HCA Healthcare (HCA)

We’re firm believers in HCA Healthcare. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why We Like HCA Healthcare

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE:HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

- Additional sales over the last five years increased its profitability as the 21.2% annual growth in its earnings per share outpaced its revenue

- Industry-leading 28.6% return on capital demonstrates management’s skill in finding high-return investments

- Unparalleled scale of $74.37 billion in revenue gives it negotiating leverage and staying power in an industry with high barriers to entry

We’re fond of companies like HCA Healthcare. The valuation seems fair when considering its quality, so this could be an opportune time to buy some shares.

Why Is Now The Time To Buy HCA Healthcare?

Why Is Now The Time To Buy HCA Healthcare?

HCA Healthcare’s stock price of $468.85 implies a valuation ratio of 16.2x forward P/E. Valuation is lower than most companies in the healthcare space, and we believe HCA Healthcare is attractively-priced for its quality.

Where you buy a stock impacts returns. Our analysis shows that business quality is a much bigger determinant of market outperformance over the long term compared to entry price, but getting a good deal on a stock certainly isn’t a bad thing.

3. HCA Healthcare (HCA) Research Report: Q4 CY2025 Update

Hospital operator HCA Healthcare (NYSE:HCA) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 6.7% year on year to $19.51 billion. The company’s full-year revenue guidance of $78.25 billion at the midpoint came in 1.1% below analysts’ estimates. Its GAAP profit of $8.14 per share was 9.2% above analysts’ consensus estimates.

HCA Healthcare (HCA) Q4 CY2025 Highlights:

- Revenue: $19.51 billion vs analyst estimates of $19.71 billion (6.7% year-on-year growth, 1% miss)

- EPS (GAAP): $8.14 vs analyst estimates of $7.46 (9.2% beat)

- Adjusted EBITDA: $4.11 billion vs analyst estimates of $4.04 billion (21.1% margin, 1.9% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $30.30 at the midpoint, beating analyst estimates by 1.9%

- EBITDA guidance for the upcoming financial year 2026 is $16 billion at the midpoint, above analyst estimates of $15.82 billion

- Operating Margin: 16.6%, up from 13.5% in the same quarter last year

- Free Cash Flow Margin: 4.5%, down from 7% in the same quarter last year

- Market Capitalization: $107.8 billion

Company Overview

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE:HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

HCA Healthcare's facilities include 180 general acute care hospitals, six behavioral health hospitals, and four rehabilitation hospitals. These facilities offer comprehensive medical services including internal medicine, surgery, cardiology, oncology, neurosurgery, orthopedics, obstetrics, and emergency care. The company's outpatient network encompasses ambulatory surgery centers, freestanding emergency facilities, urgent care centers, walk-in clinics, physician practices, and specialized treatment centers.

The company serves patients through various payment methods, including Medicare, Medicaid, private insurance, managed care plans, and direct patient payments. HCA typically negotiates discounted rates with insurance companies and other group purchasers rather than charging full list prices to most patients.

For example, a patient requiring cardiac surgery might be initially evaluated at an HCA physician practice, undergo surgery at an HCA hospital, receive post-operative care in that same facility, and then continue rehabilitation through HCA's outpatient services—all coordinated within the company's network.

HCA generates revenue primarily through patient service fees, with payment coming from government programs (Medicare and Medicaid), private insurers, managed care organizations, and patients themselves. The company leverages its size to create economies of scale in purchasing, technology systems, and administrative functions across its network.

Beyond direct patient care, HCA provides management services to its facilities, including patient safety programs, ethics and compliance initiatives, supply chain management, financial systems, and human resources support. This centralized approach allows individual facilities to focus on patient care while benefiting from enterprise-wide resources and expertise.

HCA operates under extensive regulation, including Medicare and Medicaid requirements, anti-fraud laws, patient privacy protections under HIPAA, and emergency treatment obligations. The company must navigate complex healthcare regulations while maintaining compliance across its large network of facilities.

4. Hospital Chains

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

HCA Healthcare's main competitors include other large hospital operators such as Tenet Healthcare (NYSE:THC), Universal Health Services (NYSE:UHS), Community Health Systems (NYSE:CYH), and Ascension Health, as well as regional healthcare systems in its operating markets.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $75.6 billion in revenue over the past 12 months, HCA Healthcare is one of the most scaled enterprises in healthcare. This is particularly important because hospital chains companies are volume-driven businesses due to their low margins.

6. Revenue Growth

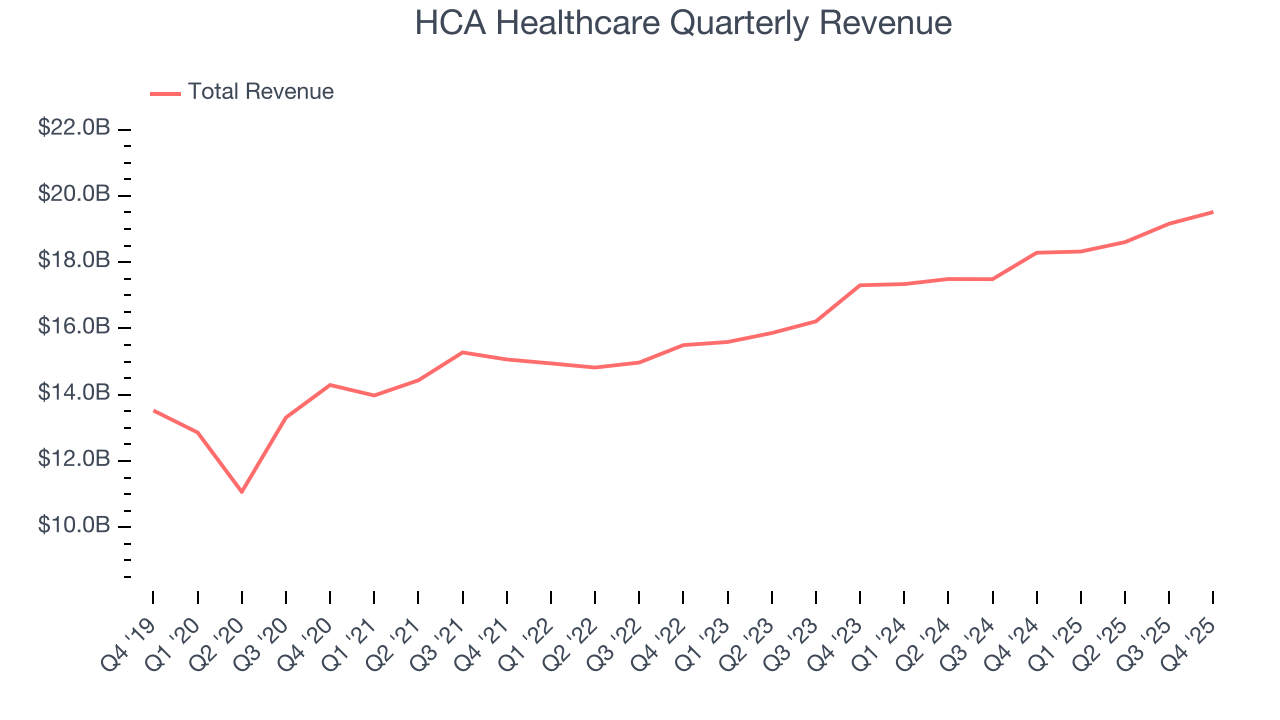

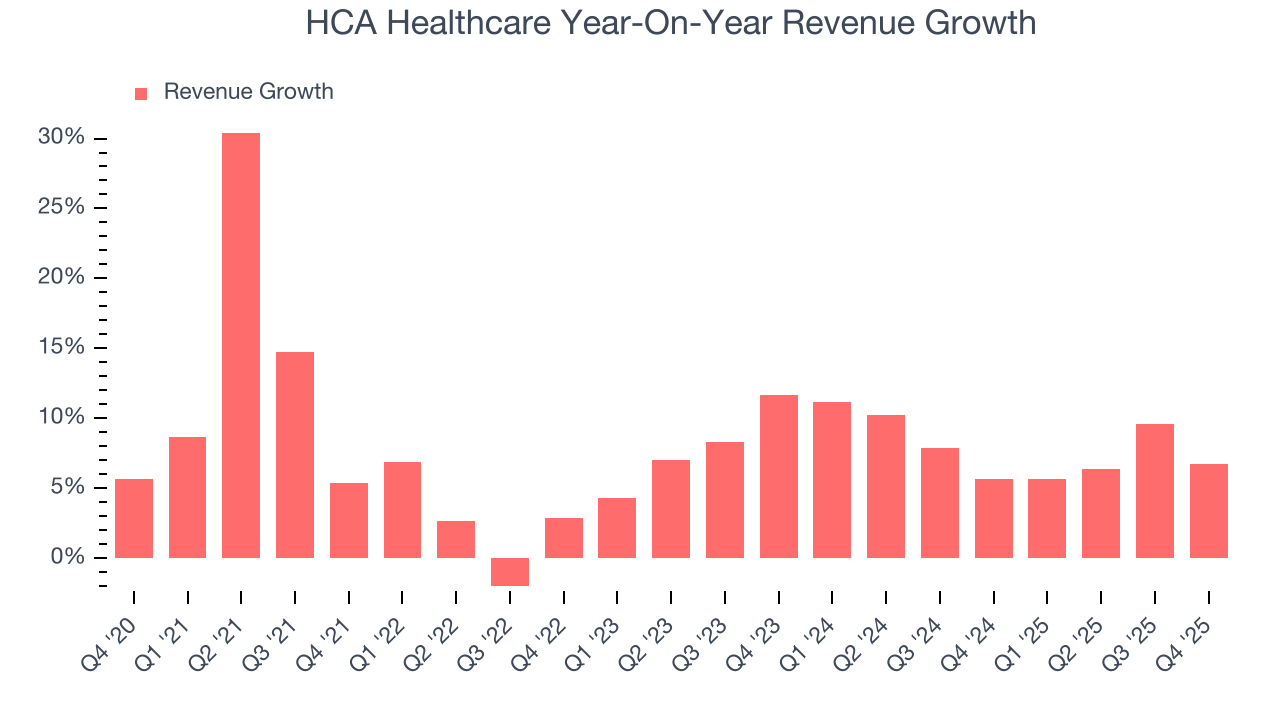

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, HCA Healthcare’s sales grew at a decent 8% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. HCA Healthcare’s annualized revenue growth of 7.9% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, HCA Healthcare’s revenue grew by 6.7% year on year to $19.51 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

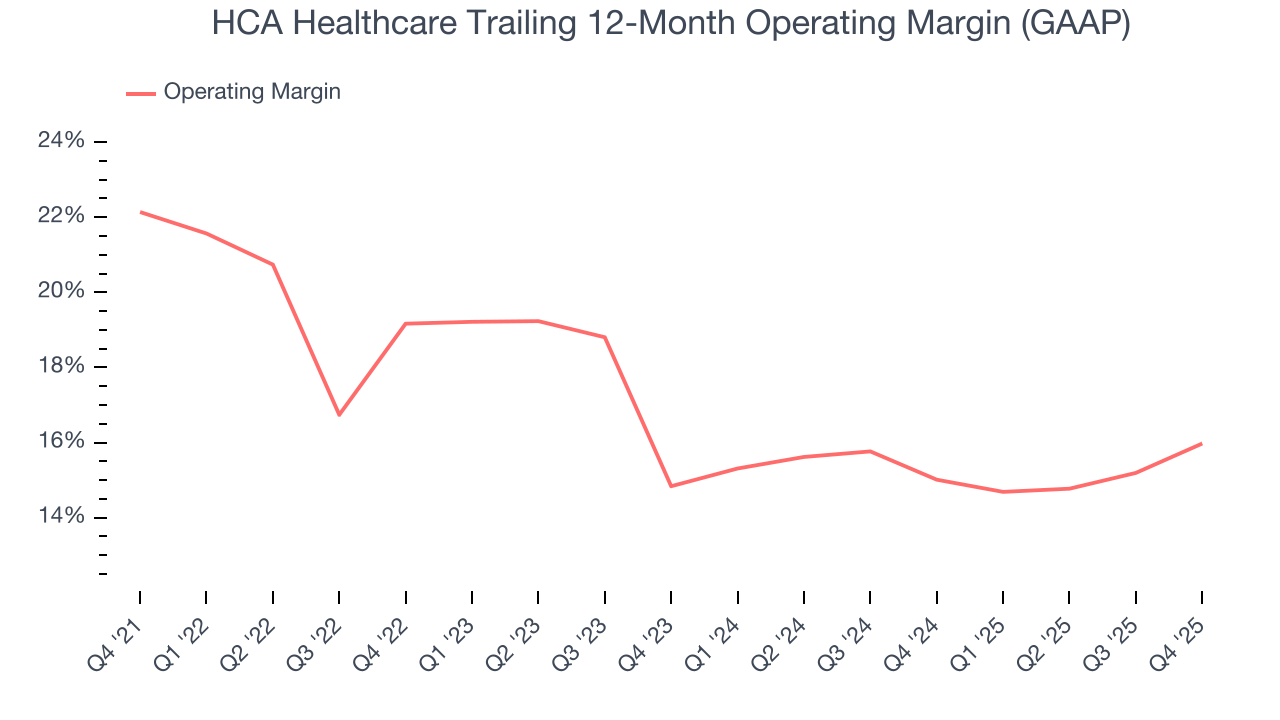

7. Operating Margin

HCA Healthcare has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 17.2%.

Analyzing the trend in its profitability, HCA Healthcare’s operating margin decreased by 6.2 percentage points over the last five years, but it rose by 1.1 percentage points on a two-year basis. We like HCA Healthcare and hope it can right the ship.

In Q4, HCA Healthcare generated an operating margin profit margin of 16.6%, up 3.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

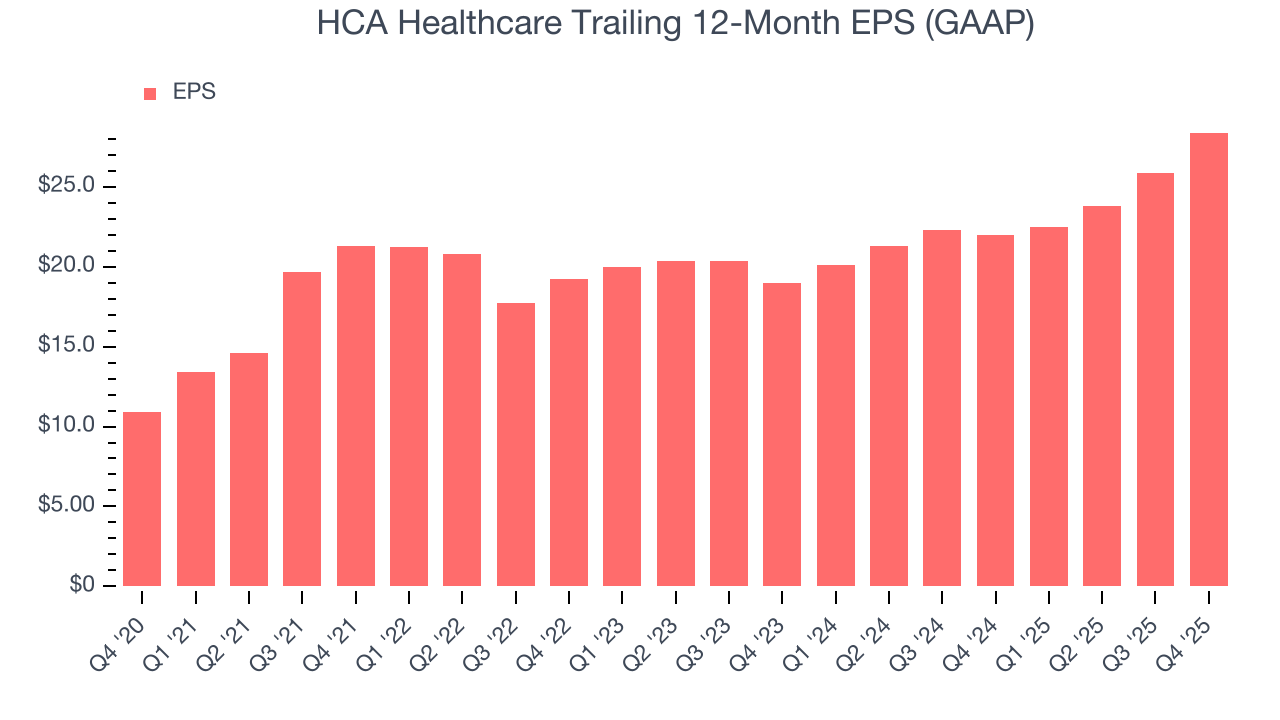

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

HCA Healthcare’s EPS grew at an astounding 21% compounded annual growth rate over the last five years, higher than its 8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

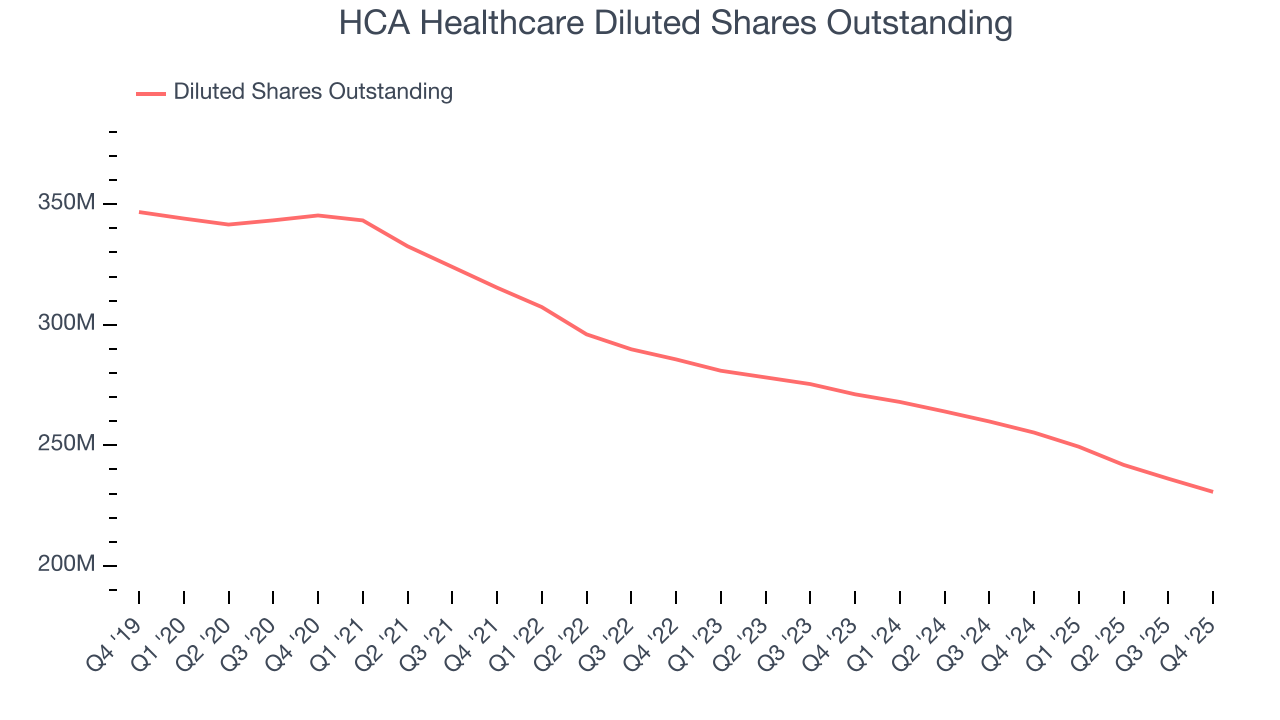

Diving into HCA Healthcare’s quality of earnings can give us a better understanding of its performance. A five-year view shows that HCA Healthcare has repurchased its stock, shrinking its share count by 33.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, HCA Healthcare reported EPS of $8.14, up from $5.63 in the same quarter last year. This print beat analysts’ estimates by 9.2%. Over the next 12 months, Wall Street expects HCA Healthcare’s full-year EPS of $28.38 to grow 6.1%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

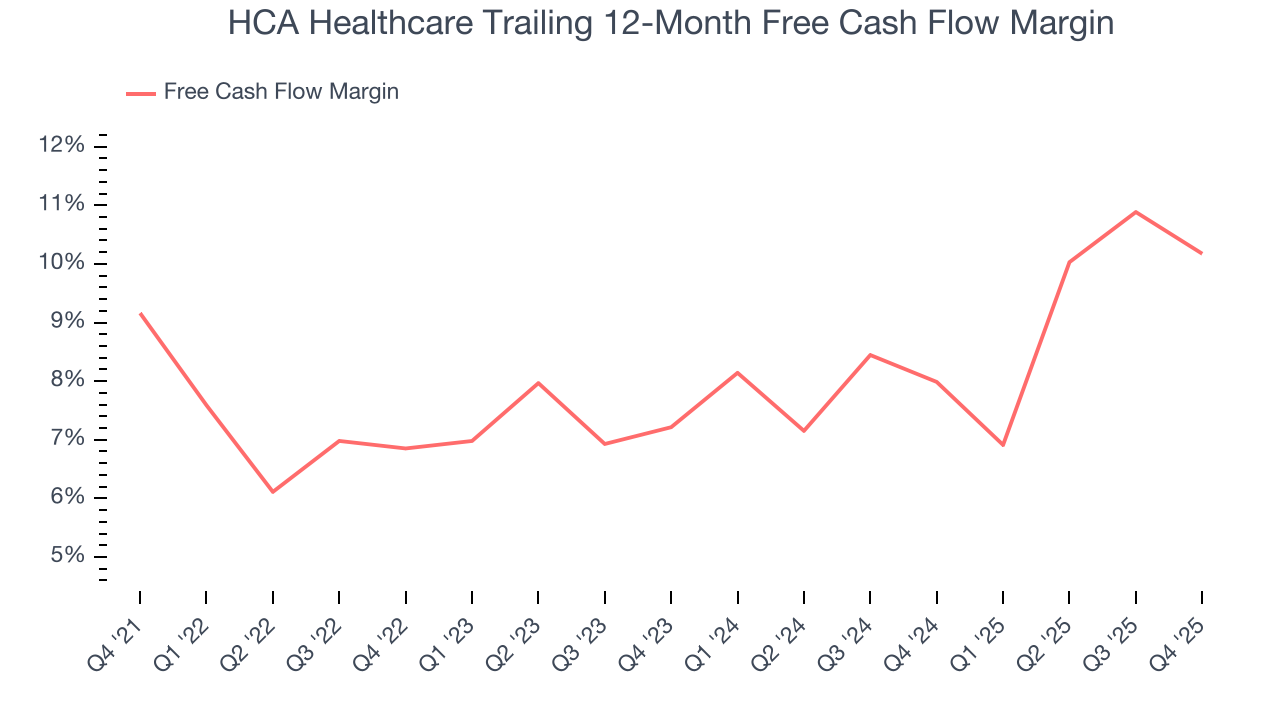

HCA Healthcare has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.3% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that HCA Healthcare’s margin expanded by 1 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

HCA Healthcare’s free cash flow clocked in at $870 million in Q4, equivalent to a 4.5% margin. The company’s cash profitability regressed as it was 2.5 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

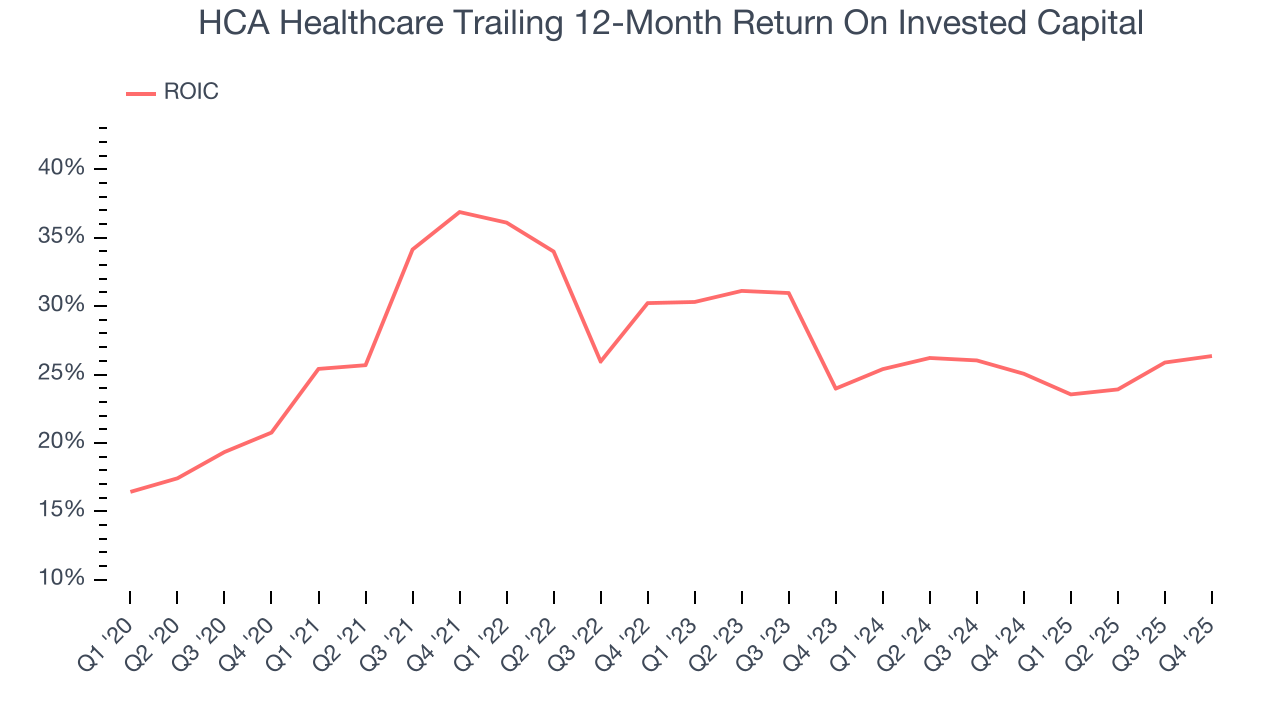

HCA Healthcare’s five-year average ROIC was 28.5%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, HCA Healthcare’s ROIC has unfortunately decreased. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

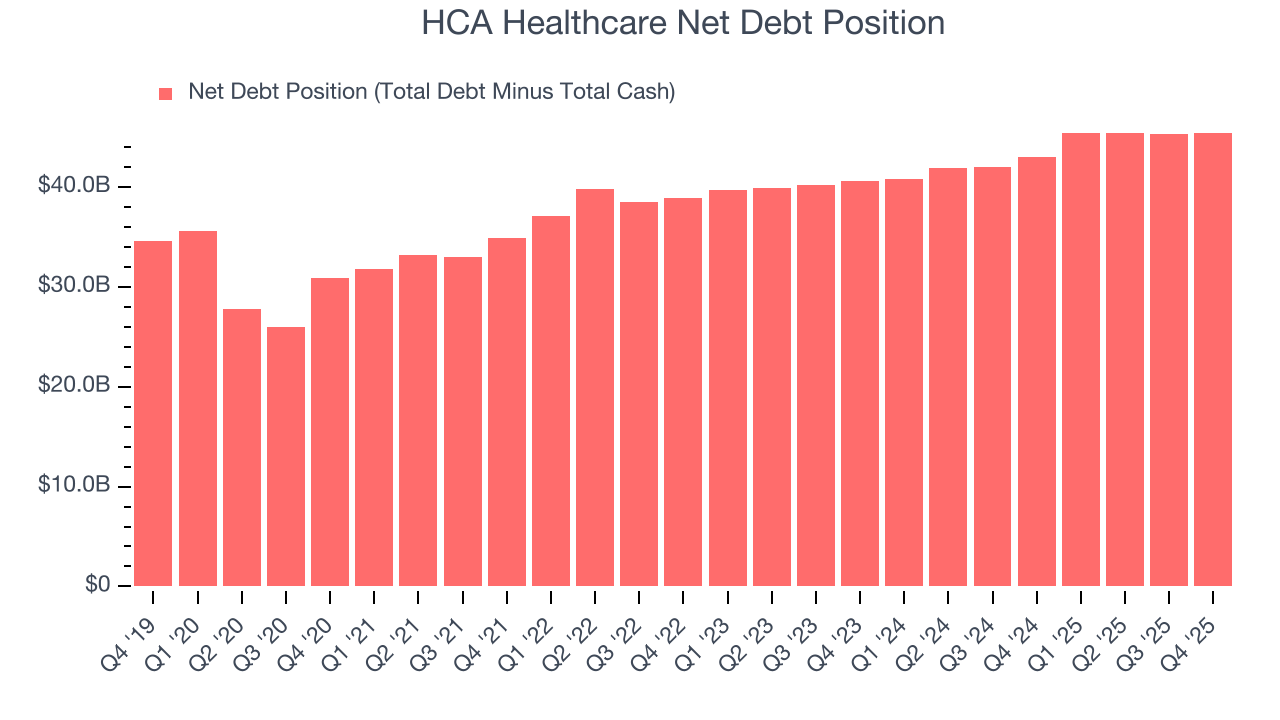

HCA Healthcare reported $1.04 billion of cash and $46.49 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $15.57 billion of EBITDA over the last 12 months, we view HCA Healthcare’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $1.10 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from HCA Healthcare’s Q4 Results

It was encouraging to see HCA Healthcare beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $471.25 immediately following the results.

13. Is Now The Time To Buy HCA Healthcare?

Updated: January 27, 2026 at 7:25 AM EST

Before investing in or passing on HCA Healthcare, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

HCA Healthcare is a fine business. First off, its revenue growth was decent over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale makes it a trusted partner with negotiating leverage. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

HCA Healthcare’s P/E ratio based on the next 12 months is 15.8x. Analyzing the healthcare landscape today, HCA Healthcare’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $488.76 on the company (compared to the current share price of $471.25), implying they see 3.7% upside in buying HCA Healthcare in the short term.