Blackstone (BX)

Blackstone is a compelling stock. Its superb revenue growth indicates its market share is increasing.― StockStory Analyst Team

1. News

2. Summary

Why We Like Blackstone

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE:BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

- Annual revenue growth of 19.2% over the last five years was superb and indicates its market share increased during this cycle

- Earnings growth has comfortably beaten the peer group average over the last five years as its EPS has compounded at 19.7% annually

- Efficiency rose over the last five years as its fee-related earnings increased by 22.7% per year

Blackstone is a top-tier company. This is easily one of the top financials stocks.

Is Now The Time To Buy Blackstone?

Is Now The Time To Buy Blackstone?

At $146.04 per share, Blackstone trades at 24.2x forward P/E. The premium valuation means there’s much good news priced into the stock - we certainly can’t argue with that.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Blackstone (BX) Research Report: Q4 CY2025 Update

Alternative investment manager Blackstone (NYSE:BX) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 4.3% year on year to $4.36 billion. Its GAAP profit of $1.30 per share was 15.8% below analysts’ consensus estimates.

Blackstone (BX) Q4 CY2025 Highlights:

- Assets Under Management: $1.27 trillion vs analyst estimates of $1.27 trillion (13.1% year-on-year growth, in line)

- Revenue: $4.36 billion vs analyst estimates of $3.72 billion (4.3% year-on-year growth, 17.2% beat)

- Fee-Related Earnings: $1.95 billion vs analyst estimates of $1.48 billion (31.7% beat)

- EPS (GAAP): $1.30 vs analyst expectations of $1.54 (15.8% miss)

- Market Capitalization: $114.9 billion

Company Overview

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE:BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

Blackstone operates through four primary business segments: Real Estate, Private Equity, Hedge Fund Solutions, and Credit & Insurance. The Real Estate division acquires properties across sectors including logistics, residential, office, hospitality, and retail. Its Private Equity arm invests in businesses across industries, often taking controlling or significant minority positions in companies with potential for operational improvement or growth.

The firm's Hedge Fund Solutions segment, operating primarily through Blackstone Alternative Asset Management (BAAM), creates customized portfolios of hedge fund investments and manages direct investment strategies. The Credit & Insurance division provides financing solutions and manages credit-focused funds investing in corporate debt, distressed securities, and structured products.

Blackstone generates revenue primarily through management fees, which are calculated as a percentage of the assets it manages, and performance fees (also called carried interest), which represent a share of the profits when investments perform above certain thresholds. For example, when Blackstone acquires an office building, improves its operations, and sells it at a profit, the firm earns a percentage of those gains.

The firm serves as a fiduciary for institutional investors like public and corporate pension funds, which need to generate returns to meet future obligations to retirees. Sovereign wealth funds, insurance companies, endowments, foundations, and high-net-worth individuals also entrust Blackstone with their capital. The company has expanded globally with offices across major financial centers in North America, Europe, Asia, and beyond.

4. Asset Management

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

Blackstone's main competitors include other alternative asset managers such as Apollo Global Management (NYSE:APO), KKR & Co. (NYSE:KKR), The Carlyle Group (NASDAQ:CG), and Brookfield Asset Management (NYSE:BAM), as well as traditional asset managers that have expanded into alternative investments.

5. Revenue Growth

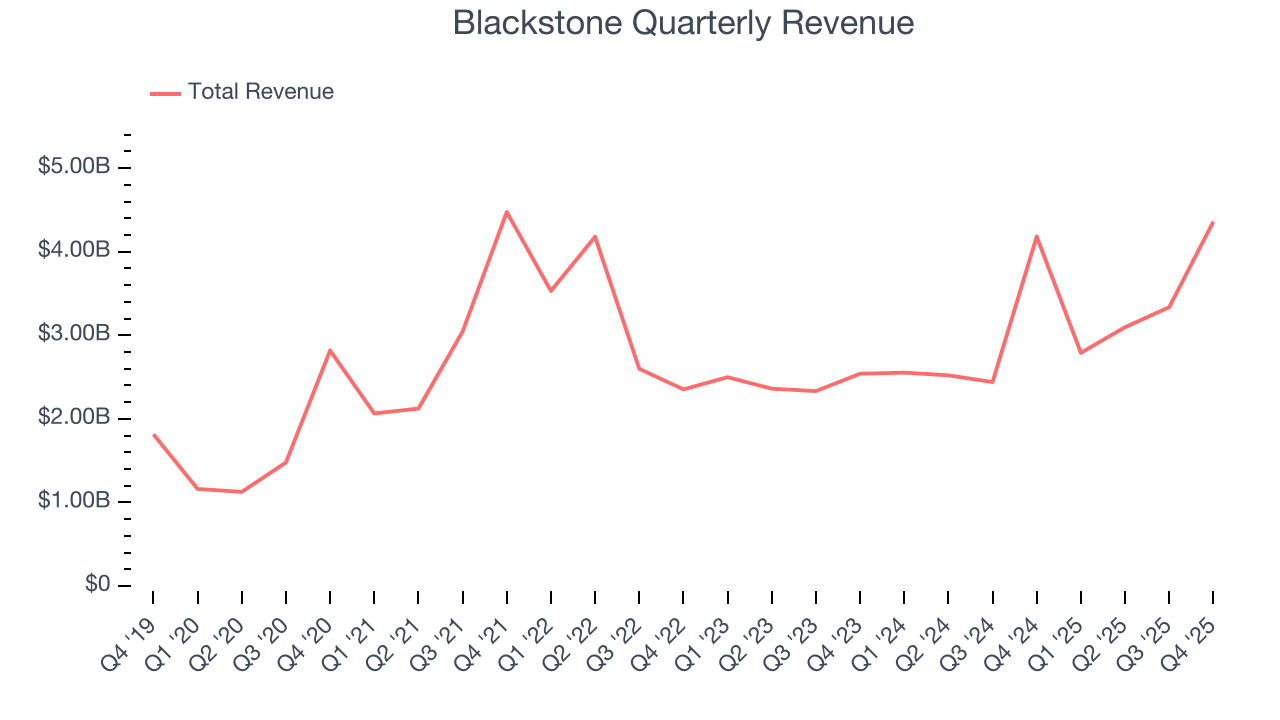

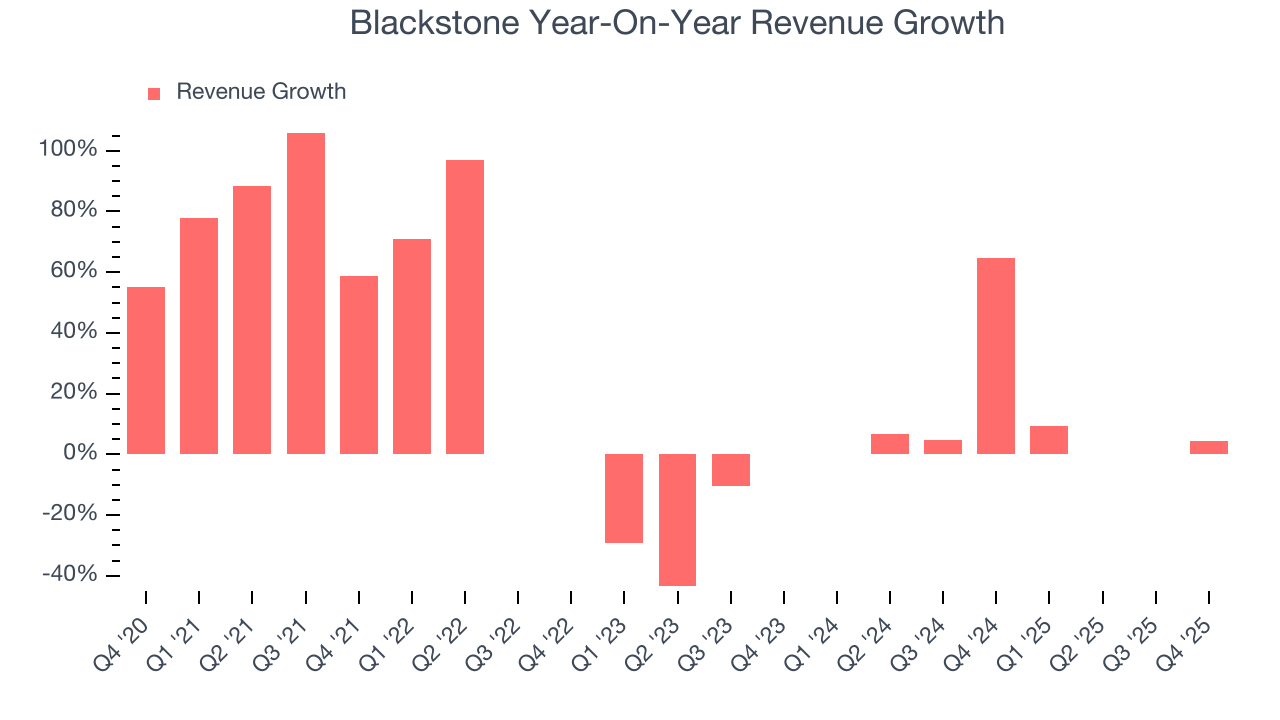

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Blackstone’s 15.6% annualized revenue growth over the last five years was impressive. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Blackstone’s annualized revenue growth of 18.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Blackstone reported modest year-on-year revenue growth of 4.3% but beat Wall Street’s estimates by 17.2%.

6. Assets Under Management (AUM)

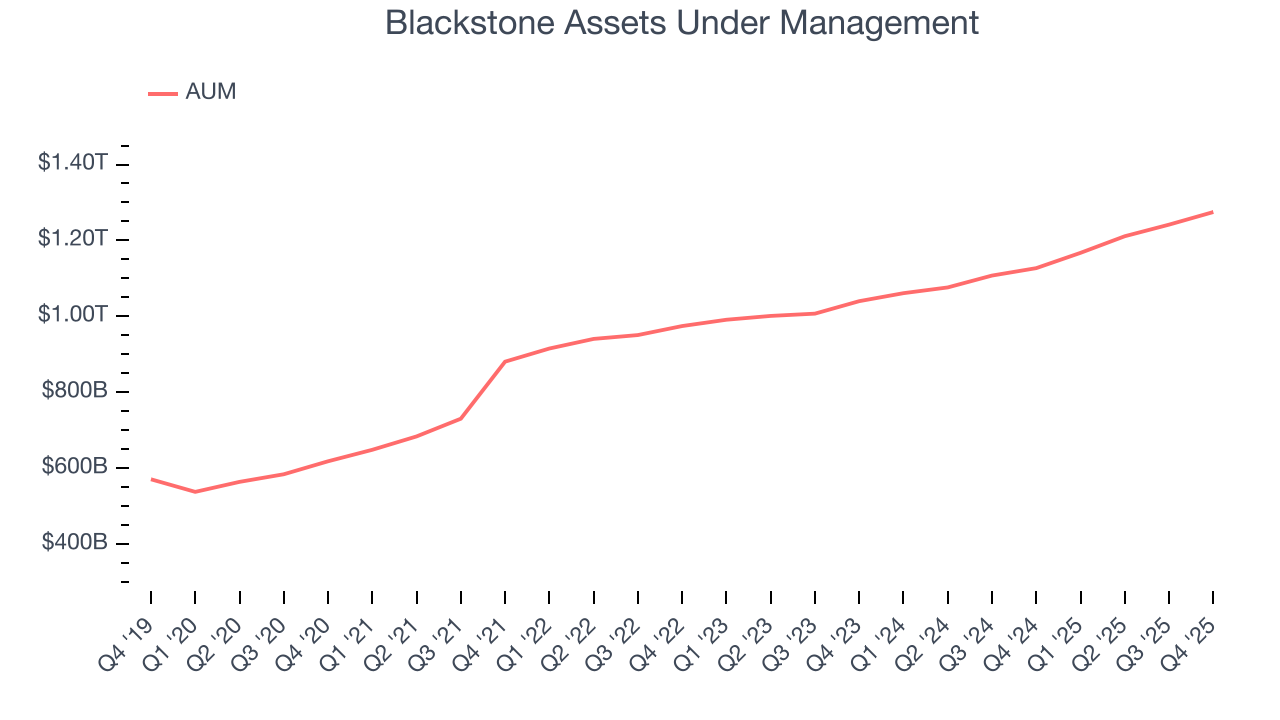

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Blackstone’s AUM has grown at an annual rate of 16.3% over the last five years, better than the broader financials industry and faster than its total revenue. When analyzing Blackstone’s AUM over the last two years, we can see that growth decelerated to 10.1% annually. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

In Q4, Blackstone’s AUM was $1.27 trillion, meeting analysts’ expectations. This print was 13.1% higher than the same quarter last year.

7. Fee-Related Earnings

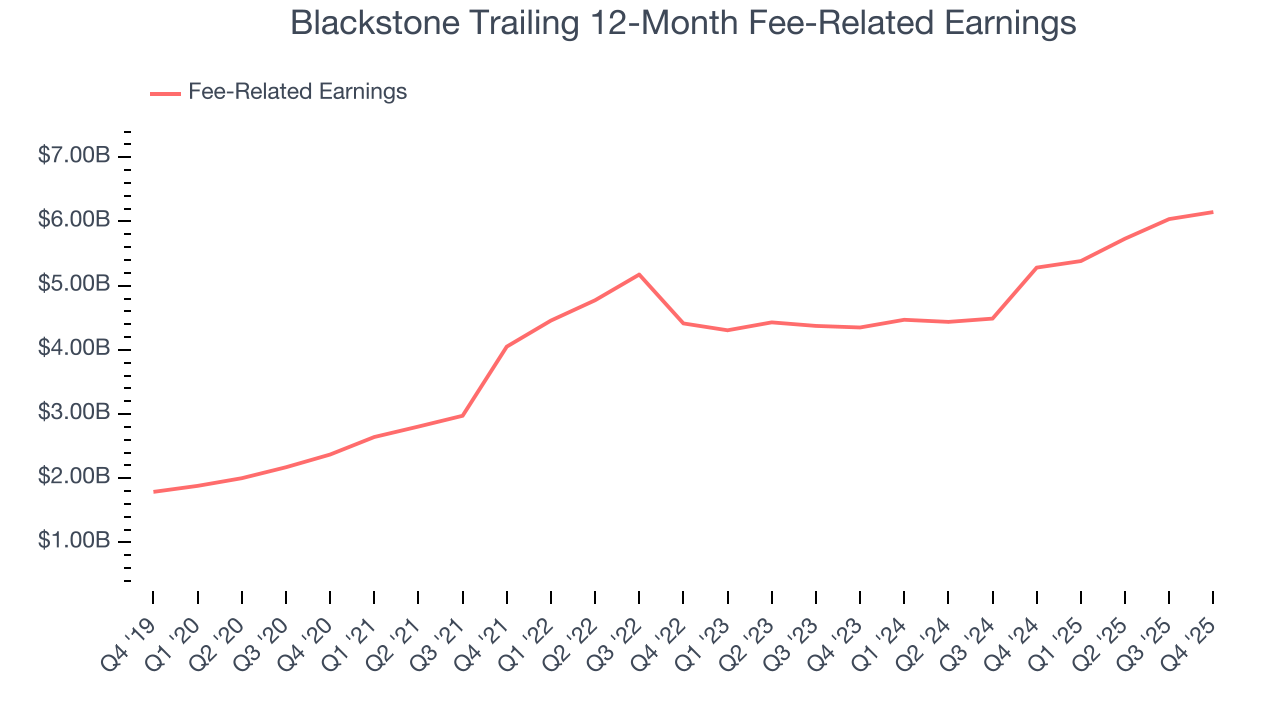

While revenue growth captures attention, the quality of that growth is what truly drives shareholder value. For asset management firms, fee-related earnings represent the stable, predictable profits from their core fee-based services, excluding the more unpredictable elements like performance fees and investment returns. This metric reveals the sustainable earnings power of the business.

Blackstone’s annual fee-related earnings growth over the last five years was 21%, a top-notch result.

As you’ve seen throughout this report, we supplement with a two-year look because a five-year view may miss recent changes in the business. Over the last two years, Blackstone’s fee-related earnings grew at an annualized pace of 18.9%, an impressive result.

Blackstone’s fee-related earnings came in at $1.95 billion this quarter, beating analysts’ expectations by 31.7%. These results represent 6% year-on-year growth.

8. A Word on Book Value and ROE

You may wonder when we will analyze book value and return on equity (ROE) since Blackstone is a financials company. We pay less attention to these metrics for asset managers because they are not great measures of business quality.

Asset managers are fee-based, capital light firms that manage client capital rather than their own, so they are not balance sheet businesses. Additionally, book value fails to capture the value of brands, investment track records, and other intangibles, thus understating intrinsic value, while ROE can look artificially high due to the relatively smaller bases of equity capital needed to operate the business compared to banks and insurers.

9. Balance Sheet Assessment

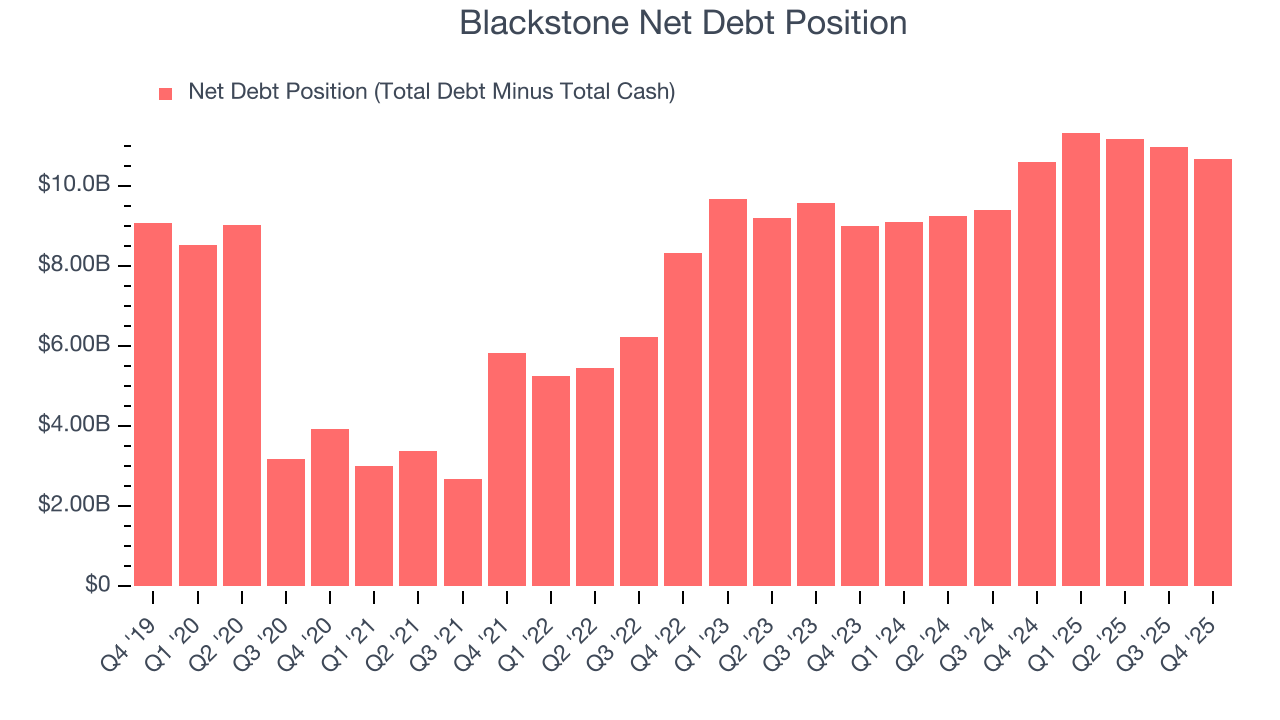

Blackstone reported $2.63 billion of cash and $13.31 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $6.15 billion of fee-related earnings over the last 12 months, we view Blackstone’s 1.7× net-debt-to-earnings ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Blackstone’s Q4 Results

We were impressed by how significantly Blackstone blew past analysts’ fee-related earnings expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.3% to $148.68 immediately after reporting.

11. Is Now The Time To Buy Blackstone?

Updated: January 29, 2026 at 8:40 AM EST

Before investing in or passing on Blackstone, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

In our opinion, Blackstone is a solid company. First off, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. On top of that, Blackstone’s AUM growth was impressive over the last five years, and its expanding fee-related earnings shows the asset management business is generating more profits.

Blackstone’s P/E ratio based on the next 12 months is 22.8x. This multiple isn’t necessarily cheap, but we’ll happily own Blackstone as its fundamentals shine bright. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $178.18 on the company (compared to the current share price of $148.68).