Covenant Logistics (CVLG)

Covenant Logistics is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Covenant Logistics Will Underperform

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ:CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

- Incremental sales over the last two years were much less profitable as its earnings per share fell by 14.9% annually while its revenue grew

- Muted 2.7% annual revenue growth over the last two years shows its demand lagged behind its industrials peers

- Gross margin of 21.1% is below its competitors, leaving less money to invest in areas like marketing and R&D

Covenant Logistics falls short of our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Covenant Logistics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Covenant Logistics

Covenant Logistics is trading at $25.79 per share, or 12.4x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Covenant Logistics (CVLG) Research Report: Q4 CY2025 Update

Freight and logistics provider Covenant Logistics (NASDAQ:CVLG) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 6.5% year on year to $295.4 million. Its non-GAAP profit of $0.31 per share was 7% below analysts’ consensus estimates.

Covenant Logistics (CVLG) Q4 CY2025 Highlights:

- Revenue: $295.4 million vs analyst estimates of $299.2 million (6.5% year-on-year growth, 1.3% miss)

- Adjusted EPS: $0.31 vs analyst expectations of $0.33 (7% miss)

- Operating Margin: -8.2%, down from 3.1% in the same quarter last year

- Market Capitalization: $636.2 million

Company Overview

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ:CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

Covenant Logistics, initially established as Covenant Transport in 1986 by David Parker, was created to meet the specific needs of shippers. These shippers sought dependable and timely long-distance freight delivery services, which were lacking in the market at the time.

Covenant Logistics specifically offers over-the-road trucking, dedicated fleets, managed transportation, and freight brokerage. For example, the company specializes in expedited shipping services where timing and the condition of goods are critical, such as delivering perishable items or high-value electronics. The company also owns subsidiaries such as Southern Refrigerated Transport and Star Transportation which enhance its service offerings, particularly in temperature-controlled and regional delivery services.

The company’s revenue model is based on freight charges, managed transportation services, and brokerage fees. Covenant Logistics primarily serves large-scale shippers and retail chains across North America, selling services through direct sales efforts and strategic partnerships.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors in the transportation and logistics industry include J.B. Hunt (NASDAQ:JBHT), C.H. Robinson (NASDAQ:CHRW), and XPO Logistics (NYSE:XPO).

5. Revenue Growth

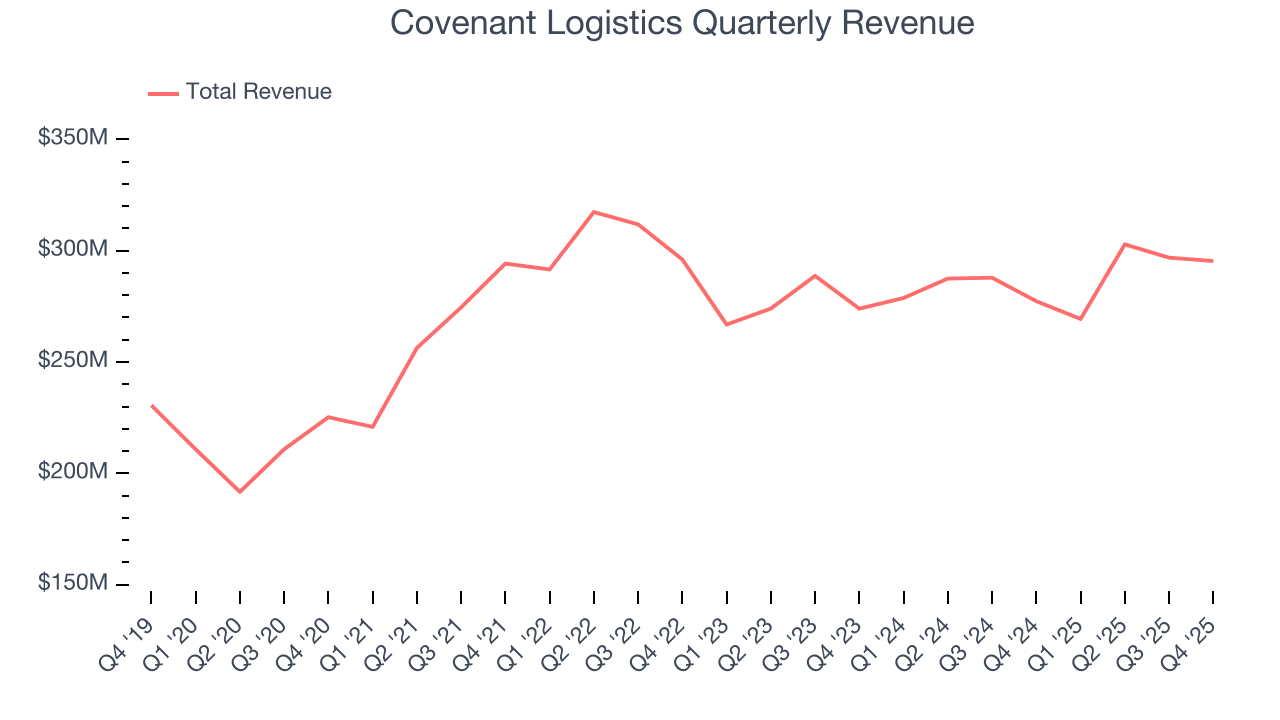

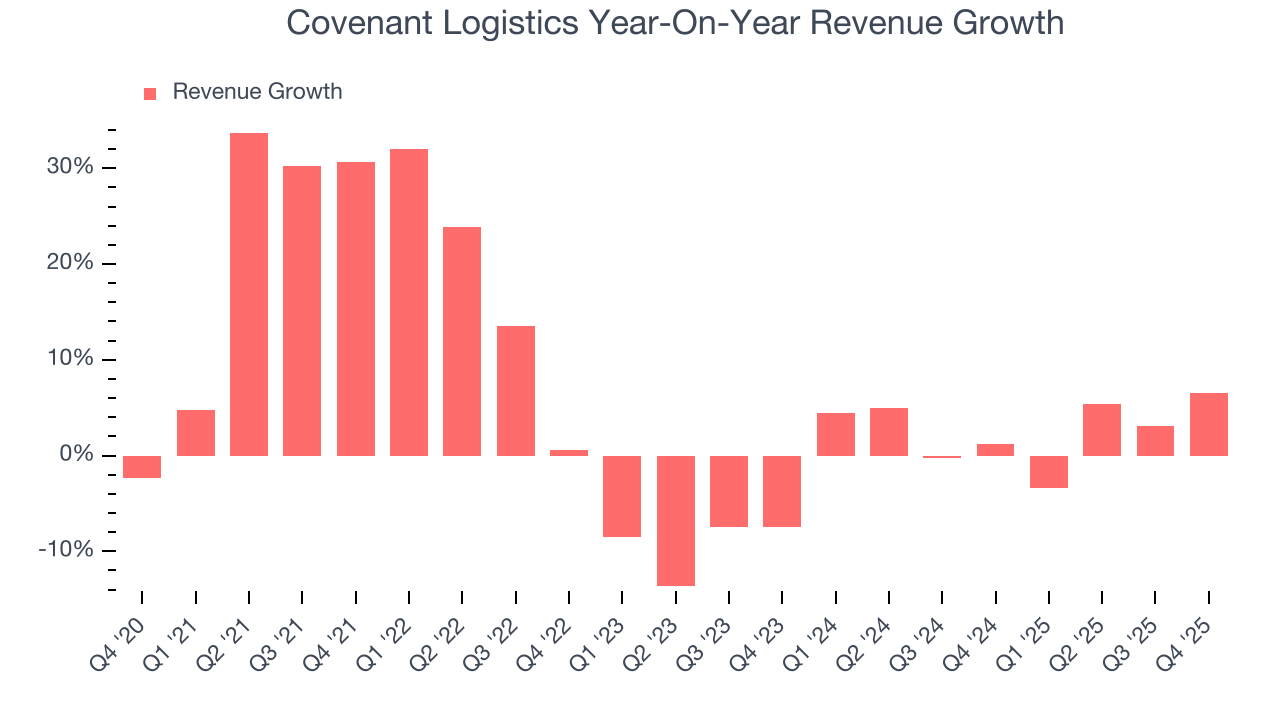

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Covenant Logistics grew its sales at a mediocre 6.8% compounded annual growth rate. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Covenant Logistics’s recent performance shows its demand has slowed as its annualized revenue growth of 2.7% over the last two years was below its five-year trend.

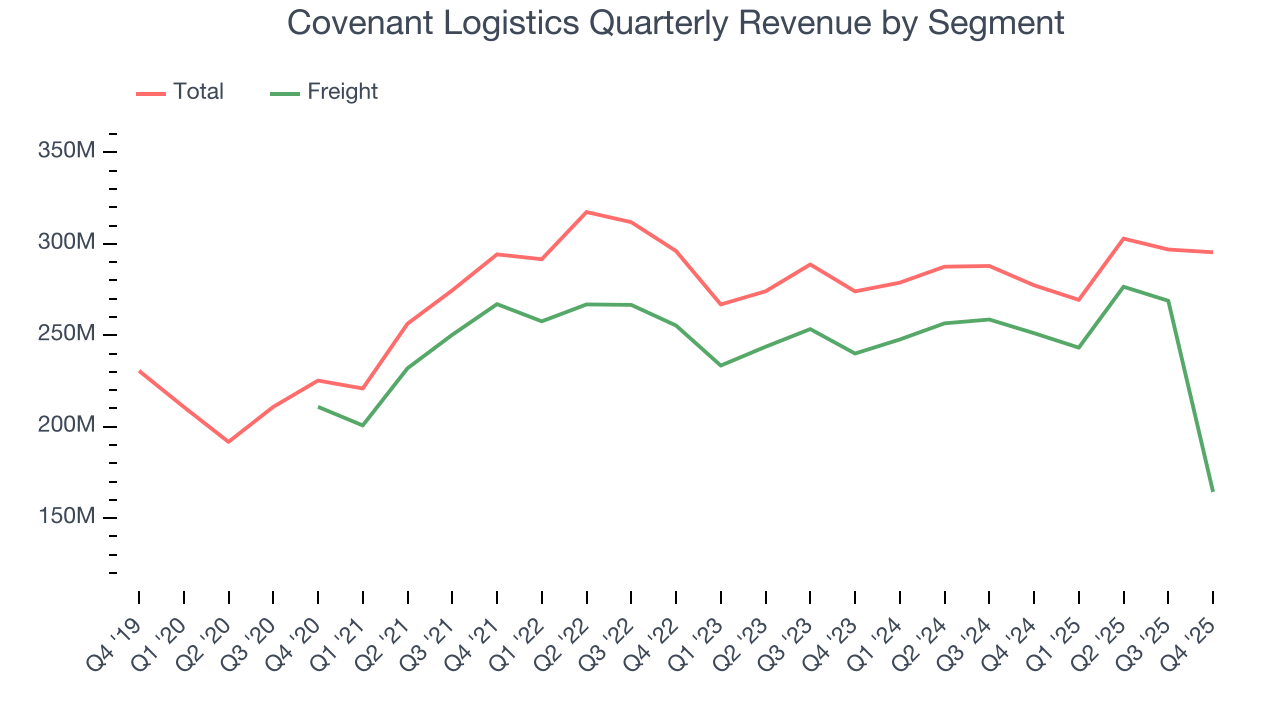

Covenant Logistics also breaks out the revenue for its most important segment, Freight. Over the last two years, Covenant Logistics’s Freight revenue (moving cargo) was flat. This segment has lagged the company’s overall sales.

This quarter, Covenant Logistics’s revenue grew by 6.5% year on year to $295.4 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, similar to its two-year rate. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

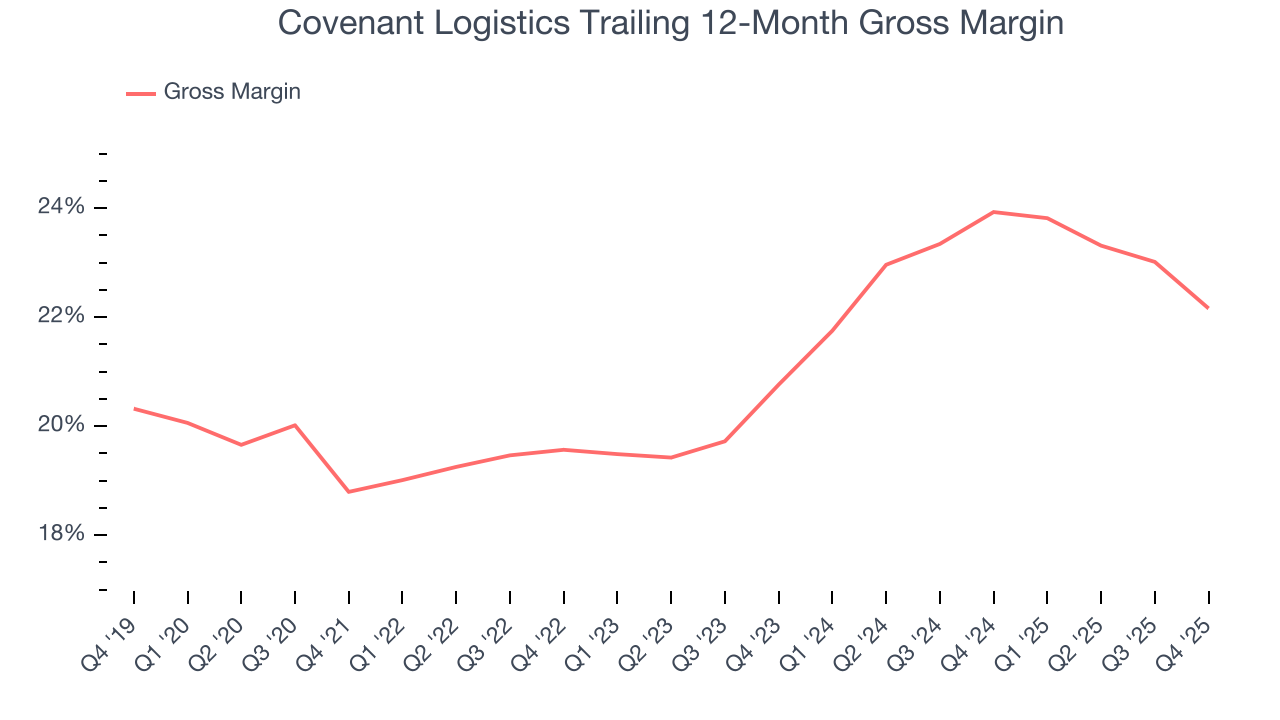

Covenant Logistics has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 21.1% gross margin over the last five years. That means Covenant Logistics paid its suppliers a lot of money ($78.94 for every $100 in revenue) to run its business.

This quarter, Covenant Logistics’s gross profit margin was 20.9%, down 3.4 percentage points year on year. Covenant Logistics’s full-year margin has also been trending down over the past 12 months, decreasing by 1.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

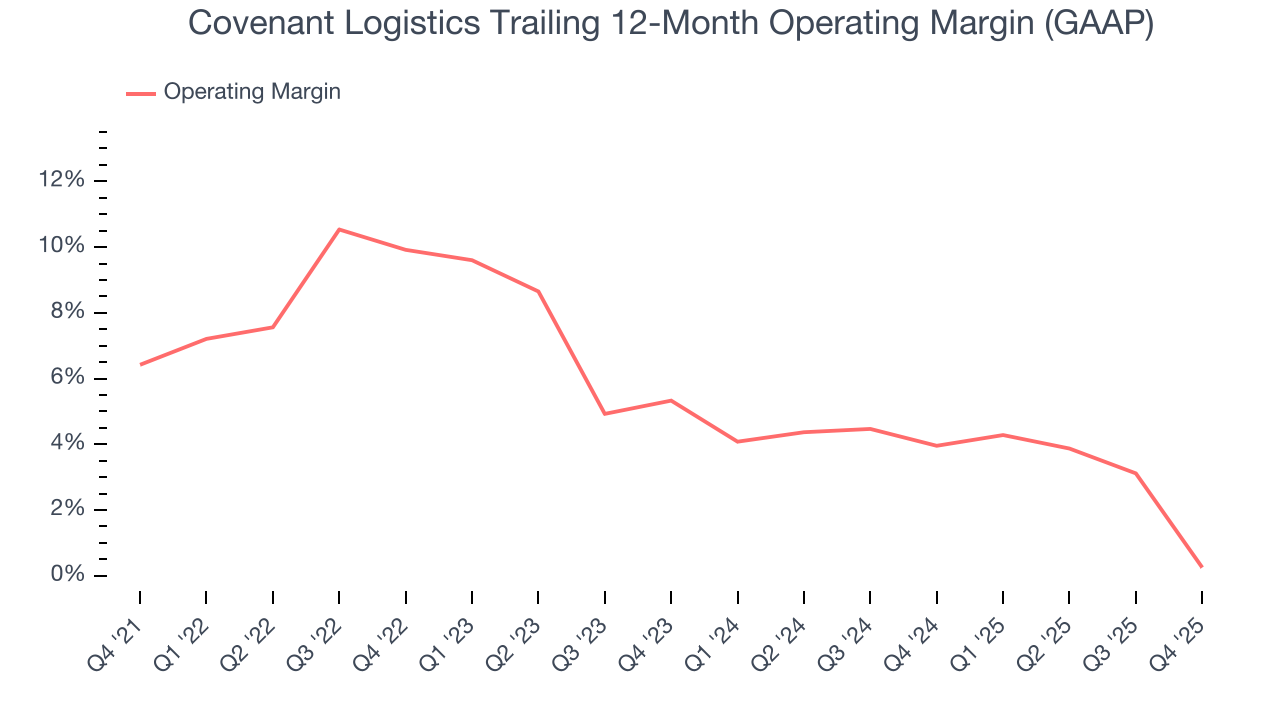

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Covenant Logistics was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Covenant Logistics’s operating margin decreased by 6.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Covenant Logistics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Covenant Logistics generated an operating margin profit margin of negative 8.2%, down 11.3 percentage points year on year. Since Covenant Logistics’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

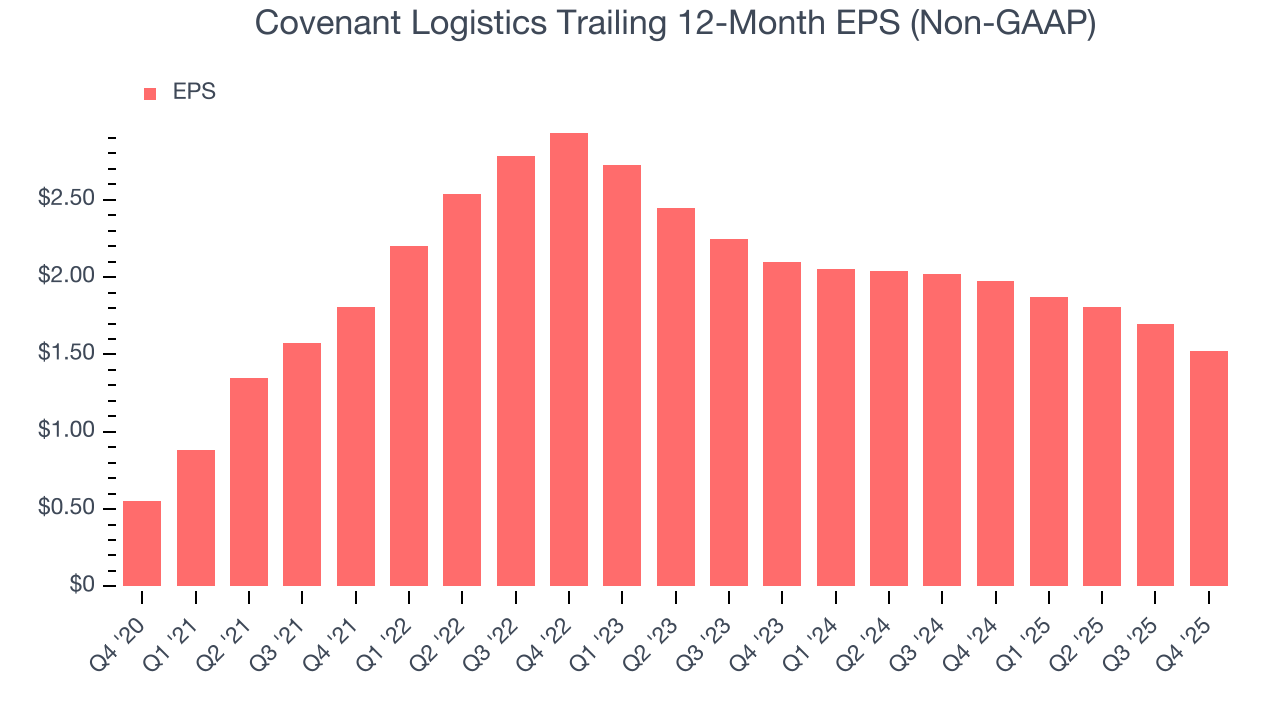

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

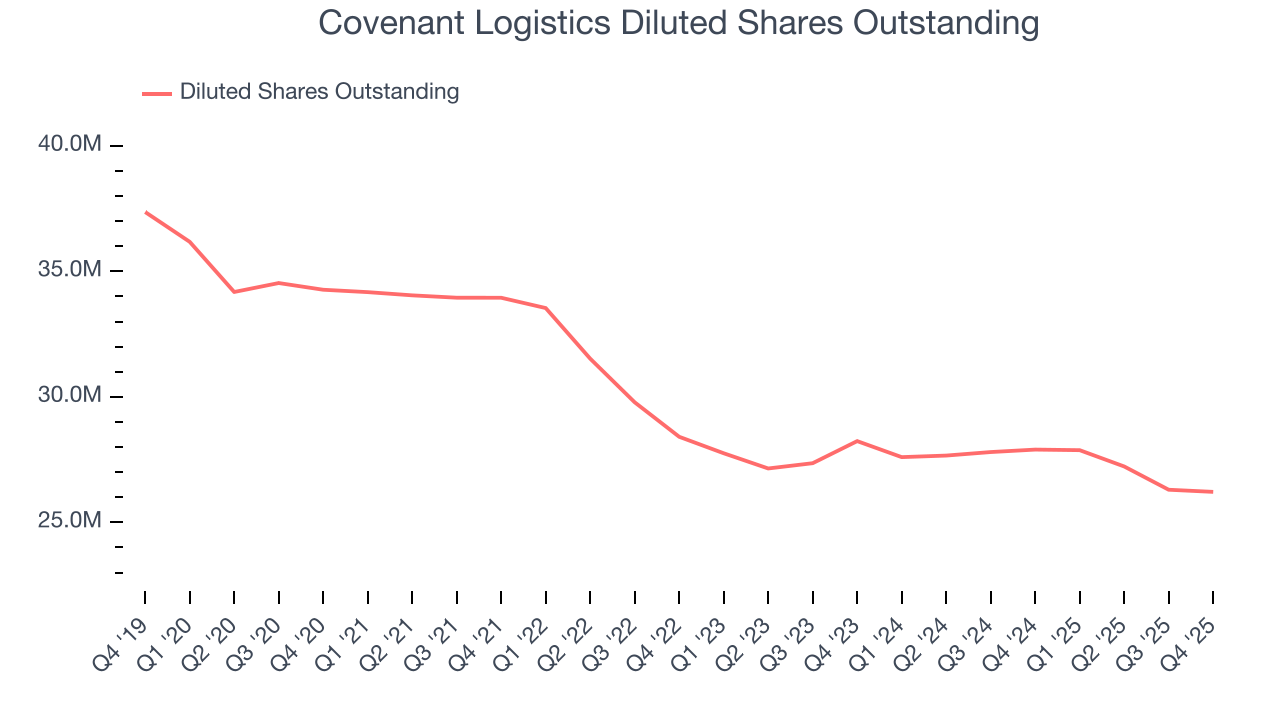

Covenant Logistics’s EPS grew at an astounding 22.3% compounded annual growth rate over the last five years, higher than its 6.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into Covenant Logistics’s earnings quality to better understand the drivers of its performance. A five-year view shows that Covenant Logistics has repurchased its stock, shrinking its share count by 23.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Covenant Logistics, its two-year annual EPS declines of 14.9% mark a reversal from its (seemingly) healthy five-year trend. We hope Covenant Logistics can return to earnings growth in the future.

In Q4, Covenant Logistics reported adjusted EPS of $0.31, down from $0.49 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Covenant Logistics’s full-year EPS of $1.52 to grow 34.9%.

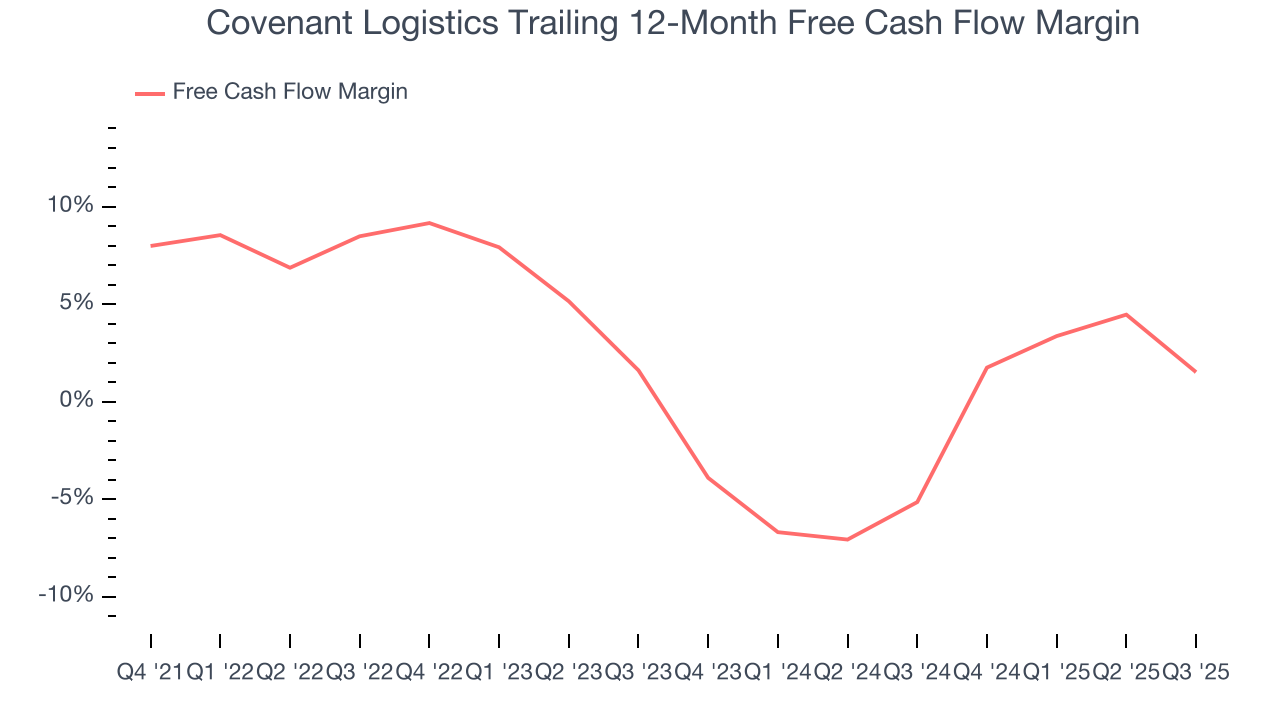

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Covenant Logistics has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for an industrials business.

Taking a step back, we can see that Covenant Logistics’s margin dropped by 12.1 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

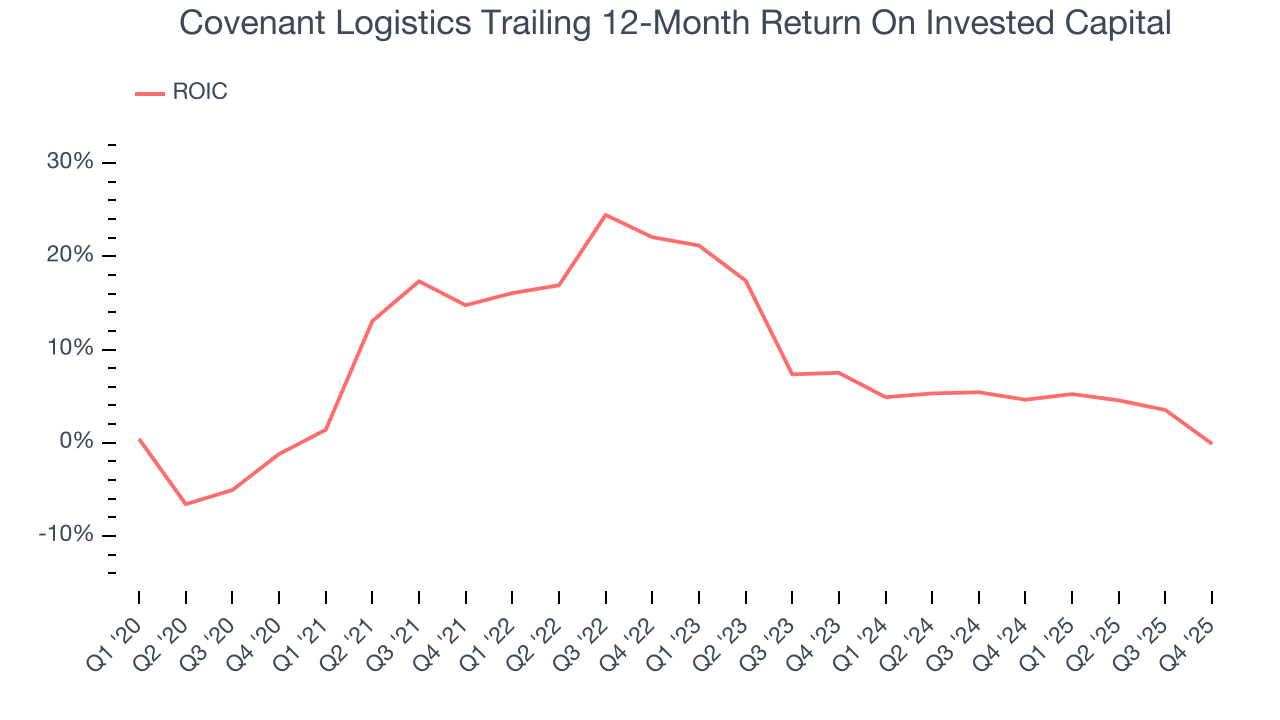

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Covenant Logistics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Covenant Logistics’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

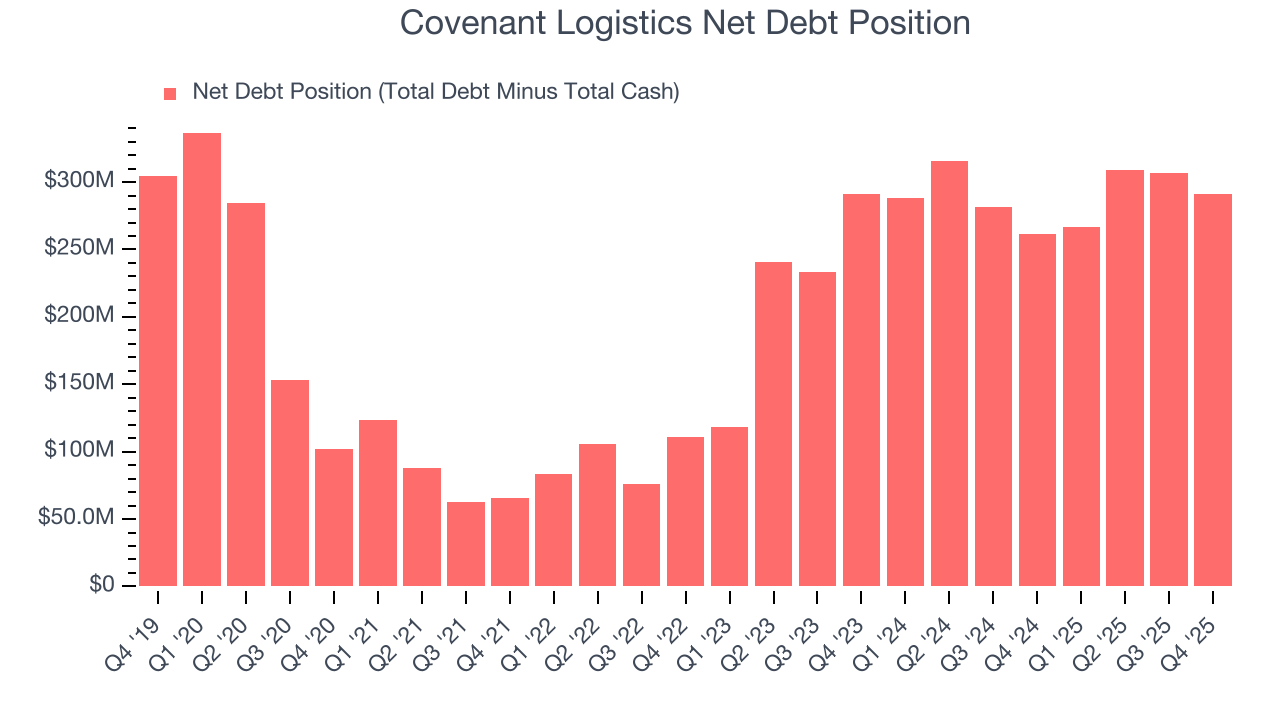

11. Balance Sheet Assessment

Covenant Logistics reported $4.9 million of cash and $296.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $102.2 million of EBITDA over the last 12 months, we view Covenant Logistics’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $5.54 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Covenant Logistics’s Q4 Results

We struggled to find many positives in these results. Its Freight revenue missed and its EPS fell short of Wall Street’s estimates. The stock remained flat at $25.79 immediately after reporting.

13. Is Now The Time To Buy Covenant Logistics?

Updated: January 29, 2026 at 10:10 PM EST

Before deciding whether to buy Covenant Logistics or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Covenant Logistics doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining operating margin shows the business has become less efficient.

Covenant Logistics’s P/E ratio based on the next 12 months is 12.4x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $32 on the company (compared to the current share price of $25.79).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.