Chipotle (CMG)

Chipotle piques our interest. Its marriage of growth and profitability makes it a strong business with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why Chipotle Is Interesting

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

- Fast expansion of new restaurants to reach markets with few or no locations is justified by its same-store sales growth

- Dominant market position is represented by its $11.93 billion in revenue and gives it fixed cost leverage when sales grow

- The stock is slightly expensive, and we suggest waiting until its quality rises or its valuation falls

Chipotle has the potential to be a high-quality business. This is a good stock to keep your eye on.

Why Should You Watch Chipotle

High Quality

Investable

Underperform

Why Should You Watch Chipotle

Chipotle’s stock price of $36.82 implies a valuation ratio of 31.7x forward P/E. Chipotle’s valuation is richer than that of other restaurant companies, on average.

Chipotle can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. Chipotle (CMG) Research Report: Q4 CY2025 Update

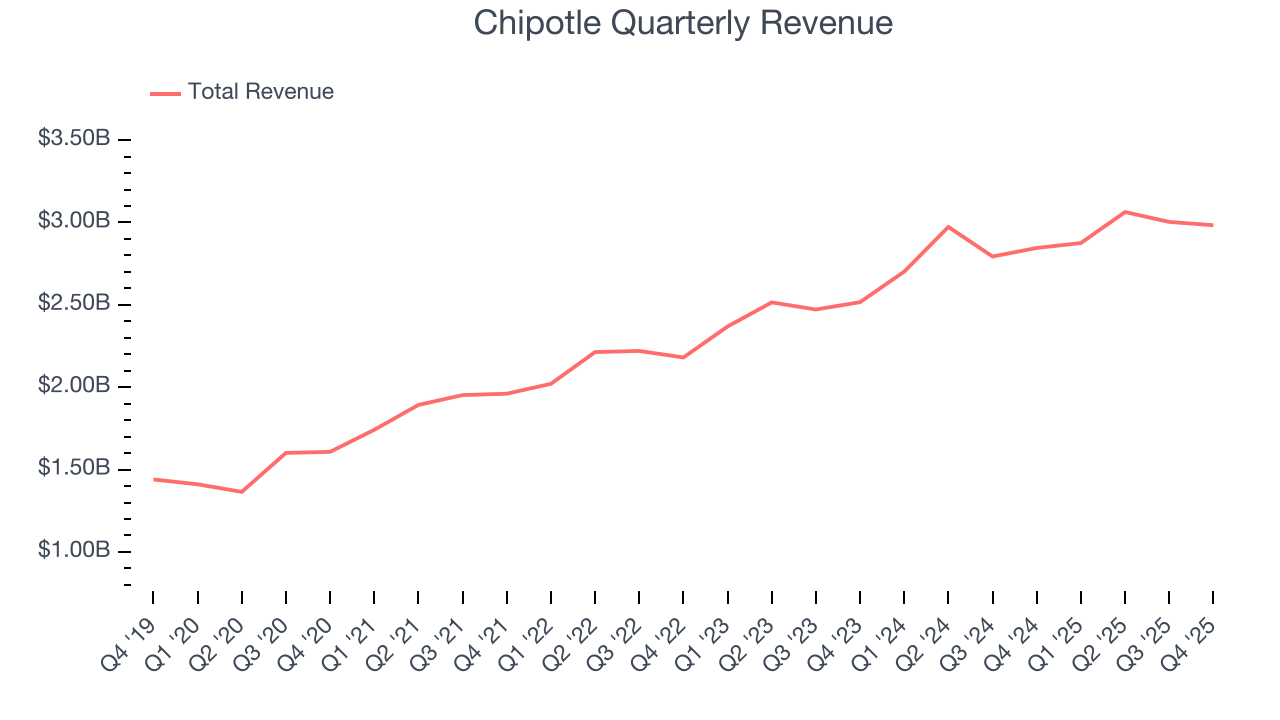

Mexican fast-food chain Chipotle (NYSE:CMG) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 4.9% year on year to $2.98 billion. Its non-GAAP profit of $0.25 per share was 4.9% above analysts’ consensus estimates.

Chipotle (CMG) Q4 CY2025 Highlights:

- Revenue: $2.98 billion vs analyst estimates of $2.97 billion (4.9% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.24 (4.9% beat)

- Adjusted EBITDA: $515.6 million vs analyst estimates of $504.4 million (17.3% margin, 2.2% beat)

- Operating Margin: 14.1%, in line with the same quarter last year

- Free Cash Flow Margin: 7.7%, down from 12.4% in the same quarter last year

- Same-Store Sales fell 2.5% year on year (5.4% in the same quarter last year)

- Market Capitalization: $50.92 billion

Company Overview

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

The company was founded in 1993 by Steve Ells, a classically trained chef, who recognized a gap in the market for fast food that didn’t compromise on taste or quality. To execute this vision, Chipotle exclusively uses top-notch ingredients like responsibly raised meats and organic produce in its burritos, bowls, tacos, and salads.

At its restaurants, each customer has the freedom to craft their meal exactly to their liking, choosing from a range of proteins, salsas, and toppings. This allows for endless combinations, ensuring that every visit to Chipotle is unique and tailored. It’s a personalized dining experience that other fast-food competitors simply don’t offer.

The average Chipotle store is designed with an open kitchen layout, allowing customers to witness the food preparation process firsthand. The assembly line-style setup ensures efficiency as customers move along, selecting their desired ingredients and watching as their creation comes to life.

In response to the digital age, Chipotle has established a strong online presence. The company's website and mobile app offer seamless ordering options, providing features such as real-time tracking, exclusive offers, and the convenience of skipping the line.

4. Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Some fast-food competitors with similar concepts include CAVA (NYSE:CAVA), Noodles & Company (NASDAQ:NDLS), Potbelly (NASDAQ:PBPB), and Sweetgreen (NYSE:SG).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $11.93 billion in revenue over the past 12 months, Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

As you can see below, Chipotle’s sales grew at an impressive 13.5% compounded annual growth rate over the last six years as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Chipotle reported modest year-on-year revenue growth of 4.9% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a deceleration versus the last six years. We still think its growth trajectory is satisfactory given its scale and suggests the market sees success for its menu offerings.

6. Restaurant Performance

Number of Restaurants

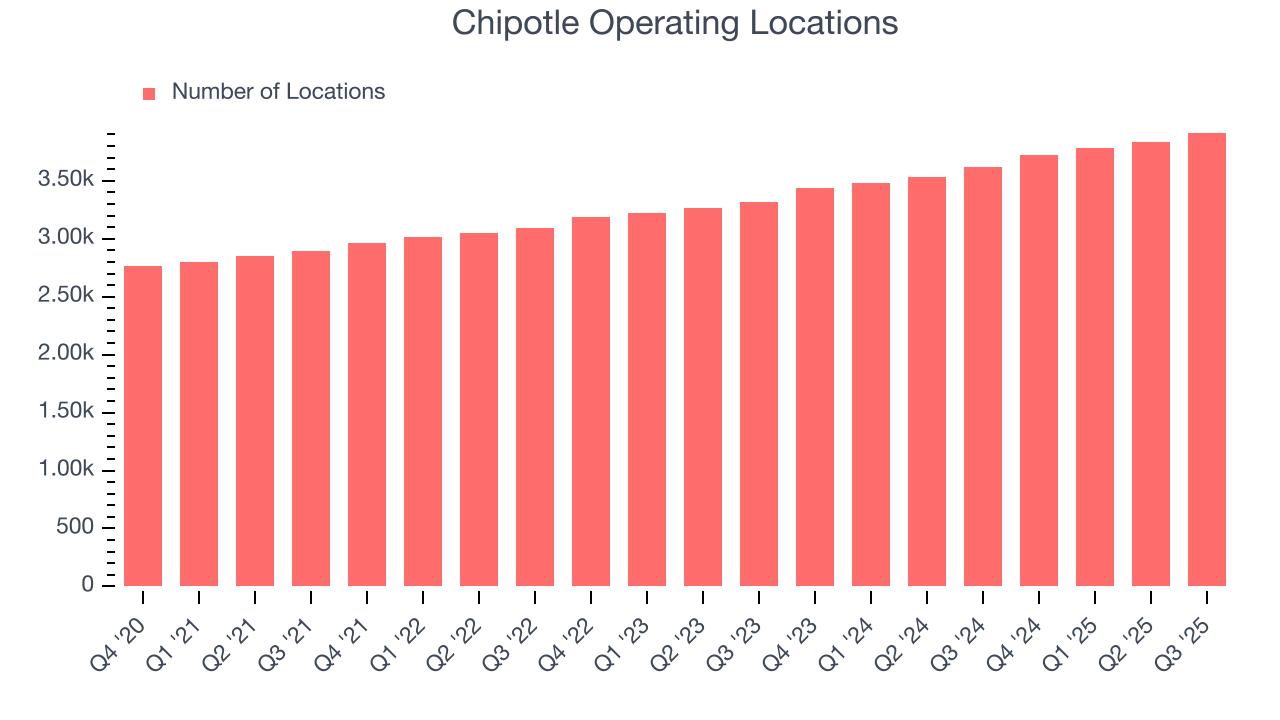

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Chipotle opened new restaurants at a rapid clip over the last two years, averaging 8.4% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that Chipotle reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

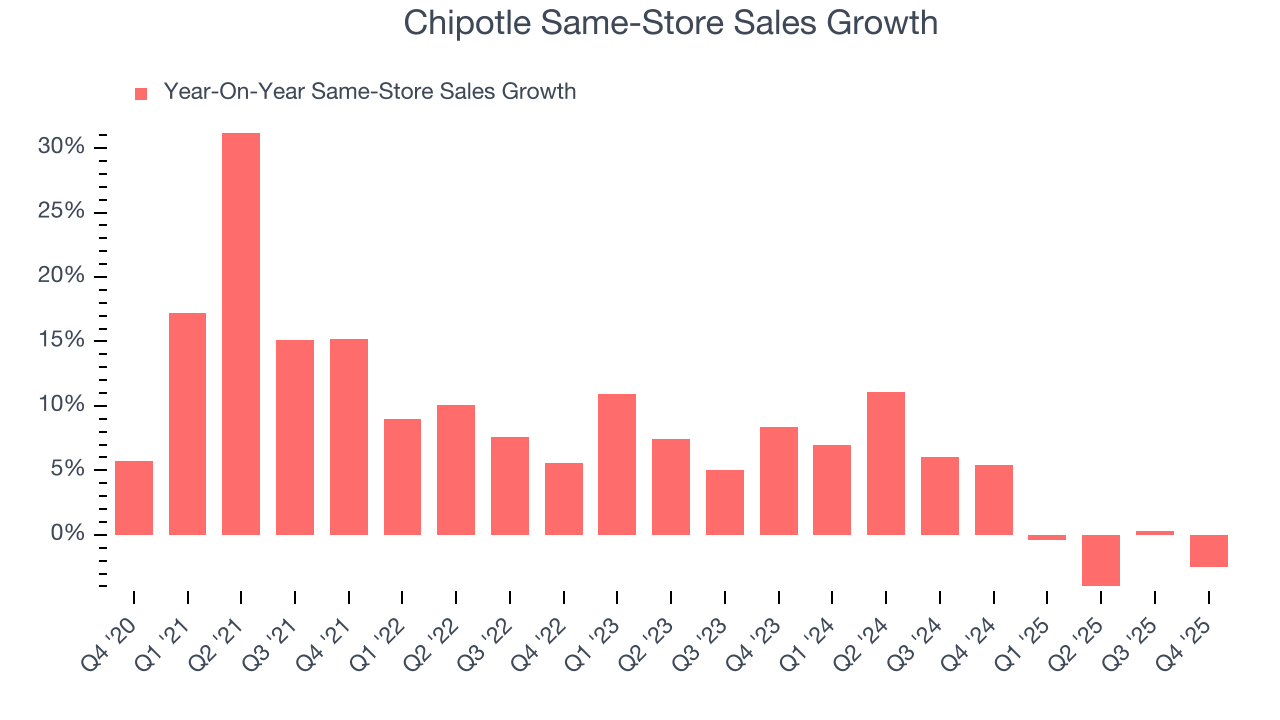

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Chipotle’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.9% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Chipotle’s same-store sales fell by 2.5% year on year. This decline was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

7. Gross Margin & Pricing Power

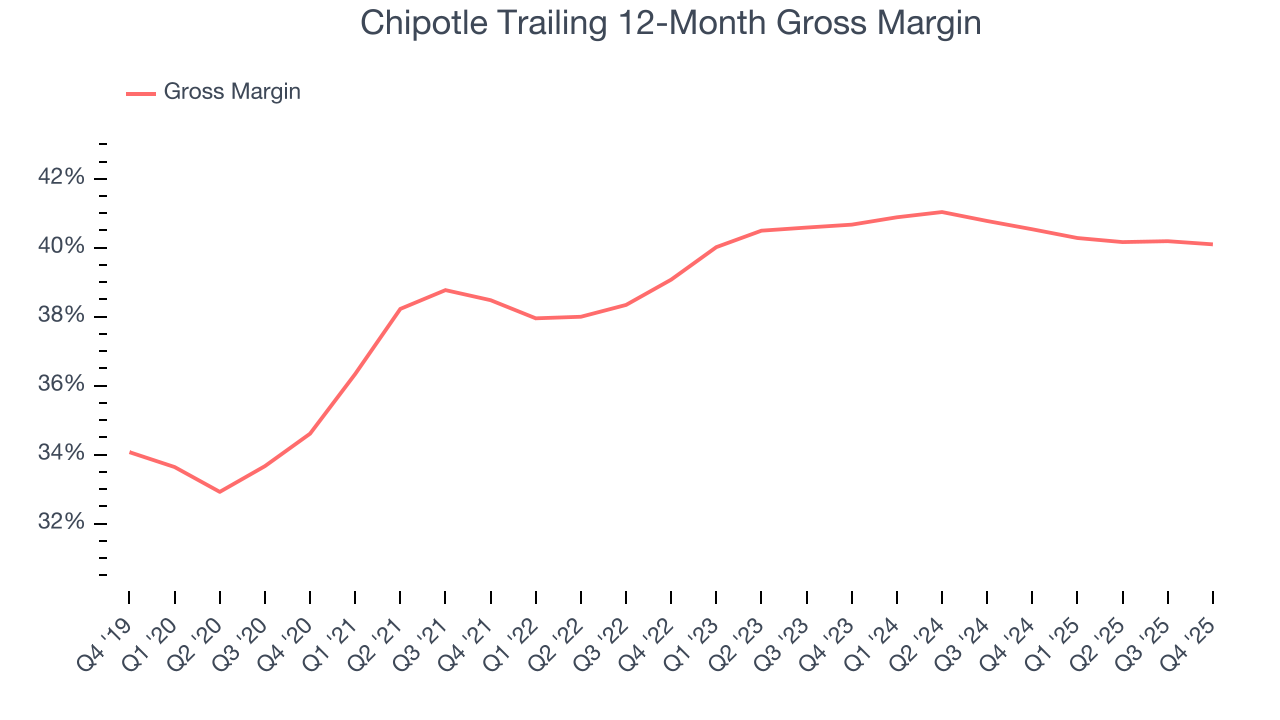

Chipotle has great unit economics for a restaurant company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 40.3% gross margin over the last two years. Said differently, roughly $40.31 was left to spend on selling, marketing, and general administrative overhead for every $100 in revenue.

Chipotle’s gross profit margin came in at 38.9% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

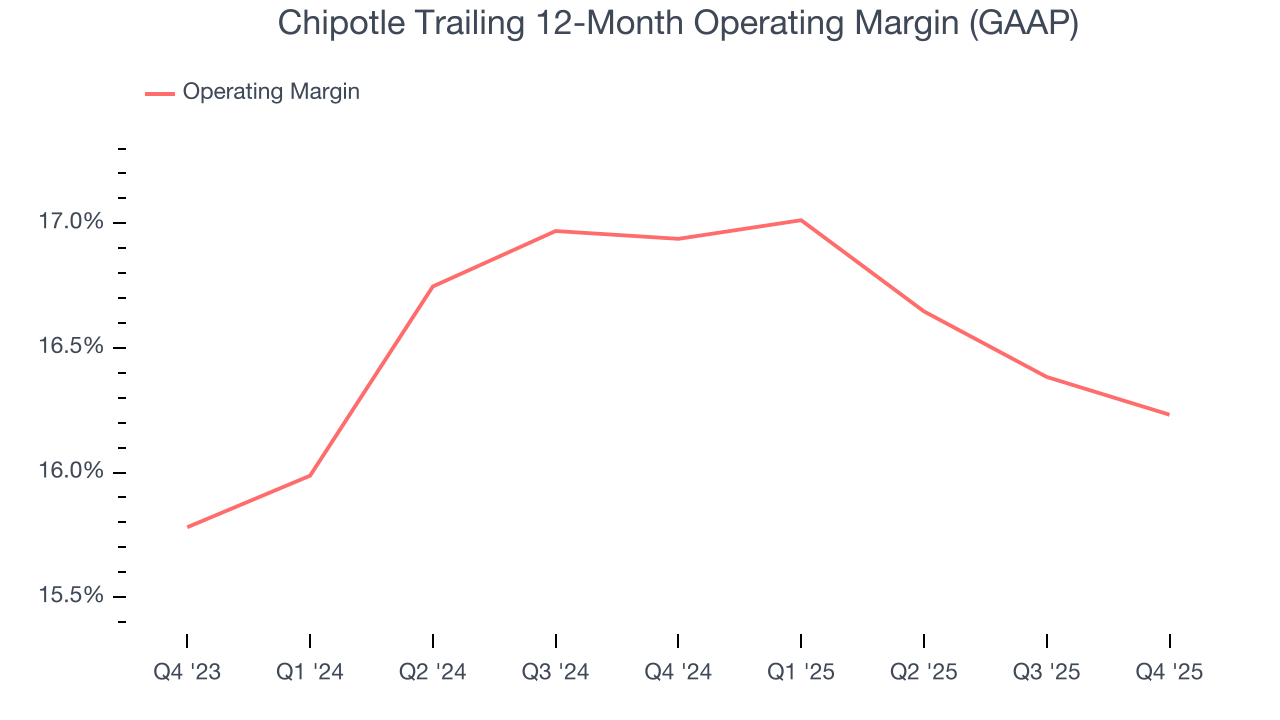

Chipotle’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 16.6% over the last two years. This profitability was top-notch for a restaurant business, showing it’s an well-run company with an efficient cost structure. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Analyzing the trend in its profitability, Chipotle’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Chipotle generated an operating margin profit margin of 14.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

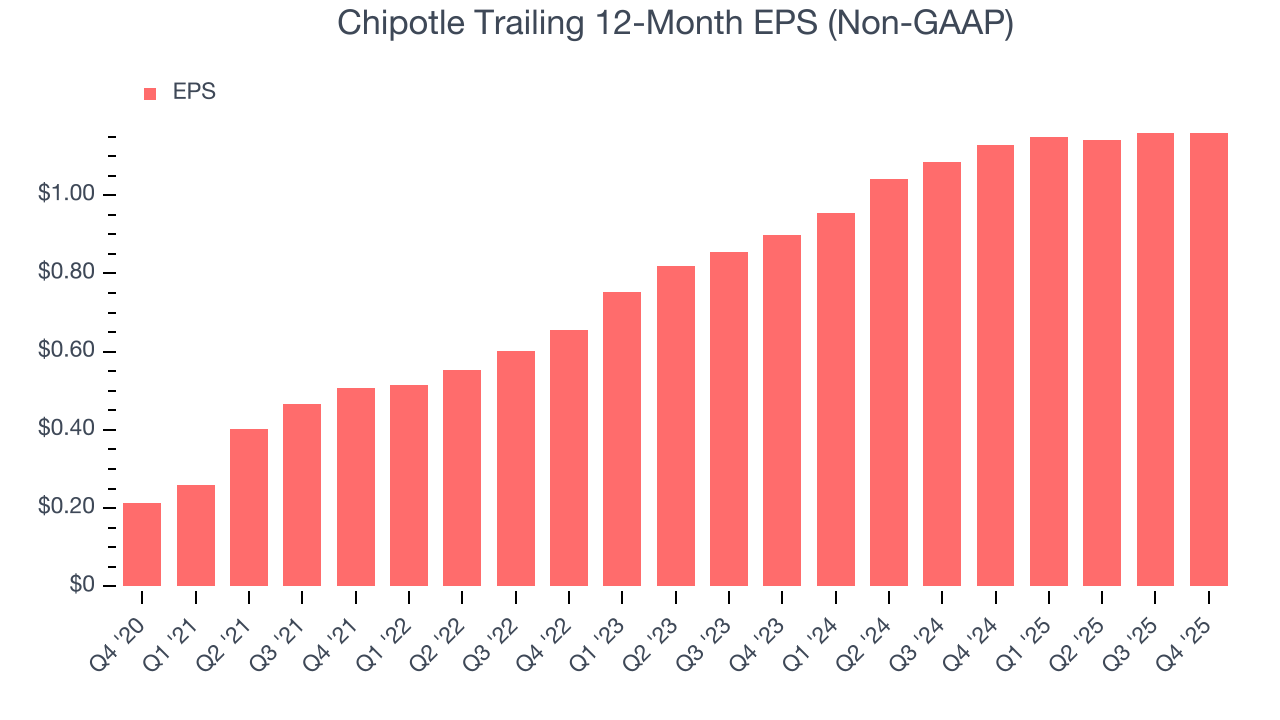

Chipotle’s EPS grew at a remarkable 26.6% compounded annual growth rate over the last six years, higher than its 13.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Chipotle reported adjusted EPS of $0.25, in line with the same quarter last year. This print beat analysts’ estimates by 4.9%. Over the next 12 months, Wall Street expects Chipotle’s full-year EPS of $1.16 to grow 4%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

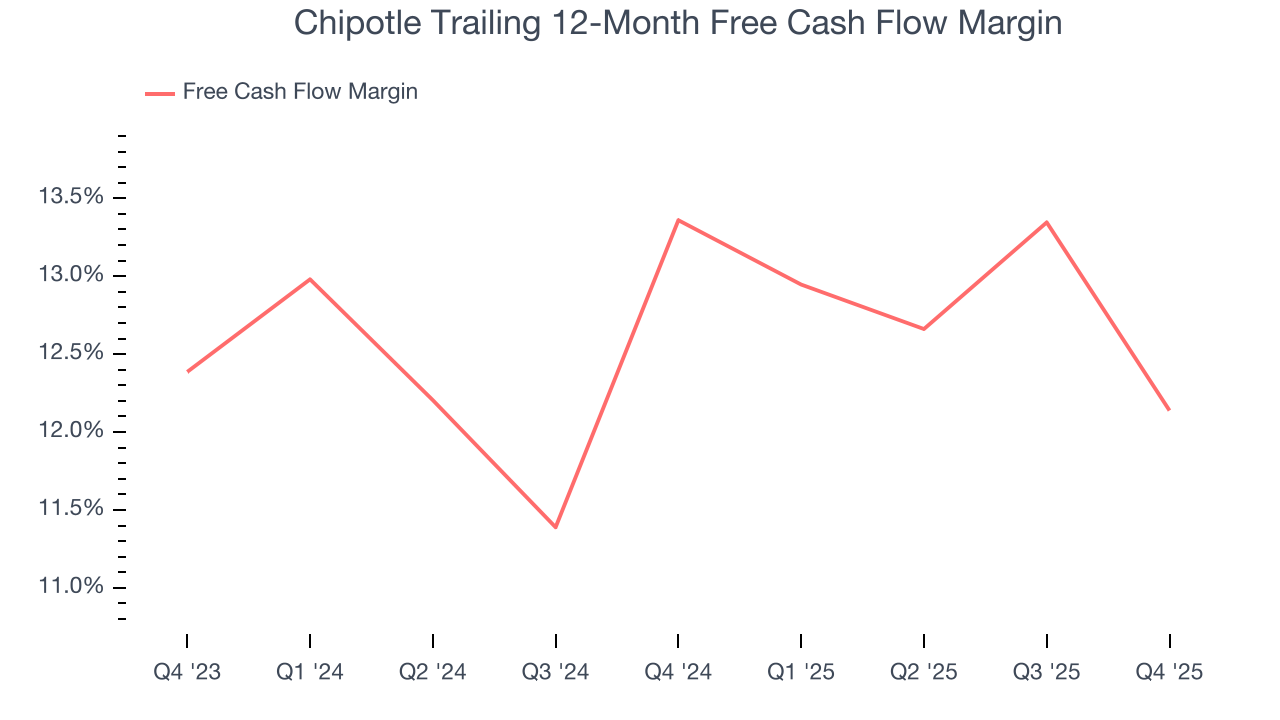

Chipotle has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 12.7% over the last two years.

Taking a step back, we can see that Chipotle’s margin dropped by 1.2 percentage points over the last year. This decrease came from the higher costs associated with opening more restaurants.

Chipotle’s free cash flow clocked in at $228.4 million in Q4, equivalent to a 7.7% margin. The company’s cash profitability regressed as it was 4.8 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Chipotle’s five-year average ROIC was 19.1%, placing it among the best restaurant companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

12. Balance Sheet Assessment

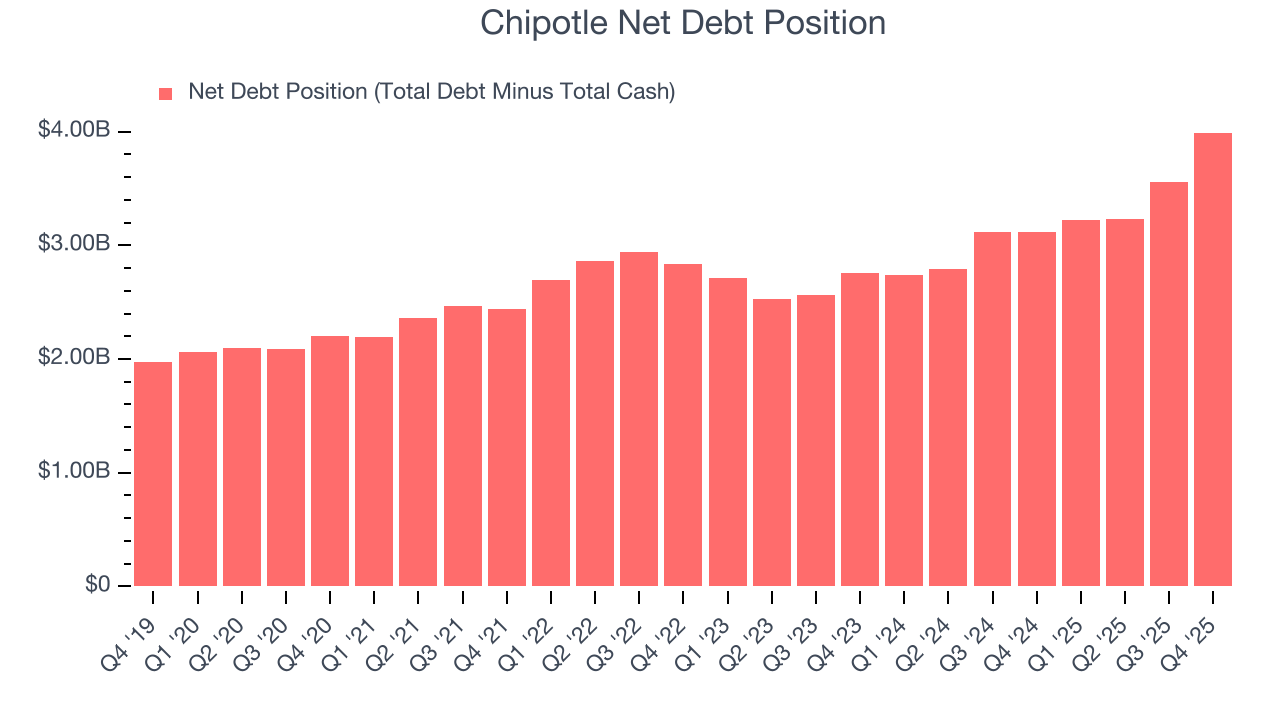

Chipotle reported $1.08 billion of cash and $5.08 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.34 billion of EBITDA over the last 12 months, we view Chipotle’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $73.72 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Chipotle’s Q4 Results

While Chipotle met analysts’ same-store sales expectations this quarter, investors worried about a more than 3% decline in traffic to established stores (one part of same-store sales is traffic, and the other part is ticket or spend per customer). So while EPS managed to beat, the stock traded down 3.2% to $37.87 immediately following the results.

14. Is Now The Time To Buy Chipotle?

Updated: February 3, 2026 at 9:51 PM EST

Are you wondering whether to buy Chipotle or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

In our opinion, Chipotle is a solid company. First off, its revenue growth was good over the last six years. And while its projected EPS for the next year is lacking, its new restaurant openings have increased its brand equity. On top of that, its unparalleled reputation makes it a household name consumers consistently turn to.

Chipotle’s P/E ratio based on the next 12 months is 31.9x. This multiple tells us that a lot of good news is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $45.18 on the company (compared to the current share price of $36.82).