Coherent (COHR)

Coherent catches our eye. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why Coherent Is Interesting

Created through the 2022 rebranding of II-VI Incorporated, a company with roots dating back to 1971, Coherent (NYSE:COHR) develops and manufactures advanced materials, lasers, and optical components for applications ranging from telecommunications to industrial manufacturing.

- Annual revenue growth of 16.9% over the last five years was superb and indicates its market share increased during this cycle

- Projected revenue growth of 24% for the next 12 months is above its two-year trend, pointing to accelerating demand

- On a dimmer note, its below-average returns on capital indicate management struggled to find compelling investment opportunities, and its falling returns suggest its earlier profit pools are drying up

Coherent almost passes our quality test. This company is certainly worth watching.

Why Should You Watch Coherent

High Quality

Investable

Underperform

Why Should You Watch Coherent

Coherent is trading at $242.75 per share, or 40.6x forward P/E. The lofty valuation multiple means there’s plenty of good news priced into shares; short-term volatility could result if anything (e.g. a mediocre quarter) rains on that parade.

Coherent could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Coherent (COHR) Research Report: Q4 CY2025 Update

Materials and photonics company Coherent (NYSE:COHR) announced better-than-expected revenue in Q4 CY2025, with sales up 17.5% year on year to $1.69 billion. On top of that, next quarter’s revenue guidance ($1.77 billion at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $1.29 per share was 7% above analysts’ consensus estimates.

Coherent (COHR) Q4 CY2025 Highlights:

- Revenue: $1.69 billion vs analyst estimates of $1.64 billion (17.5% year-on-year growth, 2.9% beat)

- Adjusted EPS: $1.29 vs analyst estimates of $1.21 (7% beat)

- Adjusted Operating Income: $336 million vs analyst estimates of $328.1 million (19.9% margin, 2.4% beat)

- Revenue Guidance for Q1 CY2026 is $1.77 billion at the midpoint, above analyst estimates of $1.71 billion

- Adjusted EPS guidance for Q1 CY2026 is $1.38 at the midpoint, above analyst estimates of $1.32

- Operating Margin: 10%, in line with the same quarter last year

- Free Cash Flow Margin: 3.4%, down from 5.7% in the same quarter last year

- Market Capitalization: $39.12 billion

Company Overview

Created through the 2022 rebranding of II-VI Incorporated, a company with roots dating back to 1971, Coherent (NYSE:COHR) develops and manufactures advanced materials, lasers, and optical components for applications ranging from telecommunications to industrial manufacturing.

Coherent operates through three main segments: Networking, Materials, and Lasers. The company's vertically integrated approach allows it to control the entire production chain from raw materials to finished products, giving it a competitive edge in specialized markets.

In its Materials segment, Coherent produces engineered substrates like silicon carbide (SiC), which are critical for electric vehicles and 5G wireless infrastructure. These materials enable more efficient power conversion in EV drivetrains and better performance in high-frequency communications equipment. The company was first to market with 200mm SiC wafers, an important advancement for scaling production of power electronics.

The Networking segment focuses on optical communications components that enable high-speed data transmission. Coherent manufactures lasers, photodetectors, and integrated modules that form the backbone of fiber-optic networks, including transceivers that can transmit data at rates up to 1.6 terabits per second. These components are essential for datacenters supporting artificial intelligence and machine learning applications, which require enormous bandwidth.

In the Lasers segment, Coherent produces a wide range of laser systems used in manufacturing processes like cutting, welding, and precision machining. For example, its CO2 lasers are used to cut organic materials like textiles and plastics, while its fiber lasers cut and weld metals in automotive production. The company also makes specialized excimer lasers used in semiconductor lithography and display manufacturing.

Beyond these core segments, Coherent serves specialized markets like aerospace and defense, where its optical components are used in missile guidance systems and satellite communications. In life sciences, its lasers and optical systems enable advanced medical diagnostics and treatments, including LASIK eye surgery.

Coherent maintains manufacturing and R&D facilities across North America, Europe, and Asia, with specialized U.S. facilities dedicated to government and defense contracts. This global footprint allows the company to serve customers worldwide while maintaining strict controls over its proprietary technologies and manufacturing processes.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Coherent's competitors include Lumentum Operations LLC and MKS Instruments in the photonics space, Wolfspeed in silicon carbide substrates, IPG Photonics in industrial lasers, and Broadcom and InnoLight Technology in optical communications components.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $6.29 billion in revenue over the past 12 months, Coherent is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

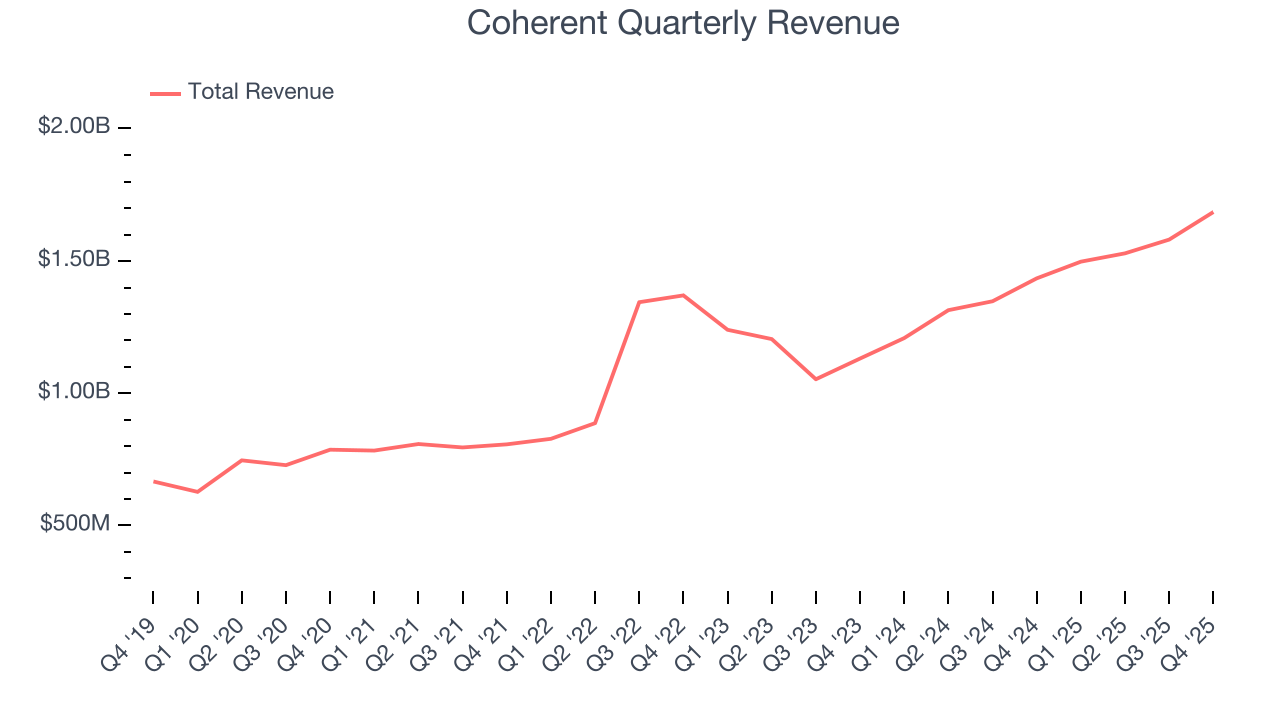

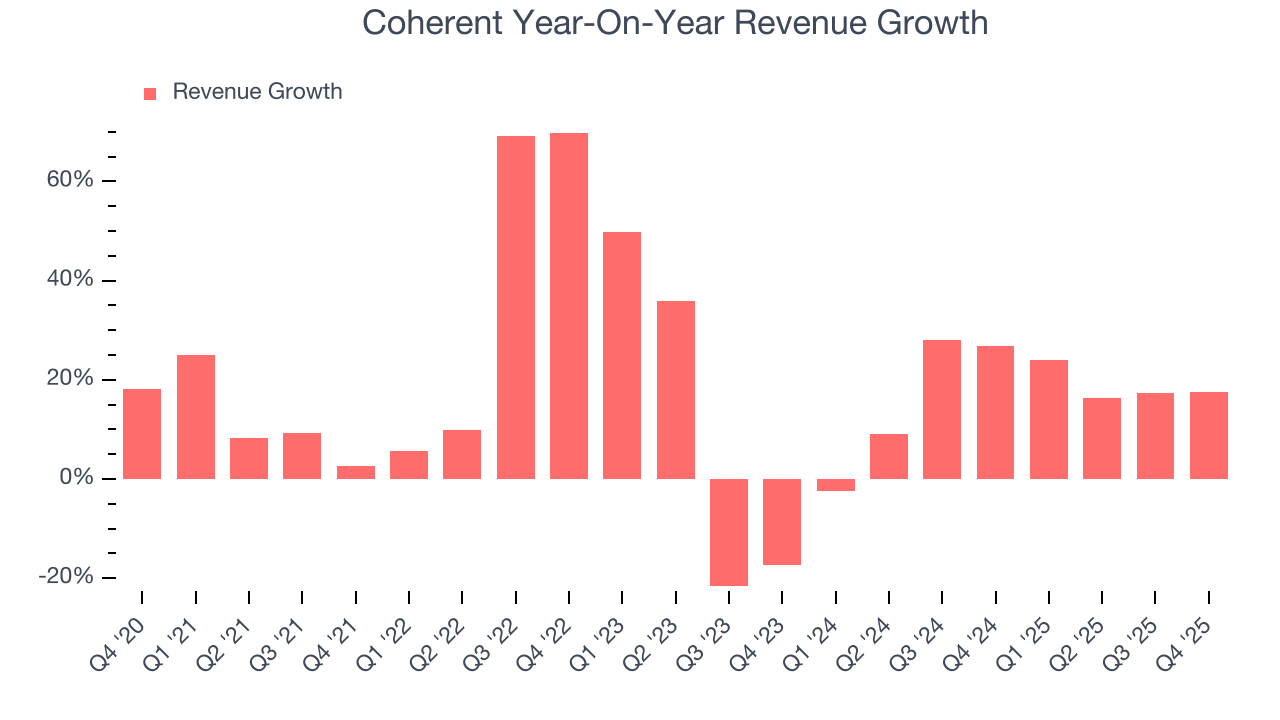

As you can see below, Coherent grew its sales at an incredible 16.9% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Coherent’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Coherent’s annualized revenue growth of 16.6% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

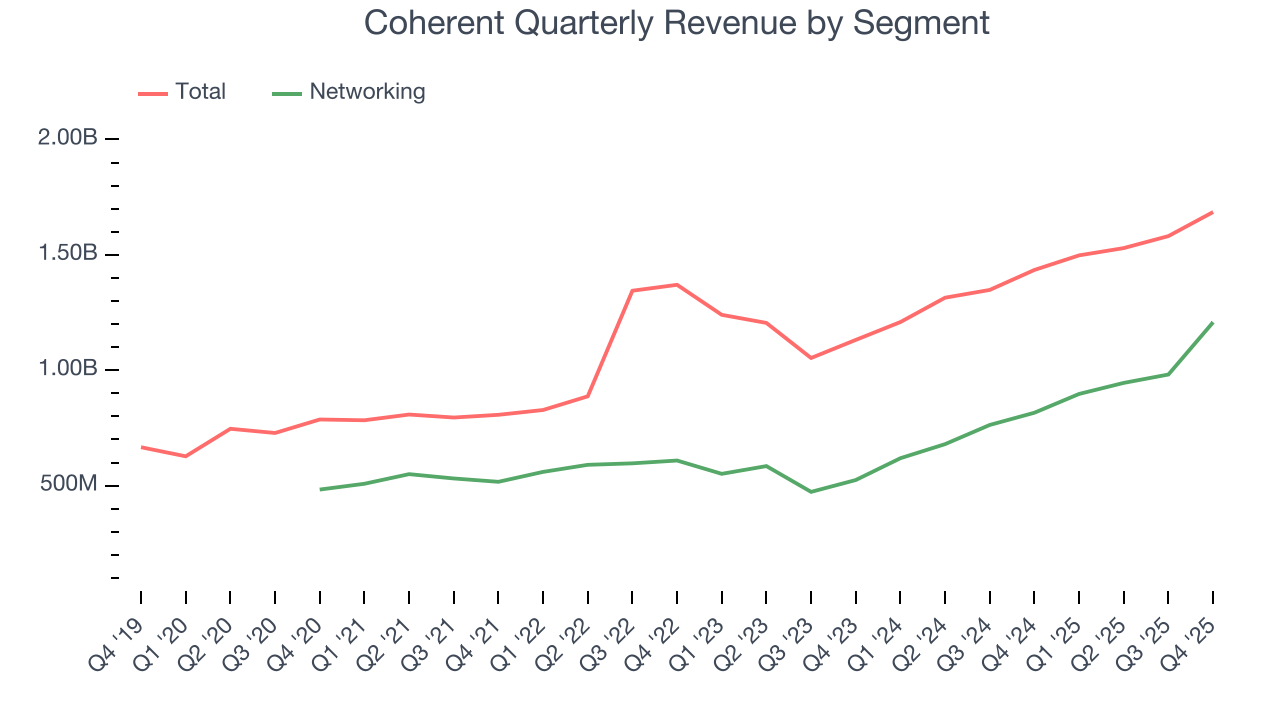

Coherent also breaks out the revenue for its most important segment, Networking. Over the last two years, Coherent’s Networking revenue (communications components and subsystems) averaged 38.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Coherent reported year-on-year revenue growth of 17.5%, and its $1.69 billion of revenue exceeded Wall Street’s estimates by 2.9%. Company management is currently guiding for a 18.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.8% over the next 12 months, similar to its two-year rate. This projection is eye-popping and suggests the market is baking in success for its products and services.

6. Adjusted Operating Margin

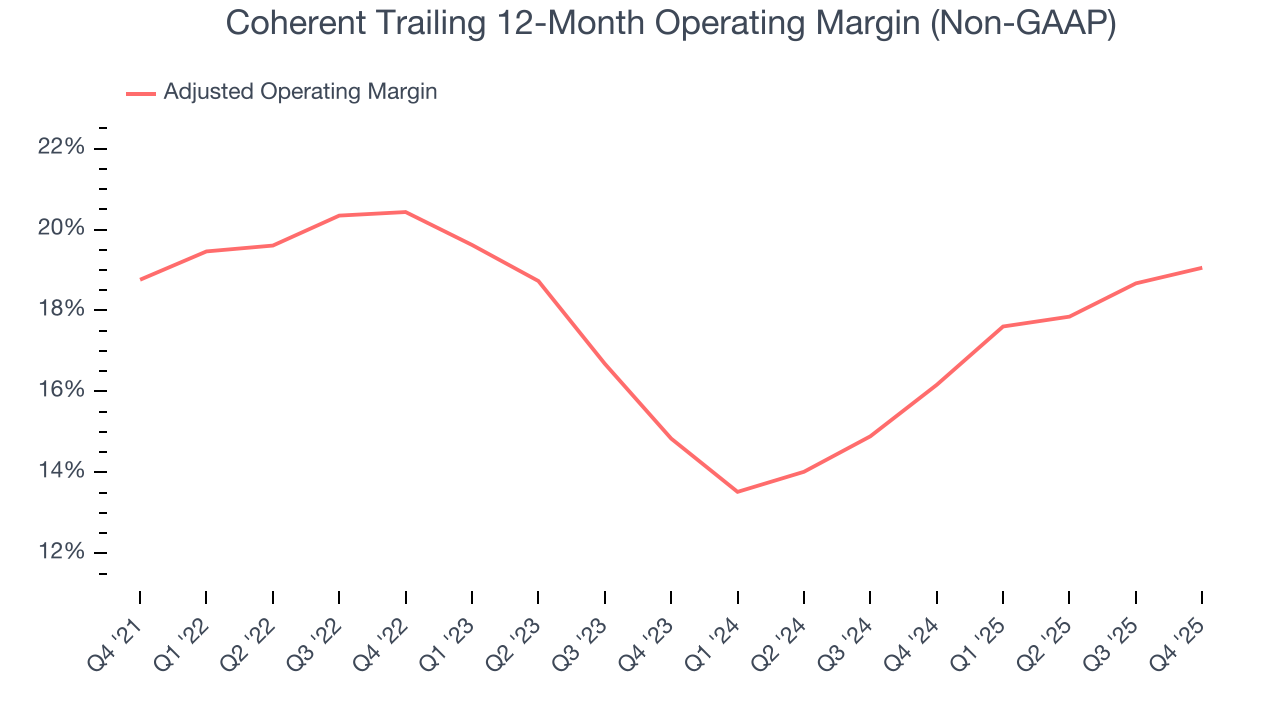

Coherent’s adjusted operating margin has risen over the last 12 months and averaged 17.8% over the last five years. On top of that, its profitability was top-notch for a business services business, showing it’s an well-run company that manages its expenses efficiently and benefits from immense operating leverage as it scales.

Analyzing the trend in its profitability, Coherent’s adjusted operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Coherent generated an adjusted operating margin profit margin of 19.9%, up 1.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

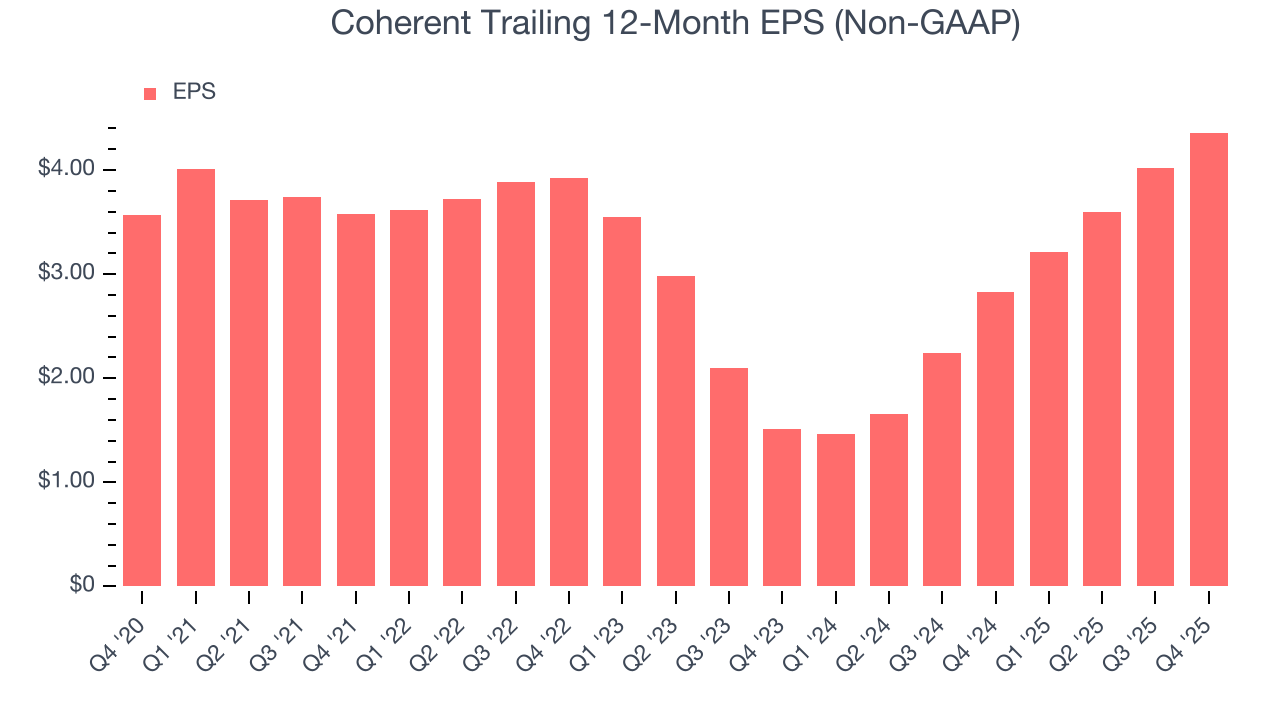

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Coherent’s EPS grew at an unimpressive 4.1% compounded annual growth rate over the last five years, lower than its 16.9% annualized revenue growth. However, its adjusted operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Coherent, its two-year annual EPS growth of 69.9% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q4, Coherent reported adjusted EPS of $1.29, up from $0.95 in the same quarter last year. This print beat analysts’ estimates by 7%. Over the next 12 months, Wall Street expects Coherent’s full-year EPS of $4.36 to grow 34.7%.

8. Cash Is King

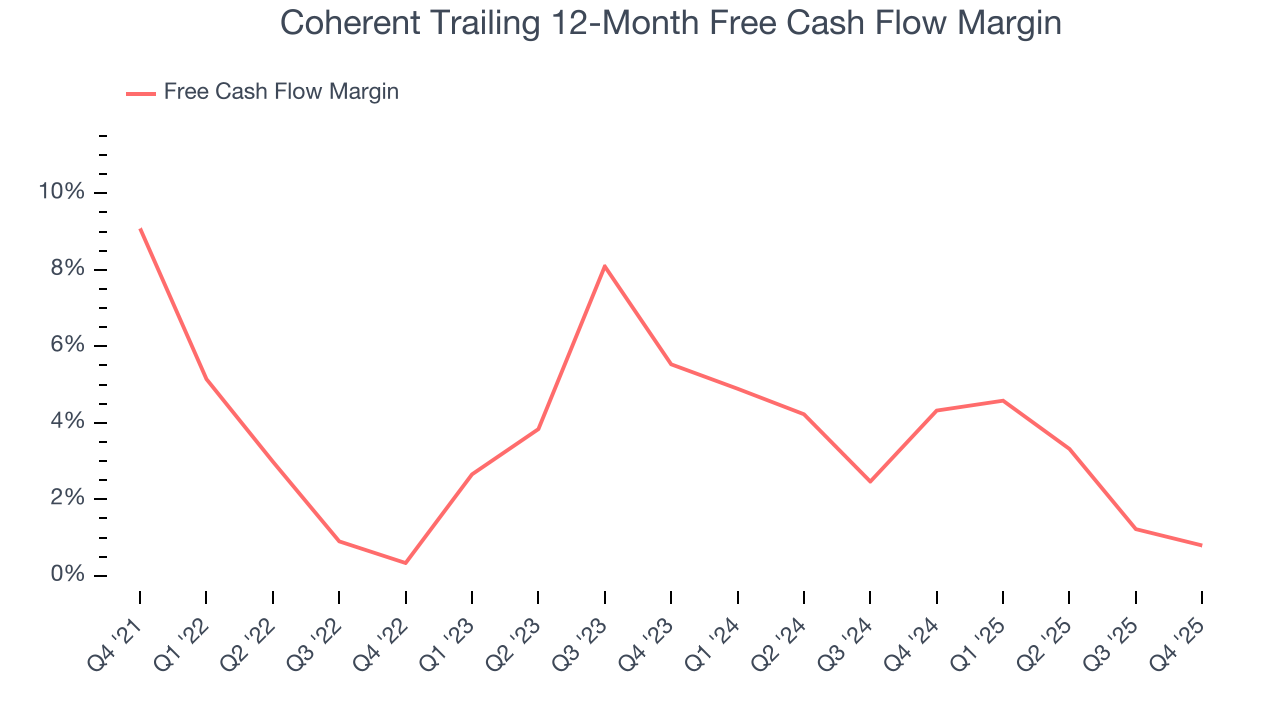

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Coherent has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for a business services business. The divergence from its good adjusted operating margin stems from its capital-intensive business model, which requires Coherent to make large cash investments in working capital and capital expenditures.

Taking a step back, we can see that Coherent’s margin dropped by 8.3 percentage points during that time. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Coherent’s free cash flow clocked in at $57.84 million in Q4, equivalent to a 3.4% margin. The company’s cash profitability regressed as it was 2.3 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

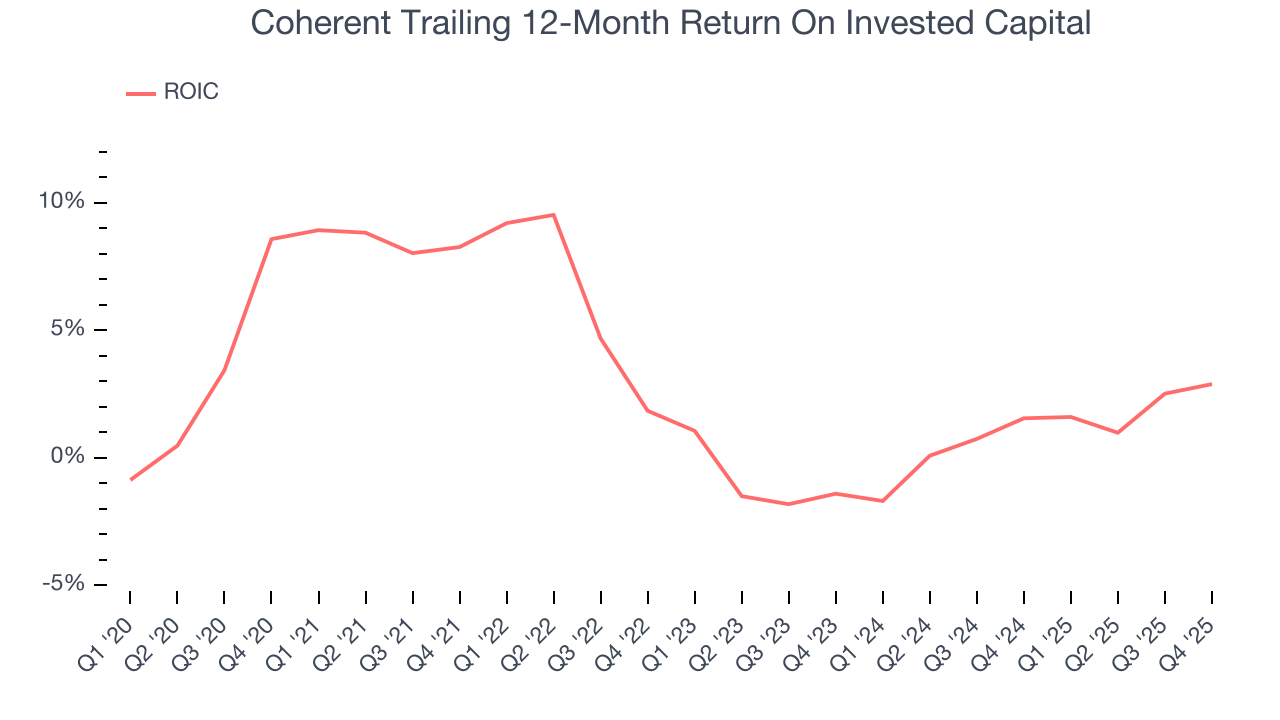

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Coherent has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.6%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Coherent’s ROIC averaged 2.8 percentage point decreases each year. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

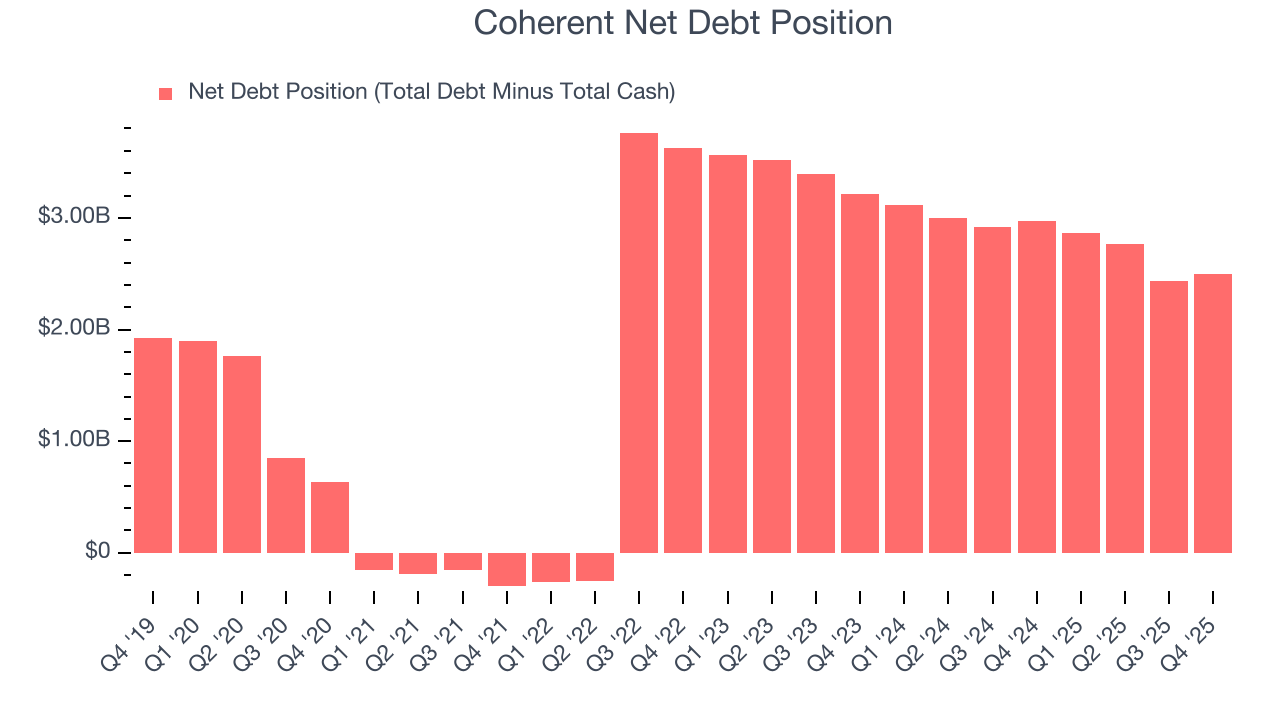

10. Balance Sheet Assessment

Coherent reported $899.2 million of cash and $3.39 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.38 billion of EBITDA over the last 12 months, we view Coherent’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $125.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Coherent’s Q4 Results

We were impressed by Coherent’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 5.8% to $223.40 immediately following the results.

12. Is Now The Time To Buy Coherent?

Updated: February 4, 2026 at 10:23 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Coherent.

We think Coherent is a good business. First off, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its cash profitability fell over the last five years, its projected EPS for the next year implies the company’s fundamentals will improve. On top of that, its impressive operating margins show it has a highly efficient business model.

Coherent’s P/E ratio based on the next 12 months is 39x. This valuation tells us that a lot of optimism is priced in. Coherent is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $203.47 on the company (compared to the current share price of $205.44).