Guidewire Software (GWRE)

We see potential in Guidewire Software. Its growth in billings suggests its market share is rising, highlighting the value its offerings provide.― StockStory Analyst Team

1. News

2. Summary

Why Guidewire Software Is Interesting

With its systems powering the operations of hundreds of insurance brands across 42 countries, Guidewire Software (NYSE:GWRE) provides a technology platform that helps property and casualty insurance companies manage their core operations, digital engagement, and analytics.

- Fast payback periods on sales and marketing expenses allow the company to invest heavily and onboard many customers concurrently

- Billings growth has averaged 20.7% over the last year, indicating a healthy pipeline of new contracts that should drive future revenue increases

- One risk is its gross margin of 63.1% reflects its relatively high servicing costs

Guidewire Software is close to becoming a high-quality business. If you believe in the company, the valuation seems reasonable.

Why Is Now The Time To Buy Guidewire Software?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Guidewire Software?

At $122.52 per share, Guidewire Software trades at 7.5x forward price-to-sales. Most software peers carry lower valuation multiples than Guidewire Software. However, we think the premium valuation is justified by higher business quality.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Guidewire Software (GWRE) Research Report: Q3 CY2025 Update

Insurance software provider Guidewire Software (NYSE:GWRE) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 26.5% year on year to $332.6 million. Guidance for next quarter’s revenue was better than expected at $342 million at the midpoint, 1.5% above analysts’ estimates. Its non-GAAP profit of $0.66 per share was 7.5% above analysts’ consensus estimates.

Guidewire Software (GWRE) Q3 CY2025 Highlights:

- Revenue: $332.6 million vs analyst estimates of $318 million (26.5% year-on-year growth, 4.6% beat)

- Adjusted EPS: $0.66 vs analyst estimates of $0.61 (7.5% beat)

- Adjusted Operating Income: $63.43 million vs analyst estimates of $51.06 million (19.1% margin, 24.2% beat)

- The company lifted its revenue guidance for the full year to $1.41 billion at the midpoint from $1.40 billion, a 1.1% increase

- Operating Margin: 5.6%, up from -1.8% in the same quarter last year

- Free Cash Flow was -$77.36 million, down from $237.7 million in the previous quarter

- Annual Recurring Revenue: $1.06 billion vs analyst estimates of $1.05 billion (21.6% year-on-year growth, 1.1% beat)

- Billings: $243.9 million at quarter end, up 19.1% year on year

- Market Capitalization: $18.26 billion

Company Overview

With its systems powering the operations of hundreds of insurance brands across 42 countries, Guidewire Software (NYSE:GWRE) provides a technology platform that helps property and casualty insurance companies manage their core operations, digital engagement, and analytics.

The company's flagship offering, InsuranceSuite Cloud, consists of three core applications that can be used together or separately: PolicyCenter for underwriting and policy administration, BillingCenter for managing billing and payments, and ClaimCenter for end-to-end claims processing. These applications run on the Guidewire Cloud Platform, built on Amazon Web Services, which combines multi-tenant cloud services with isolated database instances for each customer.

Guidewire serves the specific needs of the property and casualty (P&C) insurance industry, with customers ranging from global insurance giants to regional and state-level providers. For example, an auto insurer might use Guidewire's platform to streamline the entire process from policy creation to claims settlement after an accident, while providing digital self-service options for policyholders and data analytics to improve underwriting decisions.

The company monetizes its offerings primarily through subscription services for cloud-delivered products and term licenses for self-managed installations. Guidewire also provides implementation, migration, and integration services, either directly or through system integrator partners. Additionally, the company maintains the Guidewire Marketplace, where customers can find complementary applications and content from partners to extend the platform's capabilities.

4. Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Guidewire competes with insurers' internally developed solutions as well as specialized P&C insurance software vendors like Duck Creek, EIS Group, Insurity, Majesco, and Sapiens. The company also faces competition from horizontal software providers such as SAP and Salesforce that offer broader enterprise solutions.

5. Revenue Growth

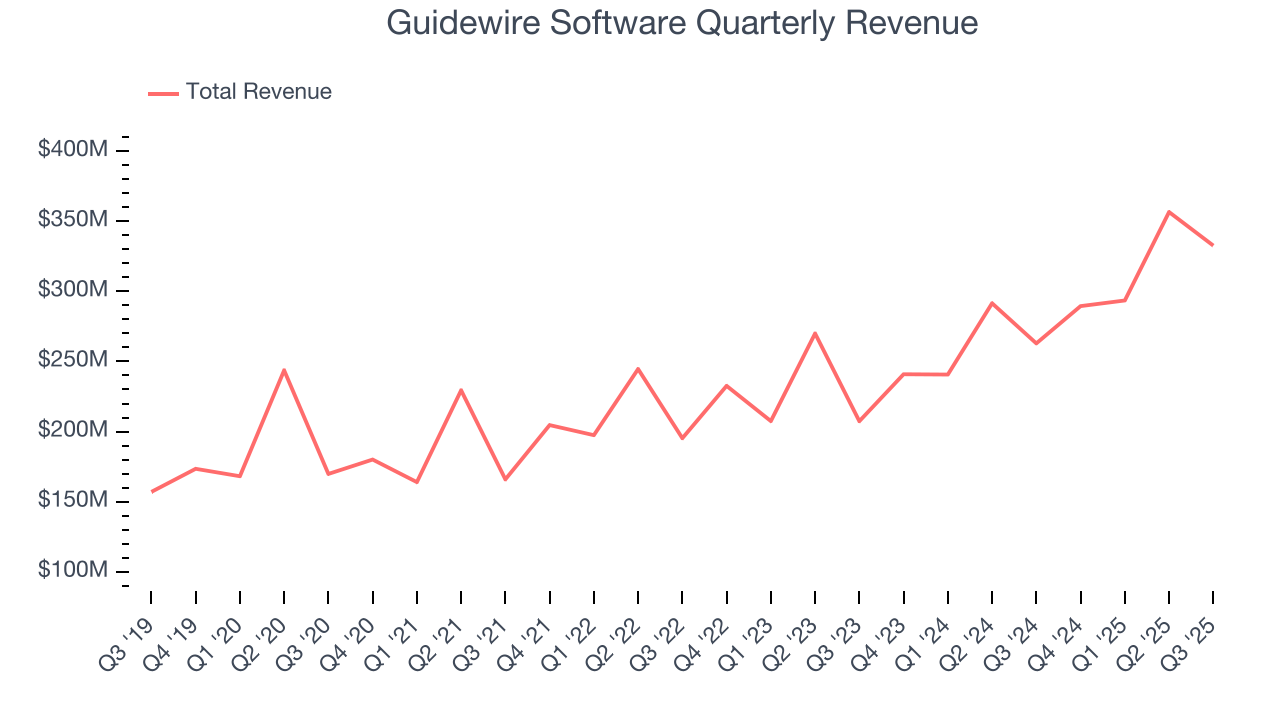

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Guidewire Software grew its sales at a 11% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Guidewire Software.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Guidewire Software’s annualized revenue growth of 17.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Guidewire Software reported robust year-on-year revenue growth of 26.5%, and its $332.6 million of revenue topped Wall Street estimates by 4.6%. Company management is currently guiding for a 18.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Guidewire Software’s ARR punched in at $1.06 billion in Q3, and over the last four quarters, its growth was solid as it averaged 17.7% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Guidewire Software is extremely efficient at acquiring new customers, and its CAC payback period checked in at 16.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Guidewire Software more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Guidewire Software, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

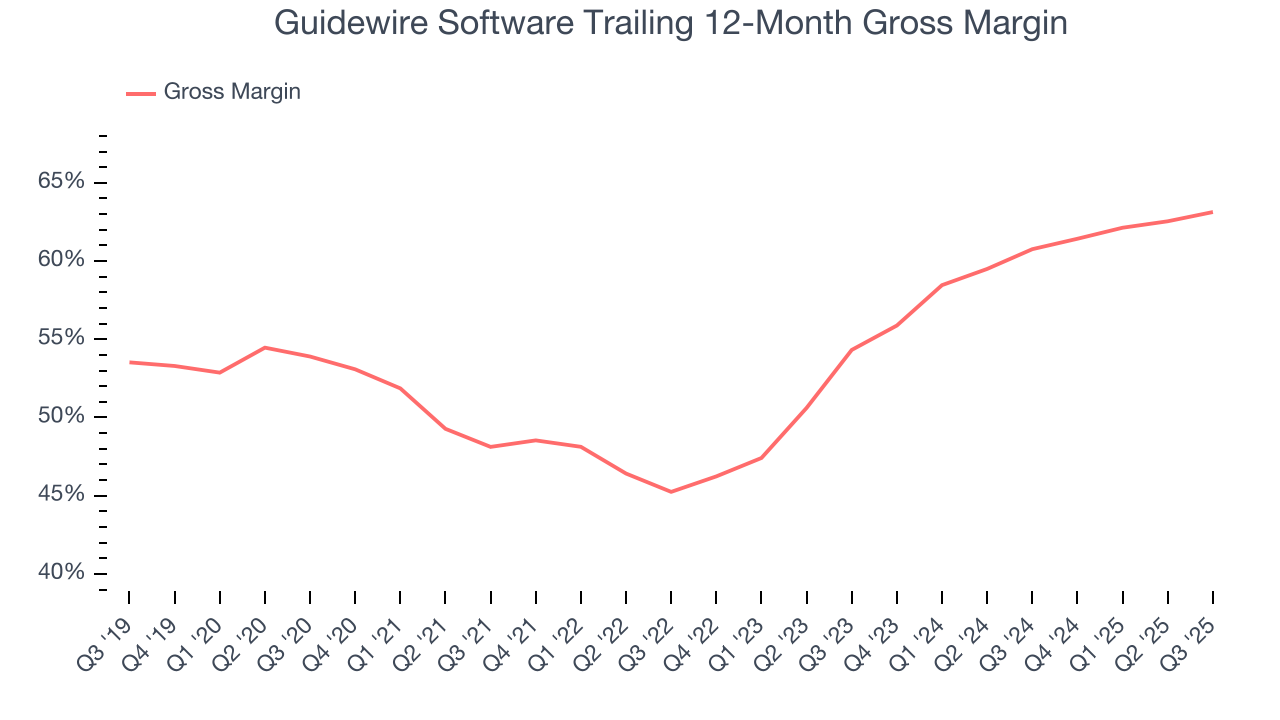

Guidewire Software’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 63.1% gross margin over the last year. That means Guidewire Software paid its providers a lot of money ($36.87 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Guidewire Software has seen gross margins improve by 8.8 percentage points over the last 2 year, which is elite in the software space.

Guidewire Software’s gross profit margin came in at 63% this quarter, marking a 2.7 percentage point increase from 60.2% in the same quarter last year. Guidewire Software’s full-year margin has also been trending up over the past 12 months, increasing by 2.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

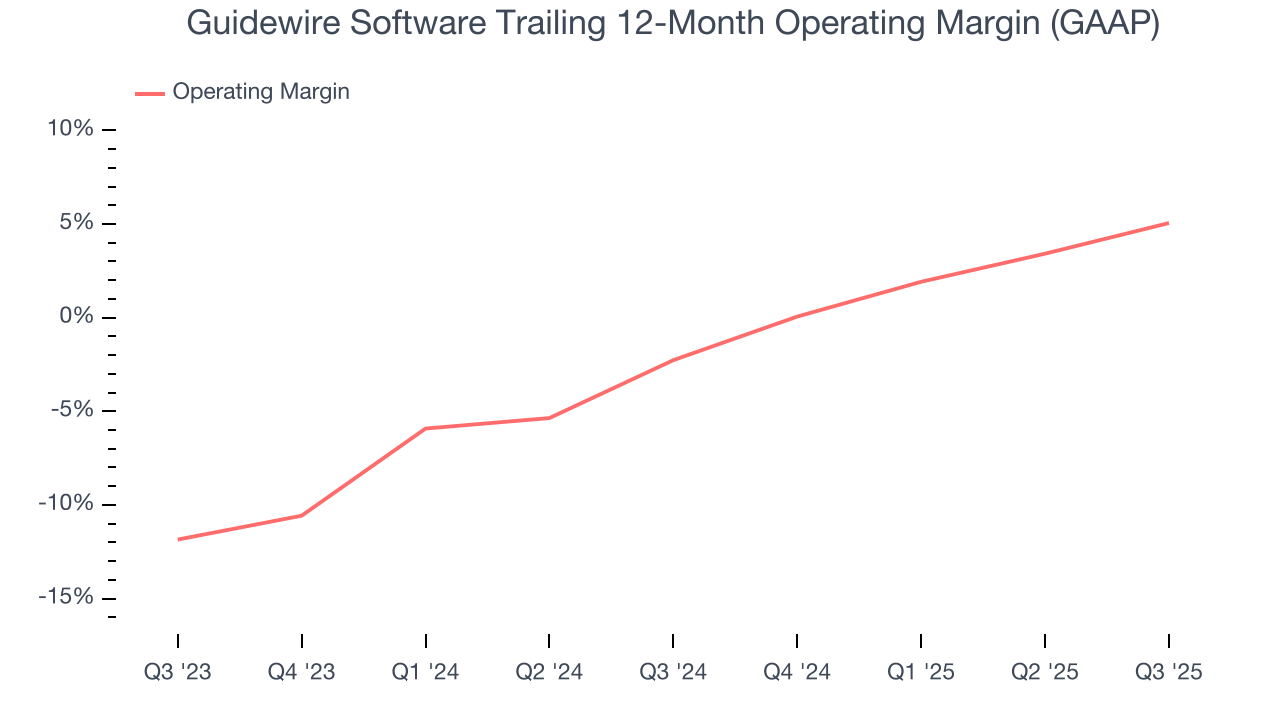

Guidewire Software has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 5.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Guidewire Software’s operating margin rose by 7.3 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, Guidewire Software generated an operating margin profit margin of 5.6%, up 7.4 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

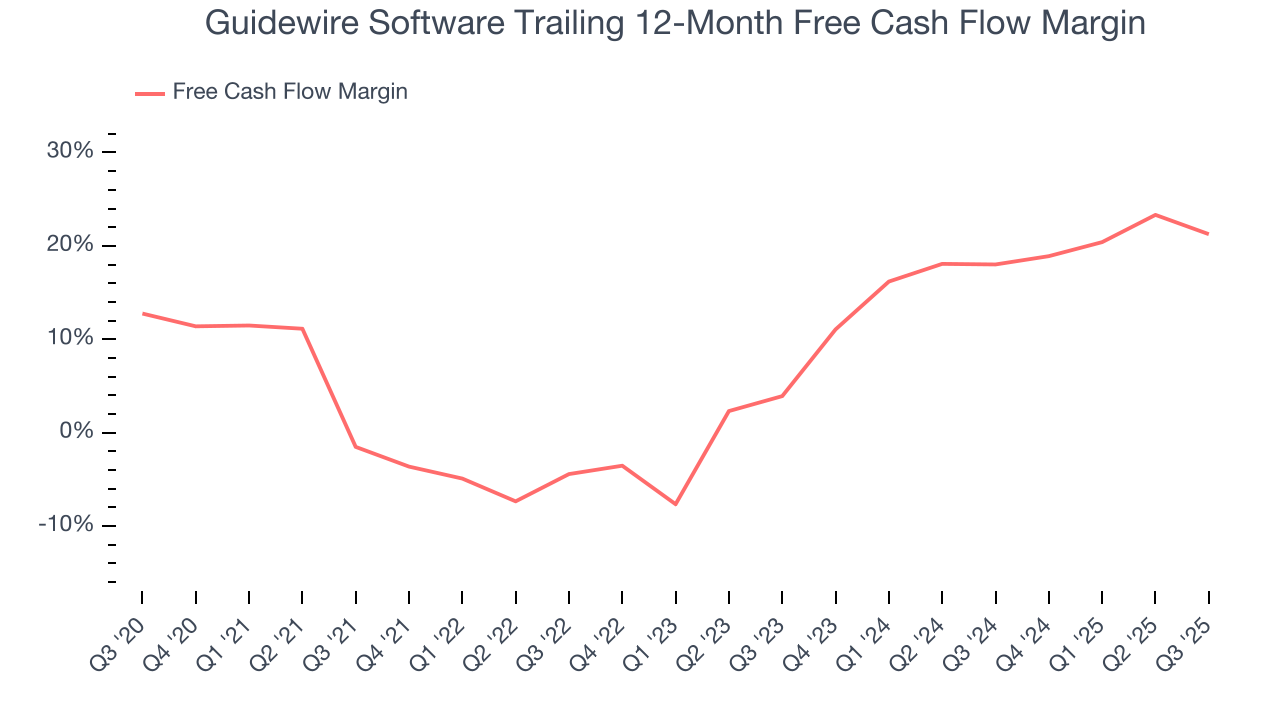

Guidewire Software has shown impressive cash profitability, driven by its cost-effective customer acquisition strategy that gives it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 21.3% over the last year, better than the broader software sector.

Guidewire Software burned through $77.36 million of cash in Q3, equivalent to a negative 23.3% margin. The company’s cash burn was similar to its $67.38 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings.

Over the next year, analysts predict Guidewire Software’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 21.3% for the last 12 months will increase to 23.5%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

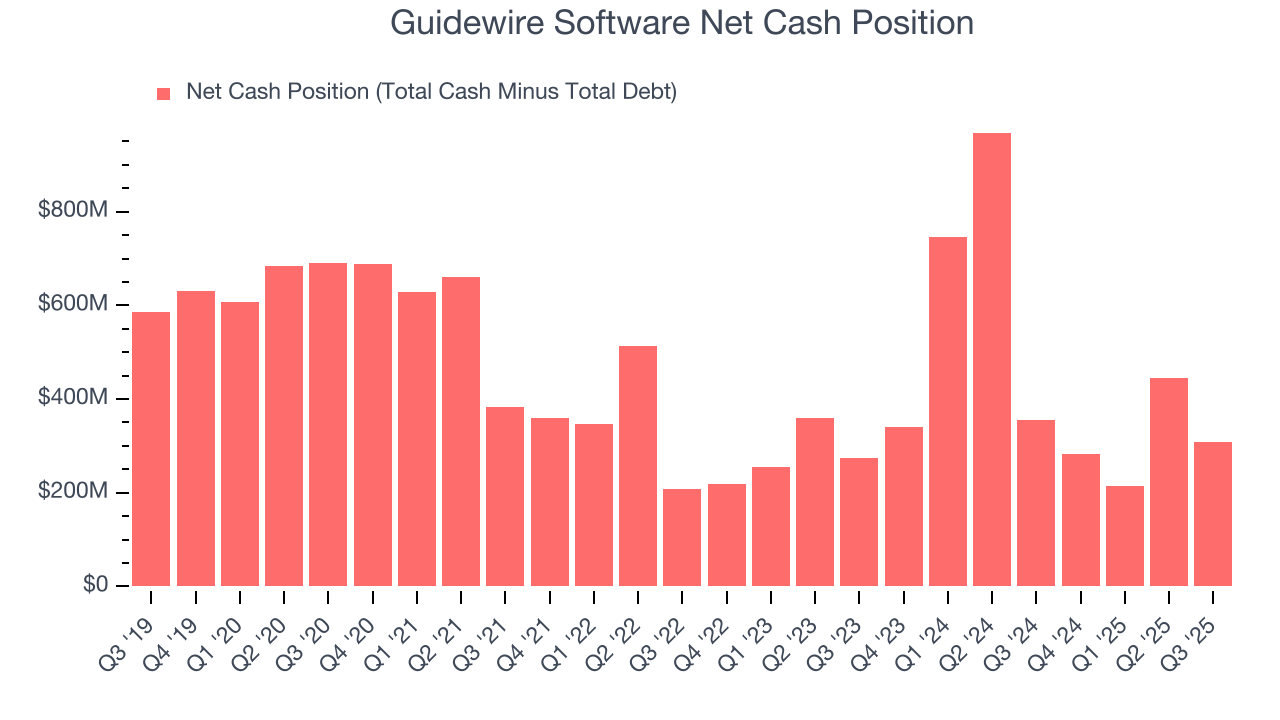

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Guidewire Software is a profitable, well-capitalized company with $1.01 billion of cash and $704.5 million of debt on its balance sheet. This $307.4 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Guidewire Software’s Q3 Results

It was encouraging to see Guidewire Software beat analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its billings missed. Zooming out, we think this was a mixed quarter. The stock traded up 4.9% to $226.40 immediately following the results.

13. Is Now The Time To Buy Guidewire Software?

Updated: February 23, 2026 at 9:41 PM EST

Before making an investment decision, investors should account for Guidewire Software’s business fundamentals and valuation in addition to what happened in the latest quarter.

We think Guidewire Software is a good business. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Guidewire Software’s gross margins show its business model is much less lucrative than other companies, its efficient sales strategy allows it to target and onboard new users at scale. On top of that, its strong free cash flow generation gives it reinvestment options.

Guidewire Software’s price-to-sales ratio based on the next 12 months is 7.5x. When scanning the software space, Guidewire Software trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $253.21 on the company (compared to the current share price of $122.52), implying they see 107% upside in buying Guidewire Software in the short term.