Boot Barn (BOOT)

Boot Barn piques our interest. Its marvelous same-store sales and new store openings show there’s healthy demand for its products.― StockStory Analyst Team

1. News

2. Summary

Why Boot Barn Is Interesting

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

- Demand for the next 12 months is expected to accelerate above its three-year trend as Wall Street forecasts robust revenue growth of 14%

- Fast expansion of new stores to reach markets with few or no locations is justified by its same-store sales growth

- On the flip side, its revenue base of $2.17 billion indicates it’s still subscale compared to its larger peers (though this creates opportunities to expand into untapped markets)

Boot Barn has some noteworthy aspects. If you’ve been itching to buy the stock, the price seems reasonable.

Why Is Now The Time To Buy Boot Barn?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Boot Barn?

At $187.11 per share, Boot Barn trades at 23x forward P/E. Compared to other consumer retail companies, we think this multiple is fair for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Boot Barn (BOOT) Research Report: Q4 CY2025 Update

Clothing and footwear retailer Boot Barn (NYSE:BOOT) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 16% year on year to $705.6 million. The company expects next quarter’s revenue to be around $530 million, coming in 1.3% above analysts’ estimates. Its GAAP profit of $2.79 per share was in line with analysts’ consensus estimates.

Boot Barn (BOOT) Q4 CY2025 Highlights:

- Revenue: $705.6 million vs analyst estimates of $705.1 million (16% year-on-year growth, in line)

- EPS (GAAP): $2.79 vs analyst estimates of $2.79 (in line)

- Adjusted EBITDA: $155.2 million vs analyst estimates of $135.7 million (22% margin, 14.4% beat)

- Revenue Guidance for Q1 CY2026 is $530 million at the midpoint, above analyst estimates of $523.2 million

- EPS (GAAP) guidance for the full year is $7.30 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 16.3%, in line with the same quarter last year

- Free Cash Flow Margin: 21%, up from 18.8% in the same quarter last year

- Locations: 514 at quarter end, up from 438 in the same quarter last year

- Same-Store Sales rose 5.7% year on year (8.6% in the same quarter last year)

- Market Capitalization: $5.54 billion

Company Overview

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Cowboy boots, western hats, jeans, and belts from brands such as Wrangler, Stetson, and Carhartt are perennially popular items. Because the western theme unifies its merchandise, Boot Barn is able to offer more breadth and depth in that style than most other general apparel retailers. The core Boot Barn customer tends to be anyone who embraces the western lifestyle, whether that’s because they’re actual ranchers or cowboys or because they simple like the aesthetic.

The average Boot Barn store is quite small, approximately 11,000 square feet and typically located in rural or suburban malls and shopping centers with other retailers. In addition to its physical stores, Boot Barn has an e-commerce presence that was launched in 2012. It allows the company to reach US customers who may not have access to one of its physical stores, as states such as New York, Ohio, Massachusetts, Michigan, and some others do not have a single store.

4. Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Niche apparel competitors include The Buckle (NYSE:BKE), Urban Outfitters (NASDAQ:URBN), and American Eagle Outfitters (NYSE:AEO).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.17 billion in revenue over the past 12 months, Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

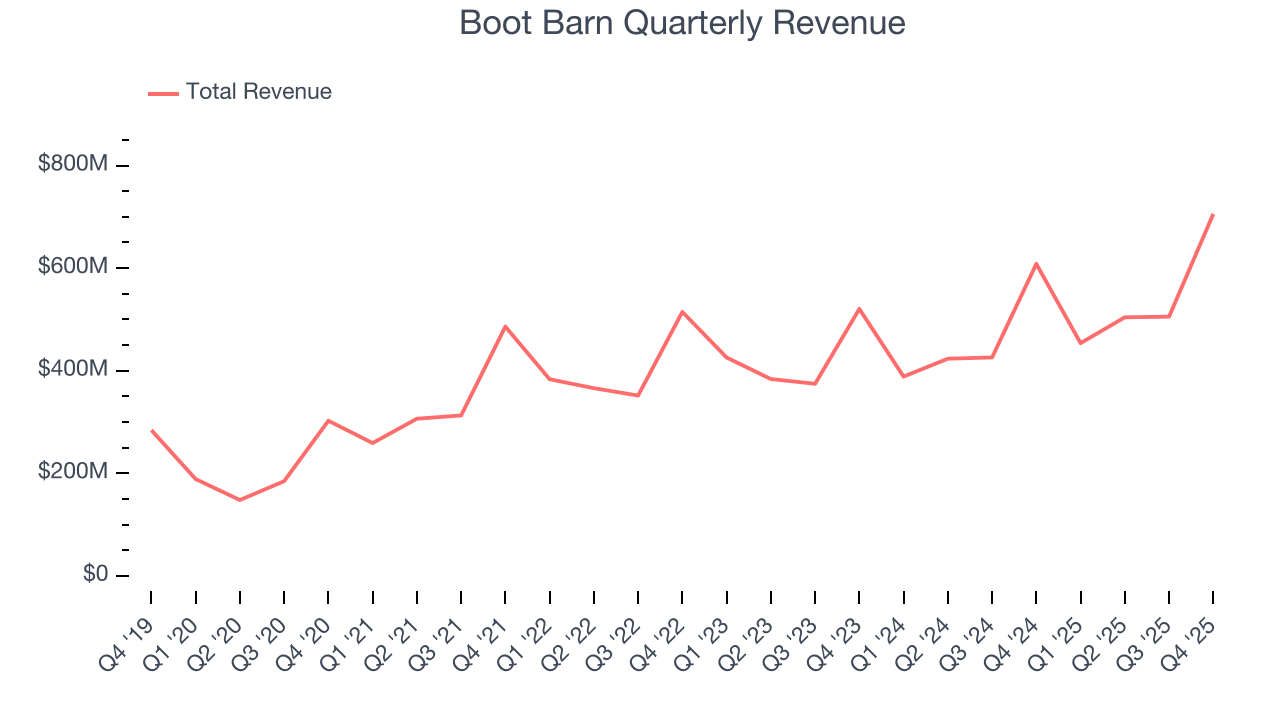

As you can see below, Boot Barn’s 10.3% annualized revenue growth over the last three years was decent as it opened new stores and increased sales at existing, established locations.

This quarter, Boot Barn’s year-on-year revenue growth was 16%, and its $705.6 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 16.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.6% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products will catalyze better top-line performance.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Boot Barn sported 514 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 15.2% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

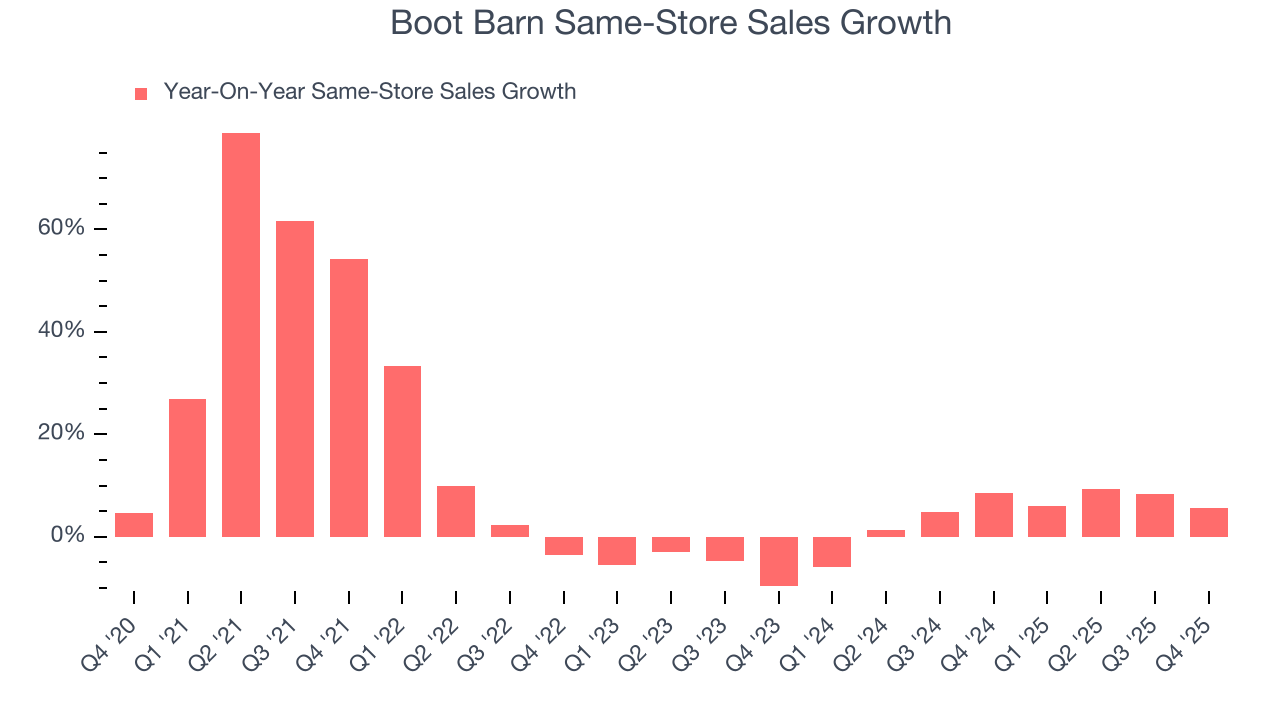

Boot Barn has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.8%. This performance along with its meaningful buildout of new stores suggest it’s playing some aggressive offense.

In the latest quarter, Boot Barn’s same-store sales rose 5.7% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

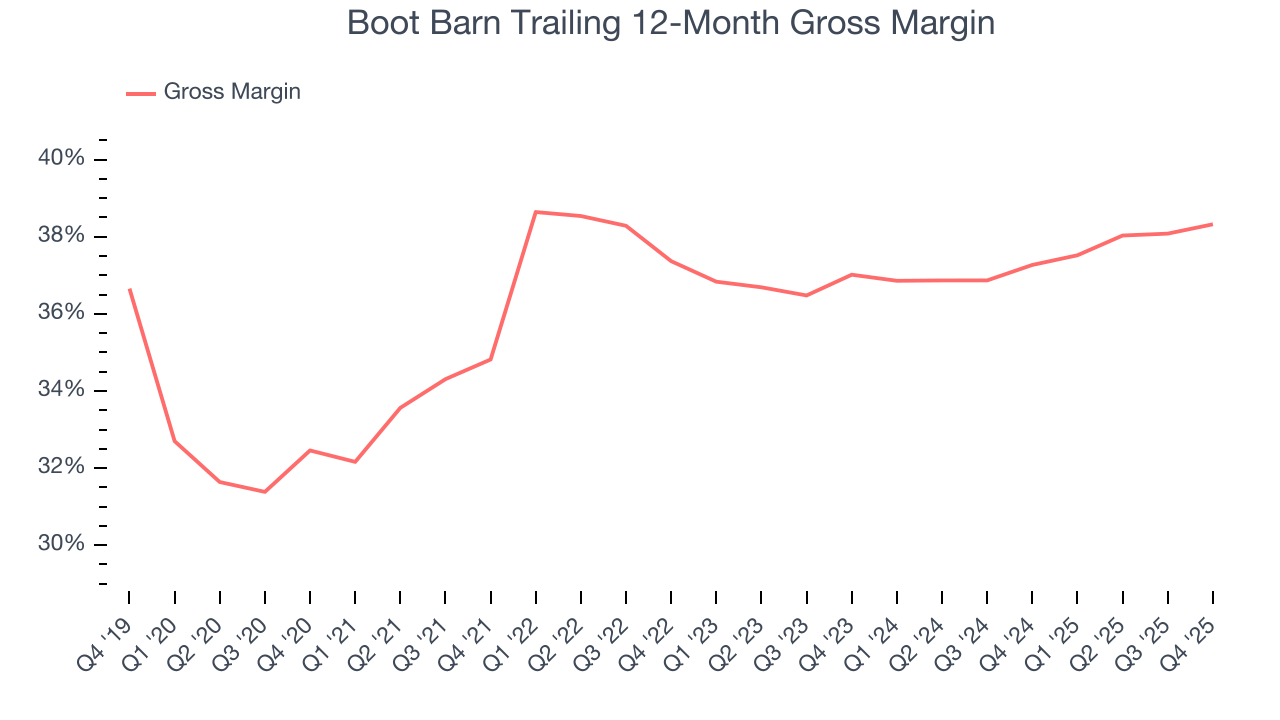

Boot Barn has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 37.8% gross margin over the last two years. Said differently, Boot Barn had to pay a chunky $62.16 to its suppliers for every $100 in revenue.

In Q4, Boot Barn produced a 39.9% gross profit margin, in line with the same quarter last year. On a wider time horizon, Boot Barn’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold.

8. Operating Margin

Boot Barn has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer retail sector, boasting an average operating margin of 12.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Boot Barn’s operating margin rose by 1.1 percentage points over the last year, as its sales growth gave it operating leverage.

In Q4, Boot Barn generated an operating margin profit margin of 16.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Boot Barn has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 3.5% over the last two years, slightly better than the broader consumer retail sector.

Taking a step back, we can see that Boot Barn’s margin expanded by 1.4 percentage points over the last year. This is encouraging because it gives the company more optionality.

Boot Barn’s free cash flow clocked in at $148 million in Q4, equivalent to a 21% margin. This result was good as its margin was 2.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Boot Barn’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.2%, slightly better than typical consumer retail business.

11. Balance Sheet Assessment

Boot Barn reported $200.1 million of cash and $704.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $405.2 million of EBITDA over the last 12 months, we view Boot Barn’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $657,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Boot Barn’s Q4 Results

We were impressed by how significantly Boot Barn blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter slightly missed. Overall, this print had some key positives. The stock traded up 3.4% to $189.40 immediately after reporting.

13. Is Now The Time To Buy Boot Barn?

Updated: February 4, 2026 at 9:42 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Boot Barn.

Boot Barn possesses a number of positive attributes. First off, its revenue growth was decent over the last three years and is expected to accelerate over the next 12 months. And while its brand caters to a niche market, its new store openings have increased its brand equity. On top of that, its marvelous same-store sales growth is on another level.

Boot Barn’s P/E ratio based on the next 12 months is 22.9x. Looking at the consumer retail landscape right now, Boot Barn trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $232.64 on the company (compared to the current share price of $187.11), implying they see 24.3% upside in buying Boot Barn in the short term.