Emerson Electric (EMR)

We aren’t fans of Emerson Electric. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Emerson Electric Is Not Exciting

Founded in 1890, Emerson Electric (NYSE:EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 1.4% over the last five years was below our standards for the industrials sector

- Estimated sales growth of 5.4% for the next 12 months implies demand will slow from its two-year trend

- One positive is that its offerings are mission-critical for businesses and lead to a best-in-class gross margin of 48.3%

Emerson Electric’s quality doesn’t meet our bar. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Emerson Electric

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Emerson Electric

At $149.27 per share, Emerson Electric trades at 22.7x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Emerson Electric (EMR) Research Report: Q4 CY2025 Update

Engineering and automation solutions company Emerson (NYSE:EMR) met Wall Streets revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $4.35 billion. Its non-GAAP profit of $1.46 per share was 3.4% above analysts’ consensus estimates.

Emerson Electric (EMR) Q4 CY2025 Highlights:

- Revenue: $4.35 billion vs analyst estimates of $4.35 billion (4.1% year-on-year growth, in line)

- Adjusted EPS: $1.46 vs analyst estimates of $1.41 (3.4% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $6.48 at the midpoint

- Operating Margin: 24.6%, up from 19.4% in the same quarter last year

- Free Cash Flow Margin: 13.9%, down from 16.6% in the same quarter last year

- Market Capitalization: $83.57 billion

Company Overview

Founded in 1890, Emerson Electric (NYSE:EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

Emerson Electric was founded in 1890, initially starting out as a manufacturer of electric motors and fans. During the mid-20th century, Emerson diversified its offerings into a broader range of consumer, commercial, and industrial products. This expansion was marked by technological advancements and strategic acquisitions that broadened its capabilities and market presence, particularly in process control systems. The late 20th and early 21st centuries saw Emerson shifting its focus towards technology and engineering solutions, emphasizing automation and process control.

Today, Emerson Electric offers a wide variety of products, from advanced automation systems to essential industrial tools. For example, they produce sophisticated control systems and software under brands like DeltaV and Ovation, which help manage and improve factory operations. On the practical side, they offer sturdy tools such as RIDGID's pipe wrenches and sewer cameras, which are used by professionals in various industries. Emerson also supplies automation components like ASCO's solenoid valves and Branson's material-joining technologies, which are crucial in industries from automotive manufacturing to food and beverage production.

Emerson Electric's revenue primarily stems from the sale of manufactured products and software. A significant portion of Emerson's revenue also comes from post-sale support such as customer support, spare parts, repair services, and software maintenance contracts, providing some stability in revenue streams.

Recently, Emerson Electric has employed a strategy to reshape its portfolio to increase its focus on its core automation segment. This coincided with its decision in 2023 to sell its majority stake in its Climate Technologies business to Blackstone for $14.0 billion, retaining a 40% interest in the new standalone business named Copeland. This deal allowed Emerson to focus more on its core automation and technology operations while still benefiting from the Climate Technologies business's performance in the HVAC and refrigeration markets. On October 11, 2023, Emerson acquired National Instruments (NI) for an equity value of $8.2 billion. NI specializes in software-connected automated test and measurement systems that help companies launch products more quickly and cost-effectively. This acquisition strengthened Emerson's position in software and automation, aligning with the company’s goals to increase its market power in the space.

4. Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Competitors of Emerson Electric include Honeywell (NASDAQ:HON), Siemens (ETR:SIE), and ABB (NYSE:ABB).

5. Revenue Growth

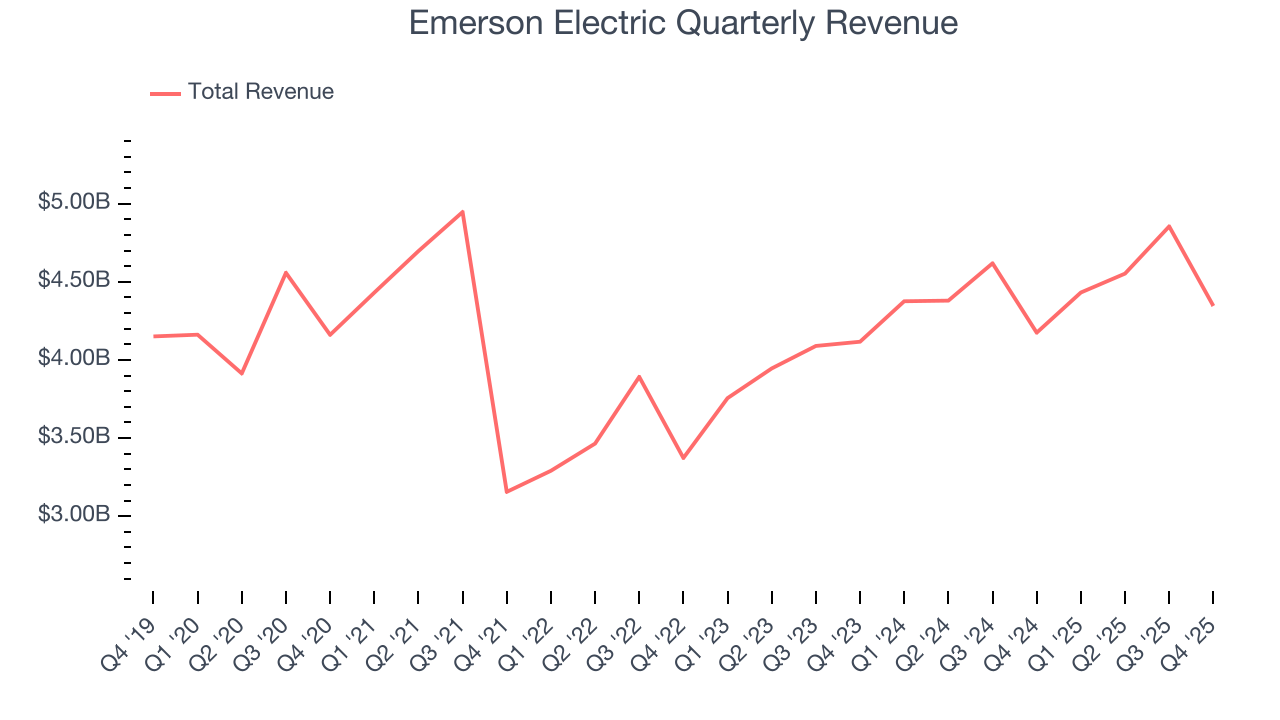

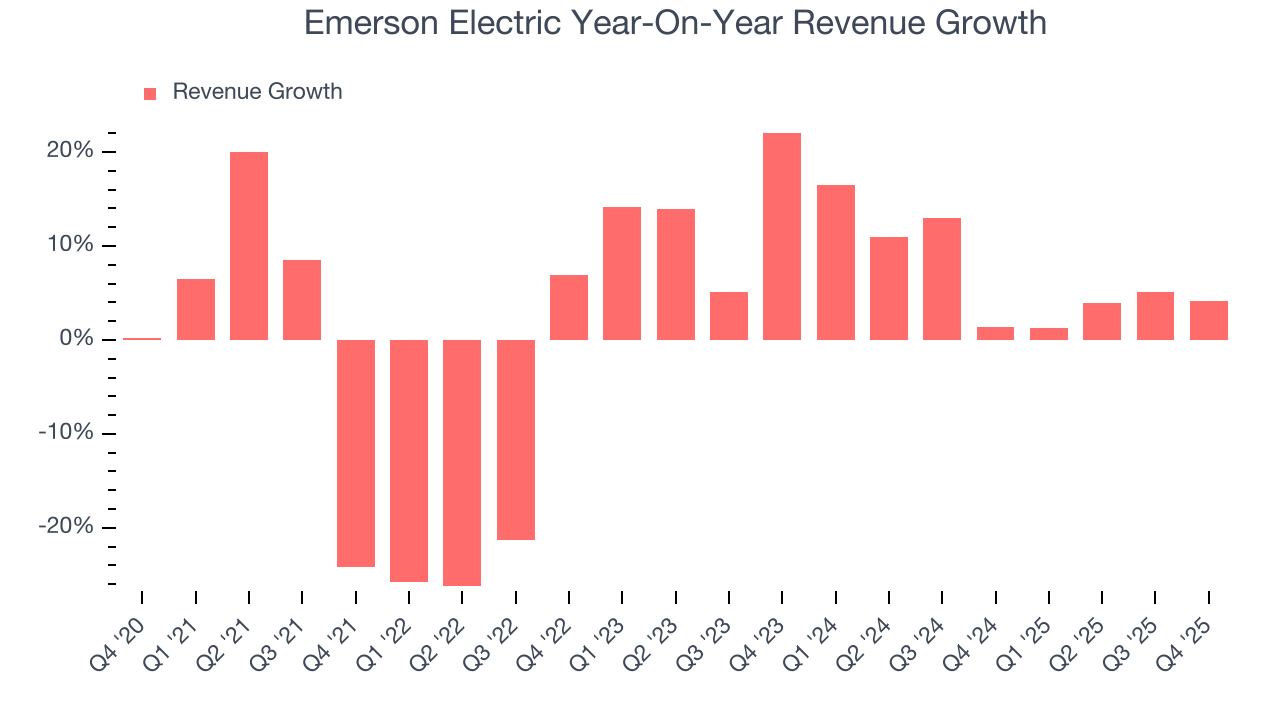

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Emerson Electric’s 1.6% annualized revenue growth over the last five years was sluggish. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Emerson Electric’s annualized revenue growth of 6.9% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Emerson Electric grew its revenue by 4.1% year on year, and its $4.35 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

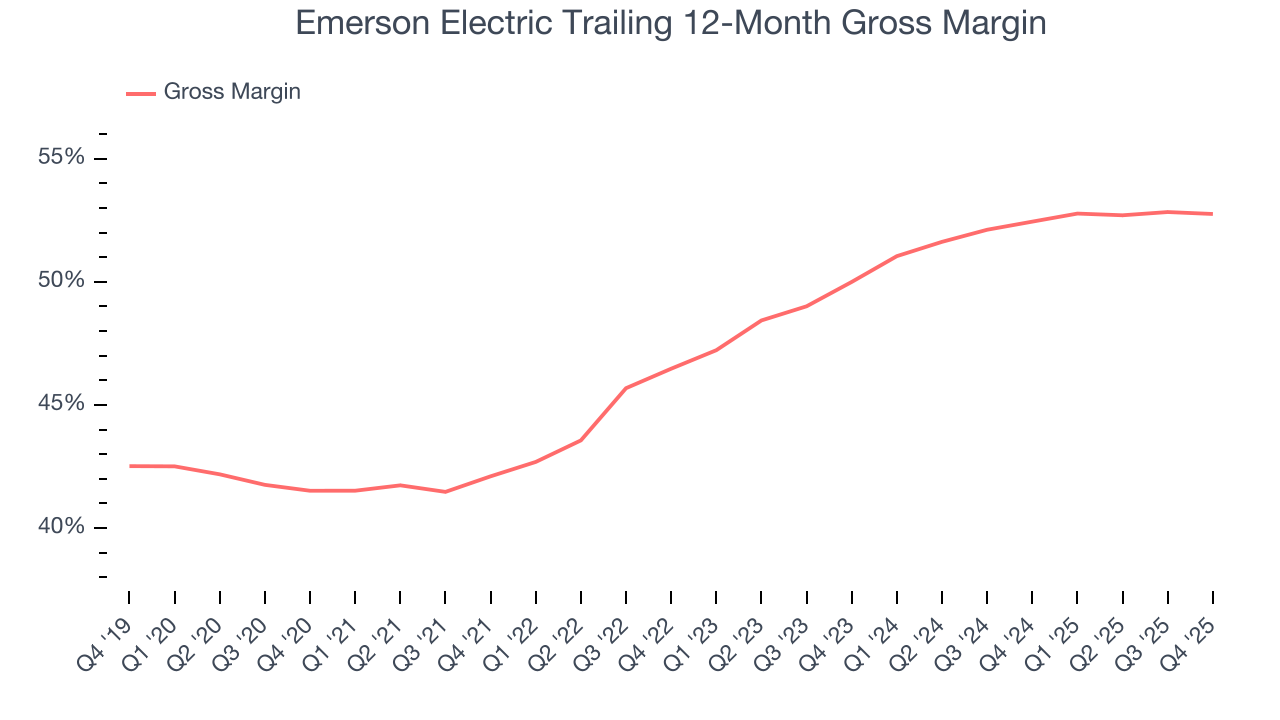

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Emerson Electric has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 48.9% gross margin over the last five years. That means Emerson Electric only paid its suppliers $51.12 for every $100 in revenue.

Emerson Electric produced a 53.2% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

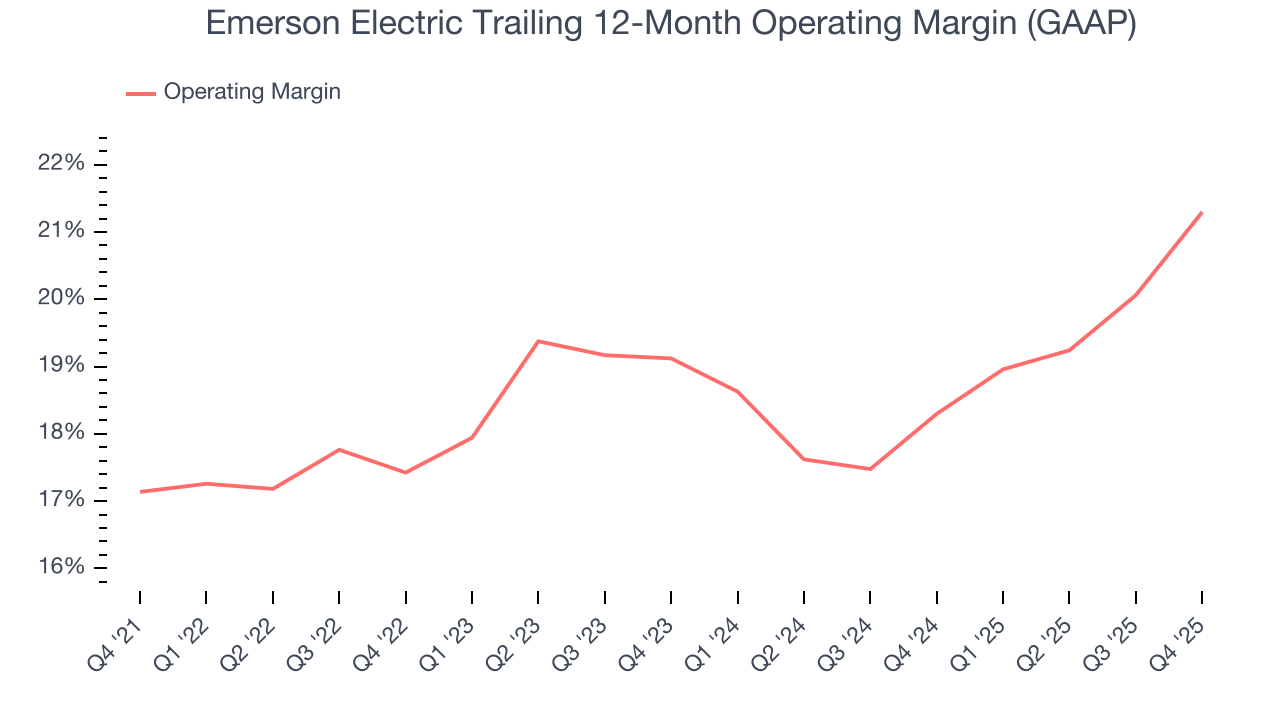

7. Operating Margin

Emerson Electric has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Emerson Electric’s operating margin rose by 4.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Emerson Electric generated an operating margin profit margin of 24.6%, up 5.2 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

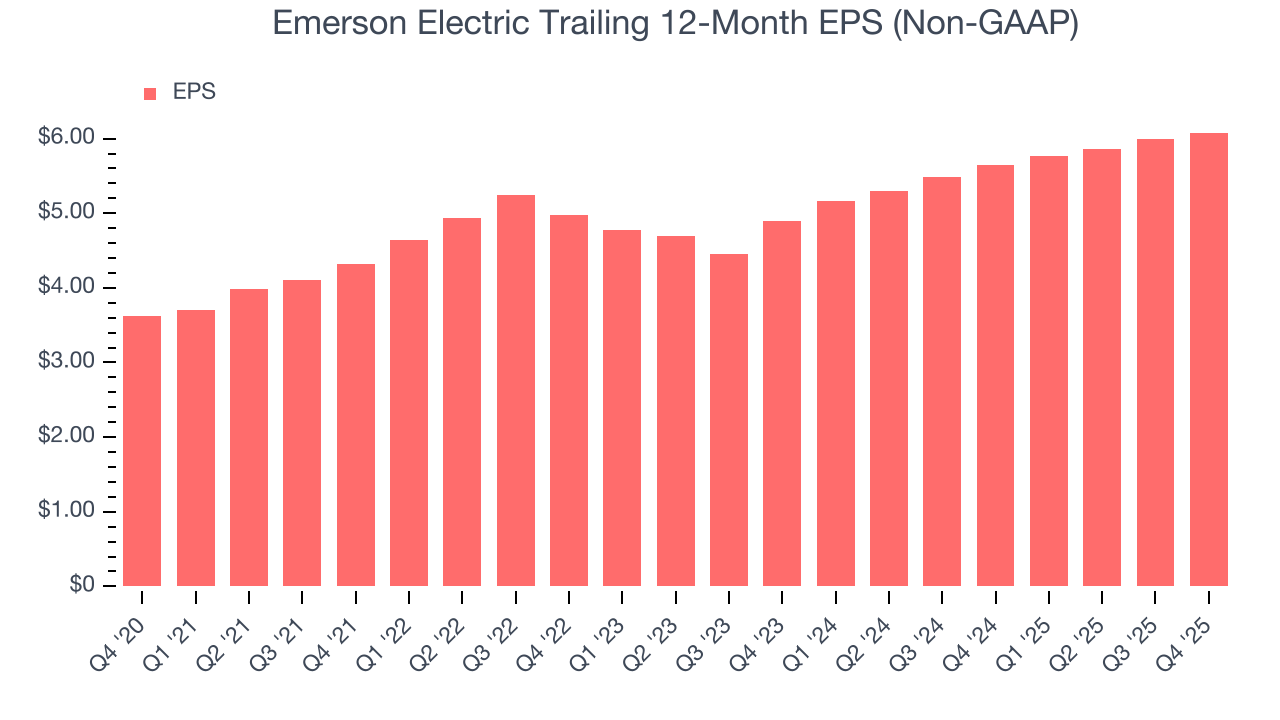

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

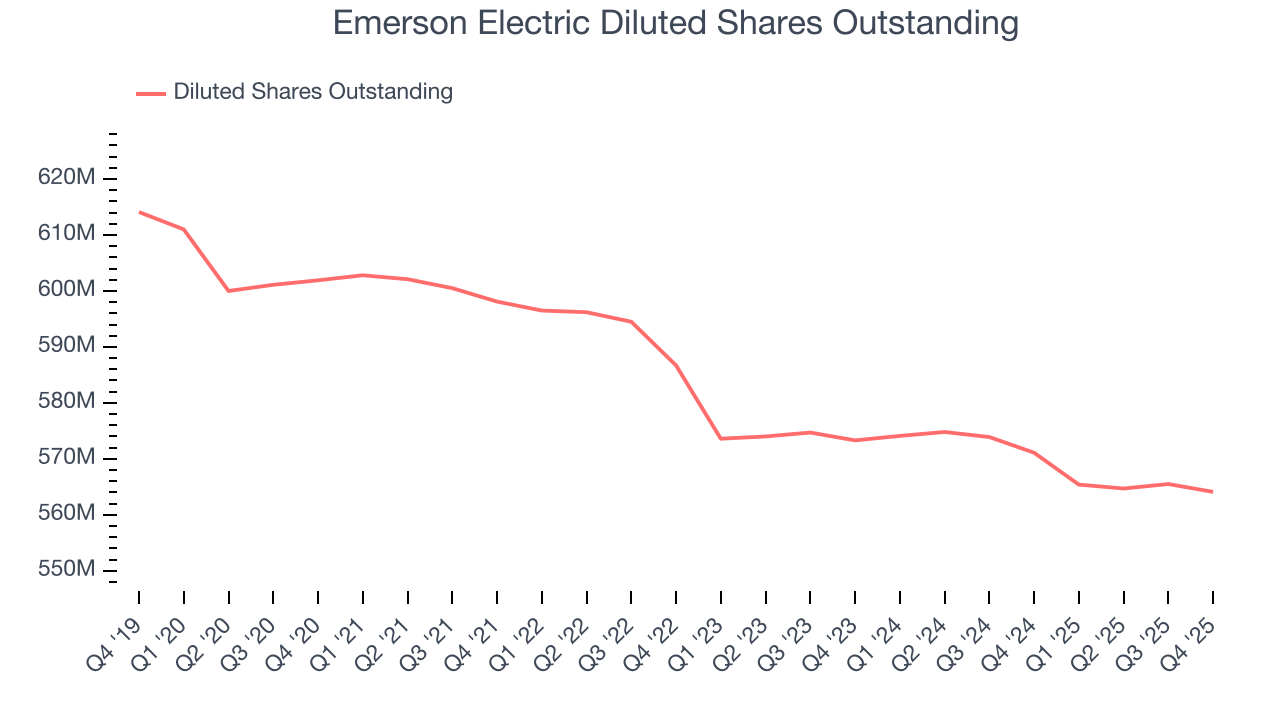

Emerson Electric’s EPS grew at a solid 10.9% compounded annual growth rate over the last five years, higher than its 1.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Emerson Electric’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Emerson Electric’s operating margin expanded by 4.2 percentage points over the last five years. On top of that, its share count shrank by 6.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Emerson Electric, its two-year annual EPS growth of 11.5% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Emerson Electric reported adjusted EPS of $1.46, up from $1.38 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects Emerson Electric’s full-year EPS of $6.08 to grow 9%.

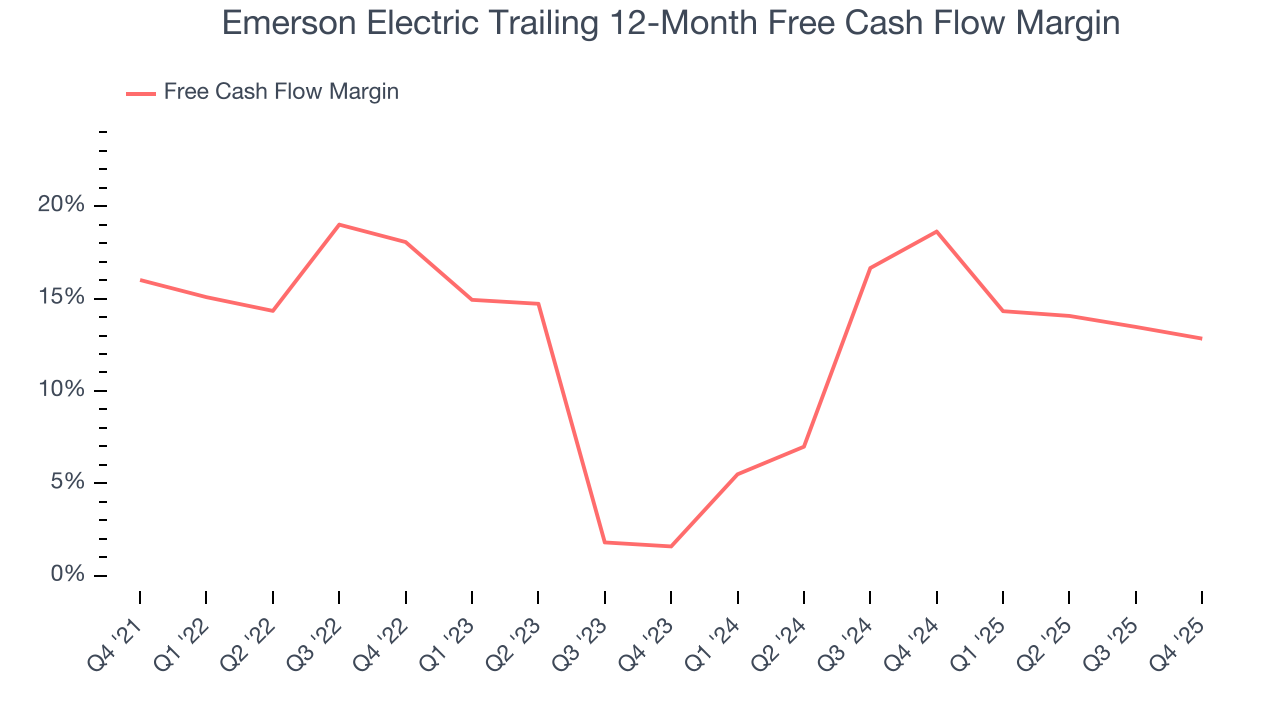

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Emerson Electric has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.4% over the last five years.

Taking a step back, we can see that Emerson Electric’s margin dropped by 3.2 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Emerson Electric’s free cash flow clocked in at $602 million in Q4, equivalent to a 13.9% margin. The company’s cash profitability regressed as it was 2.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

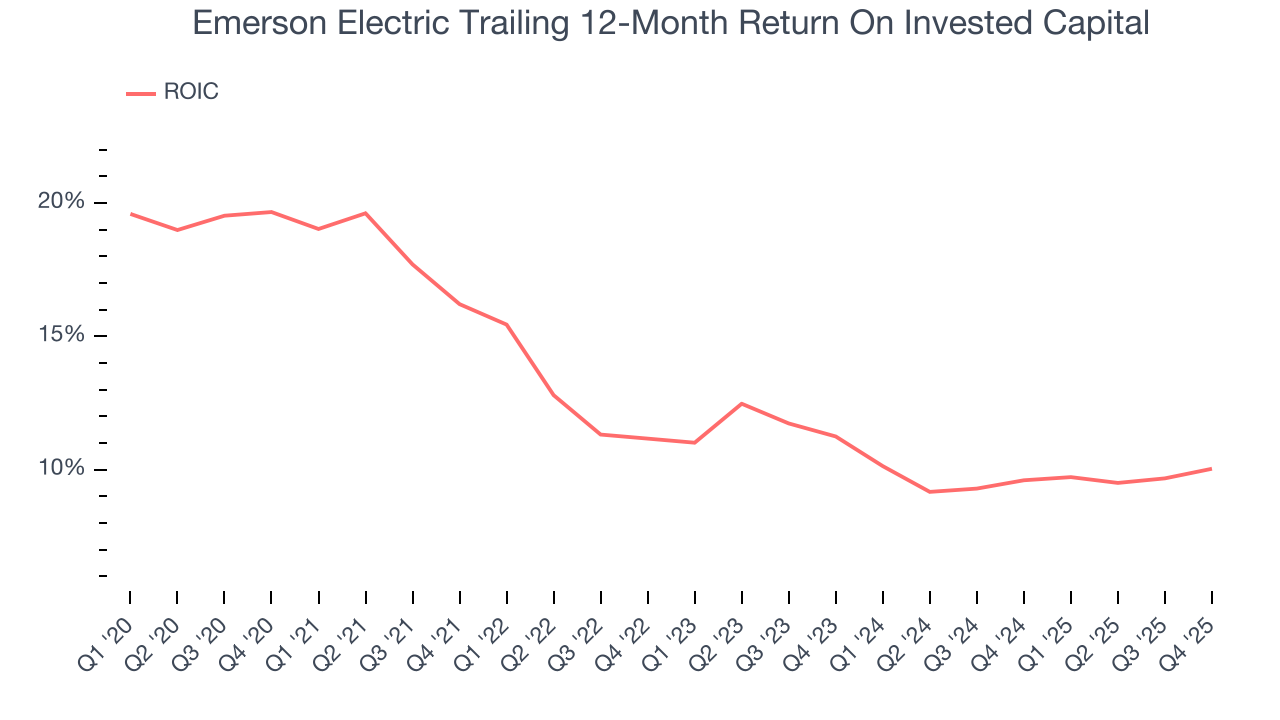

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Emerson Electric’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.6%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Emerson Electric’s ROIC averaged 3.9 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

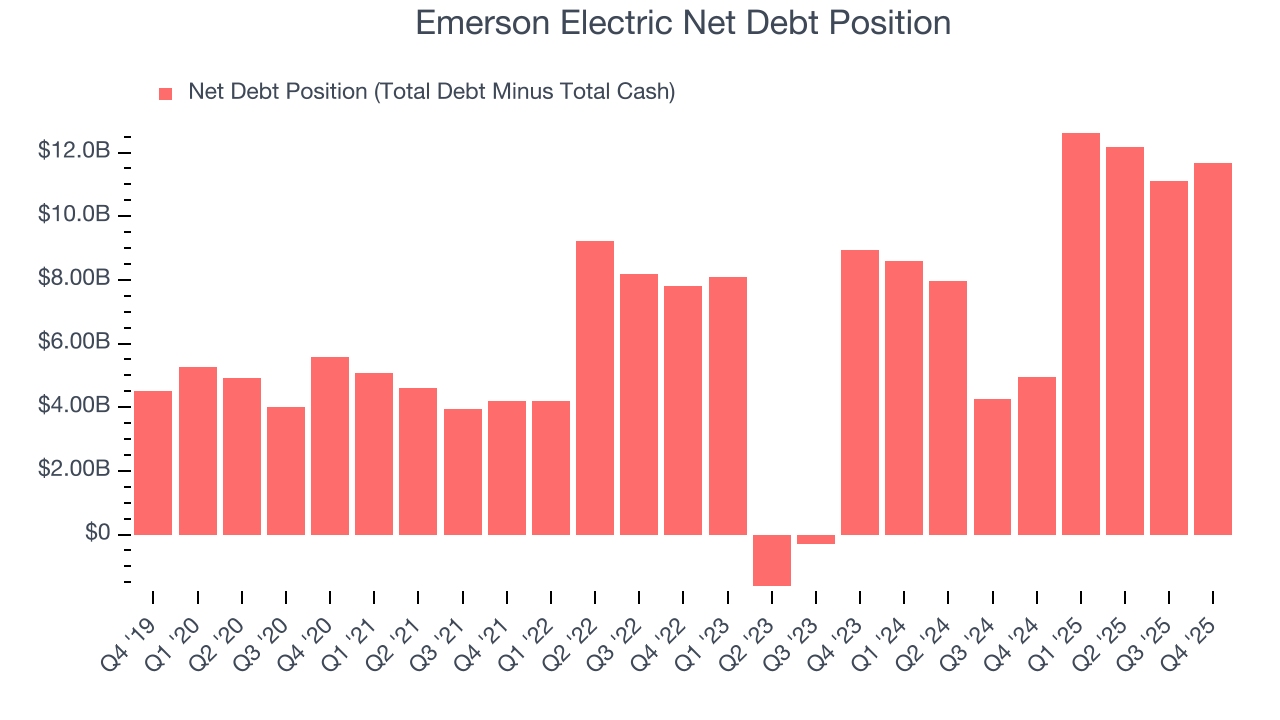

Emerson Electric reported $1.75 billion of cash and $13.41 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $4.78 billion of EBITDA over the last 12 months, we view Emerson Electric’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $138 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Emerson Electric’s Q4 Results

Despite in-line revenue, it was good to see Emerson Electric beat analysts’ EPS expectations this quarter. On the other hand, its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.6% to $157.53 immediately following the results.

13. Is Now The Time To Buy Emerson Electric?

Updated: February 3, 2026 at 5:36 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Emerson Electric, you should also grasp the company’s longer-term business quality and valuation.

Emerson Electric isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was weak over the last five years. And while its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its cash profitability fell over the last five years.

Emerson Electric’s P/E ratio based on the next 12 months is 23x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $155.95 on the company (compared to the current share price of $157.53).