FactSet (FDS)

We aren’t fans of FactSet. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why FactSet Is Not Exciting

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE:FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

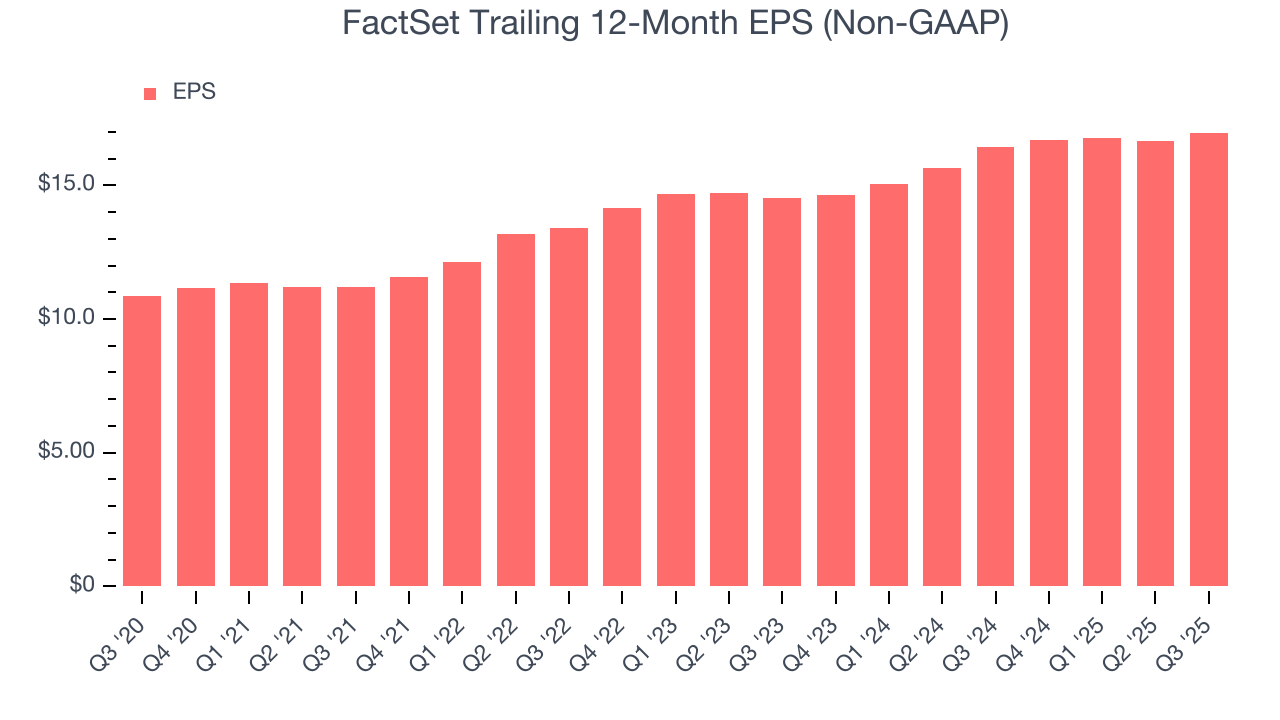

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 9.3% annually

- A bright spot is that its industry-leading 32.9% return on equity demonstrates management’s skill in finding high-return investments

FactSet fails to meet our quality criteria. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than FactSet

High Quality

Investable

Underperform

Why There Are Better Opportunities Than FactSet

FactSet is trading at $278.93 per share, or 16.1x forward P/E. This multiple expensive for its subpar fundamentals.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. FactSet (FDS) Research Report: Q3 CY2025 Update

Financial data provider FactSet (NYSE:FDS) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 6.2% year on year to $596.9 million. On the other hand, the company’s full-year revenue guidance of $2.44 billion at the midpoint came in 0.6% below analysts’ estimates. Its non-GAAP profit of $4.05 per share was 1.9% below analysts’ consensus estimates.

FactSet (FDS) Q3 CY2025 Highlights:

- Revenue: $596.9 million vs analyst estimates of $593.4 million (6.2% year-on-year growth, 0.6% beat)

- Pre-tax Profit: $189 million (31.7% margin, 61.3% year-on-year growth)

- Adjusted EPS: $4.05 vs analyst expectations of $4.13 (1.9% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $17.25 at the midpoint, missing analyst estimates by 5.6%

- Market Capitalization: $12.7 billion

Company Overview

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE:FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

FactSet operates through a subscription-based model, delivering its services via workstations, data feeds, APIs, and cloud-based solutions. The company's platform integrates vast amounts of market data with sophisticated analytical tools, enabling clients to conduct investment research, construct portfolios, measure performance, manage risk, and generate reports.

The company serves a diverse client base that includes institutional asset managers, investment bankers, wealth managers, hedge funds, private equity firms, and corporate users. For instance, a portfolio manager at an asset management firm might use FactSet to screen for investment opportunities based on specific criteria, analyze a company's financial performance against its peers, and monitor portfolio risk exposures—all within a single platform.

FactSet organizes its business into three geographic segments: Americas (accounting for about two-thirds of revenue), EMEA (Europe, Middle East, and Africa), and Asia Pacific. Its offerings are tailored to different firm types, including Institutional Buyside (serving asset managers and hedge funds), Dealmakers (serving investment bankers and corporate users), Wealth (serving financial advisors), and Partnerships and CUSIP Global Services (providing security identifiers and data solutions).

Beyond its core data and analytics, FactSet differentiates itself through managed services that function as extensions of clients' internal teams. The company continues to expand its capabilities through investments in artificial intelligence, which powers features like automated portfolio commentary generation and natural language data queries.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

FactSet's primary competitors include Bloomberg L.P., S&P Global Market Intelligence, and London Stock Exchange Group's Data & Analytics division. Other competitors in the financial data and analytics space include BlackRock's Aladdin platform, MSCI Inc., and Morningstar Inc.

5. Revenue Growth

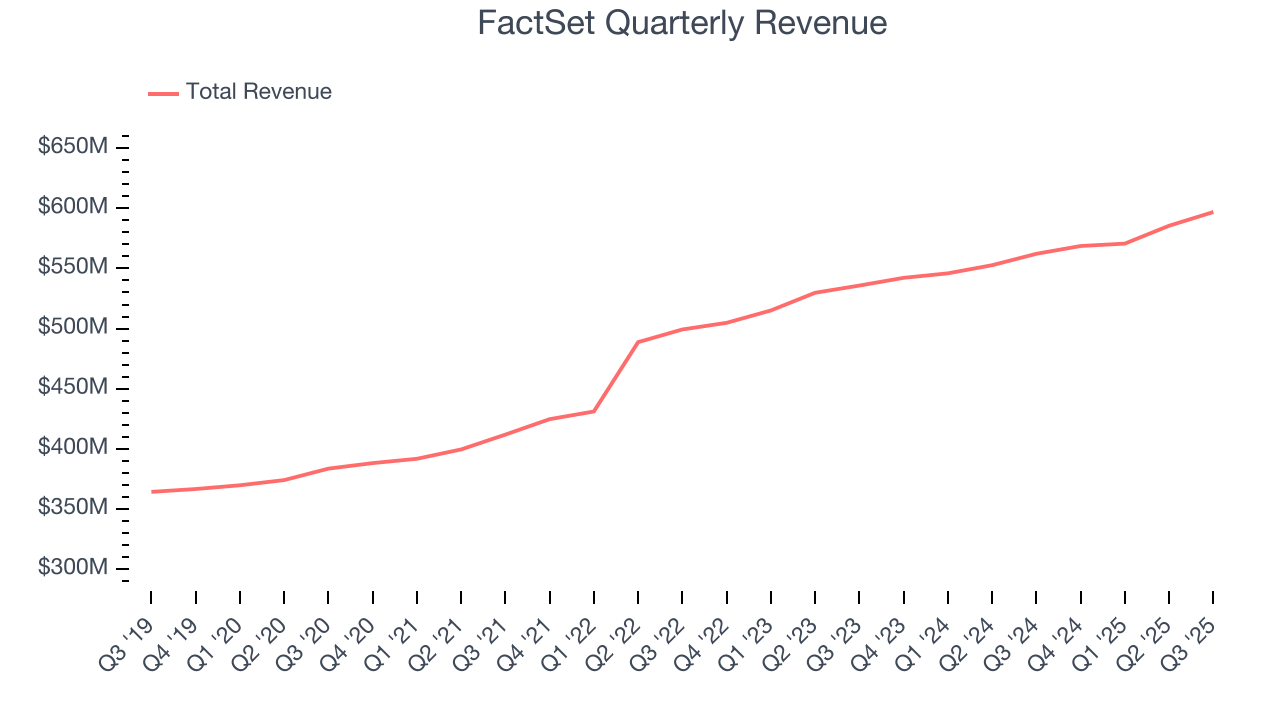

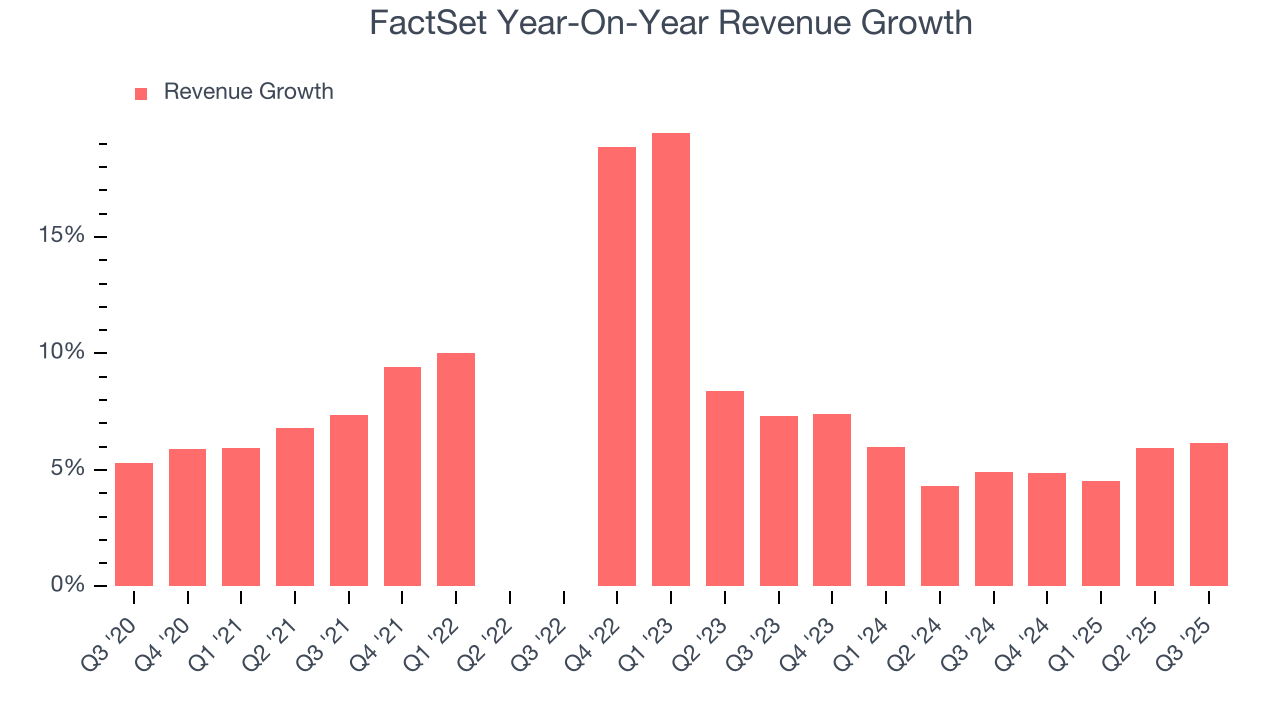

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, FactSet’s revenue grew at a decent 9.2% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. FactSet’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, FactSet reported year-on-year revenue growth of 6.2%, and its $596.9 million of revenue exceeded Wall Street’s estimates by 0.6%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

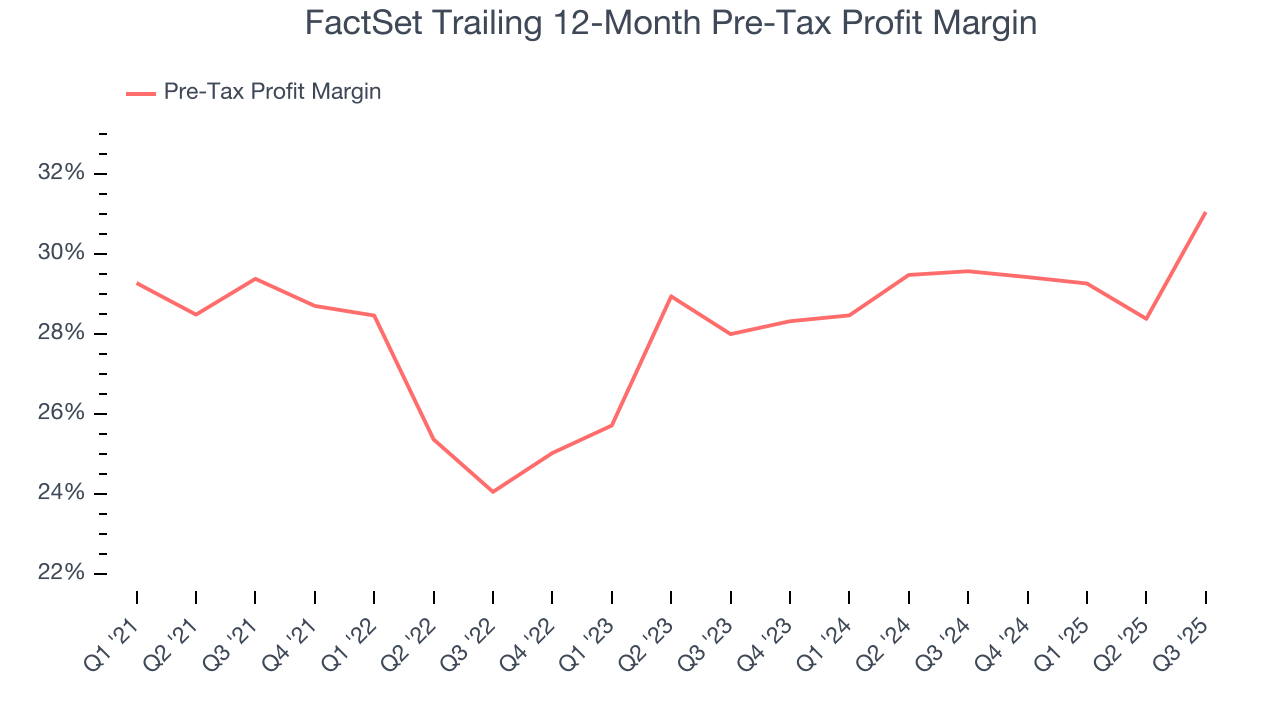

Over the last four years, FactSet’s pre-tax profit margin has risen by 1.7 percentage points, going from 29.4% to 31.1%. It has also expanded by 3.1 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q3, FactSet’s pre-tax profit margin was 31.7%. This result was 10.8 percentage points better than the same quarter last year.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

FactSet’s unimpressive 9.3% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it wasn’t great, FactSet’s two-year annual EPS growth of 8.1% topped its 5.5% two-year revenue growth.

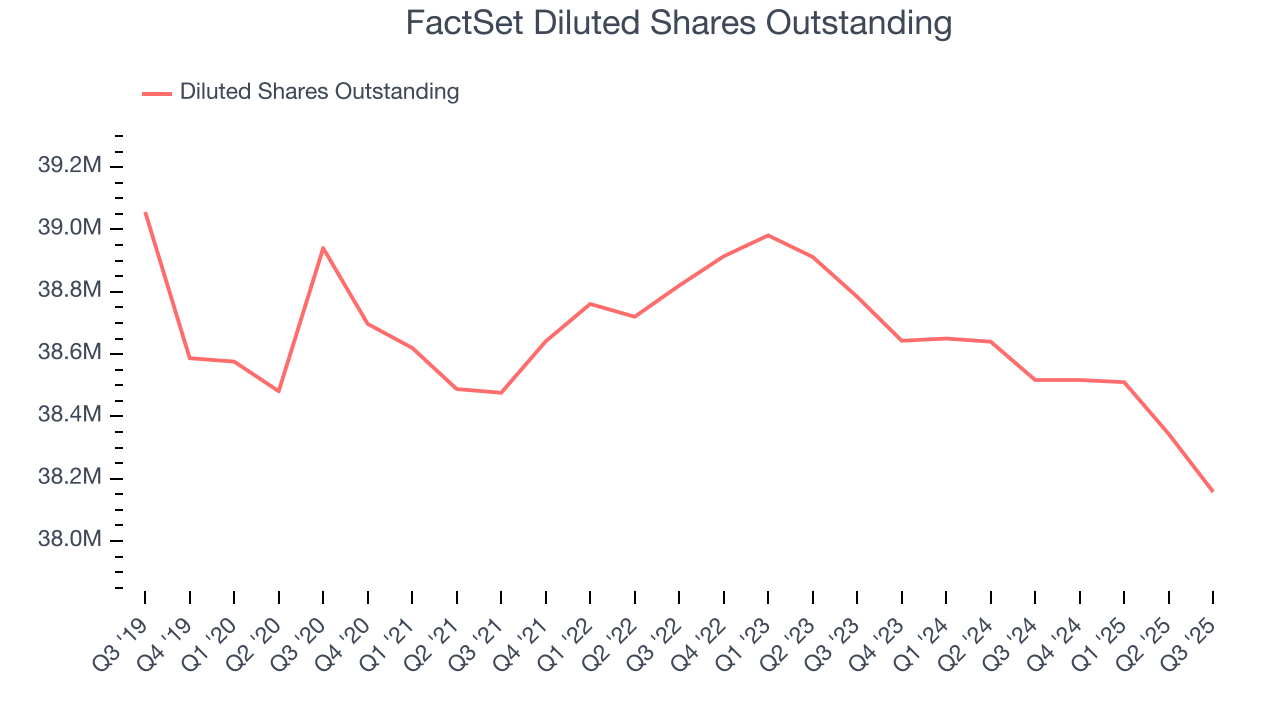

Diving into the nuances of FactSet’s earnings can give us a better understanding of its performance. FactSet’s pre-tax profit margin has expanded over the last two yearswhile its share count has shrunk 1.6%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, FactSet reported adjusted EPS of $4.05, up from $3.74 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects FactSet’s full-year EPS of $16.97 to grow 7.6%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, FactSet has averaged an ROE of 33.1%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for FactSet.

9. Balance Sheet Assessment

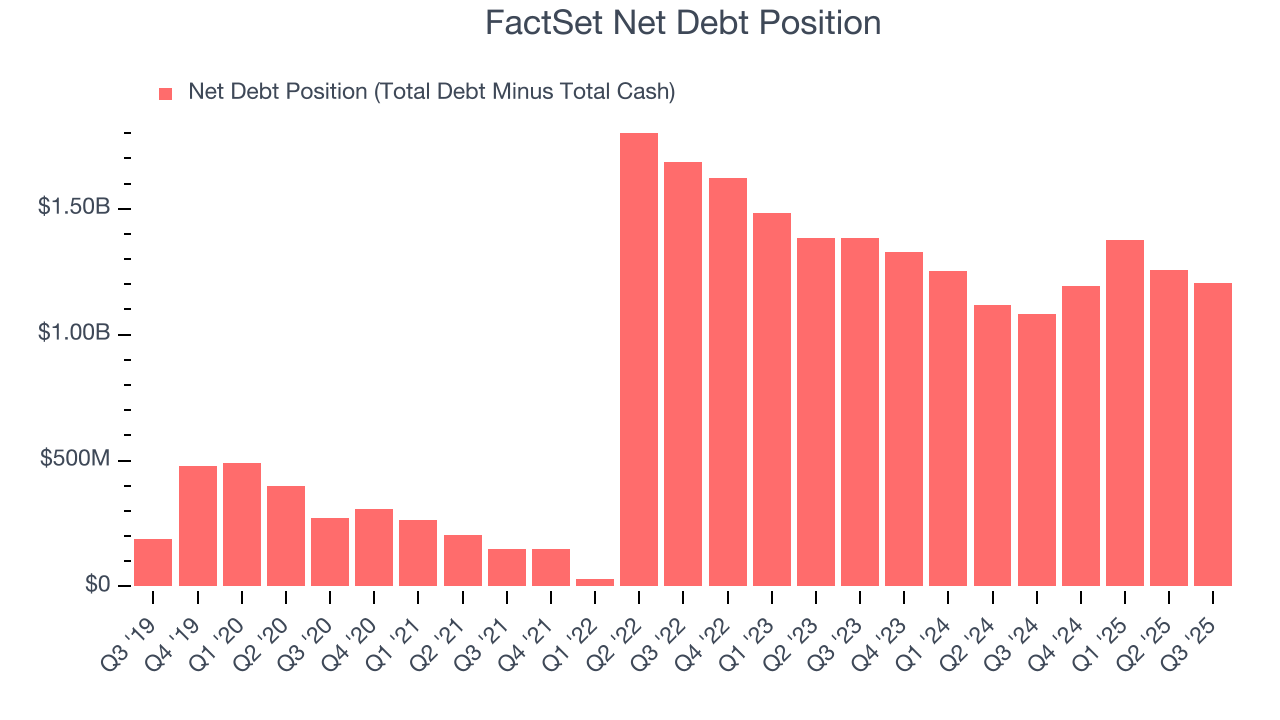

FactSet reported $355.1 million of cash and $1.56 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $935 million of EBITDA over the last 12 months, we view FactSet’s 1.3× net-debt-to-EBITDA ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from FactSet’s Q3 Results

We were impressed by how significantly FactSet blew past analysts’ EBITDA expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.8% to $326.34 immediately following the results.

11. Is Now The Time To Buy FactSet?

Updated: December 4, 2025 at 11:15 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own FactSet, you should also grasp the company’s longer-term business quality and valuation.

FactSet has some positive attributes, but it isn’t one of our picks. To kick things off, its revenue growth was decent over the last five years. On top of that, FactSet’s stellar ROE suggests it has been a well-run company historically, and its expanding pre-tax profit margin shows the business has become more efficient.

FactSet’s P/E ratio based on the next 12 months is 16.1x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $335.94 on the company (compared to the current share price of $278.93).