GXO Logistics (GXO)

We’re wary of GXO Logistics. Its poor returns on capital indicate it barely generated any profits, a must for high-quality companies.― StockStory Analyst Team

1. News

2. Summary

Why GXO Logistics Is Not Exciting

With notable customers such as Nike and Apple, GXO (NYSE:GXO) manages outsourced supply chains and warehousing for various companies.

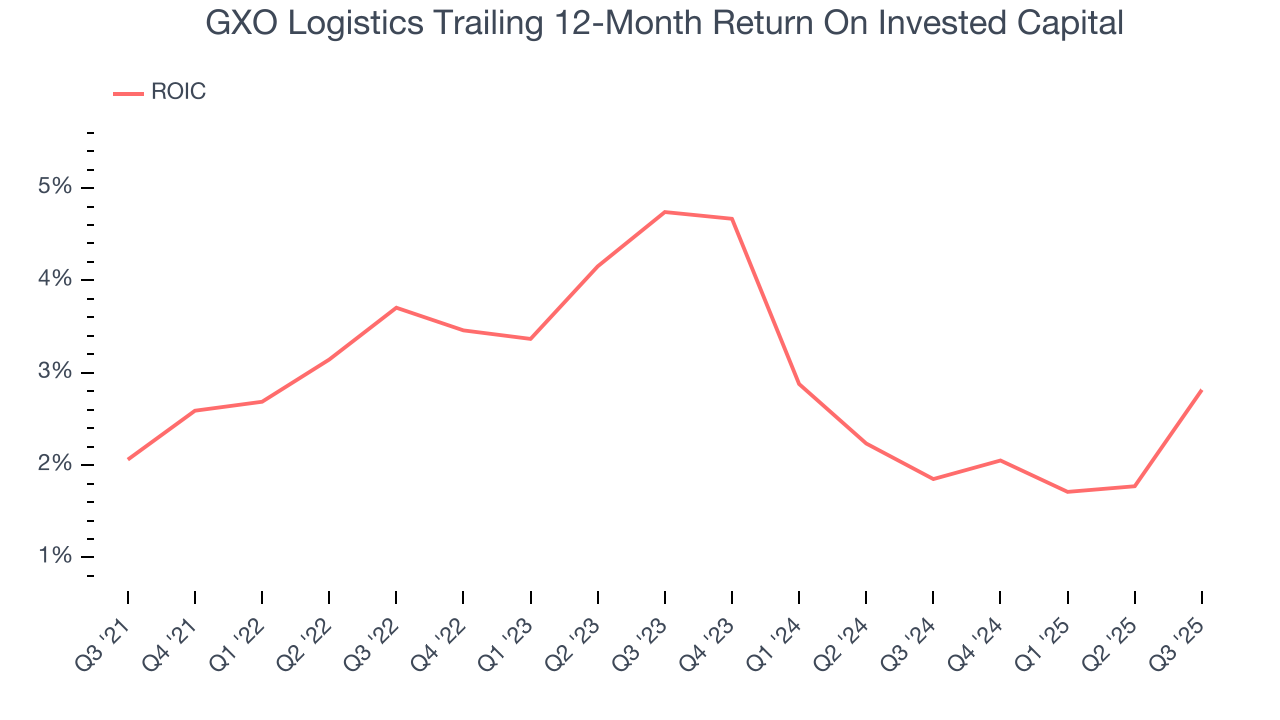

- Underwhelming 2.9% return on capital reflects management’s difficulties in finding profitable growth opportunities

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

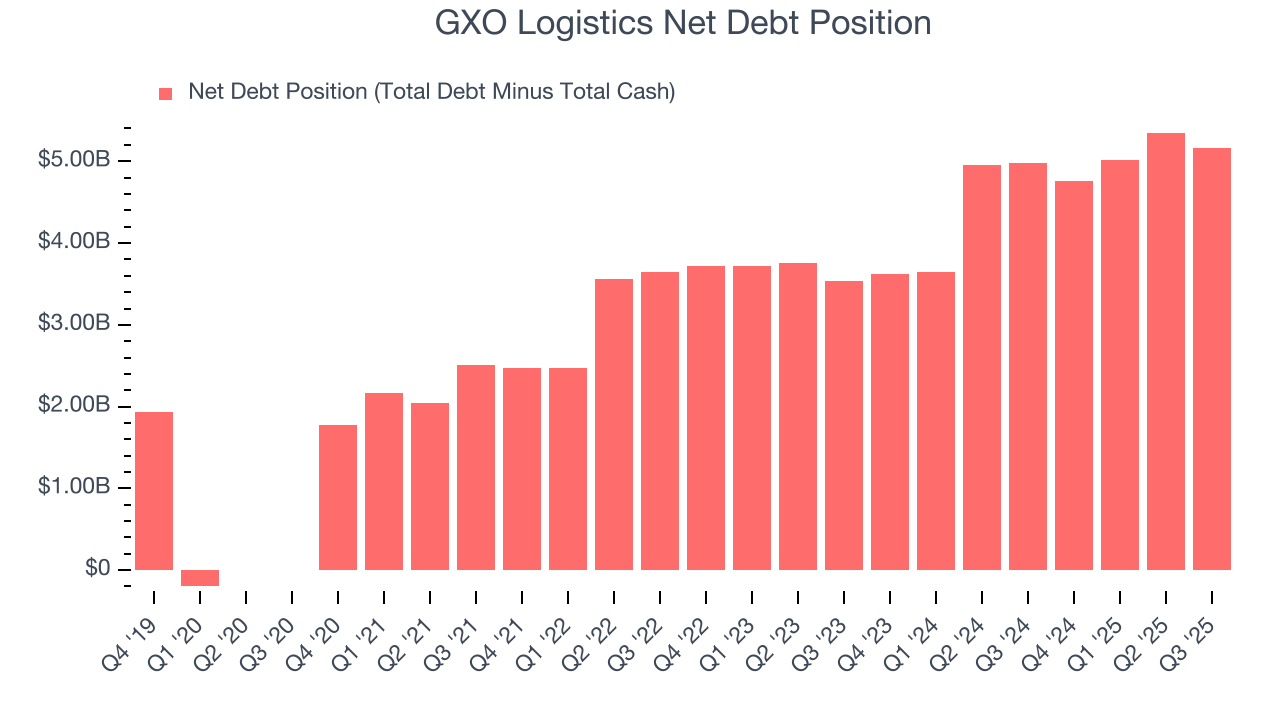

- 6× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

GXO Logistics doesn’t meet our quality criteria. Better stocks can be found in the market.

Why There Are Better Opportunities Than GXO Logistics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than GXO Logistics

GXO Logistics’s stock price of $52.57 implies a valuation ratio of 17.2x forward P/E. GXO Logistics’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. GXO Logistics (GXO) Research Report: Q3 CY2025 Update

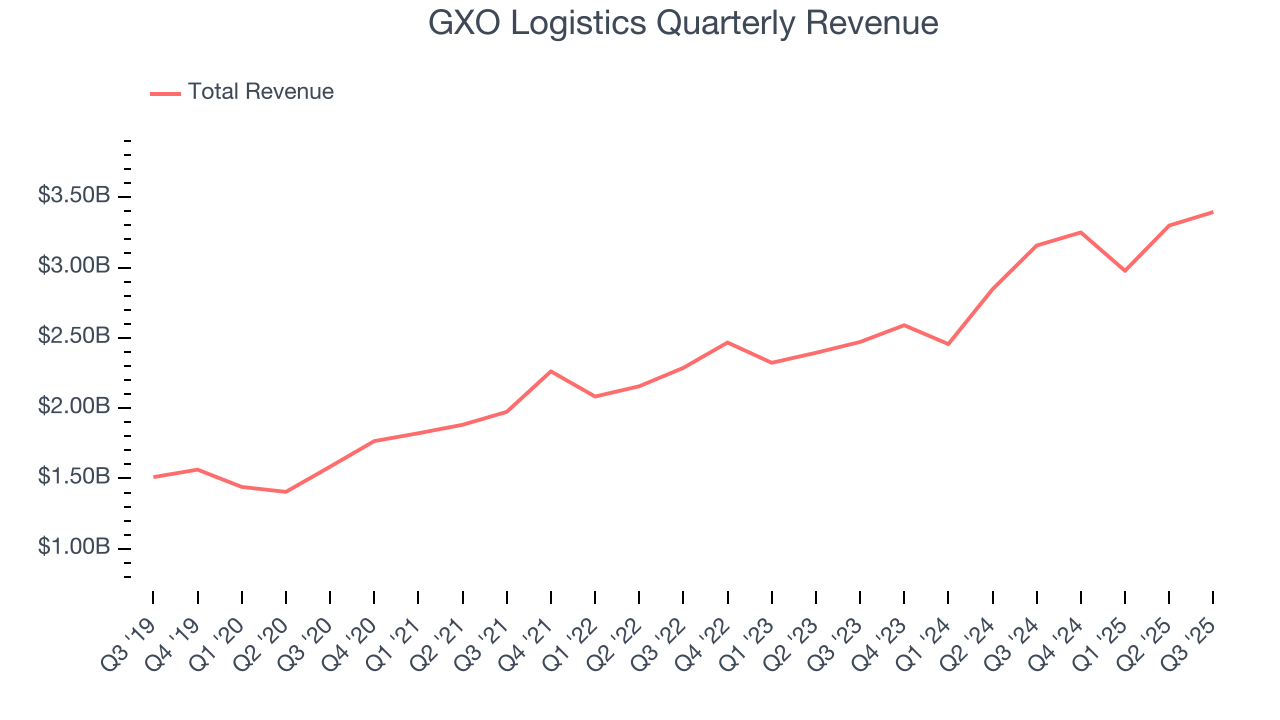

Contract logistics company GXO (NYSE:GXO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 7.5% year on year to $3.40 billion. On the other hand, next quarter’s revenue guidance of $3.41 billion was less impressive, coming in 3.2% below analysts’ estimates. Its non-GAAP profit of $0.79 per share was in line with analysts’ consensus estimates.

GXO Logistics (GXO) Q3 CY2025 Highlights:

- Revenue: $3.40 billion vs analyst estimates of $3.38 billion (7.5% year-on-year growth, in line)

- Adjusted EPS: $0.79 vs analyst estimates of $0.78 (in line)

- Adjusted EBITDA: $251 million vs analyst estimates of $244.2 million (7.4% margin, 2.8% beat)

- Revenue Guidance for Q4 CY2025 is $3.41 billion at the midpoint, below analyst estimates of $3.52 billion

- Management reiterated its full-year Adjusted EPS guidance of $2.53 at the midpoint

- EBITDA guidance for the full year is $875 million at the midpoint, in line with analyst expectations

- Operating Margin: 3.5%, in line with the same quarter last year

- Free Cash Flow Margin: 2.6%, similar to the same quarter last year

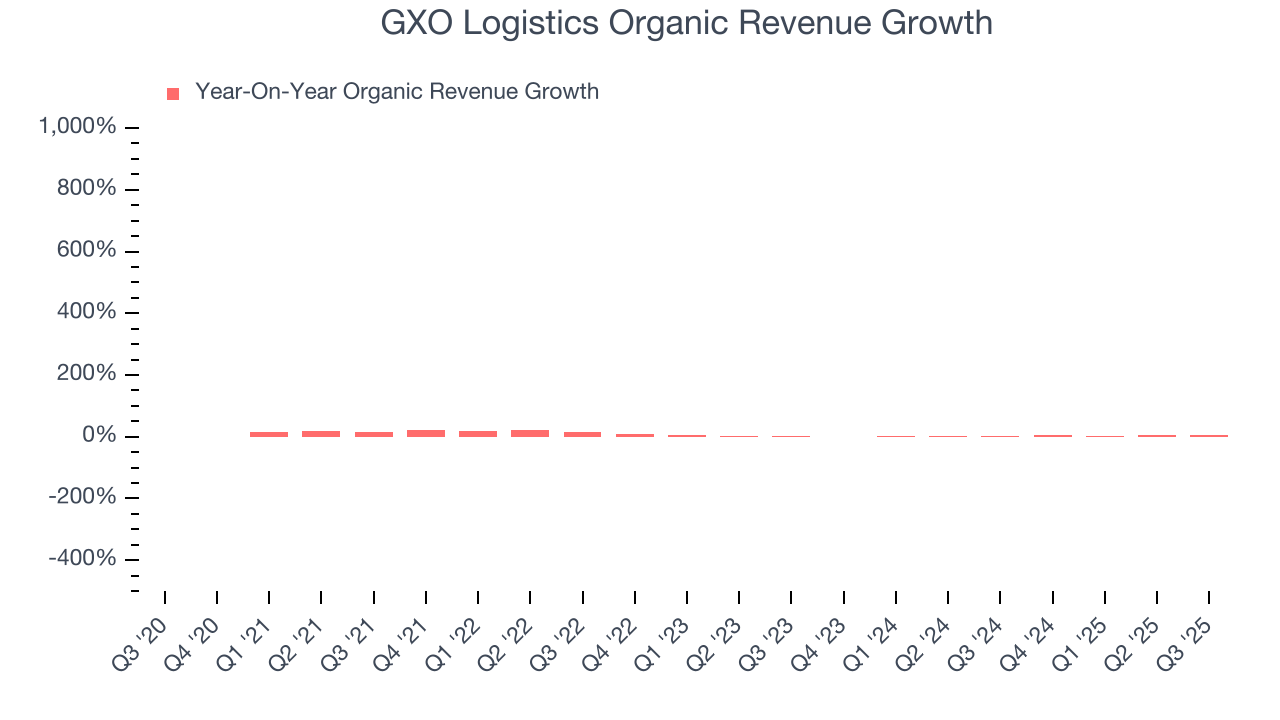

- Organic Revenue rose 3.9% year on year vs analyst estimates of 4.7% growth (77.3 basis point miss)

- Market Capitalization: $6.34 billion

Company Overview

With notable customers such as Nike and Apple, GXO (NYSE:GXO) manages outsourced supply chains and warehousing for various companies.

GXO spun off from XPO and became an independent company in 2021 which allowed it to focus exclusively on its core strengths in logistics and supply chain management. XPO, which was founded in 1989, saw the value in separating its transportation services from its logistics and supply chain management services which led to the separation of the two companies.

Since GXO became its own entity, the company has targeted sizable, well-established companies that align with its core offerings. Notably, GXO’s 2021 acquisition of Clipper Logistics for $1.3 billion increased its warehouse capacity and improved its e-commerce fulfillment services. In addition, its £762 million acquisition of Wincanton in 2024 strengthened its presence in the UK.

GXO helps companies manage its supply chain through various services such as handling online orders and managing returns. The company tracks and handles the movement of products from manufacturers or suppliers to distribution centers, and ultimately to its final location. It does not own the goods it handles but is responsible for ensuring they are properly transported and stored. The company primarily engages in contracts spanning multiple years with large corporations across the retail, consumer goods, and healthcare industries. In addition to its core offerings, it also offers consulting services and software platforms.

4. Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include FedEx (NYSE:FDX), UPS (NYSE:UPS), and C.H. Robinson (NASDAQ:CHRW).

5. Revenue Growth

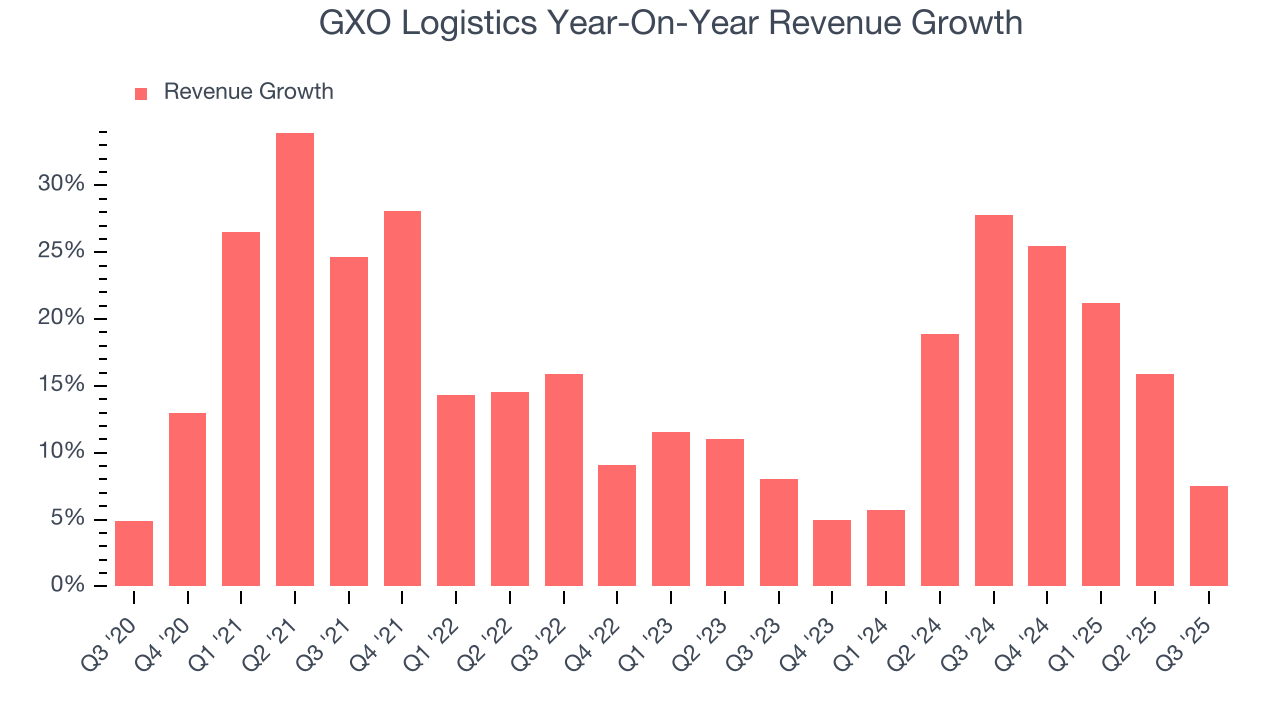

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, GXO Logistics’s sales grew at an incredible 16.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. GXO Logistics’s annualized revenue growth of 15.7% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong. GXO Logistics recent performance stands out, especially when considering many similar Air Freight and Logistics businesses faced declining sales because of cyclical headwinds.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, GXO Logistics’s organic revenue averaged 2.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, GXO Logistics grew its revenue by 7.5% year on year, and its $3.40 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

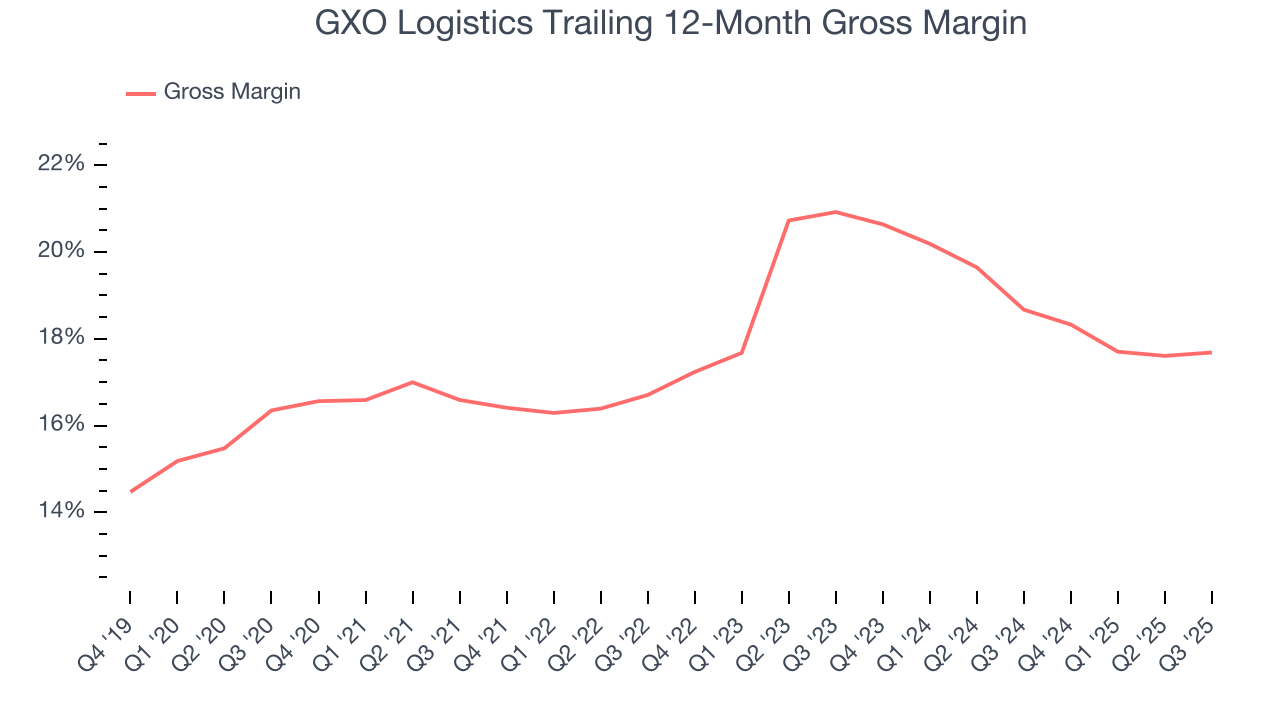

6. Gross Margin & Pricing Power

GXO Logistics has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 18.2% gross margin over the last five years. That means GXO Logistics paid its suppliers a lot of money ($81.81 for every $100 in revenue) to run its business.

In Q3, GXO Logistics produced a 15.8% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

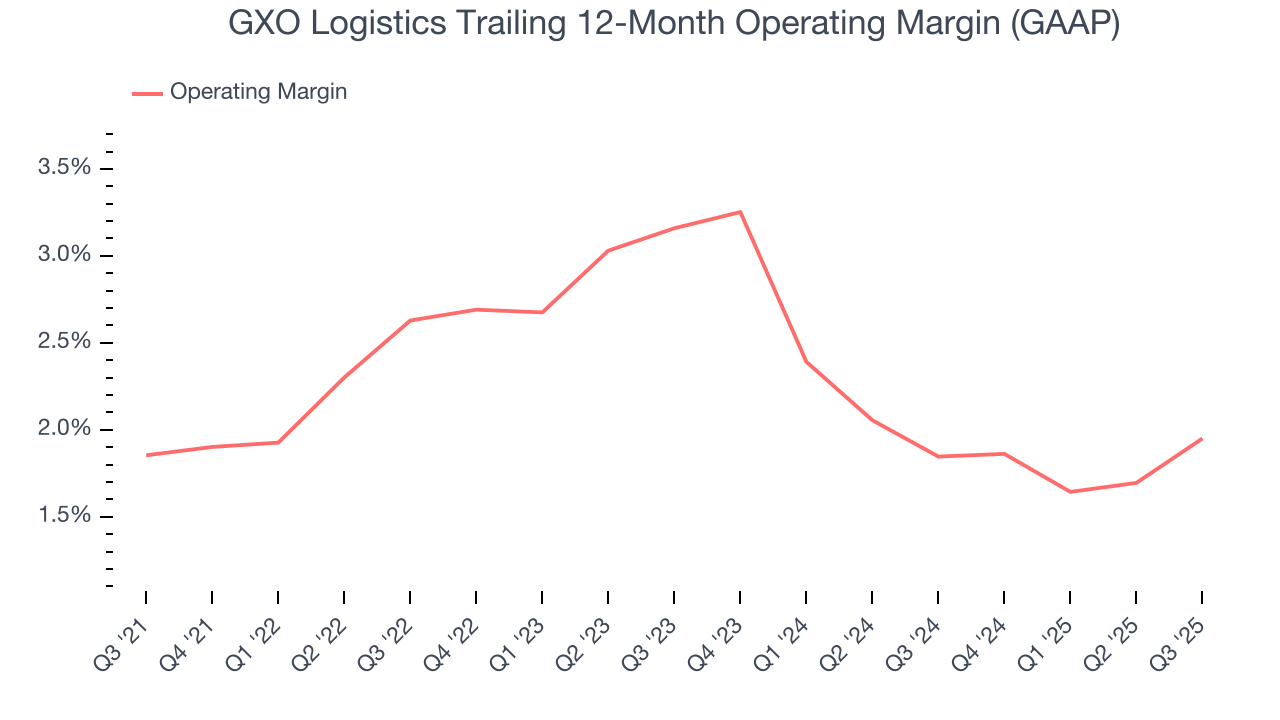

7. Operating Margin

GXO Logistics’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 2.3% over the last five years. This profitability was lousy for an industrials business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, GXO Logistics’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. GXO Logistics’s performance was poor, but we noticed this is a broad theme as many similar Air Freight and Logistics companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

In Q3, GXO Logistics generated an operating margin profit margin of 3.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

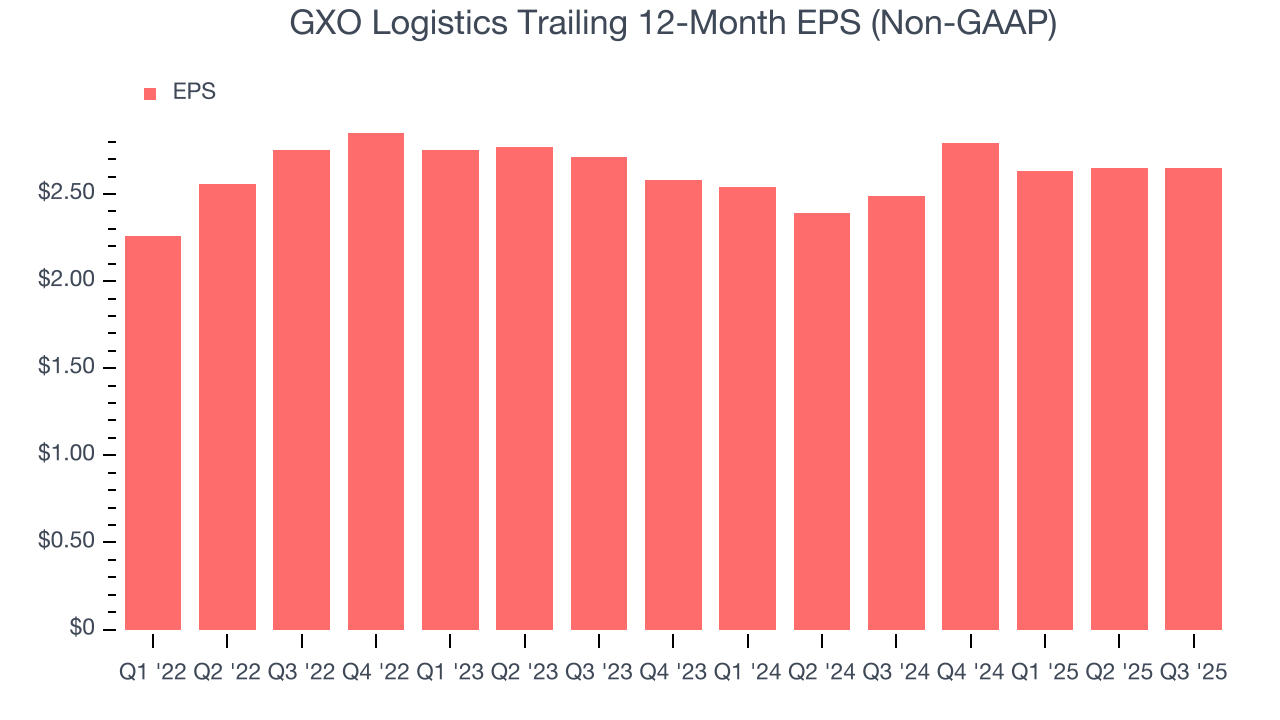

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GXO Logistics’s full-year EPS grew at a decent 9.7% compounded annual growth rate over the last four years, better than the broader industrials sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for GXO Logistics, its EPS declined by 1.1% annually over the last two years while its revenue grew by 15.7%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, GXO Logistics reported adjusted EPS of $0.79, in line with the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects GXO Logistics’s full-year EPS of $2.65 to grow 12.7%.

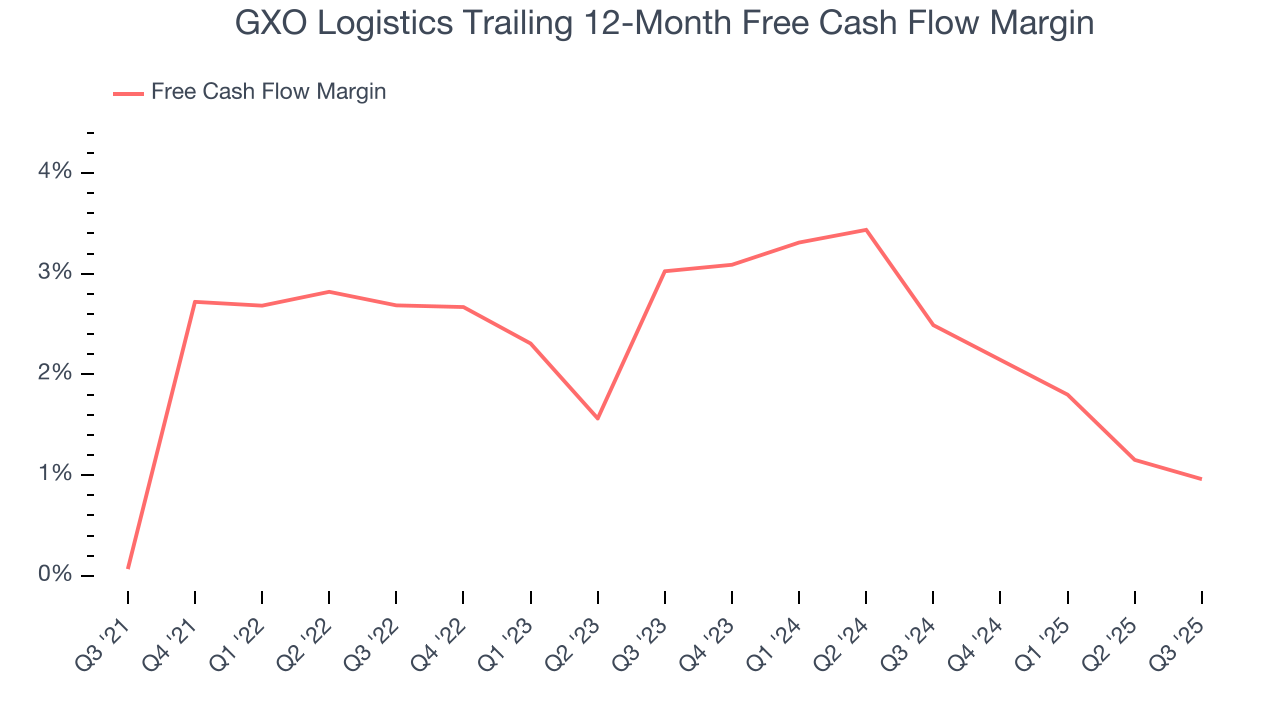

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

GXO Logistics has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, lousy for an industrials business.

GXO Logistics’s free cash flow clocked in at $88 million in Q3, equivalent to a 2.6% margin. This cash profitability was in line with the comparable period last year and its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

GXO Logistics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, GXO Logistics’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

GXO Logistics’s $5.50 billion of debt exceeds the $339 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $877 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. GXO Logistics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope GXO Logistics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from GXO Logistics’s Q3 Results

It was encouraging to see GXO Logistics beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.3% to $54.10 immediately following the results.

13. Is Now The Time To Buy GXO Logistics?

Updated: December 4, 2025 at 10:18 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in GXO Logistics.

GXO Logistics isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other industrials companies.

GXO Logistics’s P/E ratio based on the next 12 months is 17.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $63.94 on the company (compared to the current share price of $52.15).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.