General Dynamics (GD)

We’re wary of General Dynamics. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why General Dynamics Is Not Exciting

Creator of the famous M1 Abrahms tank, General Dynamics (NYSE:GD) develops aerospace, marine systems, combat systems, and information technology products.

- Sales pipeline suggests its future revenue growth may not meet our standards as its average backlog growth of 3.4% for the past two years was weak

- Estimated sales growth of 4.2% for the next 12 months implies demand will slow from its two-year trend

- A bright spot is that its market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

General Dynamics’s quality doesn’t meet our hurdle. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than General Dynamics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than General Dynamics

General Dynamics’s stock price of $364.22 implies a valuation ratio of 22.3x forward P/E. General Dynamics’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. General Dynamics (GD) Research Report: Q3 CY2025 Update

Aerospace and defense company General Dynamics (NYSE:GD) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 10.6% year on year to $12.91 billion. Its GAAP profit of $3.88 per share was 4.6% above analysts’ consensus estimates.

General Dynamics (GD) Q3 CY2025 Highlights:

- Revenue: $12.91 billion vs analyst estimates of $12.52 billion (10.6% year-on-year growth, 3.1% beat)

- EPS (GAAP): $3.88 vs analyst estimates of $3.71 (4.6% beat)

- Operating Margin: 10.3%, in line with the same quarter last year

- Free Cash Flow Margin: 14.7%, up from 10.4% in the same quarter last year

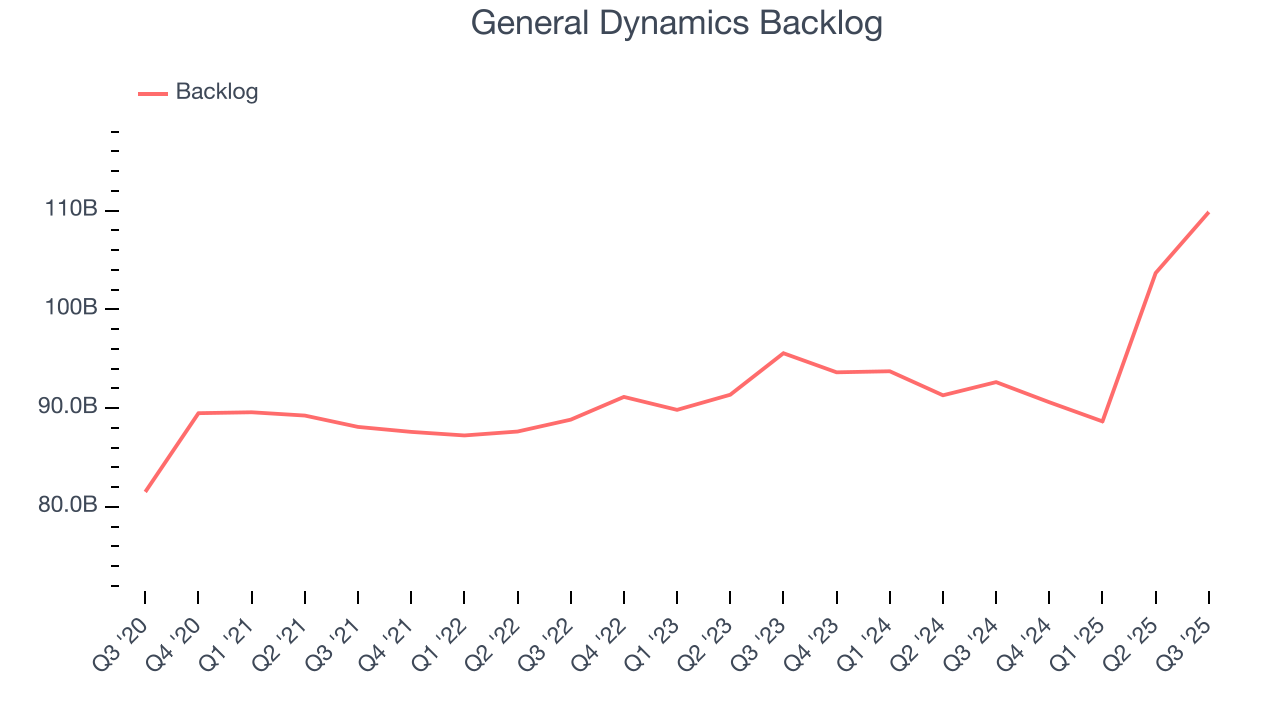

- Backlog: $109.9 billion at quarter end, up 18.6% year on year

- Market Capitalization: $91.72 billion

Company Overview

Creator of the famous M1 Abrahms tank, General Dynamics (NYSE:GD) develops aerospace, marine systems, combat systems, and information technology products.

General Dynamic’s products can be categorized into three areas: military vehicles, information systems, and commercial aircraft. This includes combat submarines, Gulfstream jets, and cyber security solutions. The company also offers services like maintenance and repair for its products.

The company primarily contracts with U.S. government agencies such as the Department of Defense as well as international governments and military organizations. It also has a presence in commercial activities, particularly aerospace, where it sells private jets to individuals and corporations.

In its U.S. government business, the majority of deals are structured as fixed-price contracts, with cost-plus contracts (reimbursement of development costs along with a fee) coming in second. Time-and-materials contracts, which require a client to pay for a contractor's time and money spent on materials, also play a role in its sales. These contracts vary in scope and duration due to the variety of services offered by the company. Internationally, General Dynamic’s non-US subsidiaries sell its products by establishing themselves as regional suppliers through relations with each respective government.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

General Dynamic’s peers and competitors include Boeing (NYSE:BA), Raytheon (NYSE:RTX), Northrop Grumman (NYSE: NOC), and Lockheed Martin (NYSE:LMT).

5. Revenue Growth

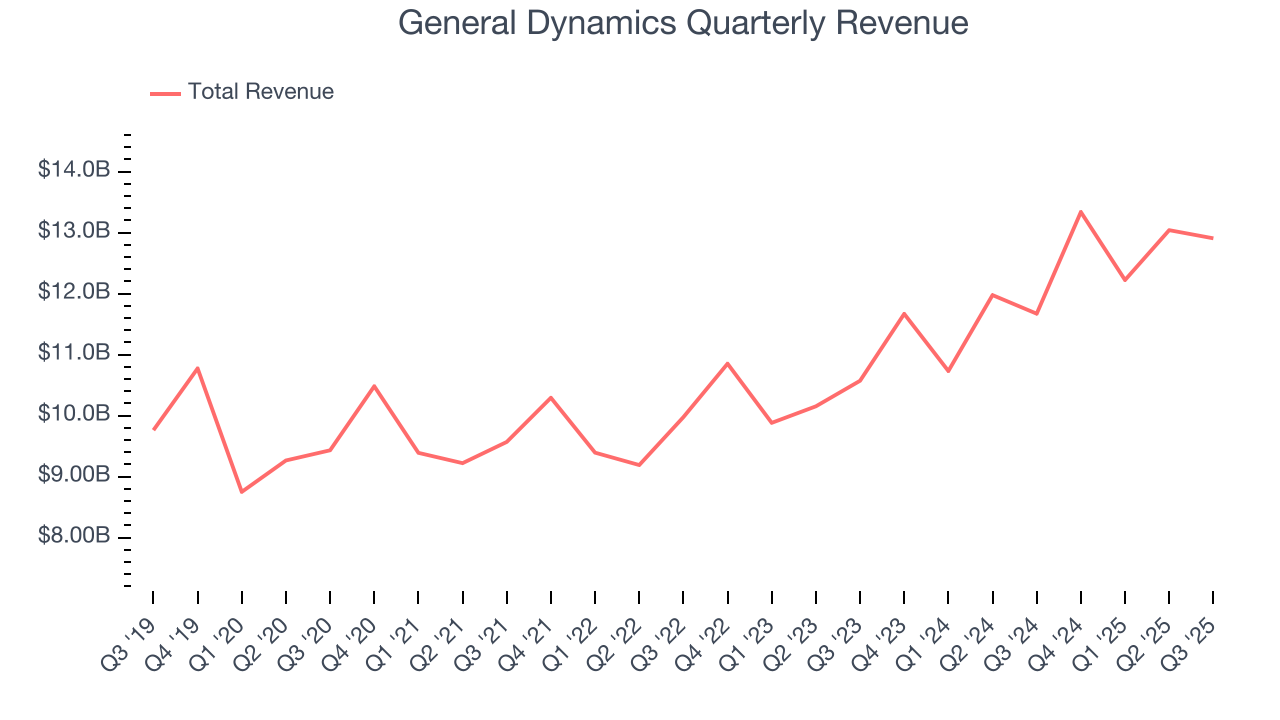

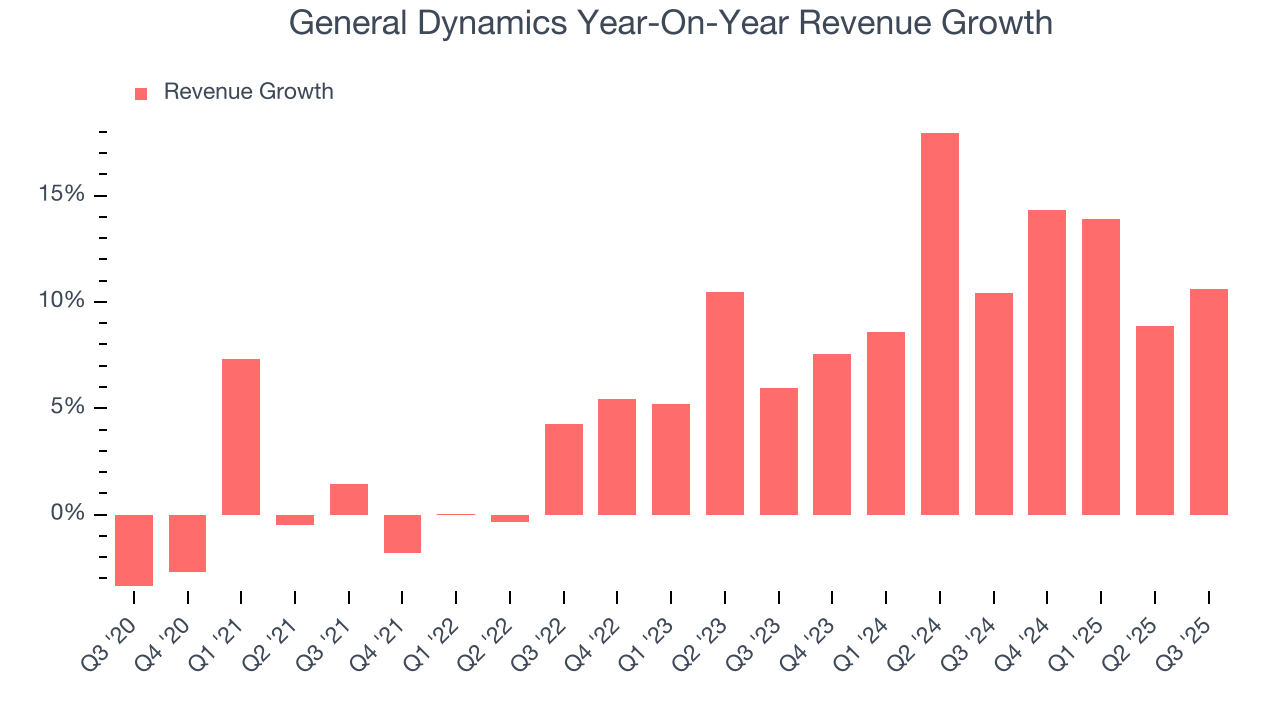

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, General Dynamics grew its sales at a mediocre 6.2% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. General Dynamics’s annualized revenue growth of 11.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. General Dynamics’s backlog reached $109.9 billion in the latest quarter and averaged 3.4% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies General Dynamics was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, General Dynamics reported year-on-year revenue growth of 10.6%, and its $12.91 billion of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

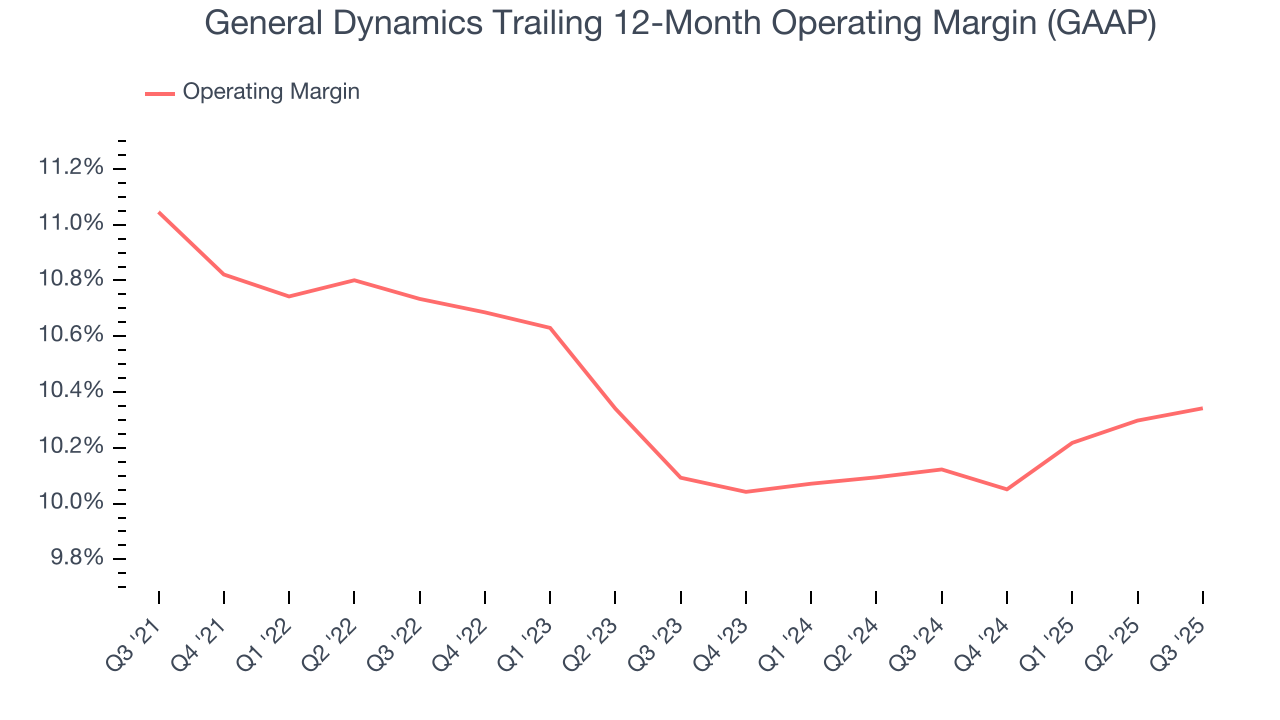

General Dynamics’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 10.4% over the last five years. This profitability was solid for an industrials business and shows it’s an efficient company that manages its expenses well.

Analyzing the trend in its profitability, General Dynamics’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, General Dynamics generated an operating margin profit margin of 10.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

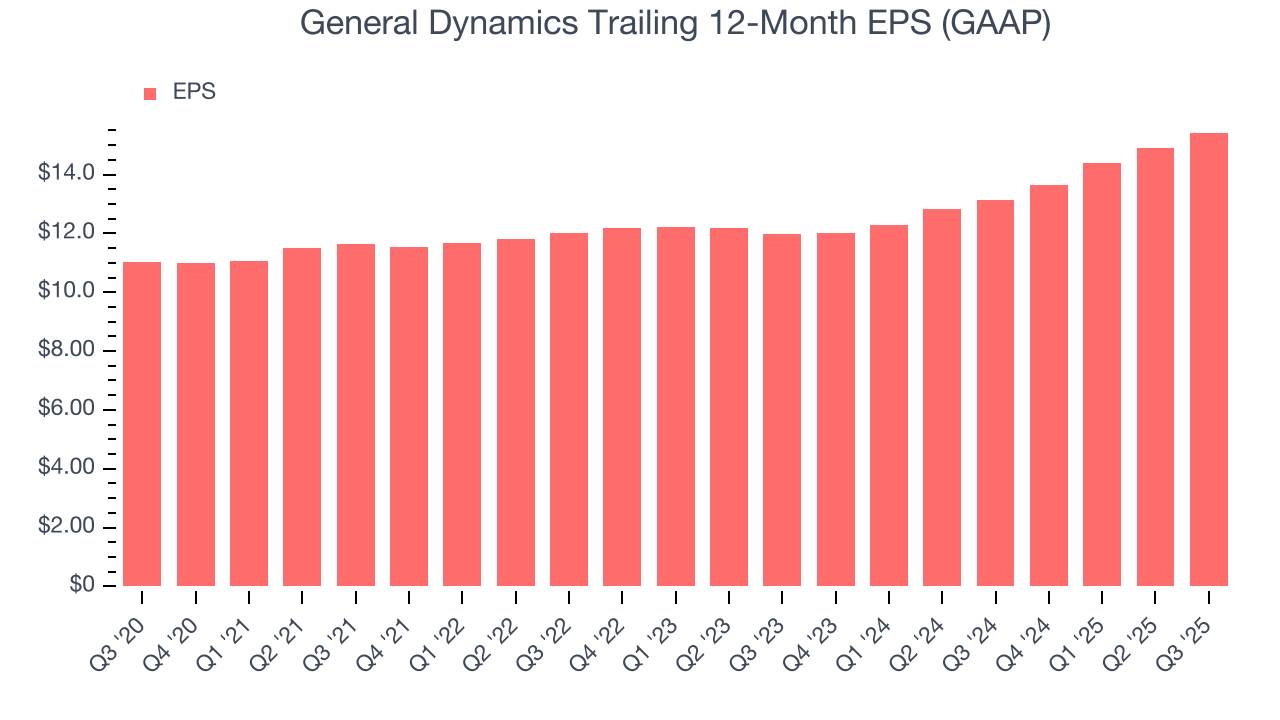

General Dynamics’s unimpressive 7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For General Dynamics, its two-year annual EPS growth of 13.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, General Dynamics reported EPS of $3.88, up from $3.35 in the same quarter last year. This print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects General Dynamics’s full-year EPS of $15.43 to grow 6.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

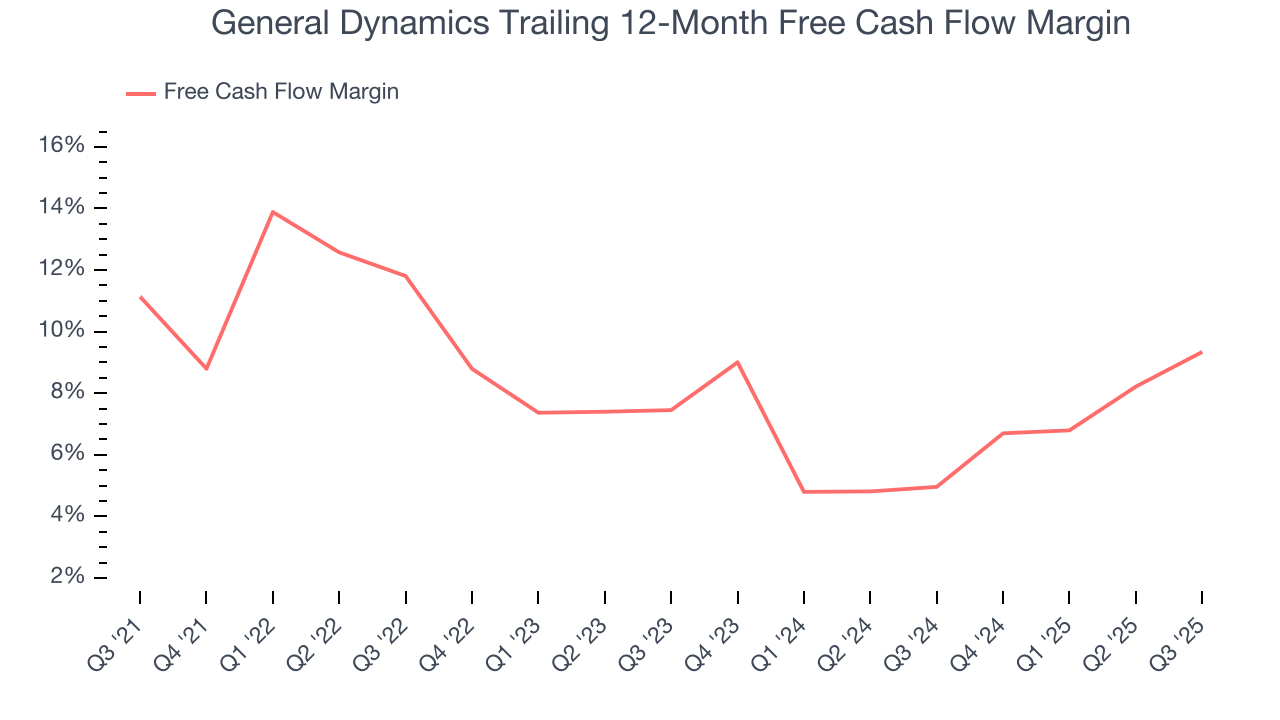

General Dynamics has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that General Dynamics’s margin dropped by 1.8 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

General Dynamics’s free cash flow clocked in at $1.90 billion in Q3, equivalent to a 14.7% margin. This result was good as its margin was 4.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

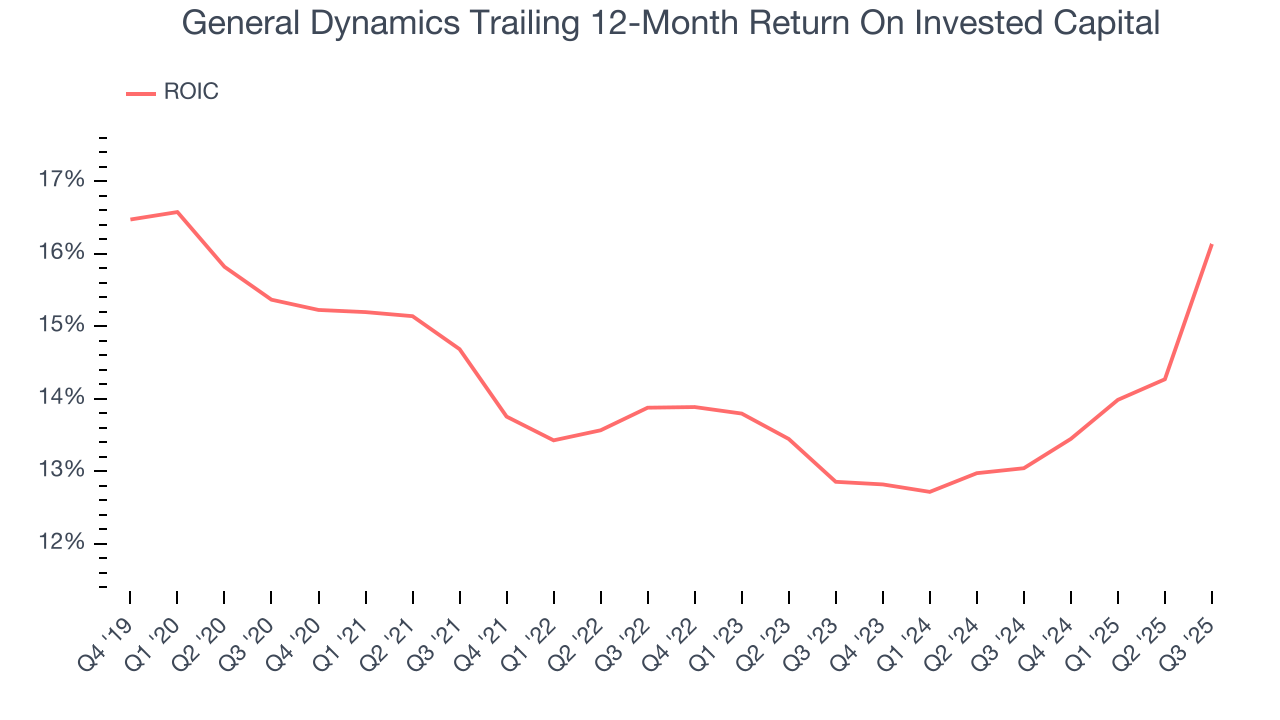

Although General Dynamics hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 14.1%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, General Dynamics’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

10. Balance Sheet Assessment

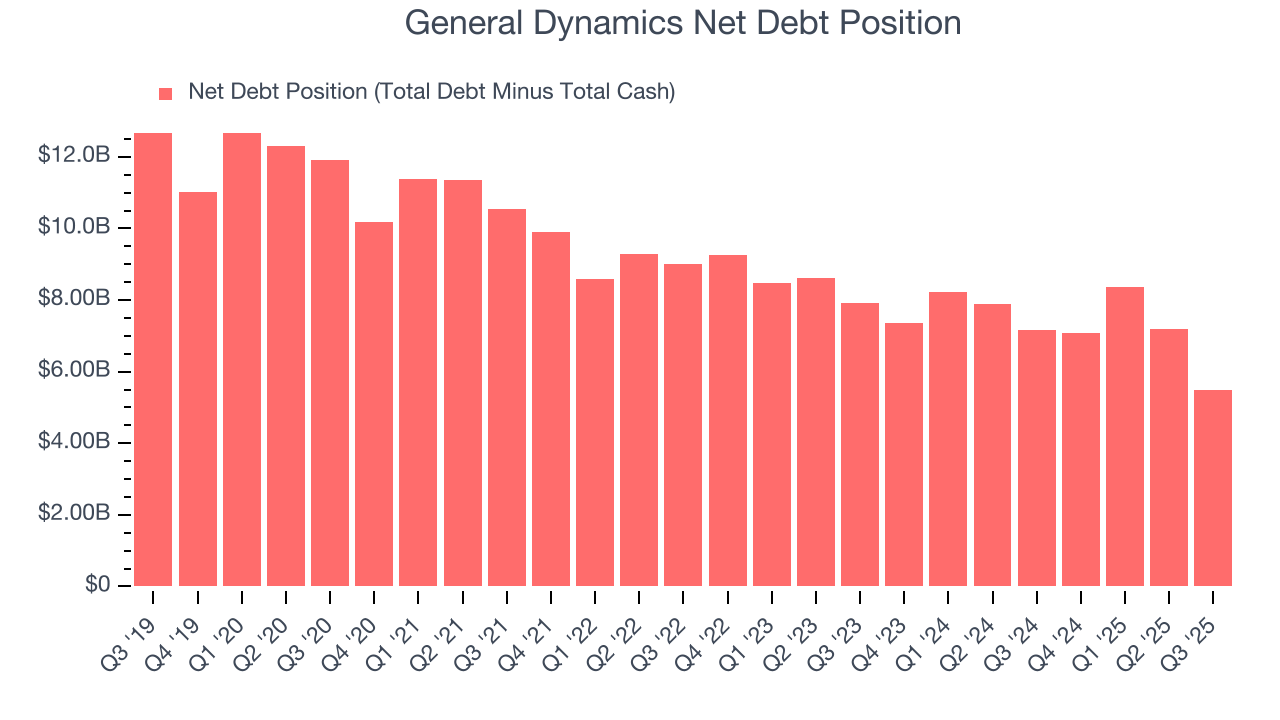

General Dynamics reported $2.52 billion of cash and $8.01 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $6.24 billion of EBITDA over the last 12 months, we view General Dynamics’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $327 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from General Dynamics’s Q3 Results

We were impressed by how significantly General Dynamics blew past analysts’ backlog expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.5% to $346.50 immediately after reporting.

12. Is Now The Time To Buy General Dynamics?

Updated: January 24, 2026 at 10:35 PM EST

Before making an investment decision, investors should account for General Dynamics’s business fundamentals and valuation in addition to what happened in the latest quarter.

General Dynamics isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its solid ROIC suggests it has grown profitably in the past, the downside is its backlog growth has disappointed. On top of that, its projected EPS for the next year is lacking.

General Dynamics’s P/E ratio based on the next 12 months is 22.3x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $393.01 on the company (compared to the current share price of $364.22).