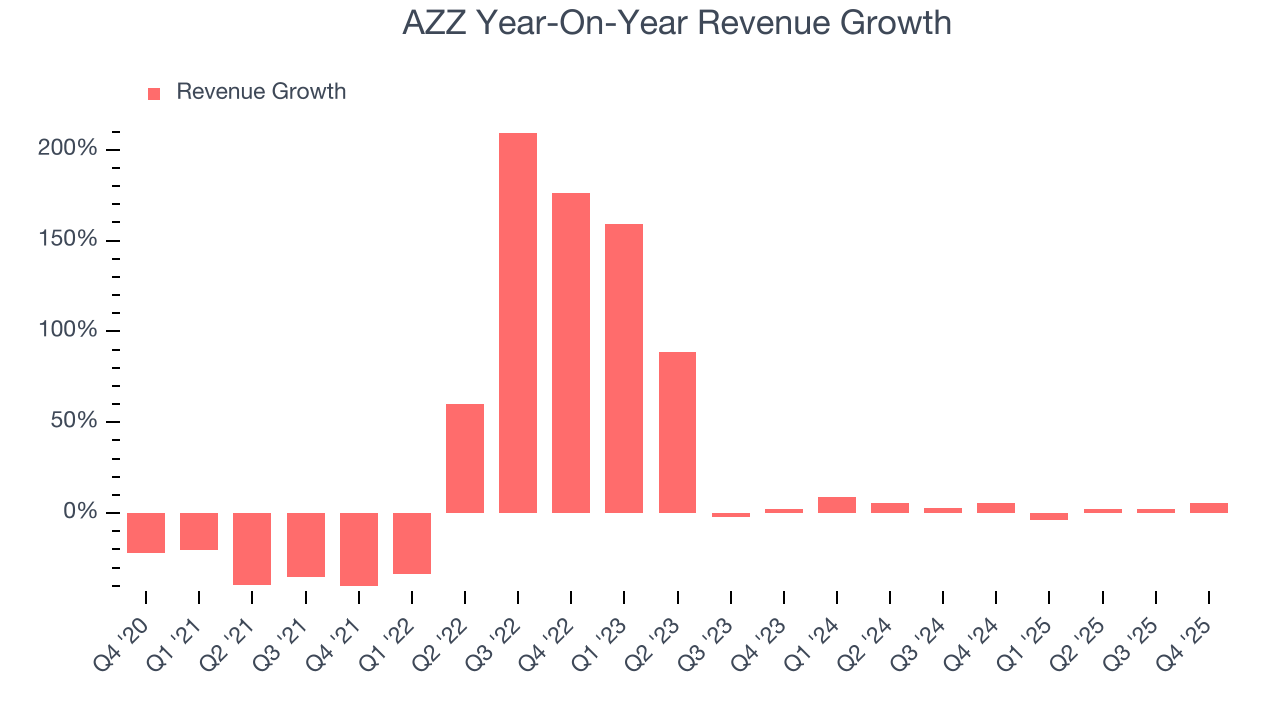

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, AZZ’s sales grew at an excellent 12.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AZZ’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.6% over the last two years was well below its five-year trend.

This quarter, AZZ reported year-on-year revenue growth of 5.5%, and its $425.7 million of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

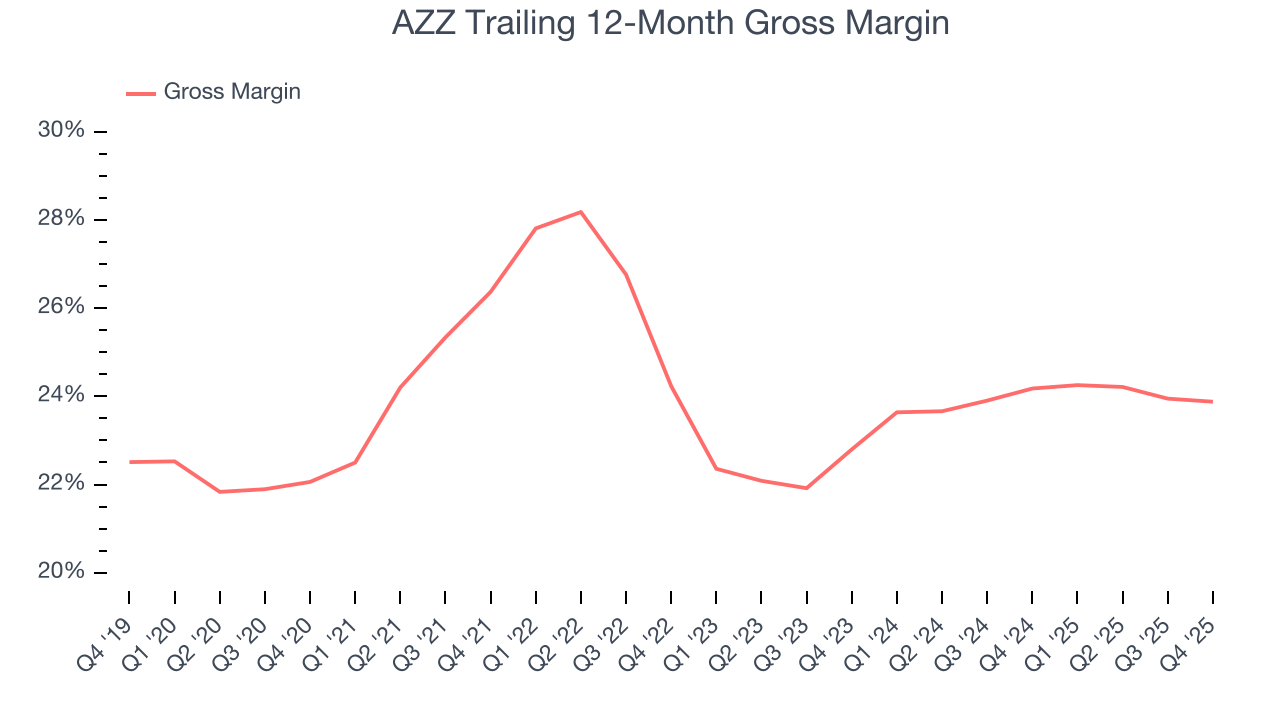

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

AZZ has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24% gross margin over the last five years. That means AZZ paid its suppliers a lot of money ($76.01 for every $100 in revenue) to run its business.

This quarter, AZZ’s gross profit margin was 23.9%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

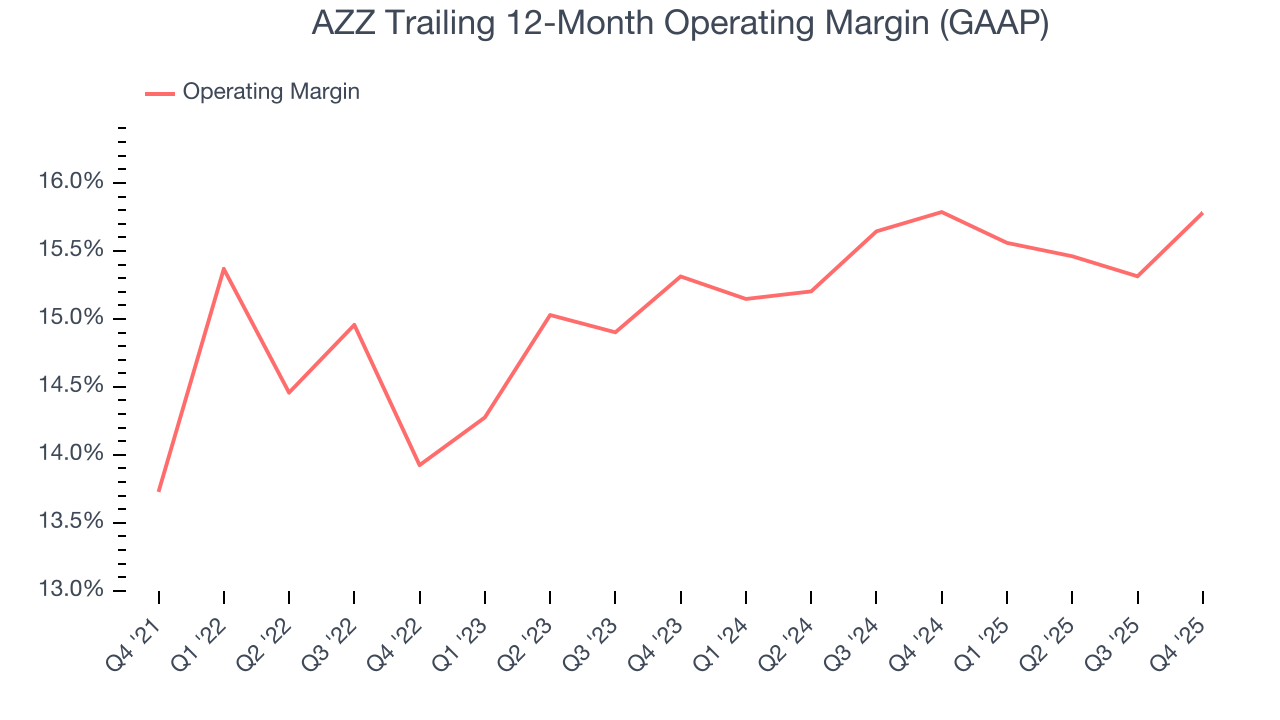

7. Operating Margin

AZZ has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, AZZ’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, AZZ generated an operating margin profit margin of 16.3%, up 1.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

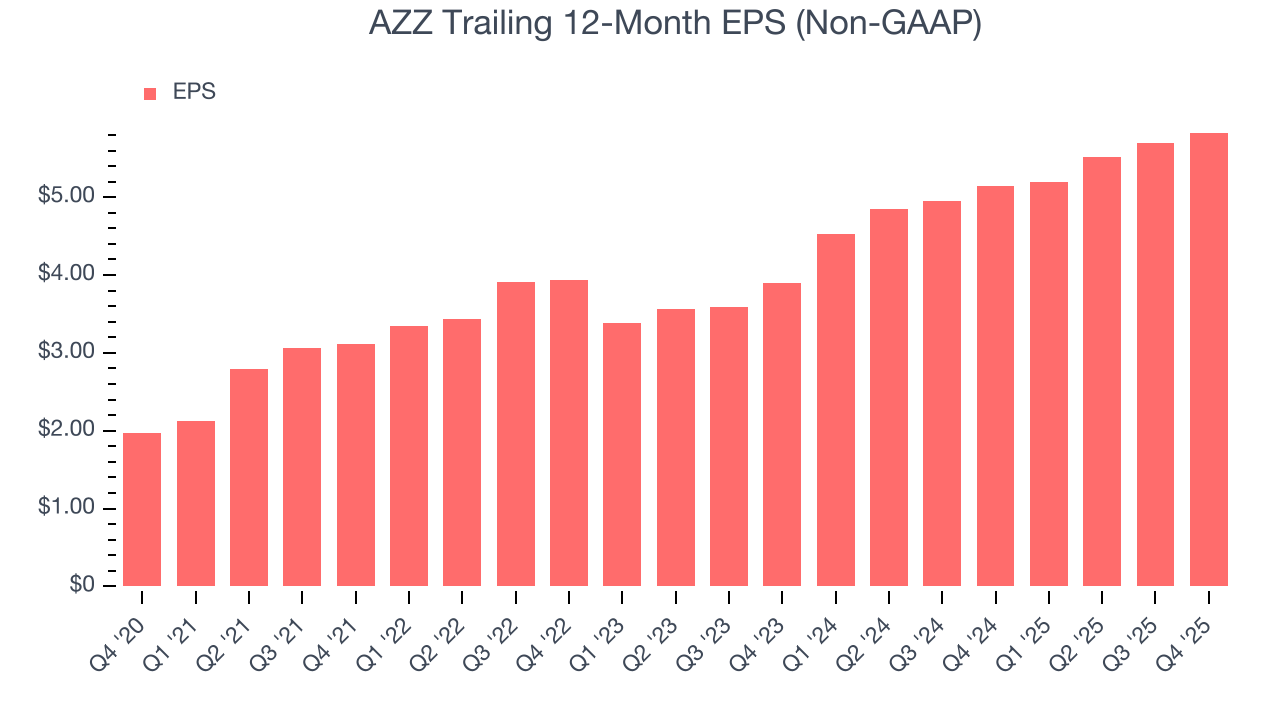

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AZZ’s EPS grew at an astounding 24.2% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into AZZ’s earnings to better understand the drivers of its performance. As we mentioned earlier, AZZ’s operating margin expanded by 2.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AZZ, its two-year annual EPS growth of 22.3% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, AZZ reported adjusted EPS of $1.52, up from $1.39 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects AZZ’s full-year EPS of $5.83 to grow 10.4%.

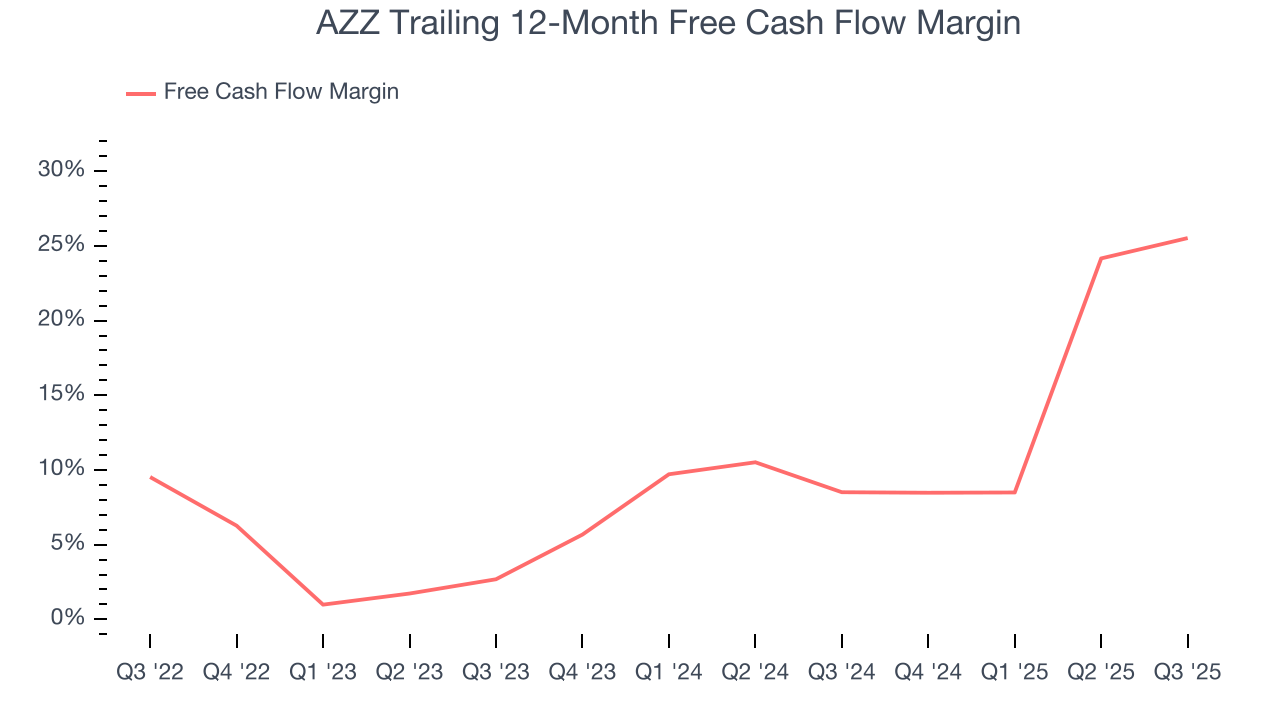

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AZZ has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that AZZ’s margin expanded by 34.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

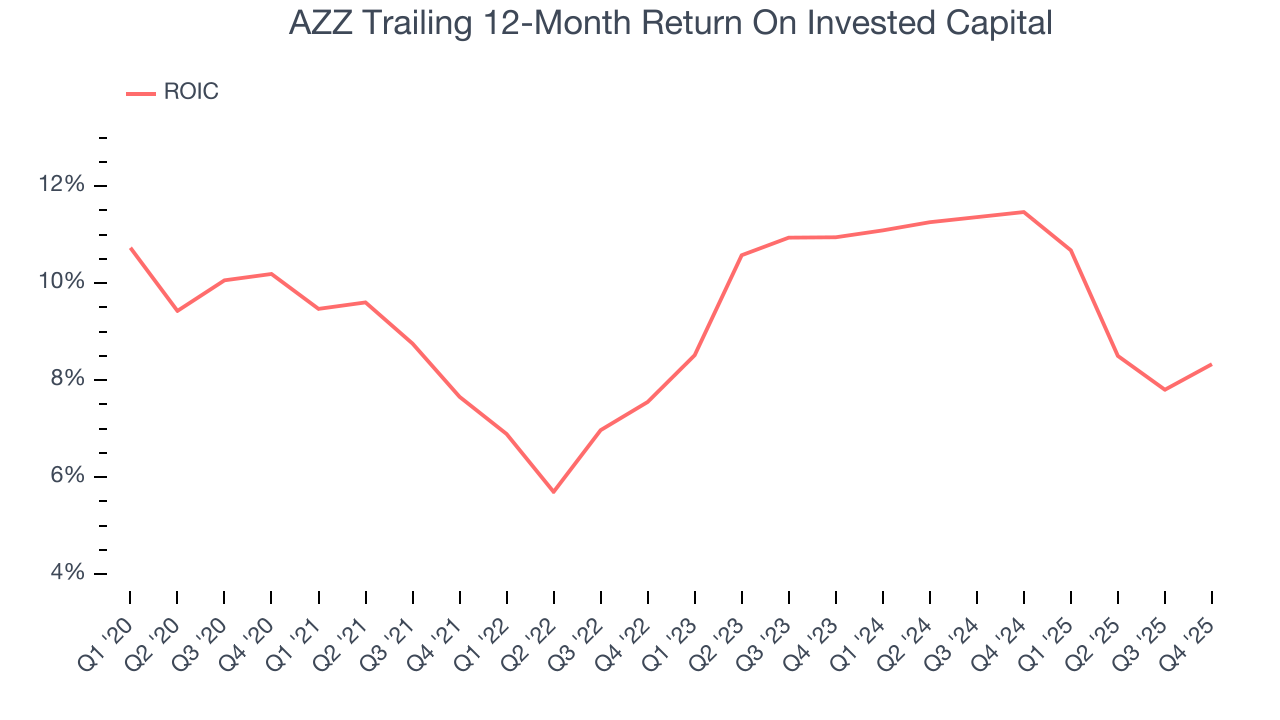

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although AZZ has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, AZZ’s ROIC averaged 2.3 percentage point increases over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

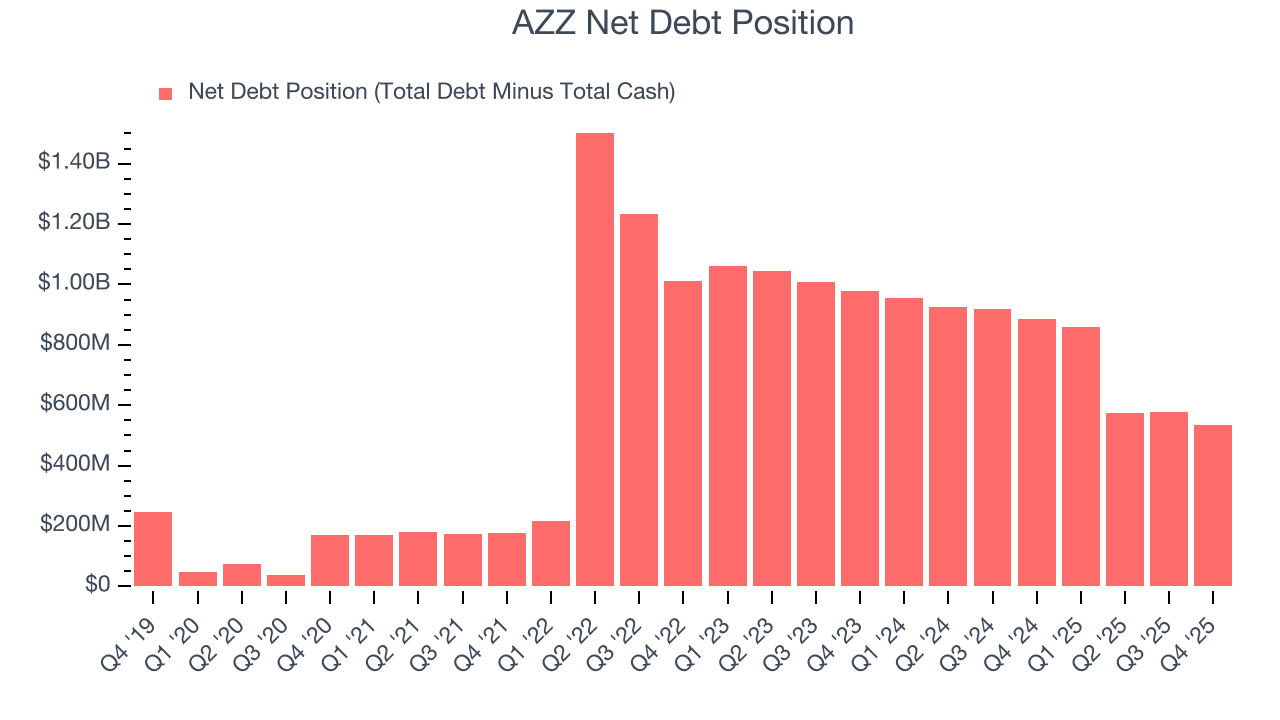

11. Balance Sheet Assessment

AZZ reported $623,000 of cash and $534.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $357.5 million of EBITDA over the last 12 months, we view AZZ’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $61.81 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AZZ’s Q4 Results

We enjoyed seeing AZZ beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.2% to $113.50 immediately following the results.

13. Is Now The Time To Buy AZZ?

Updated: February 18, 2026 at 10:37 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AZZ.

There are several reasons why we think AZZ is a great business. For starters, its revenue growth was impressive over the last five years. And while its low gross margins indicate some combination of competitive pressures and high production costs, its rising cash profitability gives it more optionality. On top of that, AZZ’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

AZZ’s P/E ratio based on the next 12 months is 20.9x. Analyzing the industrials landscape today, AZZ’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $139.56 on the company (compared to the current share price of $133.18), implying they see 4.8% upside in buying AZZ in the short term.