Federated Hermes (FHI)

Federated Hermes piques our interest. Its remarkable ROE underscores its knack for targeting and investing in highly profitable growth initiatives.― StockStory Analyst Team

1. News

2. Summary

Why Federated Hermes Is Interesting

With roots dating back to 1955 and a pioneering role in money market funds, Federated Hermes (NYSE:FHI) is an investment management firm that offers a wide range of funds and strategies for institutional and individual investors.

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- One risk is its muted 3.9% annual revenue growth over the last five years shows its demand lagged behind its financials peers

Federated Hermes has some noteworthy aspects. If you like the story, the price seems reasonable.

Why Is Now The Time To Buy Federated Hermes?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Federated Hermes?

At $53.69 per share, Federated Hermes trades at 11.1x forward P/E. The current valuation is below that of most financials companies, but this isn’t a bargain. Instead, the price is appropriate for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Federated Hermes (FHI) Research Report: Q3 CY2025 Update

Investment management firm Federated Hermes (NYSE:FHI) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 14.9% year on year to $469.4 million. Its GAAP profit of $1.34 per share was 19.2% above analysts’ consensus estimates.

Federated Hermes (FHI) Q3 CY2025 Highlights:

- Revenue: $469.4 million vs analyst estimates of $445.1 million (14.9% year-on-year growth, 5.5% beat)

- Pre-tax Profit: $140.3 million (29.9% margin, 14.5% year-on-year growth)

- EPS (GAAP): $1.34 vs analyst estimates of $1.12 (19.2% beat)

- Market Capitalization: $3.52 billion

Company Overview

With roots dating back to 1955 and a pioneering role in money market funds, Federated Hermes (NYSE:FHI) is an investment management firm that offers a wide range of funds and strategies for institutional and individual investors.

Federated Hermes manages assets across equity, fixed-income, alternative/private markets, multi-asset, and liquidity management strategies. The company is particularly known for its money market funds, which provide investors with relatively stable, liquid investments for cash management. These funds are used by corporations, government entities, and financial institutions to park short-term cash while earning modest returns.

The firm serves a diverse client base that includes banks, broker-dealers, wealth managers, retirement plans, public entities, corporations, insurance companies, foundations, and individual investors. Clients turn to Federated Hermes to access professional investment management, diversification, and expertise in navigating financial markets.

For example, a corporate treasurer might use Federated Hermes' money market funds to manage the company's cash reserves, while a pension fund might invest in the firm's equity or fixed-income strategies to meet long-term obligations to retirees. Meanwhile, individual investors can access the company's mutual funds through their financial advisors or retirement plans.

Federated Hermes generates revenue primarily through management fees based on assets under management. The company expanded its global presence and strengthened its environmental, social, and governance (ESG) capabilities through its acquisition of a majority stake in UK-based Hermes Investment Management in 2018, fully completing the acquisition in 2020. The firm operates globally with offices across North America, Europe, and parts of Asia, allowing it to serve clients worldwide while providing insights into regional market dynamics.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Federated Hermes competes with other asset management firms including BlackRock (NYSE:BLK), Vanguard, Fidelity Investments, T. Rowe Price (NASDAQ:TROW), Franklin Templeton (NYSE:BEN), and Invesco (NYSE:IVZ).

5. Revenue Growth

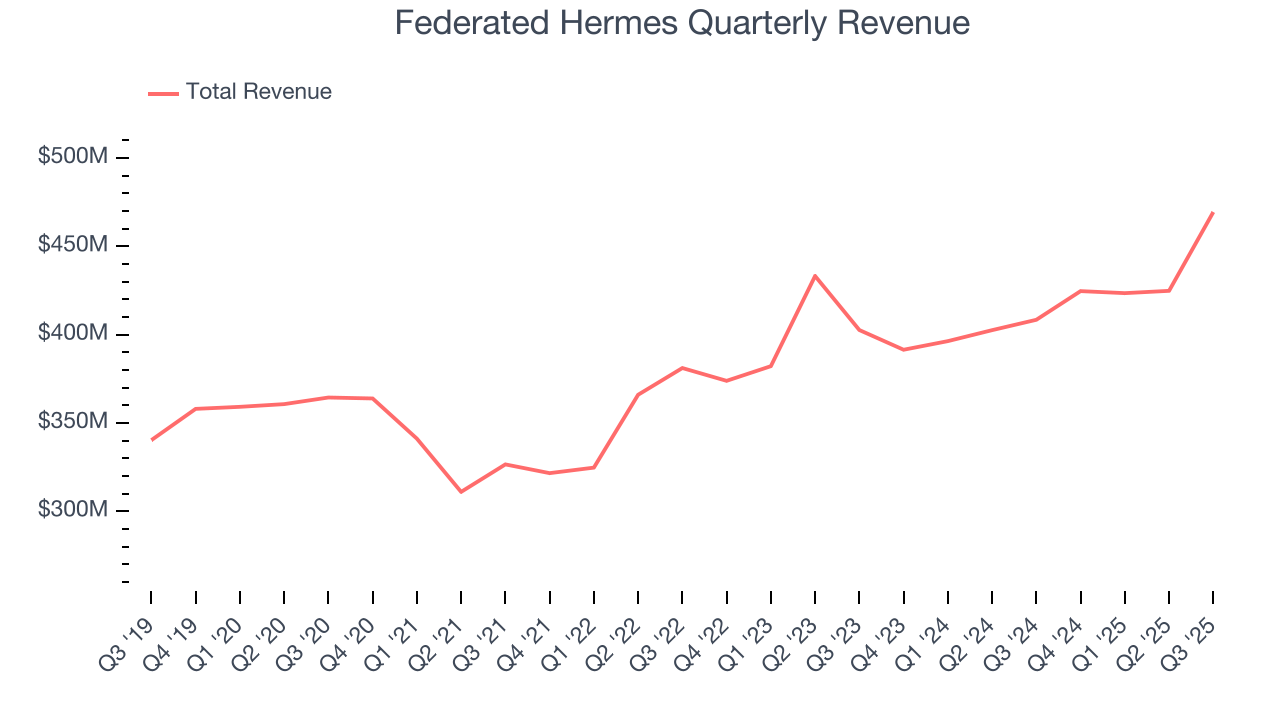

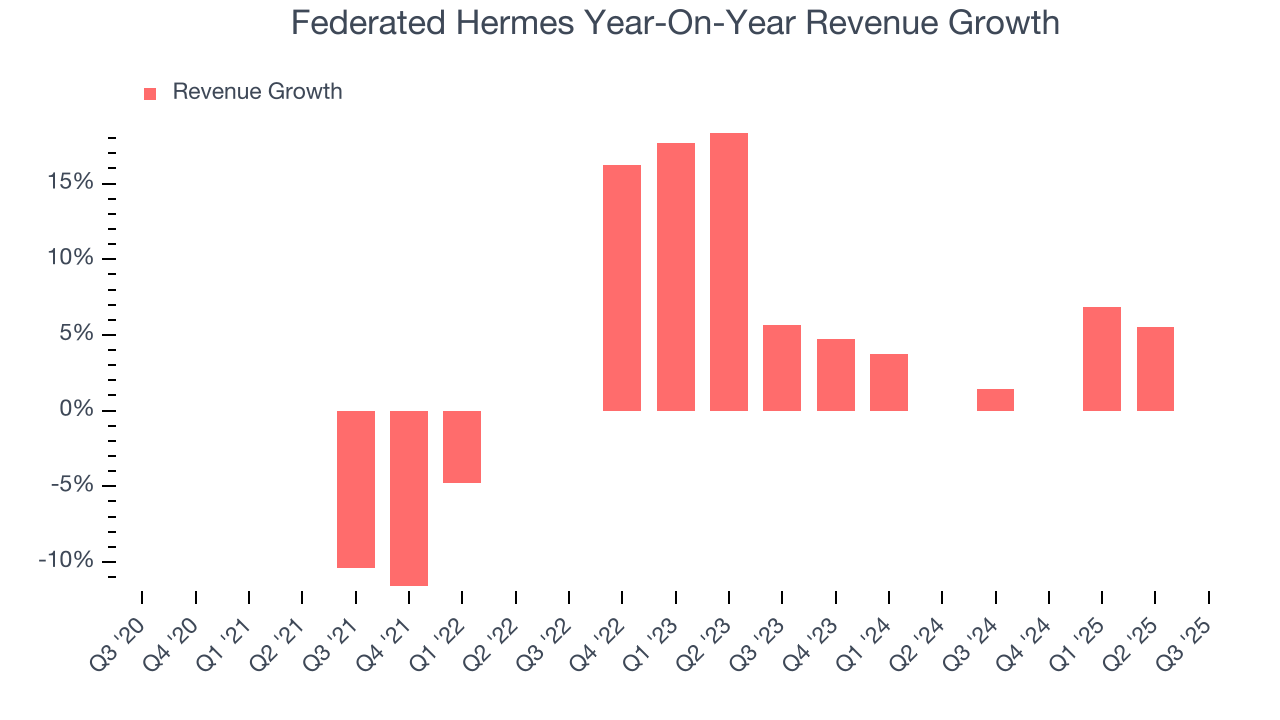

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Federated Hermes grew its revenue at a sluggish 3.9% compounded annual growth rate. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Federated Hermes.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Federated Hermes’s annualized revenue growth of 4.6% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Federated Hermes reported year-on-year revenue growth of 14.9%, and its $469.4 million of revenue exceeded Wall Street’s estimates by 5.5%.

6. Assets Under Management (AUM)

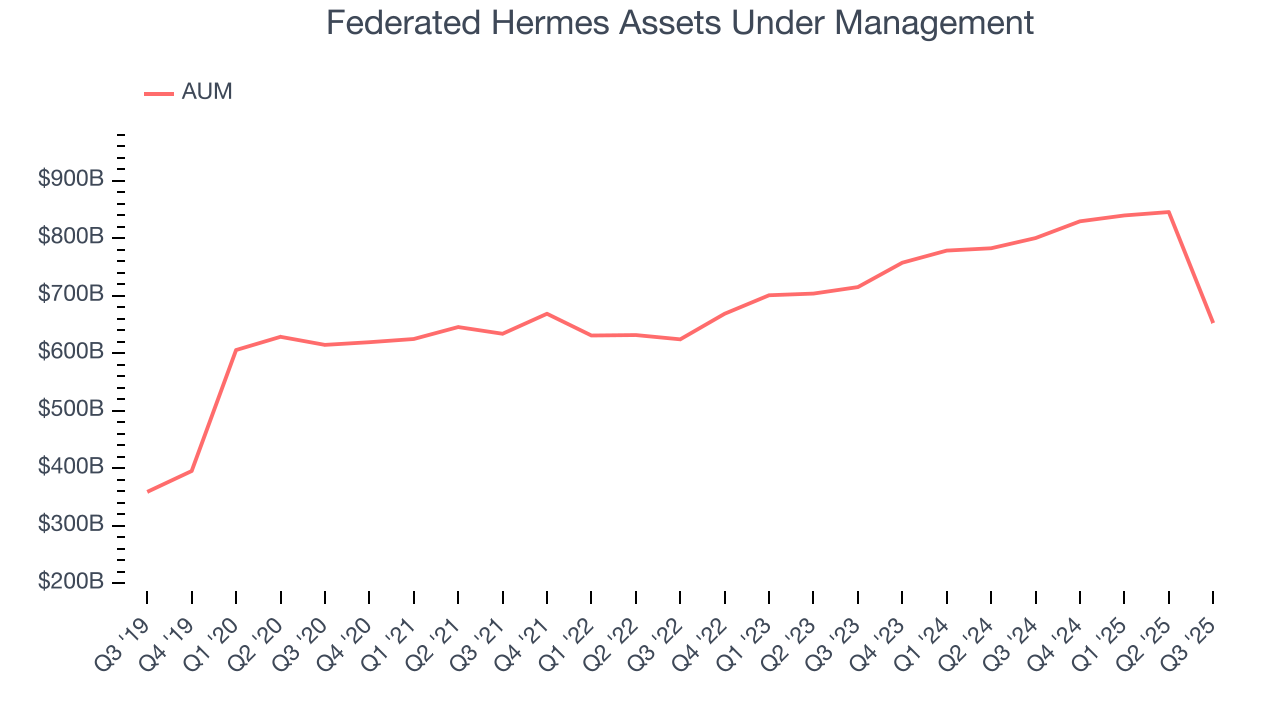

Assets Under Management (AUM) is the total capital a firm oversees or manages on behalf of clients. Fees on this AUM, typically a small percentage, are contractually recurring and provide a high level of stability to revenue even if investment performance lags (although too much poor investment performance eventually hurts fundraising ability).

Federated Hermes’s AUM has grown at an annual rate of 7.1% over the last five years, slightly worse than the broader financials industry but faster than its total revenue. When analyzing Federated Hermes’s AUM over the last two years, we can see that growth decelerated to 6.6% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

Federated Hermes’s AUM punched in at $652.8 billion this quarter, falling 24% short of analysts’ expectations. This print was 18.5% lower than the same quarter last year.

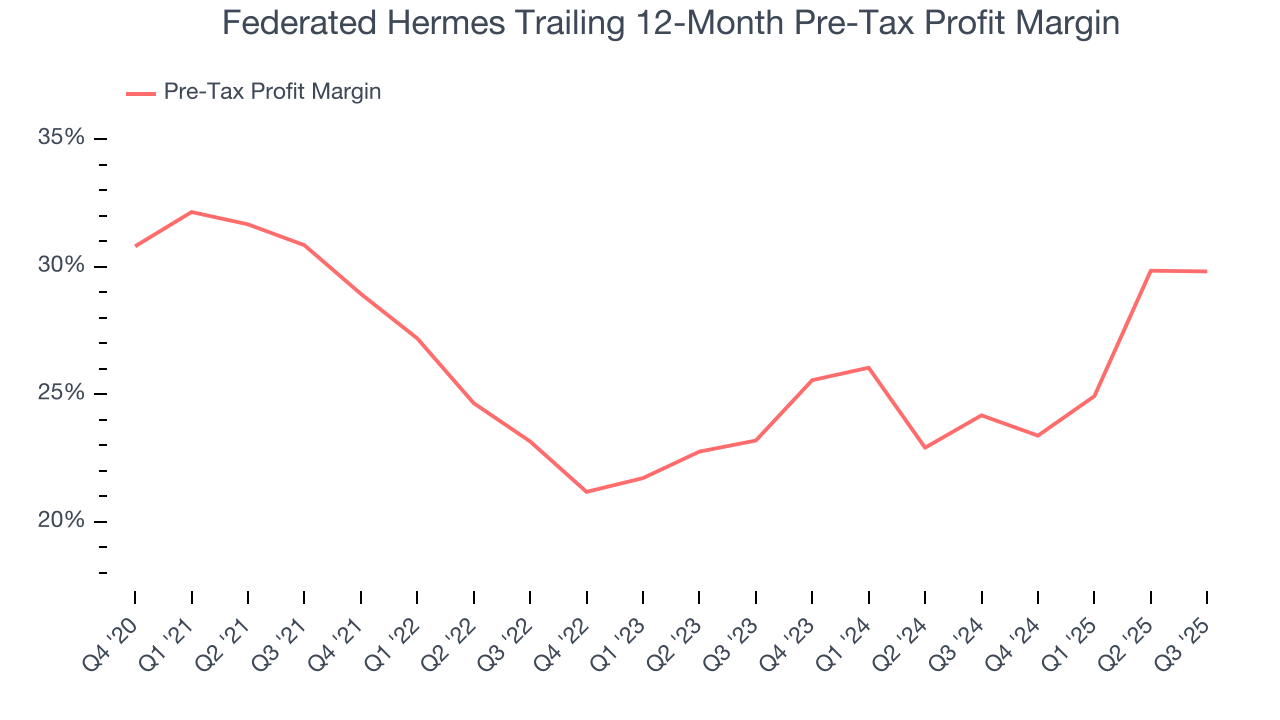

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last four years, Federated Hermes’s pre-tax profit margin has risen by 1 percentage points, going from 30.8% to 29.8%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 6.6 percentage points on a two-year basis.

Federated Hermes’s pre-tax profit margin came in at 29.9% this quarter. This result was in line with the same quarter last year.

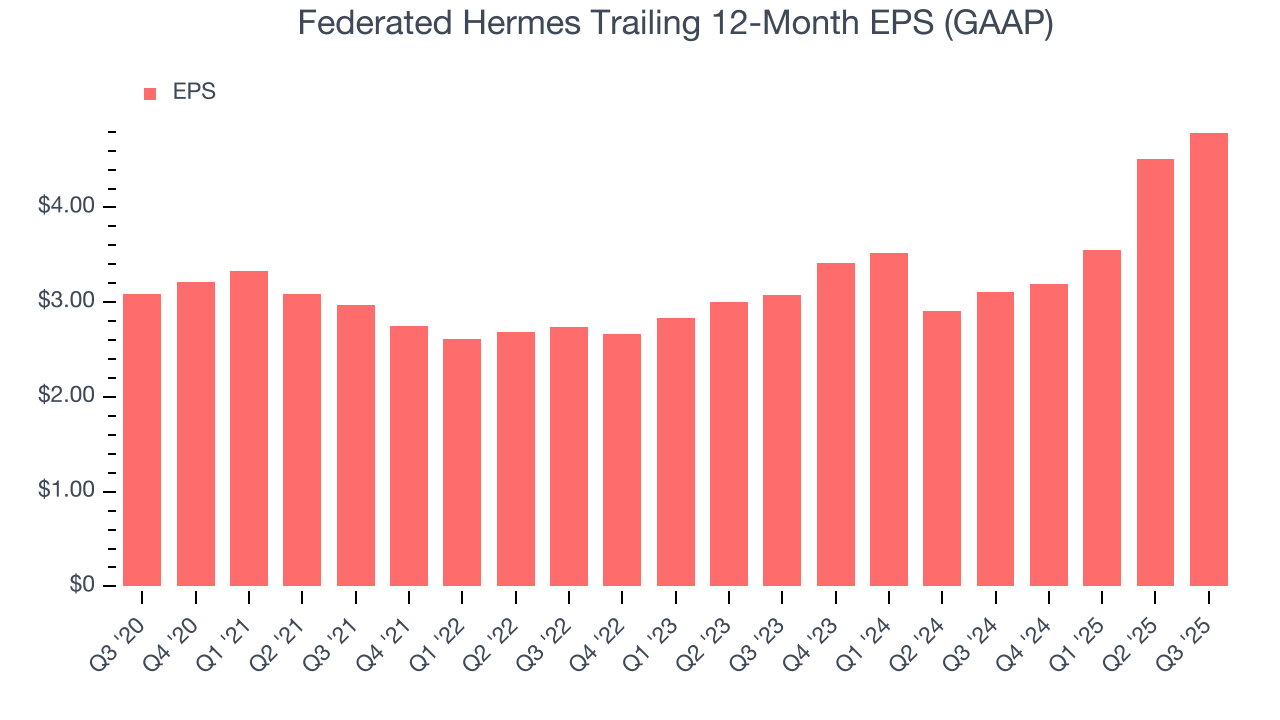

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Federated Hermes’s EPS grew at an unimpressive 9.2% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its pre-tax profit margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Federated Hermes, its two-year annual EPS growth of 24.7% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q3, Federated Hermes reported EPS of $1.34, up from $1.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Federated Hermes’s full-year EPS of $4.79 to shrink by 2.5%.

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Federated Hermes has averaged an ROE of 24.6%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Federated Hermes has a strong competitive moat.

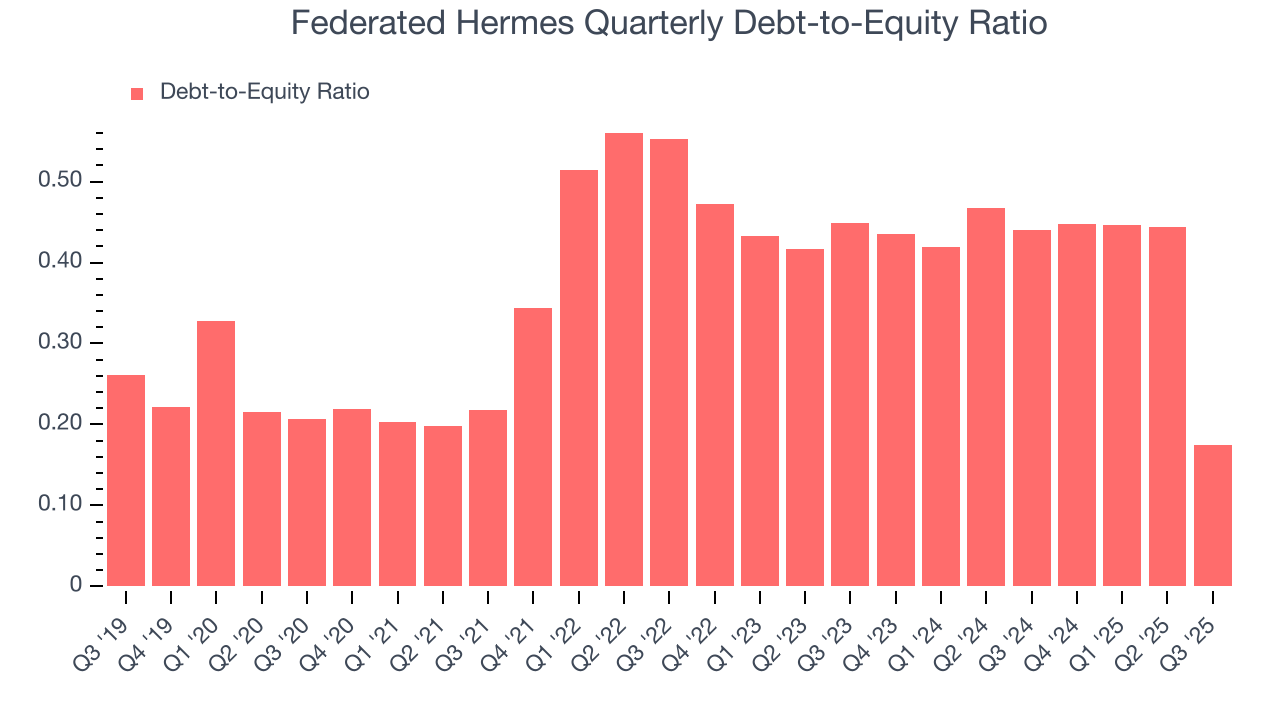

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Federated Hermes currently has $348.3 million of debt and $1.99 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.4×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Federated Hermes’s Q3 Results

It was good to see Federated Hermes beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $47.52 immediately following the results.

12. Is Now The Time To Buy Federated Hermes?

Updated: January 23, 2026 at 11:32 PM EST

When considering an investment in Federated Hermes, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are definitely a lot of things to like about Federated Hermes. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Federated Hermes’s unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, its stellar ROE suggests it has been a well-run company historically.

Federated Hermes’s P/E ratio based on the next 12 months is 11.1x. Looking at the financials landscape right now, Federated Hermes trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $54 on the company (compared to the current share price of $53.69).