Baxter (BAX)

Baxter keeps us up at night. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Baxter Will Underperform

With a history dating back to 1931 and products used in over 100 countries, Baxter International (NYSE:BAX) provides essential healthcare products including dialysis therapies, IV solutions, infusion systems, surgical products, and patient monitoring technologies to hospitals and clinics worldwide.

- Earnings per share fell by 6% annually over the last five years while its revenue was flat, showing each sale was less profitable

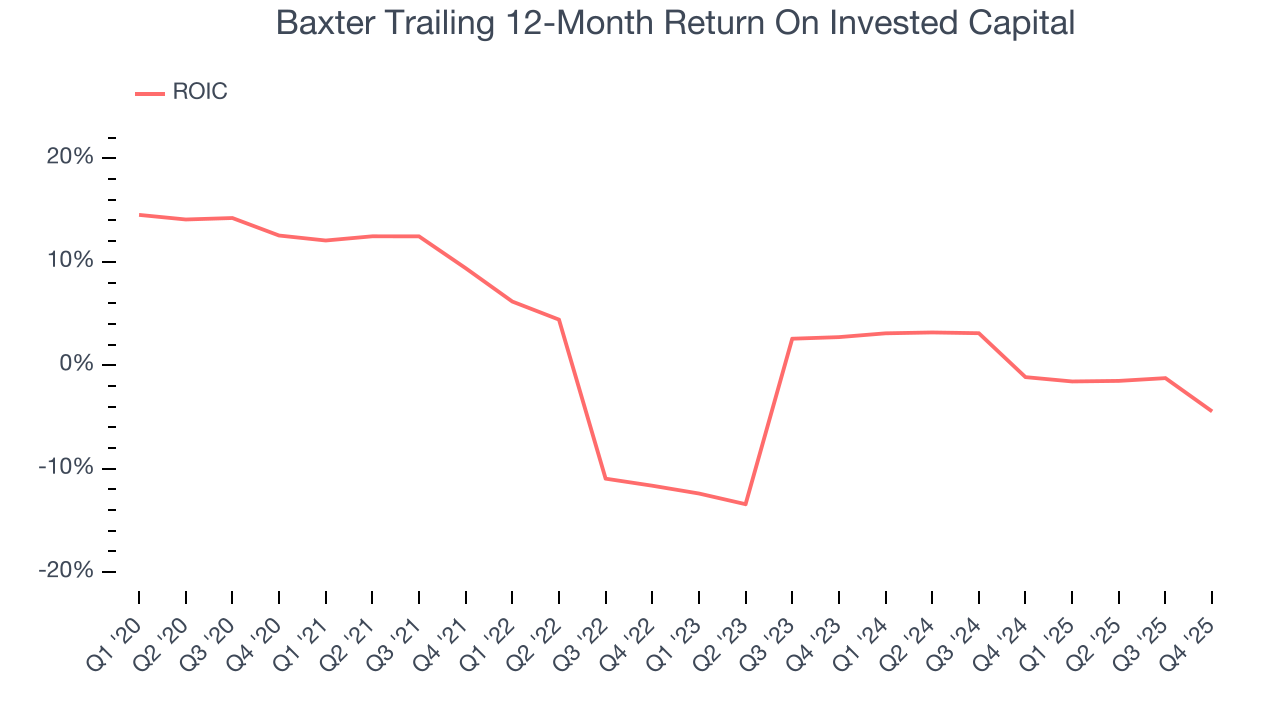

- Negative returns on capital show that some of its growth strategies have backfired, and its falling returns suggest its earlier profit pools are drying up

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

Baxter falls below our quality standards. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Baxter

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Baxter

Baxter’s stock price of $18.91 implies a valuation ratio of 11.4x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Baxter (BAX) Research Report: Q4 CY2025 Update

Healthcare company Baxter International (NYSE:BAX) announced better-than-expected revenue in Q4 CY2025, with sales up 8% year on year to $2.97 billion. Its non-GAAP profit of $0.44 per share was 17.8% below analysts’ consensus estimates.

Baxter (BAX) Q4 CY2025 Highlights:

- Revenue: $2.97 billion vs analyst estimates of $2.81 billion (8% year-on-year growth, 5.7% beat)

- Adjusted EPS: $0.44 vs analyst expectations of $0.54 (17.8% miss)

- Adjusted EBITDA: $592 million vs analyst estimates of $508.8 million (19.9% margin, 16.4% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.95 at the midpoint, missing analyst estimates by 12.8%

- Operating Margin: -24.5%, down from -15.8% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 12.9% in the same quarter last year

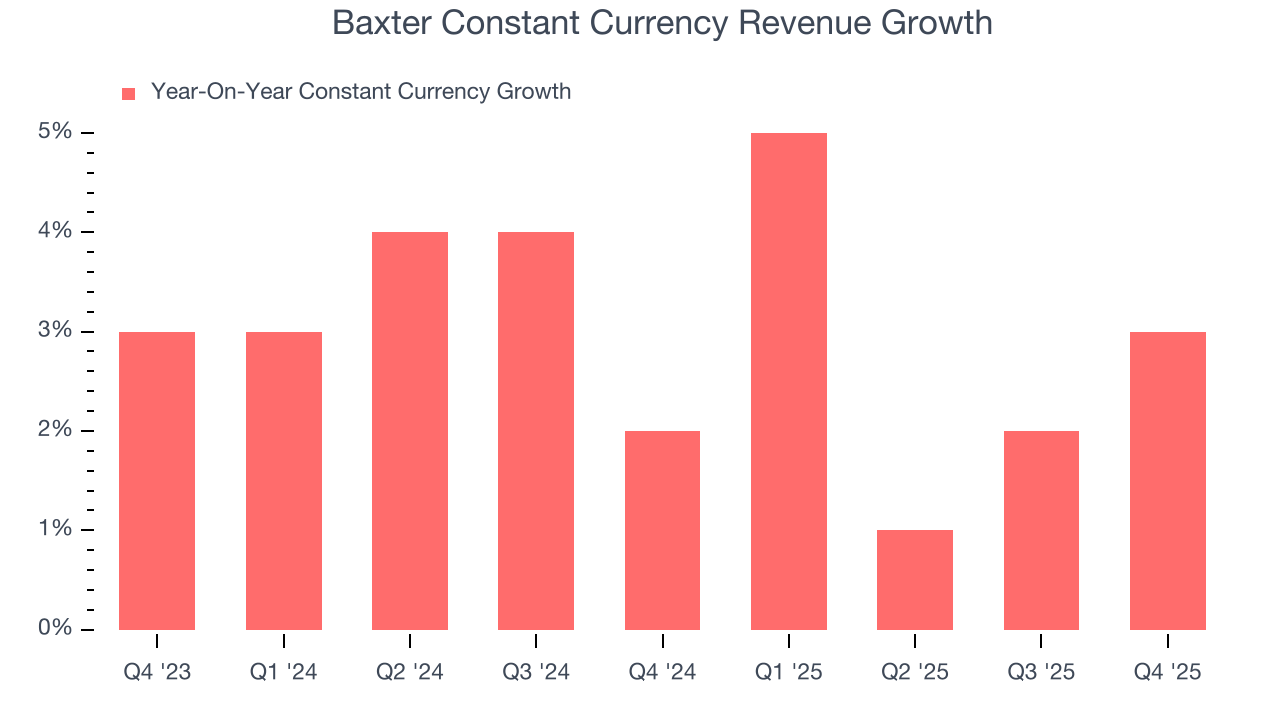

- Constant Currency Revenue rose 3% year on year (2% in the same quarter last year)

- Market Capitalization: $9.62 billion

Company Overview

With a history dating back to 1931 and products used in over 100 countries, Baxter International (NYSE:BAX) provides essential healthcare products including dialysis therapies, IV solutions, infusion systems, surgical products, and patient monitoring technologies to hospitals and clinics worldwide.

Baxter operates through four distinct segments that address different healthcare needs. The Medical Products and Therapies segment offers sterile IV solutions, infusion systems, and surgical products that are fundamental to hospital care. The Healthcare Systems and Technologies segment provides connected care solutions including smart beds, patient monitoring systems, and advanced surgical equipment that help clinicians deliver more efficient care. The Pharmaceuticals segment focuses on specialty injectable medications, inhaled anesthetics, and drug compounding services. The Kidney Care segment delivers dialysis therapies for patients with kidney failure, including peritoneal dialysis, hemodialysis, and continuous renal replacement therapies.

The company's products are used across a wide spectrum of healthcare settings—from major hospital systems to small clinics, nursing homes, and even patients' homes under physician supervision. For example, a hospital might use Baxter's IV solutions and pumps to deliver medications to patients, while simultaneously relying on their patient monitoring systems to track vital signs, and their surgical sealants during operations.

Baxter generates revenue through direct sales to healthcare providers and through distributors. In the United States, the company works with major distributors like Cardinal Health to warehouse and ship products to customers. Internationally, Baxter maintains operations across Europe, the Middle East, Africa, Asia-Pacific, Latin America, and Canada, with manufacturing facilities in over 20 countries.

The company invests significantly in research and development to create new products and improve existing ones. As a healthcare company, Baxter operates in a highly regulated environment, with oversight from agencies like the FDA in the United States, the European Medicines Agency in Europe, and the China Food and Drug Administration. Many of Baxter's products require specific regulatory approval before they can be marketed and sold in different countries.

4. Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Baxter International competes with several major healthcare companies including Fresenius Medical Care (NYSE:FMS) in dialysis products, Becton Dickinson (NYSE:BDX) in IV solutions and infusion systems, Medtronic (NYSE:MDT) in patient monitoring, and B. Braun in IV and surgical products.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $11.24 billion in revenue over the past 12 months, Baxter has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

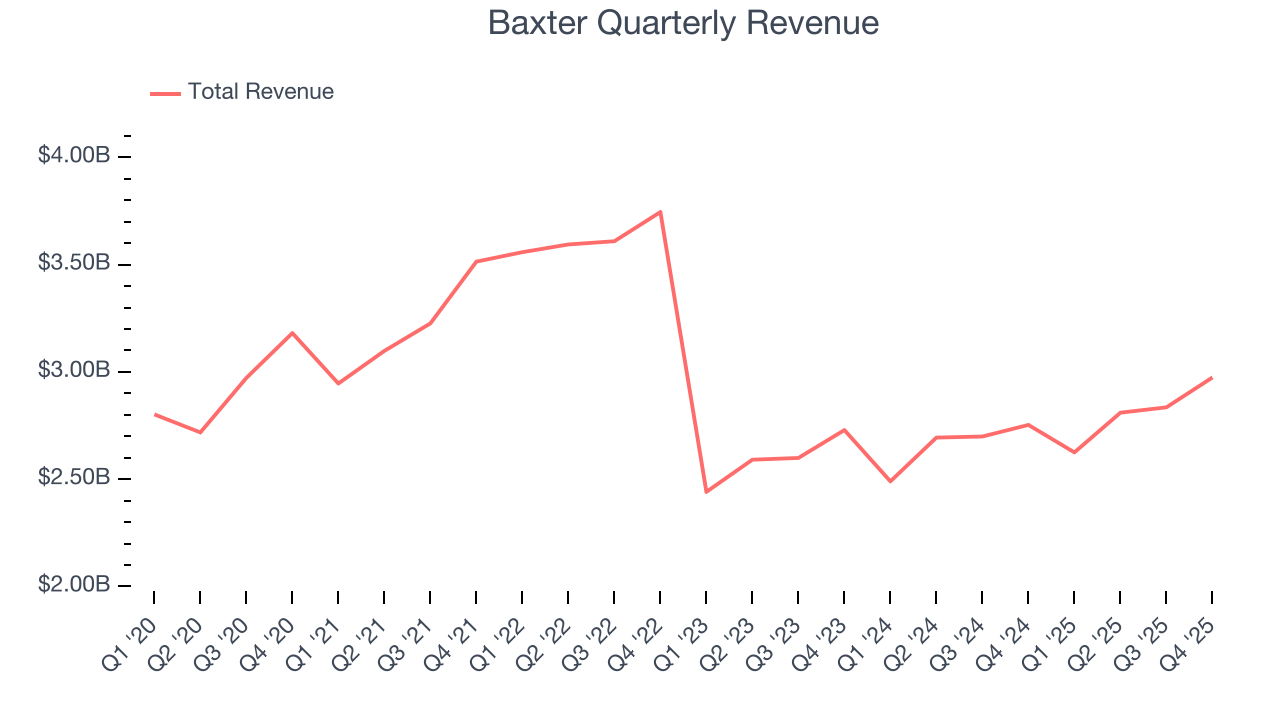

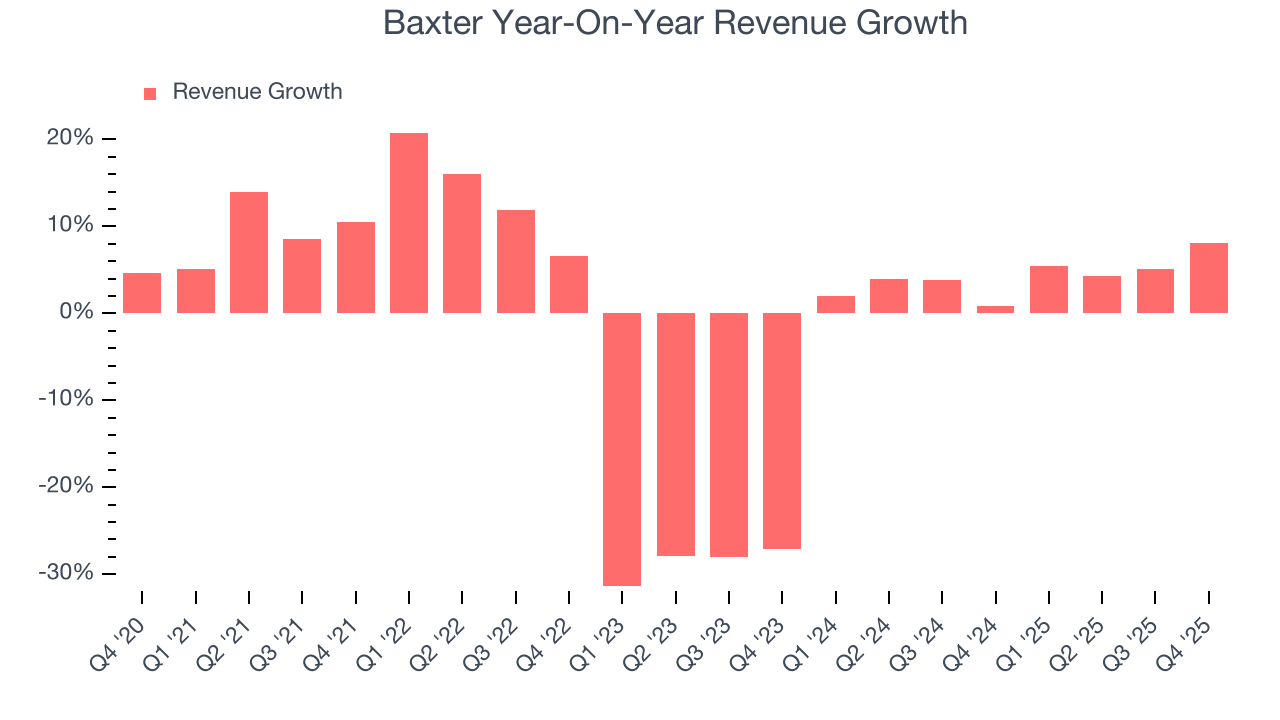

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Baxter struggled to consistently increase demand as its $11.24 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Baxter’s annualized revenue growth of 4.2% over the last two years is above its five-year trend, which is encouraging.

Baxter also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Baxter has properly hedged its foreign currency exposure.

This quarter, Baxter reported year-on-year revenue growth of 8%, and its $2.97 billion of revenue exceeded Wall Street’s estimates by 5.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

7. Adjusted Operating Margin

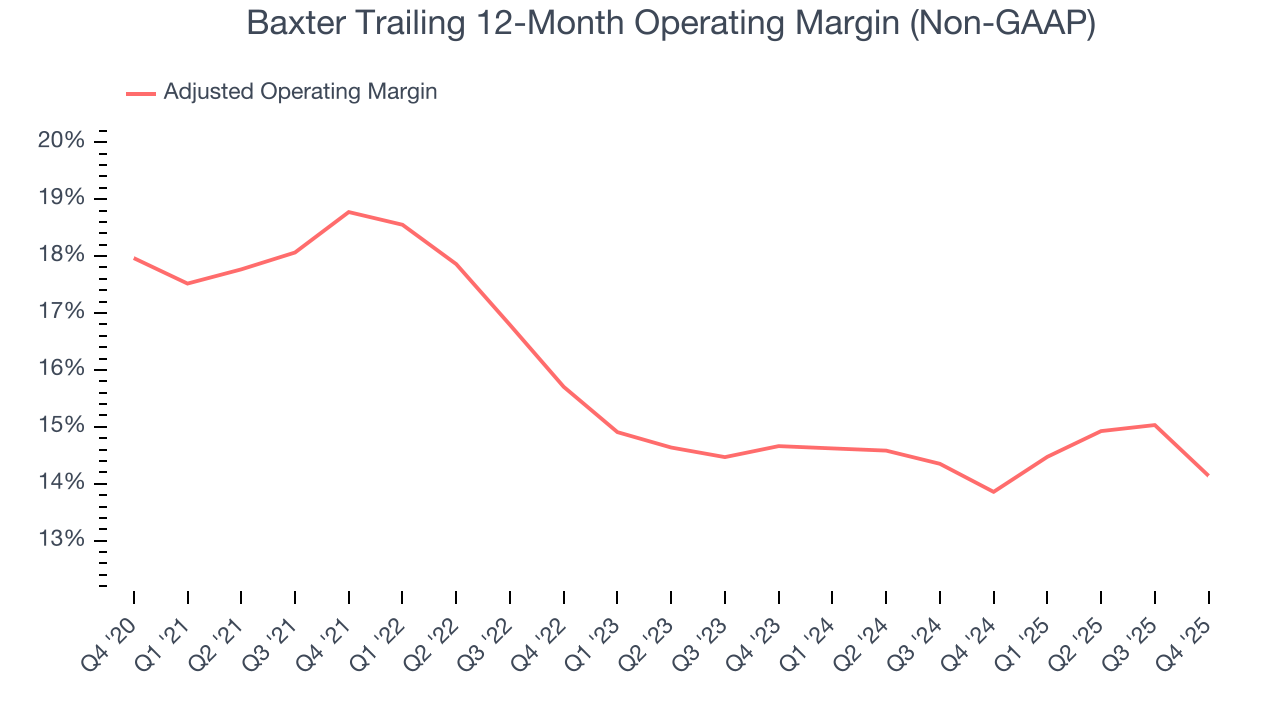

Baxter has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 15.6%.

Looking at the trend in its profitability, Baxter’s adjusted operating margin decreased by 4.6 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see Baxter become more profitable in the future.

In Q4, Baxter generated an adjusted operating margin profit margin of 11.8%, down 3.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

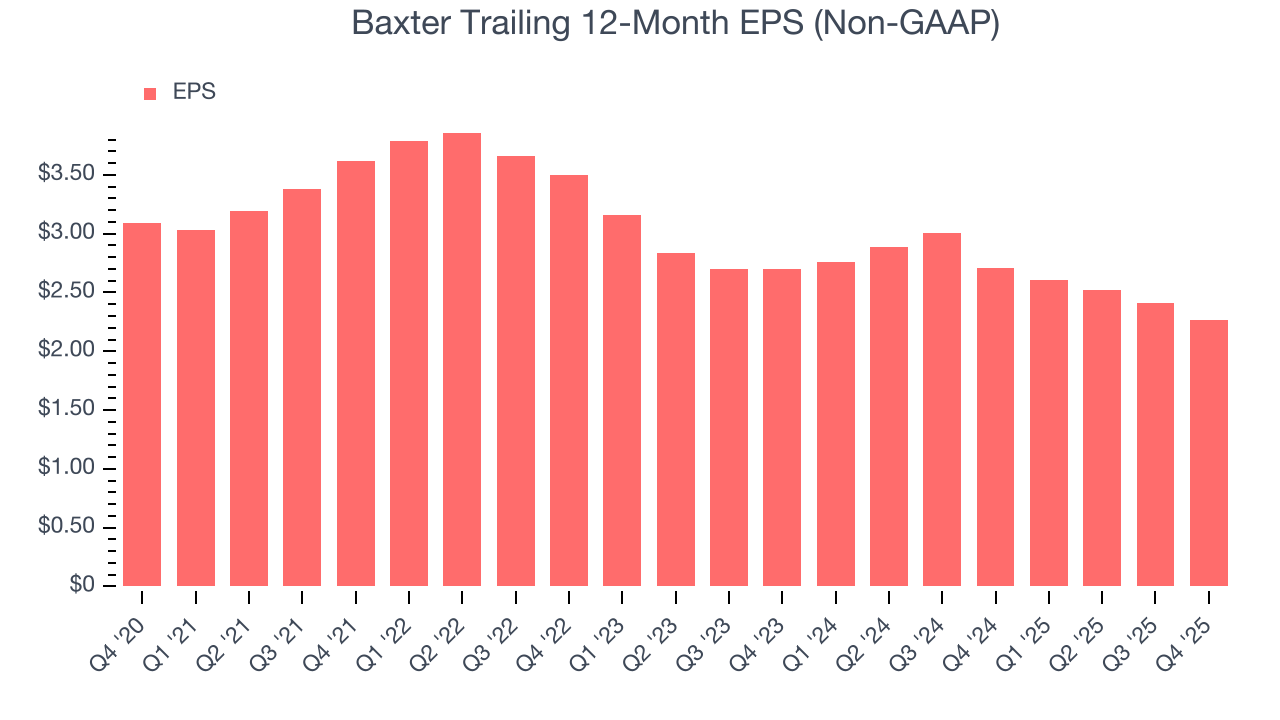

Sadly for Baxter, its EPS declined by 6% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

We can take a deeper look into Baxter’s earnings to better understand the drivers of its performance. As we mentioned earlier, Baxter’s adjusted operating margin declined by 4.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Baxter reported adjusted EPS of $0.44, down from $0.58 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Baxter’s full-year EPS of $2.27 to shrink by 14.2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

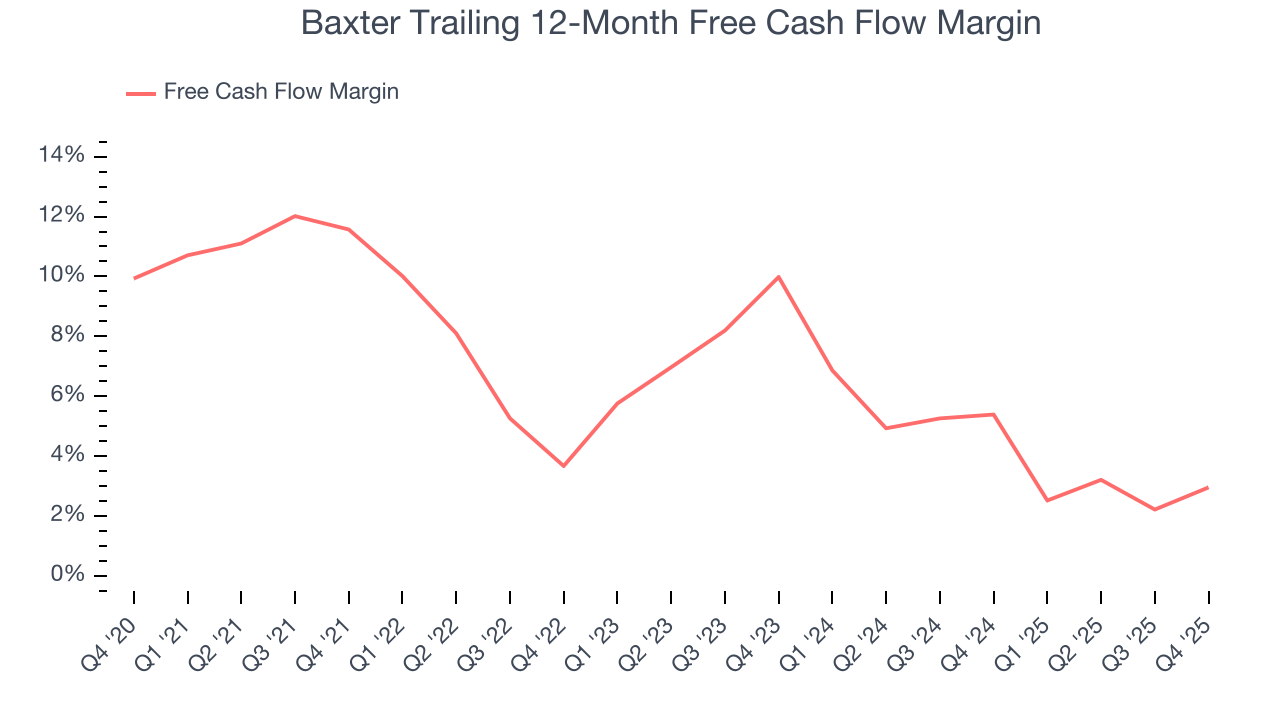

Baxter has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.6% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Baxter’s margin dropped by 8.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Baxter’s free cash flow clocked in at $444 million in Q4, equivalent to a 14.9% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Baxter’s five-year average ROIC was negative 1%, meaning management lost money while trying to expand the business. Investors are likely hoping for a change soon.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Baxter’s ROIC averaged 1.7 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

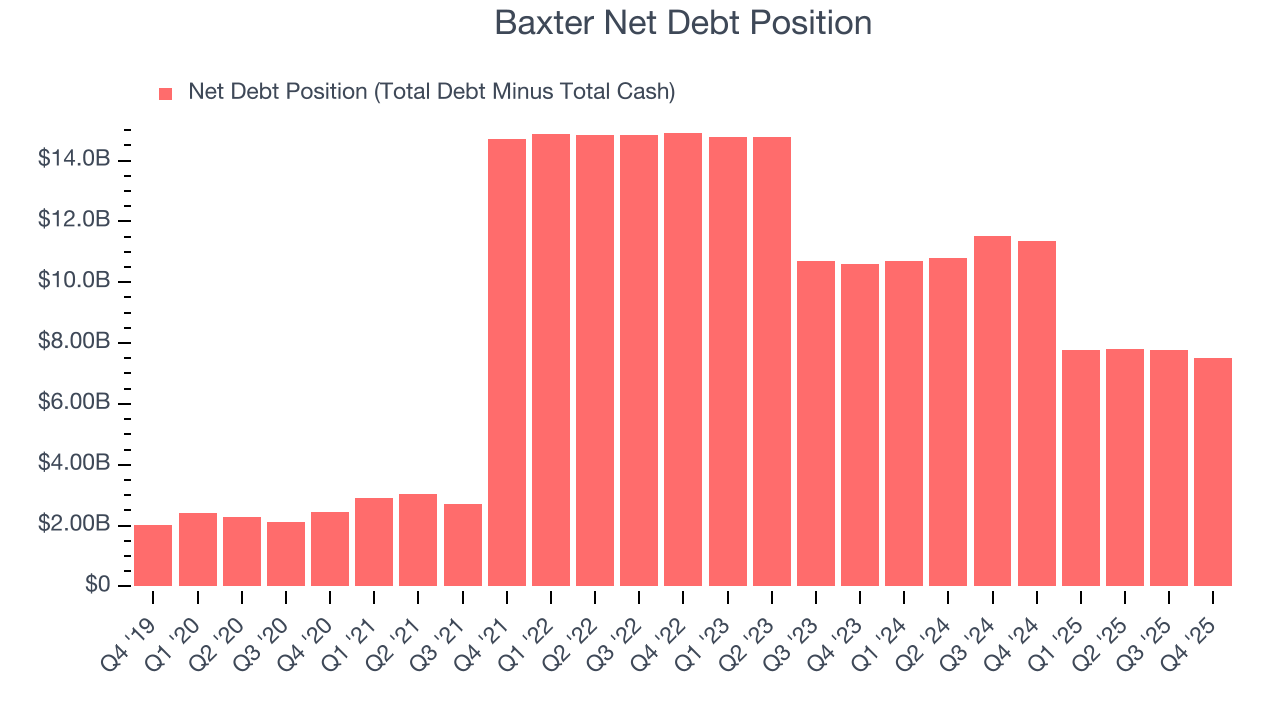

11. Balance Sheet Assessment

Baxter reported $1.97 billion of cash and $9.48 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.57 billion of EBITDA over the last 12 months, we view Baxter’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $238 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Baxter’s Q4 Results

We were impressed by how significantly Baxter blew past analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 1.1% to $18.91 immediately after reporting.

13. Is Now The Time To Buy Baxter?

Updated: February 12, 2026 at 10:54 PM EST

When considering an investment in Baxter, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies making people healthier, but in the case of Baxter, we’re out. To begin with, its revenue growth was uninspiring over the last five years. While its operating margins are in line with the overall healthcare sector, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Baxter’s P/E ratio based on the next 12 months is 11.4x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $22.50 on the company (compared to the current share price of $18.91).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.