Genuine Parts (GPC)

We’re wary of Genuine Parts. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Genuine Parts Will Underperform

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

- Annual sales growth of 4% over the last three years lagged behind its consumer retail peers as its large revenue base made it difficult to generate incremental demand

- Performance over the past three years shows its incremental sales were much less profitable, as its earnings per share fell by 2.7% annually

- Rapid rollout of new stores raises questions since current locations haven’t demonstrated acceptable same-store sales growth

Genuine Parts is in the penalty box. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Genuine Parts

Why There Are Better Opportunities Than Genuine Parts

At $149.66 per share, Genuine Parts trades at 17.8x forward P/E. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Genuine Parts (GPC) Research Report: Q4 CY2025 Update

Auto and industrial parts retailer Genuine Parts (NYSE:GPC) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 4.1% year on year to $6.01 billion. Its non-GAAP profit of $1.55 per share was 14.8% below analysts’ consensus estimates.

Genuine Parts (GPC) Q4 CY2025 Highlights:

- Revenue: $6.01 billion vs analyst estimates of $6.06 billion (4.1% year-on-year growth, 0.8% miss)

- Adjusted EPS: $1.55 vs analyst expectations of $1.82 (14.8% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.75 at the midpoint, missing analyst estimates by 8%

- Operating Margin: -0.6%, down from 3.3% in the same quarter last year

- Free Cash Flow was $260.7 million, up from -$26.72 million in the same quarter last year

- Same-Store Sales rose 1.7% year on year (-0.5% in the same quarter last year)

- Market Capitalization: $20.47 billion

Company Overview

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

These customers include mechanics, maintenance technicians, and other industrial service professionals. However, some brands carried by Genuine Parts, such as NAPA Auto Parts cater to do-it-yourself (DIY) customers. This brand’s wide range of auto parts and accessories means that the ‘average Joe’ can find products he can work with, especially since Genuine Parts stores are staffed with knowledgeable associates willing to help any customer.

Aside from the well-known NAPA brand, Genuine Parts carries other trusted auto parts brands such as ACDelco, Bosch, and Gates. These names offer everything from spark plugs to carburetors in auto. With regards to industrial products, the company carries power transmission, electrical, and wiring products from brands such as 3M, Motion Industries, Wagner, EIS, and Inenco.

Genuine Parts stores range from 2,500 to 12,500 square feet depending on the location. These stores can be found in urban and suburban areas, often strategically placed in proximity of auto body shops and industrial parks where customers may operate. In addition to the store footprint, Genuine Parts has an e-commerce presence, launched in 1999, where customers can search and purchase products online, with options for in-store pickup or delivery.

4. Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Competitors offering auto and/or industrial parts include Advance Auto Parts (NYSE:AAP), AutoZone (NYSE:AZO), Grainger (NYSE:GWW), and Fastenal (NASDAQ:FAST).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $24.3 billion in revenue over the past 12 months, Genuine Parts is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Genuine Parts likely needs to optimize its pricing or lean into international expansion.

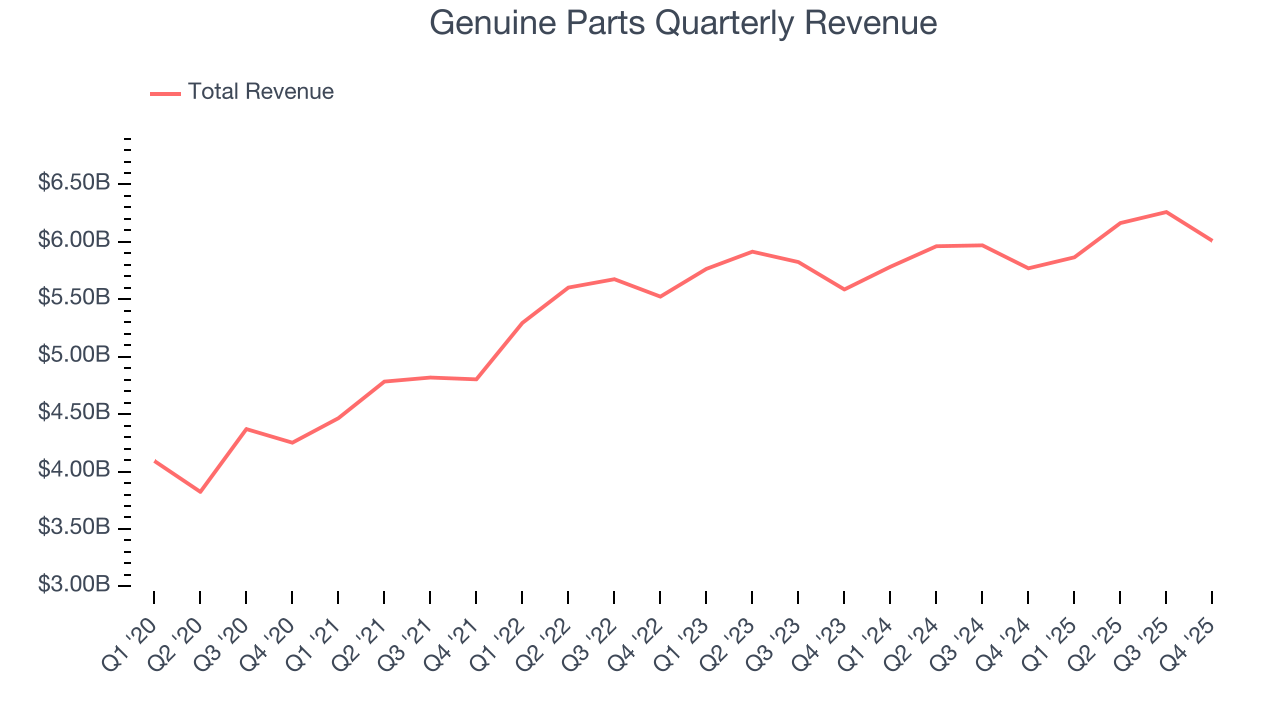

As you can see below, Genuine Parts’s sales grew at a sluggish 3.2% compounded annual growth rate over the last three years.

This quarter, Genuine Parts’s revenue grew by 4.1% year on year to $6.01 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, similar to its three-year rate. This projection is above the sector average and suggests its newer products will help sustain its historical top-line performance.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

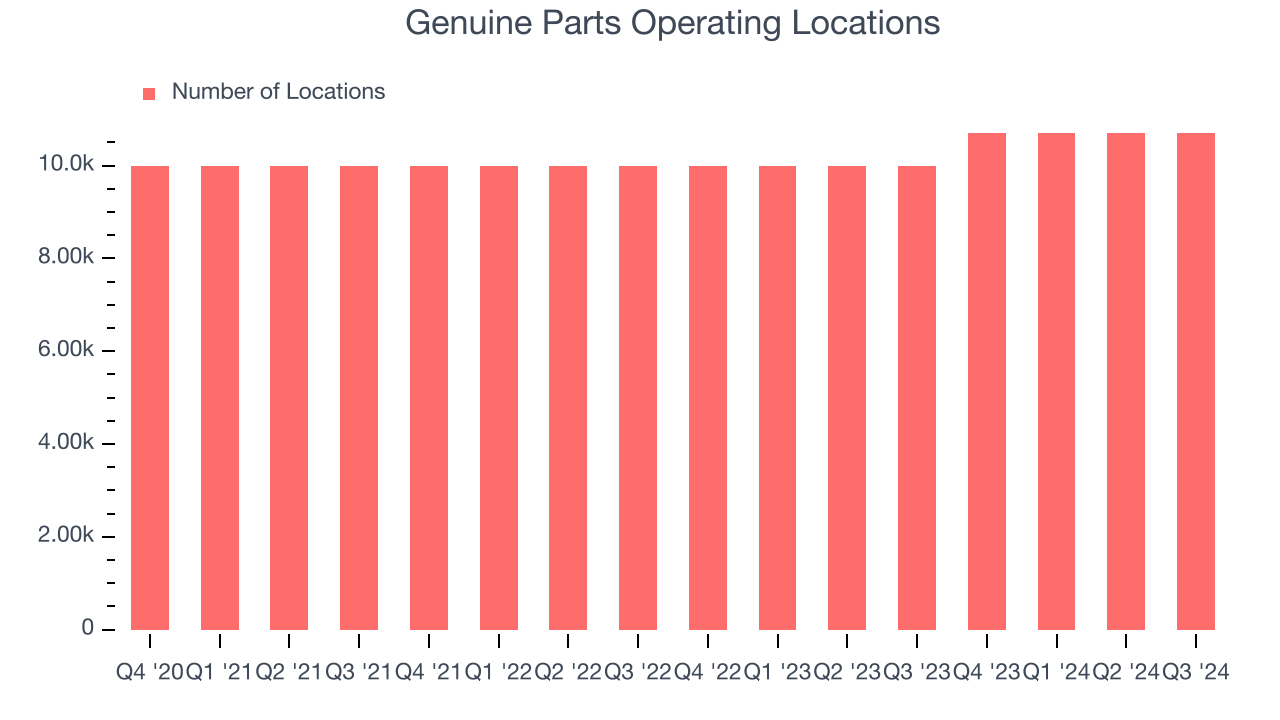

Over the last two years, Genuine Parts opened new stores at a rapid clip by averaging 7% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Genuine Parts reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

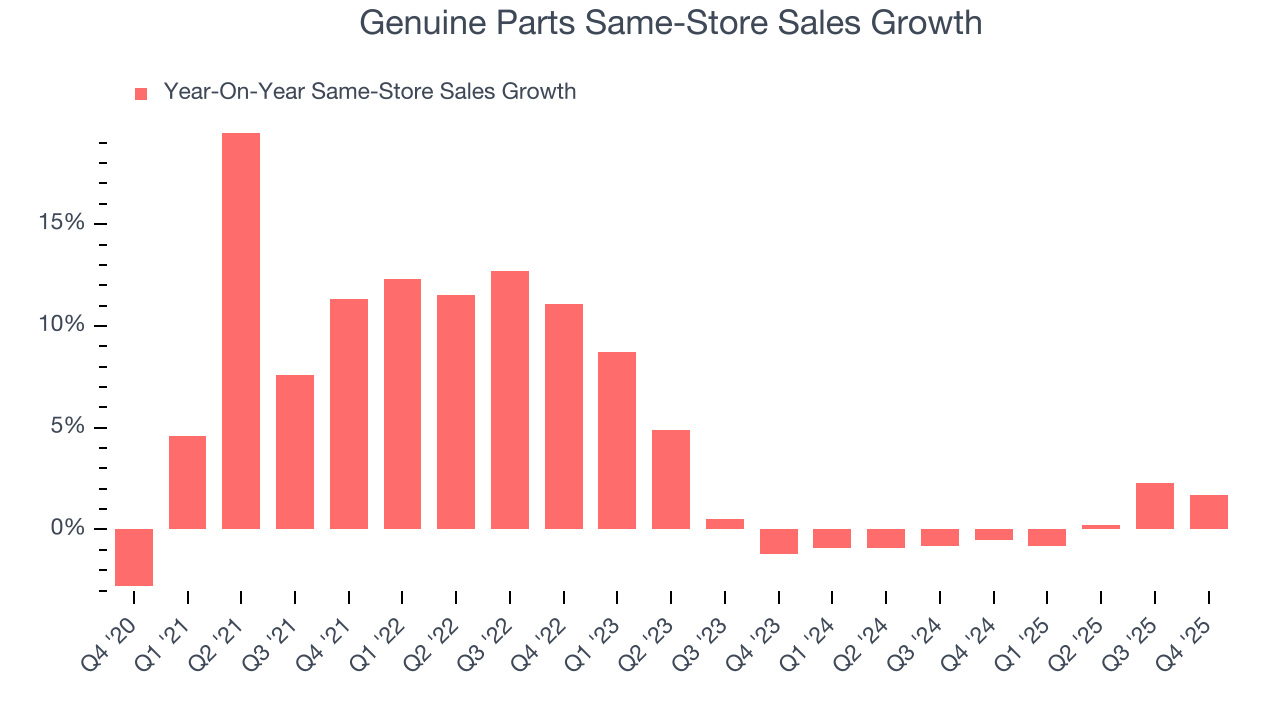

Genuine Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Genuine Parts should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Genuine Parts’s same-store sales rose 1.7% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

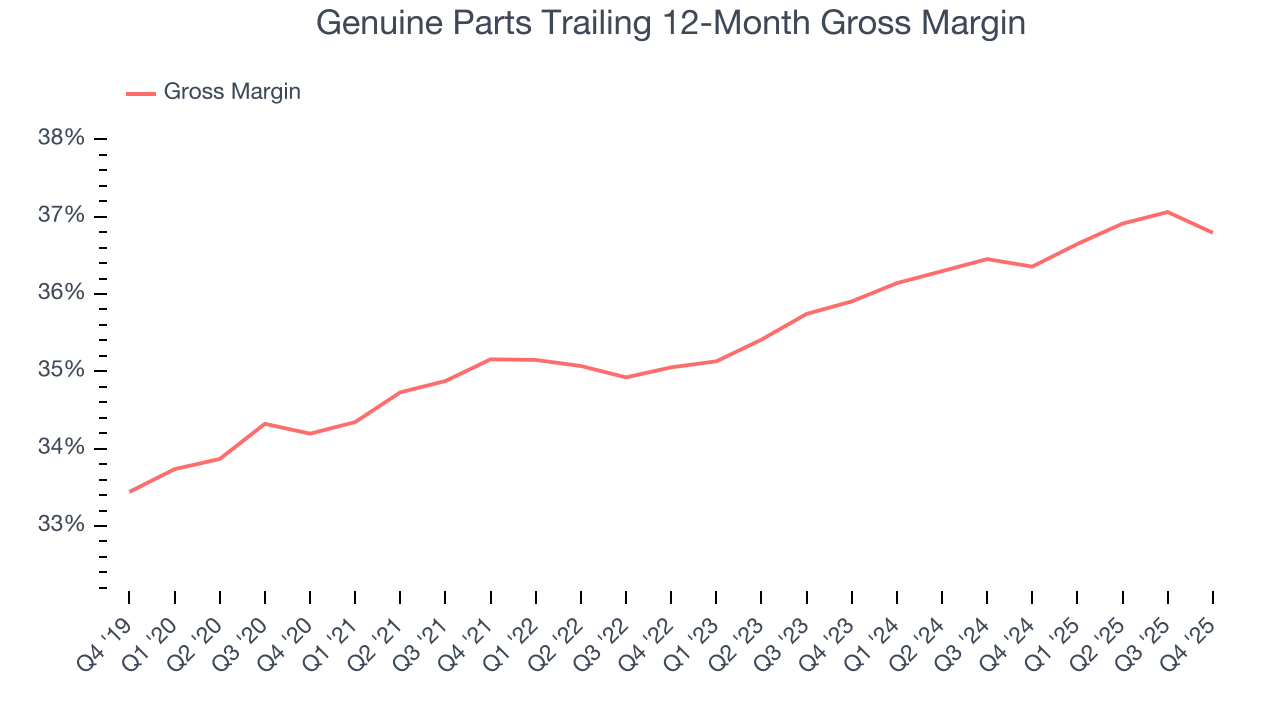

Genuine Parts has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 36.6% gross margin over the last two years. That means Genuine Parts paid its suppliers a lot of money ($63.42 for every $100 in revenue) to run its business.

This quarter, Genuine Parts’s gross profit margin was 35%, down 1 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

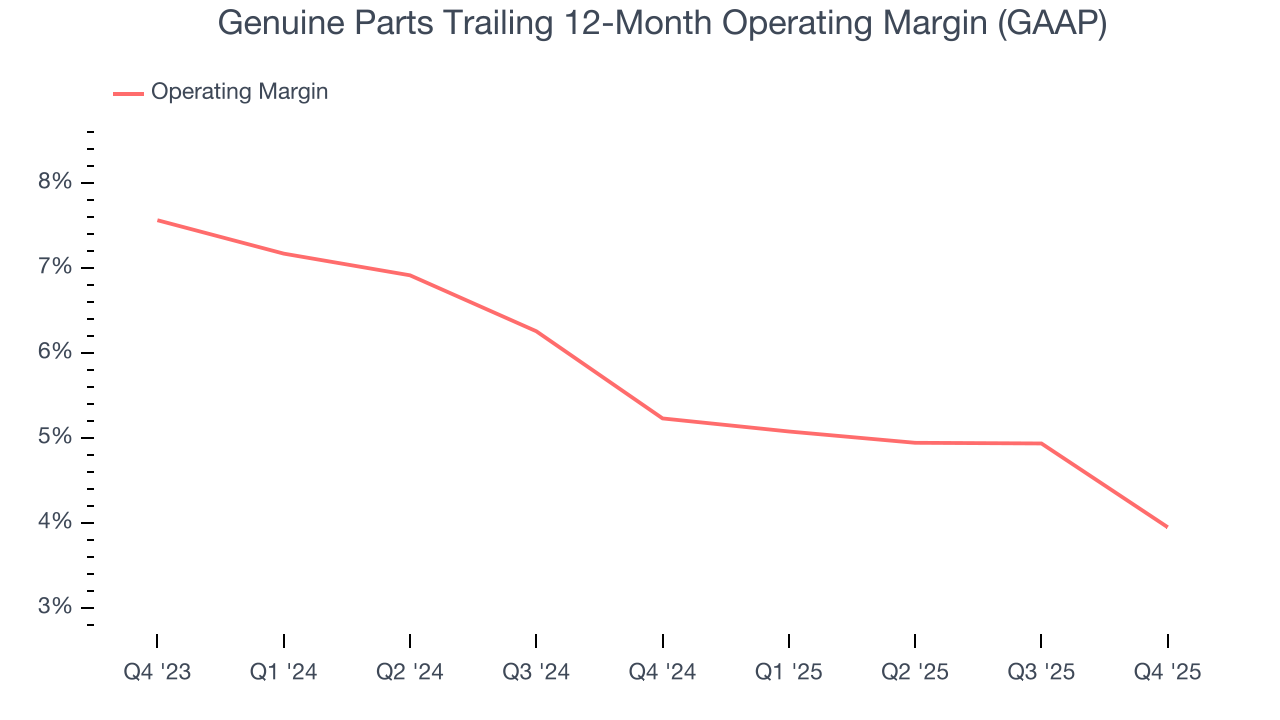

8. Operating Margin

Genuine Parts was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.6% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Genuine Parts’s operating margin decreased by 1.3 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Genuine Parts’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Genuine Parts’s breakeven margin was -0.6%, down 3.9 percentage points year on year. Since Genuine Parts’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

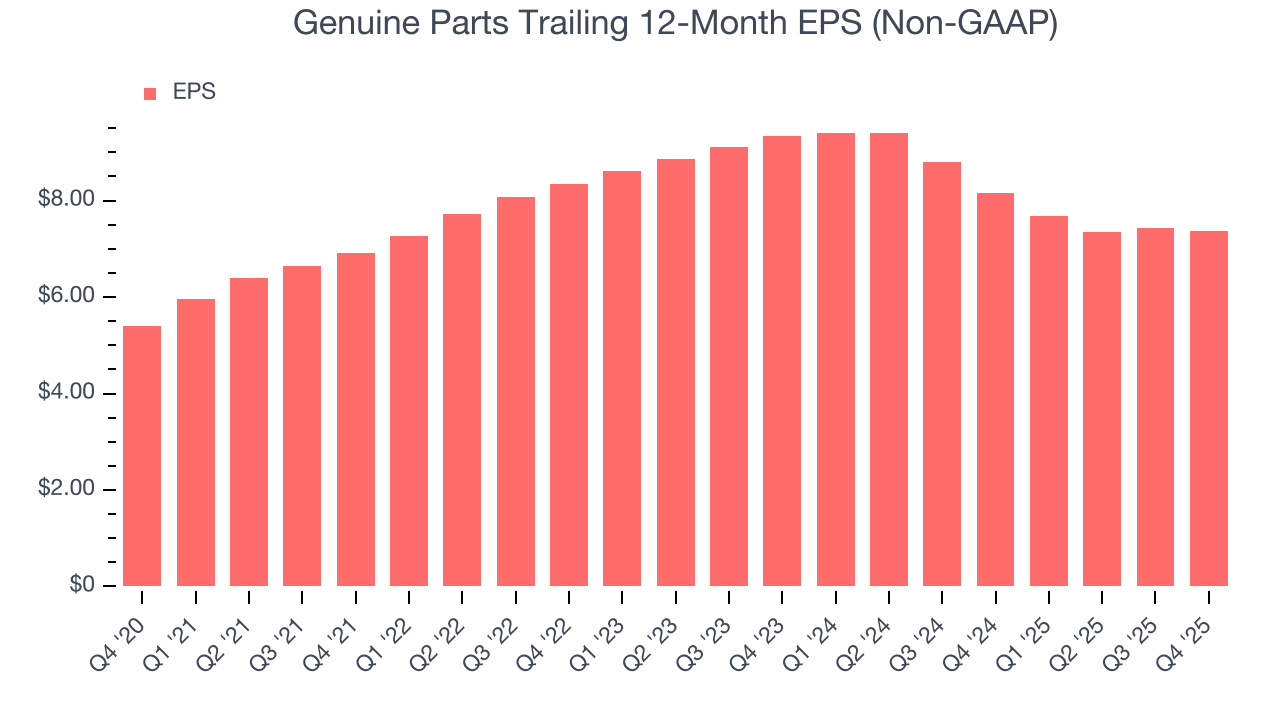

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Genuine Parts, its EPS declined by 4% annually over the last three years while its revenue grew by 3.2%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Genuine Parts reported adjusted EPS of $1.55, down from $1.61 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Genuine Parts’s full-year EPS of $7.38 to grow 14.1%.

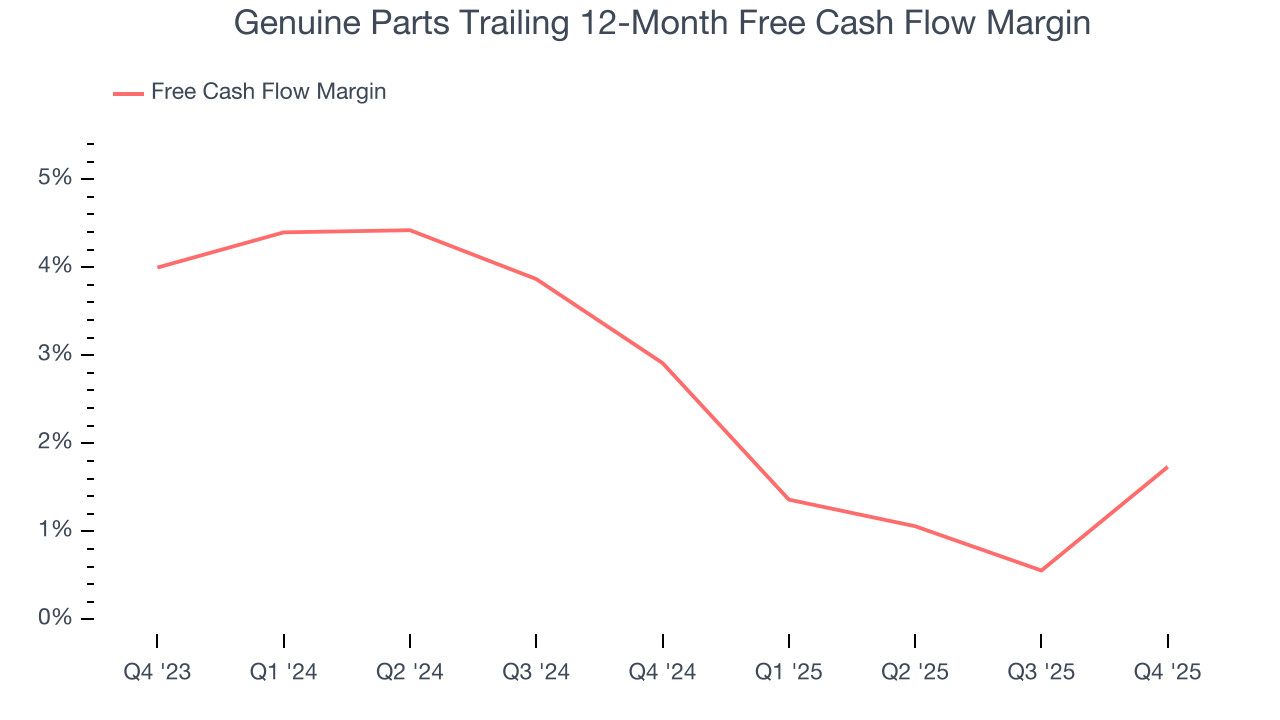

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Genuine Parts has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a consumer retail business.

Taking a step back, we can see that Genuine Parts’s margin dropped by 1.2 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Genuine Parts’s free cash flow clocked in at $260.7 million in Q4, equivalent to a 4.3% margin. This result was good as its margin was 4.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Genuine Parts historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.2%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

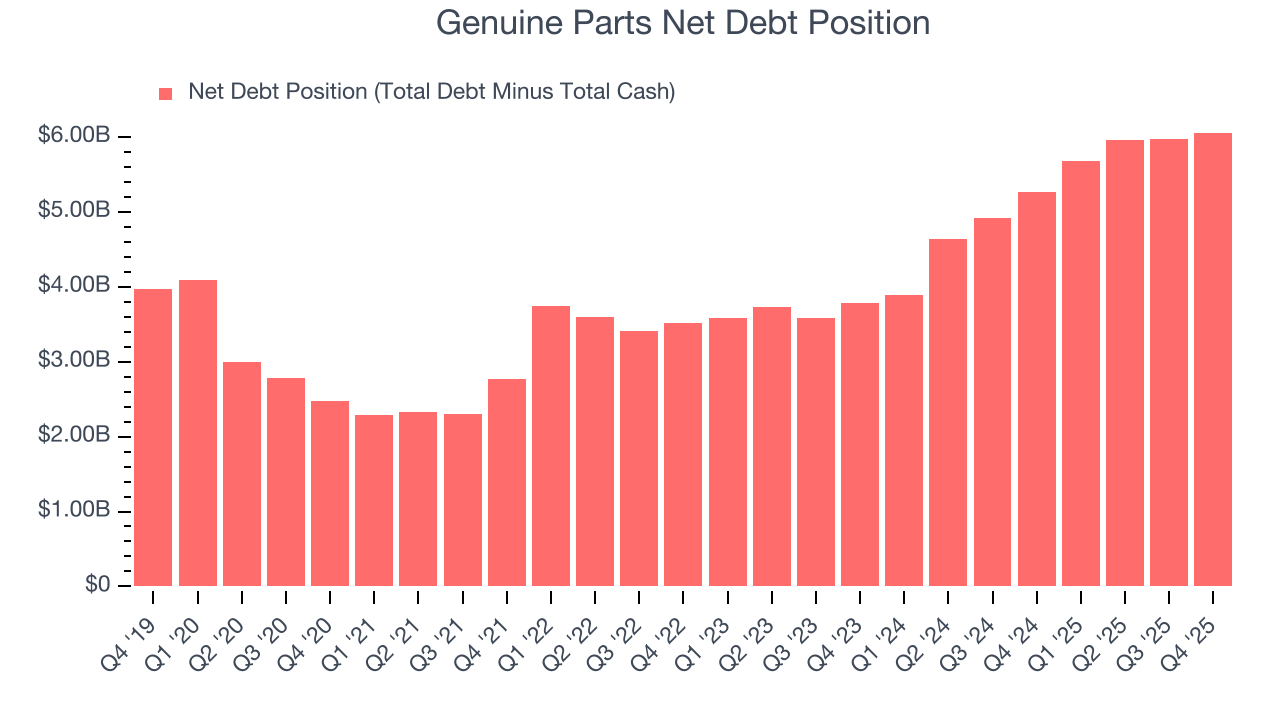

12. Balance Sheet Assessment

Genuine Parts reported $477.2 million of cash and $6.54 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.69 billion of EBITDA over the last 12 months, we view Genuine Parts’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $72.03 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Genuine Parts’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed. Overall, this quarter could have been better. The stock traded down 6.6% to $137.50 immediately after reporting.

14. Is Now The Time To Buy Genuine Parts?

Updated: February 17, 2026 at 7:05 AM EST

Before deciding whether to buy Genuine Parts or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Genuine Parts’s business quality ultimately falls short of our standards. To kick things off, its revenue growth was uninspiring over the last three years, and analysts don’t see anything changing over the next 12 months. While its new store openings have increased its brand equity, the downside is its poor same-store sales performance has been a headwind. On top of that, its operating margins are low compared to other retailers.

Genuine Parts’s P/E ratio based on the next 12 months is 17.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $152.78 on the company (compared to the current share price of $137.50).