Hims & Hers Health (HIMS)

Hims & Hers Health catches our eye. Its innovative offerings are driving strong demand, as seen by the increase in its customer base.― StockStory Analyst Team

1. News

2. Summary

Why Hims & Hers Health Is Interesting

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE:HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

- Annual revenue growth of 75.7% over the last five years was superb and indicates its market share increased during this cycle

- Market share will likely rise over the next 12 months as its expected revenue growth of 20.1% is robust

- A blemish is its negative returns on capital show management lost money while trying to expand the business

Hims & Hers Health almost passes our quality test. If you’ve been itching to buy the stock, the valuation seems reasonable.

Why Is Now The Time To Buy Hims & Hers Health?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Hims & Hers Health?

Hims & Hers Health’s stock price of $29.62 implies a valuation ratio of 30.8x forward P/E. While this multiple is higher than most healthcare companies, we think the valuation is deserved for the revenue growth you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Hims & Hers Health (HIMS) Research Report: Q3 CY2025 Update

Telehealth company Hims & Hers Health (NYSE:HIMS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 49.2% year on year to $599 million. On the other hand, next quarter’s revenue guidance of $615 million was less impressive, coming in 2.6% below analysts’ estimates. Its GAAP profit of $0.06 per share was 43.7% below analysts’ consensus estimates.

Hims & Hers Health (HIMS) Q3 CY2025 Highlights:

- Revenue: $599 million vs analyst estimates of $579.6 million (49.2% year-on-year growth, 3.3% beat)

- EPS (GAAP): $0.06 vs analyst expectations of $0.11 (43.7% miss)

- Adjusted EBITDA: $78.37 million vs analyst estimates of $68.04 million (13.1% margin, 15.2% beat)

- Revenue Guidance for Q4 CY2025 is $615 million at the midpoint, below analyst estimates of $631.6 million

- EBITDA guidance for the full year is $312 million at the midpoint, below analyst estimates of $316.9 million

- Operating Margin: 2%, down from 5.6% in the same quarter last year

- Free Cash Flow Margin: 13.2%, down from 19.8% in the same quarter last year

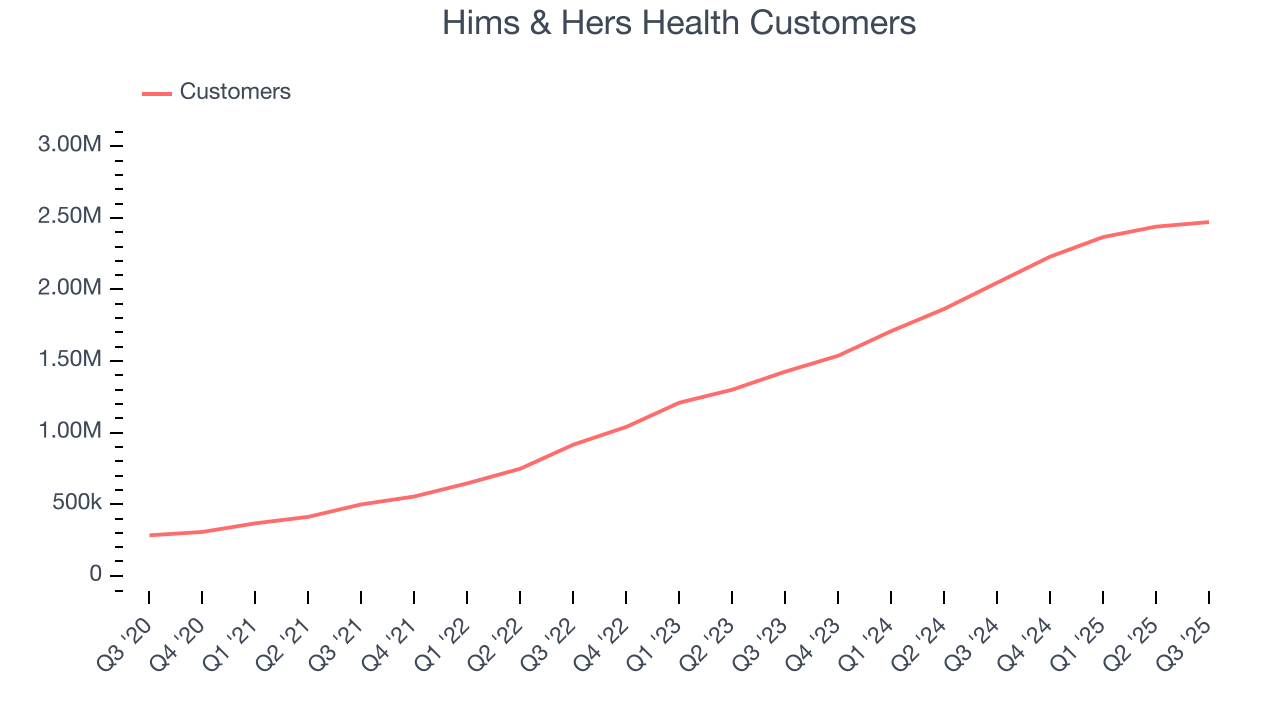

- Customers: 2.47 million, up from 2.44 million in the previous quarter

- Market Capitalization: $10.27 billion

Company Overview

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE:HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

The company's digital platform enables customers to consult with licensed healthcare professionals remotely for a range of conditions, including sexual health, hair loss, dermatology, mental health, and weight management. When appropriate, providers can prescribe medications that are then fulfilled through partner pharmacies and delivered to customers, typically on a subscription basis. This recurring revenue model creates predictable income streams while providing customers with convenient ongoing care.

Hims & Hers also offers a variety of over-the-counter products, including both white-labeled items and proprietary formulations developed with manufacturing partners. These products span categories like skincare, wellness supplements, and sexual health accessories. Many of these non-prescription items are available not only through the company's digital channels but also in thousands of retail locations across the United States.

For example, a customer experiencing hair loss might take an online assessment, connect with a provider through the platform for a virtual consultation, receive a prescription for finasteride if appropriate, and set up regular deliveries of both the medication and complementary non-prescription products like specialized shampoos.

The company's business model navigates the complex regulatory landscape of healthcare through contractual relationships with independent medical groups that employ the providers who deliver care through the platform. These "Affiliated Medical Groups" work exclusively with Hims & Hers, while the company provides the technology infrastructure, administrative support, and customer service that enables the entire ecosystem to function efficiently.

Hims & Hers has also established partnerships with traditional healthcare systems like Mount Sinai and Ochsner Health, creating pathways for customers to access in-person care when needed, complementing the digital-first approach that defines the company's core offering.

4. Healthcare Technology for Patients

The consumer-focused healthcare technology sector leverages digital platforms to make healthcare more accessible and affordable, offering services like telemedicine and prescription discounts. Looking forward, growth is supported by increasing consumer comfort with telehealth and the demand for cost-saving tools amidst rising healthcare expenses. AI-powered diagnostics and personalized digital care also present significant opportunities. However, the sector faces headwinds from heightened competition as large technology and established healthcare companies expand their digital presence.

Hims & Hers Health competes with other telehealth providers like Teladoc Health (NYSE:TDOC) and Amwell (NYSE:AMWL), direct-to-consumer health companies such as Roman Health (parent company Ro is private), and traditional healthcare providers that have expanded into telehealth services.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.21 billion in revenue over the past 12 months, Hims & Hers Health lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Hims & Hers Health’s smaller revenue base allows it to grow faster if it can execute well.

6. Revenue Growth

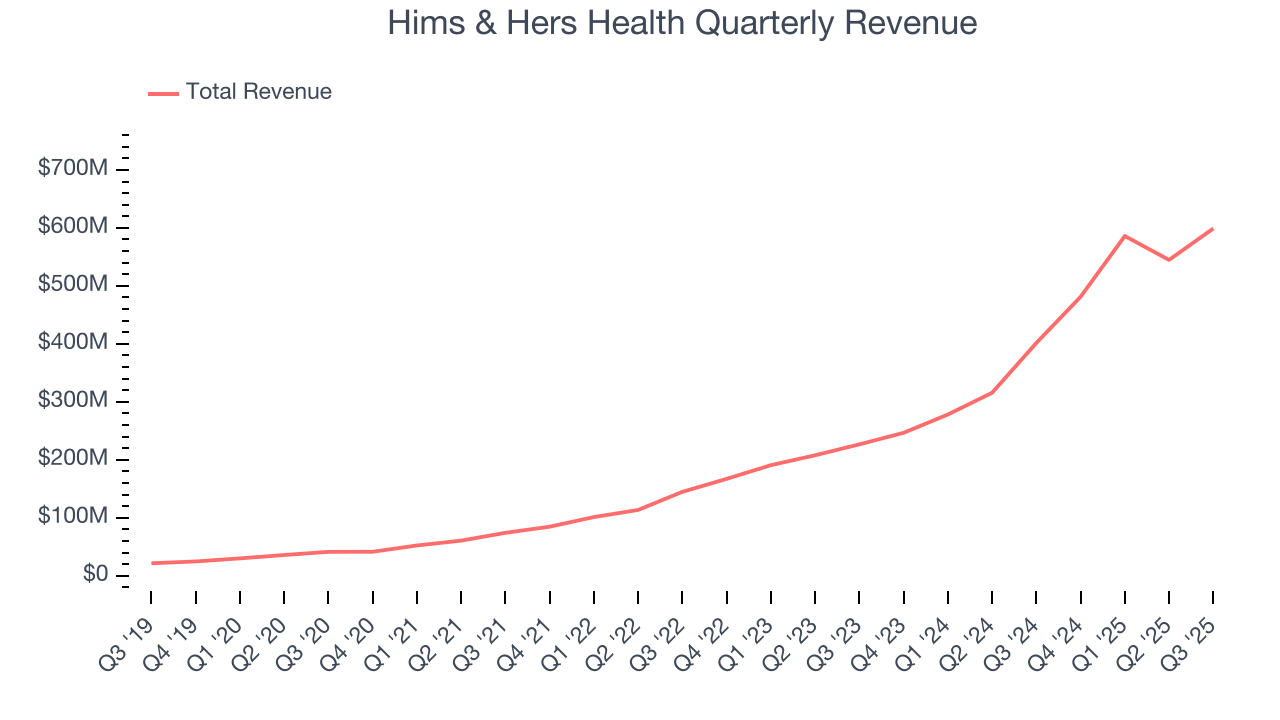

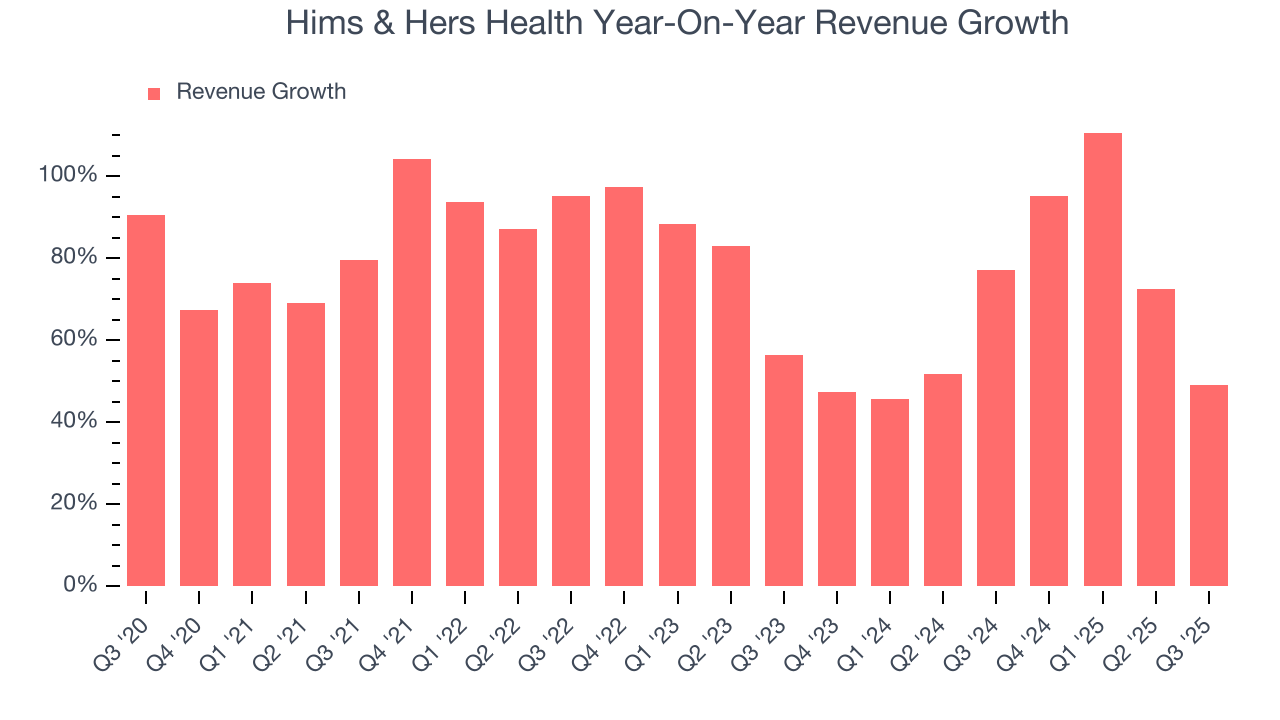

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Hims & Hers Health’s 75.7% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Hims & Hers Health’s annualized revenue growth of 67% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

Hims & Hers Health also reports its number of customers, which reached 2.47 million in the latest quarter. Over the last two years, Hims & Hers Health’s customer base averaged 38.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Hims & Hers Health reported magnificent year-on-year revenue growth of 49.2%, and its $599 million of revenue beat Wall Street’s estimates by 3.3%. Company management is currently guiding for a 27.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market is baking in success for its products and services.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

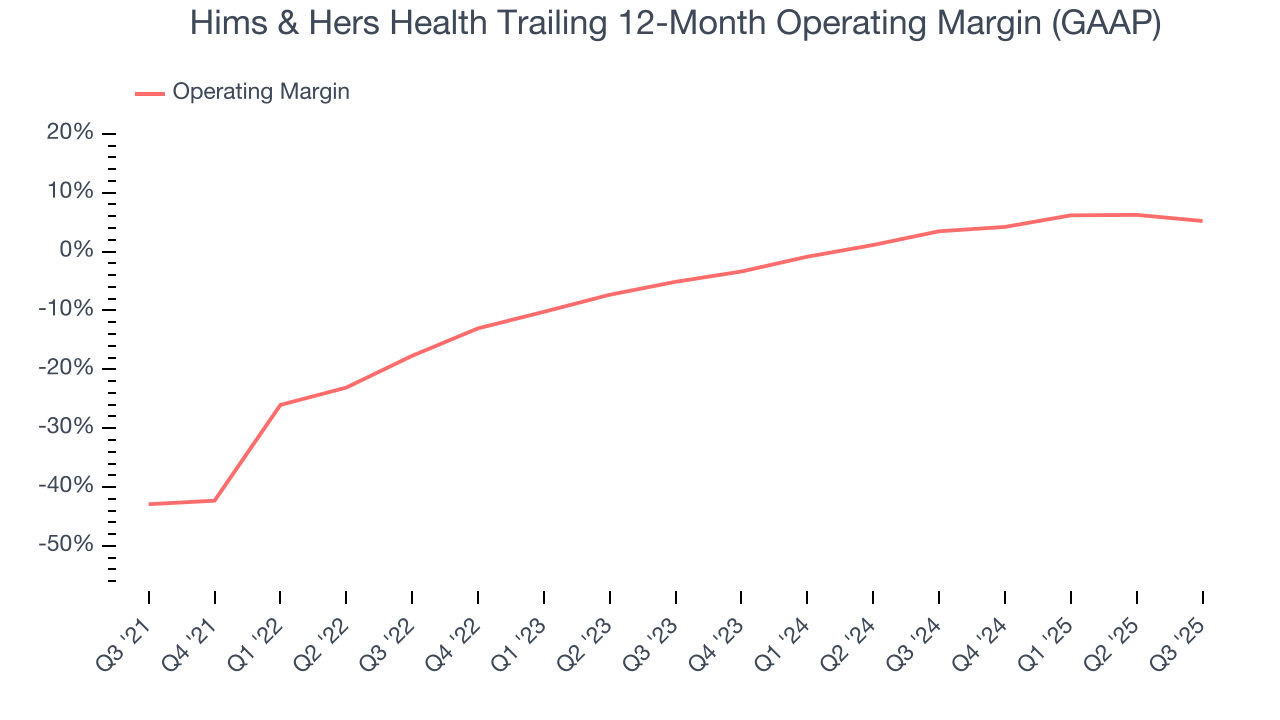

Although Hims & Hers Health was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Hims & Hers Health’s operating margin rose by 48.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 10.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, Hims & Hers Health generated an operating margin profit margin of 2%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

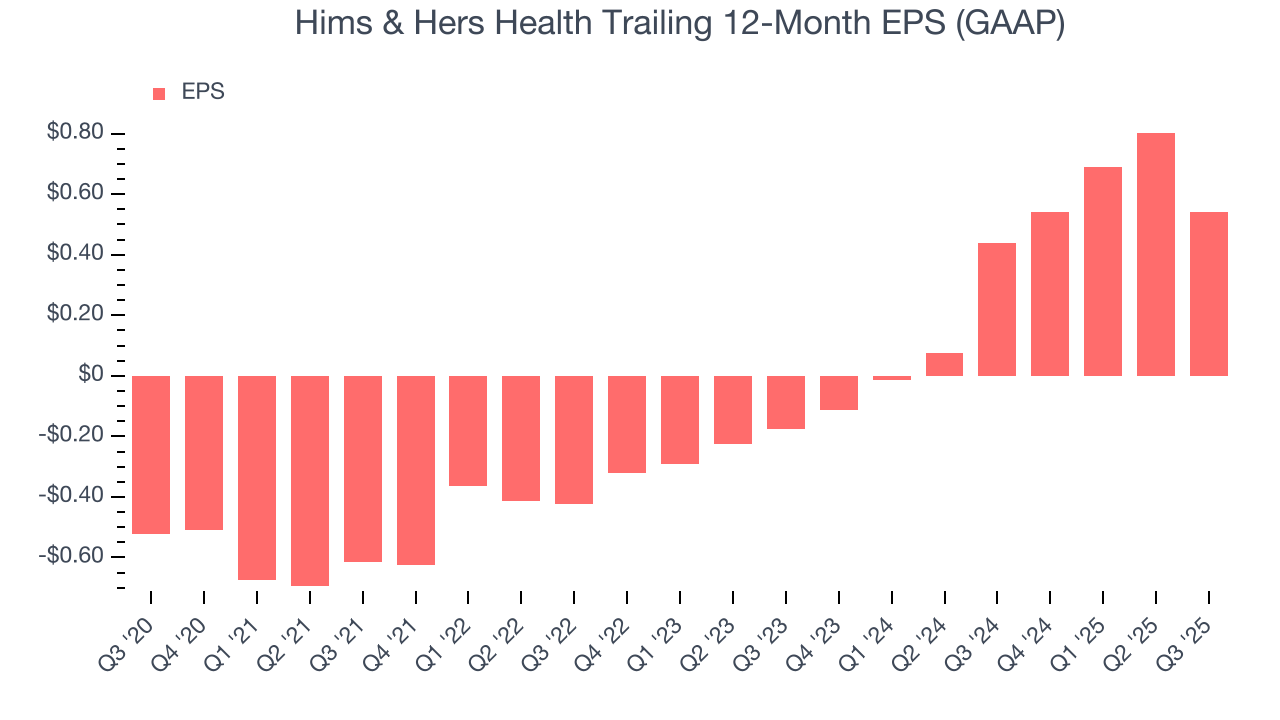

Hims & Hers Health’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, Hims & Hers Health reported EPS of $0.06, down from $0.32 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Hims & Hers Health’s full-year EPS of $0.54 to grow 42.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

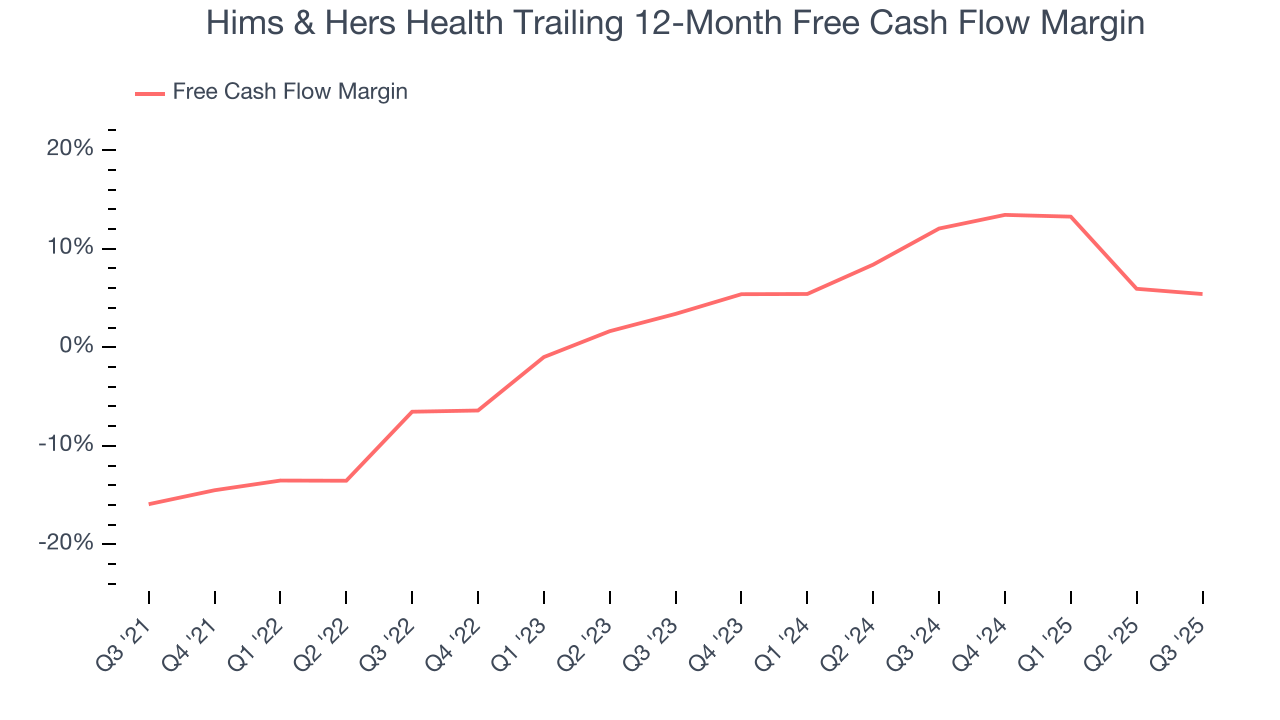

Hims & Hers Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.7%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Hims & Hers Health’s margin expanded by 21.3 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Hims & Hers Health’s free cash flow clocked in at $79.36 million in Q3, equivalent to a 13.2% margin. The company’s cash profitability regressed as it was 6.5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Hims & Hers Health has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 4.4%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hims & Hers Health’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

Hims & Hers Health reported $629.7 million of cash and $1.12 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $305.8 million of EBITDA over the last 12 months, we view Hims & Hers Health’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $6.26 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Hims & Hers Health’s Q3 Results

We enjoyed seeing Hims & Hers Health beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.9% to $46.10 immediately following the results.

13. Is Now The Time To Buy Hims & Hers Health?

Updated: January 24, 2026 at 11:30 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

In our opinion, Hims & Hers Health is a solid company. To kick things off, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its customer growth has been marvelous. On top of that, its rising cash profitability gives it more optionality.

Hims & Hers Health’s P/E ratio based on the next 12 months is 30.8x. Looking at the healthcare landscape right now, Hims & Hers Health trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $41.62 on the company (compared to the current share price of $29.62), implying they see 40.5% upside in buying Hims & Hers Health in the short term.