Floor And Decor (FND)

We wouldn’t recommend Floor And Decor. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Floor And Decor Will Underperform

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

- Weak same-store sales trends over the past two years suggest there may be few opportunities in its core markets to open new locations

- Underwhelming 8.8% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its falling returns suggest its earlier profit pools are drying up

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

Floor And Decor doesn’t meet our quality criteria. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Floor And Decor

Why There Are Better Opportunities Than Floor And Decor

Floor And Decor is trading at $75.90 per share, or 37.9x forward P/E. This multiple expensive for its subpar fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Floor And Decor (FND) Research Report: Q3 CY2025 Update

Specialty flooring retailer Floor & Decor (NYSE:FND) met Wall Streets revenue expectations in Q3 CY2025, with sales up 5.5% year on year to $1.18 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $4.69 billion at the midpoint. Its GAAP profit of $0.53 per share was 15.6% above analysts’ consensus estimates.

Floor And Decor (FND) Q3 CY2025 Highlights:

- Revenue: $1.18 billion vs analyst estimates of $1.18 billion (5.5% year-on-year growth, in line)

- EPS (GAAP): $0.53 vs analyst estimates of $0.46 (15.6% beat)

- Adjusted EBITDA: $138.8 million vs analyst estimates of $138.2 million (11.8% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $4.69 billion at the midpoint

- EPS (GAAP) guidance for the full year is $1.92 at the midpoint, beating analyst estimates by 7.2%

- EBITDA guidance for the full year is $537.5 million at the midpoint, above analyst estimates of $532.1 million

- Operating Margin: 6.1%, in line with the same quarter last year

- Free Cash Flow Margin: 2.1%, down from 3.3% in the same quarter last year

- Locations: 262 at quarter end, up from 241 in the same quarter last year

- Same-Store Sales rose 1.2% year on year (-6.4% in the same quarter last year)

- Market Capitalization: $7.44 billion

Company Overview

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

While other home improvement retailers sell flooring products in addition to a whole host of other categories such as paint, appliances, lumber, and even plants, Floor & Decor is focused largely

The core customer is both the do-it-yourself (DIY) homeowner as well as the professional contractor. The DIY shopper values the ability to touch and feel products as well as the helpful sales associates trained strictly in flooring. For the professional contractor, Floor & Decor’s vast selection and high in-stock positions mean they don’t have to shop around to find everything they need, allowing them to maximize time devoted to their projects. There are also loyalty programs and volume discounts for Pros.

The company has a vertically integrated business model, which means they control every aspect of the supply chain from product development to procurement to distribution. Since Floor & Decor deals directly with manufacturers (competitors often use buying agents and middlemen), they can keep prices extremely competitive. It also allows the company to introduce new products and respond to trends in a more timely manner.

4. Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Competitors offering flooring products and materials include LL Flooring (NYSE:LL), Tile Shop (NASDAQ:TTSH), Home Depot (NYSE:HD), and Lowe’s (NYSE:LOW).

5. Revenue Growth

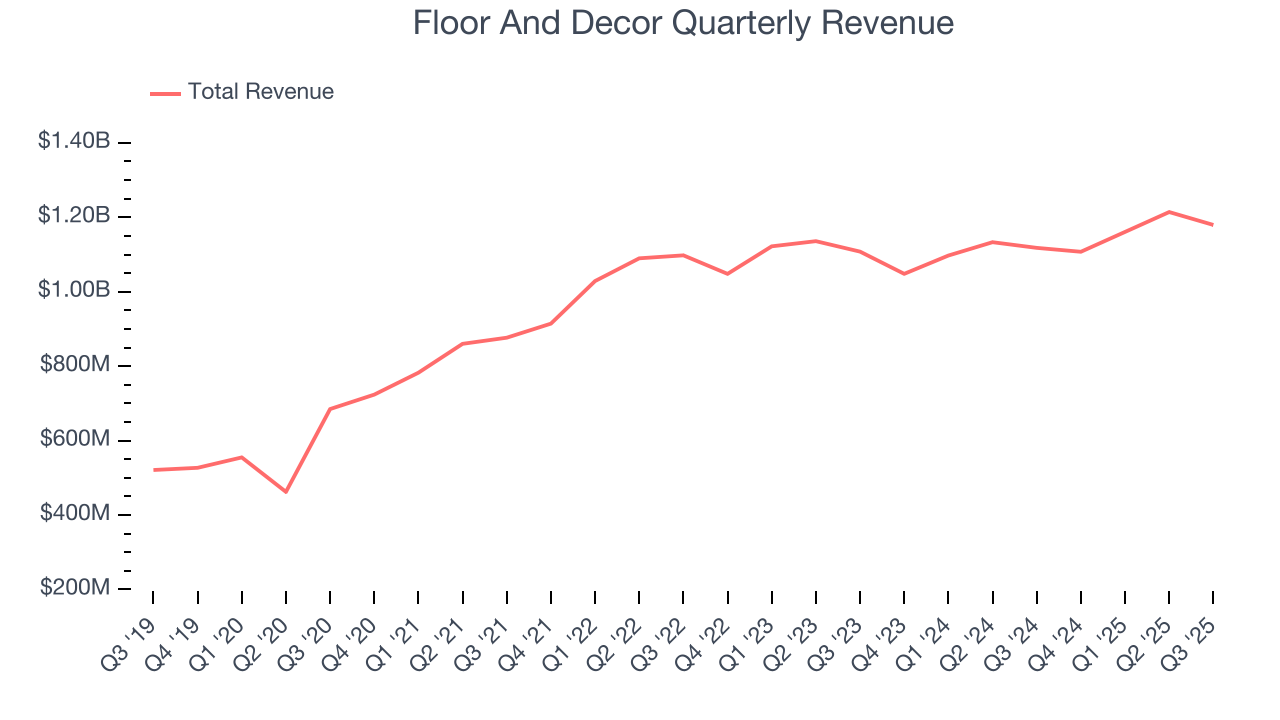

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.66 billion in revenue over the past 12 months, Floor And Decor is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

As you can see below, Floor And Decor’s sales grew at an impressive 15.6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Floor And Decor grew its revenue by 5.5% year on year, and its $1.18 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a deceleration versus the last six years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products.

6. Store Performance

Number of Stores

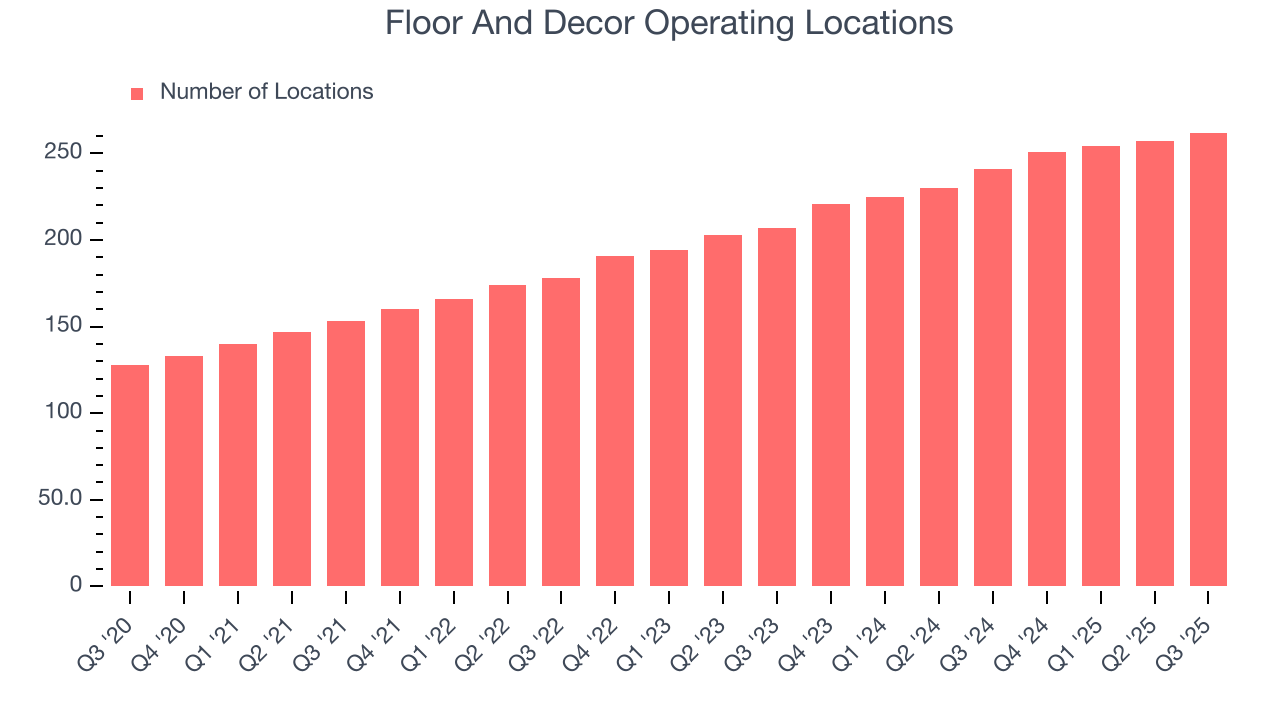

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Floor And Decor sported 262 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 13.5% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

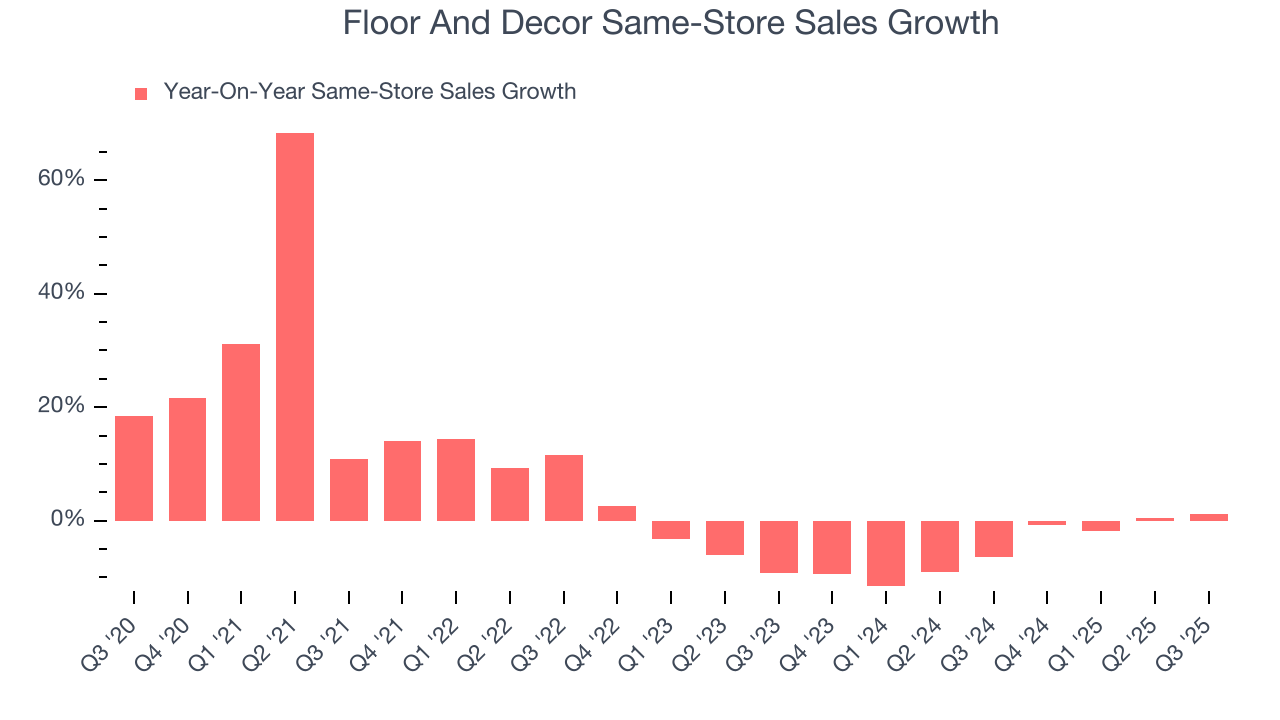

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Floor And Decor’s demand has been shrinking over the last two years as its same-store sales have averaged 4.7% annual declines. This performance is concerning - it shows Floor And Decor artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Floor And Decor’s same-store sales rose 1.2% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

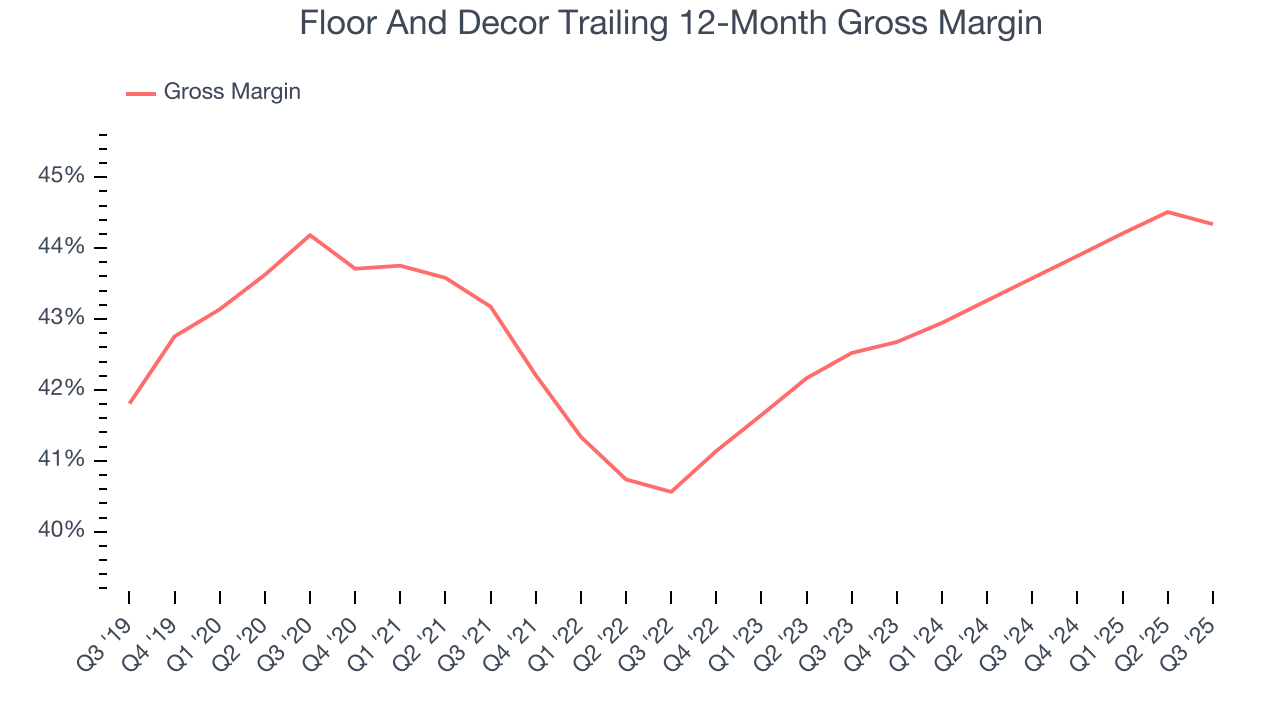

Floor And Decor has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 44% gross margin over the last two years. That means for every $100 in revenue, only $56.03 went towards paying for inventory, transportation, and distribution.

Floor And Decor produced a 43.4% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

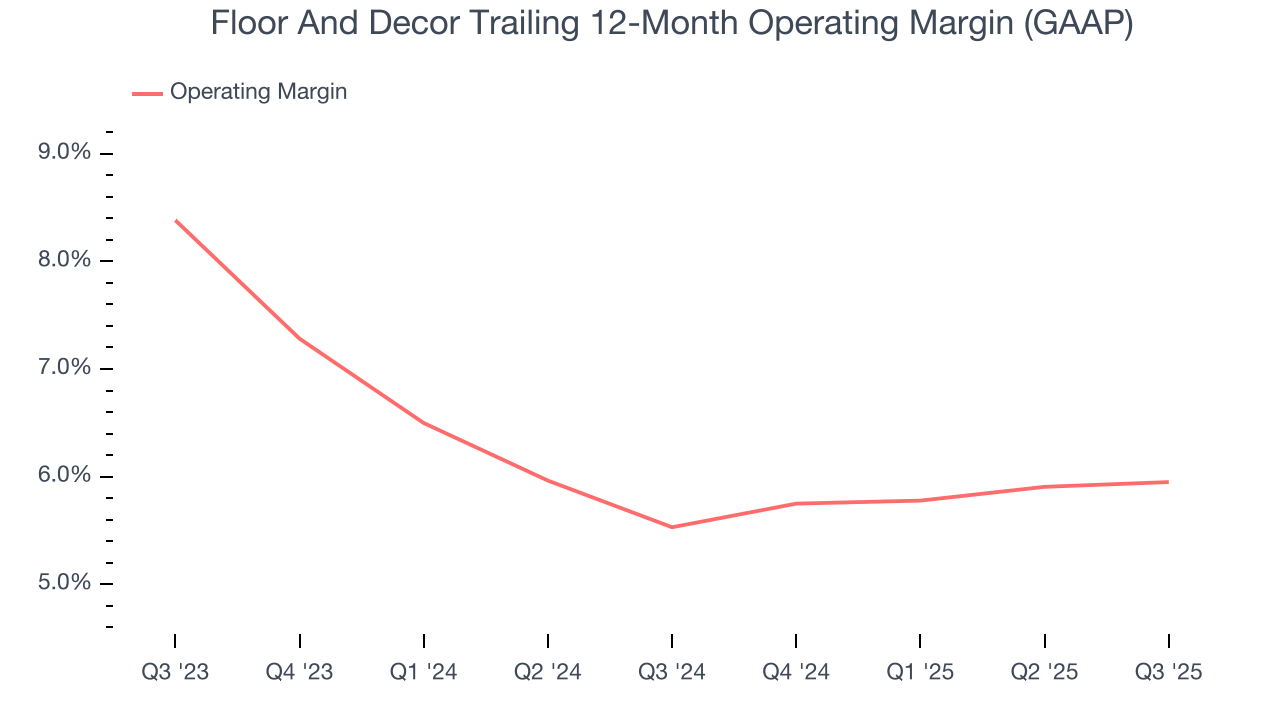

Floor And Decor’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5.7% over the last two years. This profitability was paltry for a consumer retail business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Floor And Decor’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Floor And Decor generated an operating margin profit margin of 6.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

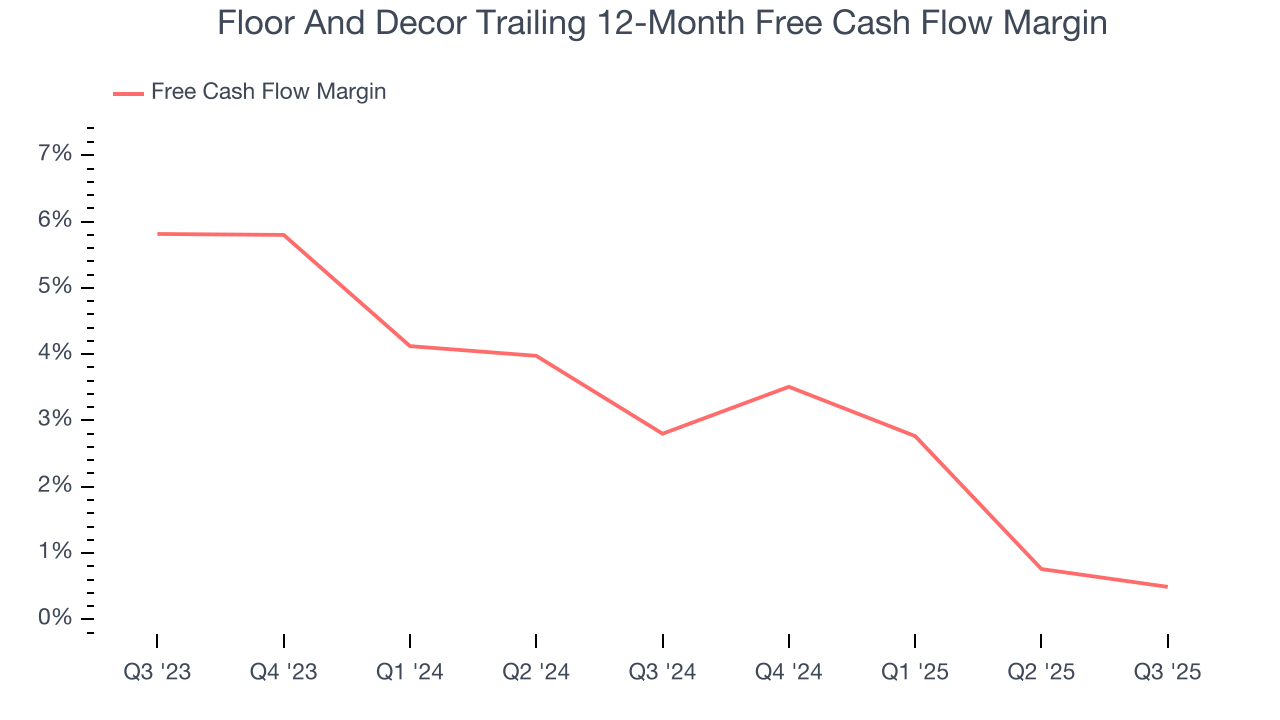

Floor And Decor has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.6%, subpar for a consumer retail business.

Taking a step back, we can see that Floor And Decor’s margin dropped by 2.3 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Floor And Decor’s free cash flow clocked in at $24.48 million in Q3, equivalent to a 2.1% margin. The company’s cash profitability regressed as it was 1.2 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Floor And Decor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

11. Balance Sheet Assessment

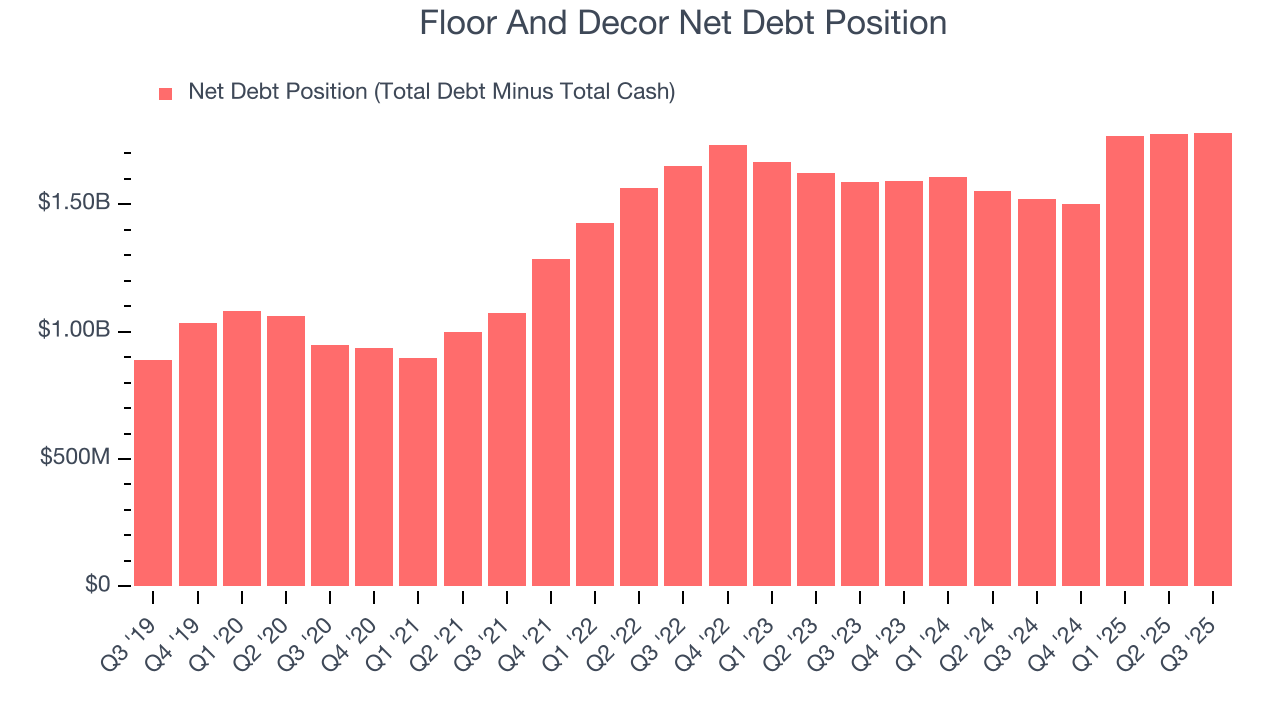

Floor And Decor reported $204.5 million of cash and $1.99 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $538.5 million of EBITDA over the last 12 months, we view Floor And Decor’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $2.00 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Floor And Decor’s Q3 Results

It was good to see Floor And Decor beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, its gross margin was in line. Overall, this print had some key positives. The stock traded up 6.2% to $69.05 immediately after reporting.

13. Is Now The Time To Buy Floor And Decor?

Updated: January 22, 2026 at 9:36 PM EST

Before making an investment decision, investors should account for Floor And Decor’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Floor And Decor, we’ll be cheering from the sidelines. First off, its revenue growth was a little slower over the last three years. And while its new store openings have increased its brand equity, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Floor And Decor’s P/E ratio based on the next 12 months is 37.9x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $77.27 on the company (compared to the current share price of $75.90).