F&G Annuities & Life (FG)

F&G Annuities & Life is one of our favorite stocks. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Like F&G Annuities & Life

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE:FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

- Market share has increased this cycle as its 61.4% annual revenue growth over the last five years was exceptional

- Balance sheet strength has increased this cycle as its 37.7% annual book value per share growth over the last two years was exceptional

- Net premiums earned surged by 92% annually over the past five years, reflecting strong market share gains this cycle

We have an affinity for F&G Annuities & Life. The valuation looks fair when considering its quality, and we think now is a favorable time to invest.

Why Is Now The Time To Buy F&G Annuities & Life?

Why Is Now The Time To Buy F&G Annuities & Life?

F&G Annuities & Life’s stock price of $28.76 implies a valuation ratio of 0.8x forward P/B. The valuation sure appears attractive, and we suspect the stock is trading below its intrinsic value when factoring in its business quality.

A powerful one-two punch is a company that can both grow earnings and earn a higher multiple over time. High-quality companies trading at big discounts to intrinsic value are good ways to set up this combination.

3. F&G Annuities & Life (FG) Research Report: Q4 CY2025 Update

Insurance solutions provider F&G Annuities & Life (NYSE:FG) announced better-than-expected revenue in Q4 CY2025, with sales up 10.8% year on year to $1.77 billion. Its non-GAAP profit of $0.91 per share was 24.4% below analysts’ consensus estimates.

F&G Annuities & Life (FG) Q4 CY2025 Highlights:

- Net Premiums Earned: $987 million vs analyst estimates of $705 million (26.6% year-on-year decline, 40% beat)

- Revenue: $1.77 billion vs analyst estimates of $1.55 billion (10.8% year-on-year growth, 14.1% beat)

- Pre-tax Profit: $161 million (9.1% margin)

- Adjusted EPS: $0.91 vs analyst expectations of $1.20 (24.4% miss)

- Book Value per Share: $33.49 vs analyst estimates of $47.05 (7.5% year-on-year growth, 28.8% miss)

- Market Capitalization: $3.88 billion

Company Overview

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE:FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

F&G specializes in retirement and protection products, with fixed indexed annuities (FIAs) forming the core of its retail business. These products allow customers to participate in market gains through indices like the S&P 500 while protecting their principal from market downturns. The company also offers multi-year guarantee annuities (MYGAs) that provide guaranteed interest rates over specified periods, and recently expanded into registered index-linked annuities (RILAs) that offer higher return potential with some downside risk.

For institutional clients, F&G provides pension risk transfer solutions where it assumes responsibility for pension obligations from corporate plan sponsors, converting them into guaranteed income streams for retirees. The company also issues funding agreements to generate spread-based income without mortality risk.

F&G distributes its retail products through three main channels: independent agents (via approximately 280 independent marketing organizations representing nearly 102,000 agents), banks, and broker-dealers (through about 21 institutions representing approximately 10,000 financial advisers). This multi-channel approach allows F&G to reach diverse customer segments seeking retirement security.

The company generates revenue primarily through spread-based earnings—investing policyholder premiums in fixed income securities while paying out guaranteed rates or index-linked returns to policyholders. F&G manages risk through strategic reinsurance arrangements with various partners, allowing it to optimize capital efficiency and manage reserve requirements.

F&G leverages its strategic partnership with Blackstone, which provides investment management expertise to enhance portfolio yields while maintaining appropriate risk levels across varying market cycles.

4. Life Insurance

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

F&G Annuities & Life competes with major insurance providers in the annuity and life insurance markets, including Athene (owned by Apollo Global Management), American Equity Investment Life, Global Atlantic (owned by KKR), Lincoln Financial Group (NYSE:LNC), and Prudential Financial (NYSE:PRU).

5. Revenue Growth

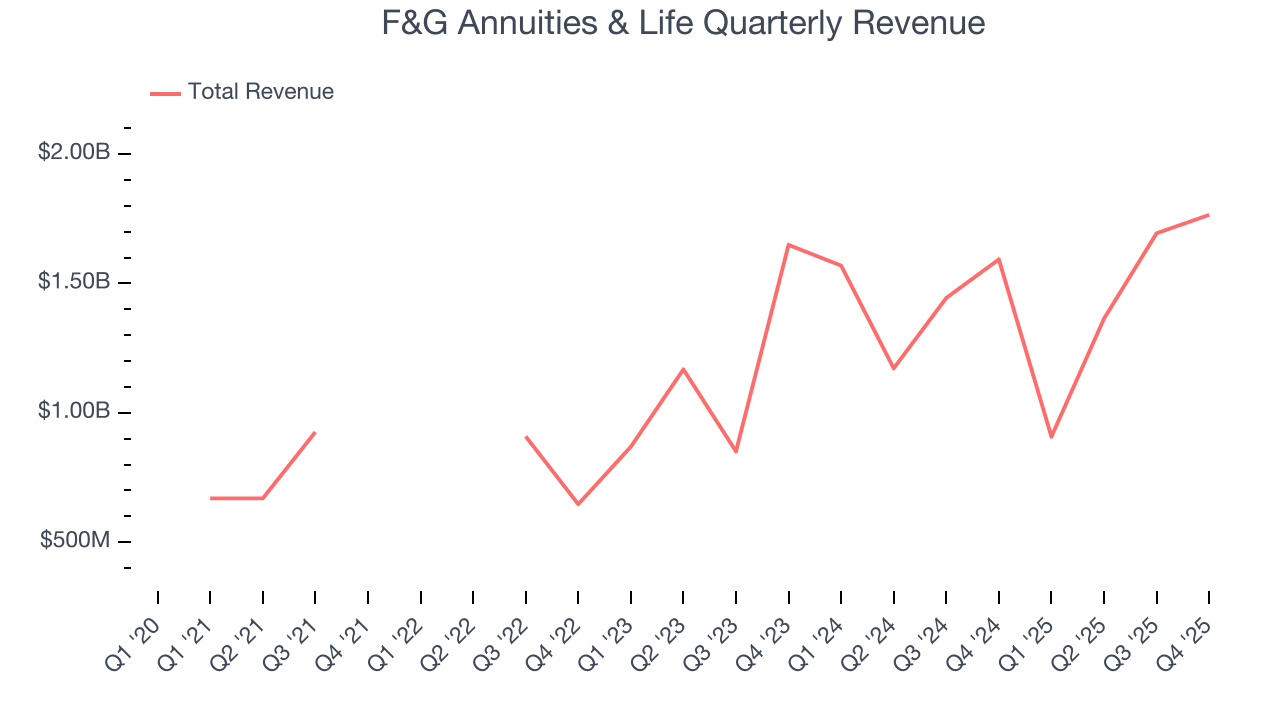

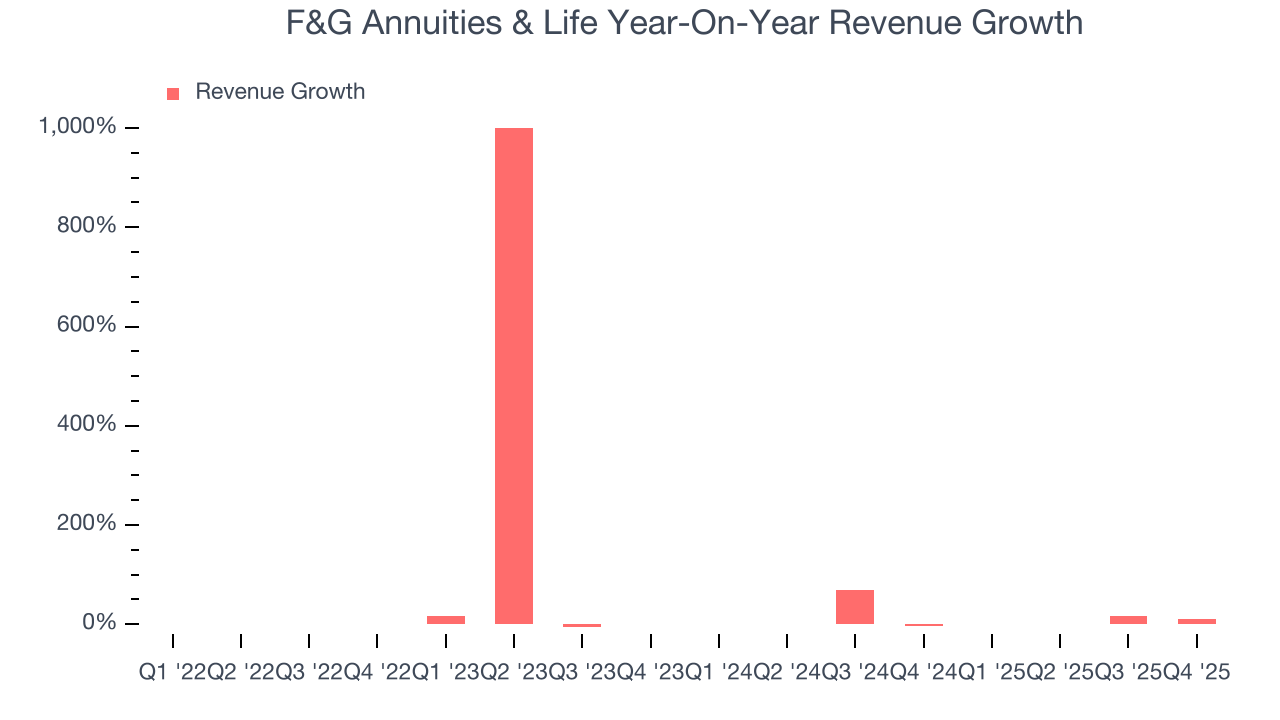

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last four years, F&G Annuities & Life grew its revenue at a solid 9.7% compounded annual growth rate. Its growth surpassed the average insurance company and shows its offerings resonate with customers, a great starting point for our analysis.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. F&G Annuities & Life’s annualized revenue growth of 12.4% over the last two years is above its four-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, F&G Annuities & Life reported year-on-year revenue growth of 10.8%, and its $1.77 billion of revenue exceeded Wall Street’s estimates by 14.1%.

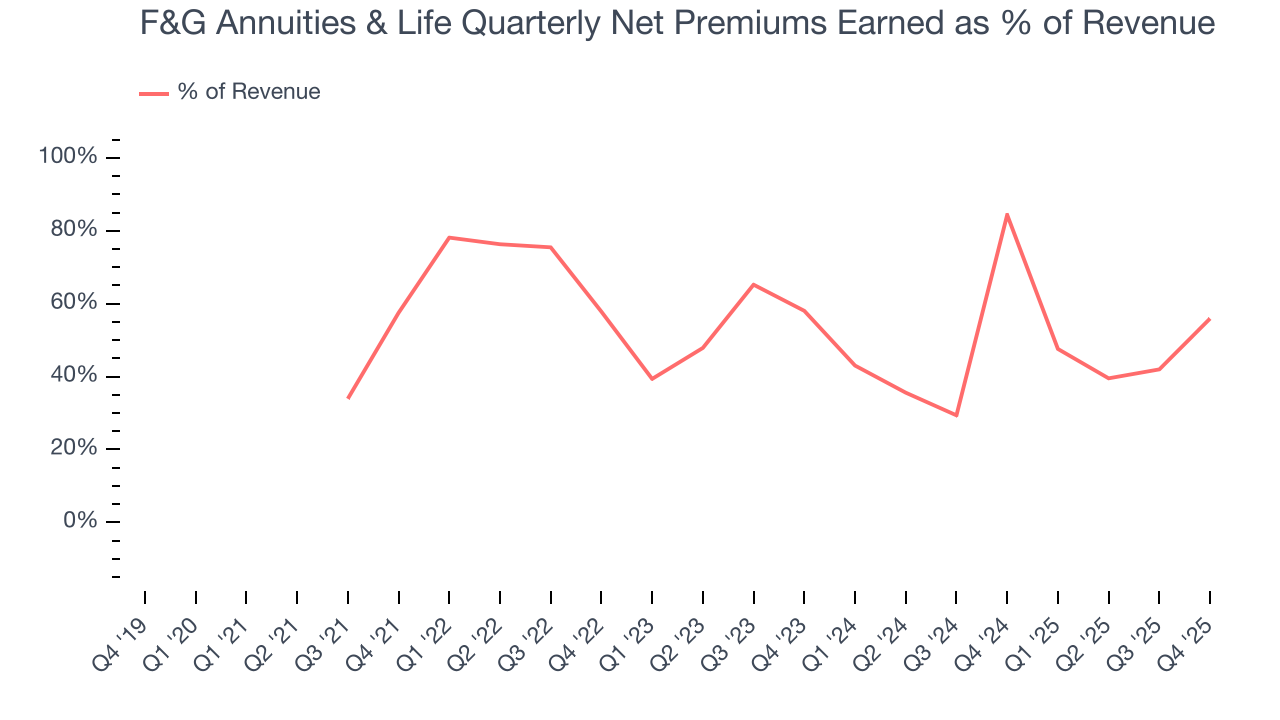

Net premiums earned made up 49.3% of the company’s total revenue during the last five years, meaning F&G Annuities & Life’s growth drivers strike a balance between insurance and non-insurance activities.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

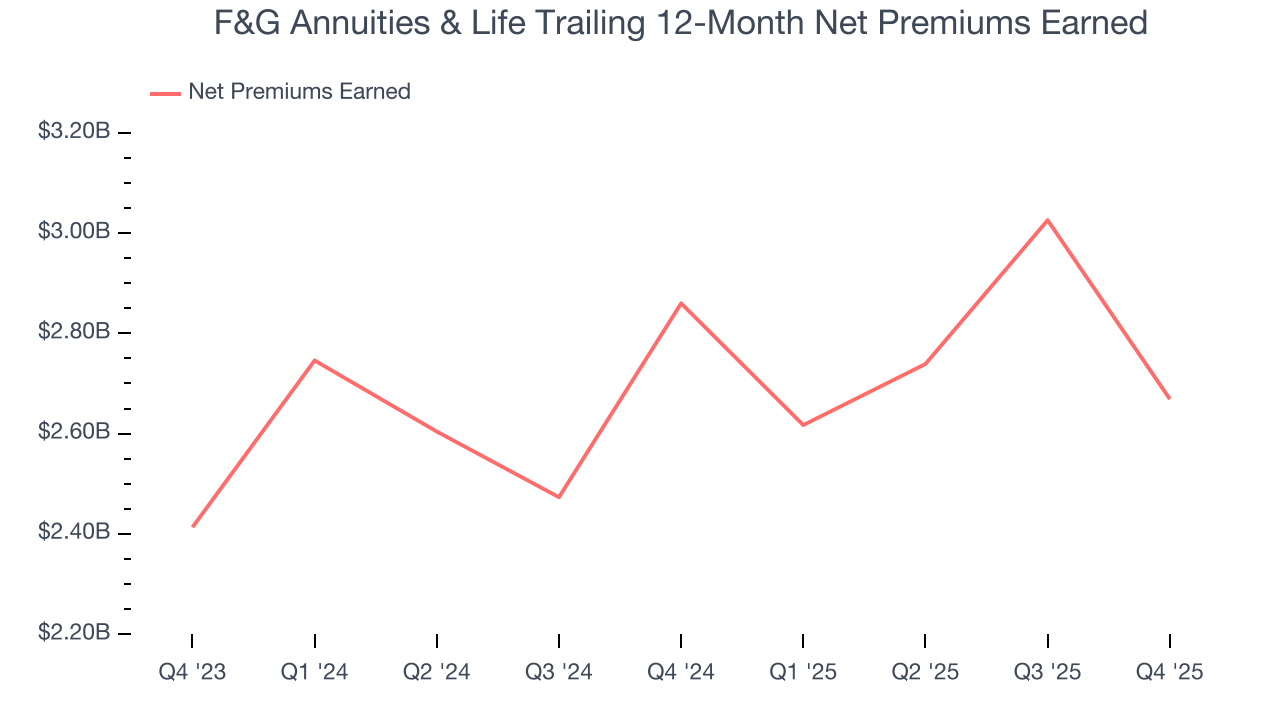

F&G Annuities & Life’s net premiums earned has grown at a 17.6% annualized rate over the last four years, much better than the broader insurance industry and faster than its total revenue.

When analyzing F&G Annuities & Life’s net premiums earned over the last two years, we can see that growth decelerated to 5.2% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. These extra revenue streams are important to the bottom line, yet their performance can be inconsistent. Some firms have been more successful and consistent in managing their float, but sharp fluctuations in the fixed income and equity markets can dramatically affect short-term results.

In Q4, F&G Annuities & Life produced $987 million of net premiums earned, down 26.6% year on year. But this was still enough to top Wall Street Consensus estimates by 40%.

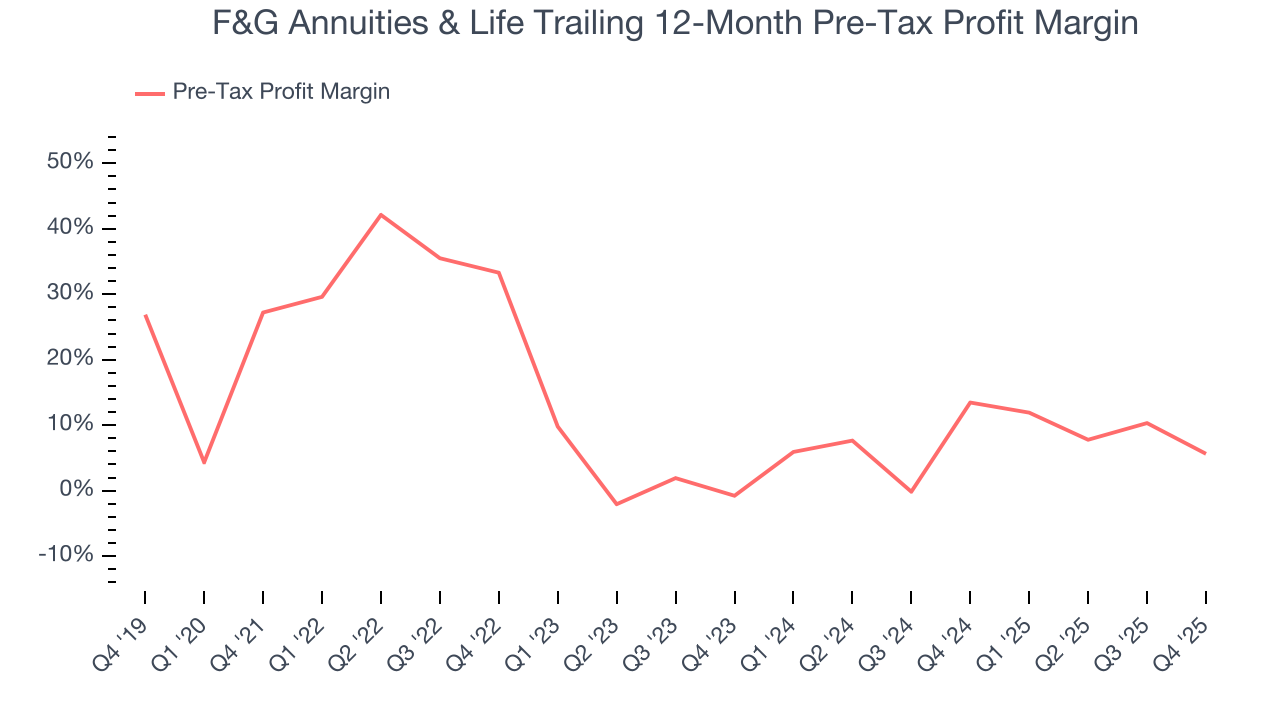

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because insurers are balance sheet businesses, where assets and liabilities define the core economics. This means that interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

Over the last four years, F&G Annuities & Life’s pre-tax profit margin has risen by 21.6 percentage points, going from 27.2% to 5.6%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 6.4 percentage points on a two-year basis.

F&G Annuities & Life’s pre-tax profit margin came in at 9.1% this quarter. This result was 16.7 percentage points worse than the same quarter last year.

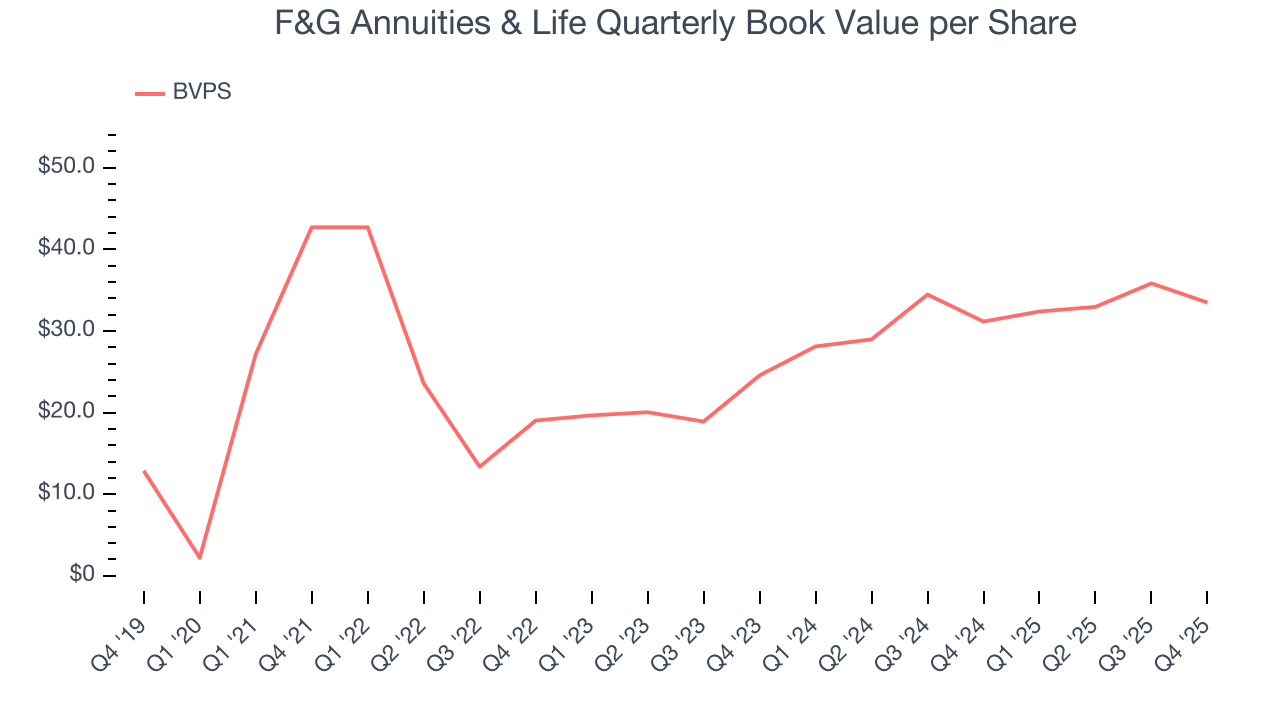

8. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

F&G Annuities & Life’s BVPS declined at a 5.9% annual clip over the last four years. However, BVPS growth has accelerated recently, growing by 16.8% annually over the last two years from $24.56 to $33.49 per share.

Over the next 12 months, Consensus estimates call for F&G Annuities & Life’s BVPS to grow by 54.9% to $47.05, elite growth rate.

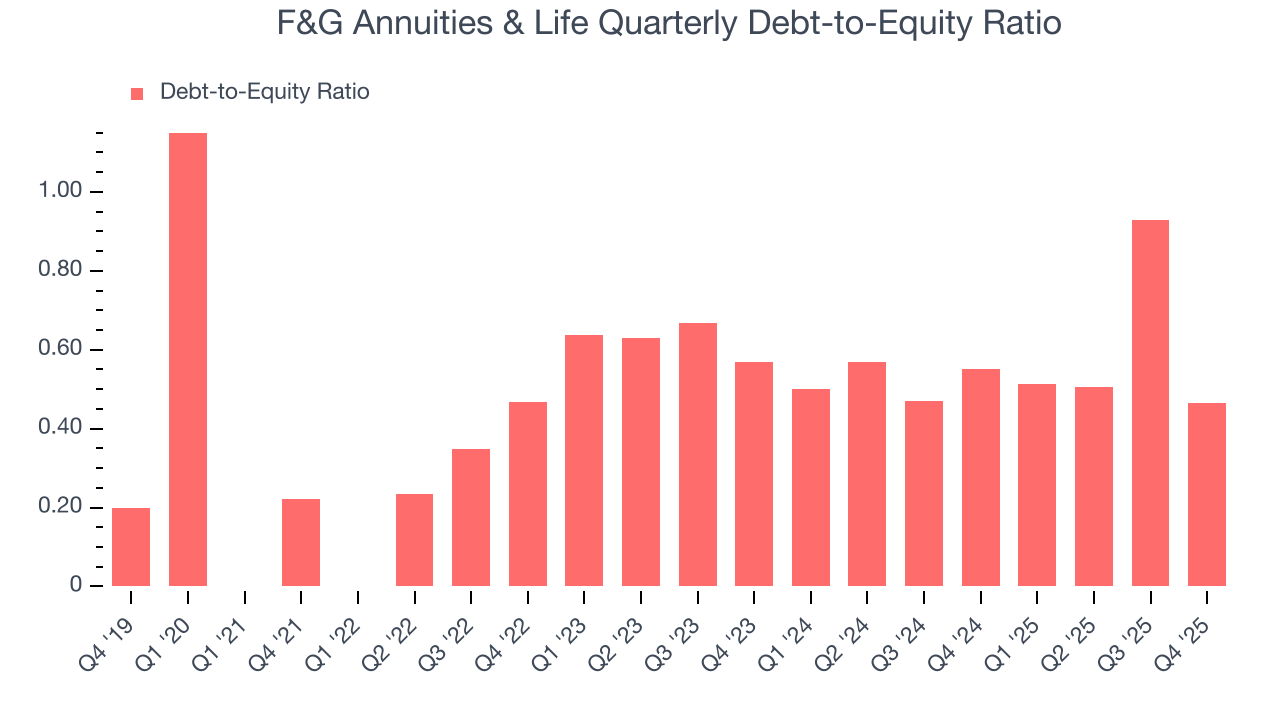

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

F&G Annuities & Life currently has $2.24 billion of debt and $4.80 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.6×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

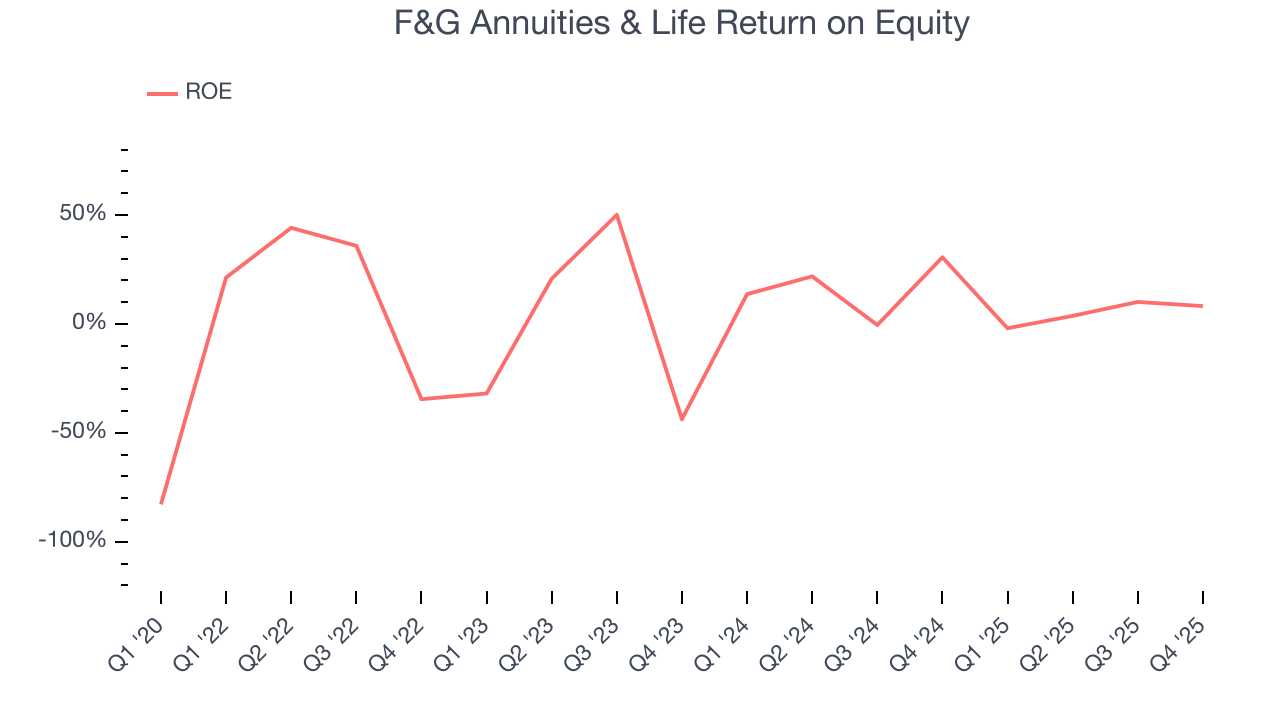

10. Return on Equity

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, F&G Annuities & Life has averaged an ROE of 9.2%, uninspiring for a company operating in a sector where the average shakes out around 12.5%. We’re optimistic F&G Annuities & Life can turn the ship around given its success in other measures of financial health.

11. Key Takeaways from F&G Annuities & Life’s Q4 Results

We were impressed by how significantly F&G Annuities & Life blew past analysts’ net premiums earned expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS missed and its book value per share fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $27.69 immediately after reporting.

12. Is Now The Time To Buy F&G Annuities & Life?

Updated: February 19, 2026 at 4:26 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own F&G Annuities & Life, you should also grasp the company’s longer-term business quality and valuation.

F&G Annuities & Life isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was solid over the last four years and Wall Street believes it will continue to grow, its BVPS has declined over the last four years. And while the company’s net premiums earned growth was exceptional over the last four years, the downside is its declining pre-tax profit margin shows the business has become less efficient.

F&G Annuities & Life’s P/B ratio based on the next 12 months is 0.7x. Looking at the insurance space today, F&G Annuities & Life’s fundamentals really stand out, and we like it at this bargain price.

Wall Street analysts have a consensus one-year price target of $32 on the company (compared to the current share price of $27.69), implying they see 15.6% upside in buying F&G Annuities & Life in the short term.

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.