Boston Scientific (BSX)

Boston Scientific is a sound business. Its impressive margins shows it has disciplined controls and a highly efficient business.― StockStory Analyst Team

1. News

2. Summary

Why Boston Scientific Is Interesting

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE:BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 19.8% over the last five years outstripped its revenue performance

- Core business is healthy and doesn’t need acquisitions to boost sales as its organic revenue growth averaged 16.2% over the past two years

- One risk is its below-average returns on capital indicate management struggled to find compelling investment opportunities

Boston Scientific shows some signs of a high-quality business. If you’re a believer, the valuation looks fair.

Why Is Now The Time To Buy Boston Scientific?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Boston Scientific?

At $91.72 per share, Boston Scientific trades at 27.7x forward P/E. While Boston Scientific’s valuation is higher than that of many in the healthcare space, we still think the valuation is fair given the top-line growth.

It could be a good time to invest if you see something the market doesn’t.

3. Boston Scientific (BSX) Research Report: Q4 CY2025 Update

Medical device company Boston Scientific (NYSE:BSX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 15.9% year on year to $5.29 billion. The company expects next quarter’s revenue to be around $5.19 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 2.4% above analysts’ consensus estimates.

Boston Scientific (BSX) Q4 CY2025 Highlights:

- Revenue: $5.29 billion vs analyst estimates of $5.27 billion (15.9% year-on-year growth, in line)

- Adjusted EPS: $0.80 vs analyst estimates of $0.78 (2.4% beat)

- Revenue Guidance for Q1 CY2026 is $5.19 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.46 at the midpoint, in line with analyst estimates

- Operating Margin: 15.6%, in line with the same quarter last year

- Organic Revenue rose 12.7% year on year (beat)

- Market Capitalization: $135.9 billion

Company Overview

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE:BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

Boston Scientific organizes its operations into two main segments: MedSurg and Cardiovascular. The MedSurg segment encompasses three divisions: Endoscopy, which produces devices for diagnosing and treating gastrointestinal and pulmonary conditions; Urology, which offers solutions for kidney stones, prostate conditions, and incontinence; and Neuromodulation, which creates devices to manage chronic pain and neurological movement disorders.

The Cardiovascular segment includes Cardiology (with interventional therapies and the WATCHMAN device for stroke prevention), Cardiac Rhythm Management (pacemakers and defibrillators), Electrophysiology (treatments for heart rhythm disorders), and Peripheral Interventions (products for peripheral arterial, venous, and cancer treatment).

A physician might use Boston Scientific's WATCHMAN FLX device to seal off a patient's left atrial appendage, reducing stroke risk in those with atrial fibrillation who cannot tolerate blood thinners. Or a gastroenterologist might employ the company's SpyGlass system to directly visualize and treat bile duct stones in a single procedure, avoiding more invasive surgery.

The company generates revenue by selling its devices to hospitals, clinics, and outpatient facilities worldwide. Many purchases are made through large group purchasing organizations and hospital networks. Boston Scientific maintains specialized sales forces for each medical specialty it serves, focusing on both the physicians who use the devices and the hospital administrators who approve purchases.

Boston Scientific operates globally in approximately 140 countries, using a combination of direct sales forces in major markets and distributors in smaller regions. The company invests significantly in research and development to create next-generation technologies and expand into adjacent medical specialties.

4. Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Boston Scientific's primary competitors include Medtronic plc (NYSE: MDT), Abbott Laboratories (NYSE: ABT), and Johnson & Johnson (NYSE: JNJ), along with specialized competitors in specific device categories such as Edwards Lifesciences (NYSE: EW) in heart valves and Stryker Corporation (NYSE: SYK) in certain surgical technologies.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $20.08 billion in revenue over the past 12 months, Boston Scientific has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

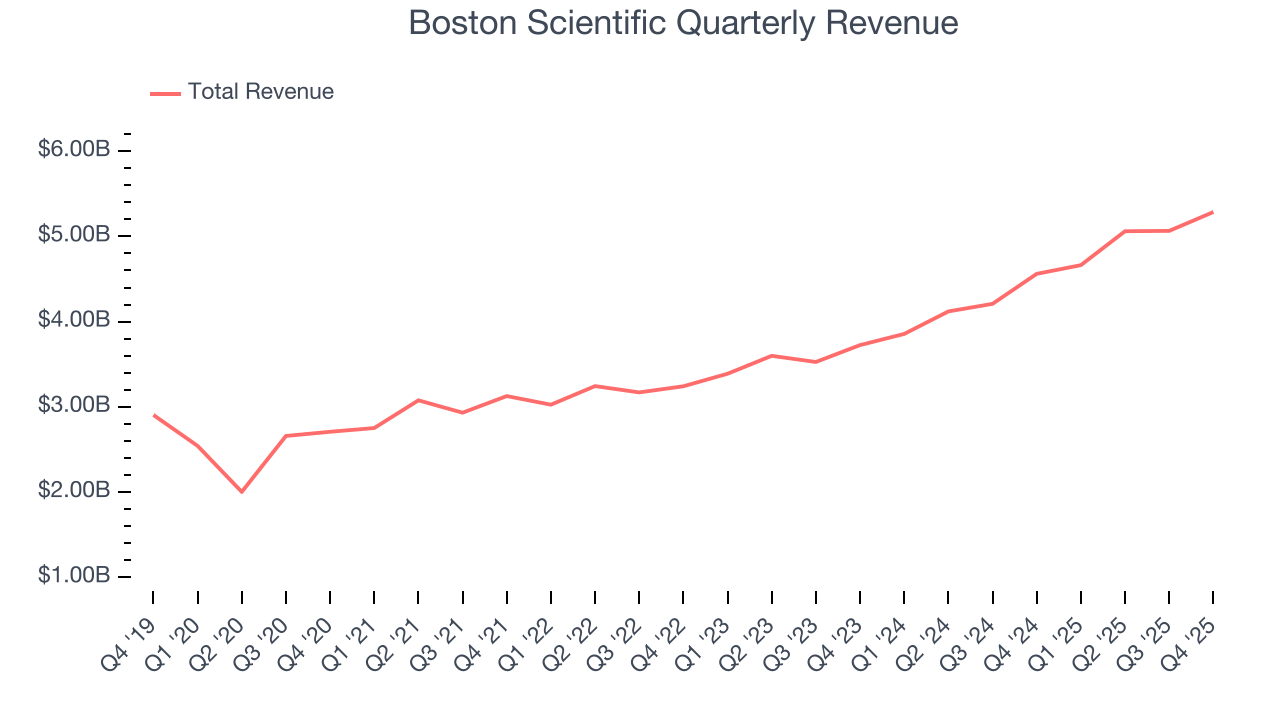

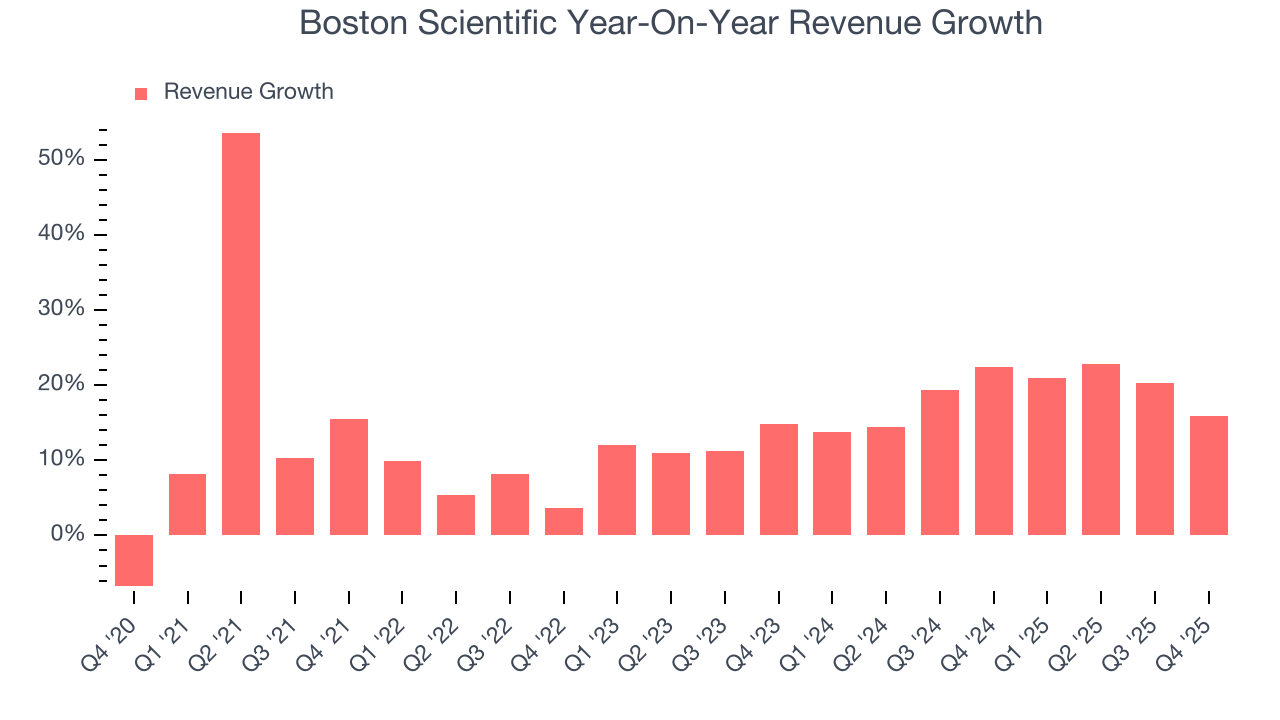

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Boston Scientific’s 15.2% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Boston Scientific’s annualized revenue growth of 18.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

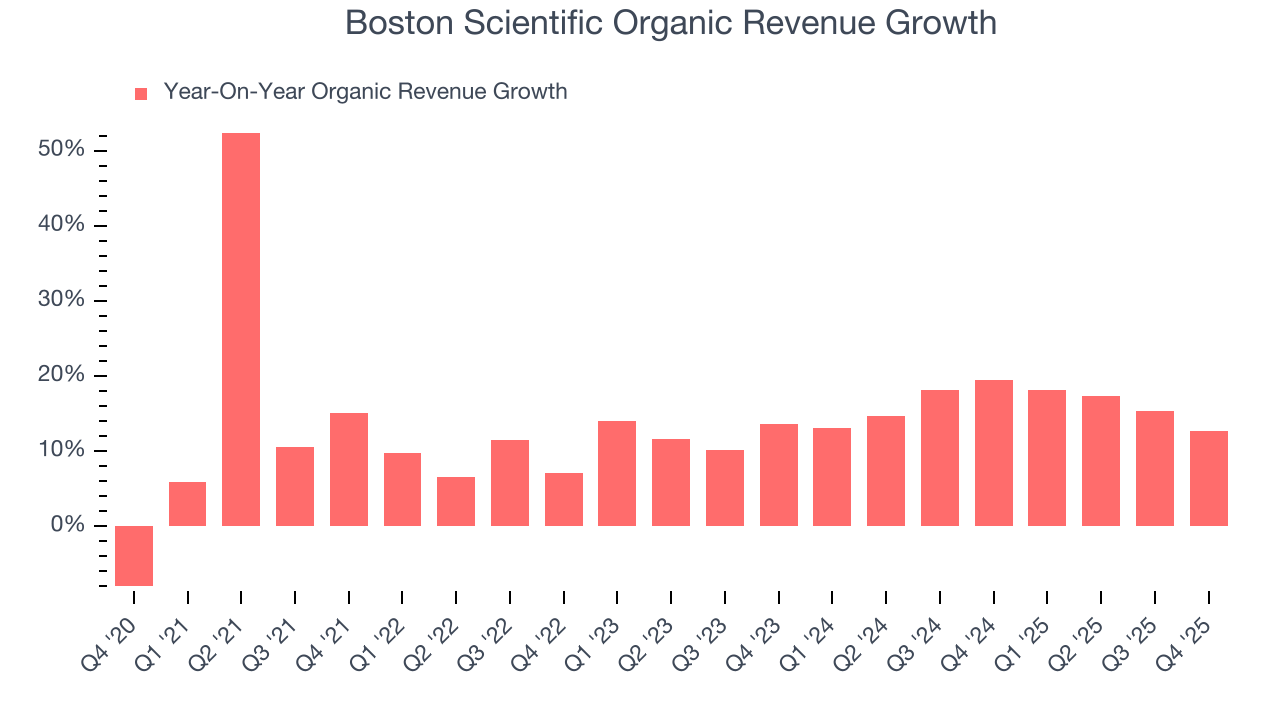

Boston Scientific also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Boston Scientific’s organic revenue averaged 16.1% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Boston Scientific’s year-on-year revenue growth was 15.9%, and its $5.29 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 11.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and indicates the market is baking in success for its products and services.

7. Operating Margin

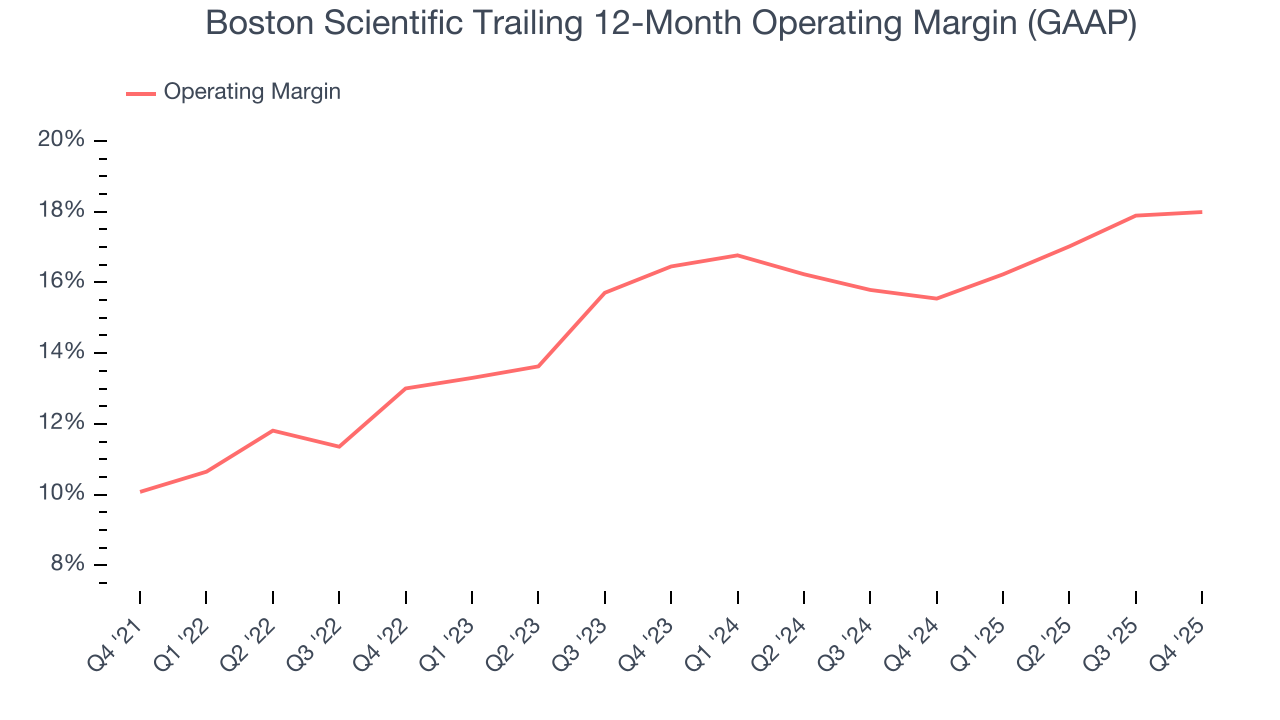

Boston Scientific has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 15.1%.

Looking at the trend in its profitability, Boston Scientific’s operating margin rose by 7.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.5 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Boston Scientific generated an operating margin profit margin of 15.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

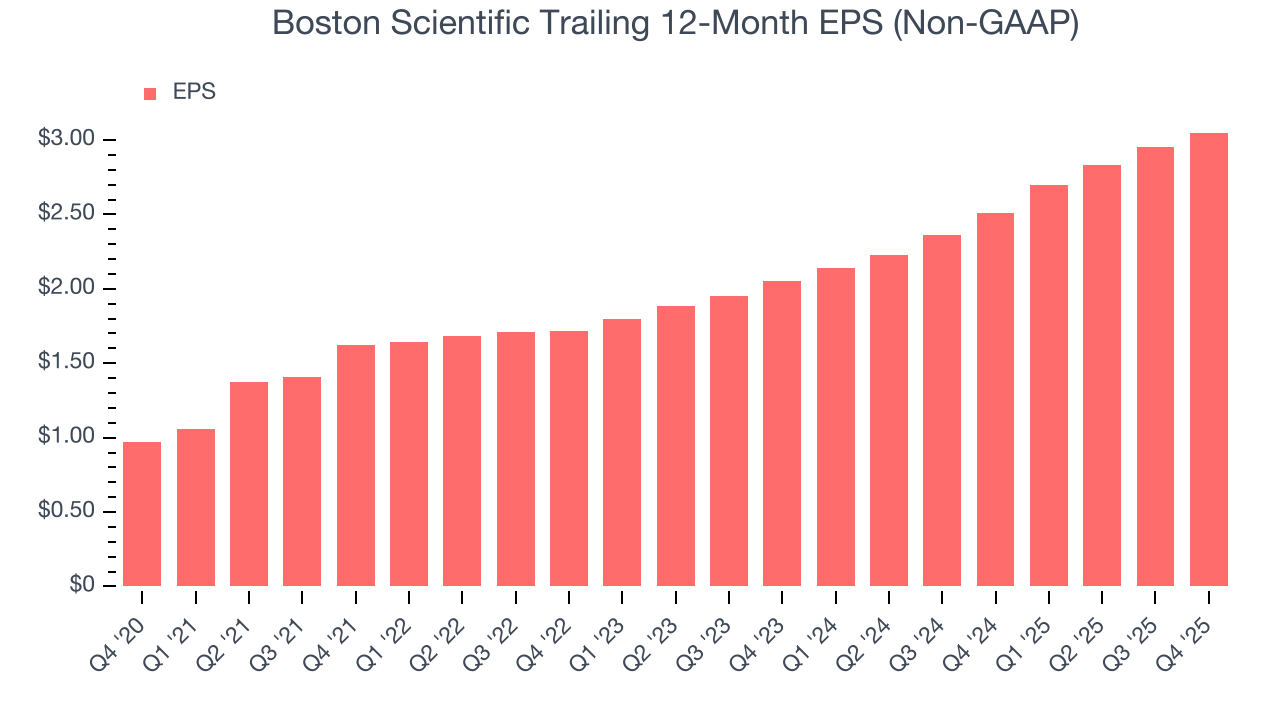

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Boston Scientific’s EPS grew at an astounding 25.8% compounded annual growth rate over the last five years, higher than its 15.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Boston Scientific’s earnings can give us a better understanding of its performance. As we mentioned earlier, Boston Scientific’s operating margin was flat this quarter but expanded by 7.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Boston Scientific reported adjusted EPS of $0.80, up from $0.70 in the same quarter last year. This print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects Boston Scientific’s full-year EPS of $3.05 to grow 13.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

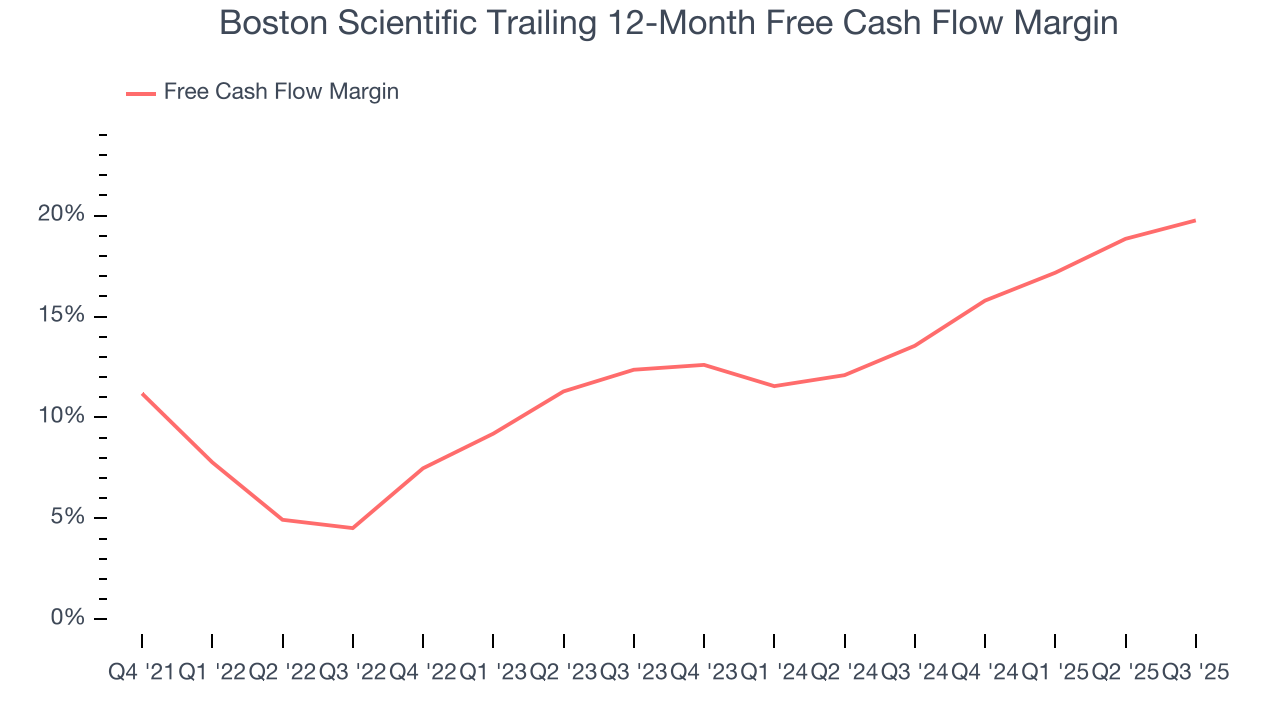

Boston Scientific has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.3% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Boston Scientific’s margin expanded by 5.2 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Boston Scientific has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.1%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Boston Scientific’s ROIC averaged 2.8 percentage point increases over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Key Takeaways from Boston Scientific’s Q4 Results

It was good to see Boston Scientific narrowly top analysts’ organic revenue expectations this quarter. On the other hand, its EPS guidance for next quarter slightly missed and its full-year EPS guidance was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5% to $87.07 immediately following the results.

12. Is Now The Time To Buy Boston Scientific?

Updated: February 4, 2026 at 6:41 AM EST

Are you wondering whether to buy Boston Scientific or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

In our opinion, Boston Scientific is a solid company. First off, its revenue growth was solid over the last five years. And while its mediocre ROIC lags the market and is a headwind for its stock price, its rising cash profitability gives it more optionality. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Boston Scientific’s P/E ratio based on the next 12 months is 26.4x. Looking at the healthcare landscape right now, Boston Scientific trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $124.03 on the company (compared to the current share price of $87.07), implying they see 42.6% upside in buying Boston Scientific in the short term.