Cohen & Steers (CNS)

We’re not sold on Cohen & Steers. Its revenue and earnings have underwhelmed, suggesting weak business fundamentals.― StockStory Analyst Team

1. News

2. Summary

Why Cohen & Steers Is Not Exciting

Founded in 1986 as a pioneer in real estate investment trusts (REITs), Cohen & Steers (NYSE:CNS) is an investment manager specializing in real estate securities, infrastructure, real assets, and preferred securities for institutional and individual investors.

- Performance over the past five years shows its incremental sales were less profitable, as its 3.7% annual earnings per share growth trailed its revenue gains

- Muted 5.4% annual revenue growth over the last five years shows its demand lagged behind its financials peers

- A bright spot is that its ROE punches in at 40.5%, illustrating management’s expertise in identifying profitable investments

Cohen & Steers doesn’t fulfill our quality requirements. You should search for better opportunities.

Why There Are Better Opportunities Than Cohen & Steers

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cohen & Steers

Cohen & Steers is trading at $65.87 per share, or 20.2x forward P/E. Not only does Cohen & Steers trade at a premium to companies in the financials space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Cohen & Steers (CNS) Research Report: Q4 CY2025 Update

Investment management firm Cohen & Steers (NYSE:CNS) met Wall Streets revenue expectations in Q4 CY2025, with sales up 2.9% year on year to $143.8 million. Its non-GAAP profit of $0.81 per share was in line with analysts’ consensus estimates.

Cohen & Steers (CNS) Q4 CY2025 Highlights:

- Revenue: $143.8 million vs analyst estimates of $143.2 million (2.9% year-on-year growth, in line)

- Pre-tax Profit: $42.29 million (29.4% margin)

- Adjusted EPS: $0.81 vs analyst estimates of $0.81 (in line)

- Market Capitalization: $3.54 billion

Company Overview

Founded in 1986 as a pioneer in real estate investment trusts (REITs), Cohen & Steers (NYSE:CNS) is an investment manager specializing in real estate securities, infrastructure, real assets, and preferred securities for institutional and individual investors.

The company operates through three main account types: institutional accounts, open-end mutual funds, and closed-end mutual funds. For institutional clients, Cohen & Steers manages customized portfolios tailored to specific investment preferences outlined in advisory agreements. These include subadvisory relationships where the firm manages investments while another entity oversees its performance.

Cohen & Steers' open-end mutual funds continuously issue and redeem shares based on investor activity, with prices determined by daily net asset value calculations. In contrast, its closed-end funds have a fixed number of shares trading on the New York Stock Exchange, often at prices that may vary from their underlying asset values based on market demand.

Beyond traditional fund management, the firm provides model-based strategy services, constructing portfolios that fulfill specific investment mandates. It maintains proprietary indices like the Cohen & Steers Realty Majors Index, which serves as the foundation for exchange-traded funds offered by other financial institutions. The company also offers portfolio consulting for investment products such as unit investment trusts.

A pension fund manager might engage Cohen & Steers to allocate a portion of their portfolio to global infrastructure assets, benefiting from the firm's specialized expertise in evaluating toll roads, airports, and utility companies. The firm generates revenue primarily through management fees calculated as a percentage of assets under management, with rates varying by account type and investment strategy. As a registered investment adviser, Cohen & Steers operates under the regulatory oversight of the SEC and must comply with various securities laws and trading regulations.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Cohen & Steers competes with other specialized asset managers like Brookfield Asset Management (NYSE:BAM), Nuveen (a subsidiary of TIAA), BlackRock (NYSE:BLK), and Invesco (NYSE:IVZ) in the real assets and alternative investment space.

5. Revenue Growth

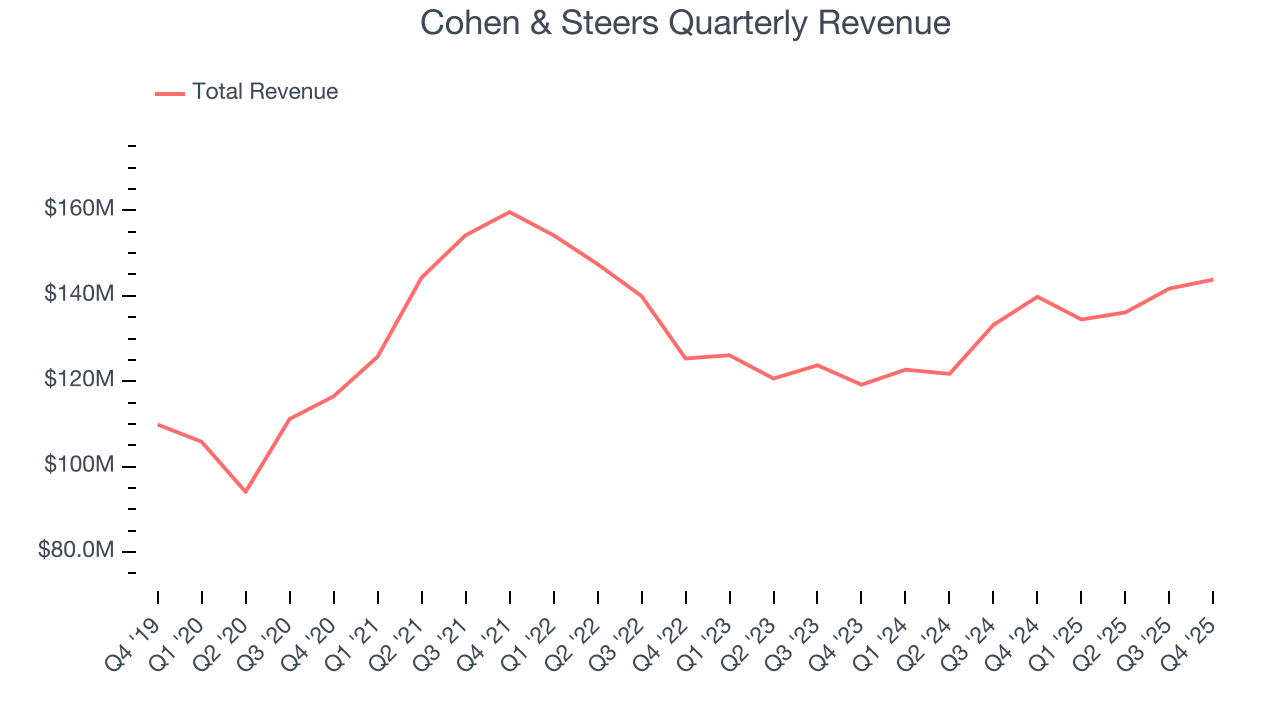

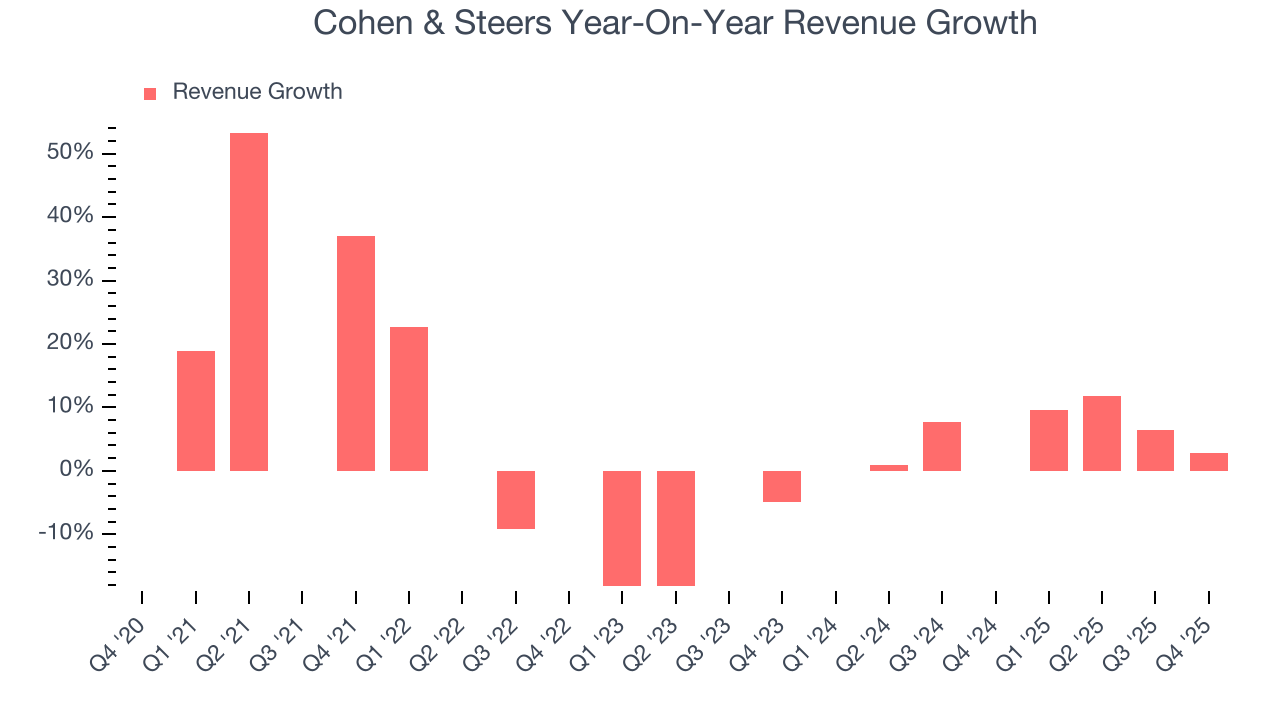

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Cohen & Steers’s revenue grew at a tepid 5.4% compounded annual growth rate over the last five years. This was below our standard for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Cohen & Steers’s annualized revenue growth of 6.6% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Cohen & Steers grew its revenue by 2.9% year on year, and its $143.8 million of revenue was in line with Wall Street’s estimates.

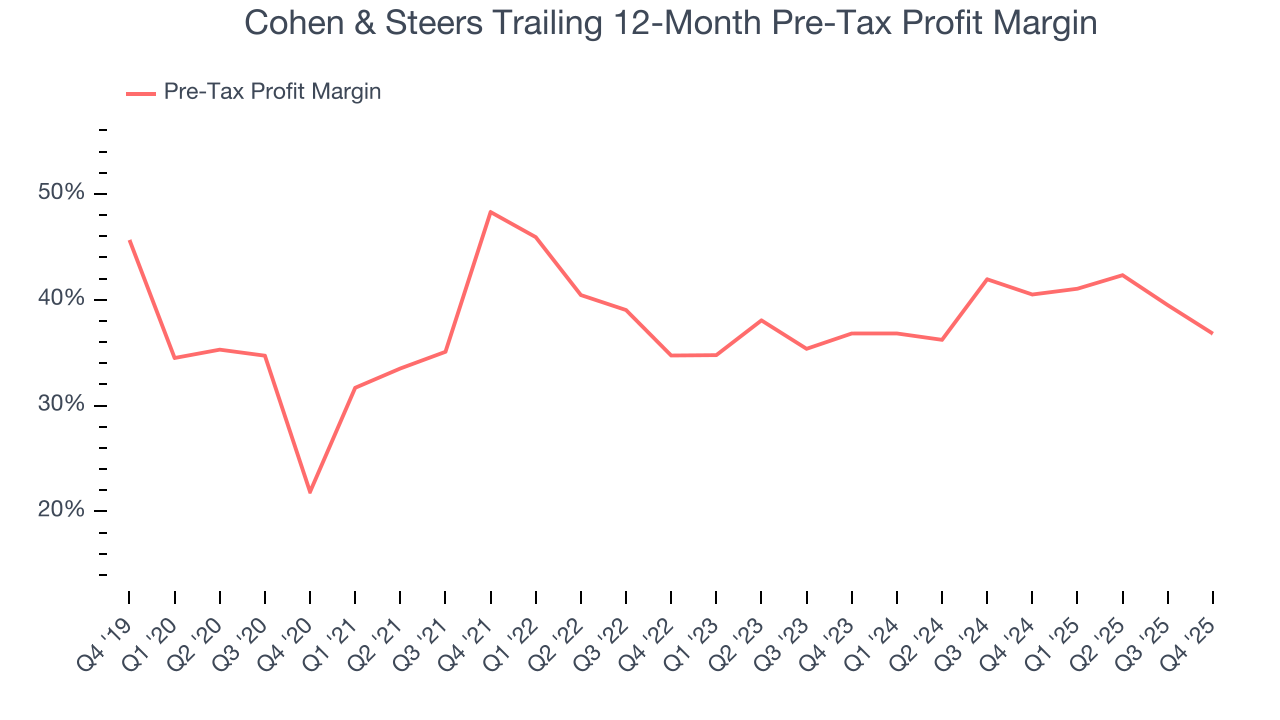

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last five years, Cohen & Steers’s pre-tax profit margin has fallen by 15 percentage points, going from 48.3% to 36.8%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

In Q4, Cohen & Steers’s pre-tax profit margin was 29.4%. This result was 10.4 percentage points worse than the same quarter last year.

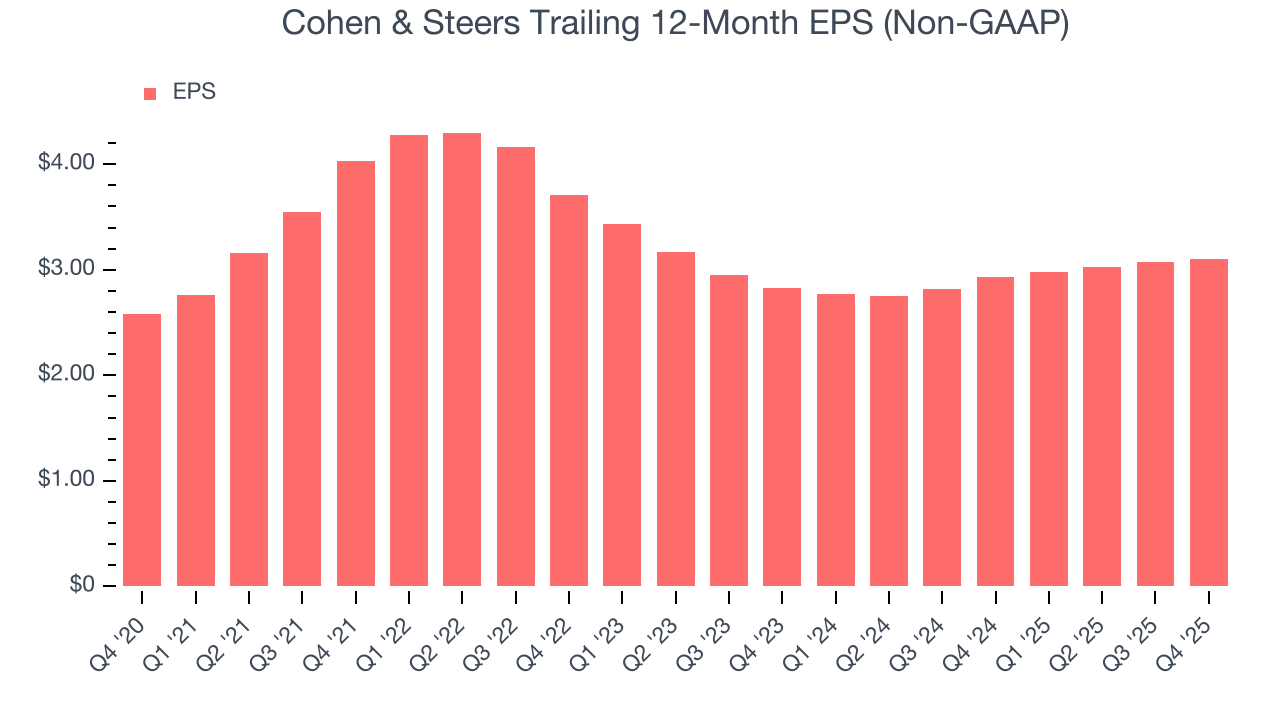

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Cohen & Steers’s weak 3.7% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Cohen & Steers, its two-year annual EPS growth of 4.7% is similar to its five-year trend, implying stable earnings.

In Q4, Cohen & Steers reported adjusted EPS of $0.81, up from $0.78 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Cohen & Steers’s full-year EPS of $3.10 to grow 7.3%.

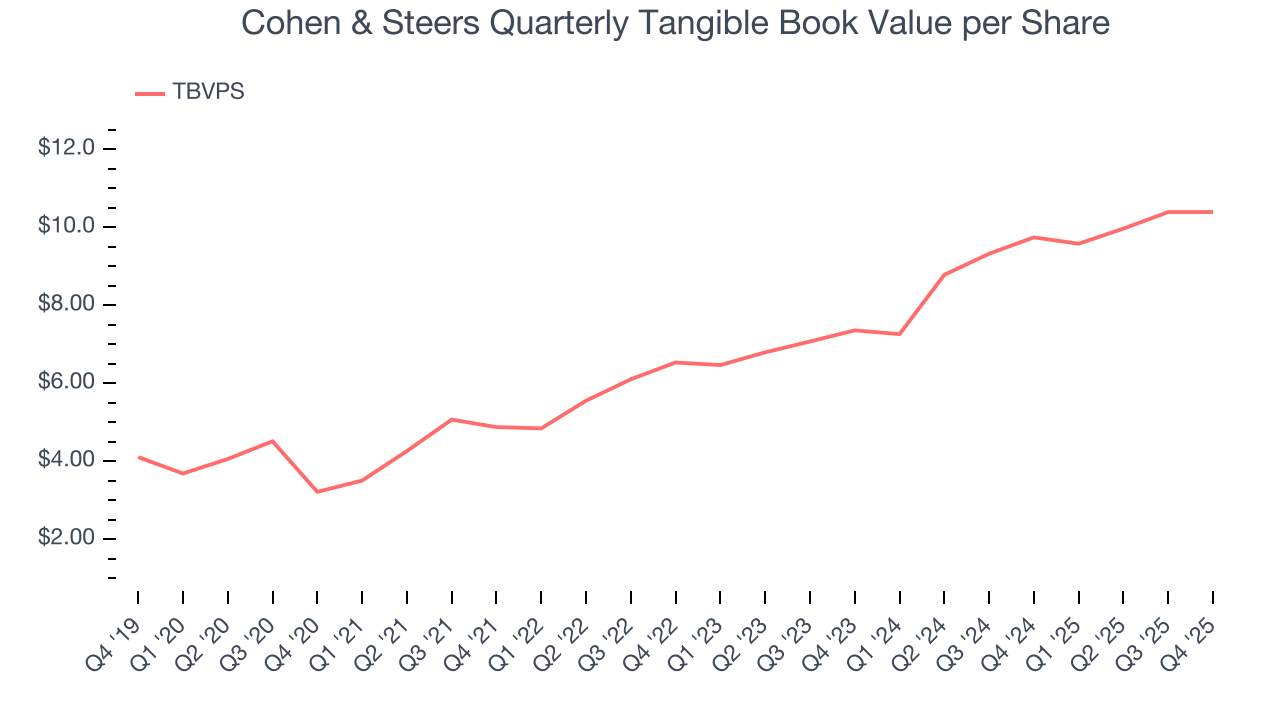

8. Tangible Book Value Per Share (TBVPS)

The balance sheet drives profitability for financial firms since earnings flow from managing diverse assets and liabilities across multiple business lines. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential across their varied operations.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. EPS can become murky due to the complexity of multiple revenue streams, acquisition impacts, or accounting flexibility across different financial services, and book value resists financial engineering manipulation.

Cohen & Steers’s TBVPS grew at an incredible 26.4% annual clip over the last five years. TBVPS growth has recently decelerated to 18.8% annual growth over the last two years (from $7.36 to $10.40 per share).

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Cohen & Steers has averaged an ROE of 41.5%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Cohen & Steers.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Cohen & Steers has no debt, so leverage is not an issue here.

11. Key Takeaways from Cohen & Steers’s Q4 Results

We struggled to find many positives in these results. Zooming out, we think this was a mixed quarter. The stock remained flat at $68.78 immediately following the results.

12. Is Now The Time To Buy Cohen & Steers?

Updated: January 24, 2026 at 11:46 PM EST

Before deciding whether to buy Cohen & Steers or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are some bright spots in Cohen & Steers’s fundamentals, but its business quality ultimately falls short. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Cohen & Steers’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, its stellar ROE suggests it has been a well-run company historically.

Cohen & Steers’s P/E ratio based on the next 12 months is 20.2x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $72.33 on the company (compared to the current share price of $65.87).