Camping World (CWH)

Camping World is up against the odds. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Camping World Will Underperform

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

- Commoditized inventory, bad unit economics, and high competition are reflected in its low gross margin of 29.9%

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Camping World doesn’t measure up to our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Camping World

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Camping World

Camping World is trading at $13.17 per share, or 18.2x forward P/E. This multiple is high given its weaker fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Camping World (CWH) Research Report: Q3 CY2025 Update

Recreational vehicle (RV) and boat retailer Camping World (NYSE:CWH) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 4.7% year on year to $1.81 billion. Its non-GAAP profit of $0.43 per share was 41% above analysts’ consensus estimates.

Camping World (CWH) Q3 CY2025 Highlights:

- Revenue: $1.81 billion vs analyst estimates of $1.74 billion (4.7% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.31 (41% beat)

- Adjusted EBITDA: $95.71 million vs analyst estimates of $93 million (5.3% margin, 2.9% beat)

- Operating Margin: 4.4%, in line with the same quarter last year

- Free Cash Flow Margin: 5.8%, down from 17.7% in the same quarter last year

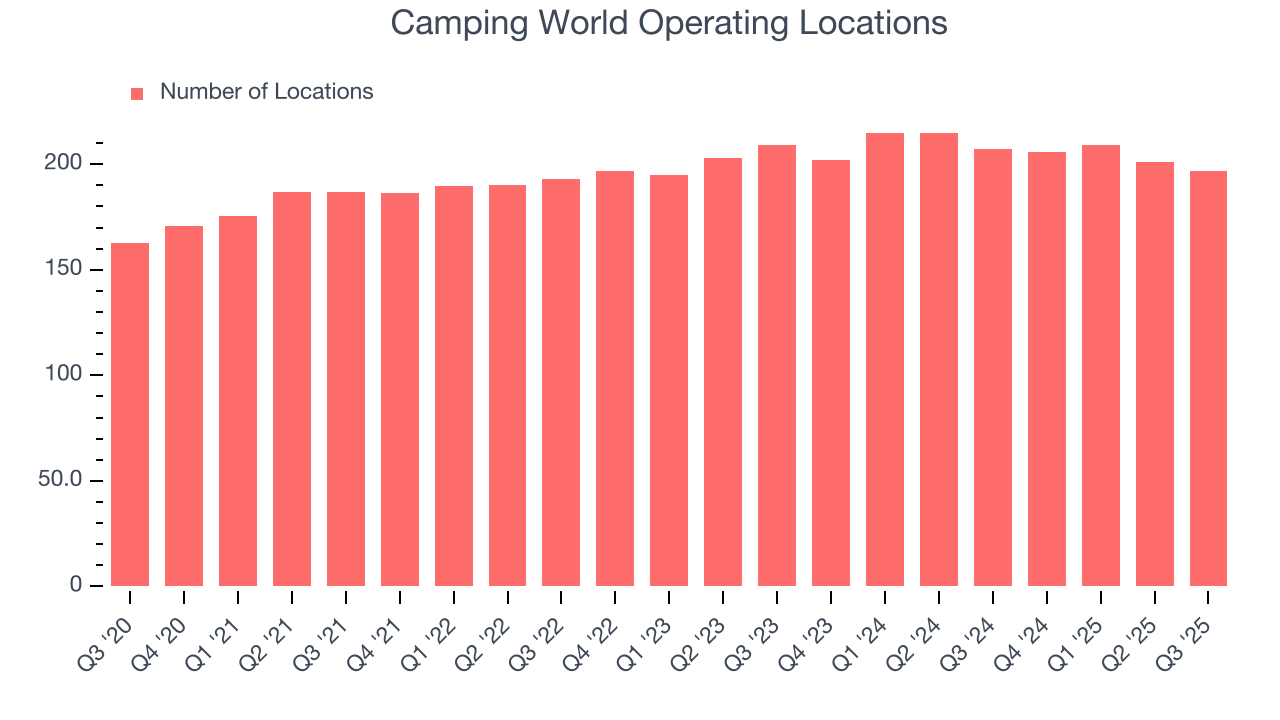

- Locations: 197 at quarter end, down from 207 in the same quarter last year

- Same-Store Sales were up 15.6% year on year

- Market Capitalization: $1.05 billion

Company Overview

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

The core customer is someone in the market for an RV, someone who already owns an RV, or a general outdoor enthusiast. At a Camping World location or on the company’s website, this core customer can buy RVs, boats, camping tents, fishing rods, and all manner of equipment to accompany your RV or boat.

The average Camping World store is around 20,000 square feet and is typically located in or near popular camping destinations or along major highways. RVs are displayed outside, while camping gear and accessories are arranged inside the store in sections. States such as Florida, Texas, and Ohio have the highest concentration of Camping World stores while Northeastern states, where the weather isn’t as conducive to outdoor activities, have the lowest.

Camping World’s e-commerce presence was launched in 2008, and today, customers can buy the company’s offerings online for direct shipment. Camping World's e-commerce platform has been an important part of reaching customers who may not have easy access to a physical store.

4. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Competitors offering merchandise for outdoor activities or recreational vehicles include Thor Industries (NYSE:THO) and Winnebago Industries (NYSE:WGO) as well as private competitors such as Lazydays Holdings and General RV Center.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

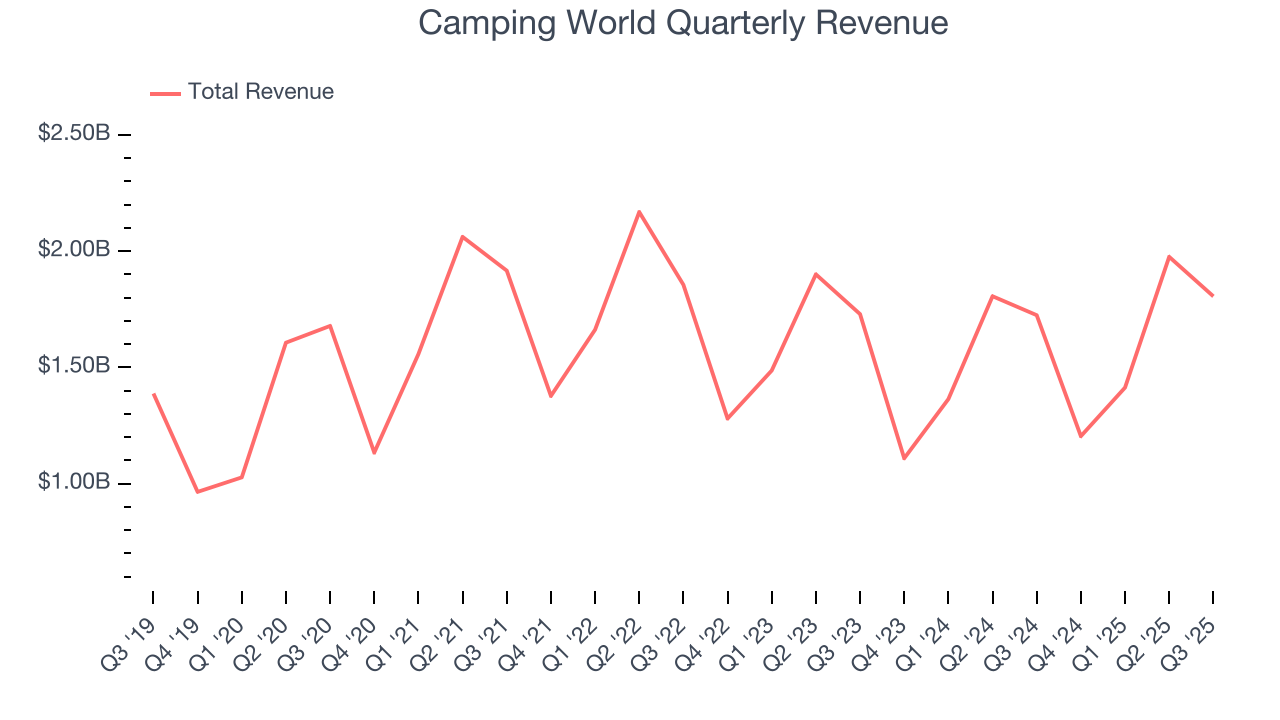

With $6.4 billion in revenue over the past 12 months, Camping World is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Camping World’s 4.5% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish as it didn’t open many new stores.

This quarter, Camping World reported modest year-on-year revenue growth of 4.7% but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its six-year rate. Despite the slowdown, this projection is above average for the sector and suggests the market is baking in some success for its newer products.

6. Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Camping World listed 197 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

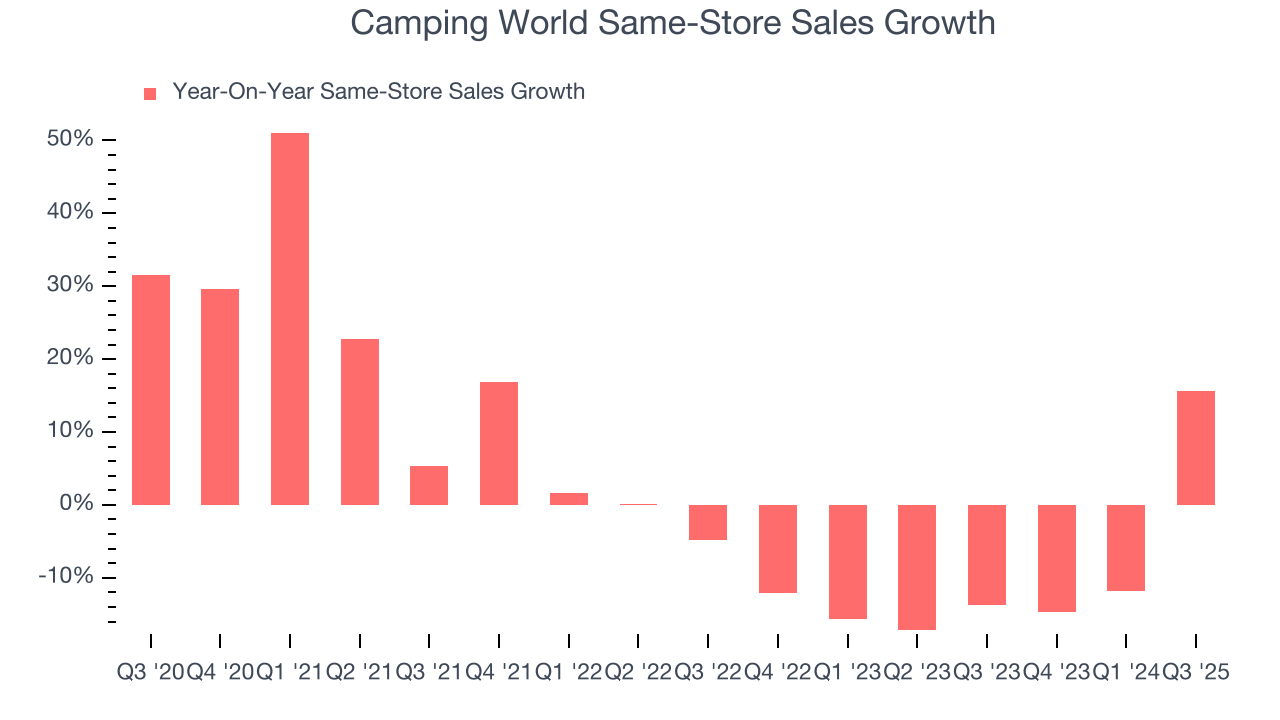

Camping World’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines. This performance isn’t ideal, and we’d be concerned if Camping World starts opening new stores to artificially boost revenue growth.

In the latest quarter, Camping World’s same-store sales rose 15.6% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

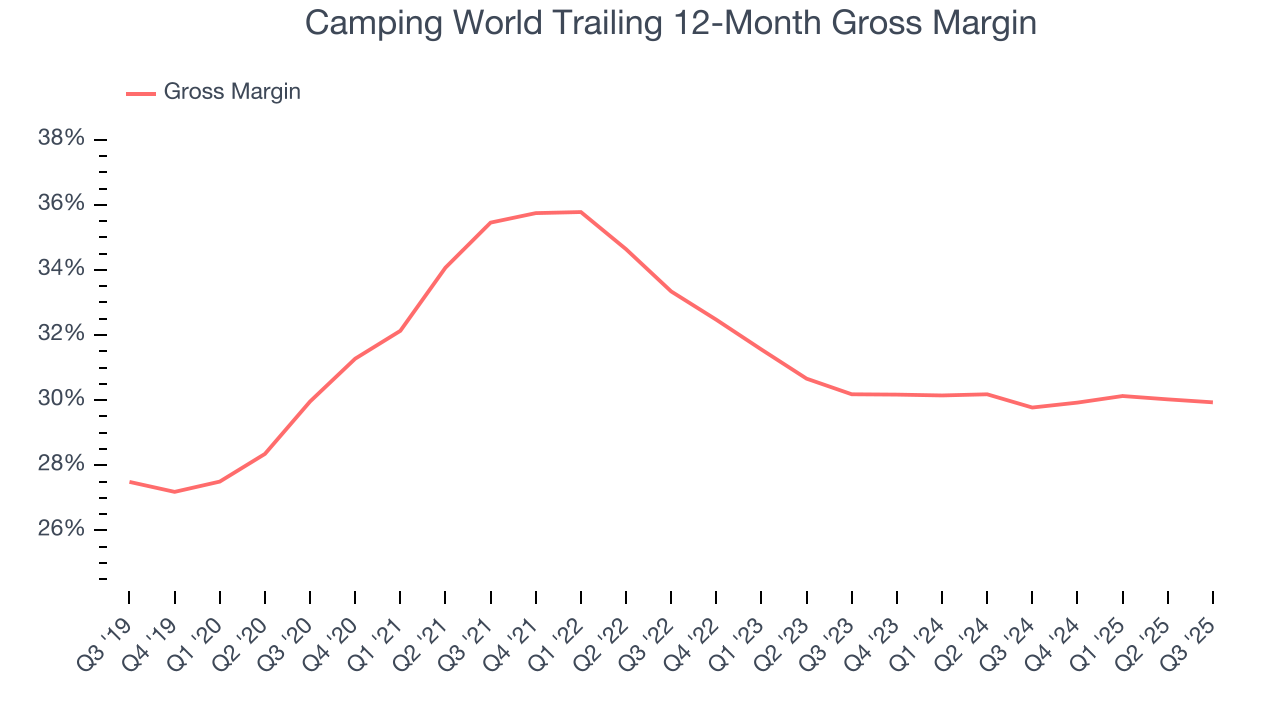

Camping World has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 29.9% gross margin over the last two years. That means Camping World paid its suppliers a lot of money ($70.14 for every $100 in revenue) to run its business.

Camping World’s gross profit margin came in at 28.6% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

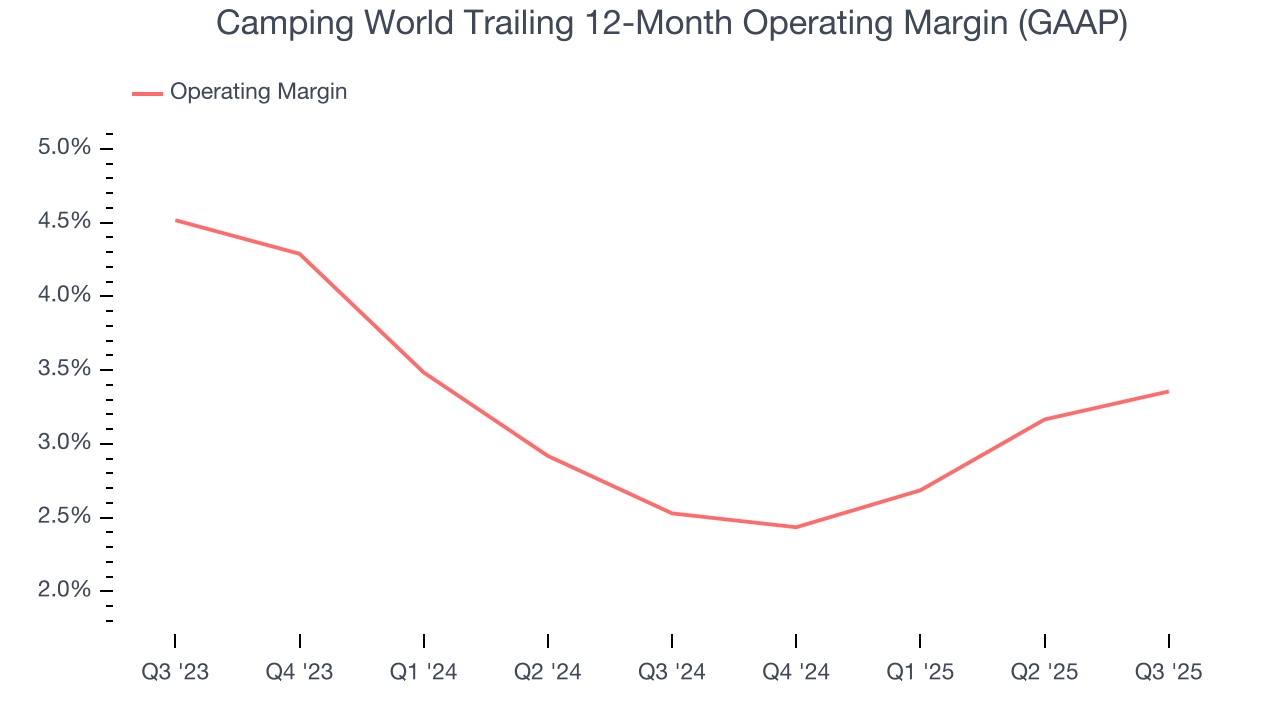

Camping World’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 3% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Camping World’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Camping World generated an operating margin profit margin of 4.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

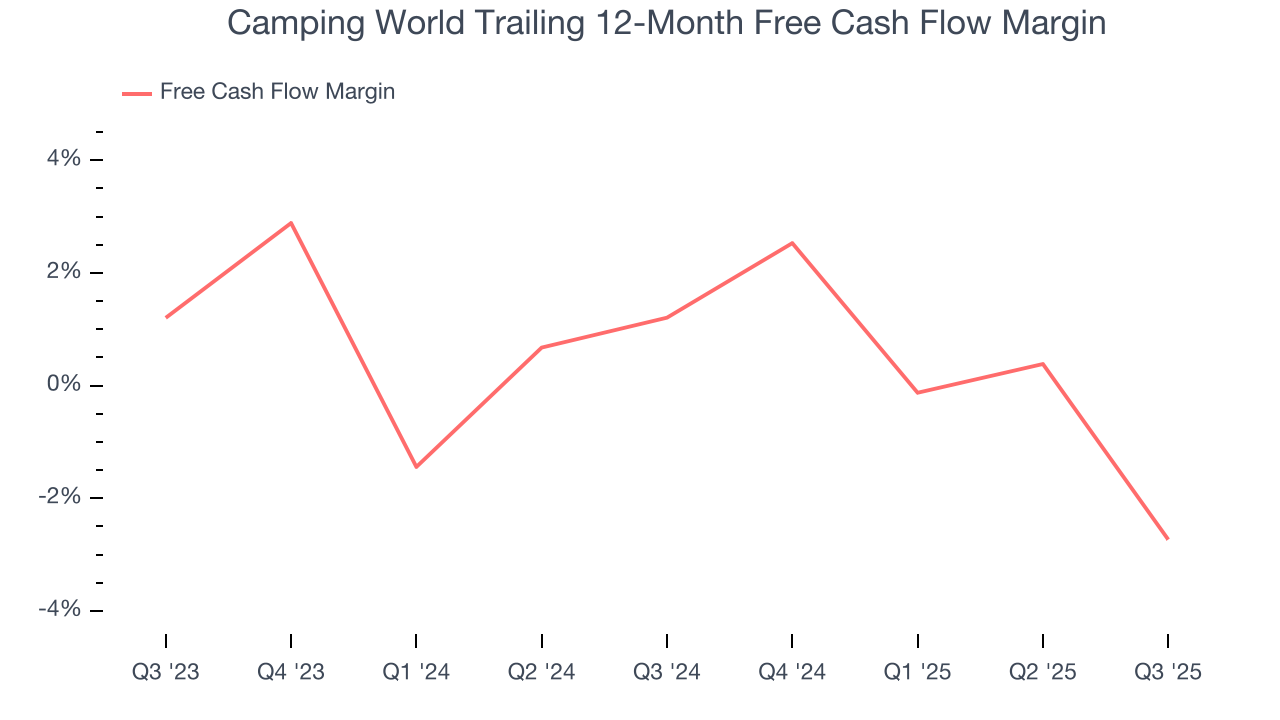

Camping World broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Camping World’s margin dropped by 3.9 percentage points over the last year. This decrease warrants extra caution because Camping World failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

Camping World’s free cash flow clocked in at $105.4 million in Q3, equivalent to a 5.8% margin. The company’s cash profitability regressed as it was 11.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Camping World’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 15.9%, slightly better than typical consumer retail business.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

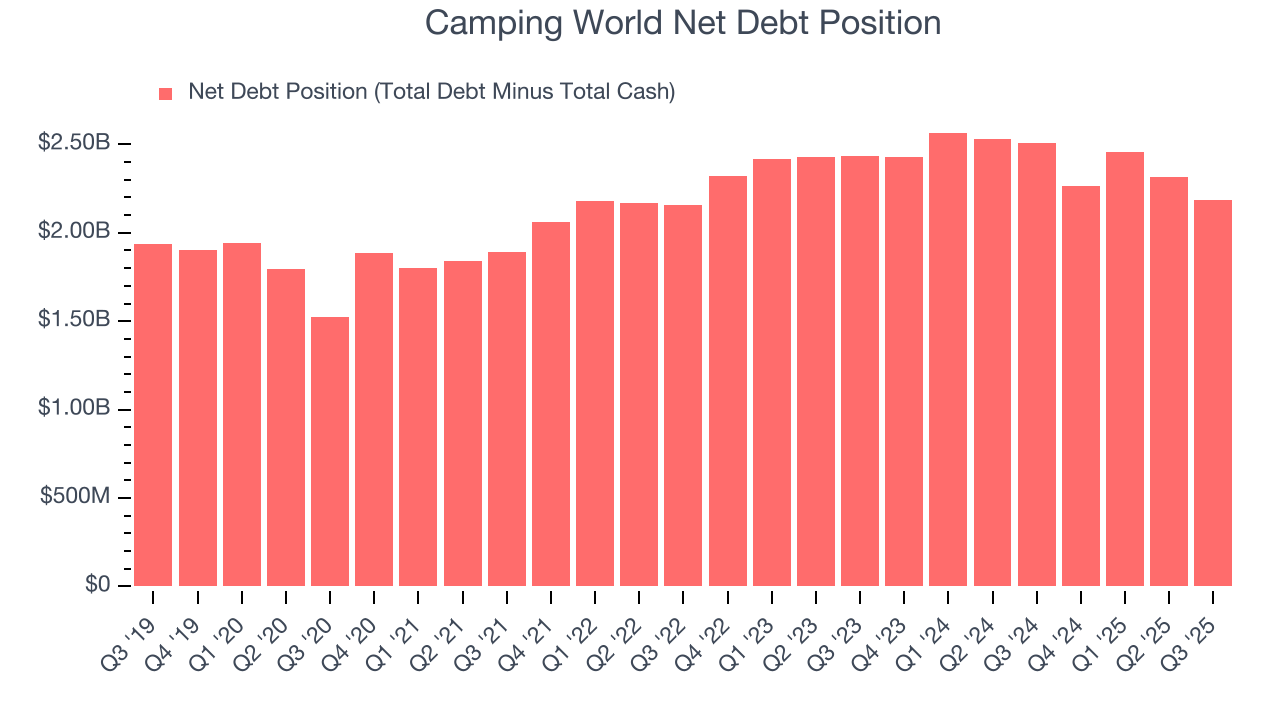

Camping World burned through $174.9 million of cash over the last year, and its $2.42 billion of debt exceeds the $230.5 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Camping World’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Camping World until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Camping World’s Q3 Results

It was good to see Camping World beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 4% to $16.15 immediately after reporting.

13. Is Now The Time To Buy Camping World?

Updated: January 30, 2026 at 9:37 PM EST

When considering an investment in Camping World, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Camping World doesn’t pass our quality test. To kick things off, its revenue has declined over the last three years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Camping World’s P/E ratio based on the next 12 months is 18.2x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $17.58 on the company (compared to the current share price of $13.17).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.