Boeing (BA)

We wouldn’t recommend Boeing. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Boeing Will Underperform

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

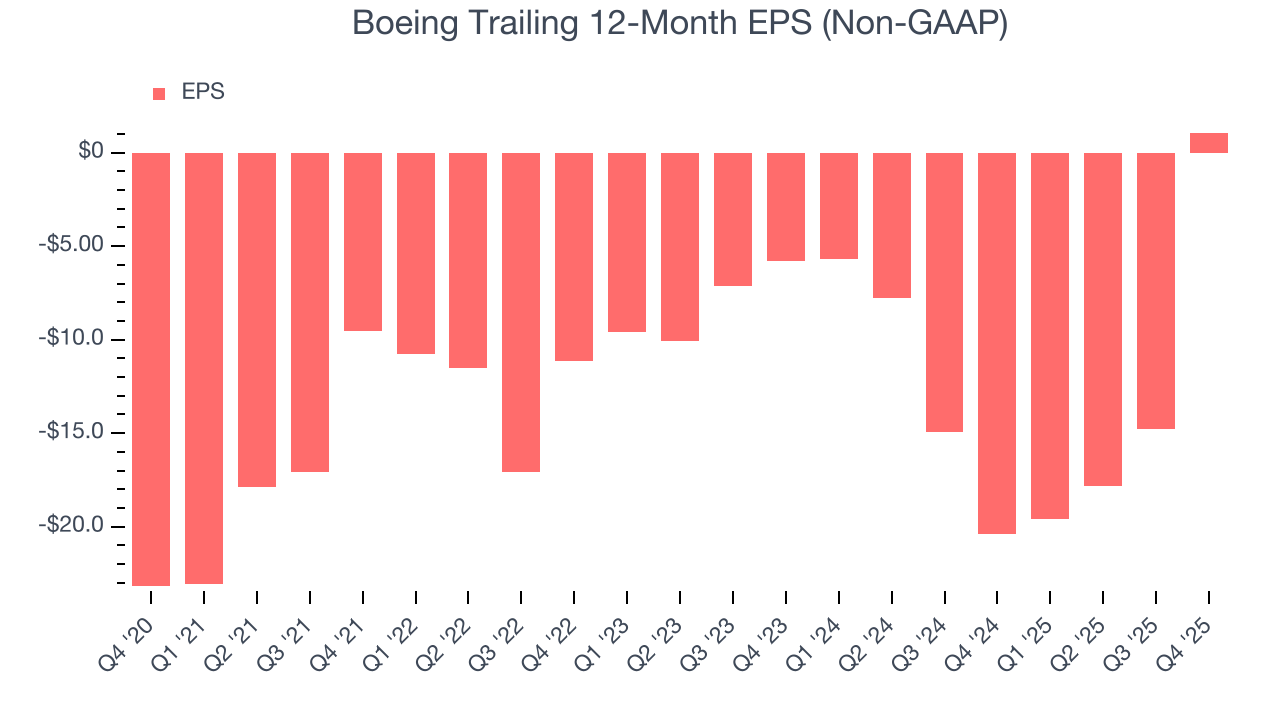

- Historically negative EPS raises concerns for risk-averse investors and makes its earnings potential harder to gauge

- Historical operating margin losses point to an inefficient cost structure

- Negative EBITDA restricts its access to capital and increases the probability of shareholder dilution if things turn unexpectedly

Boeing falls below our quality standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Boeing

Why There Are Better Opportunities Than Boeing

Boeing is trading at $248.70 per share, or 270.7x forward P/E. The current multiple is quite expensive, especially for the tepid revenue growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Boeing (BA) Research Report: Q4 CY2025 Update

Aerospace and defense company Boeing (NYSE:BA) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 57.1% year on year to $23.95 billion. Its non-GAAP profit of $9.92 per share was significantly above analysts’ consensus estimates.

Boeing (BA) Q4 CY2025 Highlights:

- Revenue: $23.95 billion vs analyst estimates of $22.39 billion (57.1% year-on-year growth, 6.9% beat)

- Adjusted EPS: $9.92 vs analyst estimates of -$0.39 (significant beat)

- Adjusted EBITDA: $9.40 billion vs analyst estimates of $1.14 billion (39.2% margin, significant beat)

- Operating Margin: 36.7%, up from -24.7% in the same quarter last year

- Free Cash Flow was $375 million, up from -$4.10 billion in the same quarter last year

- Backlog: $682.2 billion at quarter end, up 30.9% year on year

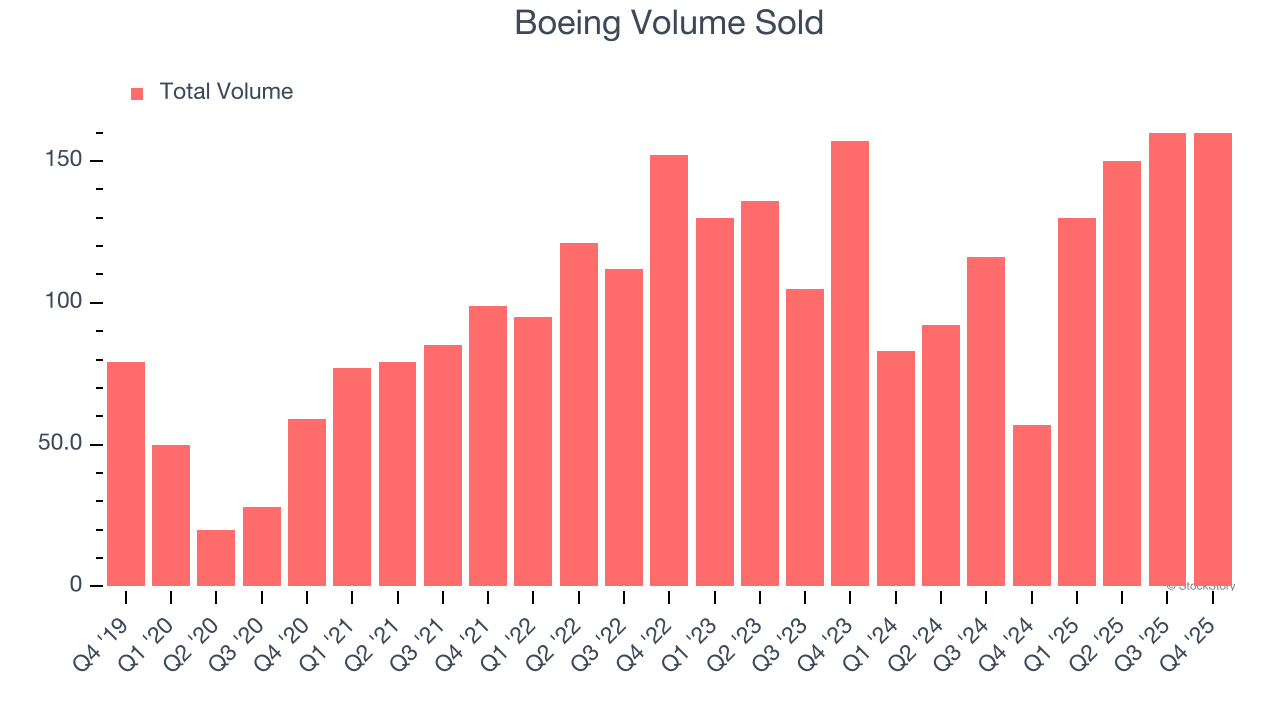

- Sales Volumes rose 181% year on year (-63.7% in the same quarter last year)

- Market Capitalization: $188.8 billion

Company Overview

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Boeing began in 1916 when William Boeing founded Pacific Aero Products in Seattle, following his construction of the B&W seaplane. The company, renamed Boeing Airplane Company the following year, capitalized on the growing demand for military aircraft brought about by World War I, initially focusing on seaplanes. Over the decades, Boeing expanded its operations beyond military aircraft to become a leading producer of commercial jetliners. The company's aircraft designs and acquisitions of competitors and strategic partners, such as McDonnell Douglas in 1997, have played a crucial role in its growth. Boeing also ventured into space technology and advanced defense systems, marking significant diversification of its product lines.

Today, Boeing offers a range of products across its commercial and defense sectors. For the commercial market, Boeing designs and manufactures jet aircraft, including the 737 narrow-body and the 767, 777, and 787 wide-body models. These models are used by many well-known airlines such as Delta and American Airlines. If you’ve flown recently, there's a good chance you were in a Boeing model.

For the defense, space & security sector, Boeing produces manned and unmanned military aircraft and systems, including fighters, rotorcraft, and surveillance systems, alongside space and satellite technologies. Additionally, to complement its products the company offers support services, including maintenance, logistics, and data analytics, to both commercial and defense customers globally. These services provide aftermarket revenue for the company.

In terms of contracting, Boeing engages in both fixed-price and cost-type contracts. Fixed-price contracts, where the payment does not change regardless of the actual costs incurred, are common within the company, particularly in its defense segments. This contract type often applies to products and services with well-defined specifications, allowing Boeing to manage financial risks effectively. Conversely, cost-type contracts are used for projects that involve significant development and technical challenges, such as new aircraft designs or advanced defense systems. These contracts ensure Boeing is reimbursed for all allowable expenses to a set limit plus additional payment to allow for a profit, which is crucial for projects with high degrees of uncertainty and complexity.

Boeing also earns a significant portion of its revenue from U.S. government contracts, including those for the Department of Defense and other federal agencies. These contracts may involve Foreign Military Sales (FMS), where Boeing supplies military equipment and services to foreign countries with the U.S. government acting as an intermediary.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Boeing’s primary competitor is Airbus (OTC:EADSY), while other competitors in the aerospace industry include Lockheed Martin (NYSE:LMT), and Northrop Grumman (NYSE:NOC).

5. Revenue Growth

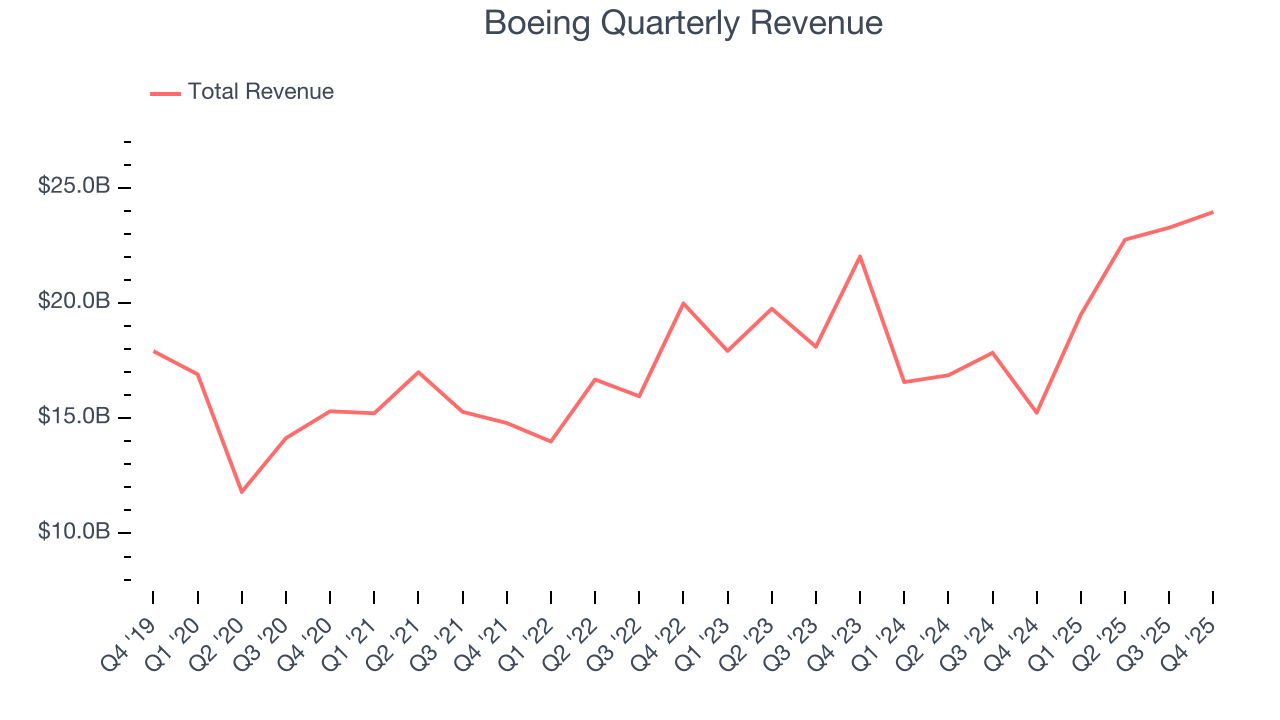

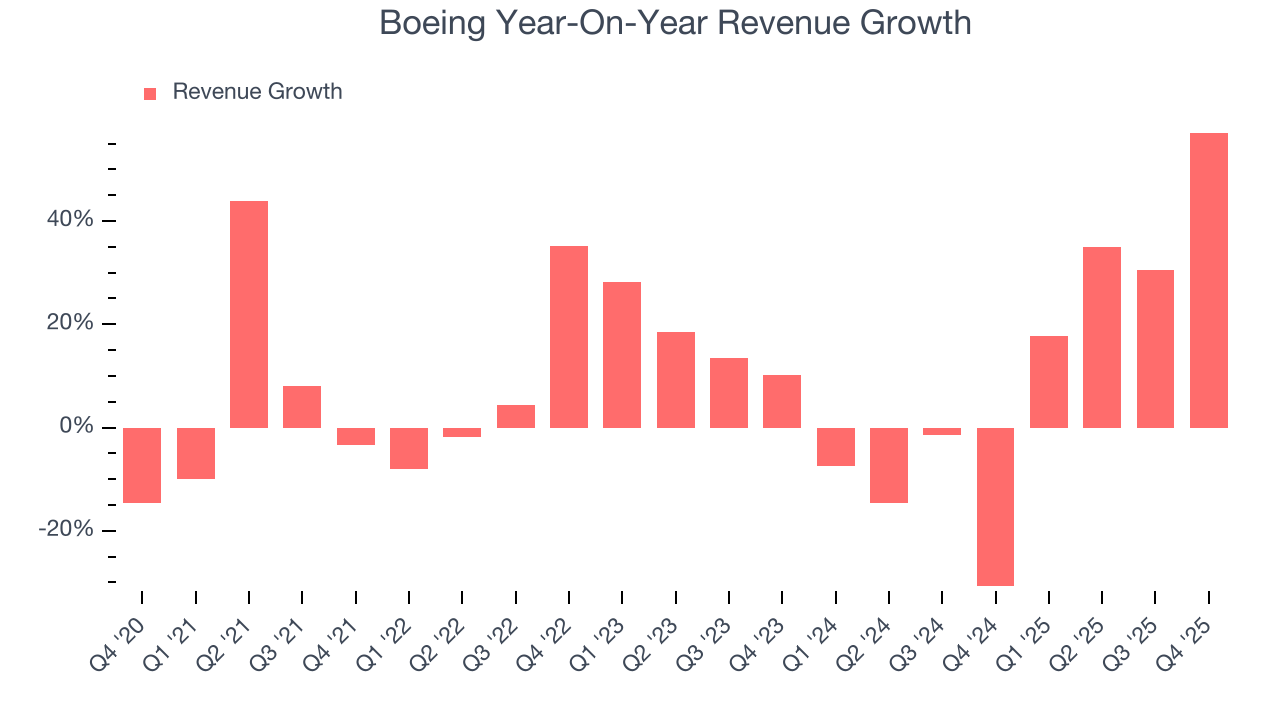

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Boeing’s 9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Boeing’s recent performance shows its demand has slowed as its annualized revenue growth of 7.2% over the last two years was below its five-year trend.

Boeing also reports its number of units sold, which reached 160 in the latest quarter. Over the last two years, Boeing’s units sold averaged 27.1% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Boeing reported magnificent year-on-year revenue growth of 57.1%, and its $23.95 billion of revenue beat Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

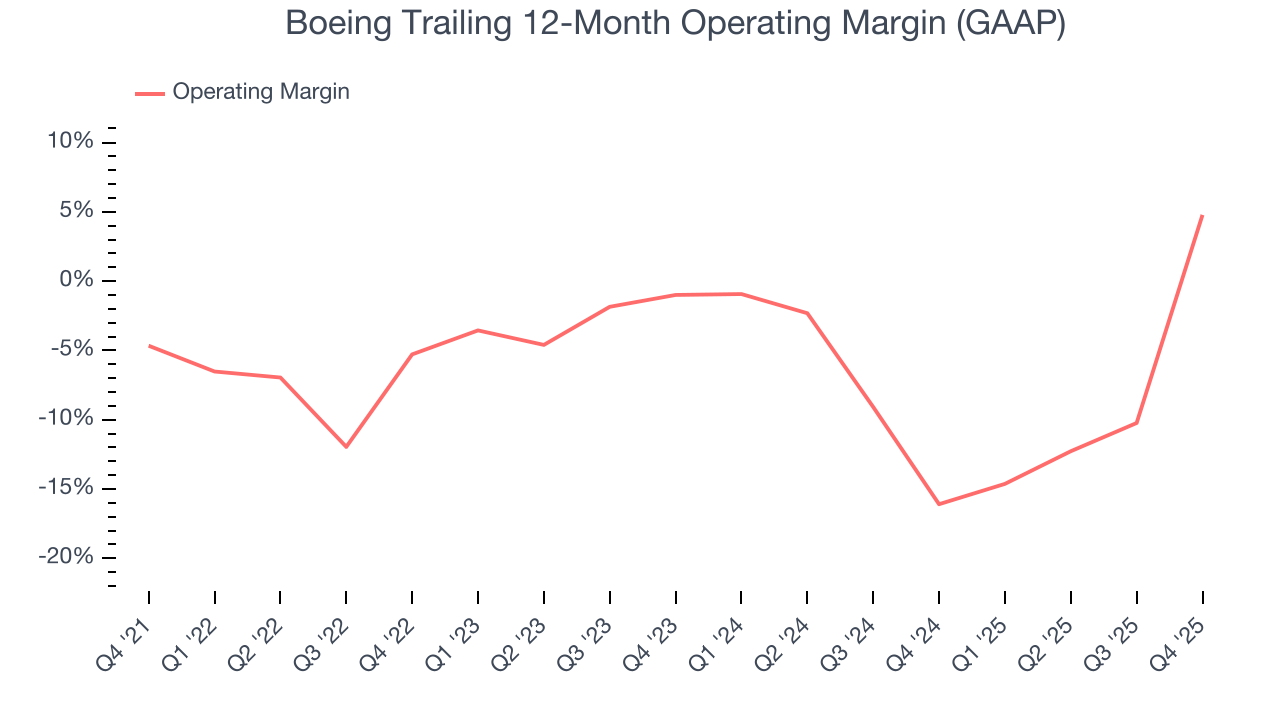

Although Boeing was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Boeing’s operating margin rose by 9.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q4, Boeing generated an operating margin profit margin of 36.7%, up 61.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boeing’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Boeing, its two-year annual EPS growth of 47.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Boeing reported adjusted EPS of $9.92, up from negative $5.90 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Boeing’s full-year EPS of $1.07 to grow 116%.

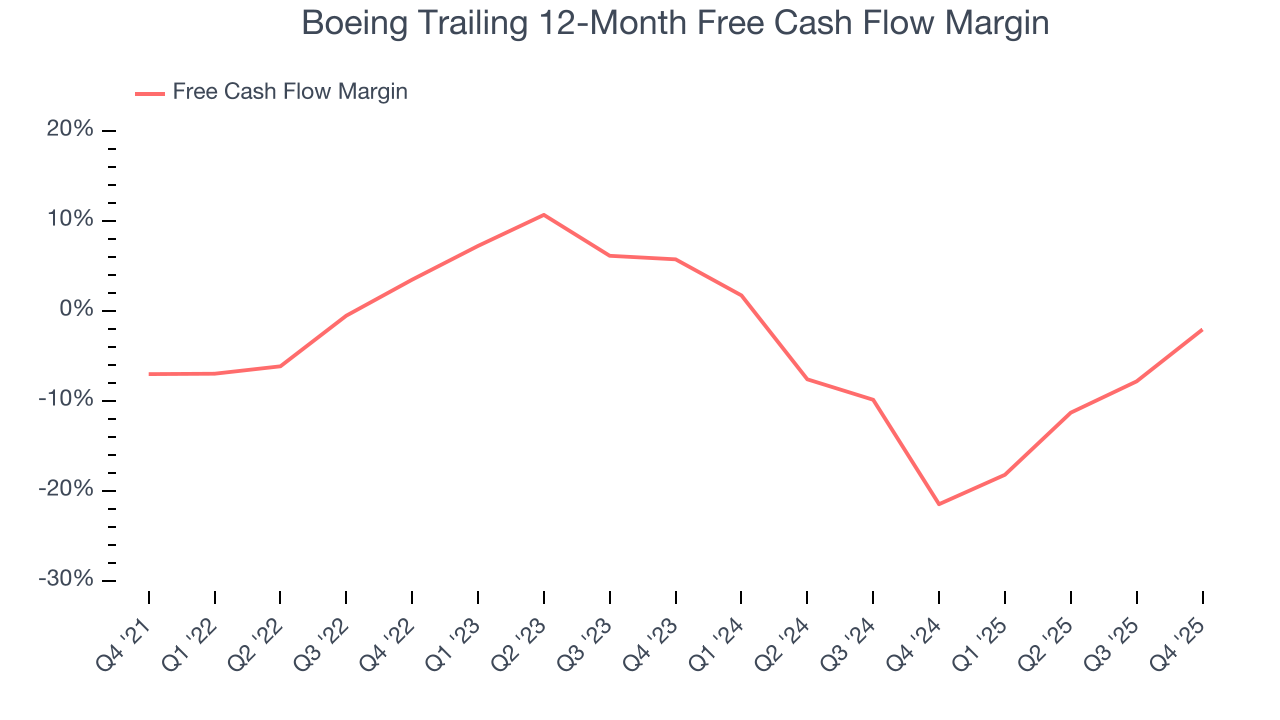

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Boeing posted positive free cash flow this quarter, the broader story hasn’t been so clean. Boeing’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.8%, meaning it lit $3.82 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Boeing’s margin expanded by 5 percentage points during that time. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

Boeing’s free cash flow clocked in at $375 million in Q4, equivalent to a 1.6% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

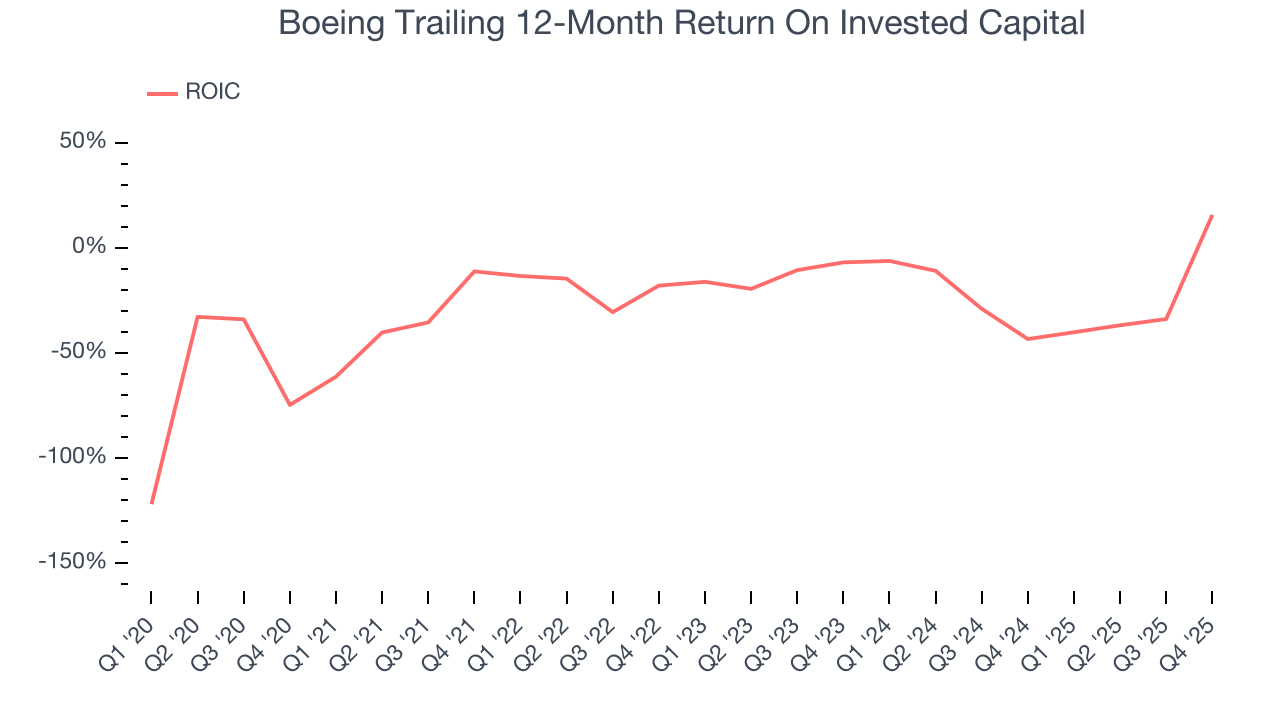

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Boeing’s five-year average ROIC was negative 12.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Boeing’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

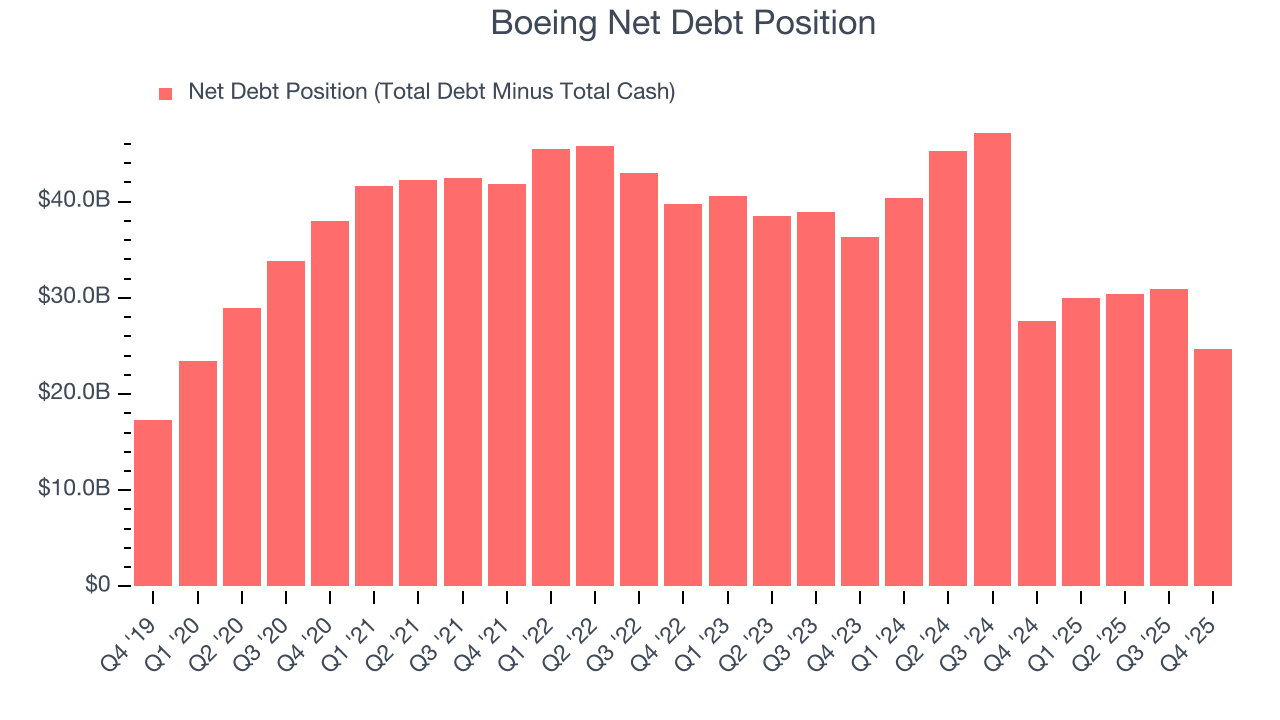

10. Balance Sheet Assessment

Boeing reported $29.4 billion of cash and $54.1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.53 billion of EBITDA over the last 12 months, we view Boeing’s 4.5× net-debt-to-EBITDA ratio as safe. We also see its $2.73 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Boeing’s Q4 Results

It was good to see Boeing beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $247.89 immediately following the results.

12. Is Now The Time To Buy Boeing?

Updated: January 27, 2026 at 7:43 AM EST

Before deciding whether to buy Boeing or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There’s plenty to admire about Boeing. First off, its revenue growth was good over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its growth in unit sales was surging. On top of that, its expanding operating margin shows the business has become more efficient.

Boeing’s P/E ratio based on the next 12 months is 107.7x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $258.04 on the company (compared to the current share price of $247.89).