Forestar Group (FOR)

1. News

2. Forestar Group (FOR) Research Report: Q3 CY2025 Update

Residential lot developer Forestar Group (NYSE:FOR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 21.6% year on year to $670.5 million. Its non-GAAP profit of $1.70 per share was 34.9% above analysts’ consensus estimates.

Forestar Group (FOR) Q3 CY2025 Highlights:

- Revenue: $670.5 million vs analyst estimates of $552.7 million (21.6% year-on-year growth, 21.3% beat)

- Adjusted EPS: $1.70 vs analyst estimates of $1.26 (34.9% beat)

- Adjusted EBITDA: $112.4 million vs analyst estimates of $85.31 million (16.8% margin, 31.8% beat)

- Operating Margin: 16.6%, down from 18.9% in the same quarter last year

- Free Cash Flow Margin: 38.1%, up from 21.5% in the same quarter last year

- Sales Volumes fell 9% year on year (7.8% in the same quarter last year)

- Market Capitalization: $1.39 billion

Company Overview

As a majority-owned subsidiary of homebuilding giant D.R. Horton, Forestar Group (NYSE:FOR) develops and sells finished residential lots to homebuilders, focusing primarily on land acquisition and development for single-family homes.

Forestar operates across 59 markets in 24 states, strategically selecting land parcels, securing necessary entitlements, and developing the infrastructure required for residential communities. The company typically invests in short-duration projects that can be developed in phases, allowing them to match lot delivery with market demand. This approach enables homebuilders to avoid tying up capital in land while still ensuring a pipeline of buildable lots.

The company's business model centers on the full development cycle: acquiring raw land, obtaining zoning approvals and permits, installing infrastructure (roads, utilities, and drainage systems), and delivering finished lots ready for home construction. Forestar's target market primarily consists of lots for entry-level and first-time move-up homes—the largest segments of the new home market—as well as active adult communities and build-to-rent operators.

Beyond traditional lot development, Forestar also engages in strategic short-term investments through "lot banking" (purchasing finished lots) and "land banking" (acquiring undeveloped land) to efficiently utilize available capital before deploying it into longer-term projects. This approach provides flexibility in their capital allocation while maintaining a steady pipeline of development opportunities. The company's relationship with D.R. Horton provides a reliable customer base while still serving other national, regional, and local homebuilders.

3. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Forestar Group's competitors include other land developers and lot suppliers such as St. Joe Company (NYSE:JOE), Five Point Holdings (NYSE:FPH), and privately-held land development companies that operate in regional markets. The company also competes with homebuilders that maintain their own land development operations.

4. Revenue Growth

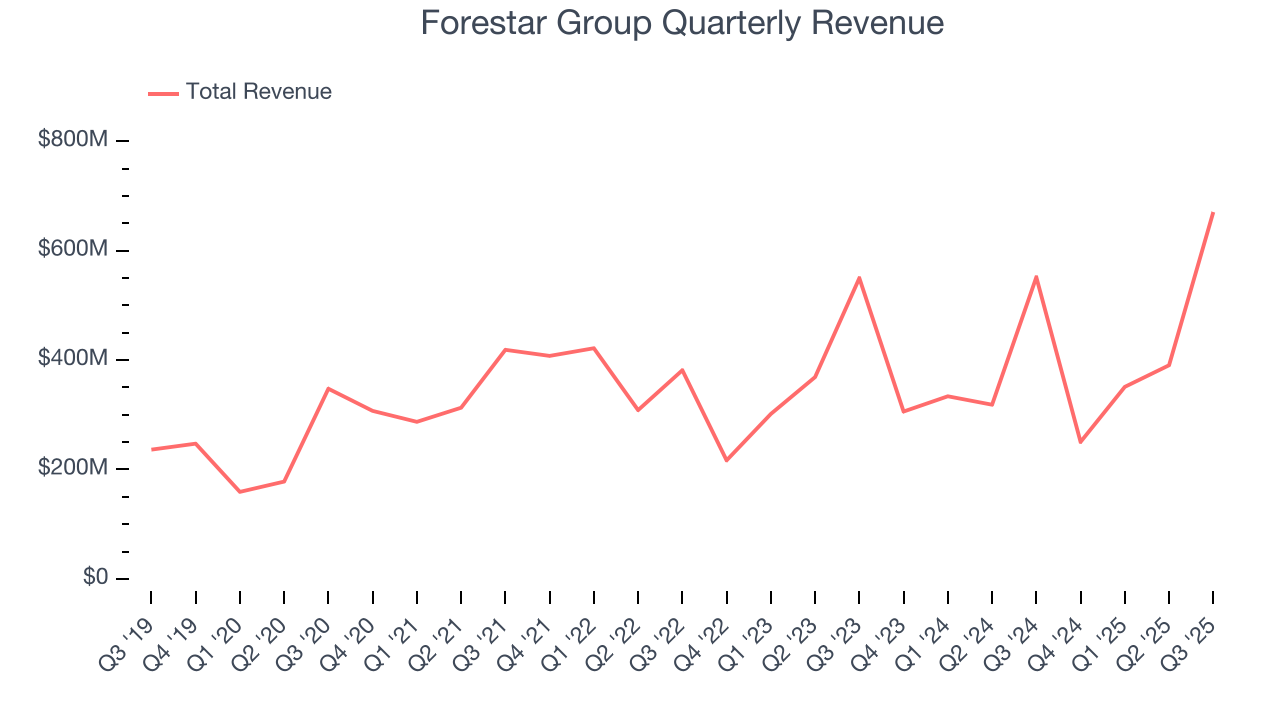

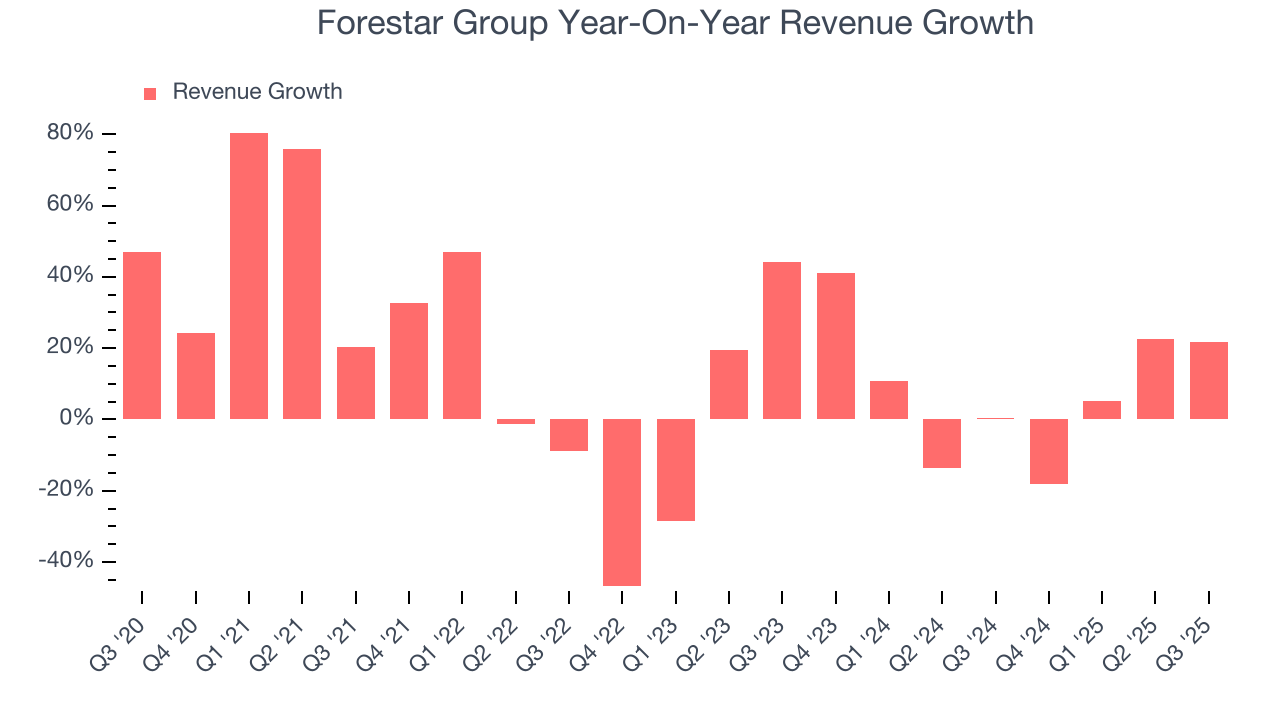

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Forestar Group grew its sales at a 12.3% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Forestar Group’s recent performance shows its demand has slowed as its annualized revenue growth of 7.6% over the last two years was below its five-year trend.

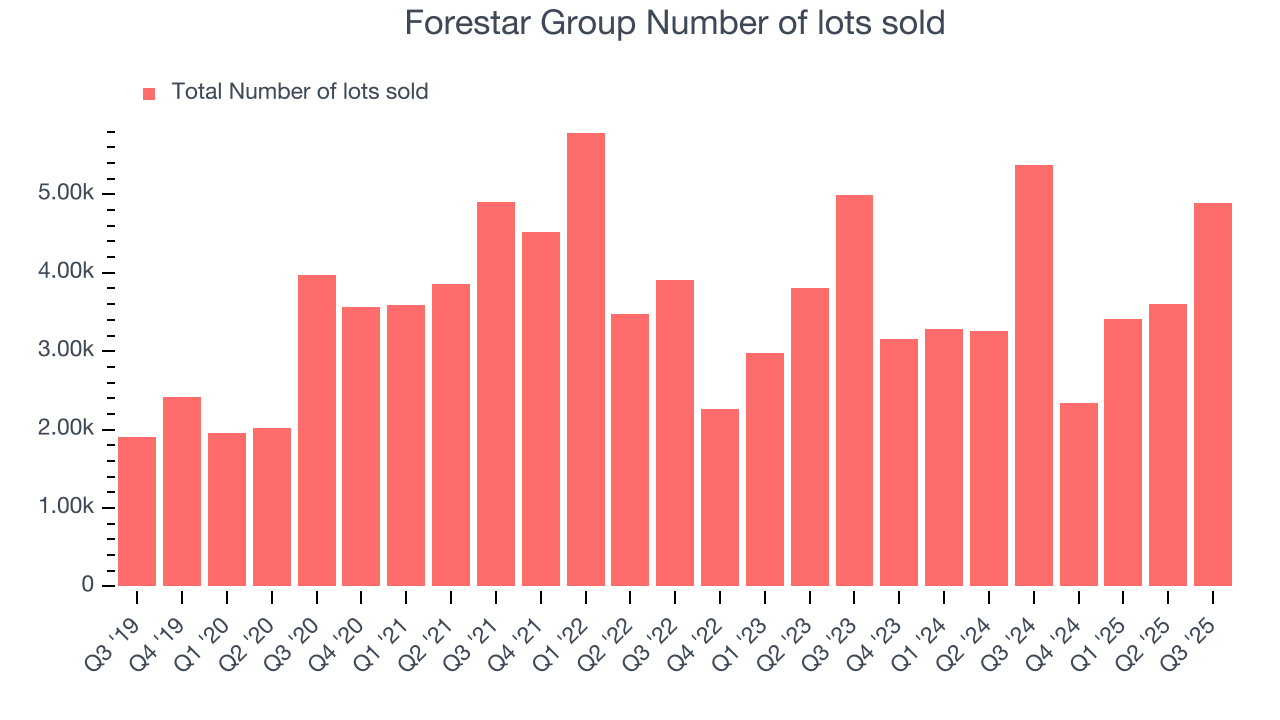

We can better understand the company’s revenue dynamics by analyzing its number of number of lots sold, which reached 4,891 in the latest quarter. Over the last two years, Forestar Group’s number of lots sold averaged 2.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Forestar Group reported robust year-on-year revenue growth of 21.6%, and its $670.5 million of revenue topped Wall Street estimates by 21.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

5. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

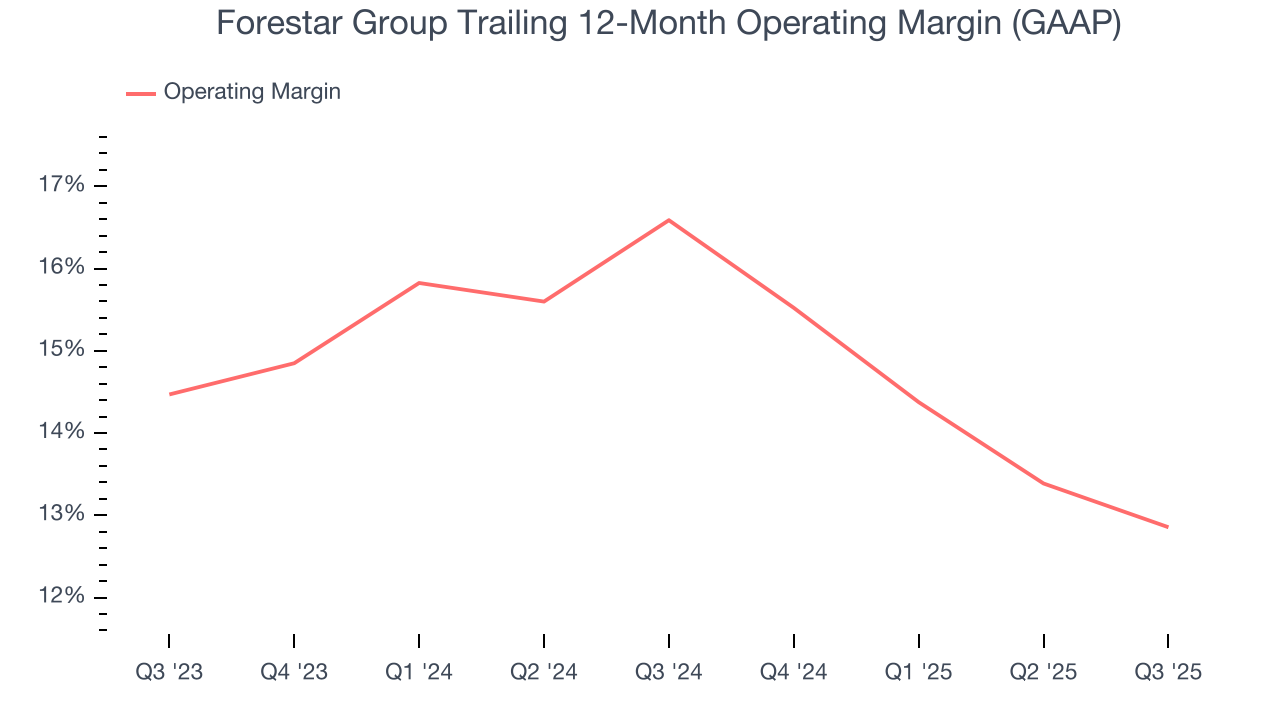

Forestar Group’s operating margin has been trending down over the last 12 months and averaged 14.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q3, Forestar Group generated an operating margin profit margin of 16.6%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

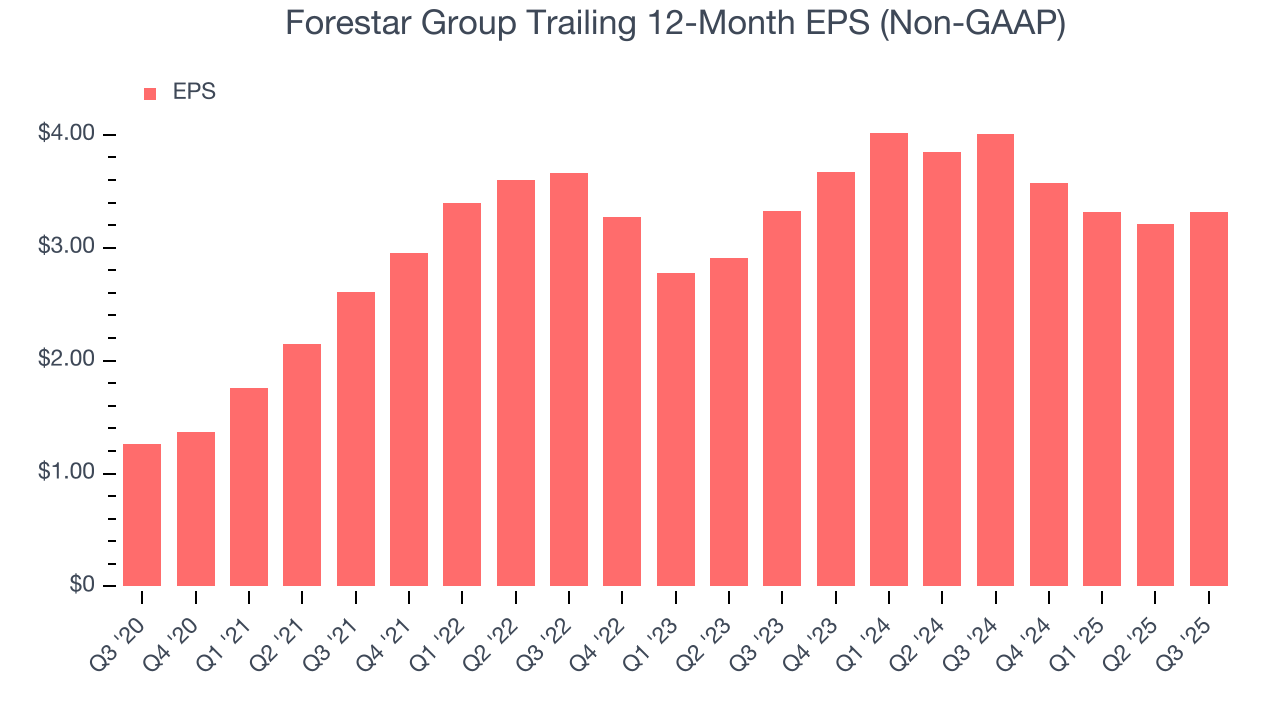

6. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Forestar Group’s EPS grew at a weak 21.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 12.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Forestar Group reported adjusted EPS of $1.70, up from $1.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Forestar Group’s full-year EPS of $3.31 to shrink by 8.7%.

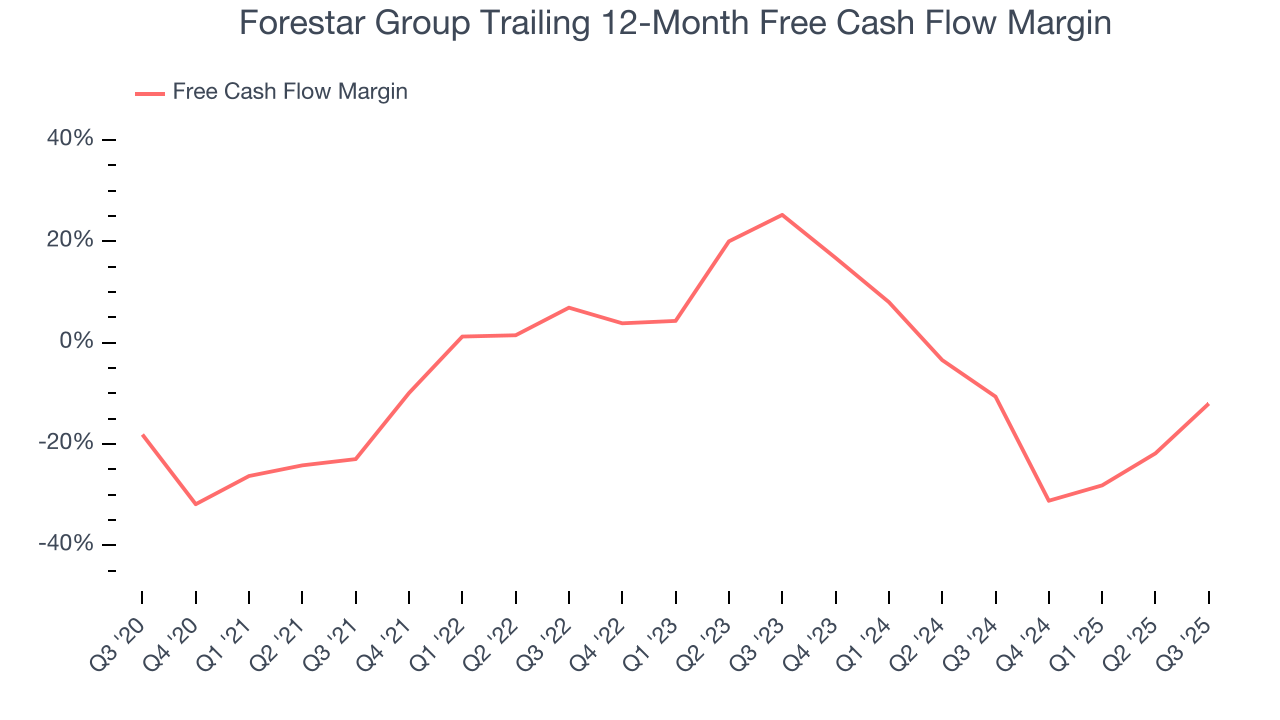

7. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While Forestar Group posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Forestar Group’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 11.4%, meaning it lit $11.37 of cash on fire for every $100 in revenue.

Forestar Group’s free cash flow clocked in at $255.6 million in Q3, equivalent to a 38.1% margin. This result was good as its margin was 16.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

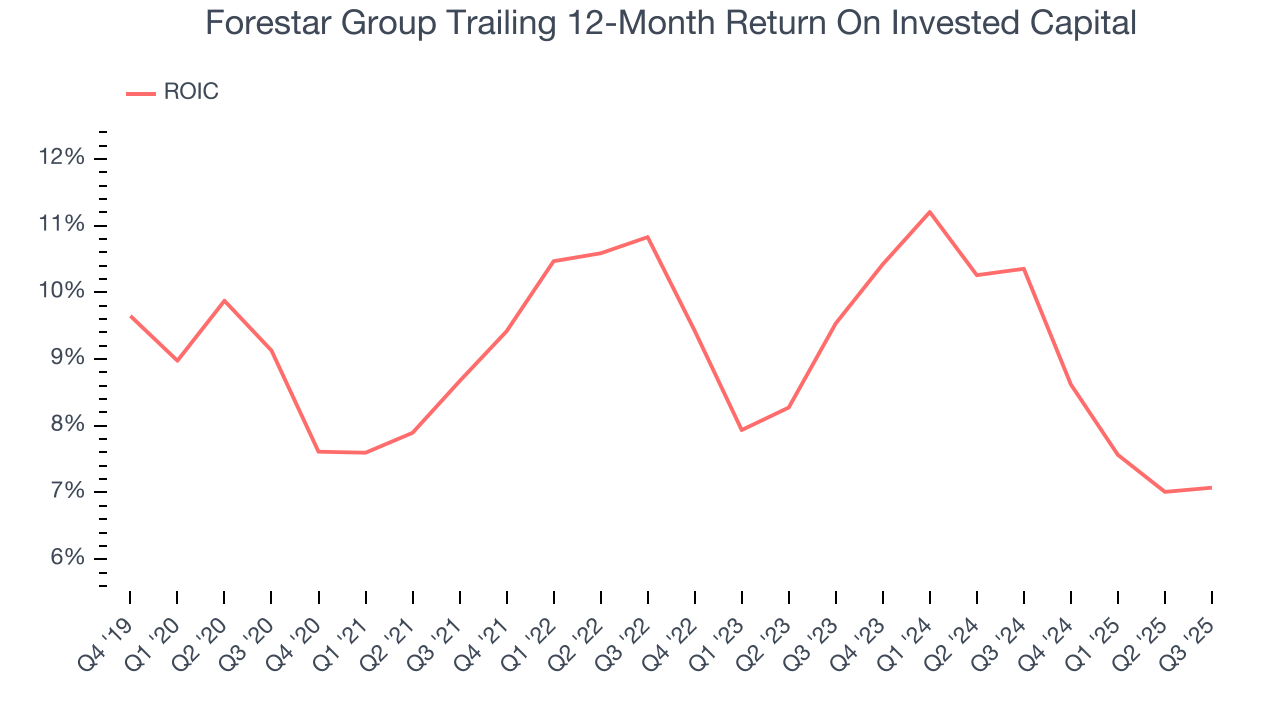

8. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Forestar Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Forestar Group’s ROIC averaged 1 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

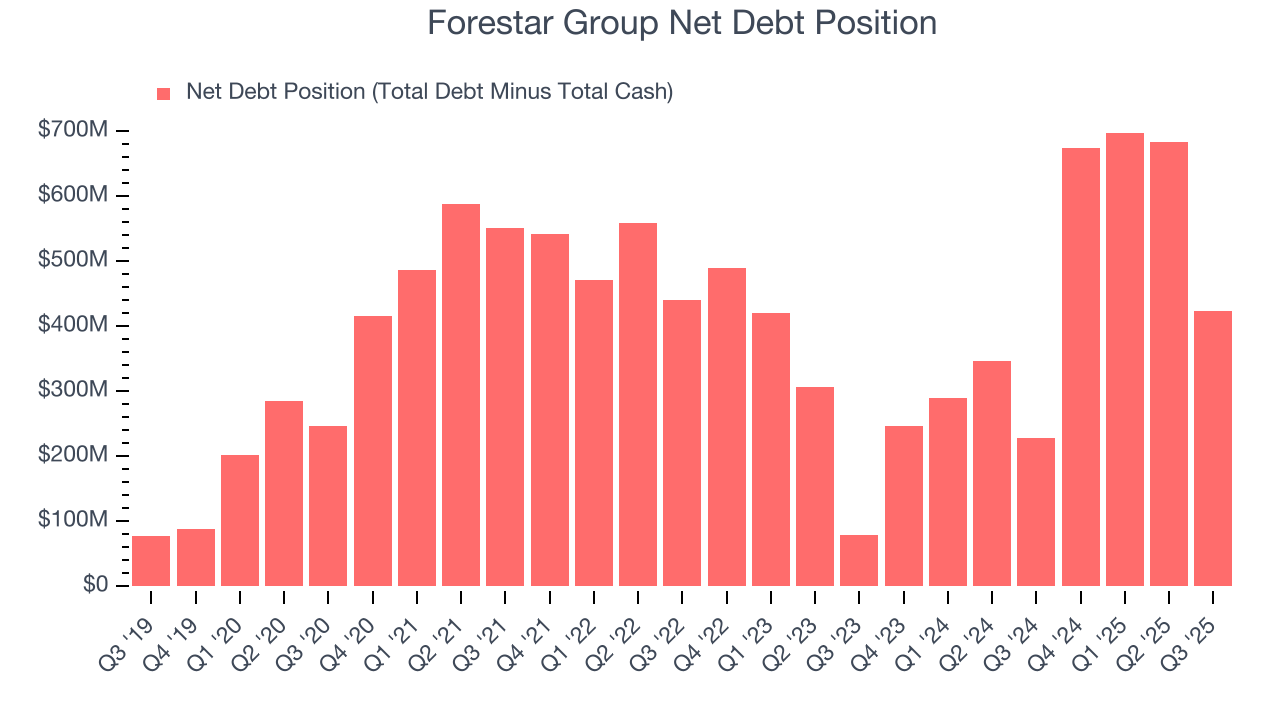

9. Balance Sheet Assessment

Forestar Group reported $379.2 million of cash and $802.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $216 million of EBITDA over the last 12 months, we view Forestar Group’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $4.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Forestar Group’s Q3 Results

It was good to see Forestar Group beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $27.92 immediately after reporting.

11. Is Now The Time To Buy Forestar Group?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Forestar Group.

Forestar Group falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Forestar Group’s , and its projected EPS for the next year is lacking.

Forestar Group’s P/E ratio based on the next 12 months is 9.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $32.25 on the company (compared to the current share price of $27.92).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.