BankUnited (BKU)

We’re cautious of BankUnited. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think BankUnited Will Underperform

Born from the ashes of a failed Florida thrift during the 2009 financial crisis, BankUnited (NYSE:BKU) is a regional bank that provides commercial lending, deposit services, and treasury solutions to businesses and consumers primarily in Florida and the New York metropolitan area.

- Efficiency ratio is expected to worsen by 15.3 percentage points over the next year

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 4.9% annually

- A consolation is that its demand will likely accelerate over the next 12 months as its forecasted net interest income growth of 9.3% is above its five-year trend

BankUnited doesn’t check our boxes. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than BankUnited

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BankUnited

BankUnited is trading at $49 per share, or 1.1x forward P/B. BankUnited’s multiple may seem like a great deal among banking peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. BankUnited (BKU) Research Report: Q4 CY2025 Update

Regional banking company BankUnited (NYSE:BKU) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 7.8% year on year to $288.2 million. Its non-GAAP profit of $0.94 per share was 5.5% above analysts’ consensus estimates.

BankUnited (BKU) Q4 CY2025 Highlights:

- Net Interest Income: $258.2 million vs analyst estimates of $253.9 million (7.9% year-on-year growth, 1.7% beat)

- Net Interest Margin: 3.1% vs analyst estimates of 3% (5.7 basis point beat)

- Revenue: $288.2 million vs analyst estimates of $281.9 million (7.8% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.94 vs analyst estimates of $0.89 (5.5% beat)

- Tangible Book Value per Share: $40.14 vs analyst estimates of $40.03 (9.6% year-on-year growth, in line)

- Market Capitalization: $3.49 billion

Company Overview

Born from the ashes of a failed Florida thrift during the 2009 financial crisis, BankUnited (NYSE:BKU) is a regional bank that provides commercial lending, deposit services, and treasury solutions to businesses and consumers primarily in Florida and the New York metropolitan area.

BankUnited operates through a network of banking centers primarily in Florida and the New York metropolitan area, with additional locations in Dallas and Atlanta. The bank's business model centers on serving small and middle-market companies with a comprehensive suite of financial products. Its commercial lending portfolio includes secured and unsecured lines of credit, equipment loans, commercial real estate financing, and specialized offerings like SBA loans and trade finance.

Through its subsidiaries, Pinnacle Public Finance and Bridge Funding Group, BankUnited extends its reach nationally, providing municipal financing to state and local governments and equipment leasing solutions to businesses. The bank also maintains a residential mortgage operation that purchases jumbo mortgages through correspondent channels nationwide, allowing it to diversify its loan portfolio geographically.

On the deposit side, BankUnited offers traditional checking and savings accounts, certificates of deposit, and sophisticated treasury management services. A business owner in Miami might use BankUnited for a commercial real estate loan to expand operations while also utilizing the bank's cash management services to optimize their company's working capital. The bank generates revenue primarily through interest income on loans and investments, as well as fees from deposit accounts and treasury services.

BankUnited employs a three-tiered approach to credit risk management, with business lines sourcing opportunities, a credit administration division providing oversight, and an independent credit review function reporting directly to the board's Risk Committee.

4. Regional Banks

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

BankUnited competes with large national banks like JPMorgan Chase, Bank of America, and Wells Fargo, as well as regional players including Truist, PNC, Regions Bank, and TD Bank in its Florida and Southeast markets. In the Tri-State area, additional competitors include Capital One, Valley National Bank, and M&T Bank, along with numerous community banks.

5. Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Regrettably, BankUnited’s revenue grew at a sluggish 4.5% compounded annual growth rate over the last five years. This was below our standard for the banking sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. BankUnited’s annualized revenue growth of 5.4% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, BankUnited reported year-on-year revenue growth of 7.8%, and its $288.2 million of revenue exceeded Wall Street’s estimates by 2.2%.

Net interest income made up 88.4% of the company’s total revenue during the last five years, meaning BankUnited barely relies on non-interest income to drive its overall growth.

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

6. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

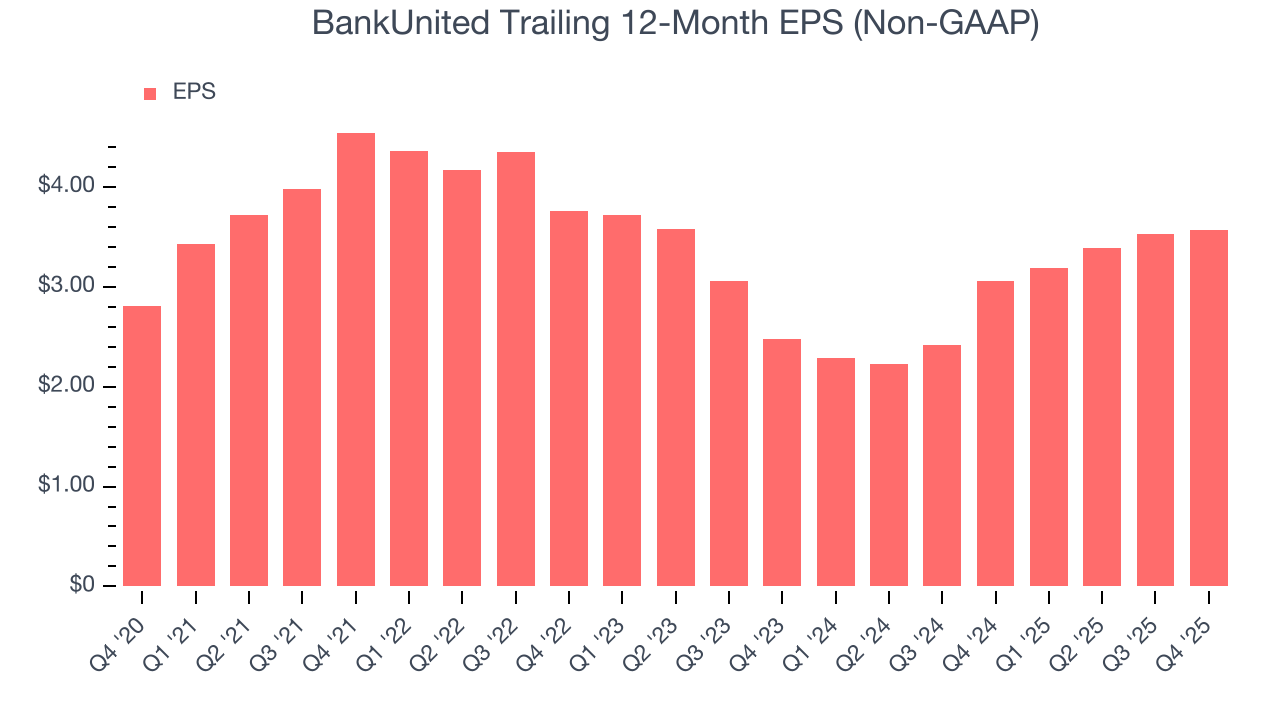

BankUnited’s weak 4.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For BankUnited, its two-year annual EPS growth of 20% was higher than its five-year trend. This acceleration made it one of the faster-growing banking companies in recent history.

In Q4, BankUnited reported adjusted EPS of $0.94, up from $0.90 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects BankUnited’s full-year EPS of $3.57 to grow 2.1%.

7. Tangible Book Value Per Share (TBVPS)

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

BankUnited’s TBVPS grew at a decent 5.2% annual clip over the last five years. TBVPS growth has accelerated recently, growing by 9.3% annually over the last two years from $33.62 to $40.14 per share.

Over the next 12 months, Consensus estimates call for BankUnited’s TBVPS to grow by 6.2% to $42.62, lousy growth rate.

8. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, BankUnited has averaged a Tier 1 capital ratio of 12%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, BankUnited has averaged an ROE of 9.8%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

10. Key Takeaways from BankUnited’s Q4 Results

It was encouraging to see BankUnited beat analysts’ revenue expectations this quarter. We were also happy its net interest income outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $46.29 immediately following the results.

11. Is Now The Time To Buy BankUnited?

Updated: February 21, 2026 at 12:02 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own BankUnited, you should also grasp the company’s longer-term business quality and valuation.

BankUnited isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years. While its expanding net interest margin shows its loan book is becoming more profitable, the downside is its anticipated efficiency ratio over the next year signals its day-to-day expenses will rise. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

BankUnited’s P/B ratio based on the next 12 months is 1.1x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $53.64 on the company (compared to the current share price of $50.07).