Curtiss-Wright (CW)

We see solid potential in Curtiss-Wright. It not only prints profits but also has increased its margins, showing its fundamentals are improving.― StockStory Analyst Team

1. News

2. Summary

Why We Like Curtiss-Wright

Formed from a merger of 12 companies, Curtiss-Wright (NYSE:CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

- Earnings growth has massively outpaced its peers over the last two years as its EPS has compounded at 18% annually

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its profits increased over the last five years as it scaled

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

Curtiss-Wright is a top-tier company. No coincidence the stock is up 480% over the last five years.

Is Now The Time To Buy Curtiss-Wright?

High Quality

Investable

Underperform

Is Now The Time To Buy Curtiss-Wright?

Curtiss-Wright is trading at $649.73 per share, or 47x forward P/E. There are high expectations given this pricey multiple; we can’t deny that.

Do you admire this business? If so, a small position seems prudent as the long-term outlook seems solid. Be aware that Curtiss-Wright’s premium valuation could result in choppy short-term stock performance.

3. Curtiss-Wright (CW) Research Report: Q3 CY2025 Update

Aerospace and defense company Curtiss-Wright (NYSE:CW) met Wall Streets revenue expectations in Q3 CY2025, with sales up 8.8% year on year to $869.2 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.44 billion at the midpoint. Its non-GAAP profit of $3.40 per share was 3.3% above analysts’ consensus estimates.

Curtiss-Wright (CW) Q3 CY2025 Highlights:

- Revenue: $869.2 million vs analyst estimates of $867.4 million (8.8% year-on-year growth, in line)

- Adjusted EPS: $3.40 vs analyst estimates of $3.29 (3.3% beat)

- The company slightly lifted its revenue guidance for the full year to $3.44 billion at the midpoint from $3.41 billion

- Management raised its full-year Adjusted EPS guidance to $13.08 at the midpoint, a 1.8% increase

- Operating Margin: 19.1%, in line with the same quarter last year

- Free Cash Flow Margin: 20.2%, similar to the same quarter last year

- Market Capitalization: $22.08 billion

Company Overview

Formed from a merger of 12 companies, Curtiss-Wright (NYSE:CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Curtiss-Wright was formed in 1929 through the merger of companies founded by Glenn Curtiss, the father of naval aviation, and the Wright brothers, who are credited with building the world’s first successful airplane. It initially focused on aircraft manufacturing and has since diversified into various products including electronic systems and flow control technologies.

Today, Curtiss-Wright offers specialized products and services across the aerospace, defense, and power industries. The company produces everything from power management electronics and aircraft sensors to advanced surface treatments that improve the durability of metal parts. Specifically, in defense, Curtiss-Wright provides vital technologies such as embedded computing systems, flight testing instruments, and communication solutions while in the naval and energy sectors it supplies equipment like naval propulsion systems and coolant pumps for nuclear reactors.

Curtiss-Wright primarily goes to market through a global network of direct sales forces and independent representatives. Revenue is largely generated from the sale of engineered components, systems, and services, and a significant portion comes from long-term contracts with government and defense entities as well as commercial agreements within the power generation and naval sectors.

In addition to outright sales, Curtiss-Wright benefits from aftermarket revenue sources such as maintenance, repair, and overhaul services, and the supply of replacement parts. These services are crucial for ensuring the operational continuity and efficiency of customer equipment, thus creating a consistent demand and revenue stream.

The financial performance of Curtiss-Wright is closely linked to governmental defense spending, the health of the aerospace industry, and the global demand for energy, particularly nuclear power. These factors directly affect the company’s sales volumes and the development of new projects within its key market segments.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Curtiss-Wright’s peers and competitors include Lockheed Martin (NYSE:LMT), General Electrics (NYSE:GE), and Honeywell International (NASDAQ:HON)

5. Revenue Growth

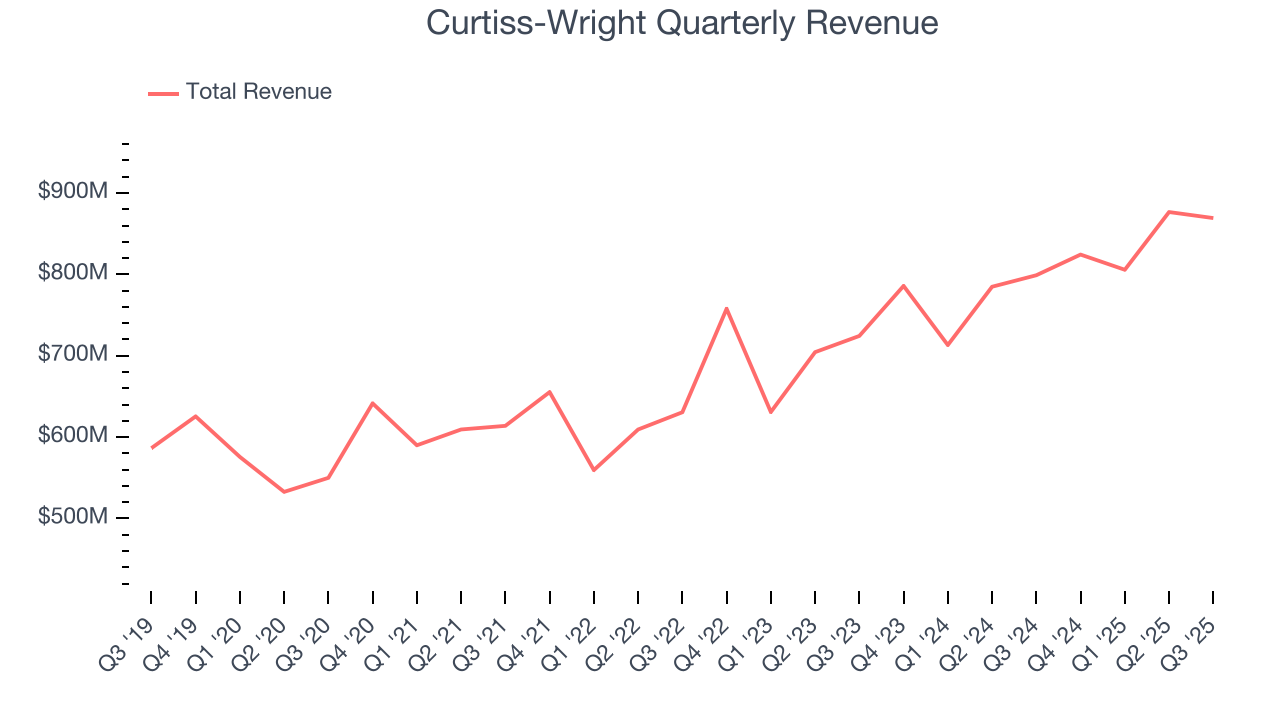

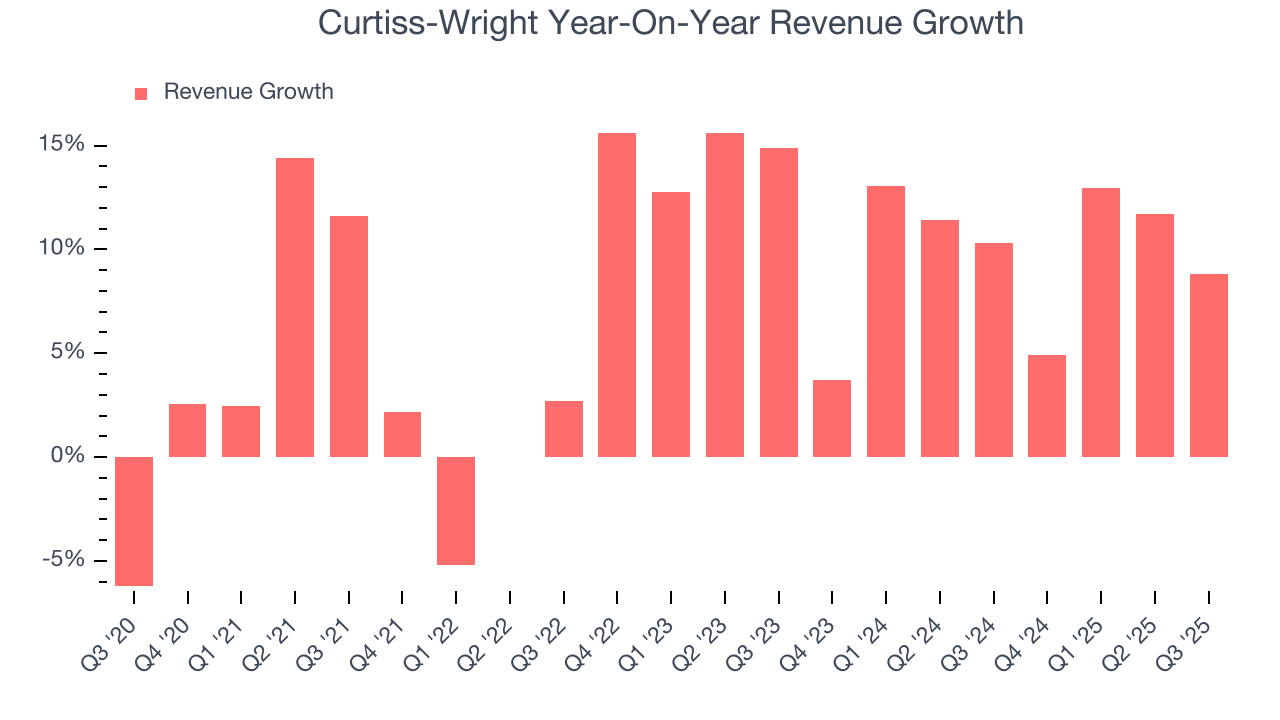

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Curtiss-Wright’s 8.1% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Curtiss-Wright’s annualized revenue growth of 9.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

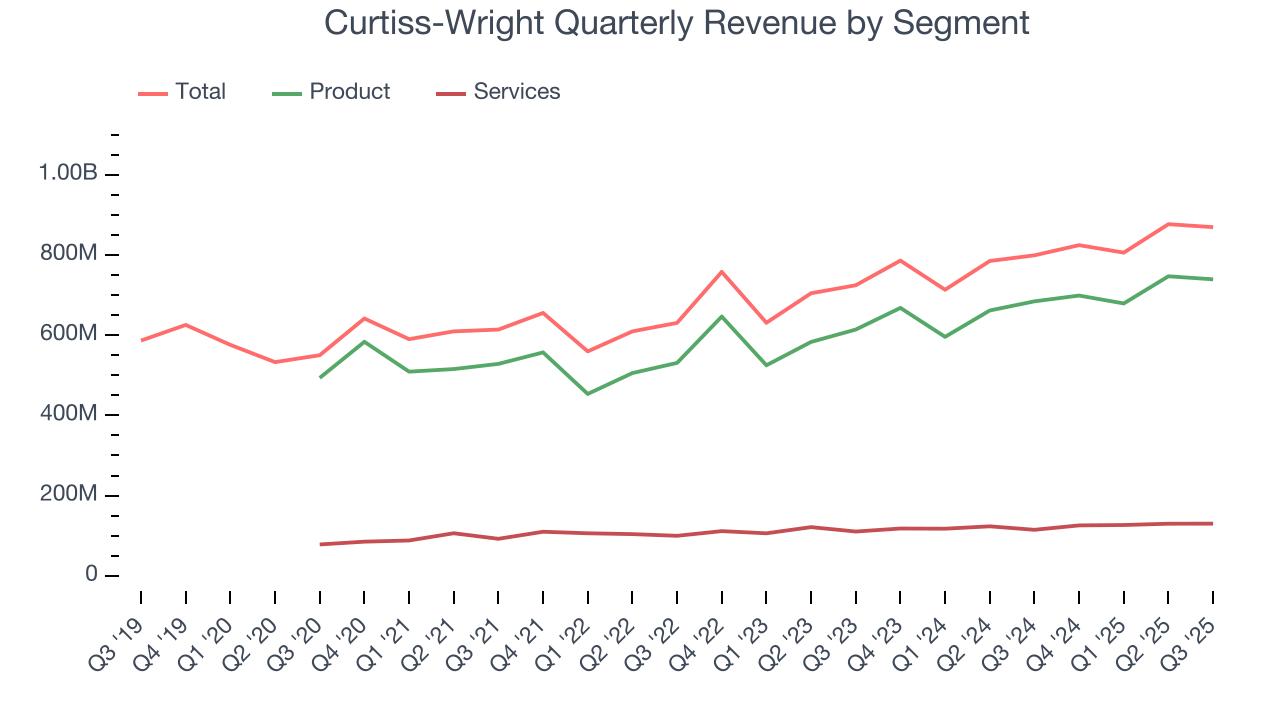

We can better understand the company’s revenue dynamics by analyzing its most important segments, Product and Services, which are 85% and 15% of revenue. Over the last two years, Curtiss-Wright’s Product revenue (aerospace & defense technology) averaged 10.2% year-on-year growth while its Services revenue (testing, maintenance, consulting) averaged 6.9% growth.

This quarter, Curtiss-Wright grew its revenue by 8.8% year on year, and its $869.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

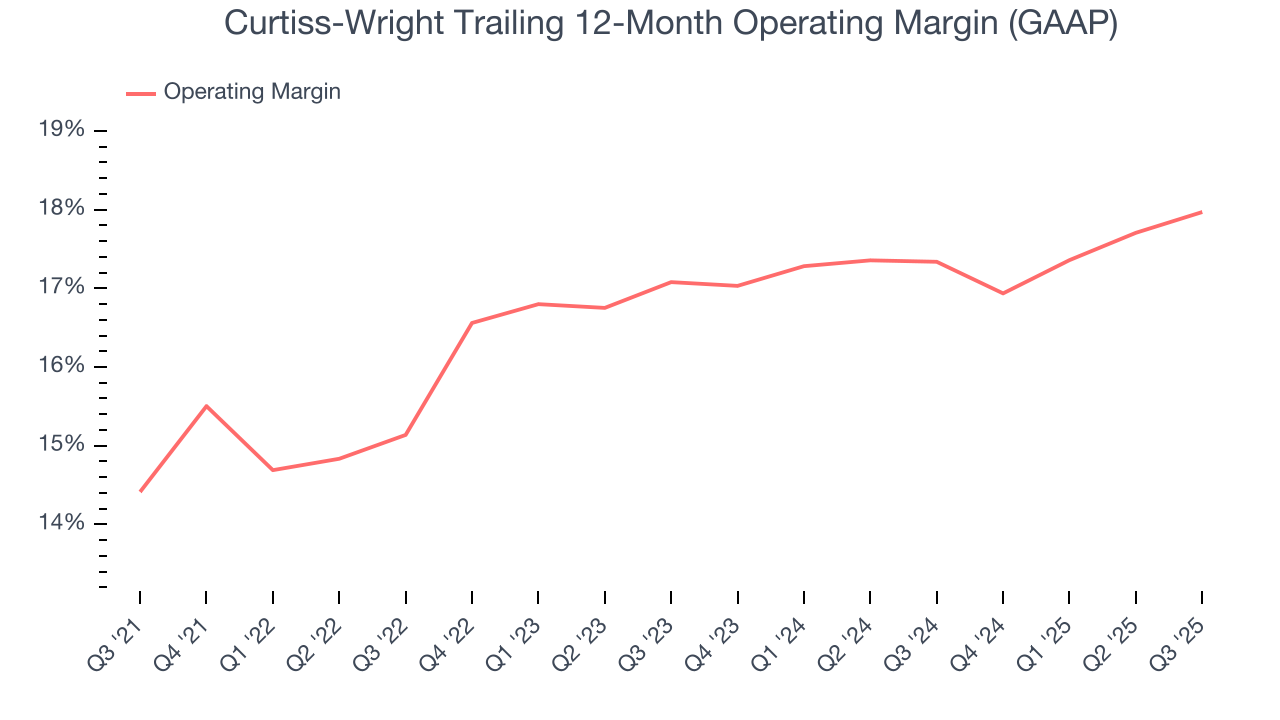

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Curtiss-Wright has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.5%.

Looking at the trend in its profitability, Curtiss-Wright’s operating margin rose by 3.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Curtiss-Wright generated an operating margin profit margin of 19.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

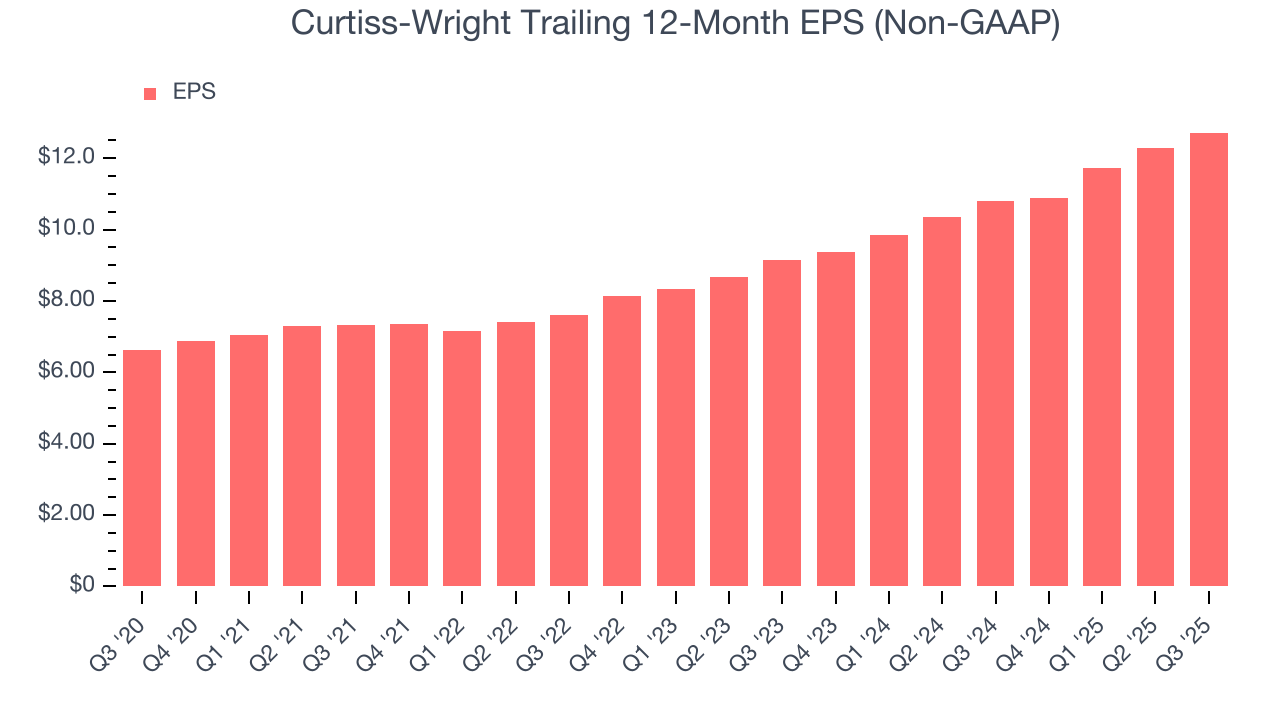

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

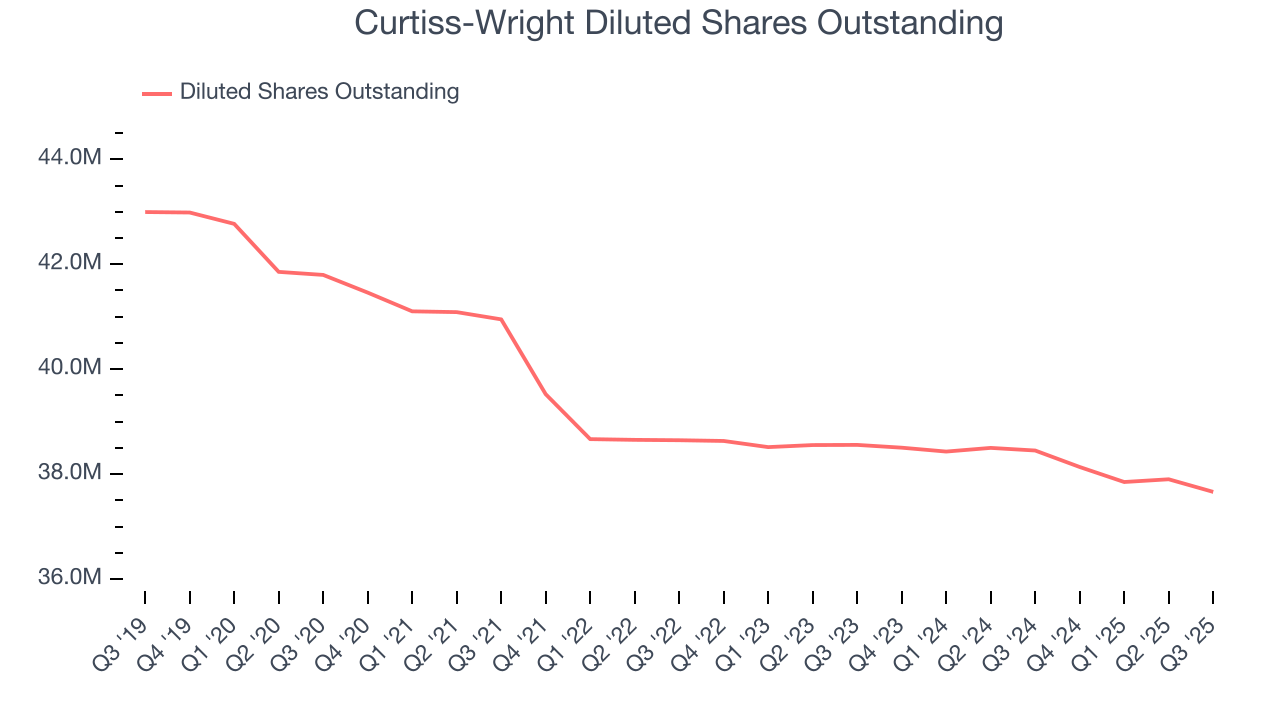

Curtiss-Wright’s EPS grew at a remarkable 14% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Curtiss-Wright’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Curtiss-Wright’s operating margin was flat this quarter but expanded by 3.6 percentage points over the last five years. On top of that, its share count shrank by 9.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Curtiss-Wright, its two-year annual EPS growth of 18% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Curtiss-Wright reported adjusted EPS of $3.40, up from $2.97 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Curtiss-Wright’s full-year EPS of $12.72 to grow 8.9%.

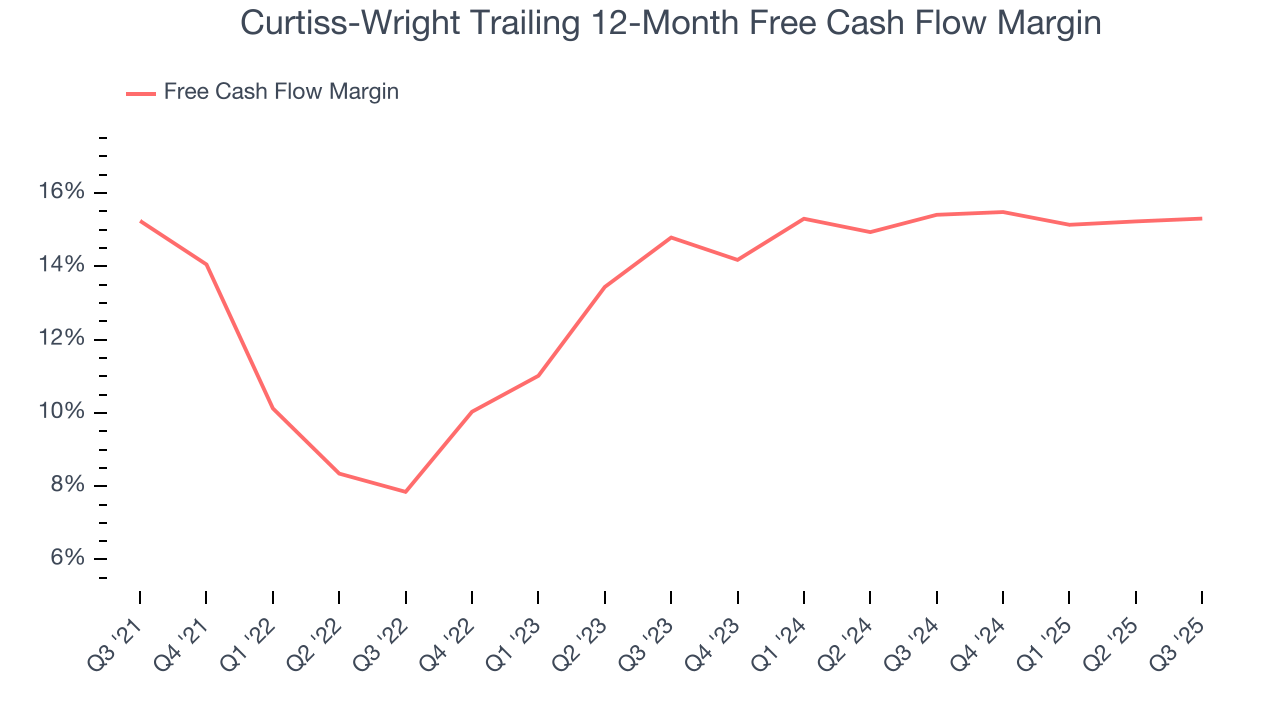

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Curtiss-Wright has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.9% over the last five years.

Curtiss-Wright’s free cash flow clocked in at $176 million in Q3, equivalent to a 20.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

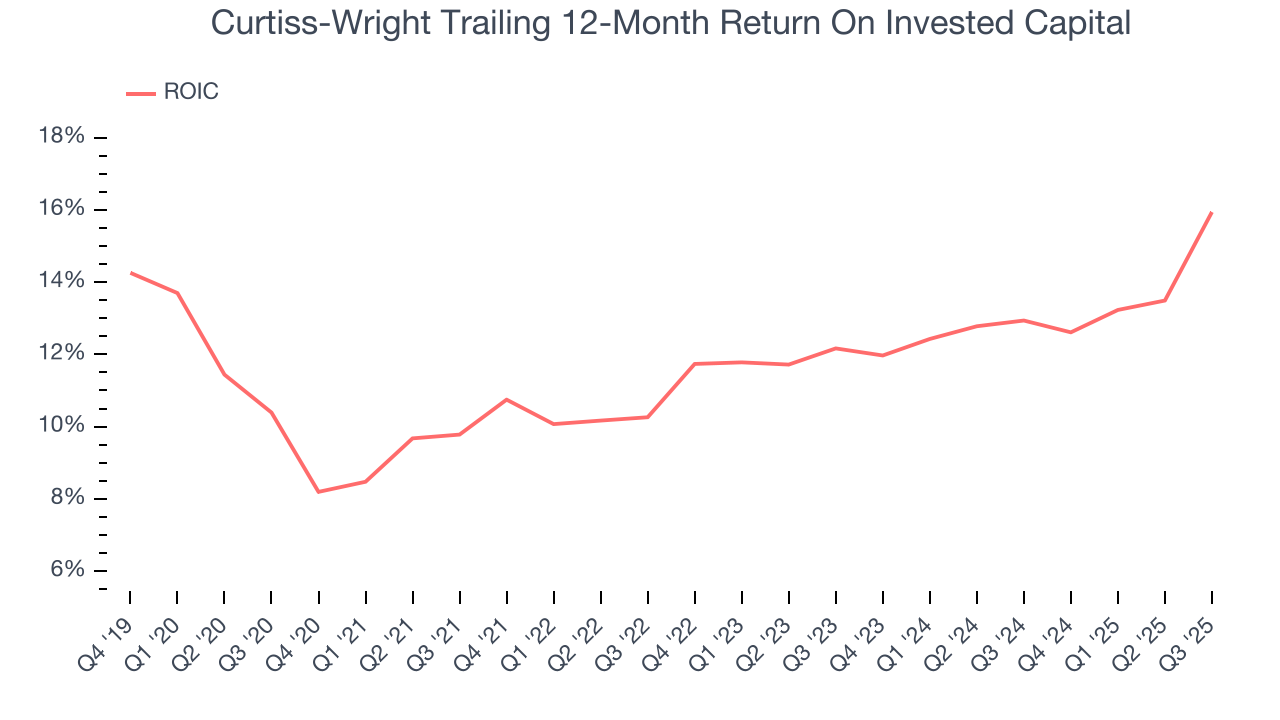

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Curtiss-Wright’s five-year average ROIC was 12.2%, higher than most industrials businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Curtiss-Wright’s ROIC increased by 4.4 percentage points annually over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

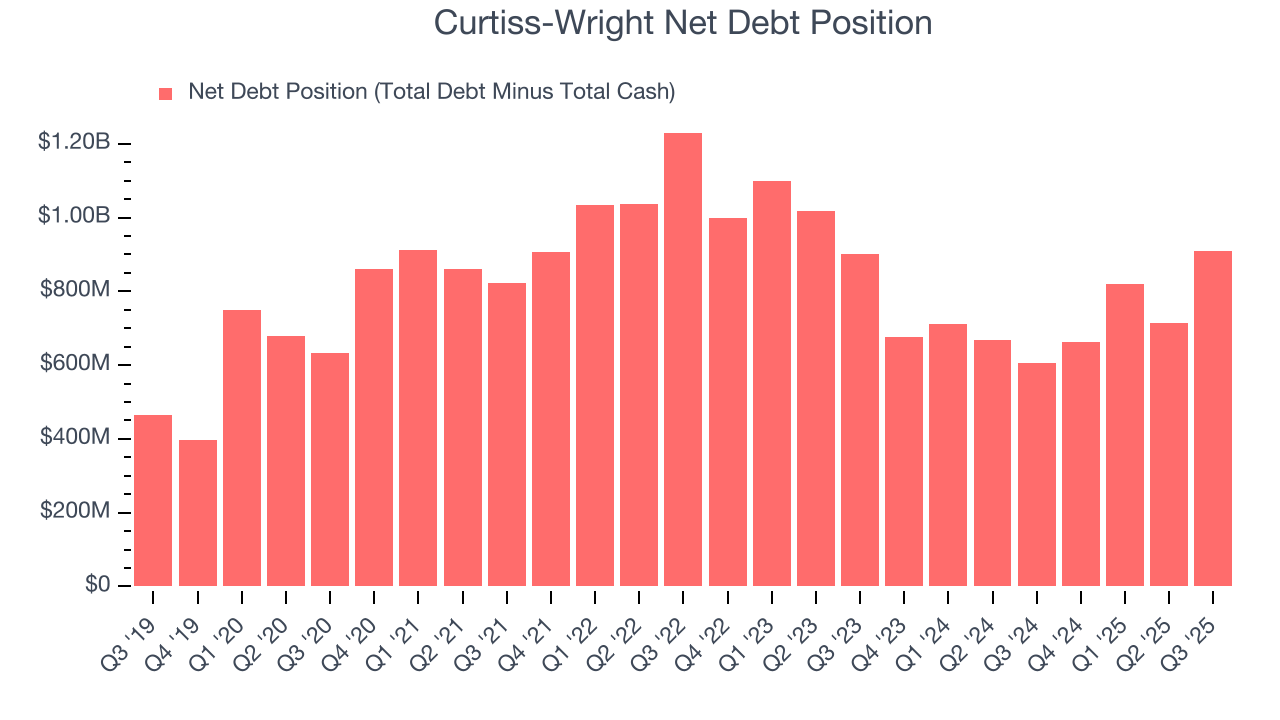

10. Balance Sheet Assessment

Curtiss-Wright reported $225.4 million of cash and $1.13 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $726.9 million of EBITDA over the last 12 months, we view Curtiss-Wright’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $42.83 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Curtiss-Wright’s Q3 Results

It was good to see Curtiss-Wright provide full-year EPS guidance that slightly beat analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $587 immediately following the results.

12. Is Now The Time To Buy Curtiss-Wright?

Updated: January 23, 2026 at 10:29 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Curtiss-Wright is a high-quality business worth owning. For starters, its revenue growth was decent over the last five years, and analysts believe it can continue growing at these levels. On top of that, its impressive operating margins show it has a highly efficient business model, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Curtiss-Wright’s P/E ratio based on the next 12 months is 47x. A lot of good news is certainly baked in given its premium multiple, but we’ll happily own Curtiss-Wright as its fundamentals really stand out. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with high valuations.

Wall Street analysts have a consensus one-year price target of $638.14 on the company (compared to the current share price of $649.73).