Boyd Gaming (BYD)

Boyd Gaming keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Boyd Gaming Will Underperform

Run by the Boyd family, Boyd Gaming (NYSE:BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

- Lackluster 13.4% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Projected sales are flat for the next 12 months, implying demand will slow from its two-year trend

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Boyd Gaming falls short of our quality standards. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Boyd Gaming

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Boyd Gaming

Boyd Gaming is trading at $82.90 per share, or 10.8x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Boyd Gaming (BYD) Research Report: Q4 CY2025 Update

Gaming and hospitality company Boyd Gaming (NYSE:BYD) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 2% year on year to $1.06 billion. Its non-GAAP profit of $2.21 per share was 14.2% above analysts’ consensus estimates.

Boyd Gaming (BYD) Q4 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.02 billion (2% year-on-year growth, 4% beat)

- Adjusted EPS: $2.21 vs analyst estimates of $1.94 (14.2% beat)

- Adjusted EBITDA: $308 million vs analyst estimates of $307.9 million (29% margin, in line)

- Operating Margin: 15.7%, down from 25.1% in the same quarter last year

- Market Capitalization: $6.62 billion

Company Overview

Run by the Boyd family, Boyd Gaming (NYSE:BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming was established in 1975 by Sam Boyd, a former casino dealer with extensive experience in the gaming industry. Today, Boyd Gaming operates a diverse portfolio of properties across various states that allow its guests to gamble.

The company's offerings include not only casino games but also hotel accommodations, dining options, and recreational activities. This holistic approach caters to a broad audience, from gaming enthusiasts to families seeking a complete entertainment experience. Boyd Gaming's properties often feature amenities like pools, spas, shopping centers, and convention spaces.

The primary revenue streams for Boyd Gaming come from its casino operations, hotel services, food and beverage sales, and entertainment offerings. Despite being based in Paradise, Nevada, the company is geographically diversified, allowing it to appeal to both local customers and tourists.

4. Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Competitors in the gaming sector include Caesars Entertainment (NASDAQ:CZR), MGM Resorts (NYSE:MGM), and PENN Entertainment (NASDAQ:PENN).

5. Revenue Growth

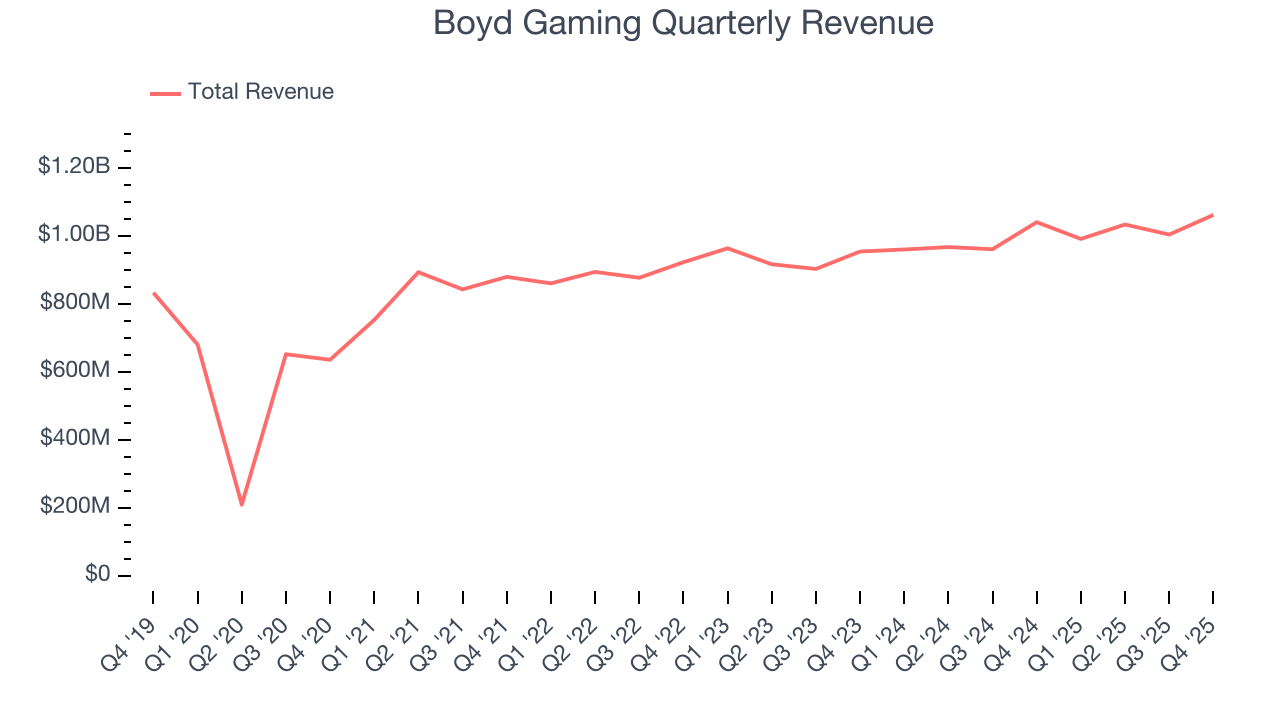

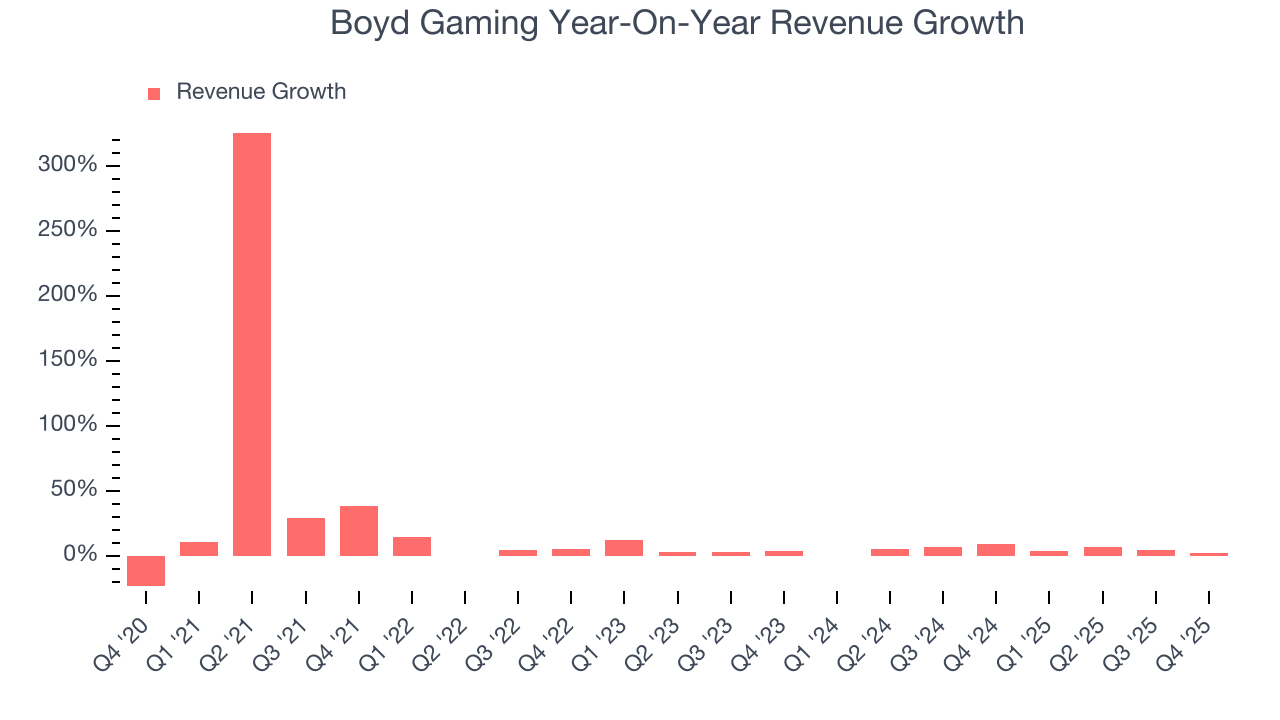

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Boyd Gaming grew its sales at a 13.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

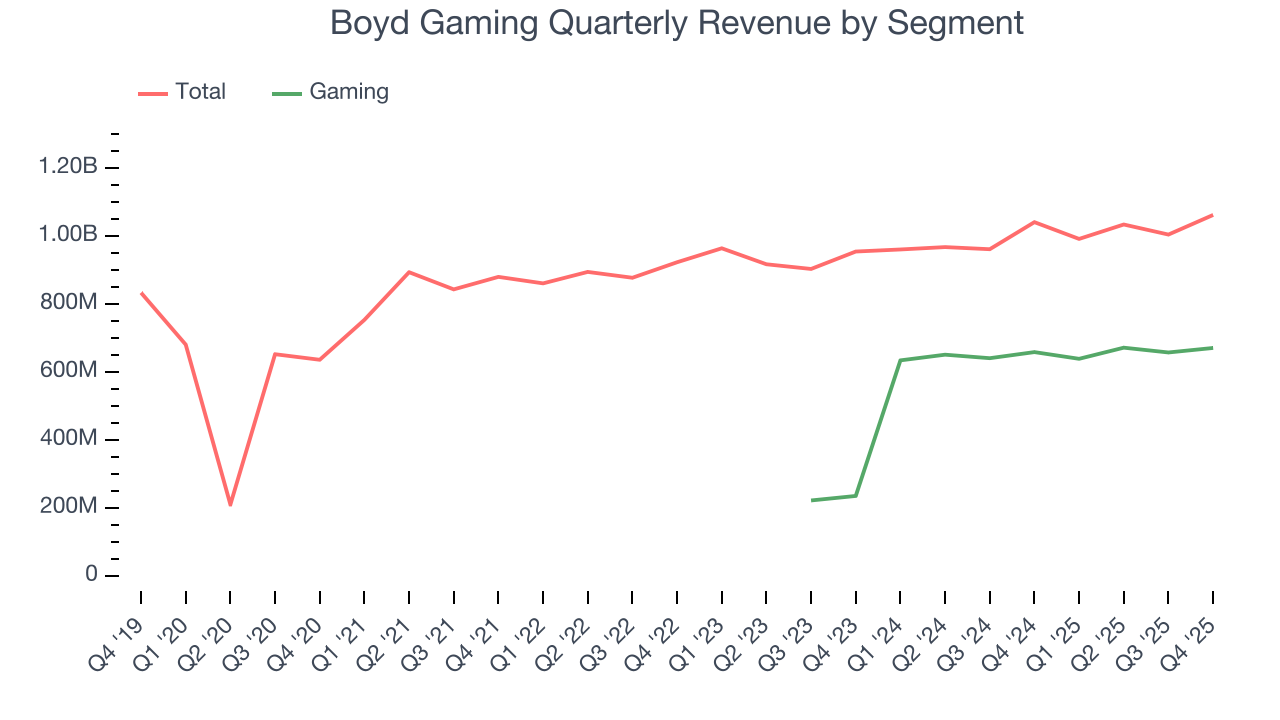

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Boyd Gaming’s recent performance shows its demand has slowed as its annualized revenue growth of 4.6% over the last two years was below its five-year trend. Note that COVID hurt Boyd Gaming’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Gaming. Over the last two years, Boyd Gaming’s Gaming revenue (casino games) averaged 62.9% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Boyd Gaming reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

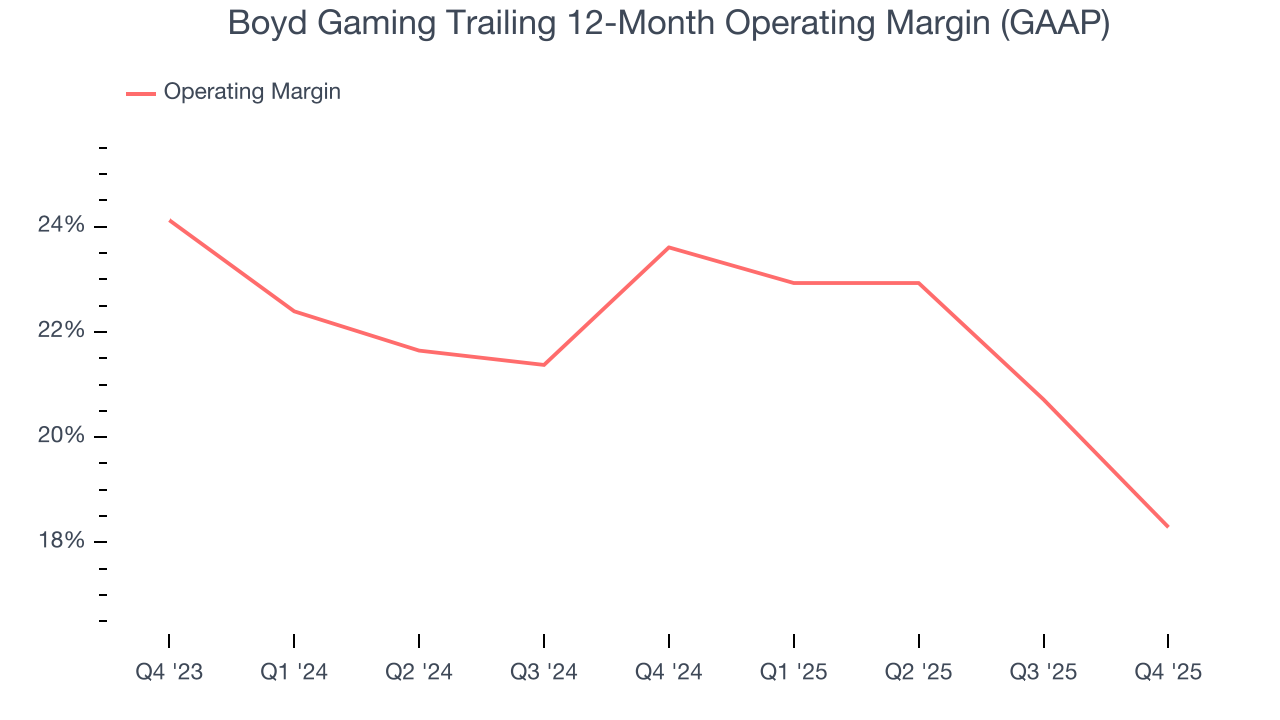

6. Operating Margin

Boyd Gaming’s operating margin has shrunk over the last 12 months and averaged 20.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Boyd Gaming generated an operating margin profit margin of 15.7%, down 9.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

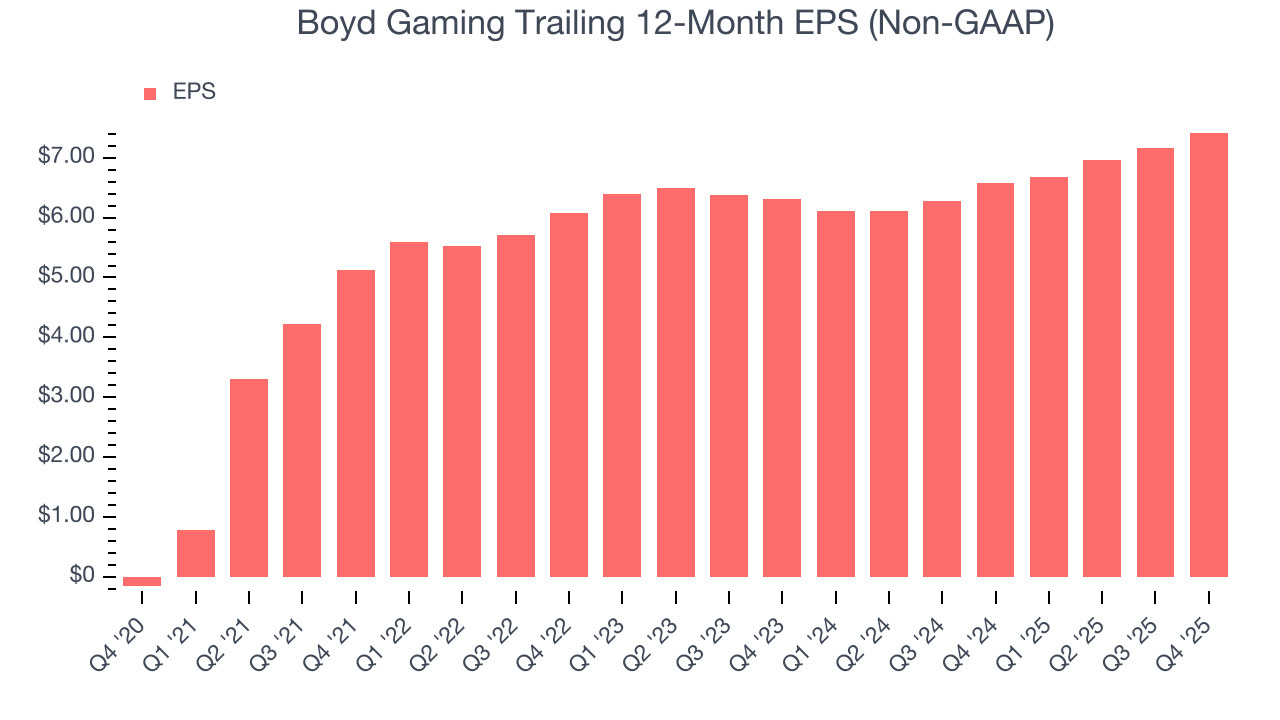

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boyd Gaming’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Boyd Gaming reported adjusted EPS of $2.21, up from $1.96 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Boyd Gaming’s full-year EPS of $7.42 to grow 5.9%.

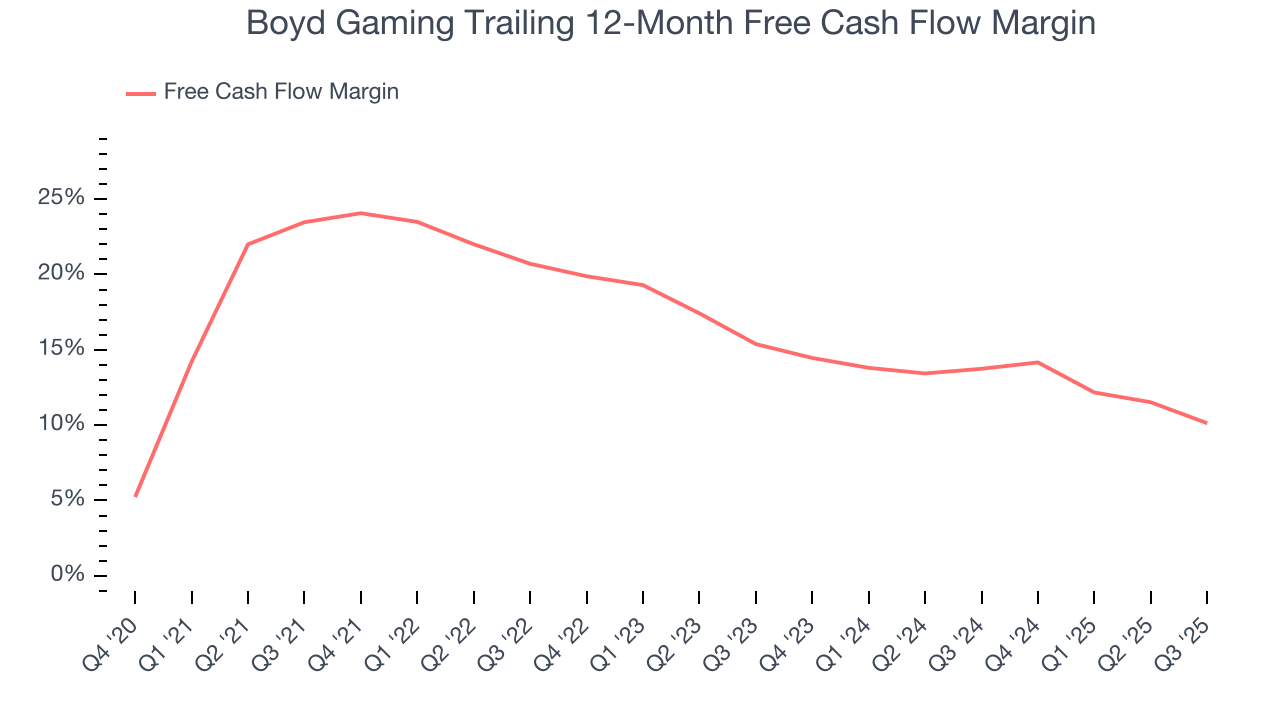

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Boyd Gaming has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.8%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Boyd Gaming historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Boyd Gaming’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

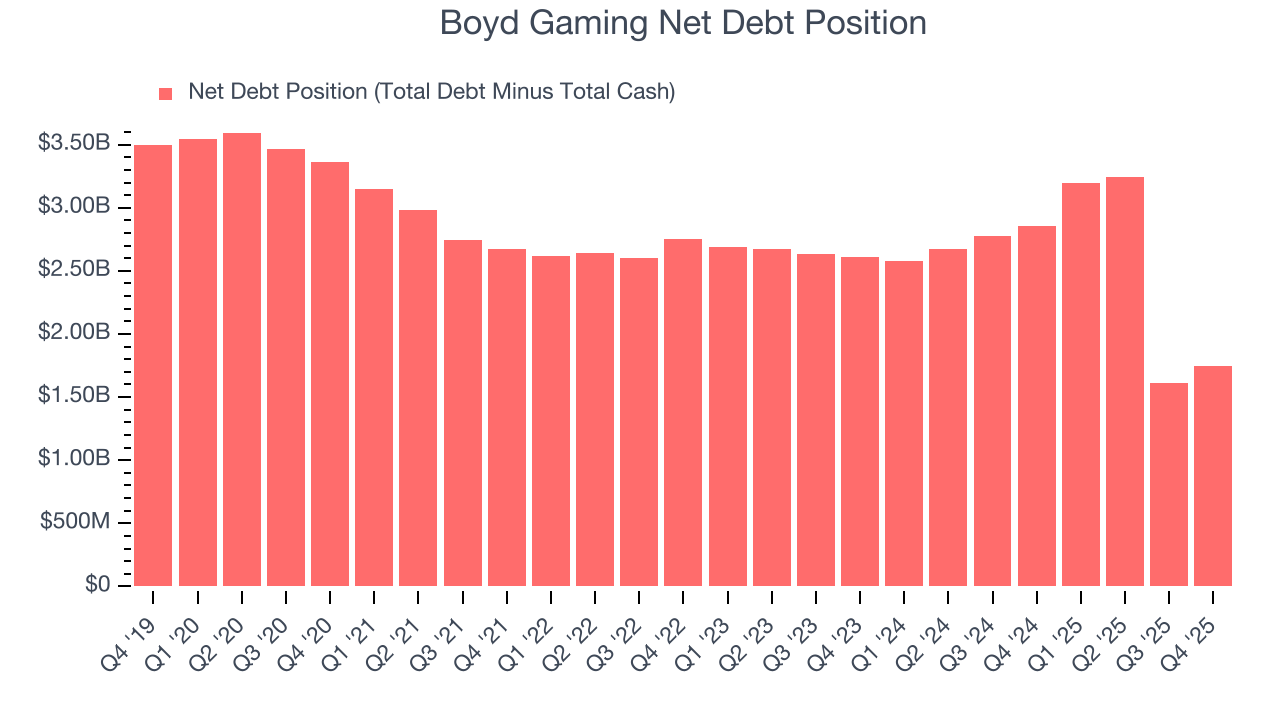

10. Balance Sheet Assessment

Boyd Gaming reported $353.4 million of cash and $2.1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.24 billion of EBITDA over the last 12 months, we view Boyd Gaming’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $104.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Boyd Gaming’s Q4 Results

We enjoyed seeing Boyd Gaming beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 1% to $84.72 immediately after reporting.

12. Is Now The Time To Buy Boyd Gaming?

Updated: February 5, 2026 at 9:52 PM EST

Before investing in or passing on Boyd Gaming, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping consumers, but in the case of Boyd Gaming, we’re out. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion. On top of that, its projected EPS for the next year is lacking.

Boyd Gaming’s P/E ratio based on the next 12 months is 10.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $94.67 on the company (compared to the current share price of $82.90).