Badger Meter (BMI)

We’re bullish on Badger Meter. Its fusion of high growth and profitability makes it an unstoppable force with big upside.― StockStory Analyst Team

1. News

2. Summary

Why We Like Badger Meter

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE:BMI) provides water control and measure equipment to various industries.

- Impressive 16.5% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Additional sales over the last five years increased its profitability as the 23% annual growth in its earnings per share outpaced its revenue

- Successful business model is illustrated by its impressive operating margin, and it turbocharged its profits by achieving some fixed cost leverage

Badger Meter is a top-tier company. The valuation looks fair based on its quality, and we believe now is an opportune time to invest.

Why Is Now The Time To Buy Badger Meter?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Badger Meter?

Badger Meter’s stock price of $167.50 implies a valuation ratio of 33x forward P/E. Most companies in the industrials sector may feature a cheaper multiple, but we think Badger Meter is priced fairly given its fundamentals.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. Badger Meter (BMI) Research Report: Q4 CY2025 Update

Water control and measure company Badger Meter (NYSE:BMI) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 7.6% year on year to $220.7 million. Its GAAP profit of $1.14 per share was 1.5% above analysts’ consensus estimates.

Badger Meter (BMI) Q4 CY2025 Highlights:

- Revenue: $220.7 million vs analyst estimates of $232 million (7.6% year-on-year growth, 4.9% miss)

- EPS (GAAP): $1.14 vs analyst estimates of $1.12 (1.5% beat)

- Operating Margin: 19.5%, in line with the same quarter last year

- Free Cash Flow Margin: 23%, similar to the same quarter last year

- Market Capitalization: $4.85 billion

Company Overview

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE:BMI) provides water control and measure equipment to various industries.

Badger Meter was established in 1905 by a hydraulic engineer producing water meters. The company has stuck true to its roots offering water meters but has also expanded to offer complementary products. The company was able to strengthen its position in the market by making acquisitions. Specifically, the acquisitions of D-Flow, United Utilities, and Sensus were instrumental for the company’s growth.

Today, Badger Meter’s product portfolio includes flow meters, valves, and other instrumentation that measure and control the flow of liquids. In addition, the company’s equipment enables accurate measurement and monitoring of water consumption, leakage detection, and enhanced billing accuracy. These products are essential for municipalities, industrial companies, and commercial entities that rely on data for efficiency and compliance.

Badger Meter distributes its products primarily through direct sales and authorized distributors and channel partners. The company secures long-term contracts, providing equipment and systems over several years to ensure stability and predictability. Additionally, Badger Meter offers service agreements that include maintenance, calibration, and support services. For specific projects, the company engages in project-based contracts with set timeframes.

4. Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Competitors offering similar products include Itron (NASDAQ:ITRI), Xylem (NYSE:XYL), and Mueller Water (NYSE:MWA).

5. Revenue Growth

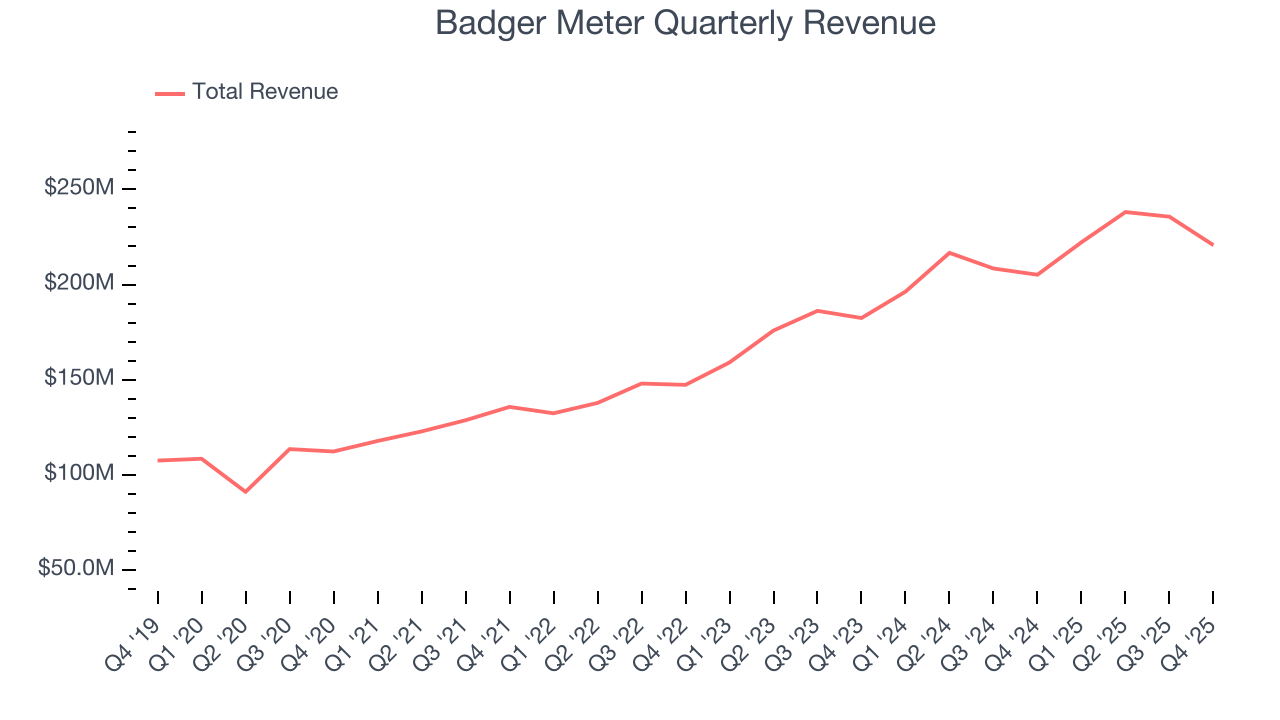

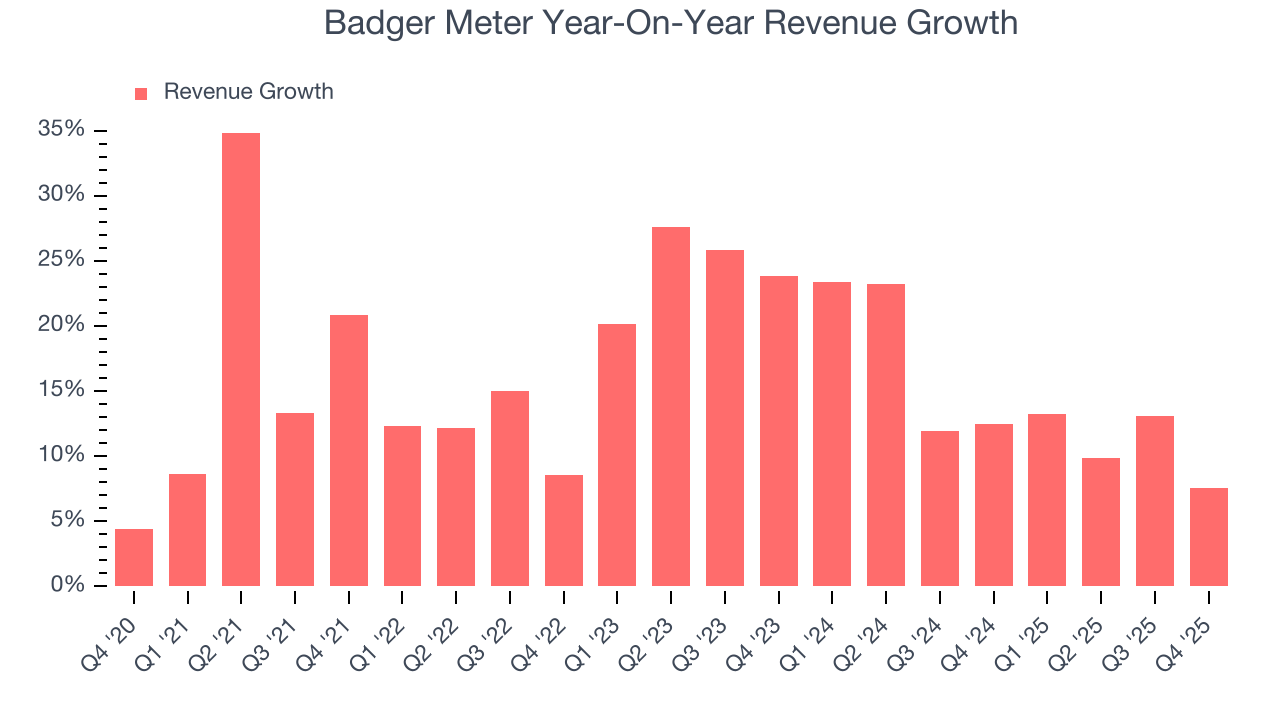

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Badger Meter’s 16.6% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Badger Meter’s annualized revenue growth of 14.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Badger Meter’s revenue grew by 7.6% year on year to $220.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

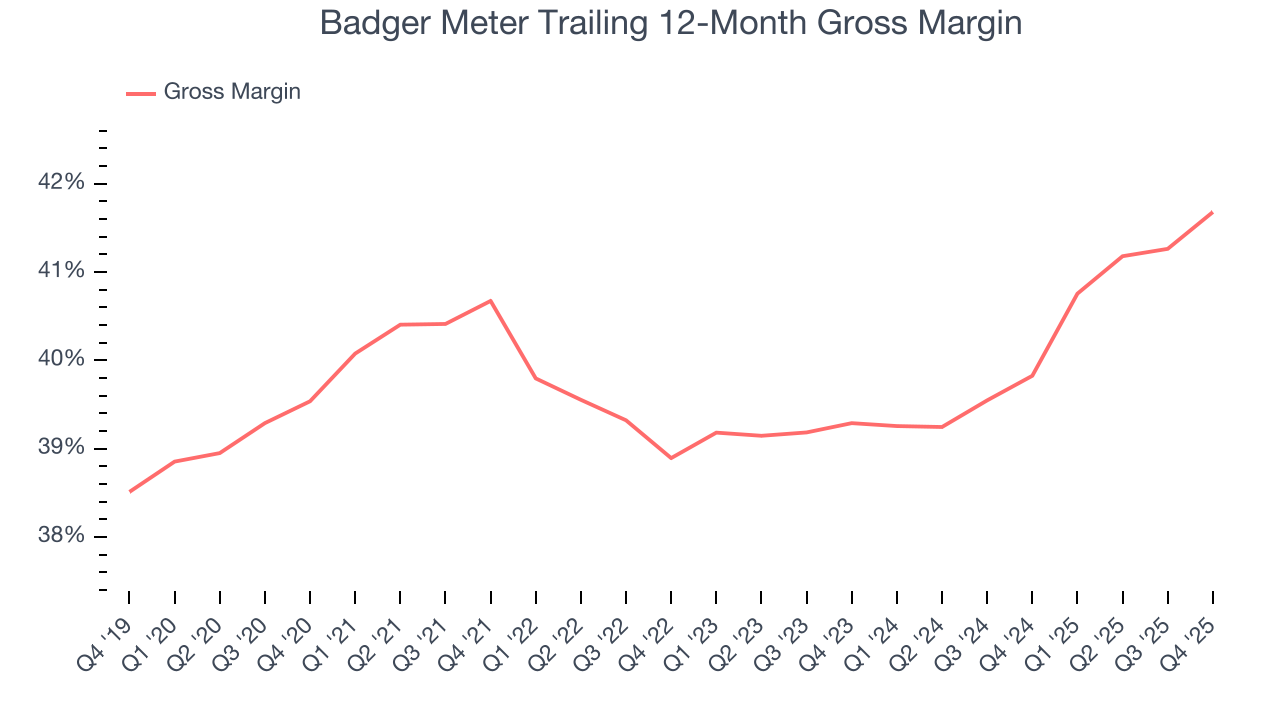

Badger Meter’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40.2% gross margin over the last five years. Said differently, roughly $40.17 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Badger Meter produced a 42.1% gross profit margin in Q4, up 1.8 percentage points year on year. Badger Meter’s full-year margin has also been trending up over the past 12 months, increasing by 1.9 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

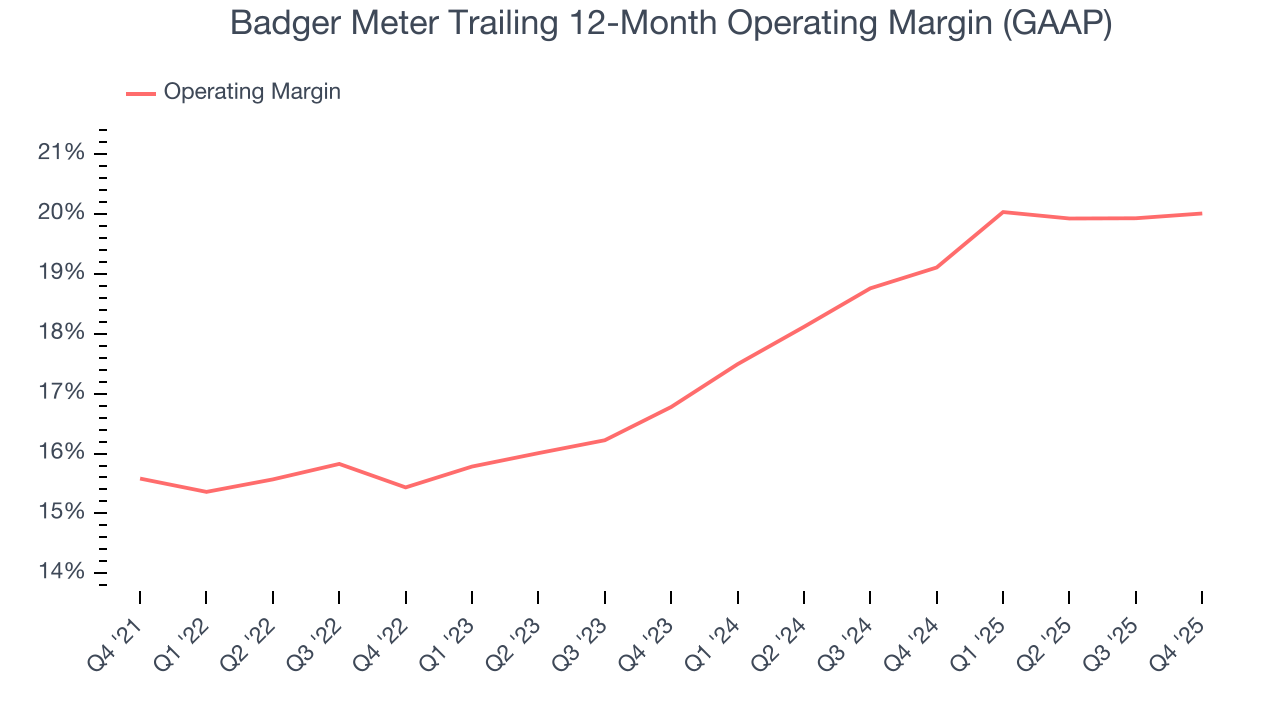

Badger Meter has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Badger Meter’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Badger Meter generated an operating margin profit margin of 19.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

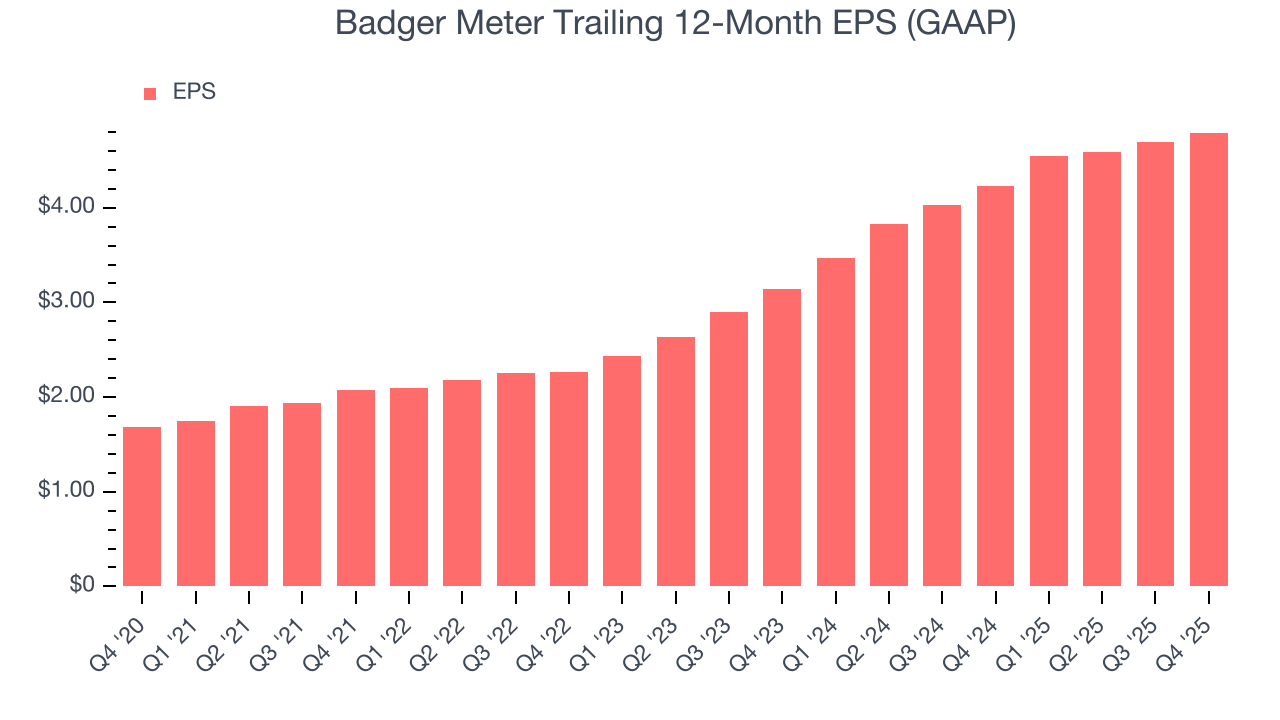

Badger Meter’s EPS grew at an astounding 23.2% compounded annual growth rate over the last five years, higher than its 16.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Badger Meter’s earnings can give us a better understanding of its performance. As we mentioned earlier, Badger Meter’s operating margin was flat this quarter but expanded by 4.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Badger Meter, its two-year annual EPS growth of 23.5% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Badger Meter reported EPS of $1.14, up from $1.04 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Badger Meter’s full-year EPS of $4.79 to grow 10.6%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

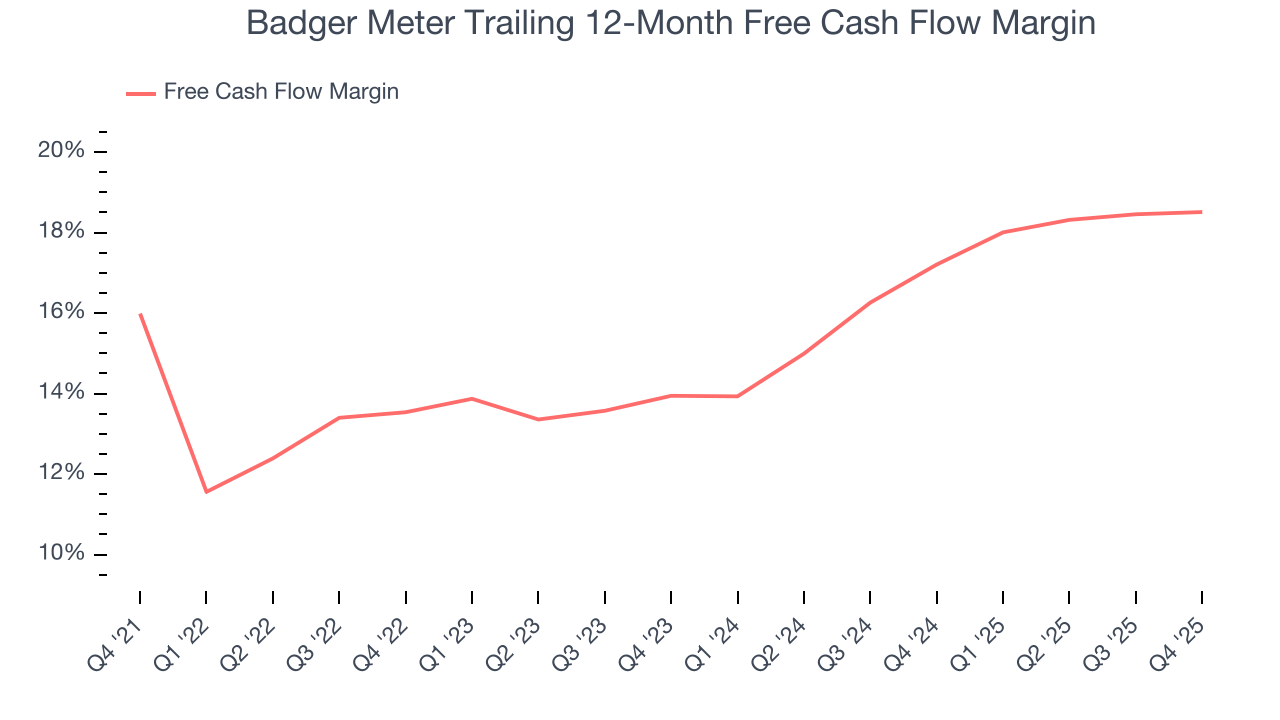

Badger Meter has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.1% over the last five years.

Taking a step back, we can see that Badger Meter’s margin expanded by 2.5 percentage points during that time. This is encouraging because it gives the company more optionality.

Badger Meter’s free cash flow clocked in at $50.77 million in Q4, equivalent to a 23% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

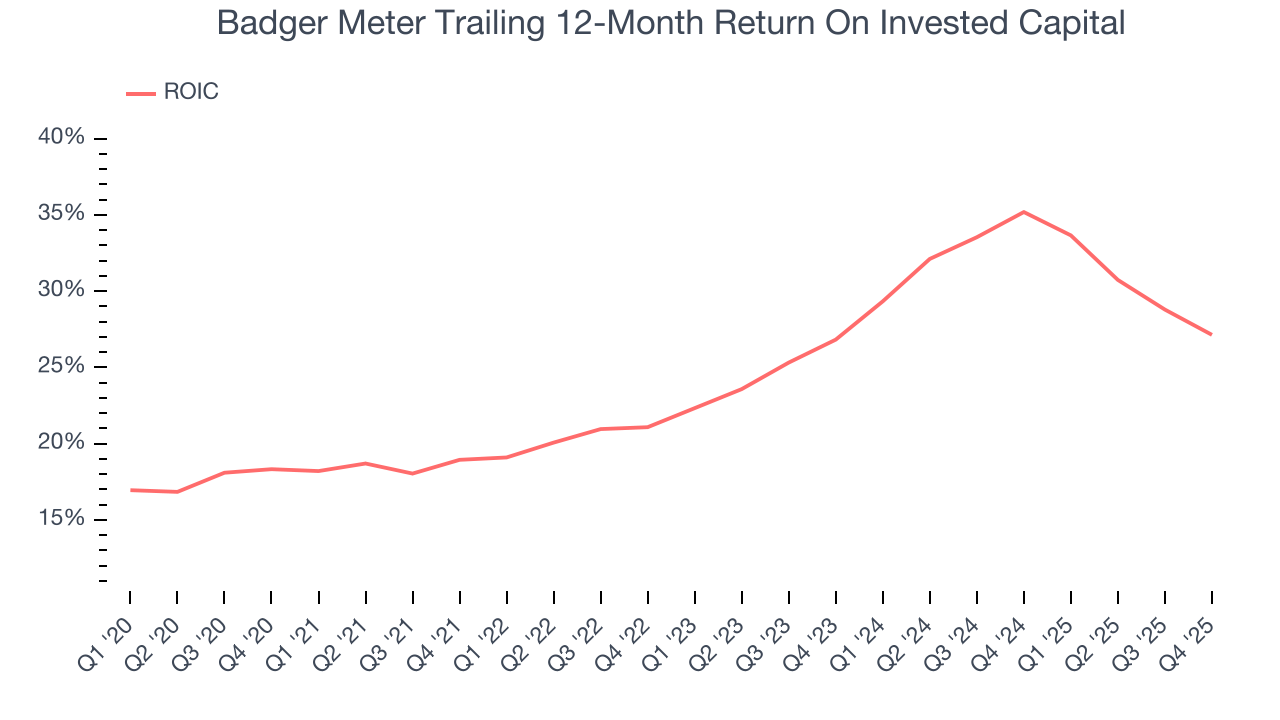

Badger Meter’s five-year average ROIC was 25.8%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Badger Meter’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Key Takeaways from Badger Meter’s Q4 Results

Revenue missed by a fairly large amount. Despite an EPS beat, we think that overall, this quarter could have been better. The stock traded down 6.9% to $153 immediately following the results.

12. Is Now The Time To Buy Badger Meter?

Updated: January 28, 2026 at 8:41 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Badger Meter.

There are multiple reasons why we think Badger Meter is an elite industrials company. For starters, its revenue growth was exceptional over the last five years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

Badger Meter’s P/E ratio based on the next 12 months is 30.2x. Scanning the industrials landscape today, Badger Meter’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $211.30 on the company (compared to the current share price of $153), implying they see 38.1% upside in buying Badger Meter in the short term.