Cencora (COR)

We see solid potential in Cencora. Its market-beating ROIC illustrates its ability to invest in highly profitable ventures.― StockStory Analyst Team

1. News

2. Summary

Why We Like Cencora

Formerly known as AmerisourceBergen until its 2023 rebranding, Cencora (NYSE:COR) is a global pharmaceutical distribution company that connects manufacturers with healthcare providers while offering logistics, data analytics, and consulting services.

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Massive revenue base of $325.8 billion gives it meaningful leverage when negotiating reimbursement rates

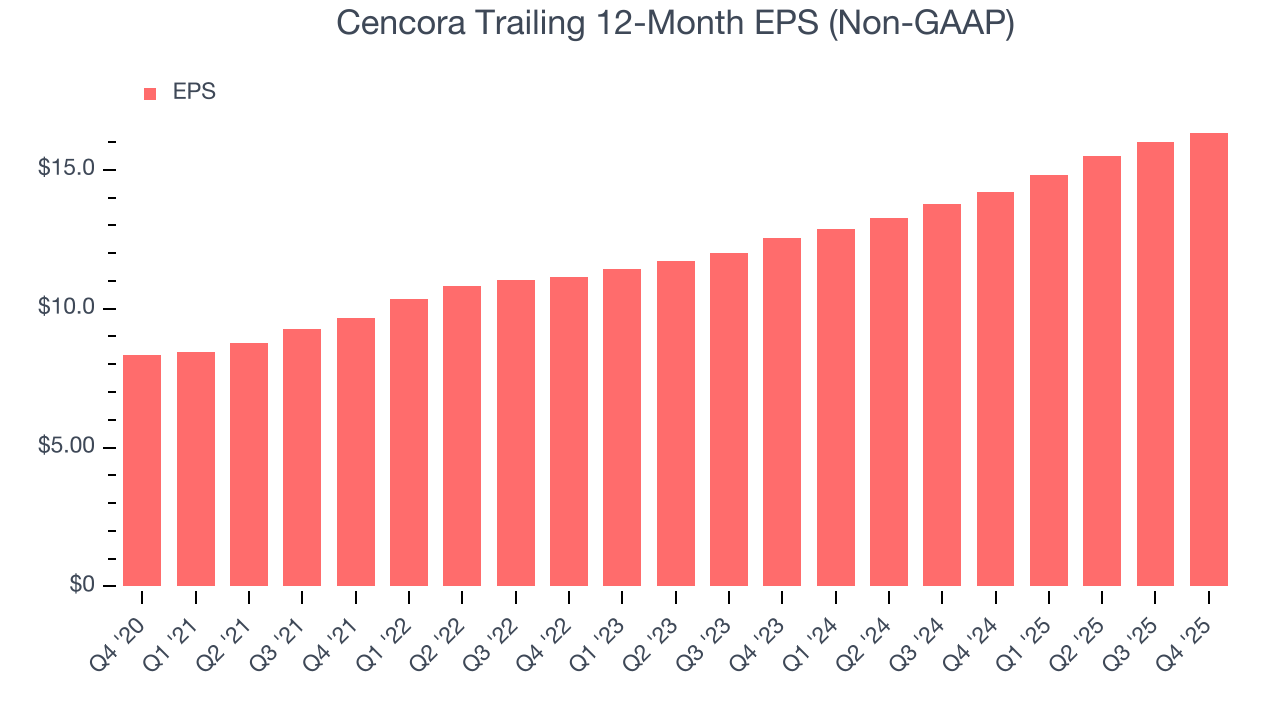

- Earnings per share grew by 14.5% annually over the last five years, massively outpacing its peers

We have an affinity for Cencora. The valuation seems fair in light of its quality, so this might be an opportune time to invest in some shares.

Why Is Now The Time To Buy Cencora?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Cencora?

Cencora is trading at $360.09 per share, or 20.2x forward P/E. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. Cencora (COR) Research Report: Q4 CY2025 Update

Healthcare distributor Cencora (NYSE:COR) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 5.5% year on year to $85.93 billion. Its non-GAAP profit of $4.08 per share was 1% above analysts’ consensus estimates.

Cencora (COR) Q4 CY2025 Highlights:

- Revenue: $85.93 billion vs analyst estimates of $86.45 billion (5.5% year-on-year growth, 0.6% miss)

- Adjusted EPS: $4.08 vs analyst estimates of $4.04 (1% beat)

- Management reiterated its full-year Adjusted EPS guidance of $17.60 at the midpoint

- Operating Margin: 0.9%, in line with the same quarter last year

- Free Cash Flow was -$2.42 billion compared to -$2.82 billion in the same quarter last year

- Market Capitalization: $70.37 billion

Company Overview

Formerly known as AmerisourceBergen until its 2023 rebranding, Cencora (NYSE:COR) is a global pharmaceutical distribution company that connects manufacturers with healthcare providers while offering logistics, data analytics, and consulting services.

Cencora serves as a critical intermediary in the healthcare supply chain, sourcing and distributing pharmaceuticals, specialty medications, over-the-counter products, and medical supplies to a diverse range of customers. The company operates through two main segments: U.S. Healthcare Solutions and International Healthcare Solutions.

In its core distribution business, Cencora acts as the primary supplier for many healthcare providers, maintaining extensive inventory of thousands of products that it delivers through its network of distribution centers. A hospital pharmacy manager might rely on Cencora for daily deliveries of everything from common antibiotics to specialized oncology drugs, ensuring patients receive timely treatments.

Beyond basic distribution, Cencora provides specialty logistics for sensitive biopharmaceutical products requiring temperature-controlled handling. The company also offers data analytics services that help manufacturers understand market trends and healthcare providers optimize their inventory management.

Cencora generates revenue primarily through the markup on pharmaceutical products it distributes, as well as fees for value-added services. Its customer base spans the healthcare spectrum, including retail pharmacy chains, independent pharmacies, hospitals, physician practices, long-term care facilities, and veterinary clinics.

The company has expanded its service offerings to include clinical trial support, regulatory consulting, and commercialization services for pharmaceutical manufacturers. This positions Cencora to participate in multiple stages of a drug's lifecycle, from development through market distribution.

With operations across North America and Europe, Cencora leverages its scale and technology investments to maintain efficient distribution networks that can deliver products quickly while meeting strict regulatory requirements for pharmaceutical handling and tracking.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Cencora's primary competitors in pharmaceutical distribution include McKesson Corporation (NYSE:MCK) and Cardinal Health (NYSE:CAH), which together with Cencora form the "Big Three" distributors that dominate the U.S. market. In specialty logistics, the company competes with UPS Healthcare (NYSE:UPS) and FedEx (NYSE:FDX).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $325.8 billion in revenue over the past 12 months, Cencora is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

6. Revenue Growth

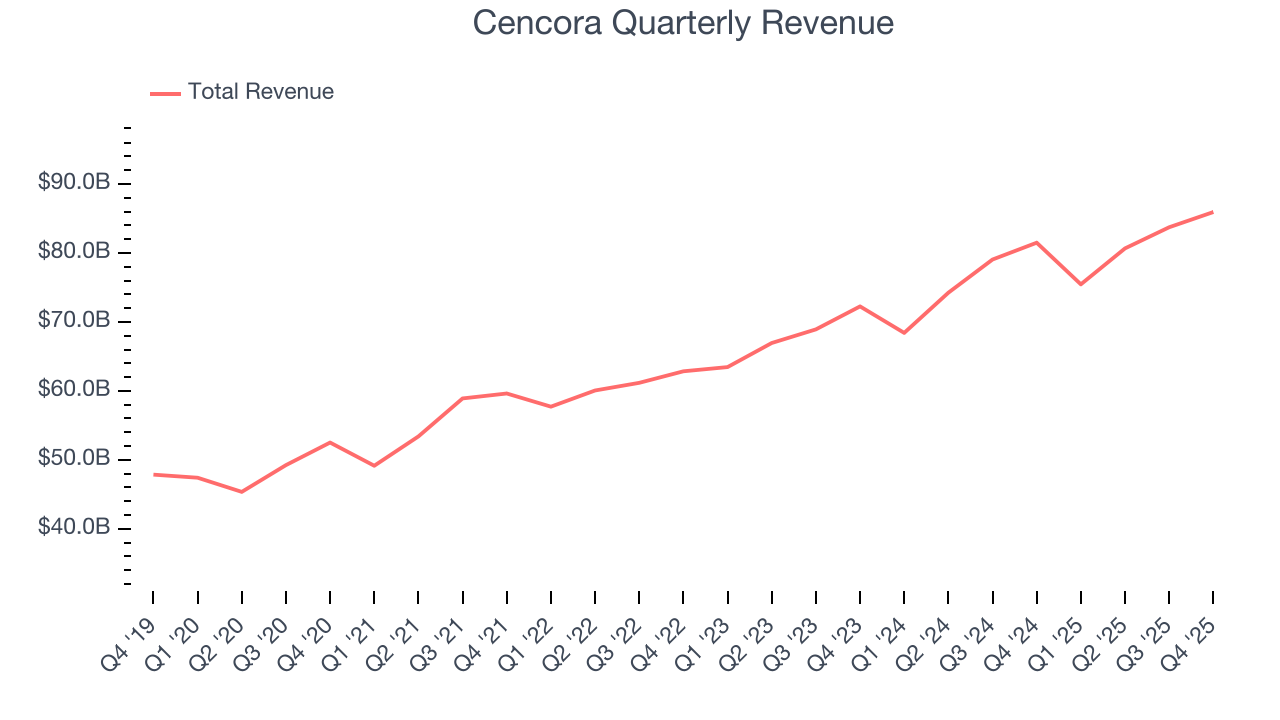

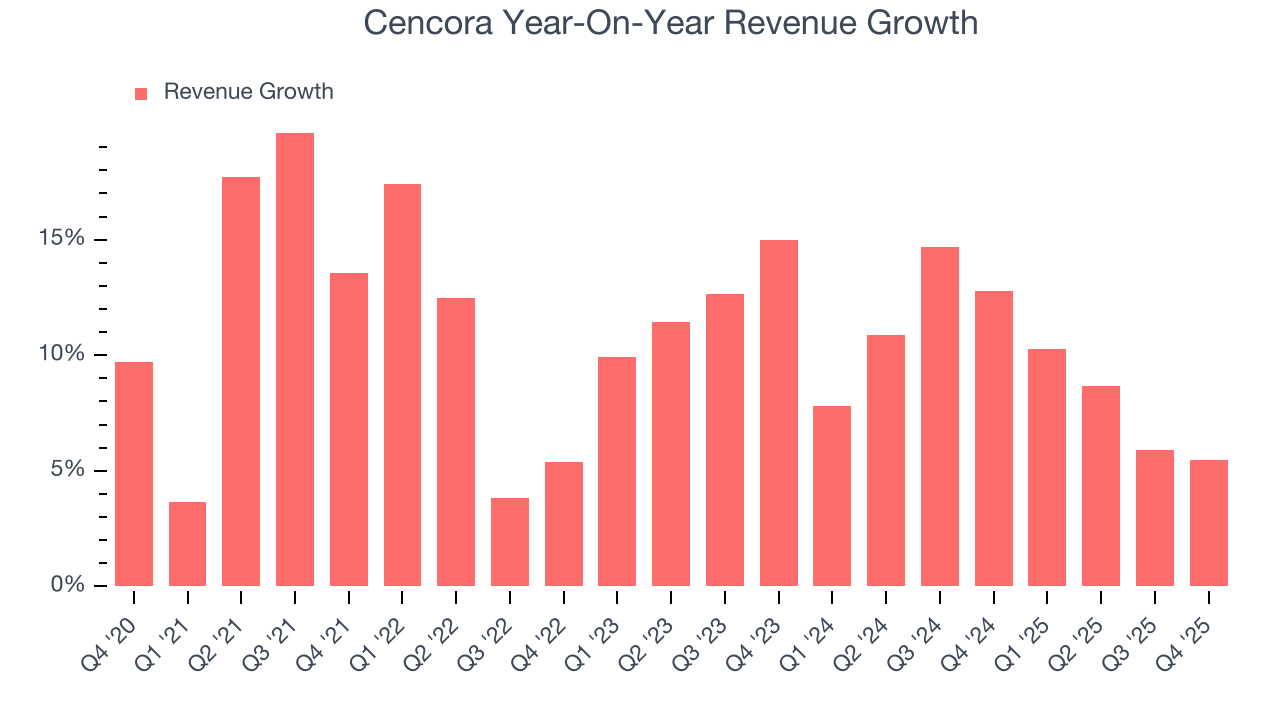

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Cencora grew its sales at a decent 10.9% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Cencora’s annualized revenue growth of 9.5% over the last two years is below its five-year trend, but we still think the results were respectable.

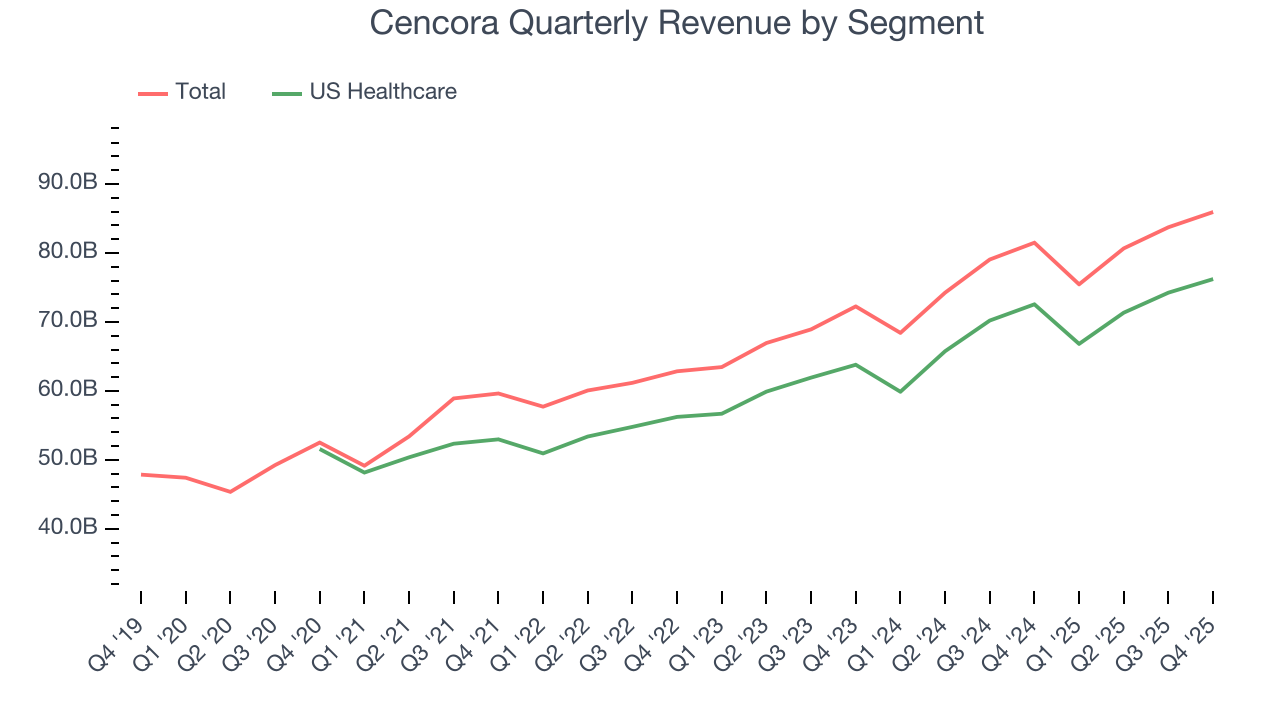

We can dig further into the company’s revenue dynamics by analyzing its most important segment, US Healthcare. Over the last two years, Cencora’s US Healthcare revenue averaged 9.2% year-on-year growth.

This quarter, Cencora’s revenue grew by 5.5% year on year to $85.93 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is forecasting success for its products and services.

7. Operating Margin

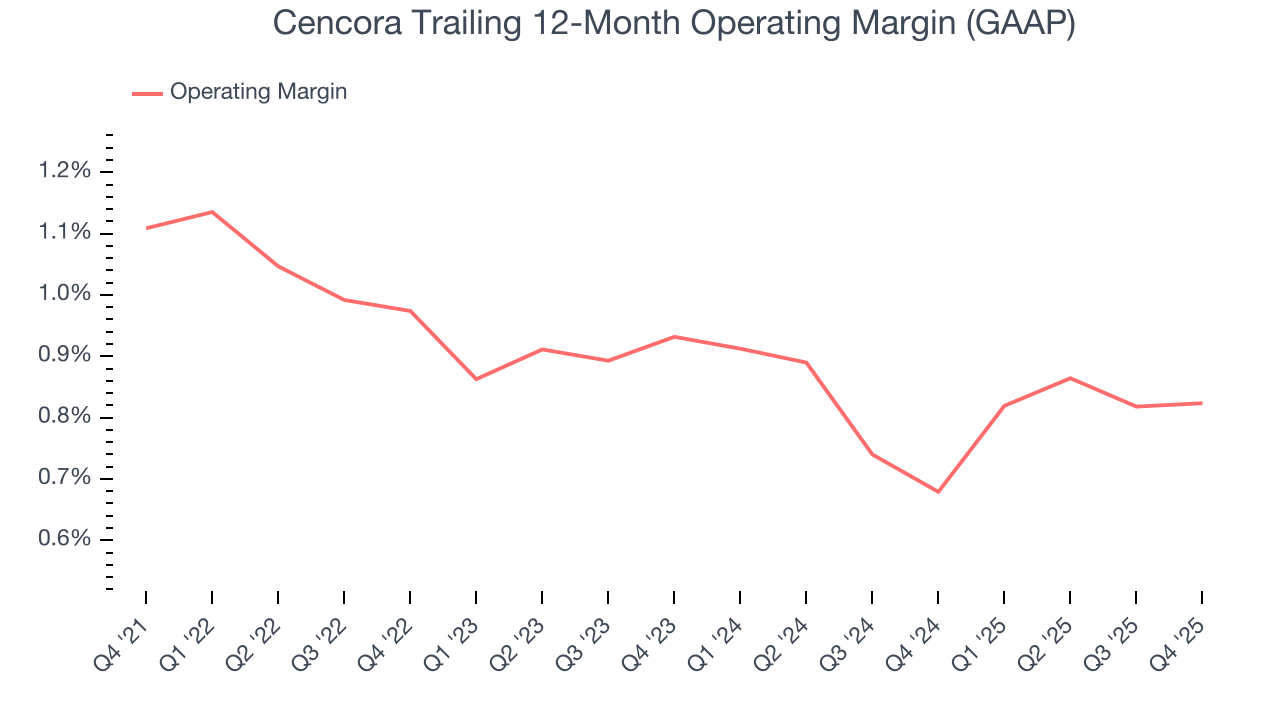

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Cencora’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last five years, lousy for a healthcare business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

Looking at the trend in its profitability, Cencora’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Cencora’s breakeven margin was in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Cencora’s EPS grew at a spectacular 14.5% compounded annual growth rate over the last five years, higher than its 10.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

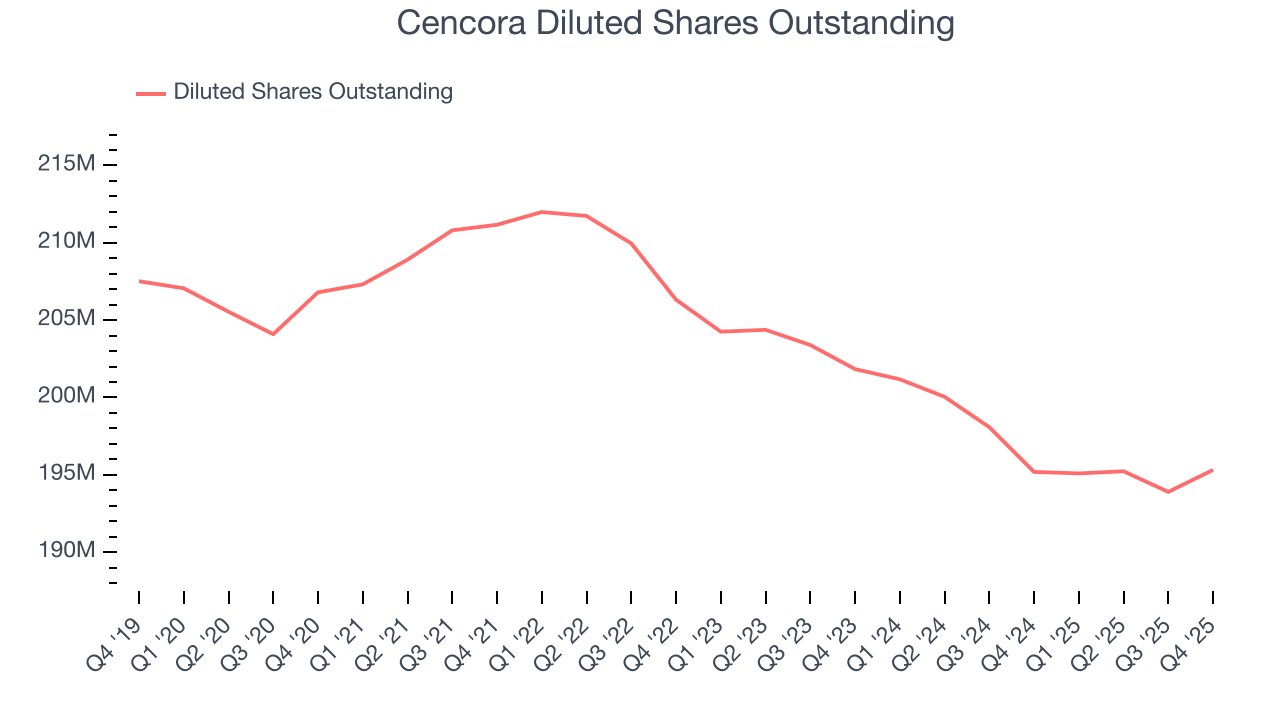

We can take a deeper look into Cencora’s earnings quality to better understand the drivers of its performance. A five-year view shows that Cencora has repurchased its stock, shrinking its share count by 5.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Cencora reported adjusted EPS of $4.08, up from $3.73 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Cencora’s full-year EPS of $16.34 to grow 10%.

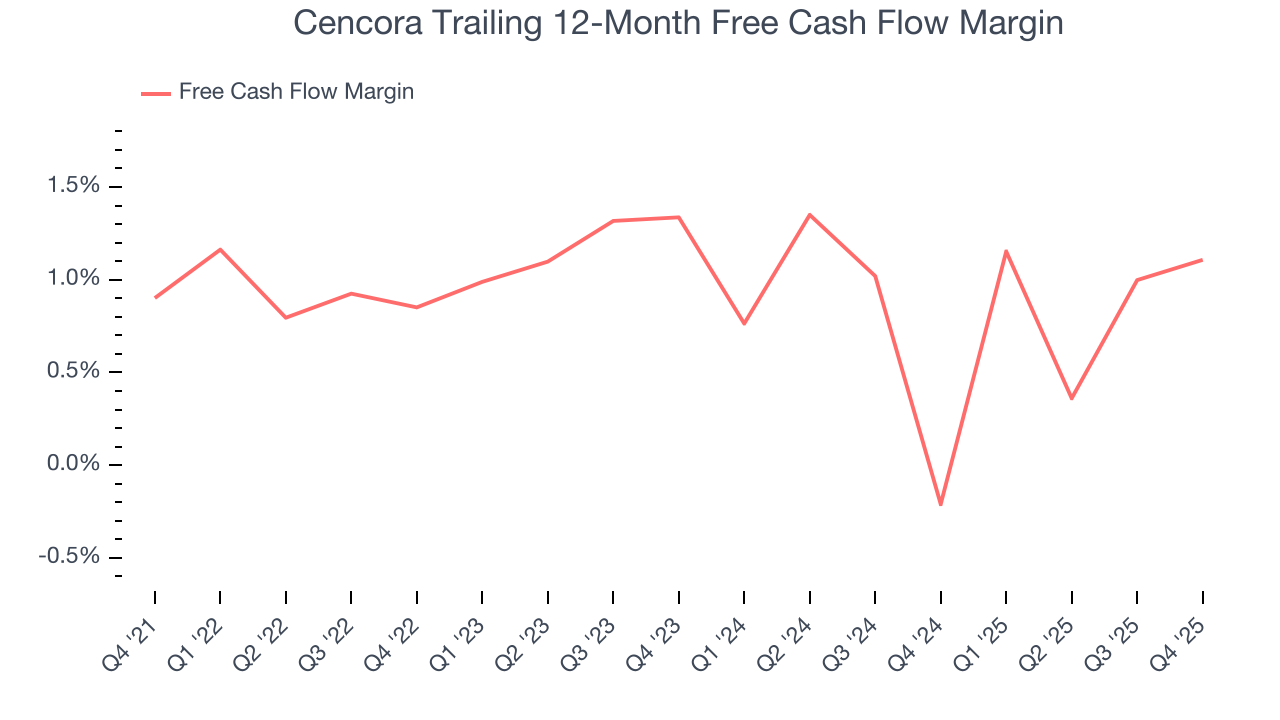

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Cencora broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Cencora burned through $2.42 billion of cash in Q4, equivalent to a negative 2.8% margin. The company’s cash burn slowed from $2.82 billion of lost cash in the same quarter last year.

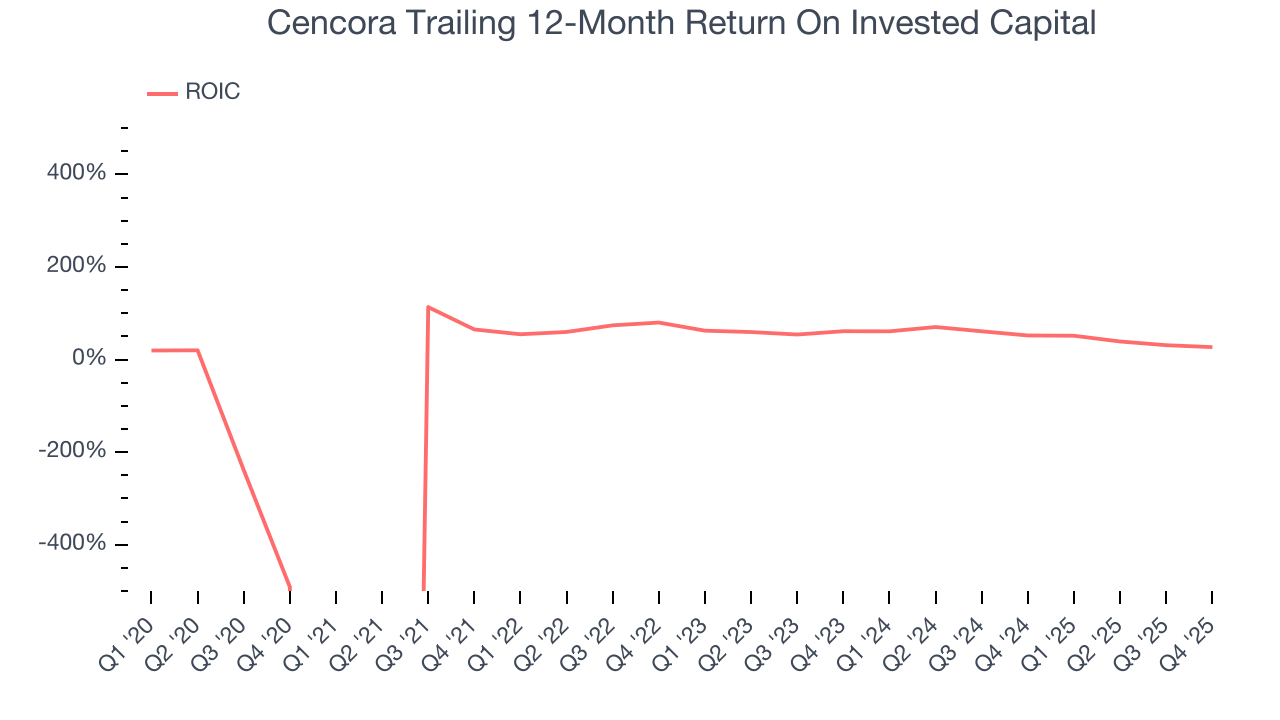

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Cencora’s five-year average ROIC was 57%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Cencora’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

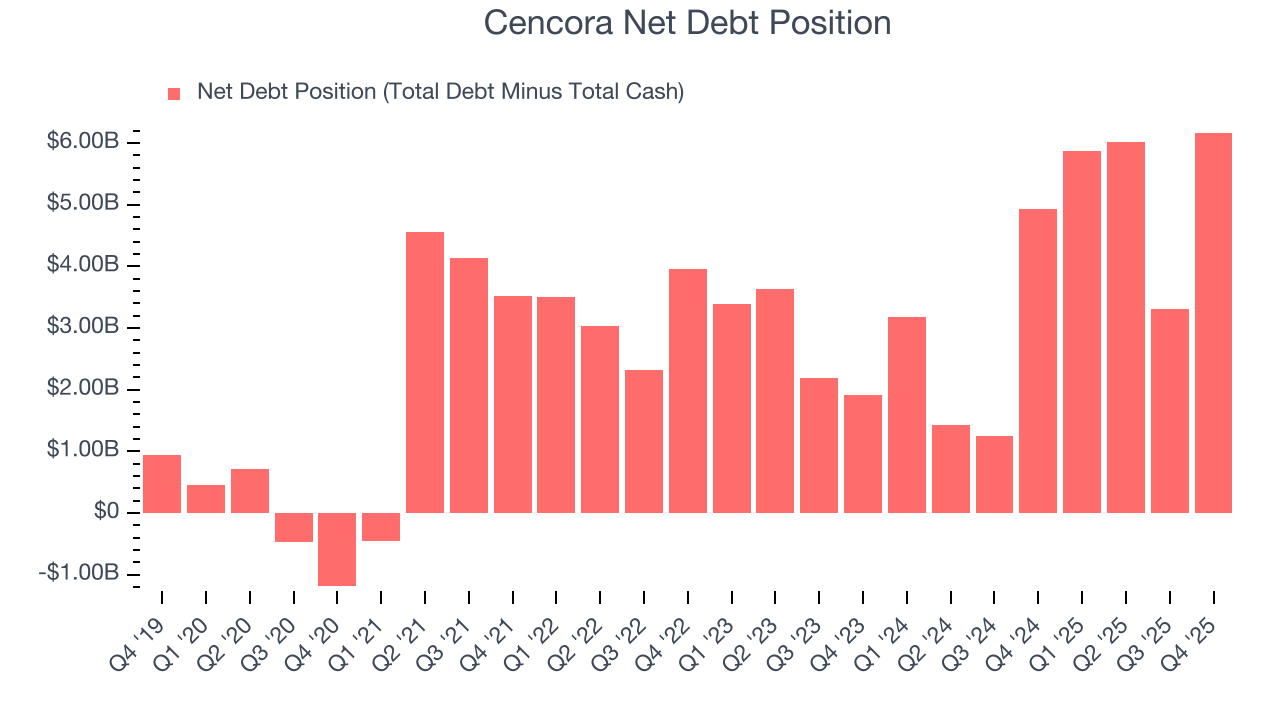

Cencora reported $1.75 billion of cash and $7.92 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $4.70 billion of EBITDA over the last 12 months, we view Cencora’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $191.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Cencora’s Q4 Results

Revenue missed, and this is weighing on shares. While EPS managed to beat, it was still a softer quarter. The stock traded down 3.1% to $350.51 immediately following the results.

13. Is Now The Time To Buy Cencora?

Updated: February 18, 2026 at 11:08 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Cencora, you should also grasp the company’s longer-term business quality and valuation.

There are multiple reasons why we think Cencora is an amazing business. First of all, the company’s revenue growth was good over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale gives it meaningful leverage when negotiating reimbursement rates. On top of that, Cencora’s stellar ROIC suggests it has been a well-run company historically.

Cencora’s P/E ratio based on the next 12 months is 20.2x. Looking across the spectrum of healthcare companies today, Cencora’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $403.79 on the company (compared to the current share price of $360.09), implying they see 12.1% upside in buying Cencora in the short term.