Carlisle (CSL)

Carlisle catches our eye. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Carlisle Is Interesting

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE:CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its profits increased over the last five years as it scaled

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders, and its rising cash conversion increases its margin of safety

- A downside is its estimated sales growth of 2% for the next 12 months implies demand will slow from its two-year trend

Carlisle is solid, but not perfect. If you like the story, the price looks reasonable.

Why Is Now The Time To Buy Carlisle?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Carlisle?

Carlisle is trading at $369.50 per share, or 16.7x forward P/E. Carlisle’s current multiple might be below that of most industrials peers, but we think this valuation is warranted after considering its business quality.

It could be a good time to invest if you see something the market doesn’t.

3. Carlisle (CSL) Research Report: Q4 CY2025 Update

Building envelope solutions provider Carlisle Companies (NYSE:CSL) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.13 billion. Its non-GAAP profit of $3.90 per share was 8.9% above analysts’ consensus estimates.

Carlisle (CSL) Q4 CY2025 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.11 billion (flat year on year, 1.4% beat)

- Adjusted EPS: $3.90 vs analyst estimates of $3.58 (8.9% beat)

- Adjusted EBITDA: $249 million vs analyst estimates of $234.2 million (22.1% margin, 6.3% beat)

- Operating Margin: 16.8%, down from 19.9% in the same quarter last year

- Free Cash Flow Margin: 31.2%, similar to the same quarter last year

- Organic Revenue fell 2.5% year on year (beat)

- Market Capitalization: $14.32 billion

Company Overview

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE:CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Due to the nature of its products, most of Carlisle's customers are industrial and commercial companies.

For example, in the construction industry, it provides products like building envelopes (weatherproofing materials needed for real estate development), insulation, engineered metal roofing, and panel systems. In other industries such as commercial aerospace, defense electronics, and medicine, Carlisle manufactures high-performance wire, cable, and other electronic devices. In addition, the company makes liquid, powder, sealants, and adhesive finishing equipment.

Specifically, commercial contractors are a key source of revenue while aircraft manufacturers, defense contractors, medical equipment companies, and automotive manufacturers are also part of Carlisle’s customer base. Prices paid by these customers can vary even for the same products depending on volumes and purchase frequency.

Carlisle’s products can be broken down into three key categories: construction materials, technologies, and fluids. Construction materials make up the vast majority of its revenue, followed by its technologies and fluid industry products.

4. Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Companies providing construction materials include Owens Corning (NYSE:OC); companies competing in the technological sector of Carlisle include TE Connectivity (NYSE:TEL); and companies competing in the fluid technologies industry include Graco (NYSE:GGG).

5. Revenue Growth

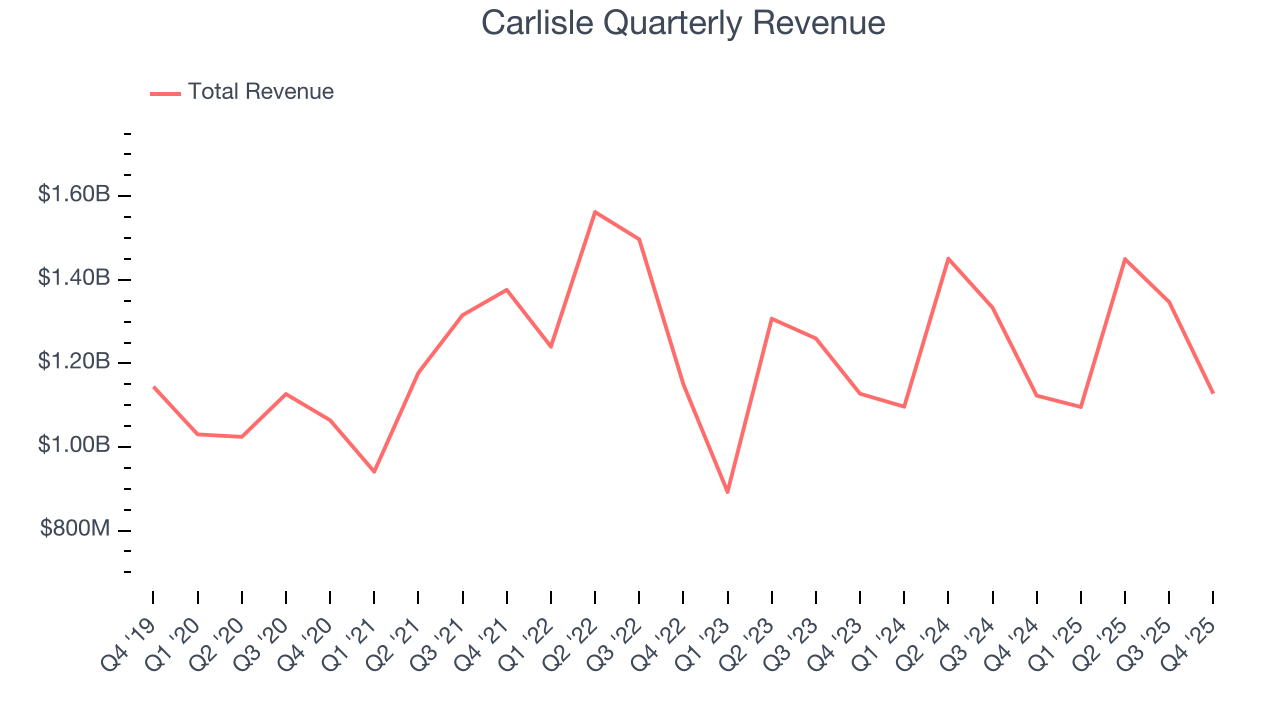

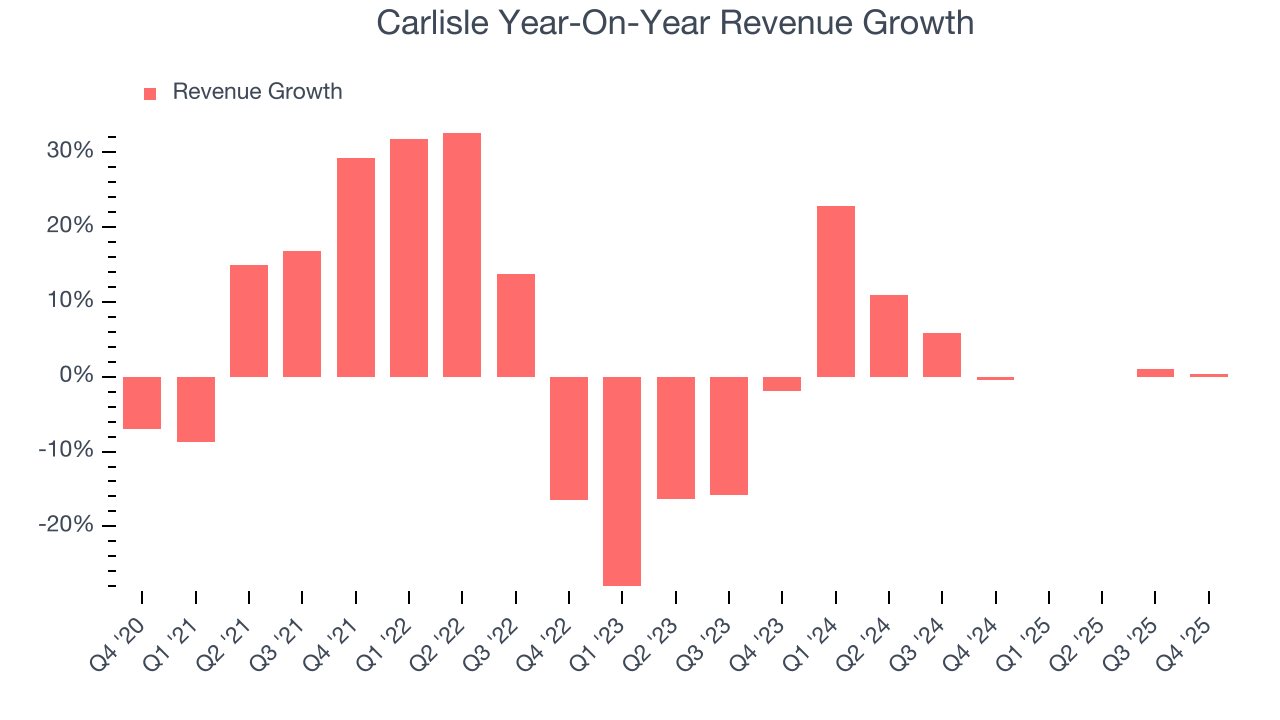

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Carlisle’s sales grew at a sluggish 3.4% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Carlisle.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Carlisle’s annualized revenue growth of 4.6% over the last two years is above its five-year trend, but we were still disappointed by the results.

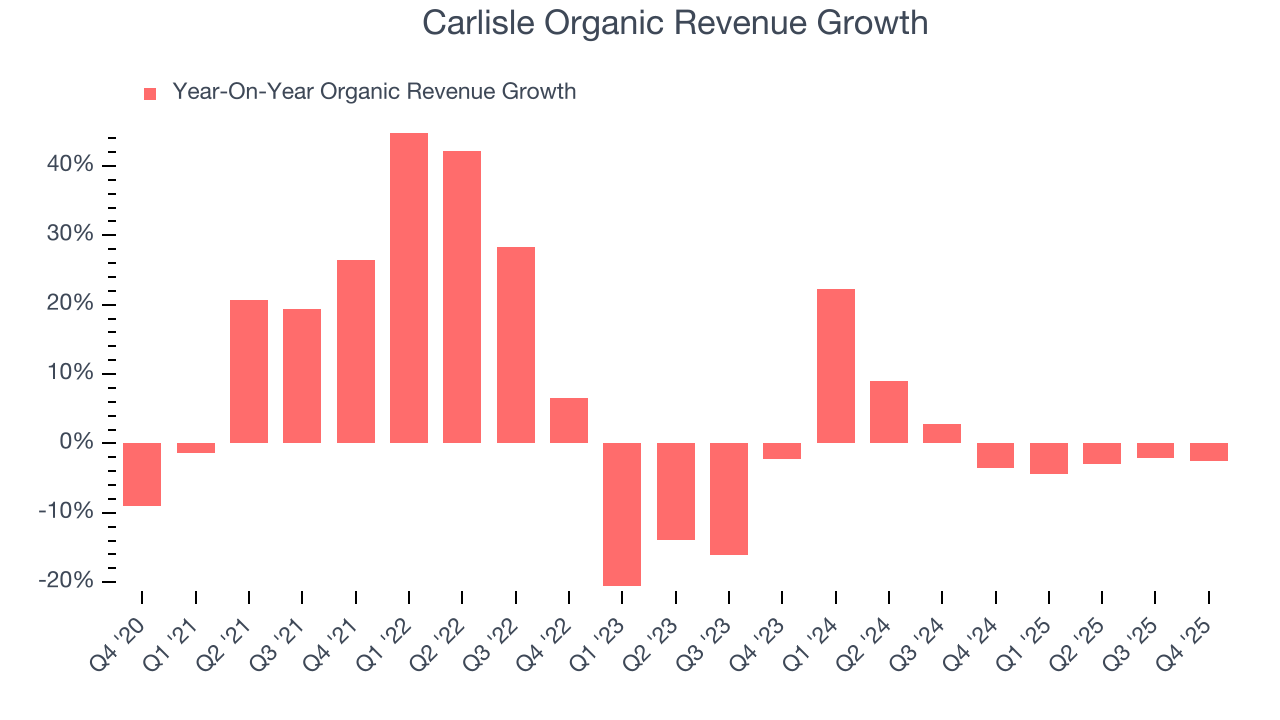

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Carlisle’s organic revenue averaged 2.4% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Carlisle’s $1.13 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

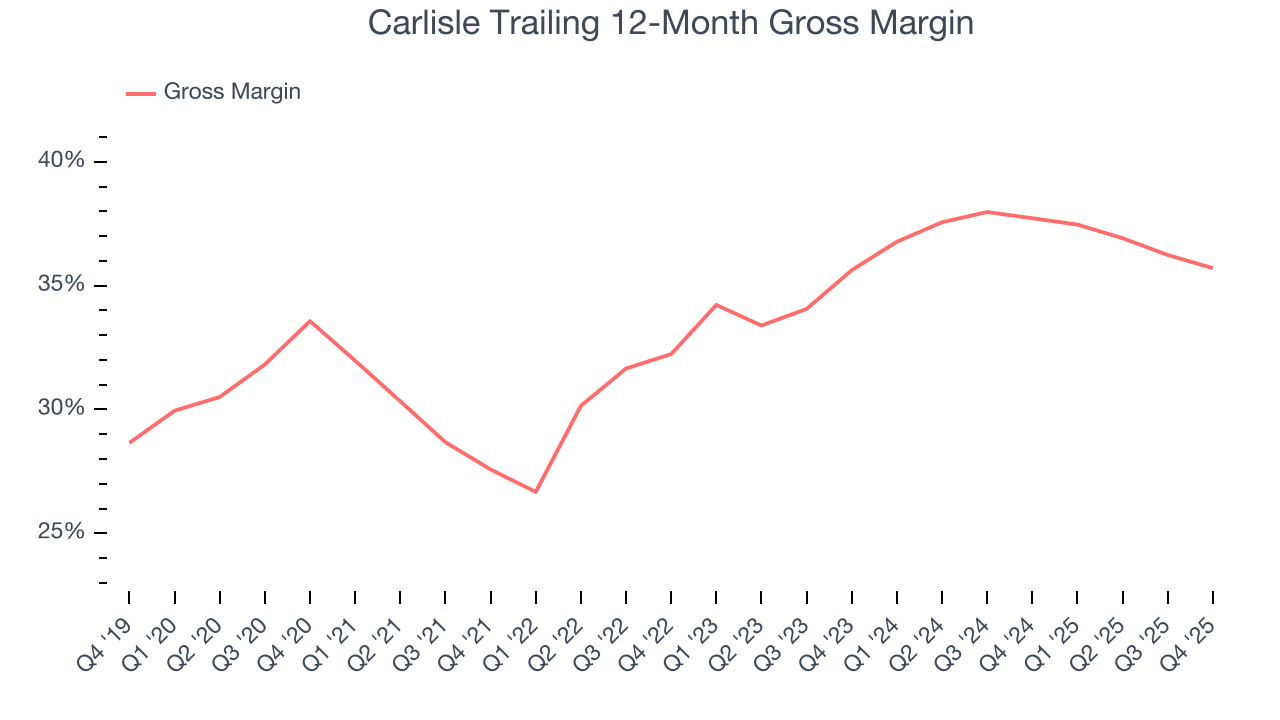

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Carlisle’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.8% gross margin over the last five years. Said differently, Carlisle paid its suppliers $66.23 for every $100 in revenue.

Carlisle’s gross profit margin came in at 33.8% this quarter, down 2.4 percentage points year on year. Carlisle’s full-year margin has also been trending down over the past 12 months, decreasing by 2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

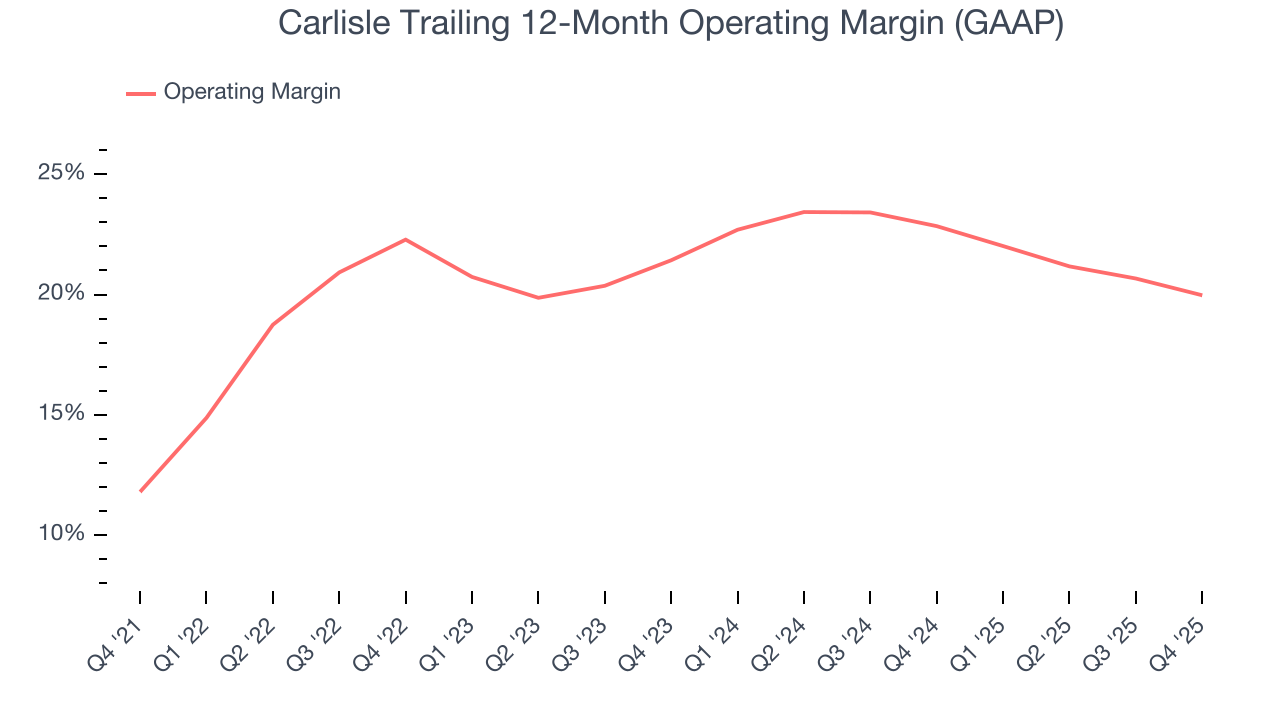

Carlisle has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.7%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Carlisle’s operating margin rose by 8.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Carlisle generated an operating margin profit margin of 16.8%, down 3.1 percentage points year on year. Since Carlisle’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

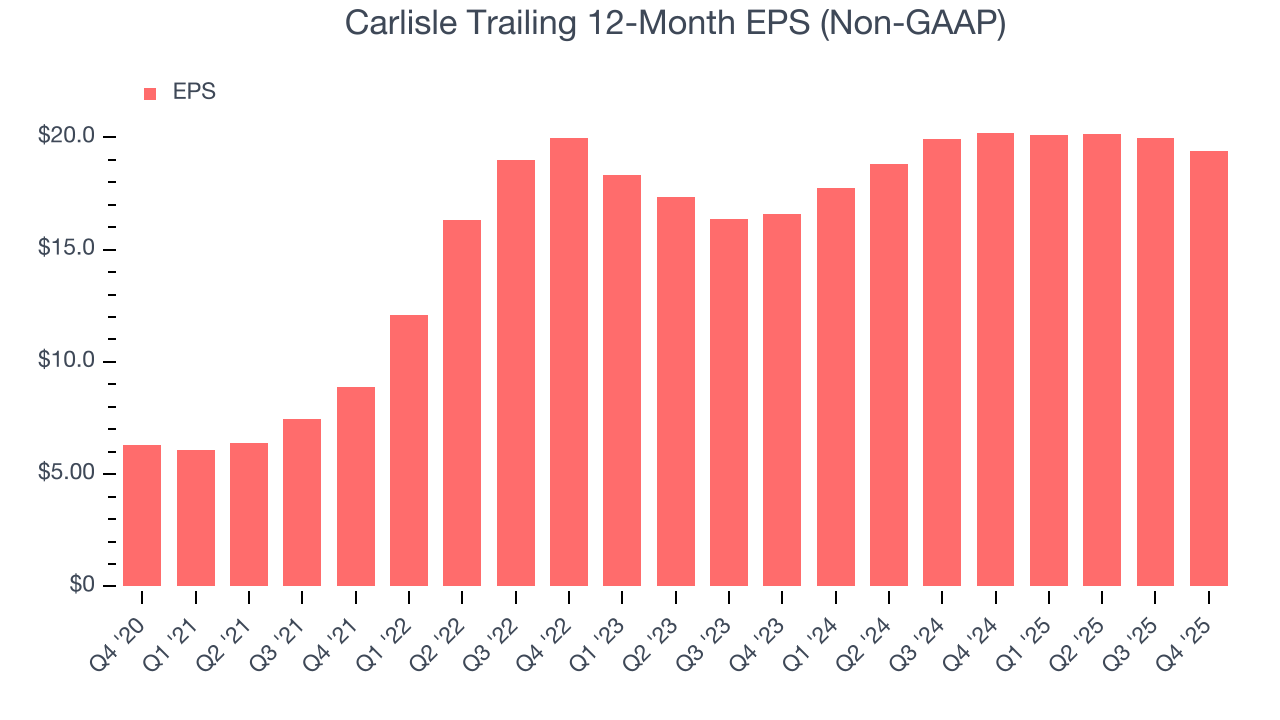

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

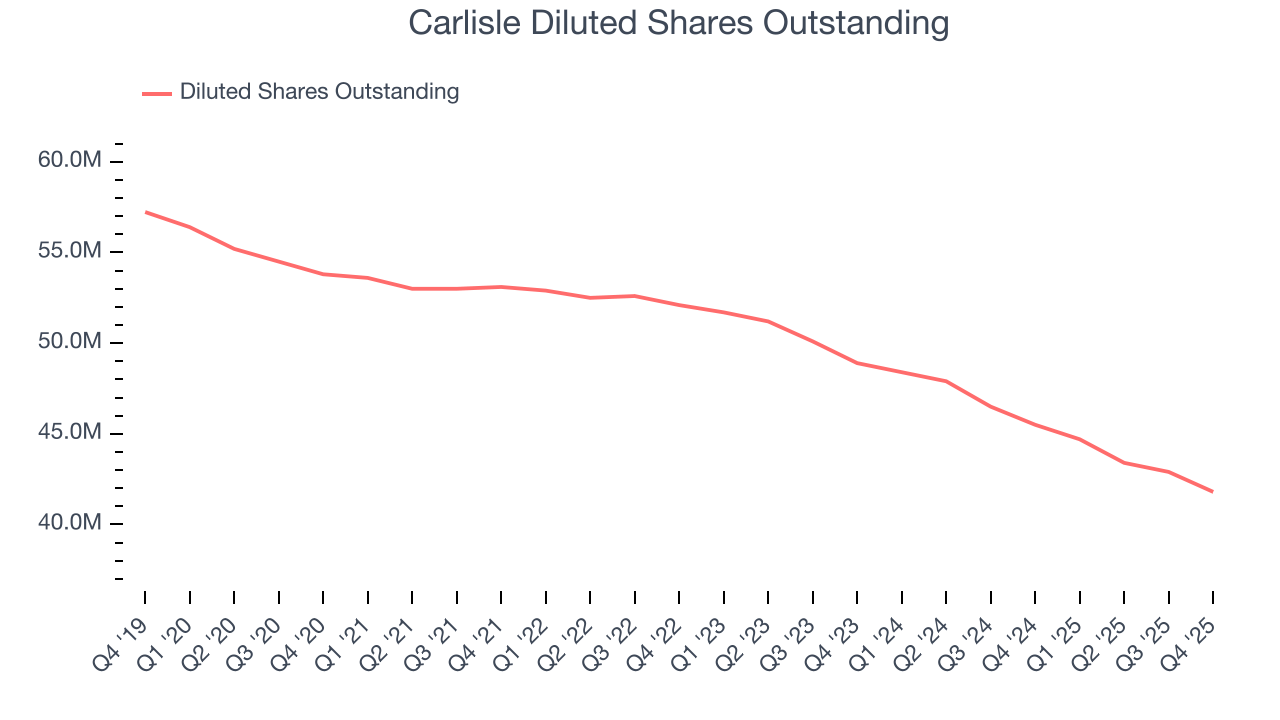

Carlisle’s EPS grew at an astounding 25.1% compounded annual growth rate over the last five years, higher than its 3.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Carlisle’s earnings to better understand the drivers of its performance. As we mentioned earlier, Carlisle’s operating margin declined this quarter but expanded by 8.2 percentage points over the last five years. Its share count also shrank by 22.3%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Carlisle, its two-year annual EPS growth of 8.1% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Carlisle reported adjusted EPS of $3.90, down from $4.47 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.9%. Over the next 12 months, Wall Street expects Carlisle’s full-year EPS of $19.39 to grow 5.7%.

9. Cash Is King

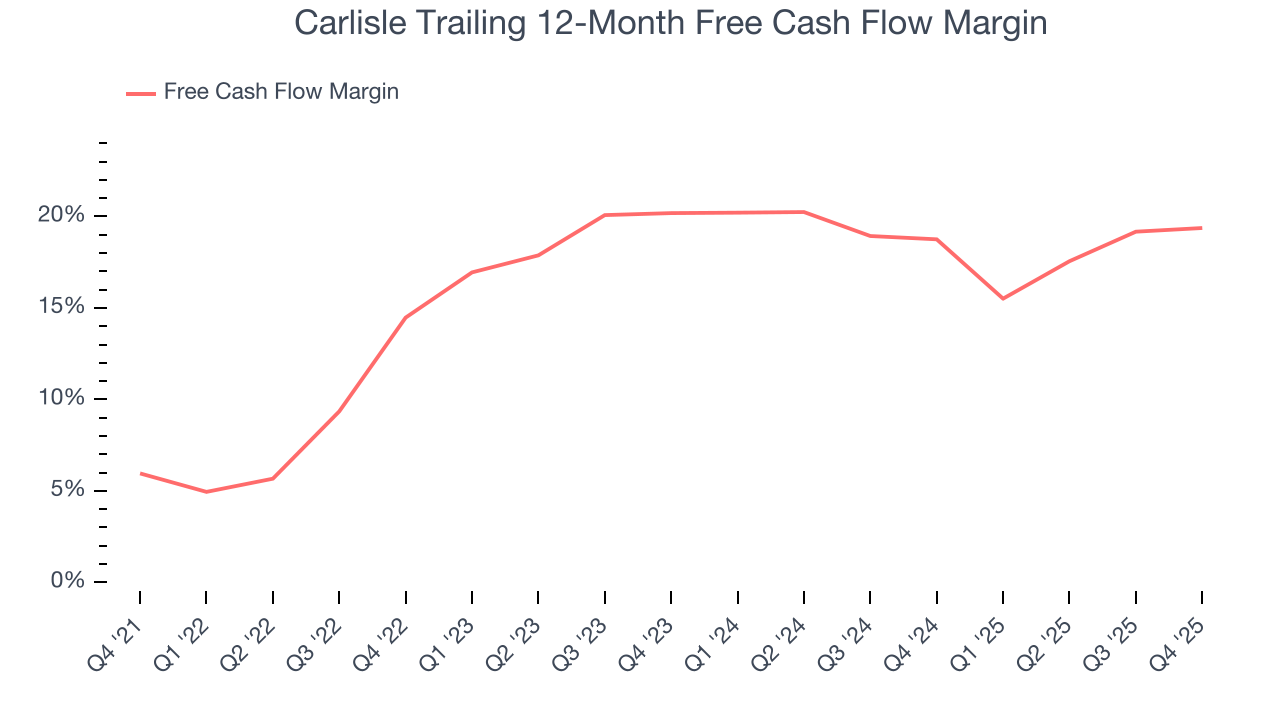

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carlisle has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 15.7% over the last five years.

Taking a step back, we can see that Carlisle’s margin expanded by 13.4 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Carlisle’s free cash flow clocked in at $352.1 million in Q4, equivalent to a 31.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

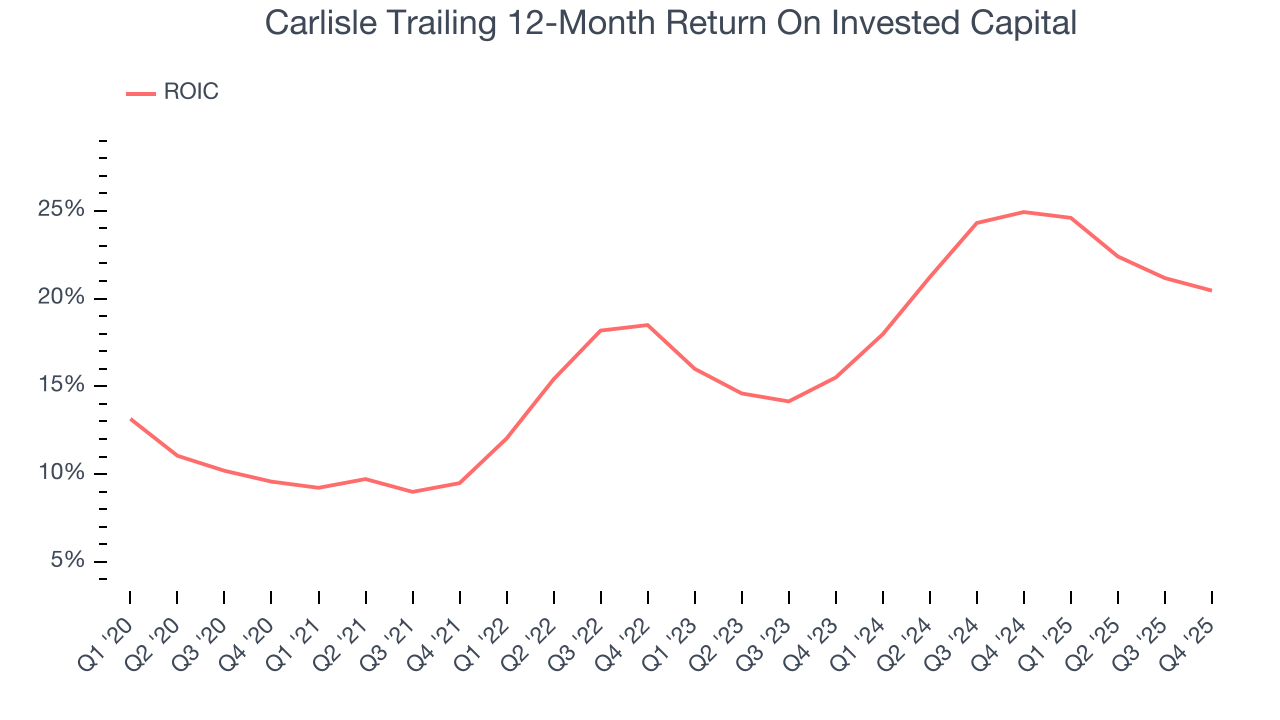

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Carlisle’s five-year average ROIC was 17.8%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Carlisle’s ROIC has increased. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

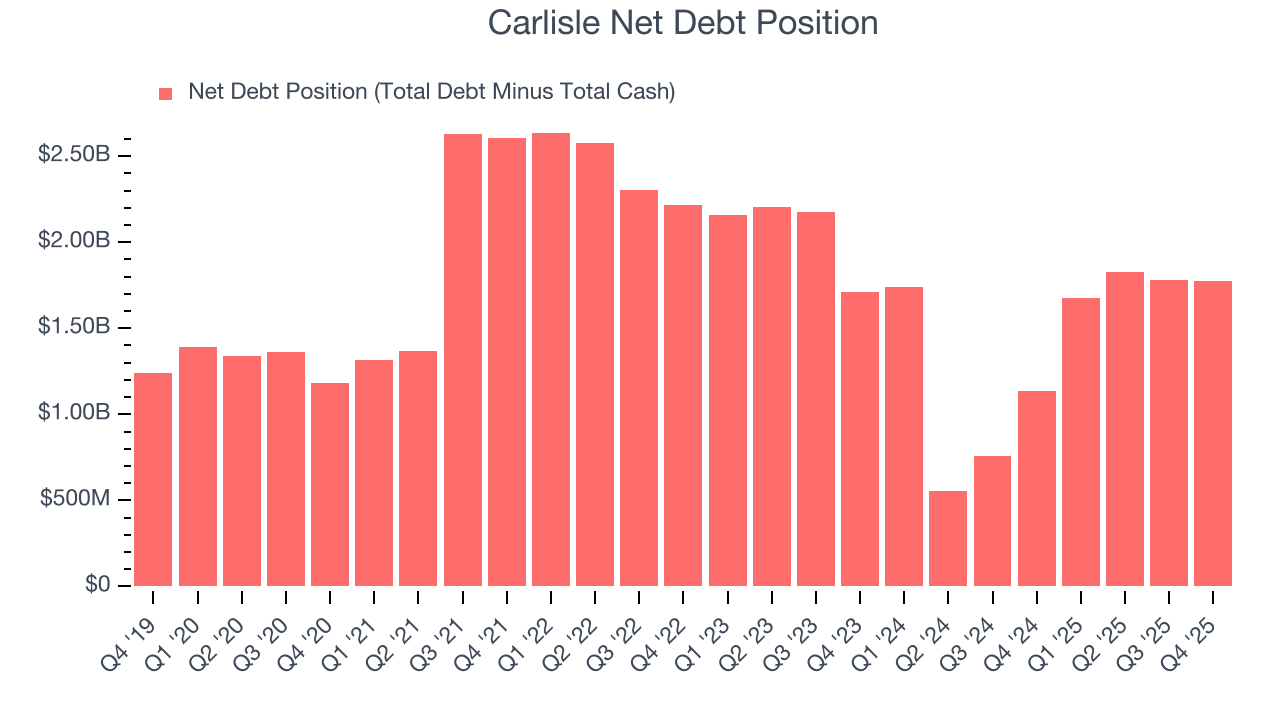

11. Balance Sheet Assessment

Carlisle reported $1.11 billion of cash and $2.89 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.23 billion of EBITDA over the last 12 months, we view Carlisle’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $19.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Carlisle’s Q4 Results

We enjoyed seeing Carlisle beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 5.9% to $377 immediately following the results.

13. Is Now The Time To Buy Carlisle?

Updated: February 3, 2026 at 10:15 PM EST

Before making an investment decision, investors should account for Carlisle’s business fundamentals and valuation in addition to what happened in the latest quarter.

Carlisle is a fine business. Although its revenue growth was weak over the last five years and analysts expect growth to slow over the next 12 months, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. And while its organic revenue growth has disappointed, its impressive operating margins show it has a highly efficient business model.

Carlisle’s P/E ratio based on the next 12 months is 16.7x. Looking at the industrials landscape right now, Carlisle trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $371.25 on the company (compared to the current share price of $369.50).