Evolent Health (EVH)

We’re wary of Evolent Health. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Evolent Health Will Underperform

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE:EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

- Negative returns on capital show management lost money while trying to expand the business, and its decreasing returns suggest its historical profit centers are aging

- Poor expense management has led to an adjusted operating margin that is below the industry average

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Evolent Health falls short of our quality standards. There are more promising prospects in the market.

Why There Are Better Opportunities Than Evolent Health

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Evolent Health

Evolent Health is trading at $3.87 per share, or 16.9x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Evolent Health (EVH) Research Report: Q3 CY2025 Update

Healthcare solutions company Evolent Health (NYSE:EVH) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 22.8% year on year to $479.5 million. On the other hand, next quarter’s revenue guidance of $467 million was less impressive, coming in 1.2% below analysts’ estimates. Its non-GAAP profit of $0.05 per share was 52.5% below analysts’ consensus estimates.

Evolent Health (EVH) Q3 CY2025 Highlights:

- Revenue: $479.5 million vs analyst estimates of $467.3 million (22.8% year-on-year decline, 2.6% beat)

- Adjusted EPS: $0.05 vs analyst expectations of $0.11 (52.5% miss)

- Adjusted EBITDA: $38.96 million vs analyst estimates of $37.67 million (8.1% margin, 3.4% beat)

- Revenue Guidance for Q4 CY2025 is $467 million at the midpoint, below analyst estimates of $472.9 million

- EBITDA guidance for the full year is $149 million at the midpoint, below analyst estimates of $151.7 million

- Operating Margin: 0.2%, up from -2.6% in the same quarter last year

- Free Cash Flow Margin: 1.4%, similar to the same quarter last year

- Sales Volumes rose 5.2% year on year (2.5% in the same quarter last year)

- Market Capitalization: $736.4 million

Company Overview

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE:EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health focuses on three core areas: specialty care management, total cost of care management, and administrative services. The company's specialty care management services target high-cost, complex conditions like cancer, cardiovascular disease, and musculoskeletal disorders. These services include building networks of high-performing providers, designing evidence-based clinical pathways, and deploying proprietary technology to guide treatment decisions.

For specialty care management, Evolent uses its CarePro platform to provide clinical decision support and ensure providers adhere to best-practice treatment protocols. This approach aims to improve patient outcomes while reducing unnecessary costs for health plans and risk-bearing entities.

The company's total cost of care management solution helps healthcare providers succeed under value-based contracts, where they assume financial responsibility for patient populations. Evolent identifies high-risk patients and coordinates targeted interventions through primary care physicians to prevent costly complications or hospitalizations.

On the administrative side, Evolent offers its Identifi platform, which aggregates and analyzes healthcare data to manage care workflows and engage patients. The platform provides services like health plan administration, pharmacy benefit management, risk management, and analytics.

A health plan might engage Evolent to manage its cancer patients by implementing evidence-based treatment protocols, connecting patients with high-performing oncologists, and using technology to track outcomes. This approach can reduce unnecessary treatments while ensuring patients receive appropriate care.

Evolent generates revenue through service contracts with health plans, provider organizations, and other risk-bearing entities. The company has expanded its capabilities through strategic acquisitions, including New Century Health (oncology and cardiovascular care), IPG (musculoskeletal management), and NIA (radiology and genetics management).

4. Healthcare Technology for Providers

The healthcare technology sector provides software and data analytics to help hospitals and clinics streamline operations and improve patient outcomes, often through value-based care models. Future growth is expected as providers prioritize digital transformation to manage rising costs and patient demands. Tailwinds include the adoption of AI-driven tools and government incentives for digitization. There challenges as well, including long sales cycles and slow adoption by providers, who may be resistance to change. Tightening hospital budgets and cybersecurity threats are additional risks that could slow adoption.

Evolent Health competes with other healthcare management and technology companies such as Optum (part of UnitedHealth Group, NYSE:UNH), Signify Health (acquired by CVS Health, NYSE:CVS), and Evernorth (part of Cigna Group, NYSE:CI), as well as specialized care management firms like Magellan Health and AIM Specialty Health.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.05 billion in revenue over the past 12 months, Evolent Health lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

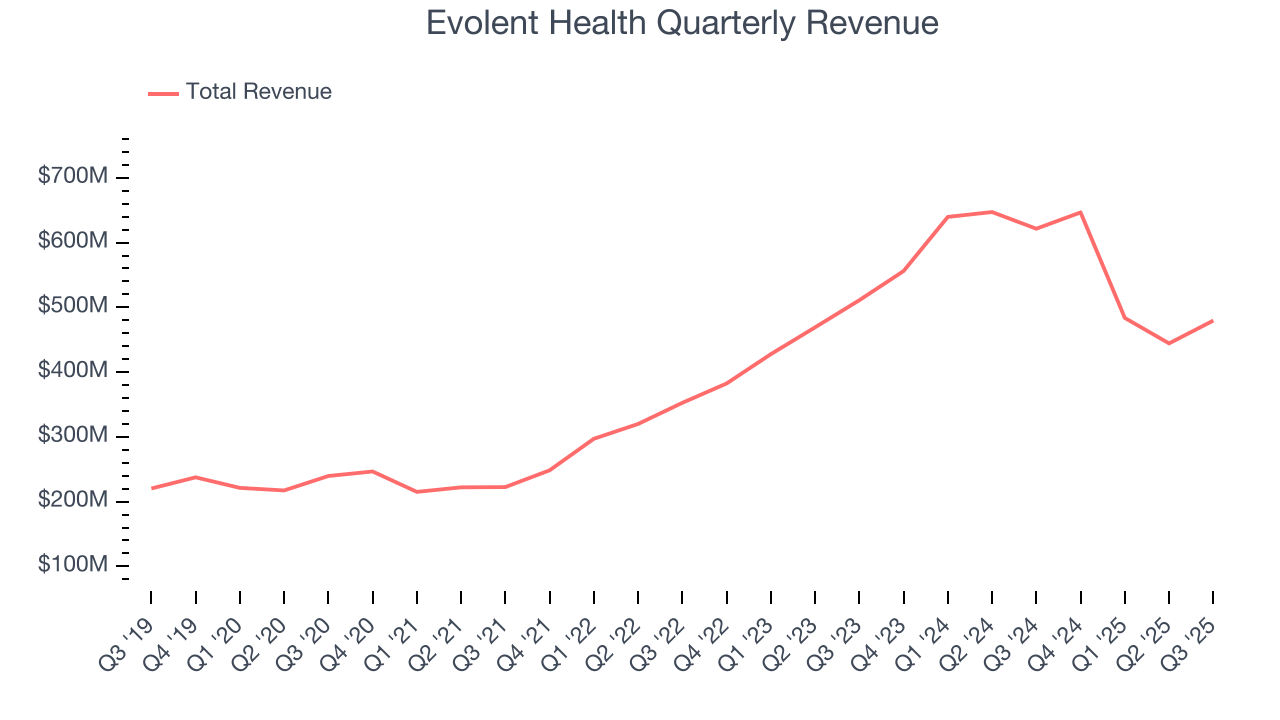

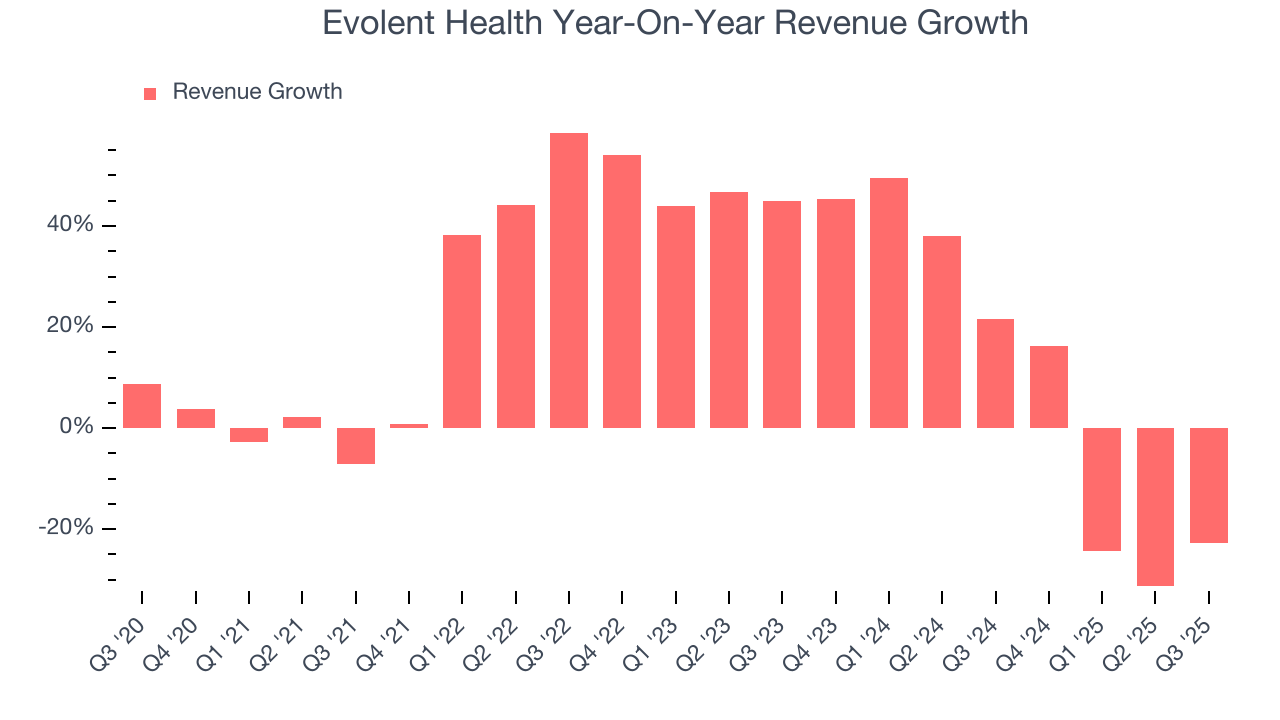

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Evolent Health grew its sales at an impressive 17.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Evolent Health’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 7.1% over the last two years was well below its five-year trend.

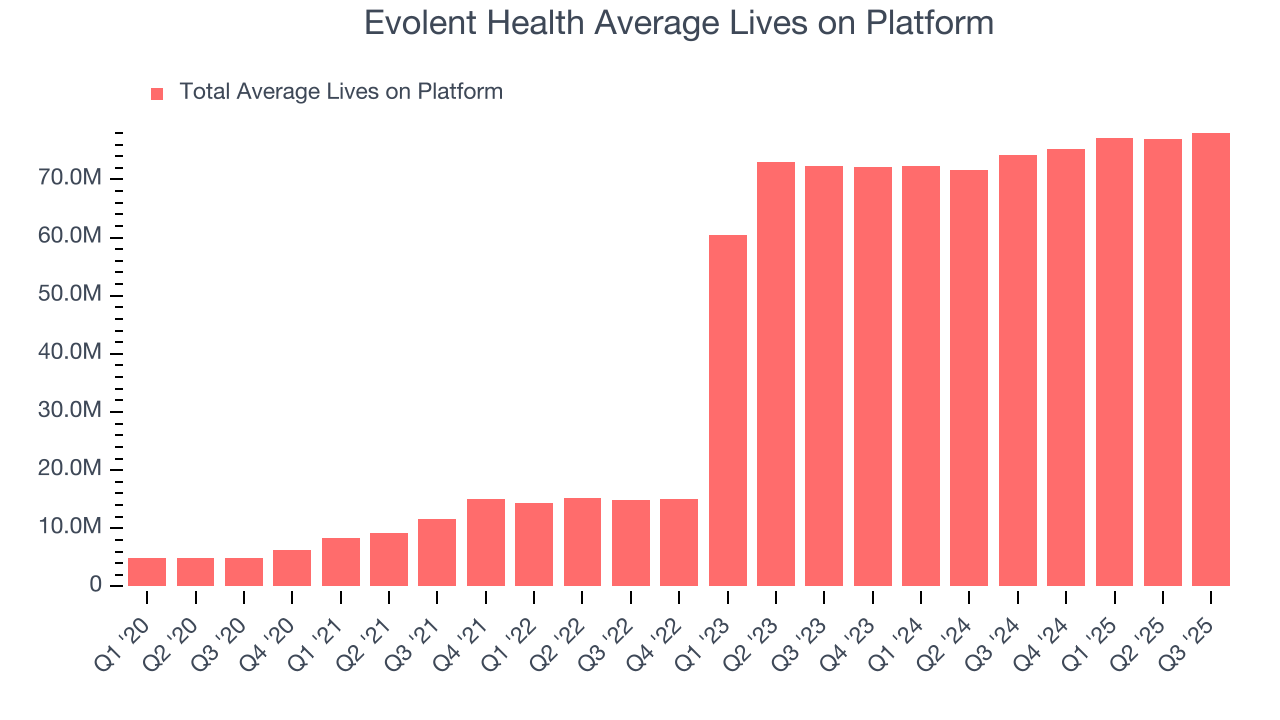

We can better understand the company’s revenue dynamics by analyzing its number of average lives on platform, which reached 78.05 million in the latest quarter. Over the last two years, Evolent Health’s average lives on platform averaged 53% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Evolent Health’s revenue fell by 22.8% year on year to $479.5 million but beat Wall Street’s estimates by 2.6%. Company management is currently guiding for a 27.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and suggests its newer products and services will spur better top-line performance.

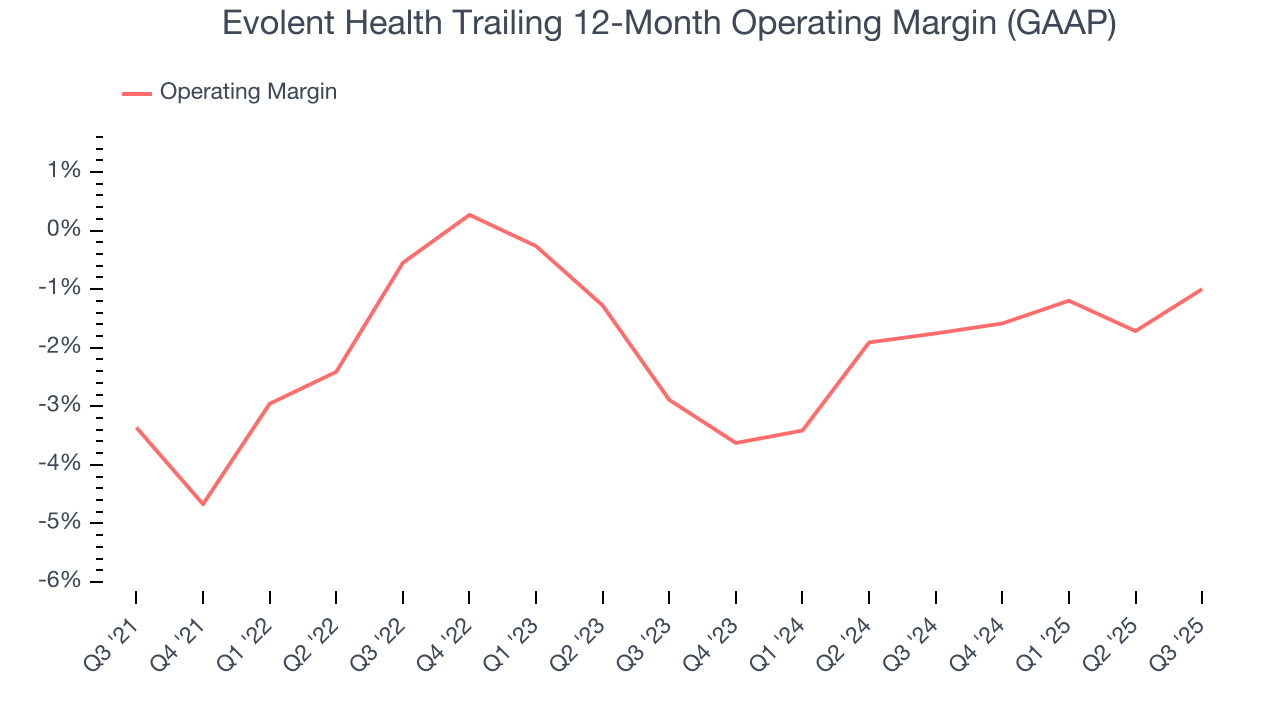

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Evolent Health broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Evolent Health’s operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, Evolent Health’s breakeven margin was up 2.8 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

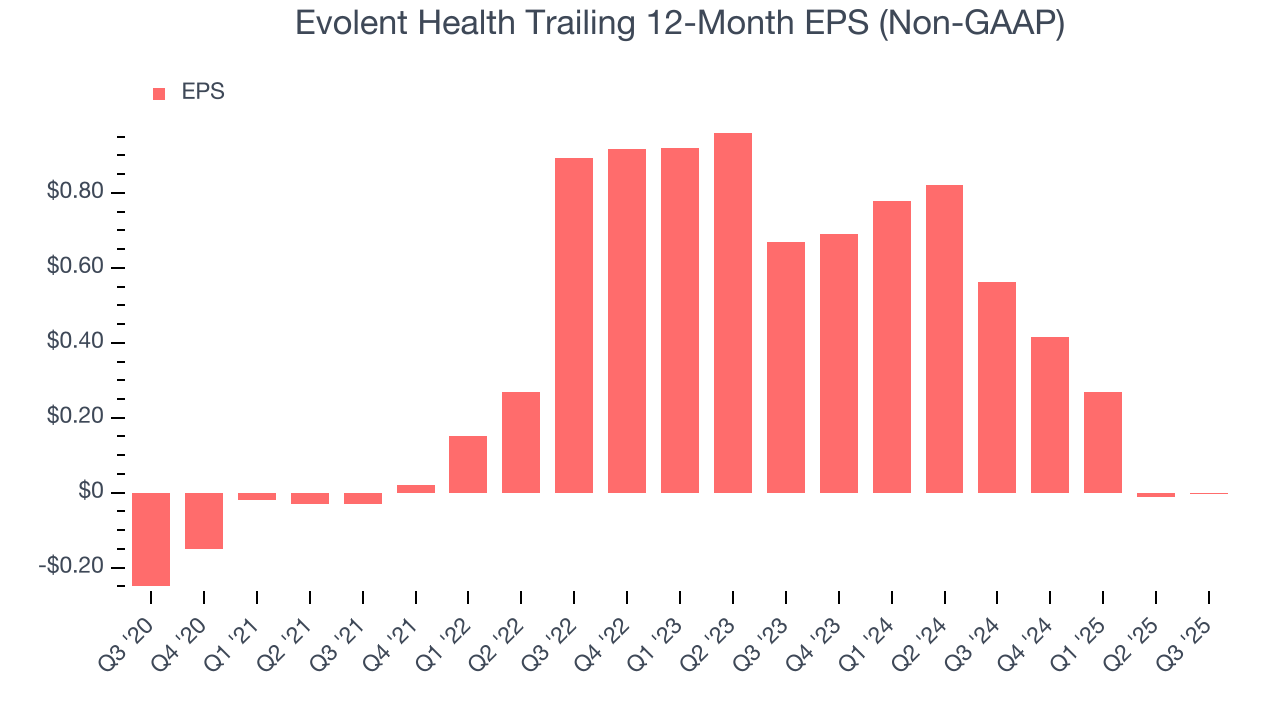

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Evolent Health’s full-year EPS flipped from negative to breakeven over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Evolent Health reported adjusted EPS of $0.05, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Evolent Health’s full-year EPS of negative $0 will flip to positive $0.60.

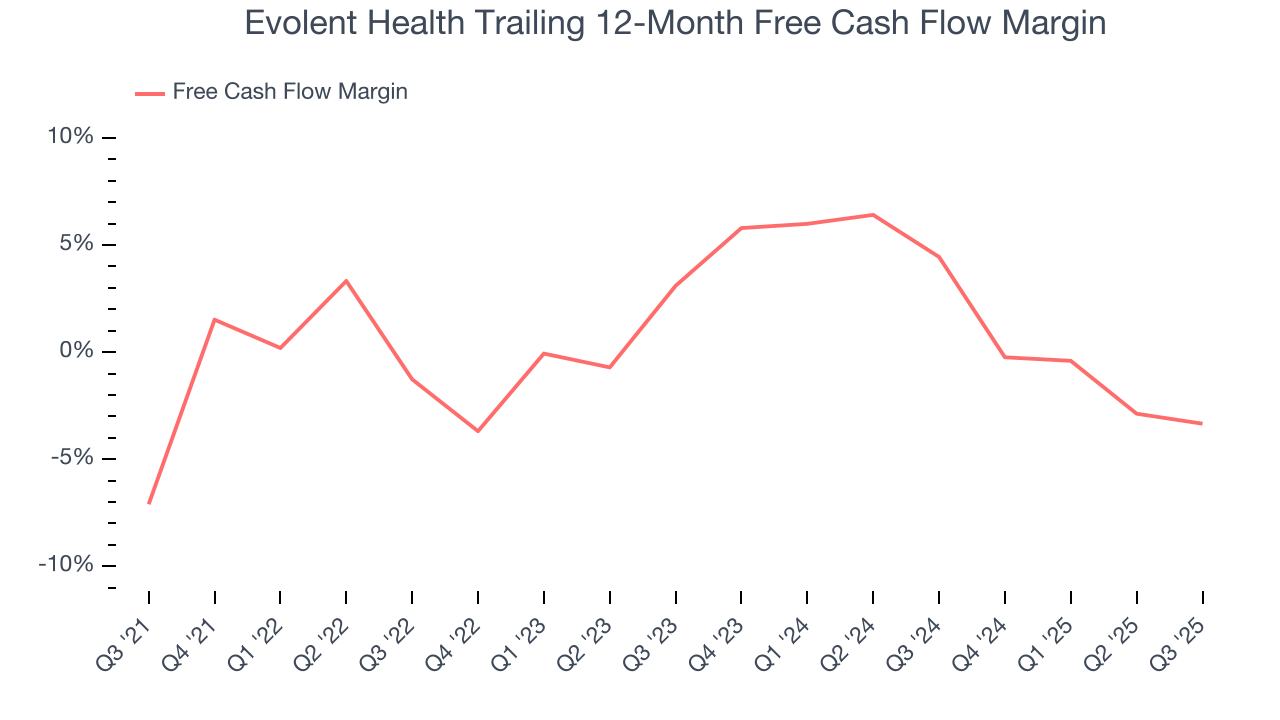

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Evolent Health broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Evolent Health’s margin expanded by 3.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Evolent Health’s free cash flow clocked in at $6.85 million in Q3, equivalent to a 1.4% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

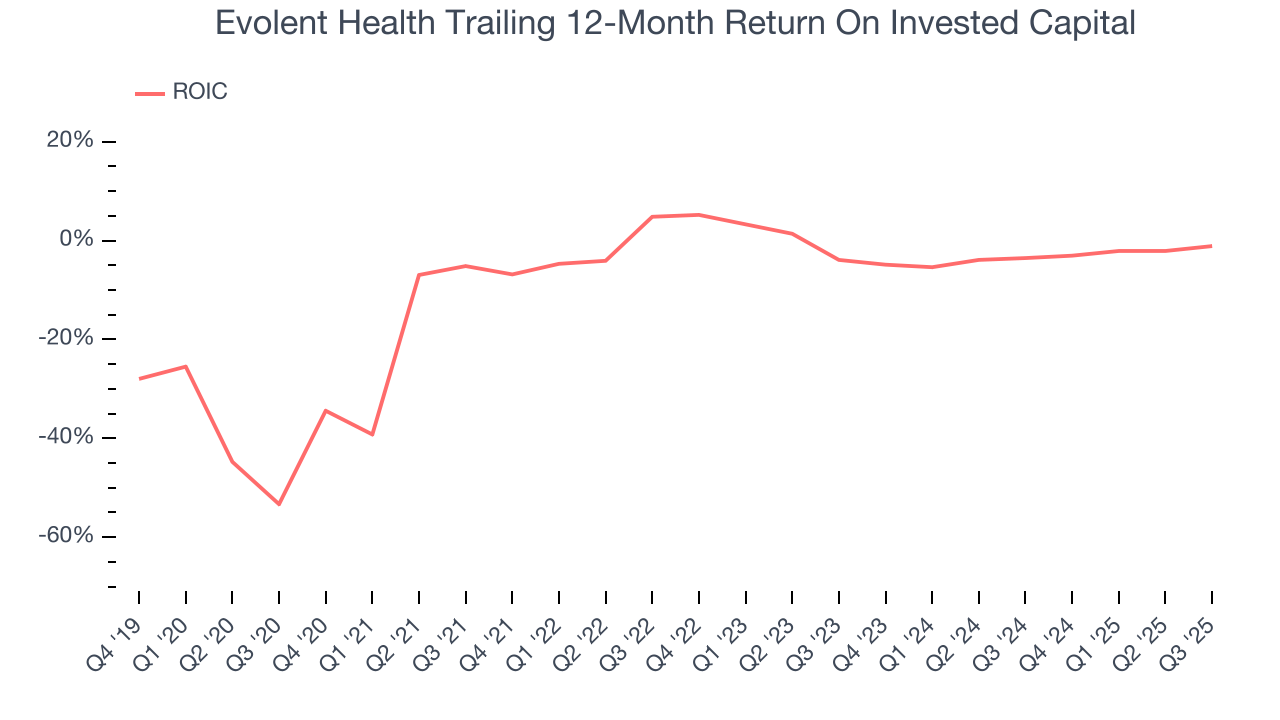

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Evolent Health’s five-year average ROIC was negative 1.8%, meaning management lost money while trying to expand the business. Investors are likely hoping for a change soon.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Evolent Health’s ROIC averaged 2.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

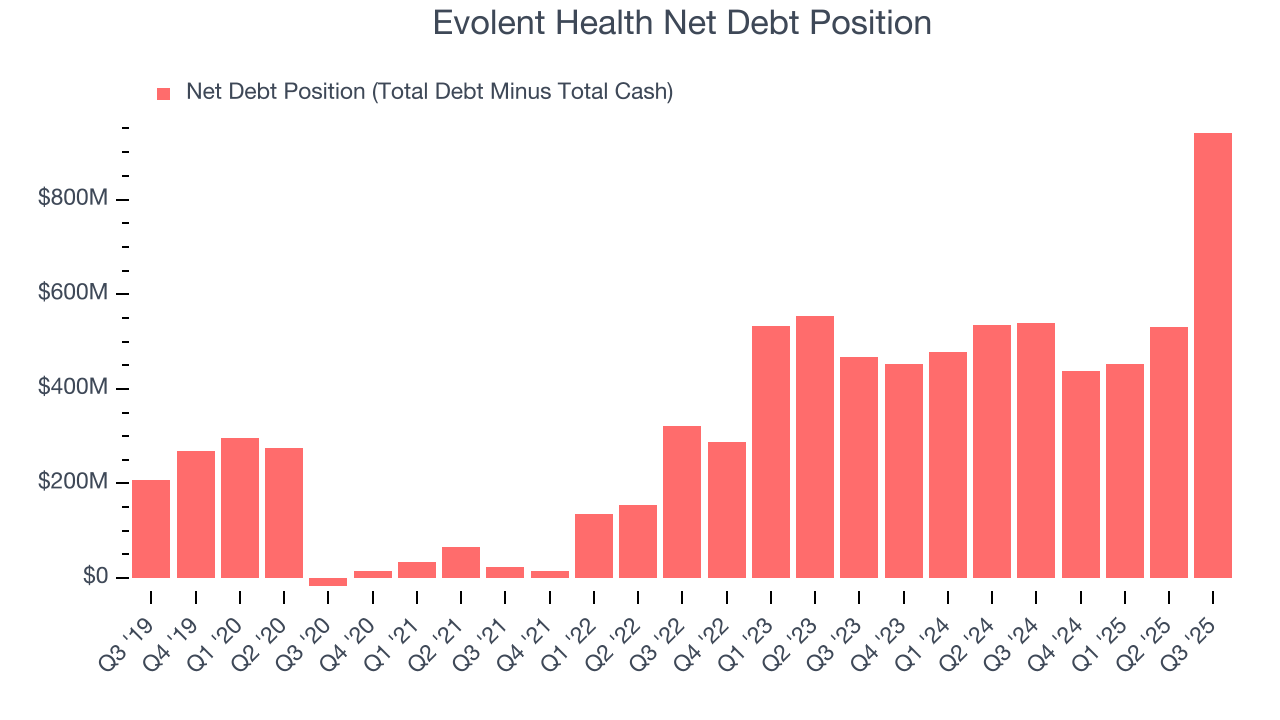

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Evolent Health’s $1.08 billion of debt exceeds the $140.3 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $136 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Evolent Health could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Evolent Health can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Evolent Health’s Q3 Results

Revenue and EBITDA beat Wall Street's expectations, which are big positives. On the other hand, guidance fell short of estimates. Overall, this was a mixed quarter. The stock traded up 15% to $6.90 immediately after reporting.

13. Is Now The Time To Buy Evolent Health?

Updated: November 25, 2025 at 11:18 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Evolent Health.

Evolent Health isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s growth in average lives on platform was surging, the downside is its operating margins are low compared to other healthcare companies.

Evolent Health’s P/E ratio based on the next 12 months is 18x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $11.04 on the company (compared to the current share price of $4.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.