Bark (BARK)

We wouldn’t buy Bark. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bark Will Underperform

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

- 5.2% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Persistent operating margin losses suggest the business manages its expenses poorly

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Bark’s quality isn’t great. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Bark

Why There Are Better Opportunities Than Bark

Bark is trading at $0.82 per share, or 39.7x forward EV-to-EBITDA. This valuation multiple seems a bit much considering the tepid revenue growth profile.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Bark (BARK) Research Report: Q4 CY2025 Update

Pet products provider Bark (NYSE:BARK) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 22.1% year on year to $98.45 million. Its non-GAAP loss of $0.03 per share was $0.01 above analysts’ consensus estimates.

Bark (BARK) Q4 CY2025 Highlights:

- On January 14, 2026, the Company received a preliminary non-binding indicative proposal letter from GNK Holdings LLC and Marcus Lemonis (collectively, the “GNK/Lemonis Group”). The GNK/Lemonis Group letter proposes that the GNK/Lemonis Group would acquire all of the outstanding shares of the Company’s common stock not already beneficially owned by the GNK/Lemonis Group, in an all-cash transaction, for $1.10 per share.

- Revenue: $98.45 million vs analyst estimates of $102.7 million (22.1% year-on-year decline, 4.1% miss)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.04 ($0.01 beat)

- Adjusted EBITDA: -$1.61 million (-1.6% margin, 3.4% year-on-year decline)

- Operating Margin: -9.1%, in line with the same quarter last year

- Free Cash Flow was $1.56 million, up from -$1.96 million in the same quarter last year

- Market Capitalization: $143.8 million

Company Overview

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

The company's journey started with a vision: to fill a gap in the market for high-quality, engaging, and personalized pet care items. This concept quickly gained traction during COVID-19, leading to its June 2021 SPAC debut.

Bark's primary offerings include subscription-based bundles such as BarkBox and Bark Super Chewer, which contain a customized selection of toys, treats, and chews. These bundles can be purchased online and scheduled for home delivery. Additionally, Bark sells pet food and dental products, and its goods can also be found at retailers like Target.

Bark’s customers are affectionate pet owners who prioritize their pets' happiness and well-being. The company's revenue is primarily derived from subscription services, supplemented by direct sales of individual products. Maintaining its subscription revenue base is key to its success.

4. Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Competitors operating in the pet care and products industry include Chewy (NYSE:CHWY), Petco (NASDAQ:WOOF), and Amazon (NASDAQ:AMZN).

5. Revenue Growth

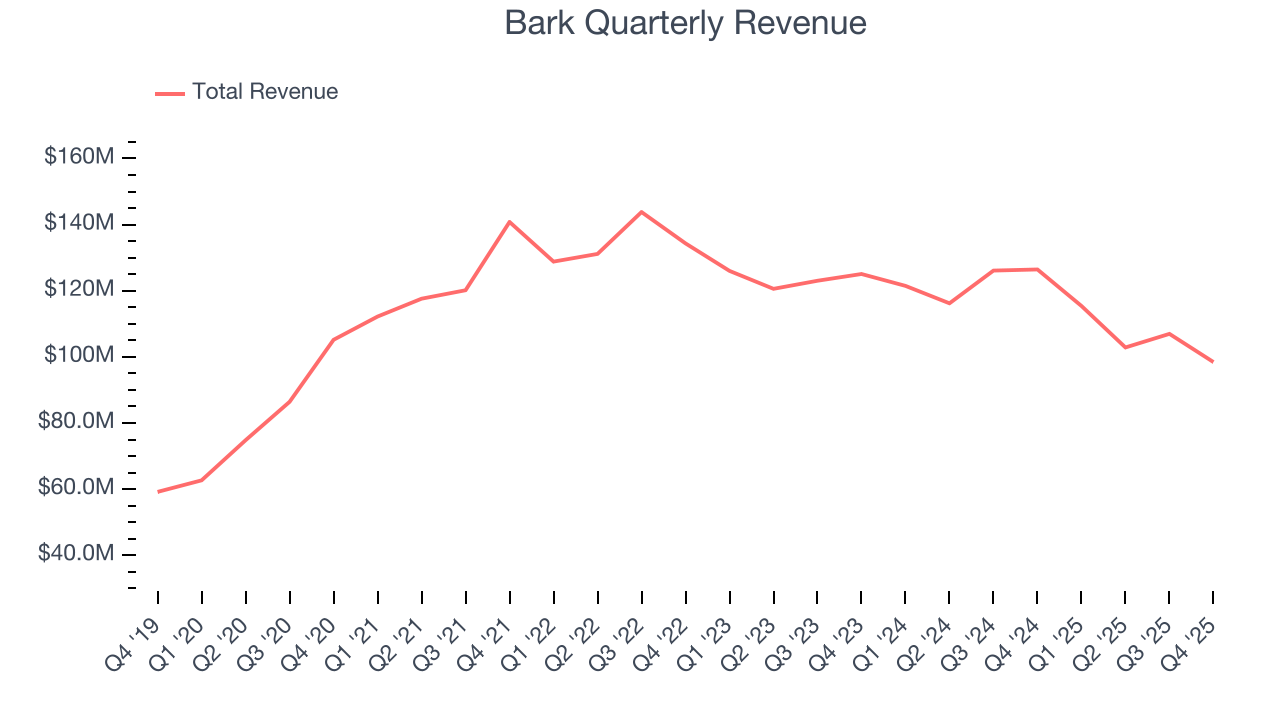

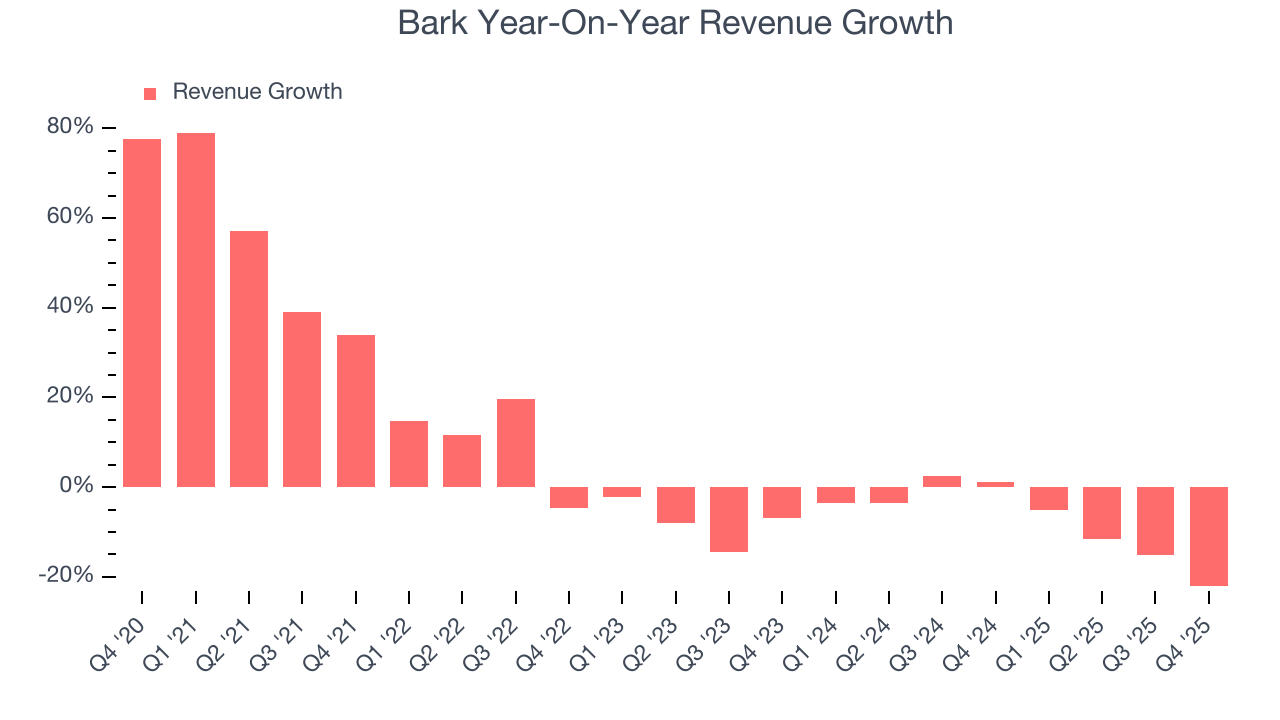

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Bark grew its sales at a weak 5.2% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bark’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.5% annually.

This quarter, Bark missed Wall Street’s estimates and reported a rather uninspiring 22.1% year-on-year revenue decline, generating $98.45 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

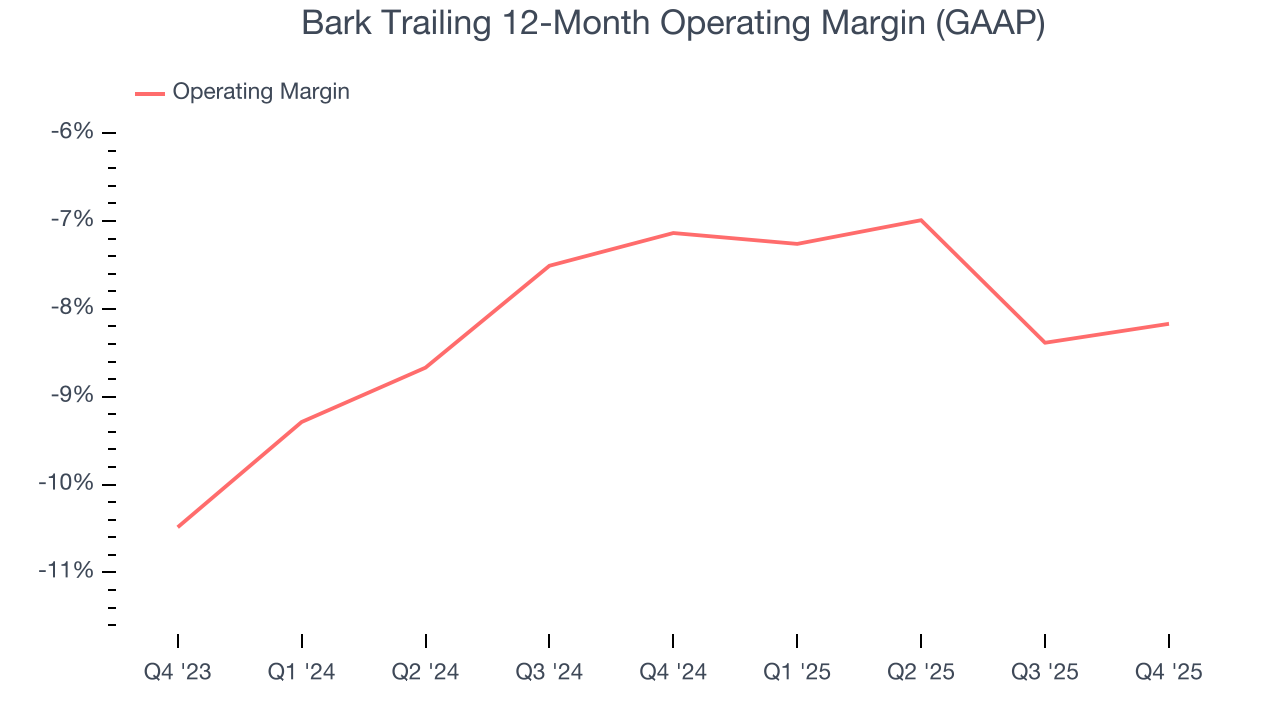

Bark’s operating margin has been trending down over the last 12 months and averaged negative 7.6% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q4, Bark generated a negative 9.1% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

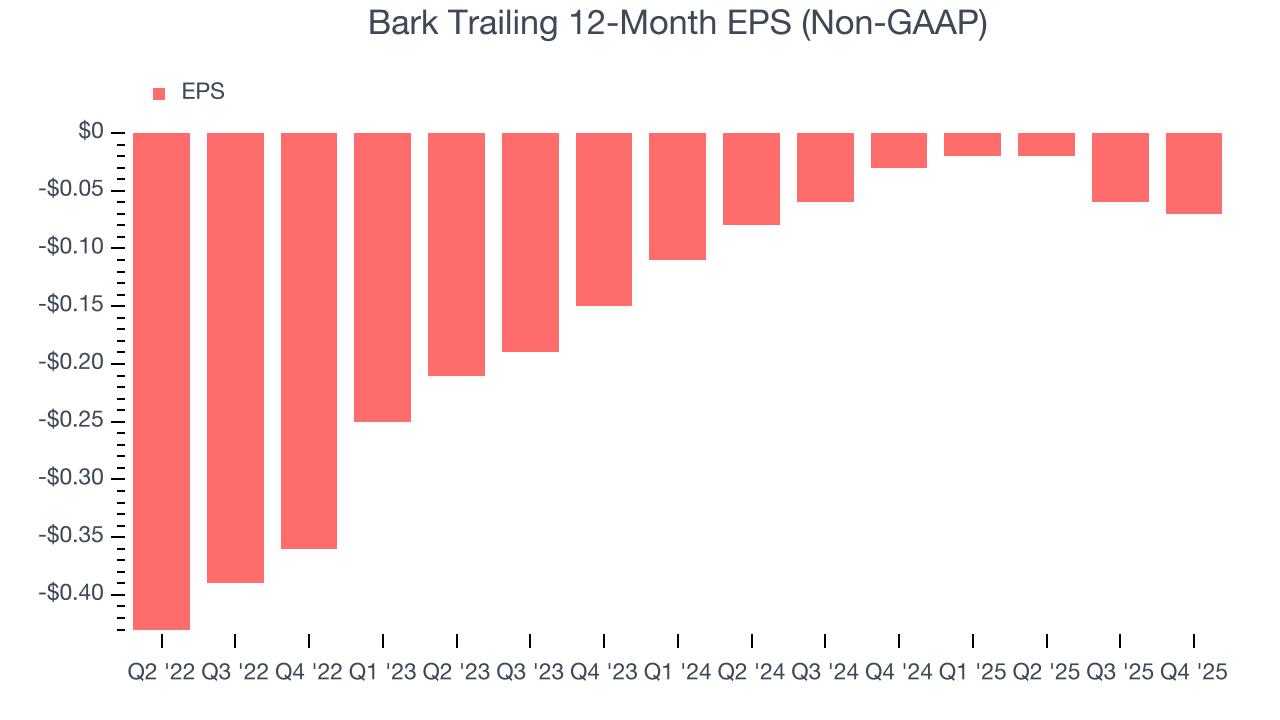

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Bark’s full-year earnings are still negative, it reduced its losses and improved its EPS by 25% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Bark reported adjusted EPS of negative $0.03, down from negative $0.02 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Bark to perform poorly. Analysts forecast its full-year EPS of negative $0.07 will tumble to negative $0.08.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

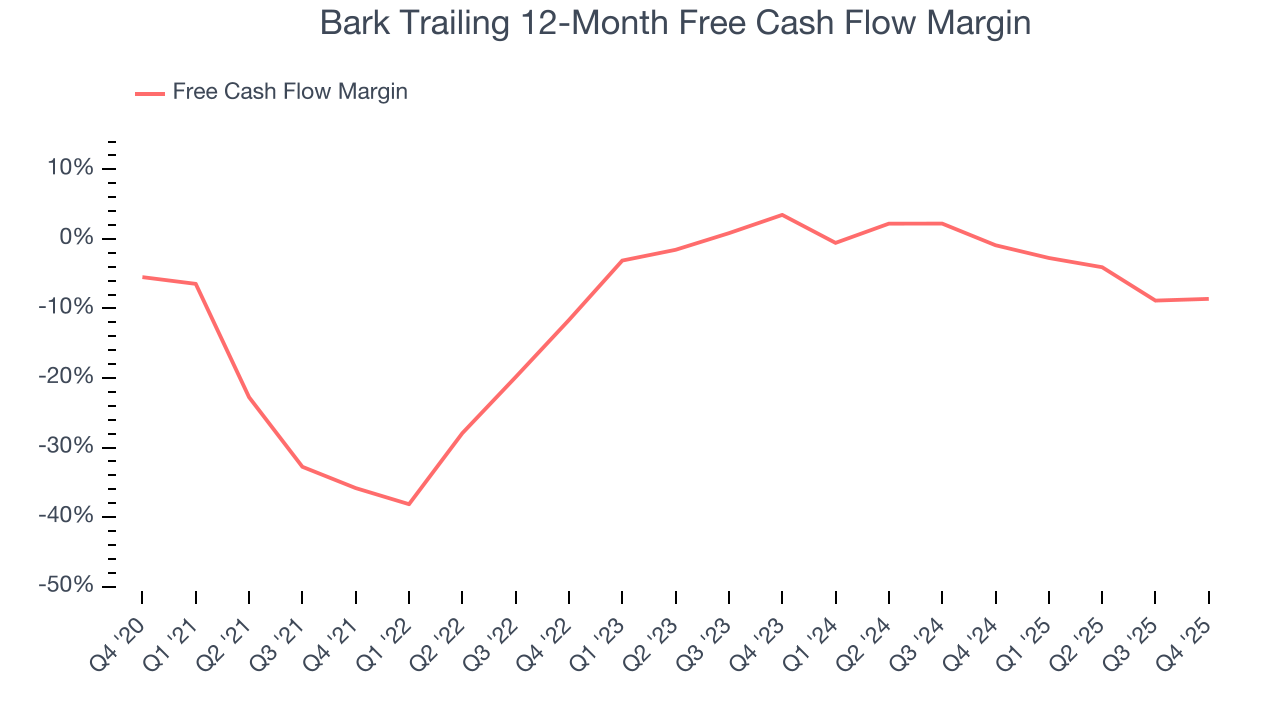

While Bark posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Bark’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 4.5%, meaning it lit $4.48 of cash on fire for every $100 in revenue.

Bark’s free cash flow clocked in at $1.56 million in Q4, equivalent to a 1.6% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

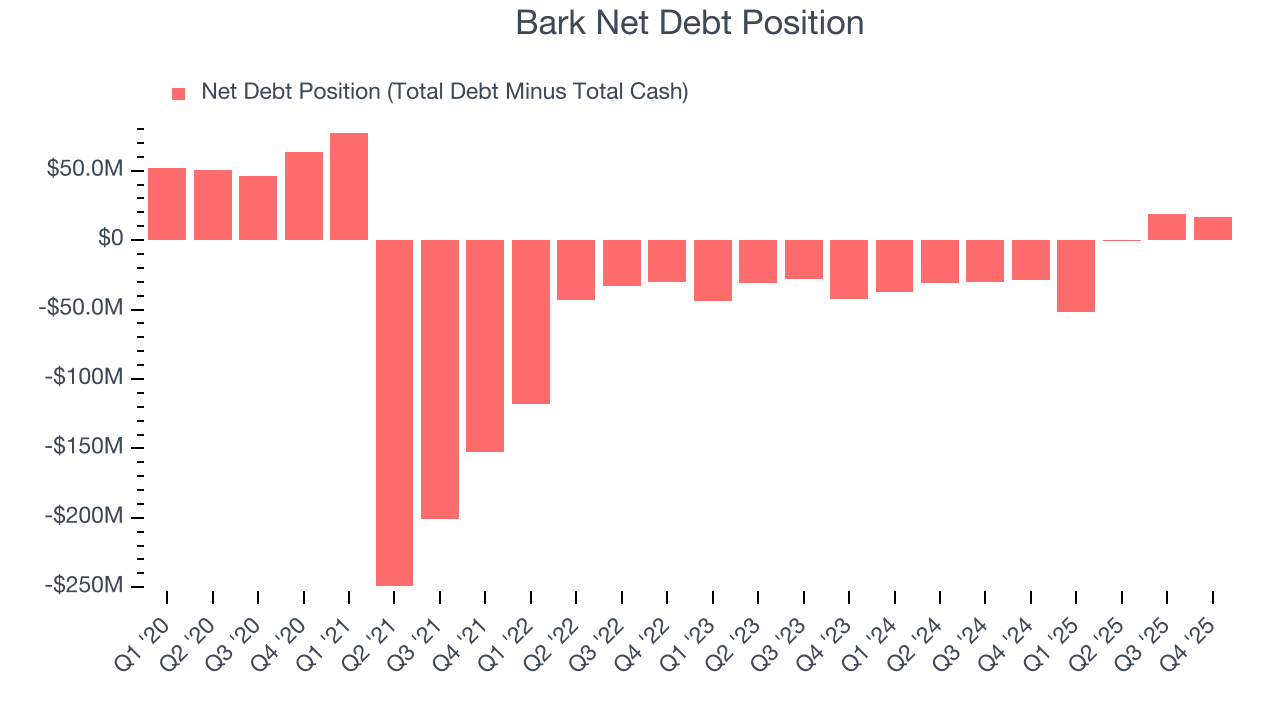

9. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Bark burned through $36.5 million of cash over the last year, and its $38.31 million of debt exceeds the $21.68 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Bark’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Bark until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

10. Key Takeaways from Bark’s Q4 Results

We were impressed by how significantly Bark blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this print had some key positives. The stock remained flat at $0.82 immediately following the results.

On January 14, 2026, the Company received a preliminary non-binding indicative proposal letter from GNK Holdings LLC and Marcus Lemonis (collectively, the “GNK/Lemonis Group”). The GNK/Lemonis Group letter proposes that the GNK/Lemonis Group would acquire all of the outstanding shares of the Company’s common stock not already beneficially owned by the GNK/Lemonis Group, in an all-cash transaction, for $1.10 per share.

11. Is Now The Time To Buy Bark?

Updated: February 5, 2026 at 10:00 PM EST

When considering an investment in Bark, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Bark falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Bark’s projected EPS for the next year is lacking, and its cash burn raises the question of whether it can sustainably maintain growth.

Bark’s EV-to-EBITDA ratio based on the next 12 months is 39.7x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $2.33 on the company (compared to the current share price of $0.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.