Benchmark (BHE)

We’re wary of Benchmark. Its underwhelming returns on capital show it struggled to generate meaningful profits for shareholders.― StockStory Analyst Team

1. News

2. Summary

Why We Think Benchmark Will Underperform

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE:BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 0.9% for the last five years

- Poor expense management has led to an operating margin that is below the industry average

- A bright spot is that its earnings per share grew by 21.2% annually over the last five years and beat its peers

Benchmark’s quality is insufficient. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Benchmark

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Benchmark

Benchmark’s stock price of $49.19 implies a valuation ratio of 20.2x forward P/E. This multiple expensive for its subpar fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Benchmark (BHE) Research Report: Q3 CY2025 Update

Electronics manufacturing services provider Benchmark (NYSE:BHE) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 3.5% year on year to $680.7 million. The company expects next quarter’s revenue to be around $695 million, close to analysts’ estimates. Its non-GAAP profit of $0.62 per share was 8.1% above analysts’ consensus estimates.

Benchmark (BHE) Q3 CY2025 Highlights:

- Revenue: $680.7 million vs analyst estimates of $661.7 million (3.5% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.62 vs analyst estimates of $0.57 (8.1% beat)

- Adjusted EBITDA: $39.89 million (5.9% margin, 5.7% year-on-year decline)

- Revenue Guidance for Q4 CY2025 is $695 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q4 CY2025 is $0.65 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 3.7%, in line with the same quarter last year

- Free Cash Flow Margin: 3.7%, similar to the same quarter last year

- Market Capitalization: $1.60 billion

Company Overview

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE:BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

Benchmark specializes in three core service areas that help bring sophisticated products to market. Its manufacturing services include printed circuit board assembly, complex subsystem integration, and complete system builds that can be shipped directly to end customers. The company also offers precision technology services such as machining, metal joining, and assembly for industries requiring exacting tolerances.

Design and engineering services form another key pillar of Benchmark's business, where its teams help customers optimize products for manufacturability, develop test protocols, and provide regulatory guidance. The company can engage at any point in a customer's design process, from initial concept through production.

Benchmark has also developed proprietary technology solutions, including reference designs and building blocks for defense systems, surveillance equipment, and radio frequency subsystems. For example, a defense contractor might partner with Benchmark to develop ruggedized communications equipment for harsh battlefield environments, leveraging the company's expertise in both design and manufacturing.

The company operates through a global network of facilities across seven countries, including the United States, Mexico, China, and several European locations. This footprint allows Benchmark to serve multinational customers with consistent quality standards while providing regional support.

Benchmark's business model relies on establishing long-term relationships with OEMs who outsource their manufacturing needs. The company typically operates under master supply agreements, providing services throughout a product's lifecycle from design through aftermarket support. Revenue comes from both the engineering services and the actual manufacturing of products, with customers paying for Benchmark's technical expertise, manufacturing capabilities, and supply chain management.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Benchmark Electronics competes with other electronics manufacturing services providers including Celestica (NYSE:CLS), Flex (NASDAQ:FLEX), Jabil (NYSE:JBL), Plexus (NASDAQ:PLXS), and Sanmina (NASDAQ:SANM).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

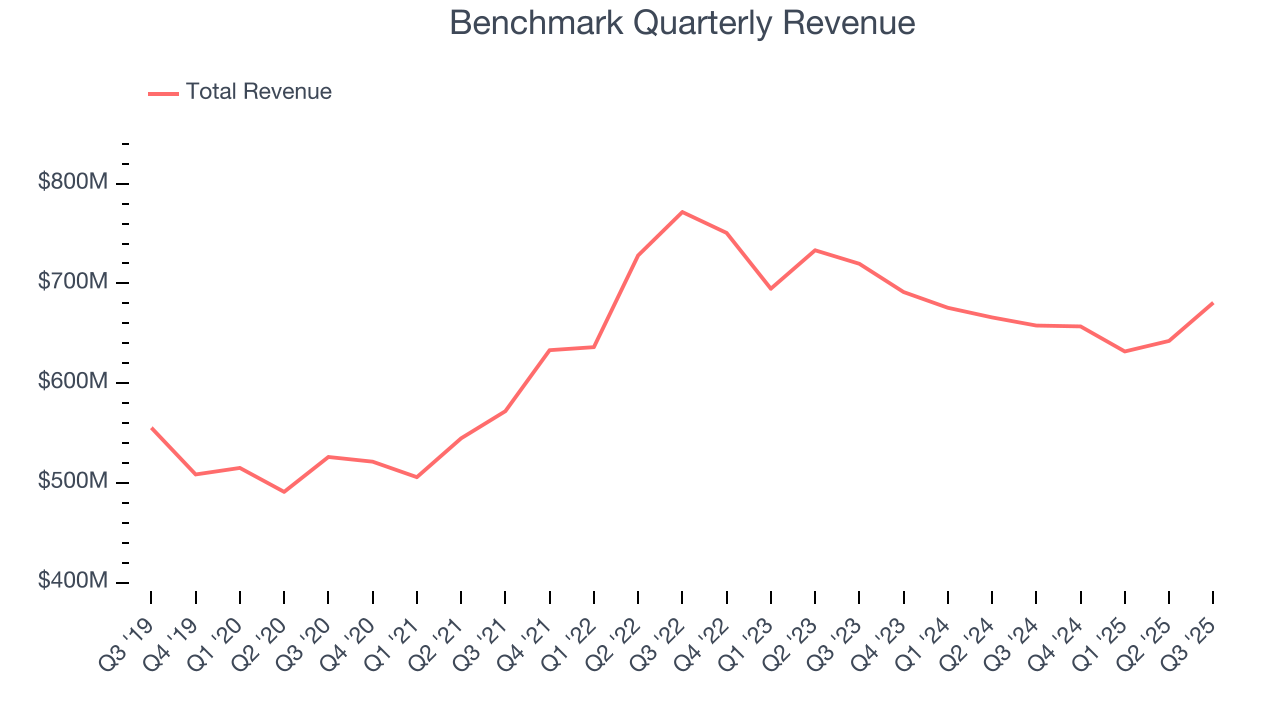

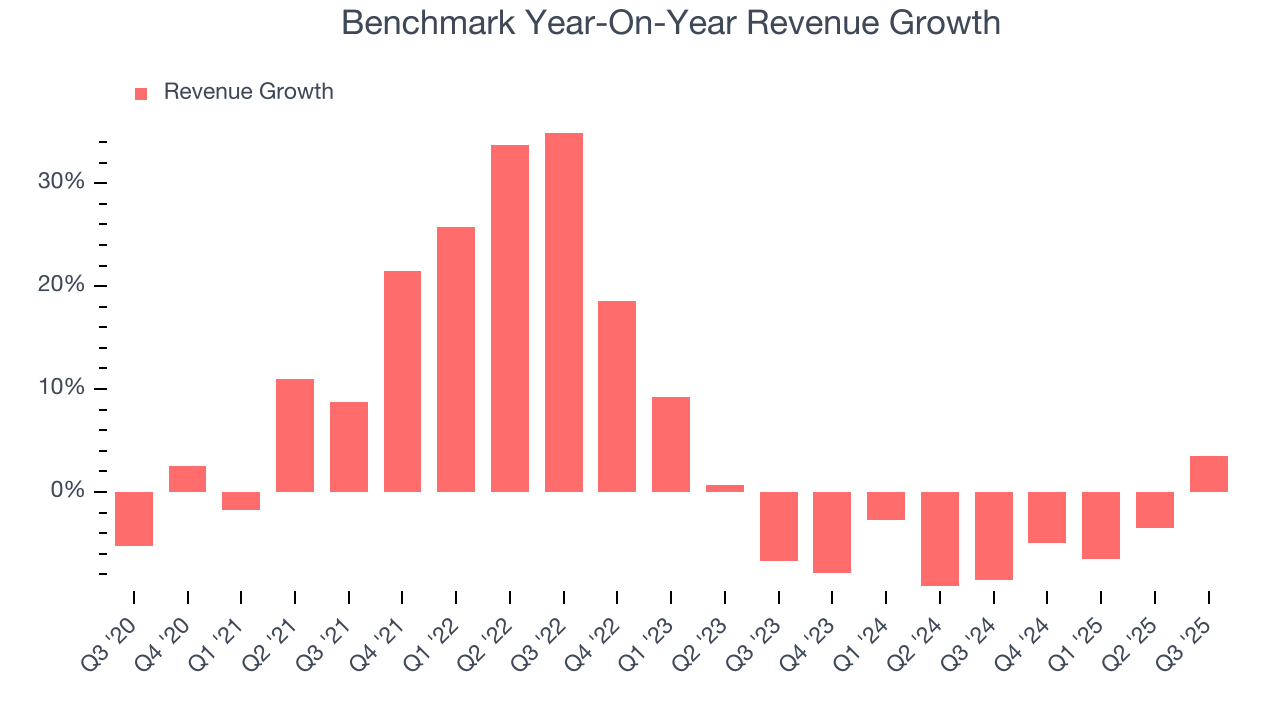

With $2.61 billion in revenue over the past 12 months, Benchmark is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Benchmark’s sales grew at a decent 5.1% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Benchmark’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.1% over the last two years.

This quarter, Benchmark reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 2.9%. Company management is currently guiding for a 5.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will catalyze better top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

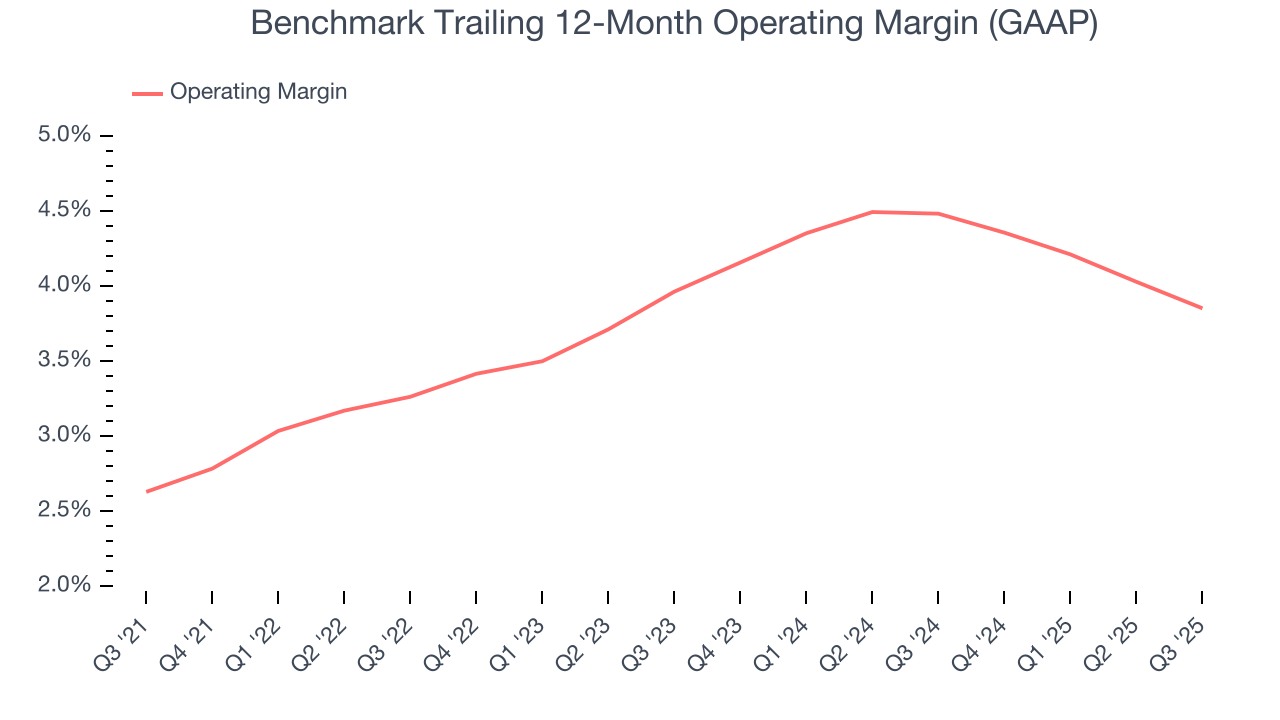

Benchmark was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.7% was weak for a business services business.

On the plus side, Benchmark’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Benchmark generated an operating margin profit margin of 3.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

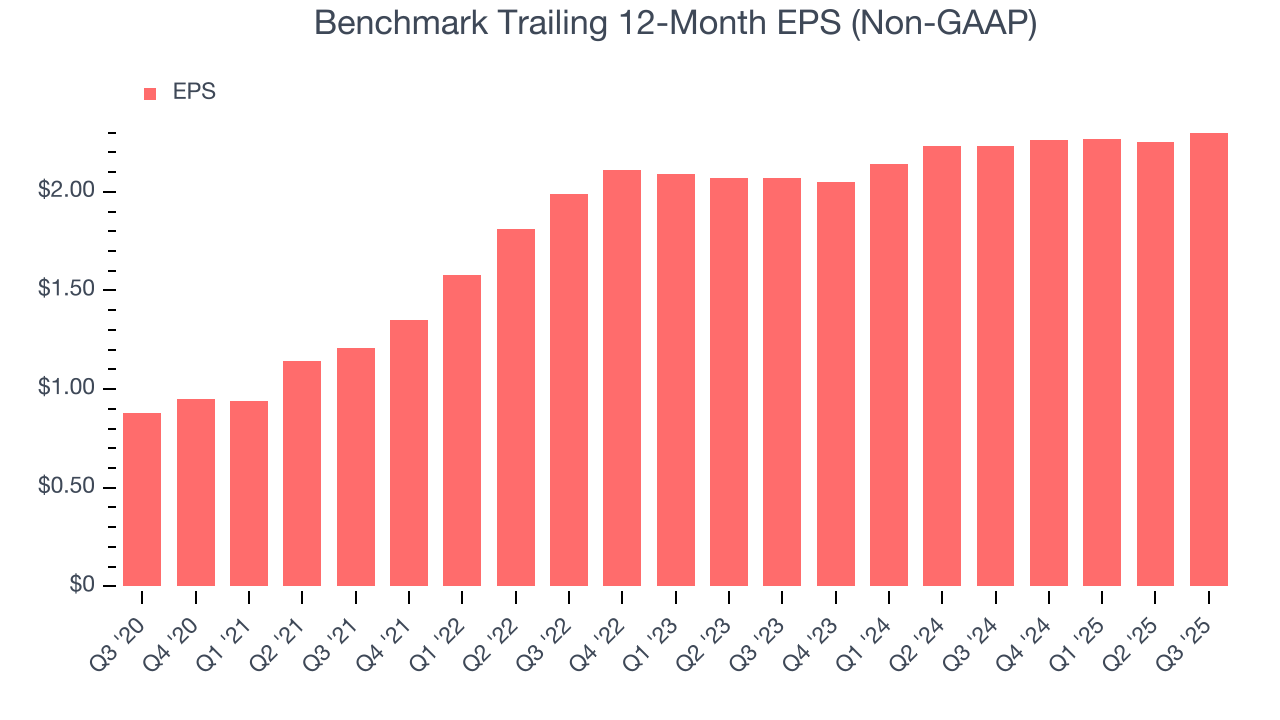

Benchmark’s EPS grew at an astounding 21.2% compounded annual growth rate over the last five years, higher than its 5.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Benchmark’s earnings to better understand the drivers of its performance. As we mentioned earlier, Benchmark’s operating margin was flat this quarter but expanded by 1.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Benchmark, its two-year annual EPS growth of 5.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Benchmark reported adjusted EPS of $0.62, up from $0.57 in the same quarter last year. This print beat analysts’ estimates by 8.1%. Over the next 12 months, Wall Street expects Benchmark’s full-year EPS of $2.30 to grow 5.2%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

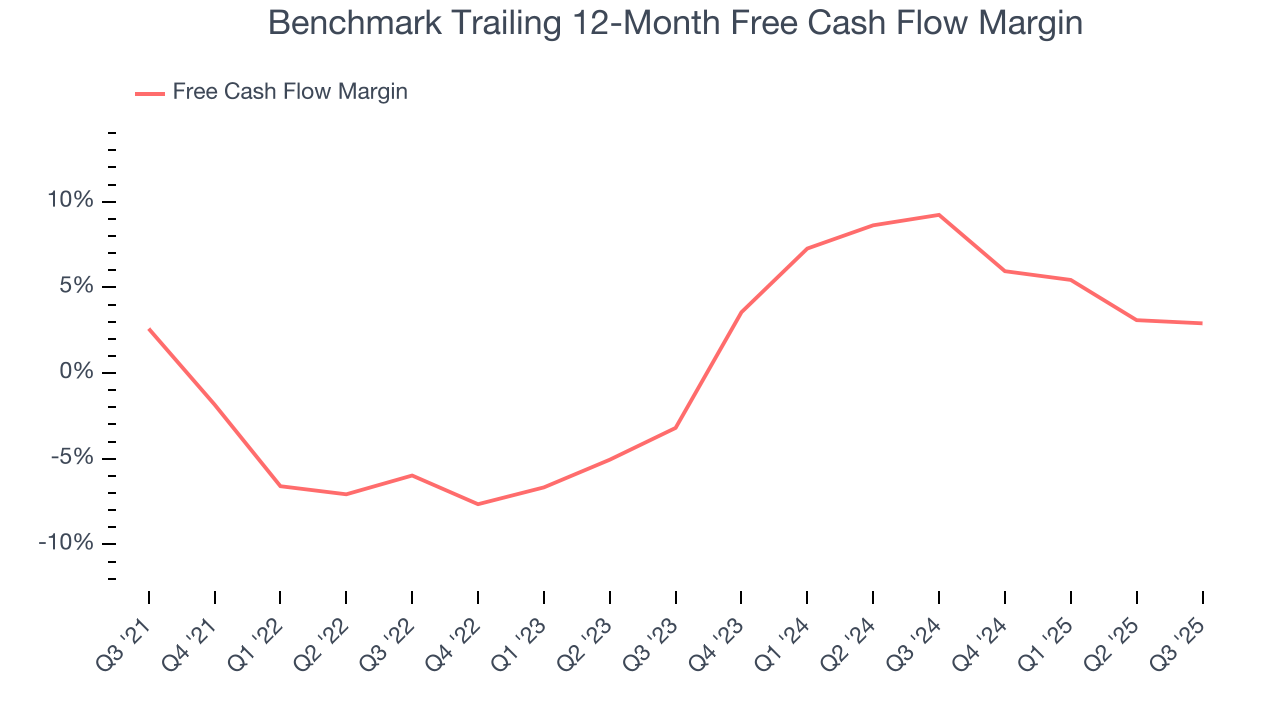

Benchmark broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Benchmark’s free cash flow clocked in at $25.11 million in Q3, equivalent to a 3.7% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

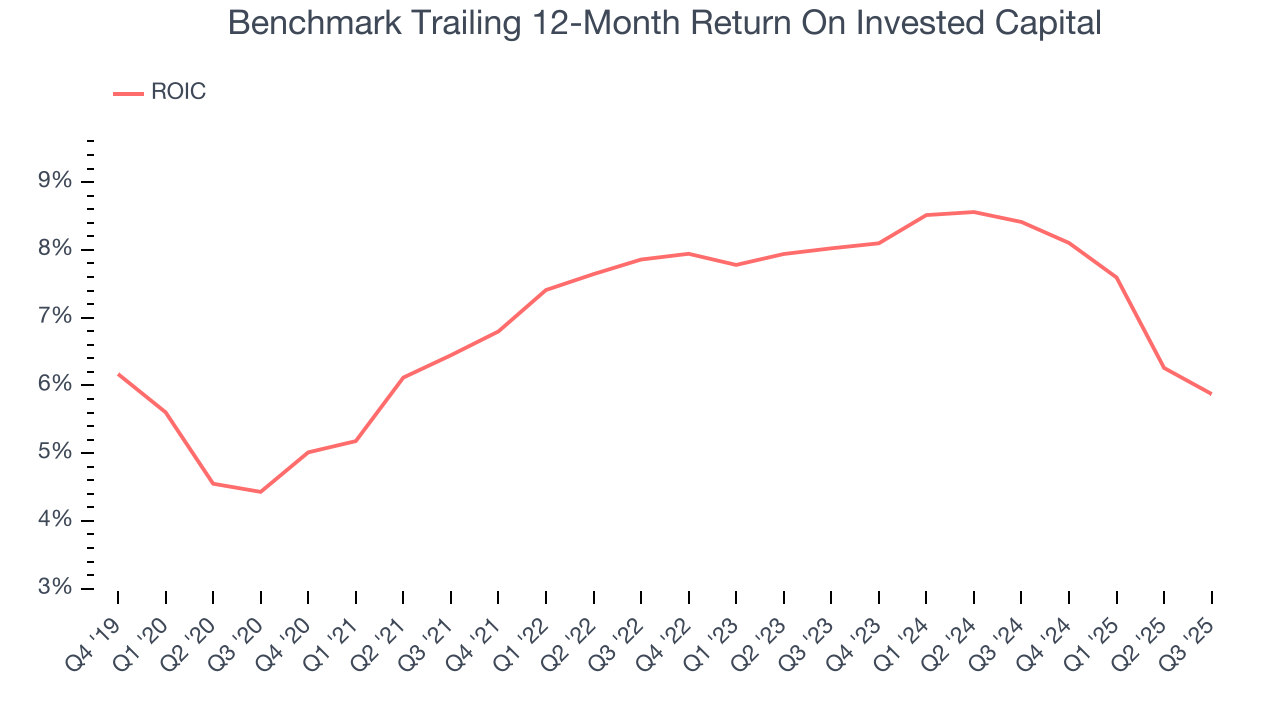

Benchmark historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.3%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Benchmark’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

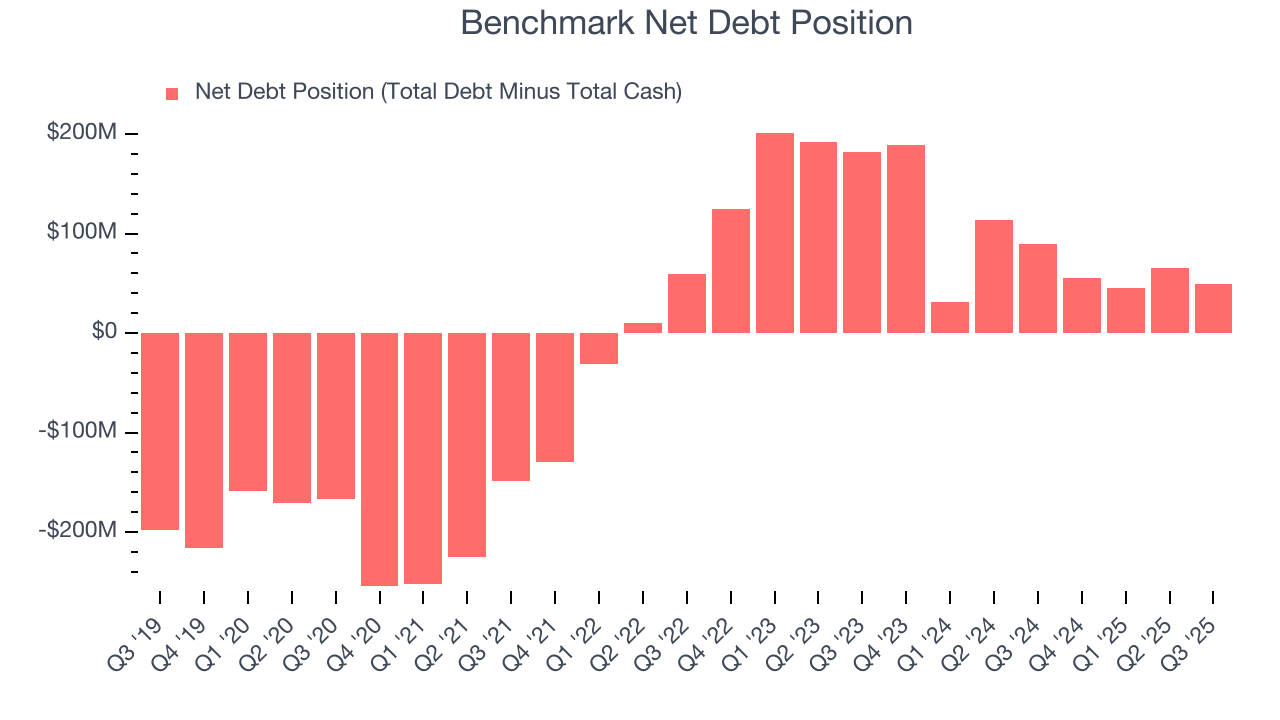

Benchmark reported $286.1 million of cash and $335.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $155.2 million of EBITDA over the last 12 months, we view Benchmark’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $11.54 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Benchmark’s Q3 Results

We enjoyed seeing Benchmark beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $44.78 immediately after reporting.

12. Is Now The Time To Buy Benchmark?

Updated: January 28, 2026 at 10:30 PM EST

When considering an investment in Benchmark, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Benchmark’s business quality ultimately falls short of our standards. Although its revenue growth was decent over the last five years and Wall Street believes it will continue to grow, its low free cash flow margins give it little breathing room. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its operating margins reveal poor profitability compared to other business services companies.

Benchmark’s P/E ratio based on the next 12 months is 20.2x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $52 on the company (compared to the current share price of $49.19).