Expeditors (EXPD)

We’re wary of Expeditors. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Expeditors Will Underperform

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

- Projected sales are flat for the next 12 months, implying demand will slow from its two-year trend

- Gross margin of 13.4% reflects its high production costs

- A positive is that its stellar returns on capital showcase management’s ability to surface highly profitable business ventures

Expeditors’s quality is insufficient. There are more promising alternatives.

Why There Are Better Opportunities Than Expeditors

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Expeditors

Expeditors’s stock price of $159.07 implies a valuation ratio of 27.3x forward P/E. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Expeditors (EXPD) Research Report: Q3 CY2025 Update

Logistics and freight forwarding company Expeditors (NYSE:EXPD) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 3.5% year on year to $2.89 billion. Its GAAP profit of $1.64 per share was 17.9% above analysts’ consensus estimates.

Expeditors (EXPD) Q3 CY2025 Highlights:

- Revenue: $2.89 billion vs analyst estimates of $2.67 billion (3.5% year-on-year decline, 8.6% beat)

- EPS (GAAP): $1.64 vs analyst estimates of $1.39 (17.9% beat)

- Adjusted EBITDA: $320.3 million vs analyst estimates of $260.9 million (11.1% margin, 22.8% beat)

- Operating Margin: 10%, in line with the same quarter last year

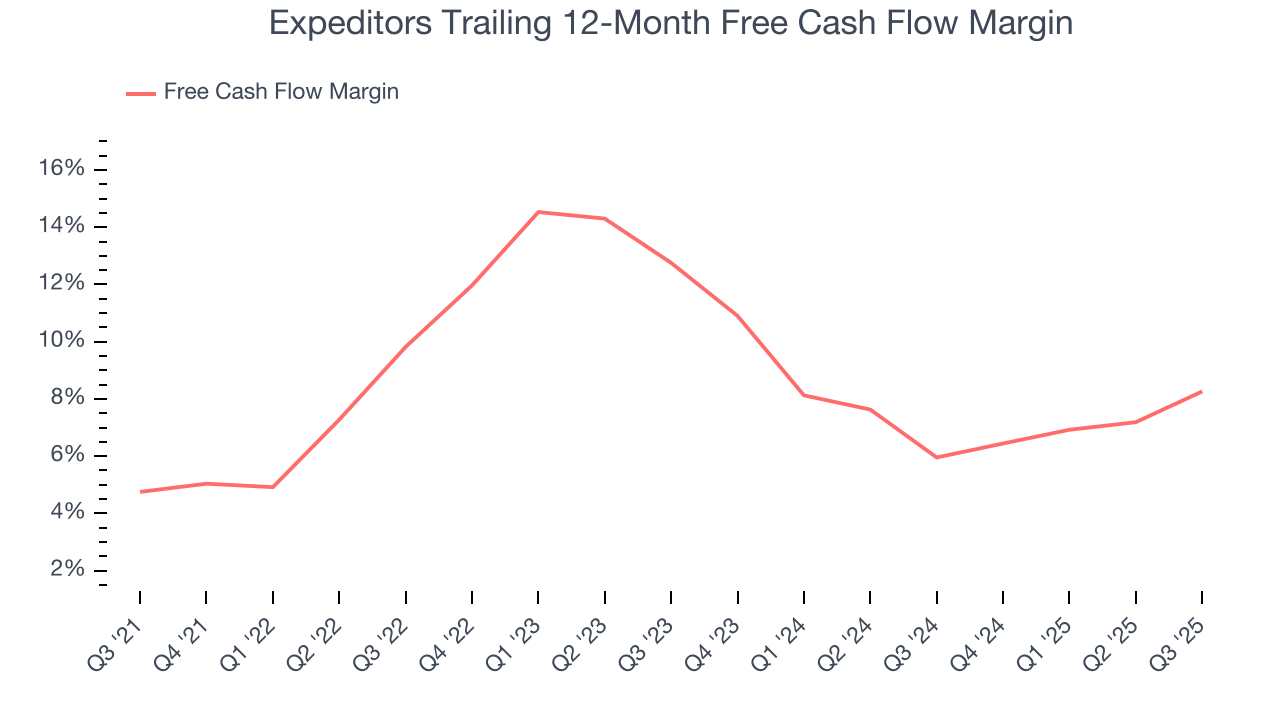

- Free Cash Flow Margin: 6.6%, up from 2.6% in the same quarter last year

- Market Capitalization: $16.62 billion

Company Overview

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

Expeditors was founded in 1979 as an ocean freight delivery company. It underwent significant growth as it entered new geographic locations and began to offer air freight and logistics services. Two pivotal acquisitions the company made include Global Transportation Services in 2010 and Mobility Services International (MSI) in 2014.

Today, Expeditors offers air and ocean freight as well as logistics services. The company delivers smaller and full container load freight by purchasing cargo from carriers on a volume basis and reselling that space to customers. It manages the entire shipping process from coordinating with carriers and handling customs documentation to delivering it to the final destination. As the weight or volume of a shipment increases, the cost that the company charges per pound or cubic inch decreases.

In addition, Expeditors also offer brokerage services to help its customers clear shipments by managing logistical hurdles such as government inspections and the storage of the goods. It generates revenue through a mix of transactional and contractual services. Transactional services include one-time shipments and customs clearance, while contractual services involve long-term agreements with businesses to make deliveries.

4. Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include UPS (NYSE:UPS), FedEx (NYSE:FDX), and C.H. Robinson (NASDAQ:CHRW).

5. Revenue Growth

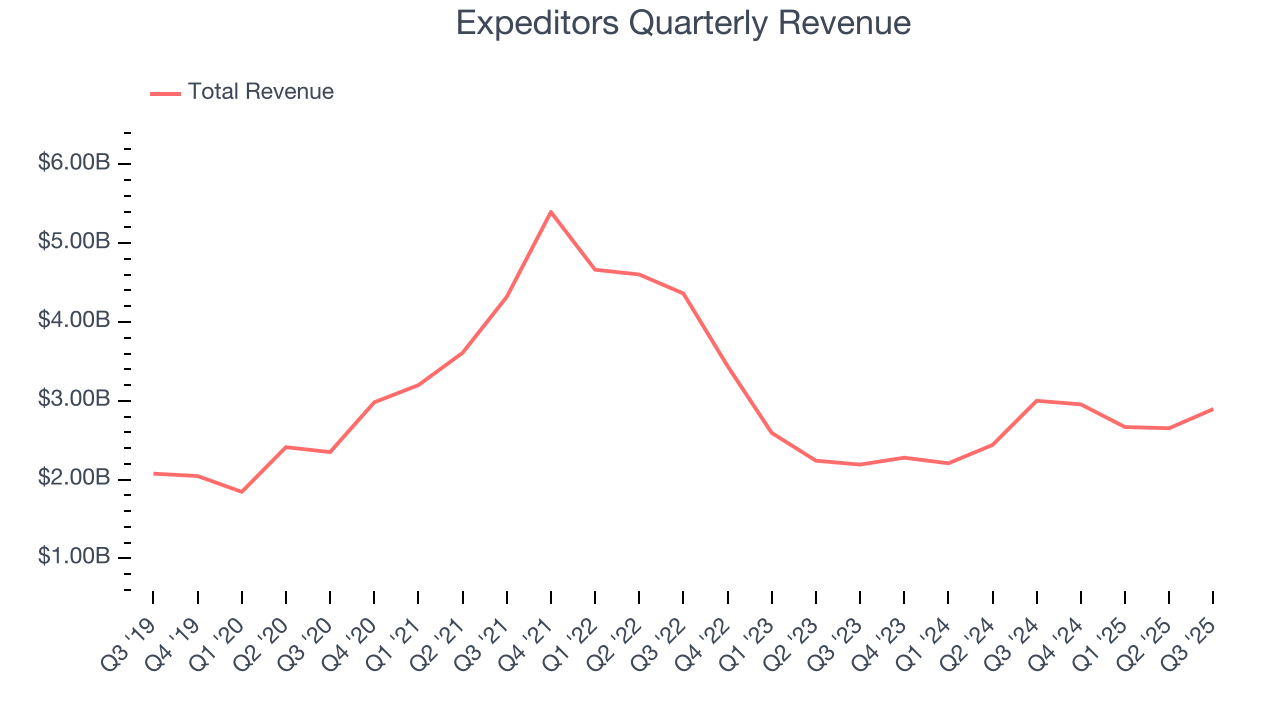

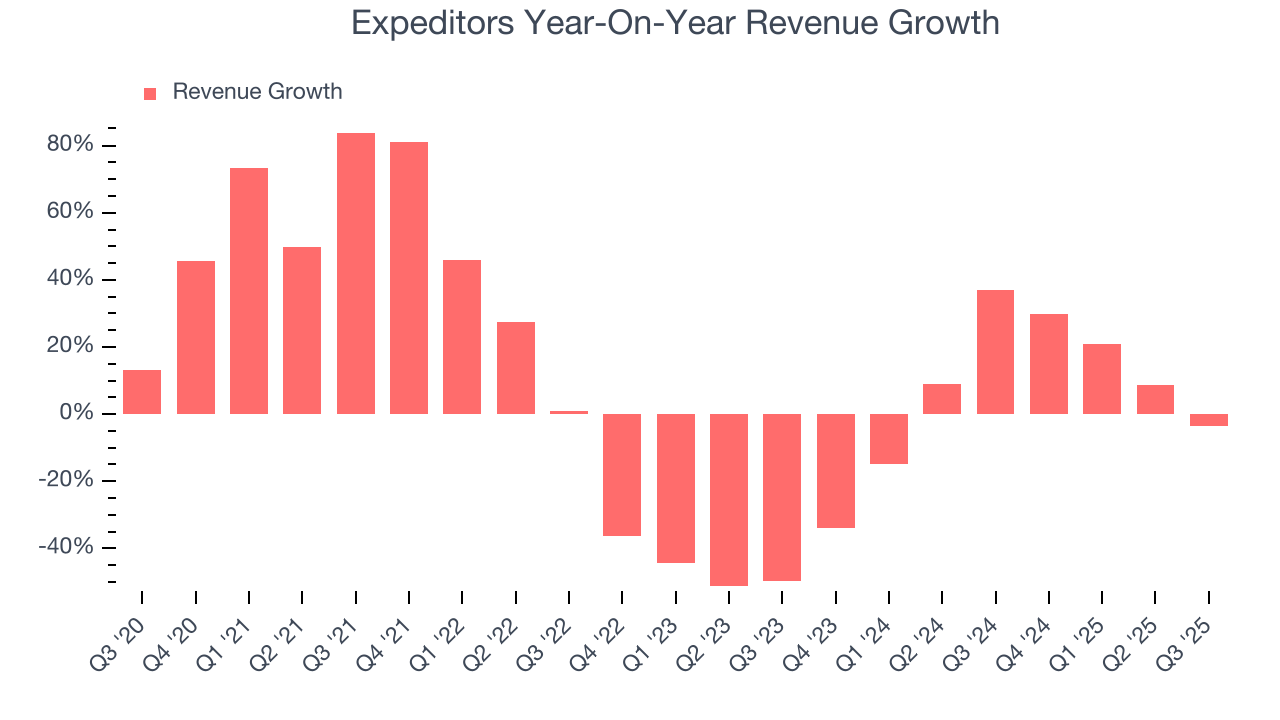

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Expeditors’s sales grew at a tepid 5.2% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Expeditors’s recent performance shows its demand has slowed as its annualized revenue growth of 3.3% over the last two years was below its five-year trend. We also note many other Air Freight and Logistics businesses have faced declining sales because of cyclical headwinds. While Expeditors grew slower than we’d like, it did do better than its peers.

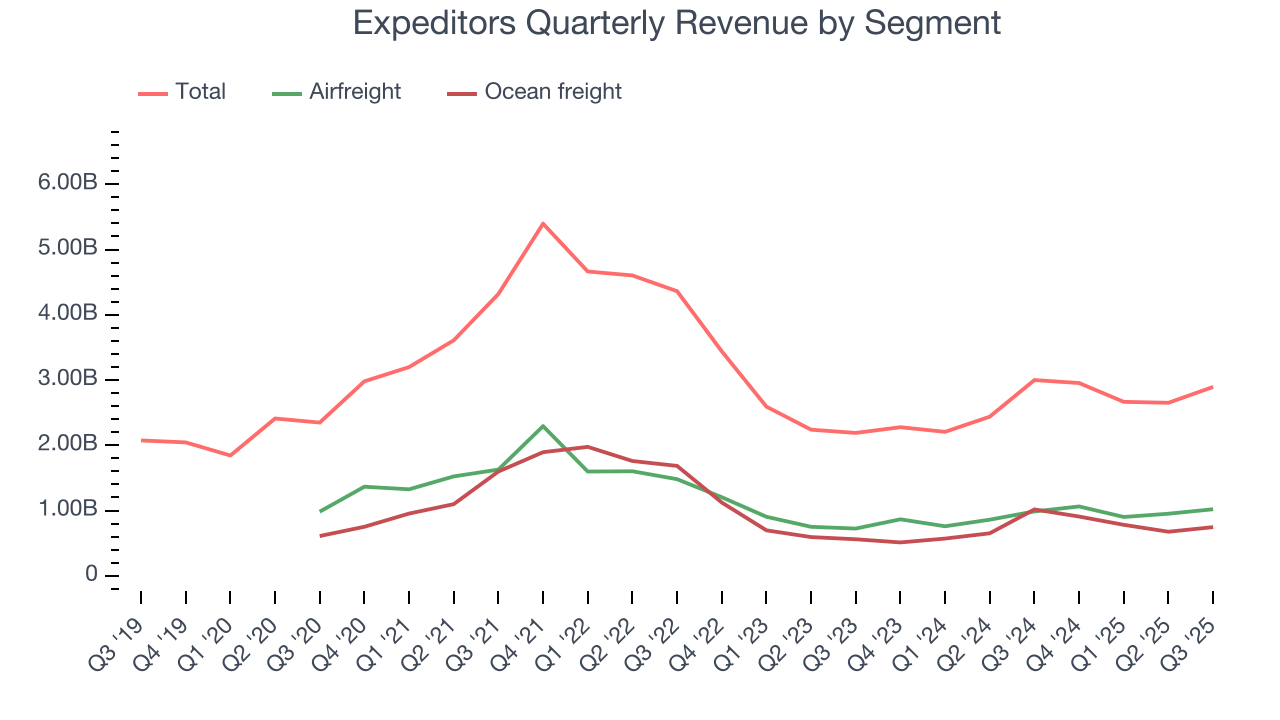

Expeditors also breaks out the revenue for its most important segments, Airfreight and Ocean freight, which are 35.2% and 25.8% of revenue. Over the last two years, Expeditors’s Airfreight revenue (transport by plane) averaged 7.8% year-on-year growth while its Ocean freight revenue (transport by sea) averaged 13.8% growth.

This quarter, Expeditors’s revenue fell by 3.5% year on year to $2.89 billion but beat Wall Street’s estimates by 8.6%.

Looking ahead, sell-side analysts expect revenue to decline by 4.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

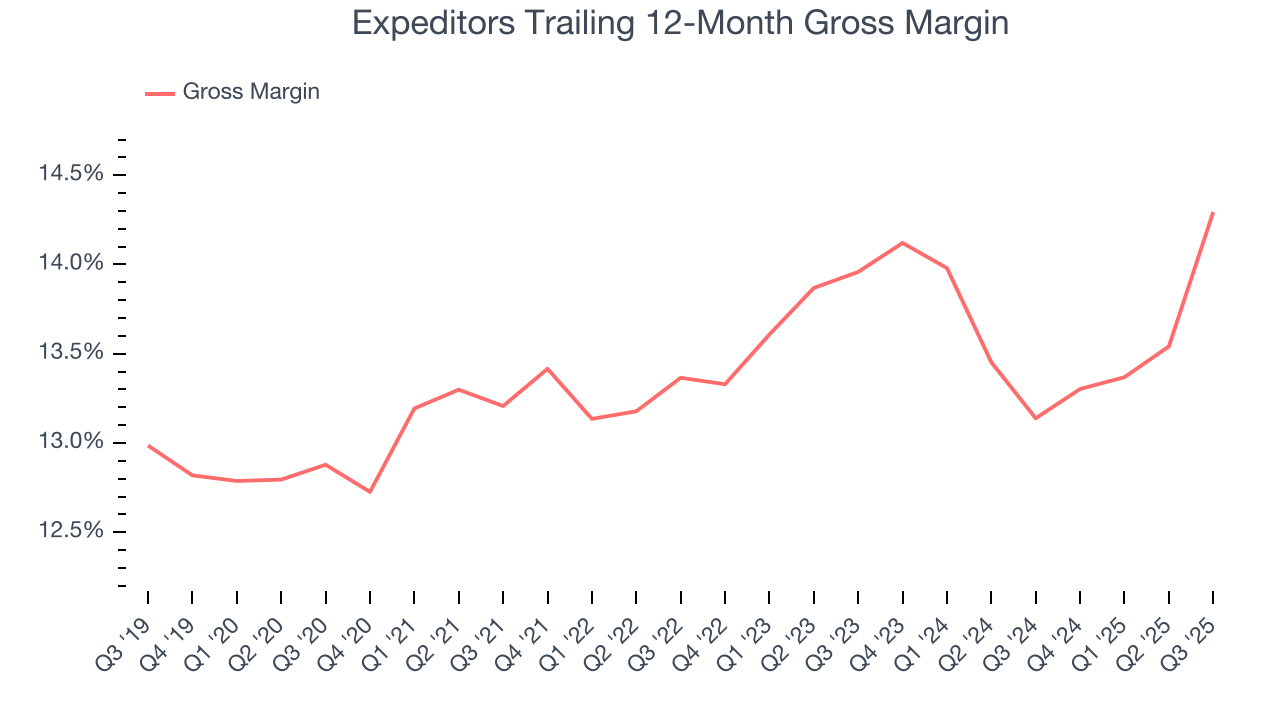

Expeditors has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.6% gross margin over the last five years. That means Expeditors paid its suppliers a lot of money ($86.45 for every $100 in revenue) to run its business.

Expeditors’s gross profit margin came in at 16.1% this quarter, marking a 2.9 percentage point increase from 13.2% in the same quarter last year. Expeditors’s full-year margin has also been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

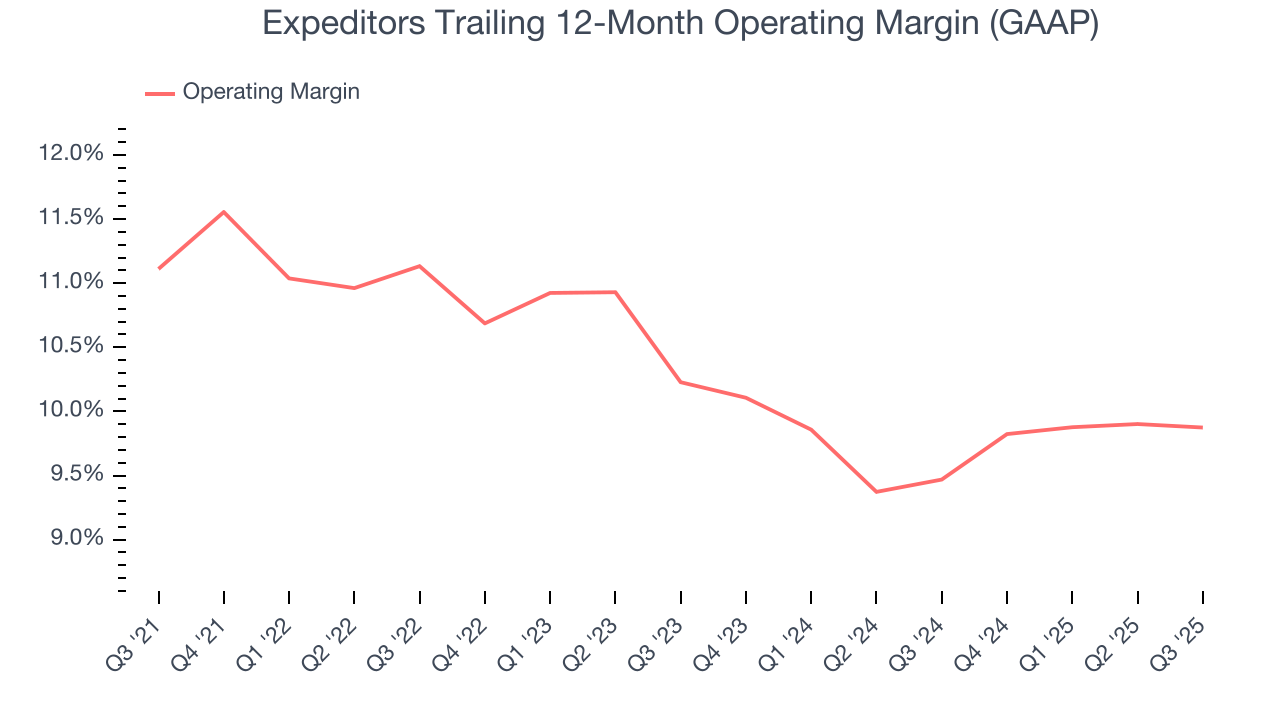

Expeditors has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Expeditors’s operating margin decreased by 1.2 percentage points over the last five years. Many Air Freight and Logistics companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Expeditors can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

In Q3, Expeditors generated an operating margin profit margin of 10%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

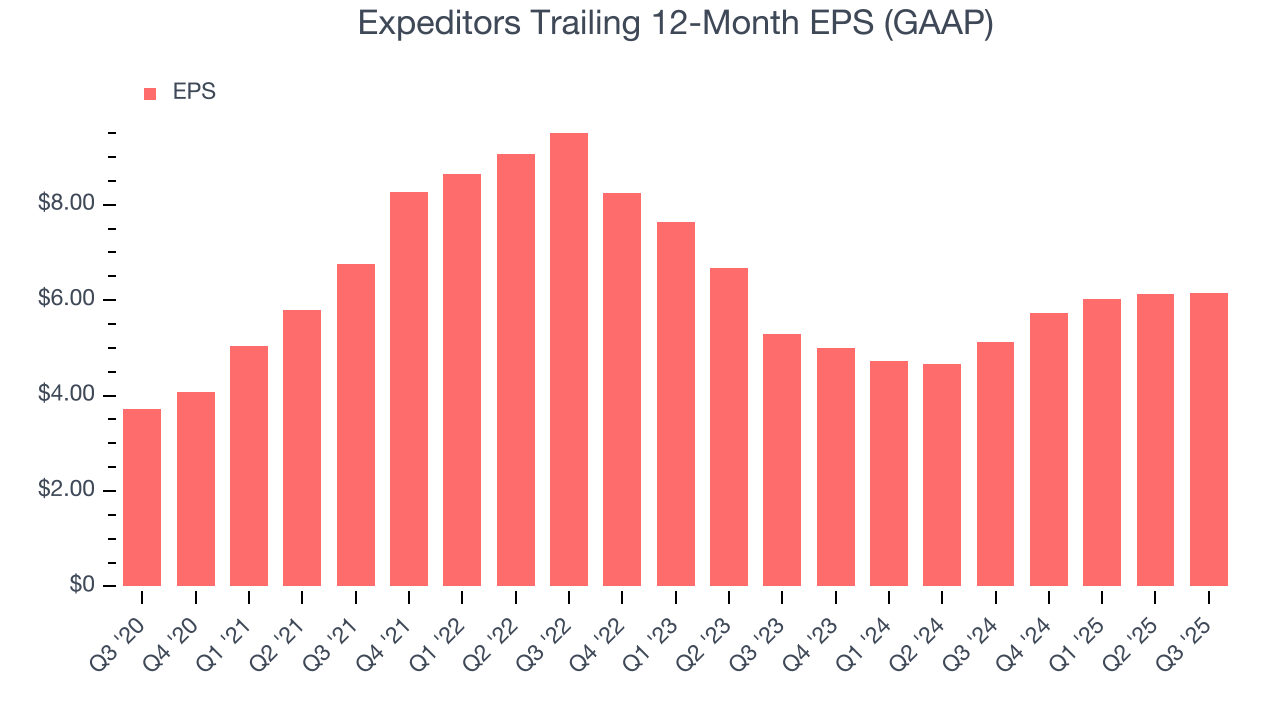

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

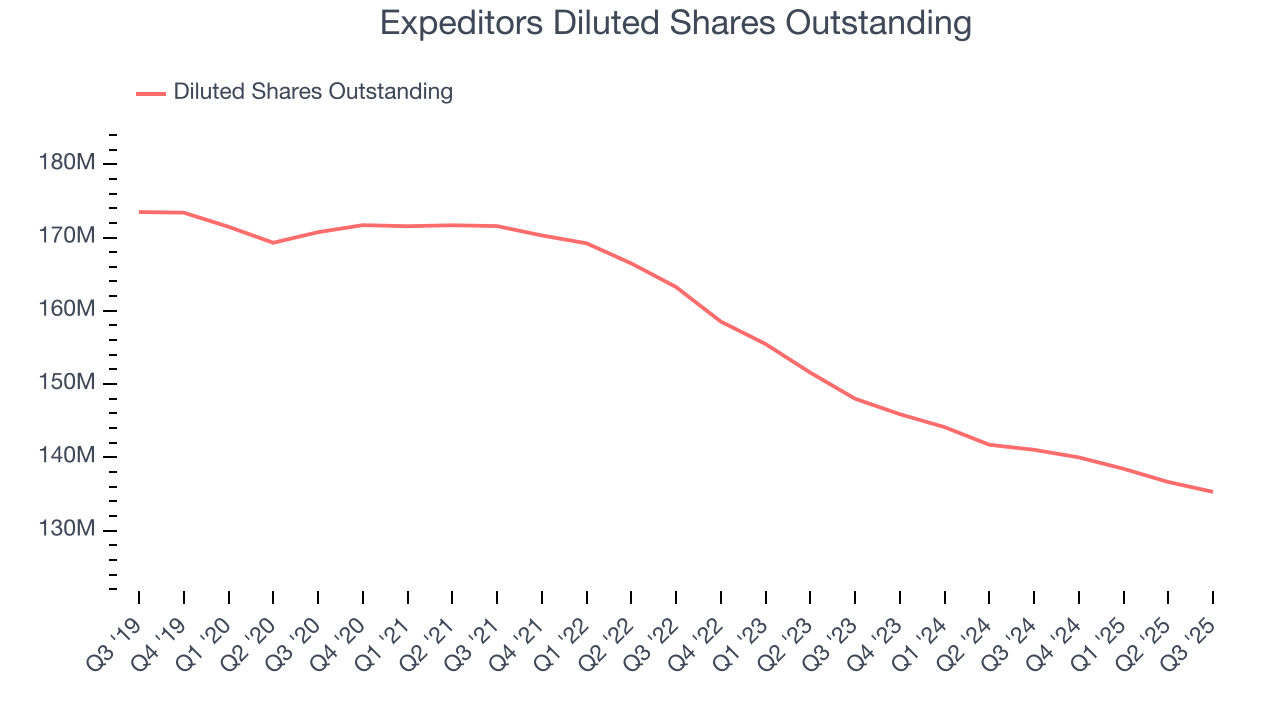

Expeditors’s EPS grew at a solid 10.6% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into Expeditors’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Expeditors has repurchased its stock, shrinking its share count by 20.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Expeditors, its two-year annual EPS growth of 7.7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Expeditors reported EPS of $1.64, up from $1.63 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Expeditors’s full-year EPS of $6.14 to shrink by 9.6%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Expeditors has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.3% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Expeditors’s margin expanded by 3.5 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Expeditors’s free cash flow clocked in at $190.3 million in Q3, equivalent to a 6.6% margin. This result was good as its margin was 4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

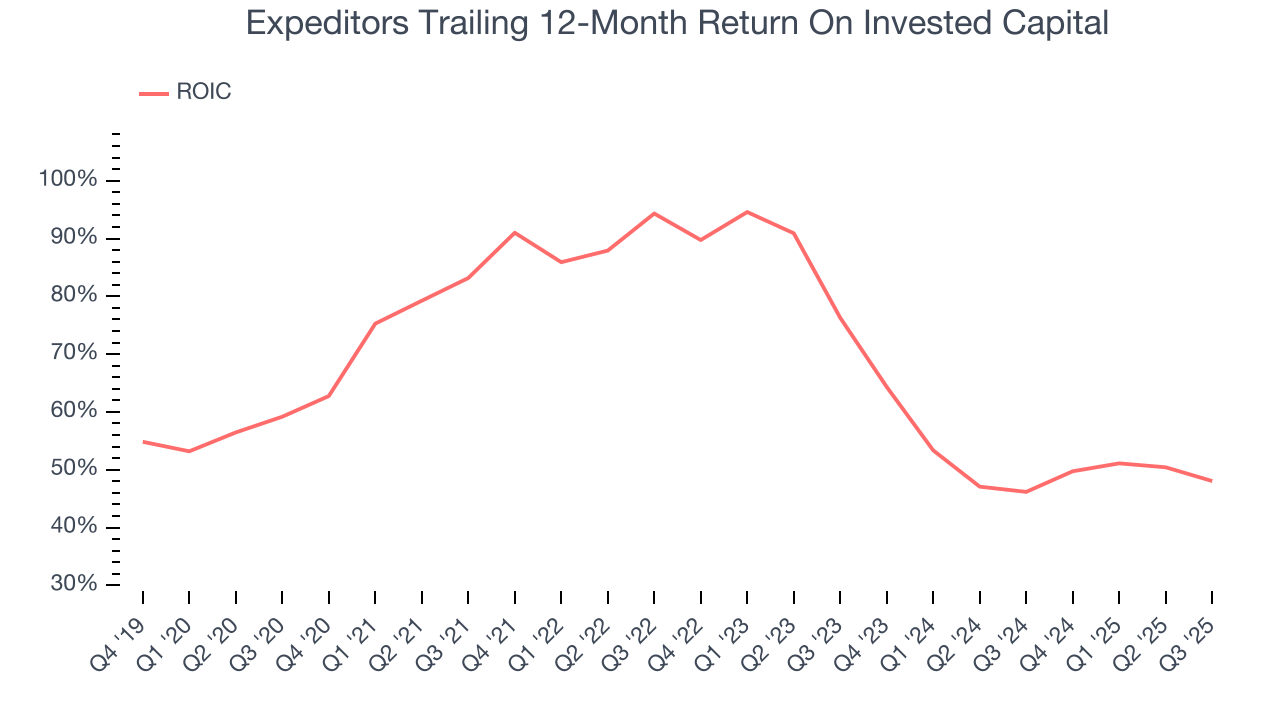

Although Expeditors hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 69.6%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Expeditors’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

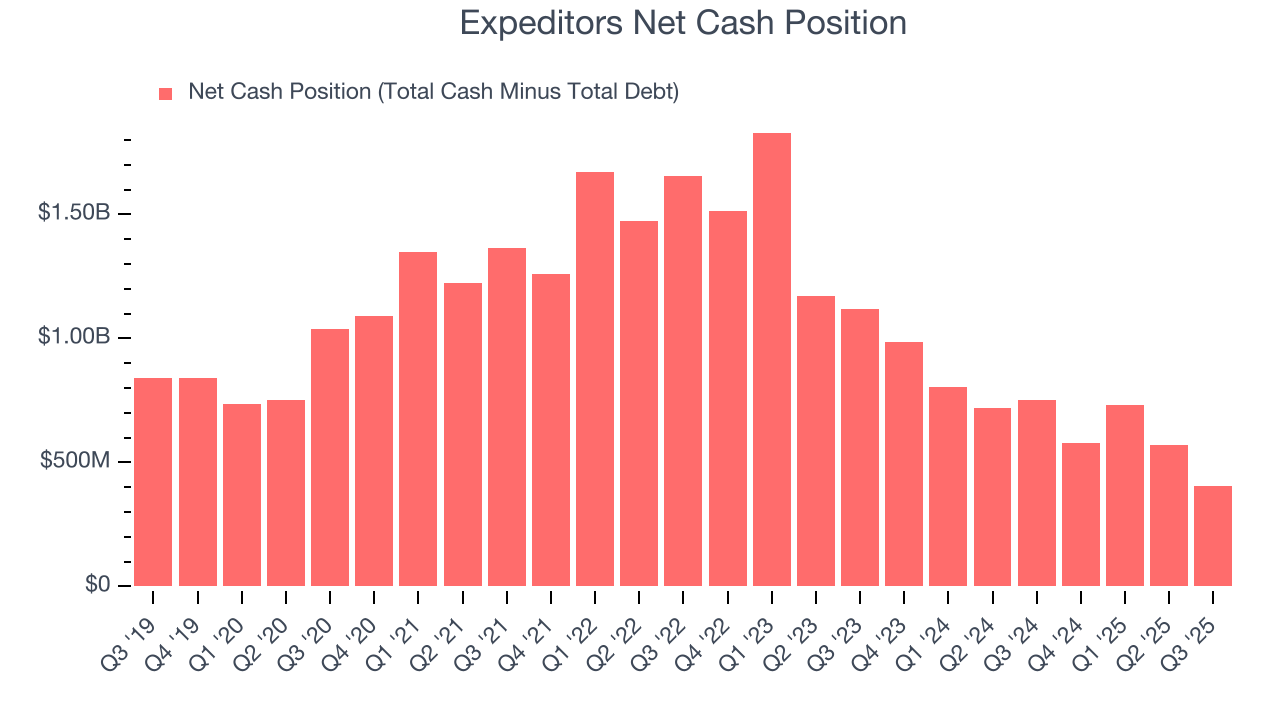

Expeditors is a profitable, well-capitalized company with $1.19 billion of cash and $783.7 million of debt on its balance sheet. This $406.4 million net cash position is 2.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Expeditors’s Q3 Results

We were impressed by how significantly Expeditors blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.8% to $126 immediately after reporting.

13. Is Now The Time To Buy Expeditors?

Updated: January 23, 2026 at 10:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Expeditors.

Expeditors isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

Expeditors’s P/E ratio based on the next 12 months is 27.3x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $140.47 on the company (compared to the current share price of $159.07), implying they don’t see much short-term potential in Expeditors.